Escolar Documentos

Profissional Documentos

Cultura Documentos

India's CAD

Enviado por

Aaditya Khare0 notas0% acharam este documento útil (0 voto)

33 visualizações7 páginasRBI reported the Current Account deficit to have touched a record high of 6.7% of Gross Domestic product ( real / article4591795.ece) up from 4.4% last year for the December quarter. The upswing was expected though the magnitude of rise is beyond comprehension. In this globalized world, countries are becoming increasingly integrated in their trades.

Descrição original:

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOCX, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoRBI reported the Current Account deficit to have touched a record high of 6.7% of Gross Domestic product ( real / article4591795.ece) up from 4.4% last year for the December quarter. The upswing was expected though the magnitude of rise is beyond comprehension. In this globalized world, countries are becoming increasingly integrated in their trades.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

33 visualizações7 páginasIndia's CAD

Enviado por

Aaditya KhareRBI reported the Current Account deficit to have touched a record high of 6.7% of Gross Domestic product ( real / article4591795.ece) up from 4.4% last year for the December quarter. The upswing was expected though the magnitude of rise is beyond comprehension. In this globalized world, countries are becoming increasingly integrated in their trades.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

Você está na página 1de 7

In a recently released report on economic indicators, RBI reported the current account deficit

(CAD) to have touched a record high of 6.7% of Gross Domestic product

(http://www.thehindu.com/opinion/columns/C_R_L__Narasimhan/cad-the-danger-is-

real/article4591795.ece) up from 4.4% last year for the December quarter. According to

finance ministry, the upswing was expected though the magnitude of rise is beyond

comprehension.

We will attempt to decipher this issue and try to understand whats happening here. But first

let us go back to basics to understand how the capital flows into and out of an economy is

measured, what constitutes Current Account in Balance of Payment and what it tells about

health of an economy.

In this globalized world, countries are becoming increasingly integrated with each other in their

trades and have become much more interdependent and vulnerable with respect to economic

and political developments. Recent impact on Indian economy due to Euro Crisis and Iran

imbroglio proves this point. As the financial health of a company is ascertained from its Balance

sheet (which is a snapshot of its assets and liabilities at a point in time) and cash flow

statements, similarly, a countrys economic health can be known by determining its Balance of

Payment.

As per the definition provided in IMFs BoP manual

The balance of payments is a statistical statement that systematically summarizes, for a specific time

period, the economic transactions of an economy with the rest of the world. A transaction itself is

defined as an economic flow that reflects the creation, transformation, exchange, transfer, or extinction

of economic value and involves changes in ownership of goods and/or financial assets, the provision of

services, or the provision of labor and capital.

BoP account for India typically comprises of the following standard components

a) Current Account b) Capital & Financial Account c)Errors and Omissions d) Change in Foreign

Exchange reserve. Theoretically, BoP for any economy is zero i.e. the current account should

balance out the Capital/finance account. However, this does not happen in reality. Let us

analyze a bit closely the current Accounts.

Under current account of the BoP, transactions are classified into merchandise (exports and

imports) and invisibles. As the country participates in global trades of good and services with

other countries, investors and industries from one country invest capital and resources in

foreign countries, there is bound to be a strong correlation between the Gross domestic

Product (GDP) of a country with its Current Account. Let us see how with an algebraic

expression.

GDP of a country = C+G+I+X-M (1)

where, C = Private Consumption Expenditure i.e. the expenditure by private households or non-

profit institutions serving households (such as religious societies, sports and clubs, political

parties) on consumption of goods and services such as housing fees and transportation

G = Government Consumption Expenditure. It includes goods and services produced by

government, as well as purchases of goods and services by governments that are supplied to

households as social transfers in kind.

I = Gross Domestic Investment which includes residential type of investment (e.g housing), non-

residential investment (by corporations on building capital such as plant, machinery, tools) and

Change in inventories of firms (stocks, change in assets)

X-M = Net of Export minus Import. Depending on the relative volume of exports and imports, it

can be positive (a surplus) or negative (a deficit).

Why corporations do not feature in this equation? This is because, in the system of national

accounts (which is what BoP and GDP along with other economic indicators collectively are part

of), only households, non-profit institutions serving households (NPISH) and government have

final consumption, whereas corporations have intermediate consumption.

Now we shall define Current Account Balance (CAB) in BoP as

CAB = X-M +NY+NCT (2)

Where, NY = Net income from abroad and includes the net income from labor, property and

entrepreneurial ventures. Labor income covers compensation of employees paid to

nonresident workers. Property and entrepreneurial income covers investment income from the

claims on foreign financial assets/ownerships (interest, dividends, rent, etc.) and nonfinancial

property income (patents, copyright)

NCT = Net current transfers mean unilateral transfer of currency capital from/to India such as

workers remitting their income to India, donations, aids and grants by institutions like IMF,

official assistance and pensions.

Now Gross National Income can be written as

GNI = C + G + I +X-M + NCT+ NY (3) or

GNI = Expenditure by (government + private) + Investment +Net income from labor(foreign-

domestic) +Net payment from abroad

If we rearrange the equation, we get GNI = GDP +CAB (X-M)

Now, Gross Income (GNI) Gross Expenditure (C+G) = Gross Savings (S) (4)

Hence, Savings - Investments = CAB (5)

The above equation means that the current account balance mirrors the saving and investment

behavior of the domestic economy.

With this background, let us try and analyze in my next post why India has a Current Account

deficit and how it is able to sustain itself for all these years.

Current account for India is said to be in deficit due to following reasons

(http://finmin.nic.in/press_room/2013/FM_statementCAD.pdf)

Widening of trade deficit due to a sharper decline in exports relative to decline in imports.

This was primarily attributed to the sudden surge of gold and oil imports which caused a

drain on Current account

Net services import recorded a rise mainly on account of travel, transport, software services

and financial services

Rise in remittances

Let us examine why gold imports surged. In India, traditional motive of gold demand has been

for jewelry. However, apart from an unusually strong cultural affinity for this yellow metal, gold

also seems to have become a safe investment asset and a hedge against inflation in India. To

curb this surge government decided to impose import duty on gold imports. Agents expecting higher

future duties for forwarded gold imports raised CAD.

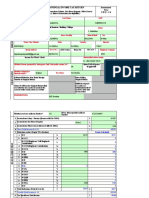

Source: FT

Second addition to the trade deficit is due to oil imports. India has always been a net importer

of oil and oil imports are one of the biggest chunks of our import bill. As we can see the effect

of raising oil imports on Current account. Volatility in international oil prices and domestic

subsidies on oil products exert a lot of pressure on import bill. Hence there is a strong need to

align the domestic pricing of oil with international oil prices to rationalize the oil consumption.

Second component of Indias CAD comprises of net invisibles which can further be classified

into three components. The first is Services comprising travel, transportation, insurance,

government not included elsewhere (GNIE), and miscellaneous. Miscellaneous services include

communication, construction, financial, software, news agency, royalties, management, and

business services. The second component of invisibles is income. And the third one is Transfers

which include grants, gifts, remittances, etc. Ney invisibles saw a rise mainly on account of rise

in receipts of software services, insurance, transportation etc. Net private remittances by non-

resident Indians and overseas workers to home country also increased. Also, Investment

income outflows are rising rapidly due to higher dividend and interest payments on existing

liabilities.

However, due to higher trade deficit there was a net pull-down effect on CAD despite rise in net

invisibles. However, increase in net invisible did moderate the worsening CAD.

Source: economic survey of India

Economists feel that there is nothing wrong with a high CAD/GDP ratio, as long as it can be

financed. At present, the current-account deficit is being funded by a surplus on capital account

as there are net capital inflows. These capital inflows are in primarily on account of portfolio

flows (majorly FIIs) or foreign direct investment (FDI). FDI tends to be also associated with non-

financial aspects, such as transfer of technology, infusion of management and supply chain

practices, etc. and are generally on a longer term. In that sense, it has a greater impact on

growth. Whereas FII flows are for a short term and are susceptible to sudden reversals.

In case of India, record FII capital inflows have supported the stock market and hence able to

sustain a massive current account deficit so far without too much economic impairment. But

the risks are very high for If FII inflows slow down or suddenly stops, funding the current

account deficit will be a huge problem. This would directly impact the rupee and it will

depreciate causing imports to become costlier as a result companies that have borrowed

abroad will get into trouble, and monetary easing may not yield any fruitful result. The

economy may go into a tailspin.

Let us now analyze from savings and investment perspective. As seen in equation (5) CAD also

reflects the balance of national savings and investments in the economy. The role of savings

here is crucial. Adequate savings is required to boost the corporate investment which in turn

increases economic growth. i.e investments will be financed by savings which include

Government savings and Private savings (Aggregate income minus aggregate expenditure). In

the equilibrium following identity should hold

Gross domestic investments = Private savings +Gov. savings + Foreign Savings (6)

i.e. all real investment in factories, housing, capital spending, and so forth has to be financed by

savings. Note here that foreign savings is considered as flipside of Current Account balance in

the national accounts identity. If you stare at equation (6) a bit, youll realize that it is nothing

but a rearrangement of components in equation (5). So another interpretation of Current

account deficit would be, we are importing savings from other countries to finance our

domestic investments.

CAD in India is reflective of low savings rather than high investment. India has been witnessing

a savings investment gaps on account of low private (household+corporate) savings. The

widening non-household saving-investment gap rose to a historical high of -7.8 per cent of GDP

in FY12 after rising to -3.5 per cent in FY11. This could mean RBI will draw down on forex

reserves to fund deficits and monetize the governments deficits through open market

operations (http://www.business-standard.com/article/opinion/fall-in-savings-must-be-

arrested-before-rate-cuts-112031600029_1.html).

Anticipating a worsening CAD, the government has been working on incentivizing foreign capital inflows

into the country. To enhace external debt flow, finance minister P. Chidambaram announced a

rationalization in foreign investment limits in the government securities and corporate bond market by

merging all existing sub-limits under two broad categories from 1 April.

These numbers reflect that the rupee is becoming a weaker currency. It may in turn fuel gold purchases,

which could again worsen the trade deficit. Spurring exports may be the only option left with the

government since it has not been able to curb imports, especially gold.

The BoP data showed that CAD was financed through capital flows, and there was no drawdown on

foreign exchange reserves. This was mainly on account of the surge in foreign portfolio investments,

which rose to $8.6 billion from $1.8 billion in the year-ago period.

The large costs to the economy of a possible balance of payments crisis due to a sudden stop can be

avoided if public authorities pay certain small price up front for a credit line from IMF.

Você também pode gostar

- Priye PahaDocumento1 páginaPriye PahaAaditya KhareAinda não há avaliações

- Core BankingDocumento6 páginasCore BankingAaditya KhareAinda não há avaliações

- Nazi Military-Industrial ComplexDocumento3 páginasNazi Military-Industrial ComplexAaditya KhareAinda não há avaliações

- FRM - Syllabus PDFDocumento64 páginasFRM - Syllabus PDFAnonymous x5odvnNVAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Master Thesis Topics in Finance and BankingDocumento8 páginasMaster Thesis Topics in Finance and Bankingangeladominguezaurora100% (1)

- 2009 Form 990 For Harvard Management CompanyDocumento55 páginas2009 Form 990 For Harvard Management CompanyresponsibleharvardAinda não há avaliações

- Lloyds TSB Bank PLC: Interim Management Report For The Half-Year To 30 June 2009Documento31 páginasLloyds TSB Bank PLC: Interim Management Report For The Half-Year To 30 June 2009saxobobAinda não há avaliações

- Introductory Financial Accounting - Mock PaperDocumento12 páginasIntroductory Financial Accounting - Mock PaperSuyash DixitAinda não há avaliações

- Earnings Per ShareDocumento3 páginasEarnings Per ShareYeshua DeluxiusAinda não há avaliações

- Bcom SylDocumento42 páginasBcom SylRajat BansalAinda não há avaliações

- Kahoot! (Buy TP NOK150) : The Compound Interest Effect With Triple Digit Revenue Growth and +40% FCF Margin Is Massive!Documento24 páginasKahoot! (Buy TP NOK150) : The Compound Interest Effect With Triple Digit Revenue Growth and +40% FCF Margin Is Massive!jainantoAinda não há avaliações

- Budget 2021 inDocumento4 páginasBudget 2021 inAkriti SharmaAinda não há avaliações

- RH Perennial - Nov 21Documento46 páginasRH Perennial - Nov 21sambitAinda não há avaliações

- 20-20 Ideas Summit 2023Documento24 páginas20-20 Ideas Summit 2023mdadnansyed2Ainda não há avaliações

- 2015 Itr1 PR9Documento9 páginas2015 Itr1 PR9Soumyaranjan SwainAinda não há avaliações

- Inter LMR Book by Prof Dani Khandelwal PDFDocumento153 páginasInter LMR Book by Prof Dani Khandelwal PDFH077 Ummulwara PatankarAinda não há avaliações

- Intro To Financial ManagementDocumento2 páginasIntro To Financial ManagementLhizaAinda não há avaliações

- Creation of Different Type of GL AccountDocumento6 páginasCreation of Different Type of GL AccountMohammed Nawaz ShariffAinda não há avaliações

- 28 - Swati Aggarwal - VedantaDocumento11 páginas28 - Swati Aggarwal - Vedantarajat_singlaAinda não há avaliações

- General Management ReportDocumento62 páginasGeneral Management ReportPraveen Chanpa100% (1)

- Tutorial 3 MFRS8 Q PDFDocumento3 páginasTutorial 3 MFRS8 Q PDFKelvin LeongAinda não há avaliações

- Module 6 TAXATION OF CORPORATIONS PDFDocumento60 páginasModule 6 TAXATION OF CORPORATIONS PDFGuinevereAinda não há avaliações

- Summary of Ias 36 Impairment of AssetsDocumento3 páginasSummary of Ias 36 Impairment of AssetsenzoAinda não há avaliações

- Identifying The IndustryDocumento7 páginasIdentifying The Industryshanul gawshindeAinda não há avaliações

- Buy Back of Shares: - Secretarial PracticeDocumento6 páginasBuy Back of Shares: - Secretarial PracticecoolsikhAinda não há avaliações

- Accounting Assignment On AutoDocumento19 páginasAccounting Assignment On Autoneo1612100% (1)

- Lady M DCF TemplateDocumento4 páginasLady M DCF Templatednesudhudh100% (1)

- Fundamentals of Accountancy, Business and Management: Adjusting Entries (Step 5)Documento39 páginasFundamentals of Accountancy, Business and Management: Adjusting Entries (Step 5)Francine Onos GalarpeAinda não há avaliações

- PBRX Financial Report Dec 2018 (Audited)Documento84 páginasPBRX Financial Report Dec 2018 (Audited)ronaldi lioeAinda não há avaliações

- Answers To QuestionsDocumento4 páginasAnswers To QuestionsAndrew WahyudiAinda não há avaliações

- CH 22Documento3 páginasCH 22dedAinda não há avaliações

- ReSA B45 FAR Final PB Exam Questions, Answers SolutionsDocumento21 páginasReSA B45 FAR Final PB Exam Questions, Answers SolutionsKeith Clyde Lagapa MuycoAinda não há avaliações

- Chapter 5 Consolidated FS - Part 2Documento13 páginasChapter 5 Consolidated FS - Part 2Geraldine Mae DamoslogAinda não há avaliações

- Landfund Partners Ii, LP - Summary Term Sheet: StructureDocumento1 páginaLandfund Partners Ii, LP - Summary Term Sheet: StructureSangeetSindanAinda não há avaliações