Escolar Documentos

Profissional Documentos

Cultura Documentos

RMC 74-99

Enviado por

Charmaine MejiaDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

RMC 74-99

Enviado por

Charmaine MejiaDireitos autorais:

Formatos disponíveis

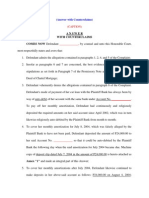

REVENUE MEMORANDUM CIRCULAR NO.

74-99

SUBJECT : Tax Treatment of Sales of Goods, Property and Services Made by

a Spplier from t!e Cstoms Territory to a PE"# $e%istered Enterprise& and Sale

Transactions Made by PE"# $e%istered Enterprises 'it!in and 'it!ot t!e

EC("()E

T( : #ll *nternal $evene (+cers and (t!ers Concerned

SECT*() ,- Scope- . T!is Circlar is bein% issed to consolidate and !armoni/e all

t!e pertinent tax la0s and t!eir correspondin% implementin% rles and re%lations

in respect of sales of %oods, property and services to and from t!e EC("()ES, in

relation to t!e provisions of $-#- )o- 12,3, as amended by $-#- )o- 4154, entitled

6T!e Special Economic "one #ct of ,2276 0!ic! created t!e P!ilippine Economic

"one #t!ority 8PE"#9- cdasia

SECT*() :- Bac;%rond- . *n %eneral, enterprises re%istered and operatin% nder

t!e said #ct, ot!er0ise ;no0n as EC("()E or PE"# re%istered enterprises, s!all

only be imposed 0it! a 7< special tax, based on 6%ross income earned6 in lie of all

taxes, except t!e real property tax- =o0ever, t!is tax incentive only applies in

respect of t!e re%istered enterprise>s operations 0it!in t!e EC("()E- T!e

EC("()ES 6are selected areas 0it! !i%!ly developed or 0!ic! !ave t!e potential to

be developed into a%ro?indstrial, indstrial torist@recreational, commercial,

ban;in%, investment and Anancial centers- #n EC("()E may contain any or all of

t!e follo0in%: indstrial estates, export processin% /ones, free trade /ones, and

torist@recreational centers-6 8SEC- 5 8a9, $-#- )o- 12,39- T!e EC("()E 6s!all be

mana%ed and operated by t!e PE"# as a separate cstoms territory-6 8SEC- 4, id-9

T!e term 6Cstoms Territory6 means 6t!e national territory of t!e P!ilippines otside

of t!e proclaimed bondaries of t!e EC("()ES except t!ose areas speciAcally

declared by ot!er la0s and@or presidential proclamations to !ave t!e stats of

special economic /ones and@or free ports-6 8Sec- , 8%9, PE"# $les and $e%lations9-

Generally, prodcts manfactred or prodced 0it!in t!e EC("()E are destined for

export to forei%n contries- '!ile sc! prodcts, nder certain conditions, may also

be sold to byers in t!e Cstoms Territory, i-e-, otside t!e EC("()E, sc! sales are

tec!nically considered as importation by sc! byer from t!e Cstoms Territory-

Since t!e EC("()E is tec!nically treated as anot!er separate Cstoms Territory,

t!e byer is treated as an importer and is imposed 0it! t!e correspondin% import

taxes and cstoms dties on !is prc!ase of prodcts from 0it!in t!e EC("()E-

'!ile all EC("()E enterprises are not necessarily manfactrer?exporters of

prodcts considerin% t!at t!ere are also service enterprises re%istered as EC("()E

enterprises, !o0ever, ta;en as a 0!ole, all t!eir inte%rated activities eventally

translate into manfactred prodcts 0!ic! are eit!er actally exported to forei%n

contries, in 0!ic! case, no B#T mst form part of its export price& or actally sold

to byers from t!e Cstoms Territory, in 0!ic! case, ,C< B#T s!all be paid t!ereon

by sc! byers, consistent 0it! t!e 6Cross Border Doctrine6 of t!e B#T system-

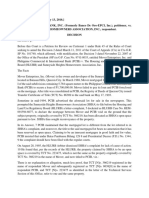

EexEib

T!e P!ilippines> Bale #dded Tax 8B#T9 la0 ad!eres to t!e 6Cross Border Doctrine6 of

t!e B#T System, 0!ic! basically means t!at no B#T s!all be imposed to form part of

t!e cost of %oods destined for consmption otside of t!e territorial border of t!e

taxin% at!ority- =ence, actal export of %oods and services from t!e P!ilippines to

a forei%n contry mst be free of t!e B#T- Conversely, t!ose destined for se or

consmption 0it!in t!e P!ilippines s!all be imposed 0it! t!e ,C< B#T- #ccordin%ly,

interpretation of t!e provisions of t!e B#T la0 !as been !armoni/ed 0it! t!e 6Cross

Border Doctrine6-

SECT*() F- Tax Treatment (f Sales Made By # B#T $e%istered Spplier Grom T!e

Cstoms Territory, To # PE"# $e%istered Enterprise- .

8,9 *f t!e Byer is a PE"# re%istered enterprise 0!ic! is sbHect to t!e 7< special

tax re%ime, in lie of all taxes, except real property tax, prsant to $-#- )o- 12,3,

as amended:

8a9 Sale of %oods 8i-e-, merc!andise9- . T!is s!all be treated as indirect export

!ence, considered sbHect to /ero percent 8C<9 B#T, prsant to Sec- ,C38#98:98a9

879, )*$C and Sec- :F of $-#- )o- 12,3, in relation to #$T- 118:9 of t!e (mnibs

*nvestments Code-

8b9 Sale of service- . T!is s!all be treated sbHect to /ero percent 8C<9 B#T

nder t!e 6cross border doctrine6 of t!e B#T System, prsant to B#T $lin% )o-

CF:?24 dated )ov- 7, ,224-

8:9 *f Byer is a PE"# re%istered enterprise 0!ic! is not embraced by t!e 7<

special tax re%ime, !ence, sbHect to taxes nder t!e )*$C, e-%-, Service

Establis!ments 0!ic! are sbHect to taxes nder t!e )*$C rat!er t!an t!e 7<

special tax re%ime:

8a9 Sale of %oods 8i-e-, merc!andise9- . T!is s!all be treated as indirect export

!ence, considered sbHect to /ero percent 8C<9 B#T, prsant to Sec- ,C38#98:98a9

879, )*$C and Sec- :F of $-#- )o- 12,3 in relation to #$T- 118:9 of t!e (mnibs

*nvestments Code-

8b9 Sale of Service- . T!is s!all be treated sbHect to /ero percent 8C<9 B#T

nder t!e 6cross border doctrine6 of t!e B#T System, prsant to B#T $lin% )o-

CF:?24 dated )ov- 7, ,224-

F- *n t!e Anal analysis, any sale of %oods, property or services made by a B#T

re%istered spplier from t!e Cstoms Territory to any re%istered enterprise

operatin% in t!e eco/one, re%ardless of t!e class or type of t!e latter>s PE"#

re%istration, is actally IaliAed and t!s le%ally entitled to t!e /ero percent 8C<9

B#T- #ccordin%ly, all sales of %oods or property to sc! enterprise made by a B#T

re%istered spplier from t!e Cstoms Territory s!all be treated sbHect to C< B#T,

prsant to Sec- ,C38#98:98a9879, )*$C, in relation to #$T- 118:9 of t!e (mnibs

*nvestments Code, 0!ile all sales of services to t!e said enterprises, made by B#T

re%istered sppliers from t!e Cstoms Territory, s!all be treated eJectively sbHect

to t!e C< B#T, prsant to Section ,C48B98F9, )*$C, in relation to t!e provisions of

$-#- 12,3 and t!e 6Cross Border Doctrine6 of t!e B#T system- Cdpr

T!is Circlar s!all serve as a s+cient basis to entitle sc! spplier of %oods,

property or services to t!e beneAt of t!e /ero percent 8C<9 B#T for sales made to

t!e aforementioned EC("()E enterprises and s!all serve as s+cient compliance

to t!e reIirement for prior approval of /ero?ratin% imposed by $evene

$e%lations )o- 1?27 eJective as of t!e date of t!e issance of t!is Circlar-

SECT*() 5- Tax Treatment (f Sales Made By # B#T?Exempt Spplier Grom T!e

Cstoms Territory, To # PE"# $e%istered Enterprise- . Sale of %oods, property and

services by B#T?Exempt Spplier from t!e Cstoms Territory, to a PE"#?re%istered

enterprise s!all be treated exempt from B#T, prsant to Sec- ,C2, in relation to

Sec- :F3, )*$C, re%ardless of 0!et!er or not t!e PE"# re%istered byer is sbHect to

taxes nder t!e )*$C, or enHoyin% t!e 7< special tax re%ime, or a re%istered

manfactrer?exporter t!e 6Cross Border Doctrine6 of t!e B#T System to t!e

contrary not0it!standin%-

SECT*() 7- Tax Treatment (f Sales Made By # PE"# $e%istered Enterprise- .

8,9 Sale of %oods 8i-e-, merc!andise9, by a PE"#?re%istered enterprise, to a byer

from t!e Cstoms Territory 8i-e-, domestic sales9- . T!is case s!all be treated as a

tec!nical importation made by t!e Byer- Sc! Byer s!all be treated as an

importer t!ereof and s!all be imposed 0it! t!e correspondin% import tax@es 8i-e-,

B#T or B#T pls excise tax, as t!e case may be9, prsant to Sec- ,C1, Title *B and

Title B*, )*$C, in relation to Sec- :3, $-#- )o- 12,3, as implemented by Sec- :, $le

B***, P#$T B of t!e PE"# rles and re%lations entitled 6$les and $e%lations to

*mplement $epblic #ct )o- 12,3-6 T!e re%istered enterprise>s 6%ross income

earned6 t!erefrom s!all be sbHect to t!e 7< special tax prsant to Sec- :5 of $-#-

)o- 12,3: Provided, !o0ever, t!at its sales in t!e Cstoms Territory do not exceed

t!e t!res!old allo0ed or permitted for sc! sales, prsant to t!e pertinent

provisions of t!e PE"# rles and re%lations: Provided, frt!er, t!at for income tax

prposes, if sc! sales s!old exceed t!e aforesaid t!res!old, its income derived

from sc! excess sales s!all be imposed 0it! t!e normal income tax prsant to t!e

provisions of Title **, )*$C: Provided, frt!er, t!at in comptin% for t!e income tax

de on sc! excess sales, its net income from sc! excess sales s!all be

determined in accordance 0it! t!e met!od of %eneral apportionment prsant to

t!e provisions of Sec- 7C, )*$C, 8i-e-, compte its total net income from total sales,

t!en, compte its net income from sc! excess sales by %eneral apportionment, as

follo0s: Excess sales divided by total sales times total net income from total sales

eIals net income from excess sales9-

8:9 Sale of Services by a PE"# $e%istered Enterprise to a Byer from t!e Cstoms

Territory- . T!is type of transaction is not embraced by t!e 7< special tax re%ime

%overnin% PE"#?re%istered enterprises prsant to $-#- )o- 12,3, as implemented

by t!e PE"# rles and re%lations !ence, sc! seller s!all be sbHect to t!e ,C<

B#T, prsant to Section ,C4 or to t!e percenta%e tax, prsant to Title B,

0!ic!ever is applicable, and to t!e normal income tax on income derived t!erefrom,

prsant to Title **, )*$C- Sc! income tax s!all be compted in accordance 0it!

t!e met!od of %eneral apportionment provided in t!e immediately precedin%

para%rap!-

8F9 Sale of Goods, by a PE"# $e%istered Enterprise, to #not!er PE"# $e%istered

Enterprise 8i-e-, *ntra EC("()E Sales of Goods9- . *ts sale of %oods or property to

anot!er /one enterprise s!all be exempt from B#T, prsant to Sec- ,C28I9, )*$C,

in relation to Sec- :5, $-#- 12,3, as implemented by Sec- ,, $le B***, P#$T B, of t!e

PE"# implementin% rles and re%lations-

859 Sale of Service by EC("()E Enterprise, to #not!er EC("()E Enterprise

8*ntra EC("()E Enterprise Sale of Service9:

8a9 *f PE"#?$e%istered Seller is SbHect to t!e 7< Special Tax $e%ime- . Exempt

from B#T or any percenta%e tax, prsant to Sec- :5, $-#- 12,3-

8b9 *f PE"#?$e%istered Seller is SbHect to Taxes Under t!e )*$C - . SbHect to

/ero percent 8C<9 B#T prsant to t!e 6Cross Border Doctrine6 of t!e B#T system,

re%ardless of t!e type or class of PE"# re%istration of t!e PE"# enterprise- Byer,

since t!e se for or beneAt from sc! prc!ase of service s!all eventally be

translated to actal export of %oods 8i-e-, s!ipment of %oods to a forei%n contry,

0!ic! is sbHect to /ero percent 8C<9 B#T, or translated into tec!nical export of

%oods 8i-e-, sale of %oods to a byer from t!e Cstoms Territory, 0!ic! is treated as

importation by sc! byer, !ence, sbHect to ,C< B#T a%ainst t!e said byer9-

SECT*() 3- $epealin% Clase- . #ny B*$ $lin%, if inconsistent !ere0it!, is !ereby

considered amended, modiAed or revo;ed accordin%ly- cdlex

8SGD-9 BEET=(BE) E- $U#E(

Commissioner of *nternal $evene

Você também pode gostar

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Sales Dialogue Template FinishedDocumento6 páginasSales Dialogue Template FinishedSherlyn Acaba100% (1)

- Answer with Counterclaims(CAPTION) Defendant files answer and counterclaimsDocumento6 páginasAnswer with Counterclaims(CAPTION) Defendant files answer and counterclaimsmegzycutes3871Ainda não há avaliações

- Islamic Banking Situational Mcqs PDFDocumento24 páginasIslamic Banking Situational Mcqs PDFNajeeb Magsi100% (1)

- Private Equity Outlook: Regulation and Healthcare Reform to Impact M&ADocumento20 páginasPrivate Equity Outlook: Regulation and Healthcare Reform to Impact M&AnikeshoksAinda não há avaliações

- Airline IndustryDocumento57 páginasAirline IndustryAchal_jainAinda não há avaliações

- 5 Warrant of ArrestDocumento4 páginas5 Warrant of ArrestCharmaine Mejia100% (1)

- Angel PresentationDocumento22 páginasAngel PresentationDharamveer Jairam Sahu100% (1)

- Department of Transportation and Communications (Dotc), Petitioner, vs. Spouses Vicente Abecina and Maria Cleofe Abecina, Respondents.Documento6 páginasDepartment of Transportation and Communications (Dotc), Petitioner, vs. Spouses Vicente Abecina and Maria Cleofe Abecina, Respondents.Charmaine MejiaAinda não há avaliações

- Adverse Possession Claim Rejected, Writs of Possession Can Be EnforcedDocumento3 páginasAdverse Possession Claim Rejected, Writs of Possession Can Be EnforcedCharmaine MejiaAinda não há avaliações

- Adverse Possession Claim Rejected, Writs of Possession Can Be EnforcedDocumento3 páginasAdverse Possession Claim Rejected, Writs of Possession Can Be EnforcedCharmaine MejiaAinda não há avaliações

- 1410160576Documento2 páginas1410160576UdkxkAinda não há avaliações

- Cir V Pascor RealtyDocumento3 páginasCir V Pascor RealtyCharmaine MejiaAinda não há avaliações

- Strategic Analysis of Operating Income and Final VarianceDocumento2 páginasStrategic Analysis of Operating Income and Final VarianceZen OrtegaAinda não há avaliações

- PHILIPPINE ASSOCIATION OF SERVICE EXPORTER INC vs. DRILON Case DigestDocumento3 páginasPHILIPPINE ASSOCIATION OF SERVICE EXPORTER INC vs. DRILON Case DigestCharmaine MejiaAinda não há avaliações

- VAT True or False QuestionsDocumento7 páginasVAT True or False QuestionsAllen Fey De JesusAinda não há avaliações

- Alano vs. Magud-Logmao - DamagesDocumento5 páginasAlano vs. Magud-Logmao - DamagesCharmaine Mejia100% (2)

- Alano vs. Magud-Logmao - DamagesDocumento5 páginasAlano vs. Magud-Logmao - DamagesCharmaine Mejia100% (2)

- 6, 7, AND 8 SubpoenaDocumento4 páginas6, 7, AND 8 SubpoenaCharmaine Mejia0% (1)

- Periodical Test in TleDocumento3 páginasPeriodical Test in TleChelby Mojica100% (2)

- Carinan vs. Sps Cueto - ObligationDocumento2 páginasCarinan vs. Sps Cueto - ObligationCharmaine MejiaAinda não há avaliações

- The United States Vs Silvestre Pompeya Case DigestDocumento2 páginasThe United States Vs Silvestre Pompeya Case DigestCharmaine Mejia100% (4)

- Gina Endaya vs Ernesto VillaosDocumento11 páginasGina Endaya vs Ernesto VillaosCharmaine MejiaAinda não há avaliações

- G.R. No. 191492, July 04, 2016Documento3 páginasG.R. No. 191492, July 04, 2016Charmaine MejiaAinda não há avaliações

- Supreme Court upholds legitimate daughter's share in father's estateDocumento6 páginasSupreme Court upholds legitimate daughter's share in father's estateCharmaine MejiaAinda não há avaliações

- .Banco de Oro Unibank, Inc. (Formerly Banco de Oro-Epci, Inc.), Petitioner, vs. Sunnyside Heights Homeowners Association, Inc.Documento7 páginas.Banco de Oro Unibank, Inc. (Formerly Banco de Oro-Epci, Inc.), Petitioner, vs. Sunnyside Heights Homeowners Association, Inc.Charmaine MejiaAinda não há avaliações

- Civil CaseDocumento3 páginasCivil CaseCharmaine MejiaAinda não há avaliações

- Order LetterDocumento1 páginaOrder LetterCharmaine MejiaAinda não há avaliações

- Old Spanish Civil Code - PartnershipDocumento5 páginasOld Spanish Civil Code - PartnershipCharmaine MejiaAinda não há avaliações

- G.R. No. 191492, July 04, 2016Documento3 páginasG.R. No. 191492, July 04, 2016Charmaine MejiaAinda não há avaliações

- Anchor Savings Bank vs. Pinzman Realty - Usurious InterestDocumento2 páginasAnchor Savings Bank vs. Pinzman Realty - Usurious InterestCharmaine Mejia100% (1)

- Supreme Court upholds legitimate daughter's share in father's estateDocumento6 páginasSupreme Court upholds legitimate daughter's share in father's estateCharmaine MejiaAinda não há avaliações

- G.R. No. 194260, April 13, 2016Documento4 páginasG.R. No. 194260, April 13, 2016Charmaine MejiaAinda não há avaliações

- Order LetterDocumento1 páginaOrder LetterCharmaine MejiaAinda não há avaliações

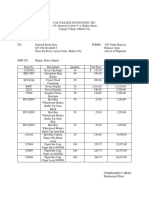

- National Book Store G/F 104 Greenbelt I Paseo de Roxas Ayala Center, Makati CityDocumento1 páginaNational Book Store G/F 104 Greenbelt I Paseo de Roxas Ayala Center, Makati CityCharmaine MejiaAinda não há avaliações

- BIR Form 1600WPDocumento1 páginaBIR Form 1600WPCharmaine MejiaAinda não há avaliações

- San Juan Structural and Steel Fabricators Inc vs. CADocumento18 páginasSan Juan Structural and Steel Fabricators Inc vs. CACharmaine MejiaAinda não há avaliações

- Aniceto Campos vs. BPIDocumento2 páginasAniceto Campos vs. BPICharmaine MejiaAinda não há avaliações

- Stonehill V DioknoDocumento19 páginasStonehill V DioknoJoseph Dimalanta DajayAinda não há avaliações

- 2 Order of ReleaseDocumento2 páginas2 Order of ReleaseCharmaine MejiaAinda não há avaliações

- Creating Brand Equity: Marketing ManagementDocumento38 páginasCreating Brand Equity: Marketing Managementharsshita pothirajAinda não há avaliações

- Tutorial Miroeconomics - StuDocumento14 páginasTutorial Miroeconomics - StuD Dávíd FungAinda não há avaliações

- CIE O Level Principals of Accounts (7110) - Theory Notes (Collected)Documento22 páginasCIE O Level Principals of Accounts (7110) - Theory Notes (Collected)MyshaM09957% (7)

- Financial Accounting I: Seat WorkDocumento1 páginaFinancial Accounting I: Seat WorkVel JuneAinda não há avaliações

- Visual Merchandising Is The Means To CommunicateDocumento2 páginasVisual Merchandising Is The Means To CommunicateShyam ChoudharyAinda não há avaliações

- Distribution of AmwayDocumento20 páginasDistribution of Amwaykalraashwin704786% (7)

- Retail Analysis of CROSSWORD BOOK STORE, ICC Trade Towers, Senapati Bapat Road, PuneDocumento18 páginasRetail Analysis of CROSSWORD BOOK STORE, ICC Trade Towers, Senapati Bapat Road, PuneJignesh SoniAinda não há avaliações

- Wild Shaw (8th Ed.) Connect GuideDocumento494 páginasWild Shaw (8th Ed.) Connect GuideSrikar RootsAinda não há avaliações

- Market Structure Original Unit 3Documento32 páginasMarket Structure Original Unit 3Priya SonuAinda não há avaliações

- Indian Stock Market MechanismDocumento2 páginasIndian Stock Market Mechanismneo0157Ainda não há avaliações

- Lecture 1 Sales TaxDocumento42 páginasLecture 1 Sales TaxYanPing AngAinda não há avaliações

- Atul Industries Limited-IC PDFDocumento23 páginasAtul Industries Limited-IC PDFSanjayAinda não há avaliações

- Centilytics JD Sales MBAGradsDocumento2 páginasCentilytics JD Sales MBAGradsKajal SinghalAinda não há avaliações

- Name: Zubash Durrani Class: Bba 2 Roll #: 43 Subject: Economics Submmited To: Maam KhatibaDocumento7 páginasName: Zubash Durrani Class: Bba 2 Roll #: 43 Subject: Economics Submmited To: Maam KhatibaAash KhanAinda não há avaliações

- GEI Industrial Systems. CMP: Rs.138.20Documento6 páginasGEI Industrial Systems. CMP: Rs.138.20Sellappan MuthusamyAinda não há avaliações

- Marketing of ServicesDocumento8 páginasMarketing of ServicesShreya GoyalAinda não há avaliações

- Store Operations: Submitted By: Submitted To: Vipin (53) Mr. Shashank Mehra PGDRM 2A Faculty of Marketing ResearchDocumento17 páginasStore Operations: Submitted By: Submitted To: Vipin (53) Mr. Shashank Mehra PGDRM 2A Faculty of Marketing ResearchmesubbuAinda não há avaliações

- FM NotesDocumento41 páginasFM Notesarchana_anuragiAinda não há avaliações

- Market StructureDocumento60 páginasMarket StructureMonina CahiligAinda não há avaliações

- Audit Receivables ProceduresDocumento14 páginasAudit Receivables ProceduresMr.AccntngAinda não há avaliações

- MA Tutorial 2Documento6 páginasMA Tutorial 2Jia WenAinda não há avaliações