Escolar Documentos

Profissional Documentos

Cultura Documentos

Youth Banking Conference 2014

Enviado por

Tlhatlhobo Mosienyane0 notas0% acharam este documento útil (0 voto)

47 visualizações9 páginasThis document provides information about the Youth SME's Banking Conference and Exhibition 2014, including the executive summary, objectives, program of events, partners, and benefits to participating organizations. The conference aims to bring together youth entrepreneurs, financial institutions, and other stakeholders to discuss improving access to financing for youth small and medium enterprises (SMEs) in Botswana and developing sustainable financial solutions. It will feature presentations from various banks and organizations, as well as panels and discussions on challenges faced by youth SMEs and developing solutions.

Descrição original:

Proposal on the Youth SME & Banking Conference hosted in Botswana

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoThis document provides information about the Youth SME's Banking Conference and Exhibition 2014, including the executive summary, objectives, program of events, partners, and benefits to participating organizations. The conference aims to bring together youth entrepreneurs, financial institutions, and other stakeholders to discuss improving access to financing for youth small and medium enterprises (SMEs) in Botswana and developing sustainable financial solutions. It will feature presentations from various banks and organizations, as well as panels and discussions on challenges faced by youth SMEs and developing solutions.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

47 visualizações9 páginasYouth Banking Conference 2014

Enviado por

Tlhatlhobo MosienyaneThis document provides information about the Youth SME's Banking Conference and Exhibition 2014, including the executive summary, objectives, program of events, partners, and benefits to participating organizations. The conference aims to bring together youth entrepreneurs, financial institutions, and other stakeholders to discuss improving access to financing for youth small and medium enterprises (SMEs) in Botswana and developing sustainable financial solutions. It will feature presentations from various banks and organizations, as well as panels and discussions on challenges faced by youth SMEs and developing solutions.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 9

1

THE Youth SMEs

BANKING CONFERENC & EXHIBITION 2014

Contents

Executive Summery 1

About The Conference 2

Objectives 3

Programme Of Events 4

Partners 5-7

Benefts To Participating Organizations 8

Conclusion 9

1

THE Youth SMEs

BANKING CONFERENC & EXHIBITION 2014

Executive Summery

Youth unemployment has consequences for the

development of a country as a whole and Botswana

cannot aford to underutilise the asset that young

people represent. It is therefore necessary to implement

inclusion strategies such as youth entrepreneurship.

The 2011 Population and Housing Census indicated that,

of the total population of 2 024 904 persons, 43% of the

population was aged below 20 years, while 35% was aged

between 20 to 40 years. Furthermore an estimated 38%

of Botswanas population falls within the 15 35 years

age category. This translates to approximately 806 500

young people. Young people today face unprecedented

socio economic challenges with unemployment

topping the list, having gainful employment and an

active participation in the main stream economy is

indeed the key ingredient in curbing and eradicating a

majority of the said challenges. According to the Global

Entrepreneurship Monitor (GEM) of 2012, 76% of young

Batswana would like to set up their own business.

However young people lack funding opportunities as

well sustainable banking options. Banking and cash fow

is an important part of doing business, but if the cost of

opening the bank account is not afordable to youth

or if the balance required to maintain that account is

huge, it becomes impossible for youth to have business

accounts. Furthermore young people are easily put of by

the documentation procedures and information required

by many commercial lenders of credit. Particularly funds

requiring less or no collaterals but that charge very

high interest rates and fees often have more complex

documentation procedures. Another problem is the time

needed to decide on an application for funding. Thus,

improving access to fnance is primordial.

To overcome these barriers, a youth-friendly regulatory

environment that recognizes the needs of youth, and

is both inclusive and protective of youth is essential.

Increased access to fnancial services and increased

fnancial capability to use those services efectively to

invest in their education, enterprises, and futures may

provide that beacon. Financial education and

entrepreneurship development can also assist youth

in taking greatest advantage of the fnancial services

available. Government policies and incentives can help

stimulate the fnancial sector to design appropriate

fnancial products as well as innovative banking

solutions. Achieving successful youth fnancial inclusion

requires a multi-stakeholder approach, that engages

government (including policy makers, regulators, and

line ministries), Financial Service Providers (FSPs), Youth

Service Organizations (YSOs), other youth stakeholders,

as well as youth SMEs themselves. That is why Maflla

Promotions & the Botswana National Youth Council

have collaborated to provide a forum for all these

stakeholders to address these challenges in the form

of a half day conference and a mini exhibition dubbed

the Youth SMEs Banking Conference & Exhibition

2014. The theme for this years inaugural conference &

exhibition is:

Shapi ng

Yout h

SME s Vi a

Sust ai nabl e

Fi nanci al

Sol ut i ons.

2

THE Youth SMEs

BANKING CONFERENC & EXHIBITION 2014

About The Conference

The inaugural Youth SMEs Banking Conference

& Exhibition 2014 will be in the form of a half day

conference. It will bring together youth run SMEs,

government (including policy makers, regulators, and

line ministries), Financial Service Providers (FSPs),

fnancial experts, Youth Service Organizations (YSOs)

& other youth stakeholders. The theme is Shaping

Youth SMEs Via Sustainable Financial Solutions. The

conference will see all the banks in Botswana as well

as other Financial Service Providers (FSPs) getting a

platform to explain their product ofering particularly

for Youth Small and medium enterprises (SMEs). The

conference also seeks to devise ways to improve access

to funding by the youth given that youth fnancing is the

major impediment and discouragement to young people

starting a business. When the conference concludes at

12pm, participants will then proceed to the conference

exhibition hall where will have the diferent partner

organizations having booths. This exercise will take an

hour before the business of the day concludes.

Event date

August 7

th

2014

Event Theme

Shaping Youth SMEs Via Sustainable Financial

Solutions

Event type

Half day conference & Exhibition

Event Venue

UB Library auditorium

Guest Speaker

To Be Confrmed

Duration & Time

8am-1pm

PAX

150 delegates

Entrance Fees

Free (Participants will have to registrar prior to the event)

Organizers

BNYC

Event Managers

Maflla Promotions

Contacts

3939735

71877234 / mafpro@gmail.com

71223309 / tkmosieyane@gmail.com

3

THE Youth SMEs

BANKING CONFERENC & EXHIBITION 2014

Objectives

1. To bring youth owned enterprises & Financial Service Providers (FSPs)

under one roof to deliberate on improving banking solutions for Small

and medium enterprises (SMEs).

2. To explore the diferent SMEs banking solutions provided by the

diferent banking/fnancial institutions in Botswana.

3. To get expert analysis on the challenges faced by youth run enterprises

with regard to SME banking.

4. To get feedback from the youth on the business banking difculties

experienced when dealing with the diferent banks.

5. To come up with practical solutions and interventions to improve SME

banking in Botswana.

6. To provide a platform for diferent banking and fnancial institutions to

disseminate information on their respective SME banking solutions.

7. To establish the impact banking solutions have on SMEs.

8. To improve access to funding by SMEs.

9. Encourage FSPs to adopt industry standards of client protection and

youth-friendly products.

10. Stimulate and support the fnancial sector to design appropriate

fnancial products that are consistent with the youth business banking

needs.

11. Explore the benefts of why SMEs should join organizations that help

SMEs such as LEA & BOCCIM.

12. To ofer TAX education as well as insight on the government tendering

process to youth SMEs.

Programme Of Events

TIME (AM) ACTIVITY SPEAKER ORGANIZATION

0700-0800 Registration

0800-0810 Welcome Speech TBC BNYC

0810-0825 Presentation by LEA LEA

0825-0840 Presentation by Barclays Barclays Bank

0840-0855 Presentation by Stanbic Stanbic Bank

0855-0915 Question & Answer Session

0915-0930 Presentation by FNB FNB

09:30-0950 Presentation by guest TBC

0950-1000 Question & Answer Session

1000-1030 Morning Tea

1030-1045 Presentation by PPADB PPADB

1045-1100 Presentation by NDB NDB

1100-1115 Presentation by BIUST BIUST

1115-1130

Presentation by CEDA

CEDA

1130-1150 Question & Answer session

1150-1205 Presentation by Banc ABC Banc ABC

1205-1220

Presentation by Botswana

Stock Exchange

Botswana Stock

Exchange

1220-1230 Question & Answer Session

1230-1235 Closing Remarks Maflla Promotions

1235-1300

Participants go to

the diferent stalls of

participating institutions

1300 Lunch & Departures

5

THE Youth SMEs

BANKING CONFERENC & EXHIBITION 2014

Partners

Event Managers

Other Sponsors

6

THE Youth SMEs

BANKING CONFERENC & EXHIBITION 2014

Benefts To Participating

Organizations

The Youth SMEs Banking Conference and Exhibition 2014

represents an ideal way for our partner organizations

to reach their target audience (Youth SMEs) at a time

when they are focused on discovering what is on ofer

by the various fnancial institutions to empower their

enterprises. Whether you are looking for an opportunity

to meet and talk with prospects or just want to establish

your frm as a leader, this is an opportunity for you. No

other conference & Exhibition in Botswana ofers our

partners an intimate and more direct contact with Youth

SMEs. Other extended benefts include;

Be one of the frst partner organizations to

participate at this exciting and ground breaking

event.

By being part of the event, you will be showing

your commitment to the national agenda of youth

economic empowerment.

You put your organization in front of a select, elite

youth audience, to powerfully communicate your

companys message regarding SME banking.

Free expert analysis from the leading fnancial

expert in Botswana on how partner organizations

can create Youth friendly SMEs products and

services.

You are guaranteed of a full house which means full

exposure given that the conference is a free entry

event to all Youth SMEs.

You demonstrate your organizations willingness to

come to the table to deliberate and fnd avenues of

improving access to fnance by Youth SMEs.

To explain in detail the products and services that

your organization is ofering that are Taylor-made

for Youth SMEs.

Get positive feedback on how your organization is

welcoming to youth SMEs and how it can improve

on its faws. This will also be an opportunity to get

the latest trends from the youth and get to know

what kind of product ofering you should omit or

introduce.

Get to exhibit your products and services at the

exhibition booths after the conference to increase

brand awareness, impact sales and showcase your

corporate image.

The opportunity to mingle with these young

business people and have one on one networking

sessions at the exhibition.

The event will give you an opportunity to explore

avenues of Private Public Partnerships (PPPs) with

other partner organizations present.

You generate new contacts, and renewed interest

for your products & services.

Get a platform to garner mileage since members of

the media will be present.

Get to check out what the competition is ofering.

Government bodies/parastatals will get an

opportunity to educate and inform about the tax

process, tendering process as well as the type of

fnancing available for youth SMEs.

7

THE Youth SMEs

BANKING CONFERENC & EXHIBITION 2014

Conclusion

The Youth SMEs Banking Conference and Exhibition 2014 rThere is an

urgent need for us to focus our attention on investing in the growth and

development of young people. The labour market today gives todays

generation of young people very few employment opportunities given

the high demand, entrepreneurship has therefore become a viable

alternative for many a young man and woman in Botswana. Financial

factors as noted by the 2012 Global Entrepreneurship Monitor report on

Botswana continue to be some of the impeding factors to young people

doing business in the country. It is indeed a necessity to create and host a

platform that will address the various fnancial issues surrounding Youth

run SMEs as well as how the banking sector can actively work towards

creating youth friendly services and products. The YOUTH SMEs BANKING

CONFERENCE & EXHIBITION is such a platform that will work towards

creating meaningful dialogue in an efort to bring out meaningful solutions

that will work well towards improving youth fnancial services. We implore

you to partner with us as we move towards ensuring that our nations

young is empowered through fnancial services and products ofered in

their country. The Botswana National Youth Council has embarked on a

campaign to create 50 000 jobs by the year 2019, the conference comes

as an initiative to create a conducive fnancial services and products

environment for our nations young. We look forward to working with you

in realizing this event and in contributing to the empowerment of young

people in Botswana.

Você também pode gostar

- Cor - Indonesia PDFDocumento1 páginaCor - Indonesia PDFsyaefulAinda não há avaliações

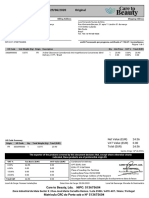

- Farnell: Please Email Your Remittance Advice ToDocumento2 páginasFarnell: Please Email Your Remittance Advice ToMohammed Mosaad LyricsAinda não há avaliações

- Sample Invoice PDFDocumento3 páginasSample Invoice PDFMarcus OlivieraaAinda não há avaliações

- Alaris InVoice Manual 3 3 1Documento136 páginasAlaris InVoice Manual 3 3 1Kristen StevensAinda não há avaliações

- Repayment Schedule Report Ac2020092465227Documento1 páginaRepayment Schedule Report Ac2020092465227Manohar ChaudharyAinda não há avaliações

- LucidChart JunioDocumento2 páginasLucidChart JunioHenry M Gutièrrez SAinda não há avaliações

- Cart Information - Reference Number: CMU0VWJYI9QDocumento2 páginasCart Information - Reference Number: CMU0VWJYI9QShashank Raj OnkarAinda não há avaliações

- OD201739914624955700 Invoice PDFDocumento3 páginasOD201739914624955700 Invoice PDFKiran N S GowdaAinda não há avaliações

- Order Invoice - Customer Sales Order MY: Contact AddressDocumento2 páginasOrder Invoice - Customer Sales Order MY: Contact AddressShahdura Hammad ThauriAinda não há avaliações

- WS Retail Services Pvt. LTD.,: Grand TotalDocumento1 páginaWS Retail Services Pvt. LTD.,: Grand TotalSurojitJanaAinda não há avaliações

- HMRC View Your Calculation - SummaryDocumento1 páginaHMRC View Your Calculation - SummaryLuca SomigliAinda não há avaliações

- 14 PayslipDocumento1 página14 PayslipSkerdi KumriaAinda não há avaliações

- June 2019Documento55 páginasJune 2019manju enterprisesAinda não há avaliações

- Notice of Assessment OriginalDocumento1 páginaNotice of Assessment OriginalWawan SaidAinda não há avaliações

- BookingReceipt IWQFVP PDFDocumento2 páginasBookingReceipt IWQFVP PDFJoseph MuroAinda não há avaliações

- In 202035125621Documento1 páginaIn 202035125621bassbngAinda não há avaliações

- Subscription InvoiceDocumento1 páginaSubscription InvoiceThabisoAinda não há avaliações

- InvoiceDocumento1 páginaInvoiceSandeep_Bharga_7849Ainda não há avaliações

- Vamsi Mobile HandsetDocumento2 páginasVamsi Mobile HandsetKayam BalajiAinda não há avaliações

- Stationary Invoice-5080 PaidDocumento2 páginasStationary Invoice-5080 PaidAnkur Agarwal100% (1)

- Statement Date: Mar 15, 2014 Billing Period Covering: Feb 16, 2014 - Mar 15, 2014Documento6 páginasStatement Date: Mar 15, 2014 Billing Period Covering: Feb 16, 2014 - Mar 15, 2014Aries BautistaAinda não há avaliações

- Komdat IP AddressDocumento12 páginasKomdat IP AddresserickstradAinda não há avaliações

- Invoice SH 44487Documento1 páginaInvoice SH 44487bonca devAinda não há avaliações

- Esfahan Badr Co, 20118476ADocumento1 páginaEsfahan Badr Co, 20118476AHamed HoseiniAinda não há avaliações

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Documento2 páginasTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)JnaniSunkavalliAinda não há avaliações

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Documento1 páginaTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Rintu DasAinda não há avaliações

- Phenomenon Consultants Inc: E/503, Borsali Apt Khanpur, Ahmedabad-380001 PH: 079-25600269Documento2 páginasPhenomenon Consultants Inc: E/503, Borsali Apt Khanpur, Ahmedabad-380001 PH: 079-25600269Murli MenonAinda não há avaliações

- Invoice Philips Trimmer PDFDocumento1 páginaInvoice Philips Trimmer PDFRahulAinda não há avaliações

- Realme 7 (Mist White, 64 GB) : Grand Total 12145.00Documento2 páginasRealme 7 (Mist White, 64 GB) : Grand Total 12145.00Sachin JaiswalAinda não há avaliações

- 1520954299311Documento1 página1520954299311AlokAinda não há avaliações

- Tax Invoice: Address: B-315, Shree Nand Dham, Sector-11, Plot.59, CBD Belapur, Navi Mumbai - 400614, MaharashtraDocumento1 páginaTax Invoice: Address: B-315, Shree Nand Dham, Sector-11, Plot.59, CBD Belapur, Navi Mumbai - 400614, MaharashtraSHANTANU PATHAKAinda não há avaliações

- Application FormDocumento3 páginasApplication FormIbrahim El AminAinda não há avaliações

- Expedia Payment PDFDocumento1 páginaExpedia Payment PDFJohan WiebeAinda não há avaliações

- GRNPrintDocumento2 páginasGRNPrintshambhu_das29Ainda não há avaliações

- 86891341504022020Documento2 páginas86891341504022020AVINASH KUMARAinda não há avaliações

- InvoiceDocumento1 páginaInvoiceraamanAinda não há avaliações

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocumento1 páginaBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountSudesh SharmaAinda não há avaliações

- WS Retail Services Pvt. LTD.,: Grand TotalDocumento1 páginaWS Retail Services Pvt. LTD.,: Grand TotalMaximAinda não há avaliações

- ShipmentReceipt 2594143506Documento1 páginaShipmentReceipt 2594143506Abdullah Al MamunAinda não há avaliações

- Certificate of Insurance: Fleet LeasingDocumento1 páginaCertificate of Insurance: Fleet LeasingghulammustafaAinda não há avaliações

- Assignment 2 - Invoice Assignment InvoiceDocumento3 páginasAssignment 2 - Invoice Assignment Invoiceapi-507334562Ainda não há avaliações

- Invoice OD000849213519917100Documento2 páginasInvoice OD000849213519917100Sanjeevan VohraAinda não há avaliações

- Pro Forma InvoiceDocumento2 páginasPro Forma Invoicemaksymandreev89Ainda não há avaliações

- PHC Invoice 800025154 800015923 PDFDocumento1 páginaPHC Invoice 800025154 800015923 PDFAnáliaFernando NunesAinda não há avaliações

- .BD & . Domain InvoiceDocumento3 páginas.BD & . Domain InvoiceBWEB SOLUTIONSAinda não há avaliações

- Invoice: Sense Connect IT PVT LTDDocumento1 páginaInvoice: Sense Connect IT PVT LTDchiranjevi rajaAinda não há avaliações

- 9202532311013275Documento2 páginas9202532311013275arjunkhareAinda não há avaliações

- Invoice OD40426072810Documento2 páginasInvoice OD40426072810war10ckjupiAinda não há avaliações

- Invoice Report For Cooley Law FirmDocumento1 páginaInvoice Report For Cooley Law FirminforumdocsAinda não há avaliações

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Documento1 páginaTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)huzefa slatewalaAinda não há avaliações

- Shipment Invoice & Packing List (B6SW-3302C, 2016.07.19Documento7 páginasShipment Invoice & Packing List (B6SW-3302C, 2016.07.197992 B Ashutosh NagarAinda não há avaliações

- Invoice Email42148307Documento2 páginasInvoice Email42148307hord72Ainda não há avaliações

- V4C SMS InvoiceDocumento1 páginaV4C SMS Invoiceaasimshaikh111Ainda não há avaliações

- Invoice: Invoice Address Delivery AddressDocumento5 páginasInvoice: Invoice Address Delivery AddressOnkar PotdarAinda não há avaliações

- Wa0000Documento1 páginaWa0000Sainath ReddyAinda não há avaliações

- Invoice #: Payment OptionsDocumento1 páginaInvoice #: Payment OptionsAustin SalsburyAinda não há avaliações

- Change of Sponsor Release FormDocumento1 páginaChange of Sponsor Release FormMoya MeiteiAinda não há avaliações

- Remarks by YEDF CEO Ms. CATHERINE NAMUYE at YALDA International ConfrenceDocumento11 páginasRemarks by YEDF CEO Ms. CATHERINE NAMUYE at YALDA International ConfrenceYouth Enterprise Development FundAinda não há avaliações

- 86-Article Text-432437-1-10-20180311Documento13 páginas86-Article Text-432437-1-10-20180311Bin SaadunAinda não há avaliações

- The Innovation Toolkit 2: The Innovation Toolkit, #2No EverandThe Innovation Toolkit 2: The Innovation Toolkit, #2Ainda não há avaliações

- 18th DDWP Meeting Minutes (ACS LEVEL)Documento31 páginas18th DDWP Meeting Minutes (ACS LEVEL)qazalbash1109588Ainda não há avaliações

- 1997 - Shaughnessy 1997Documento17 páginas1997 - Shaughnessy 1997Nathalia Morgado HdzAinda não há avaliações

- 2019-2020 Grading PolicyDocumento2 páginas2019-2020 Grading Policydior whoreAinda não há avaliações

- Literature Review of School (Case Study)Documento25 páginasLiterature Review of School (Case Study)Prashna ShresthaAinda não há avaliações

- Fellowship Programme - Terms and ConditionsDocumento4 páginasFellowship Programme - Terms and ConditionsArifatul KhoridaAinda não há avaliações

- Agmus Research Symp Call For Abstract 2016Documento2 páginasAgmus Research Symp Call For Abstract 2016Natural SciencesAinda não há avaliações

- Prospectus: FOR Short Term Educational CoursesDocumento15 páginasProspectus: FOR Short Term Educational CoursesShabbir AnjumAinda não há avaliações

- Kindergarten Worksheets: Quarter 4Documento25 páginasKindergarten Worksheets: Quarter 4JOY LUBAYAinda não há avaliações

- Sses Contingency Plan For TyphoonDocumento6 páginasSses Contingency Plan For TyphoonGirlie Ann A MarquezAinda não há avaliações

- Resume Preya Del MundoDocumento3 páginasResume Preya Del MundoPrecious Del mundoAinda não há avaliações

- NIFT MFM Question PaperDocumento60 páginasNIFT MFM Question PaperAbhishek SinghalAinda não há avaliações

- Myers Briggs Personality TraitsDocumento30 páginasMyers Briggs Personality Traitsnegreibs100% (2)

- Siwes ReportDocumento19 páginasSiwes ReportBukola OdebunmiAinda não há avaliações

- ICT Policies: Roadmap For ICT IntegrationDocumento16 páginasICT Policies: Roadmap For ICT IntegrationyoonglespianoAinda não há avaliações

- Foundations of Curriculum DevelopmentDocumento17 páginasFoundations of Curriculum DevelopmentNikki Mae ConcepcionAinda não há avaliações

- SubconsciousDocumento24 páginasSubconsciousOVVCMOULIAinda não há avaliações

- Learn Swift Programming by Examples SampleDocumento31 páginasLearn Swift Programming by Examples SampleAxyAinda não há avaliações

- Narrative Research: July 2020Documento14 páginasNarrative Research: July 2020musawar420Ainda não há avaliações

- Instant Download First Course in Probability 10th Edition Ross Solutions Manual PDF Full ChapterDocumento32 páginasInstant Download First Course in Probability 10th Edition Ross Solutions Manual PDF Full ChapterGailLarsennqfb100% (9)

- Handbook For Enhancing Professional Practice - Chapter 1 - EvidenceDocumento12 páginasHandbook For Enhancing Professional Practice - Chapter 1 - EvidenceAdvanceIllinois100% (1)

- Rajans Dental College & Hospital: Attempt CertificateDocumento1 páginaRajans Dental College & Hospital: Attempt CertificateSaurabh KumarAinda não há avaliações

- Practical Research 2 Complete GuideDocumento30 páginasPractical Research 2 Complete GuideShobe PatigayonAinda não há avaliações

- Journal NkoDocumento49 páginasJournal NkoRimarkZanoriaAinda não há avaliações

- SuyatnoDocumento10 páginasSuyatnoREFANAWUAinda não há avaliações

- Ecocriticism Essay - The Search For NatureDocumento7 páginasEcocriticism Essay - The Search For NatureemmyjayneAinda não há avaliações

- Lesson Study SystemDocumento107 páginasLesson Study Systemmarco medurandaAinda não há avaliações

- Los Temperamentos y Las Artes Magda Lissau PDFDocumento221 páginasLos Temperamentos y Las Artes Magda Lissau PDFAni Arredondo100% (1)

- AY23S1 BM4401 Collaborative Meeting Presentation Guide - ST (Accept) - 5juneDocumento8 páginasAY23S1 BM4401 Collaborative Meeting Presentation Guide - ST (Accept) - 5juneTan ChingAinda não há avaliações

- Extended Lesson Plan: Class ProfileDocumento4 páginasExtended Lesson Plan: Class Profileapi-544209102Ainda não há avaliações

- 5th GRD Citizenship LessonDocumento2 páginas5th GRD Citizenship Lessonapi-242270654Ainda não há avaliações