Escolar Documentos

Profissional Documentos

Cultura Documentos

Unit 4 Nbfcs Meaning

Enviado por

sadathnooriTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Unit 4 Nbfcs Meaning

Enviado por

sadathnooriDireitos autorais:

Formatos disponíveis

UNIT 4

NBFCs

Meaning

Non-banking Financial Companies (NBFCs) play a vital role in the context of Indian Economy.

NBFCs are the intermediaries engaged in the business of accepting deposits and delivering

credit. A non-banking financial company is a company registered under the Companies Act,

1956 and is engaged in the business of loans and advances, acquisition of

shares/stock/bonds/debentures/securities issued by government or local authority or other

securities of like marketable nature, leasing, hire-purchase, insurance business, chit business, but

does not include any institution whose principal business is that of agriculture activity, industrial

activity, sale/purchase/construction of immovable property.

DEFINITION

Non banking Financial Company has been defined under section 45 I(f) of the Reserve Bank

Of India as a financial institution, which is a company; non-banking institution, which is a

company and which has its principal business the receiving of deposits under any scheme or

lending in any manner. Such other non-banking institutions, as the bank may with the previous

approval of the central government and by notification in the official gazette, specify.

Characteristics of NBFCs

1. NBFCs cannot accept demand deposits (Demand deposits are funds deposited in an

institution, that are payable immediately on demand e.g.: Savings account, Current

account etc).

2. A NBFC cannot issue cheques, to their customers and is not a part of the payment and

settlement system.

3. Deposit insurance facility of Deposit Insurance Credit Guarantee Corporation (DICGC) is

not available for NBFC depositors.

4. They are allowed to accept/renew public deposits for a minimum period of 12 months

and maximum period of 60 months.

5. They cannot offer interest rates higher than the ceiling rate prescribed by RBI from time

to time.

6. They cannot offer gifts/incentives or any other additional benefit to the depositors.

7. They should have minimum investment grade credit rating, from the credit rating

agencies.

Classification or Types of NBFCs

NBFCs can be classified into different segments depending on the type of activities they

undertake:

1. Hire-Purchase Company- It is a company which carries on as its principal business, hire

purchase transaction or the financing of such transactions.

2. Investment Company-It means any company which carries on as its principal business

the acquisition of securities.

3. Loan Company- It is a company which carries on as its principal business, the providing

of finance whether by making loans or advances or otherwise for any activity other than

its own.

4. Mutual Benefit Finance Company- It means any company which is notified by the

central government under section 620A of the Companies Act, 1956.

5. Equipment Leasing Company-It is a company which carries on as its principal

business, the business of leasing of equipments or the financing of such activity.

6. Residuary Non-banking Company- It is a company which receives deposits under any

scheme by way of subscriptions/ contributions and does not fall in any of the above

categories. E.g. Sahara Mutual Fund was the first RNBC started in India.

7. Miscellaneous Non- banking Company- It is a company which collects from specified

number of subscribers periodically and in turn distributes the same as prizes amongst

them. Any other form of chit is also included in this category.

8. Housing Finance Company- It is a company which carries on as its principal business,

the financing of the acquisition or construction of houses including the acquisition or

development of plots of land for construction of houses.

Re-classification of NBFCs

From December 6, 2006 NBFCs registered with RBI have been re-classified as

1. Asset finance Companies (AFC) AFC are financial institutions whose principal

business is of financing physical assets such as automobiles, tractors, construction

equipments material handling equipments and other machines. E.g.: Bajaj Auto Finance

corp. , Fullerton India etc

2. Investment Companies (IC) ICs generally are involved in the business of shares,

stocks, bonds, debentures issued by government or local authority that are marketable in

nature. E.g.: Stock Broking Companies, Gilt firms.

3. Loan Companies (LC) LCs are loan giving companies which operate in the business

of providing loans. These can be housing loans, gold loans etc. E.g.: Mannapuram Gold

Finance,

Regulations on NBFCs

1. All NBFCs are not entitled to accept public deposits. Only those NBFCs holding a valid

certificate of registration with authorization to accept public deposits can accept/hold

public

deposits.

2. New NBFCs are not allowed to raise public deposits for period of two years from the date

of registration. After completion of two years, detailed review is taken of the company by

the regulator.

3. The NBFCs are allowed to accept/renew public deposits for a minimum period of 12

months and maximum period of 60 months. They cannot accept deposits repayable on

demand.

4. NBFCs cannot offer interest rates higher than the ceiling rate prescribed by RBI from

time to time. The present ceiling is 12.5 percent per annum. The interest may be paid or

compounded at rests not shorter than monthly rests.

5. NBFCs cannot accept deposits from NRI

6. NBFCs with net owned fund (NOF) of less than Rs. 25 lakhs (with or without credit

rating) are not entitled to accept public deposits.

7. Evaluation of the quality of management in respect of the promoters/directors is taken

into consideration while giving allowance for taking public deposits.

Contribution of NBFCs in the economy of India

1. Development of sectors like Transport & Infrastructure

2. Substantial employment generation

3. Help & increase wealth creation

4. Broad base economic development

5. Irreplaceable supplement to bank credit in rural segments

6. Major thrust on semi-urban, rural areas & first time buyers / users

7. To finance economically weaker sections

8. Huge contribution to the State exchequer

Role of NBFCS: A critical review of working of NBFCs

A robust banking and financial sector is critical for activating the economy and facilitating

higher economic growth. Financial intermediaries like NBFCs have a definite and very important

role in the financial sector, particularly in a developing economy like ours. They are a vital link

in the system.

After the proliferation phase of 1980s and early 90s, the NBFCs witnessed consolidation and

now the number of NBFCs eligible to accept deposits is around 600, down from 40000 in early

1990s. The number of asset financing NBFCs would be even lower, around 350, the rest are

investment and loan companies. Almost 90% of the asset financing NBFCs are engaged in

financing transportation equipments and the balance are in financing equipments for

infrastructure projects. Therefore, the role of non-banking sector in both manufacturing and

services sector is significant and they play the role of an intermediary by facilitating the flow of

credit to end consumers particularly in transportation, SMEs and other unorganized sectors.

The role of NBFCs in creation of productive national assets can hardly be undermined. This is

more than evident from the fact that most of the developed economies in the world have relied

heavily on lease finance route in their developmental process, e.g., lease penetration for asset

creation in the US is as high as 30% as against 3-4% in India. A conducive and enabling

environment has been created for the NBFC industry globally, which has helped it grow and

become an essential part of the financial sector for accelerated economic growth of the countries.

This is not the case in our country. It is, therefore, obvious that the development process of the

Indian economy shall have to include NBFCs as one of its major constituents with a very

significant role to play.

NBFCs, as an entity, play a very useful role in channelising funds towards acquisition of

commercial vehicles and consequently, aid in the development of the road transport industry.

Needless to mention, the road transport sector accounts for nearly 70% of goods movement and

80% of passenger movement across the length and breadth of the country and the role of NBFCs

in the growth and development of this sector has been historically acknowledged by several

committees set up by the Government and RBI, over the years.

NBFCs play a crucial and prominent role in the rural and social sectors of the economy by

providing finance for the acquisition of trucks, buses and tractors, which operate mainly in rural

and semi-urban India. In fact, our exposure to the rural / social sectors is direct and pronounced,

since financing for acquisition of vehicles provides a spin-off benefit by creating jobs and

opportunities in the rural parts of our country.

With the economic revival pegged to the development of the rural and suburban economies,

NBFCs role in deposit mobilisation and credit extension can hardly be over-emphasized. Given

Indias large unorganized markets, there is a huge demand for unsecured credit in areas where

banks do not have adequate reach. NBFCs fill this gap. Specialising in funding sectors where

there is a credit gap, the core strengths of NBFCs lie in their strong customer relationships,

excellent understanding of regional dynamics, well-developed collection systems, and

personalised services. These institutions play a crucial role in extending credit to the countryside,

thus preventing the concentration of credit risk in banks. In urban areas too, NBFCs focus on

segments neglected by banks-non-salaried individuals, traders, transporters and stock brokers.

These institutions are also instrumental in generating substantial employment in these regions.

In the past decade, NBFCs have played an important role in the expansion of the consumer

durables, housing and transport sectors. The industry is now witnessing a paradigm shift, as

competition is eating into the retail finance space, which has been traditionally dominated by

NBFCs. As the traditional boundaries between different financial intermediaries blur, market

participants are merging to increase their size and reach, while distributing risk over the large

base in an attempt to survive. According to the latest available numbers, registered NBFCs

declined from more than 13,000 in 2006 to 12,809 in June 2008. The number of deposit-taking

NBFCs also decreased to 364 in 2008 from over 450 in 2007

Conclusion

NBFCs are gaining momentum in last few decades with wide variety of products and services.

NBFCs collect public funds and provide loan able funds. There has been significant increase in

such companies since 1990s. They are playing a vital role in the development financial system of

our country. The banking sector is financing only 40 per cent to the trading sector and rest is

coming from the NBFC and private money lenders. At the same line 50 per cent of the credit

requirement of the manufacturing is provided by NBFCs. 65 per cent of the private construction

activities was also financed by NBFCs. Now they are also financing second hand vehicles.

NBFCs can play a significant role in channelizing the remittance from abroad to states such as

Gujarat and Kerala.

NBFCs in India have become prominent in a wide range of activities like hire purchase finance,

equipment lease finance, loans, investments, and so on. NBFCs have greater reach and flexibility

in tapping resources. Many of the NBFCs have ventured into the domain of mutual funds and

insurance. NBFCs undertake both life and general insurance business as joint venture

participants in insurance companies. The strong NBFCs have successfully emerged as Financial

Institutions in short span of time and are in the process of converting themselves into Financial

Super Market. The NBFCs are taking initiatives to establish a self-regulatory organization

(SRO). At present, NBFCs are represented by the Association of Leasing and Financial Services

(ALFS), Federation of India Hire Purchase Association (FIHPA) and Equipment Leasing

Association of India (ELA). The Reserve Bank wants these three industry bodies to come

together under one roof. The Reserve Bank has emphasis on formation of SRO Particularly for

the benefit of smaller NBFCs. Thus to conclude in the view of above NBFCs play an important

role in economic development.

HIRE PURCHASE

HP is a method of selling goods, goods are let out on hire by a finance company (creditor) to the hirer.

The buyer is required to pay an agreed amount in periodical installments during a given period. The

ownership of the property remains with creditor and passes on to hirer on the payment of last installment.

FEATURES OF HIRE PURCHASE AGREEMENT

1. The buyer takes possession of goods immediately and agrees to pay the total hire purchase price

in installments.

2. Each installment is treated as hire charges.

3. The ownership of the goods passes from buyer to seller on the payment of the installment.

4. In case the buyer makes any default in the payment of any installment the seller has right to re

posses the goods from the buyer and forfeit the amount already received treating it as hire charge.

5. The hirer has the right to terminate the agreement any time before the property passes, he has the

option to return the goods in which case he need not pay installments falling due thereafter.

6. However, he can not recover the sums already paid as such sums legally represent hire charge on

the goods in question.

7. The hire Purchase Act, 1972 defines HP agreement as an agreement under which goods are let on

hire hirer has an option to purchase them according to the terms of agreement under which:

8. Payment is to be made in installments over a specified period.

9. The possession is delivered to the hirer at the time of entering into a contract.

10. The property passes to the hirer on payment of the last installment.

11. Each installment is treated as hire charge & if default is made in payment of installment, the seller

is entitled to take away the goods.

12. The hirer/purchaser is free to return the goods without being required to pay any further

installments falling due after the return.

Hire Purchase Agreement

Is the agreement in writing and signed by both parties incorporating

1. The description of goods in a manner sufficient to identify them.

2. The hire purchase price of the goods.

3. The date of commencement of the agreement.

4. The number of installments in which hire purchase price is to be paid, the amount, and due

date.

5. Higher purchase transaction is different from credit sale. In case of sale ownership and

possession is transferred to the purchaser simultaneously, in hire purchase, the ownership

remains with the seller until last installment is paid.

Particulars Leasing Hire Purchase

Ownership The ownership remains with the lessor

throughout and the lessee (hirer) has no

option to purchase the goods.

The ownership remains with the buyer &

the title is passed on to hirer once he

pays last installment.

Method of

Financing

Leasing is a method of financing business

assets .

Hire purchase is a method of financing

both business assets and consumer

articles.

Depreciation depreciation and investment allowance can

not be claimed by the lessee.

deprecation and investment allowance

can be claimed by the hirer.

Tax Benefits The entire lease rental is tax deductible

expense

Only the interest component of the hire

purchase installment is tax deductible.

Salvage Value The lessee, not being the owner of the asset,

does not enjoy the salvage value of the

asset.

The hirer, in purchase, being the owner

of the asset, enjoys salvage value of the

asset.

Deposit Lessee is not required to make any deposit 20% deposit is required in hire purchase.

Rent-Purchase With lease, we rent with hire purchase we buy the goods.

Extent of

Finance

It is 100% financing. No immediate down

payment or margin money by the lessee is

required.

Margin of 20-25 % of the cost of the

asset is to be paid by the hirer.

Maintenance In case of finance lease only, the

maintenance of leased asset is the

responsibility of the lessee.

The cost of maintenance of the hired

asset is to be borne by the hirer himself.

Reporting The leased assets are shown by way of foot

note only .

The asset on hire purchase is shown in

the balance sheet of the hirer.

NIDHI

Nidhi in the Indian context / language means treasure. However, in the Indian financial sector

it refers to any mutual benefit society notified by the Central / Union Government as a Nidhi

Company. They are created mainly for cultivating the habit of thrift and savings amongst its

members.

The companies doing Nidhi business, viz. borrowing from members and lending to members

only, are known under different names such as Nidhi, Permanent Fund, Benefit Funds, Mutual

Benefit Funds and Mutual Benefit Company.

Nidhis are more popular in South India and are highly localized single office institutions.They

are mutual benefit societies, because their dealings are restricted only to the members; and

membership is limited to individuals. The principal source of funds is the contribution from the

members. The loans are given to the members at relatively reasonable rates for purposes such as

house construction or repairs and are generally secured. The deposits mobilized by Nidhis are

not much when compared to the organized banking sector.

Regulatory framework

Nidhis are companies registered under section 620A of the Companies Act, 1956(Section 406 of

the new Companies Bill 2012, as passed by Lok Sabha) and is regulated by Ministry of

Corporate Affairs (MCA).Even though Nidhis are regulated by the provisions of the Companies

Act, 1956, they are exempted from certain provisions of the Act, as applicable to other

companies, due to limiting their operations within members.

Nidhis are also included in the definition of Non- Banking Financial companies or (NBFCs)

which operate mainly in the unorganized money market. However, since 1997, NBFCs have

been brought increasingly under the regulatory ambit of the Indian Central Bank, RBI. Non-

banking financial entities partially or wholly regulated by the RBI include:

1. NBFCs comprising equipment leasing (EL), hire purchase finance (HP), loan (LC),

investment (1C) (including primary dealers (PDs)) and residuary non-banking (RNBC)

companies;

2. mutual benefit financial company (MBFC), i.e. nidhi company;

3. mutual benefit company (MBC), i.e. potential nidhi company; i.e., A company which is

working on the lines of a Nidhi company but has not yet been so declared by the Central

Government; has minimum net owned fund(NOF) of Rs.10 lakh, has applied to the RBI

for certificate of registration and also to Department of Company Affairs (DCA) for

being notified as Nidhi company and has not contravened directions/ regulations of

RBI/DCA.

4. miscellaneous non-banking company (MNBC), i.e. chit fund company.

Since Nidhis come under one class of NBFCs, RBI is empowered to issue directions to them in

matters relating to their deposit acceptance activities. However, in recognition of the fact that

these Nidhis deal with their shareholder-members only,RBI has exempted the notified Nidhis

from the core provisions of the RBI Act and other directions applicable to NBFCs. As on date

(February 2013) RBI does not have any specified regulatory framework for Nidhis.

The Central Government vide Notification No.5/7/2000-CL.V dated 23rd March 2000

constituted a Committee to examine the various aspects of the functioning of Nidhi

Companies.There was no Government Notification defining the word Nidhi. Taking into

consideration the manner of functioning of Nidhis and the recommendations of the Shri

P.Sabanayagam Committee in its report and also to prevent unscrupulous persons using the word

Nidhi in their name without being incorporated by Department of Company Affairs (DCA) and

yet doing Nidhi business, the Committee suggested the following definition for Nidhis:

Nidhi is a company formed with the exclusive object of cultivating the habit of thrift, savings

and functioning for the mutual benefit of members by receiving deposits only from individuals

enrolled as members and by lending only to individuals, also enrolled as members, and which

functions as per Notification and Guidelines prescribed by the DCA. The word Nidhi shall not

form part of the name of any company, firm or individual engaged in borrowing and lending

money without incorporation by DCA and such contravention will attract penal action.

Você também pode gostar

- Banking India: Accepting Deposits for the Purpose of LendingNo EverandBanking India: Accepting Deposits for the Purpose of LendingAinda não há avaliações

- Emerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaNo EverandEmerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaAinda não há avaliações

- NBFCDocumento17 páginasNBFCsagarg94gmailcom100% (1)

- Non Banking Financial Company (NBFC) Sector in India - Trends, Regulatory Issues and Way ForwardDocumento13 páginasNon Banking Financial Company (NBFC) Sector in India - Trends, Regulatory Issues and Way ForwardUbaid DarAinda não há avaliações

- NBFC: An OverviewDocumento38 páginasNBFC: An Overviewshaikhdilshaad123100% (1)

- Industry Profile: Non Banking Financial CompaniesDocumento77 páginasIndustry Profile: Non Banking Financial CompaniesIMAM JAVOORAinda não há avaliações

- Shriram Finace Sip ReportDocumento64 páginasShriram Finace Sip Reportshiv khillari75% (4)

- BBI FinalDocumento25 páginasBBI FinalVarsha ParabAinda não há avaliações

- Non-Banking Financial CompaniesDocumento25 páginasNon-Banking Financial CompaniesbboysupremoAinda não há avaliações

- "Non-Banking Finance Companies": Presented by Riddhi Ashar Liaquat Ali Manmeet KaurDocumento19 páginas"Non-Banking Finance Companies": Presented by Riddhi Ashar Liaquat Ali Manmeet KaurRohit AggarwalAinda não há avaliações

- NBFC Module 2 CompletedDocumento27 páginasNBFC Module 2 CompletedAneesha AkhilAinda não há avaliações

- Non Banking Financial Company (NBFC) Sector in India - Trends, Regulatory Issues and Way ForwardDocumento13 páginasNon Banking Financial Company (NBFC) Sector in India - Trends, Regulatory Issues and Way Forwardshubham moonAinda não há avaliações

- Banking and Finance Project Report On Non-Banking Finance Companies (NBFC) : Latest Trends and Development in IndiaDocumento20 páginasBanking and Finance Project Report On Non-Banking Finance Companies (NBFC) : Latest Trends and Development in Indiaparamitabiswas05Ainda não há avaliações

- Vishakha Black Book ProjectDocumento48 páginasVishakha Black Book ProjectrohitAinda não há avaliações

- NBFC-L&T Finance: Group MembersDocumento29 páginasNBFC-L&T Finance: Group Membershayden28Ainda não há avaliações

- NBFCDocumento3 páginasNBFCvarsha_sky24Ainda não há avaliações

- Sakshis Project PDFDocumento58 páginasSakshis Project PDFSams MadhaniAinda não há avaliações

- Non Banking Financial InstitutionsDocumento18 páginasNon Banking Financial InstitutionsNimesh Shah100% (1)

- My ProjectDocumento74 páginasMy Project..... ShahidAinda não há avaliações

- NBFC in IndaDocumento26 páginasNBFC in Indajuvi_kAinda não há avaliações

- Chapter 1 On NBFCDocumento16 páginasChapter 1 On NBFCpoojasambrekarAinda não há avaliações

- NBFCDocumento20 páginasNBFCVipul Sah100% (1)

- Banks Vs NBFCDocumento6 páginasBanks Vs NBFCNidhi Nikhil GoyalAinda não há avaliações

- Blackbook FinalDocumento86 páginasBlackbook Finalgunesh somayaAinda não há avaliações

- Mbfs NotesDocumento2 páginasMbfs NotesPougajendy SadasivameAinda não há avaliações

- Executive SummaryDocumento7 páginasExecutive SummaryHirdayraj Saroj100% (1)

- Non Banking Financial InstitutionsDocumento10 páginasNon Banking Financial InstitutionsPal MarfatiaAinda não há avaliações

- NBFC NotesDocumento2 páginasNBFC NotesHemavathy Gunaseelan100% (1)

- PPT of NBFC SDocumento56 páginasPPT of NBFC Sfm949Ainda não há avaliações

- Sneha NBFC MbaDocumento20 páginasSneha NBFC Mbashreestationery2016Ainda não há avaliações

- Regulation of Non Banking Financial Companies in India. A Critical Analysis of Its Role in Economic DevelopmentDocumento25 páginasRegulation of Non Banking Financial Companies in India. A Critical Analysis of Its Role in Economic DevelopmentGautam SahaAinda não há avaliações

- Magma Project ReportDocumento39 páginasMagma Project Report983858nandini80% (5)

- Role of NBFC in Indian Financial MarketDocumento40 páginasRole of NBFC in Indian Financial MarketPranav Vira100% (1)

- N - B F C: ON Anking Inancial OmpaniesDocumento25 páginasN - B F C: ON Anking Inancial OmpaniesShoaib Qadri Razvi AmjadiAinda não há avaliações

- 188lic of India NewDocumento99 páginas188lic of India Newpriyanka1591Ainda não há avaliações

- Dessertation Report On NBFCDocumento65 páginasDessertation Report On NBFCHarsh ChaudharyAinda não há avaliações

- UntitledDocumento16 páginasUntitledಲೋಕೇಶ್ ಎಂ ಗೌಡAinda não há avaliações

- General Knowledge Today: Last Updated: April 17, 2016 Published By: Gktoday - in Gktoday © 2017 - All Rights ReservedDocumento7 páginasGeneral Knowledge Today: Last Updated: April 17, 2016 Published By: Gktoday - in Gktoday © 2017 - All Rights ReservedNaga ChandraAinda não há avaliações

- Discuss The Recent Regulatory Changes Adopted For The Better Governance of Nbfcs in India. (Pradeeba C 215119061)Documento5 páginasDiscuss The Recent Regulatory Changes Adopted For The Better Governance of Nbfcs in India. (Pradeeba C 215119061)Pradeeba ChinnaduraiAinda não há avaliações

- Hinduja Leyland Finance LTDDocumento28 páginasHinduja Leyland Finance LTDShekhar Landage100% (1)

- Analysis of Role of Reserve Bank of India and The Banking Sector in IndiaDocumento13 páginasAnalysis of Role of Reserve Bank of India and The Banking Sector in IndiaAnkit BohraAinda não há avaliações

- All About NBFC'SDocumento3 páginasAll About NBFC'SGayatri JoshiAinda não há avaliações

- Muthoot Finance ReportDocumento10 páginasMuthoot Finance ReportNaveenAinda não há avaliações

- Shraddha ProjectDocumento70 páginasShraddha ProjectAkshay Harekar50% (2)

- Non-Banking Financial InstitutionsDocumento4 páginasNon-Banking Financial Institutionscool_vardahAinda não há avaliações

- Non-Banking Financial Companies (NBFCS) : Project byDocumento25 páginasNon-Banking Financial Companies (NBFCS) : Project byBhupen YadavAinda não há avaliações

- 08 Chapter 01Documento44 páginas08 Chapter 01anwari risalathAinda não há avaliações

- 03 - IntroductionDocumento50 páginas03 - IntroductionVirendra JhaAinda não há avaliações

- A Study On Financial Performance Analysis of The Sundaram Finance LTDDocumento56 páginasA Study On Financial Performance Analysis of The Sundaram Finance LTDSindhuja Venkatapathy88% (8)

- Overview of Indian Financial System:Non Banking Finance Companies (NBFCS)Documento12 páginasOverview of Indian Financial System:Non Banking Finance Companies (NBFCS)Neena TomyAinda não há avaliações

- NBFC-2Documento18 páginasNBFC-2nishiAinda não há avaliações

- A Study On Financial Performance Analysis of Sundaram Finance LimitedDocumento56 páginasA Study On Financial Performance Analysis of Sundaram Finance LimitedAnonymous lOz8e6tl0Ainda não há avaliações

- Non-Banking Financial Companies (NBFCS) : Reserve Bank of India (Rbi) Reserve Bank of India Act, 1934 DirectionsDocumento3 páginasNon-Banking Financial Companies (NBFCS) : Reserve Bank of India (Rbi) Reserve Bank of India Act, 1934 DirectionsDeep DograAinda não há avaliações

- (51,52) SEBI Controlled NBFCsDocumento43 páginas(51,52) SEBI Controlled NBFCsYadwinder SinghAinda não há avaliações

- NBFCDocumento12 páginasNBFCDeepakAinda não há avaliações

- Guidance Note on State-Owned Enterprise Reform for Nonsovereign and One ADB ProjectsNo EverandGuidance Note on State-Owned Enterprise Reform for Nonsovereign and One ADB ProjectsAinda não há avaliações

- Bonds Decoded: Unraveling the Mystery Behind Bond MarketsNo EverandBonds Decoded: Unraveling the Mystery Behind Bond MarketsAinda não há avaliações

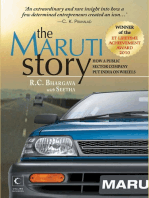

- The Maruti Story: How A Public Sector Company Put India On WheelsNo EverandThe Maruti Story: How A Public Sector Company Put India On WheelsNota: 3 de 5 estrelas3/5 (1)

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Ainda não há avaliações

- Prov List 11Documento23 páginasProv List 11sadathnooriAinda não há avaliações

- Section B Questions and Answers. Each Question Carries 5 Marks 1. Distinguish Between Accounting and Auditing. (2012, 2013)Documento8 páginasSection B Questions and Answers. Each Question Carries 5 Marks 1. Distinguish Between Accounting and Auditing. (2012, 2013)sadathnooriAinda não há avaliações

- Pá Éãdä Pàët E ÁséDocumento4 páginasPá Éãdä Pàët E ÁsésadathnooriAinda não há avaliações

- Deductions On Section 80CDocumento8 páginasDeductions On Section 80CsadathnooriAinda não há avaliações

- BNP Paribas Bank DetailsDocumento1 páginaBNP Paribas Bank DetailssadathnooriAinda não há avaliações

- Business Environment Question Bank With AnswersDocumento11 páginasBusiness Environment Question Bank With Answerssadathnoori75% (4)

- To TB JayachandraDocumento1 páginaTo TB JayachandrasadathnooriAinda não há avaliações

- CoinsDocumento2 páginasCoinssadathnooriAinda não há avaliações

- Capital Market..........Documento10 páginasCapital Market..........sadathnooriAinda não há avaliações

- DOD Penalty Reversal Latter.Documento2 páginasDOD Penalty Reversal Latter.sadathnooriAinda não há avaliações

- 99 Benefits of Reciting The Most Beautiful Names of AllahDocumento14 páginas99 Benefits of Reciting The Most Beautiful Names of AllahJon JayAinda não há avaliações

- 1Documento3 páginas1sadathnooriAinda não há avaliações

- Sub:Statement of Diesel Bill: Date Indent HSD in Ltrs Bill No Rate, Rs AmountDocumento16 páginasSub:Statement of Diesel Bill: Date Indent HSD in Ltrs Bill No Rate, Rs AmountsadathnooriAinda não há avaliações

- Tax RatesDocumento2 páginasTax RatessadathnooriAinda não há avaliações

- ªàiá£Àågé, «Μàaiàä:-°Auàgádä Ja§ «Záåyðaiàä «ΜàaiàäDocumento3 páginasªàiá£Àågé, «Μàaiàä:-°Auàgádä Ja§ «Záåyðaiàä «ΜàaiàäsadathnooriAinda não há avaliações

- Business LettersDocumento16 páginasBusiness LetterssadathnooriAinda não há avaliações

- Ipo Demat...Documento4 páginasIpo Demat...sadathnooriAinda não há avaliações

- Part-A Unit-I: Business EnvironmentDocumento4 páginasPart-A Unit-I: Business EnvironmentShankar ReddyAinda não há avaliações

- Fms TestDocumento1 páginaFms TestsadathnooriAinda não há avaliações

- Business LettersDocumento16 páginasBusiness LetterssadathnooriAinda não há avaliações

- CoinsDocumento2 páginasCoinssadathnooriAinda não há avaliações

- Explain The Various NonDocumento1 páginaExplain The Various NonsadathnooriAinda não há avaliações

- Capital Market..........Documento10 páginasCapital Market..........sadathnooriAinda não há avaliações

- MbaDocumento54 páginasMbasadathnooriAinda não há avaliações

- Changing Dimensions of Indian Business-Pranati BapatDocumento7 páginasChanging Dimensions of Indian Business-Pranati Bapatdhananjay2014Ainda não há avaliações

- A Stock ExchangeDocumento1 páginaA Stock ExchangesadathnooriAinda não há avaliações

- Business LettersDocumento16 páginasBusiness LetterssadathnooriAinda não há avaliações

- HadisDocumento1 páginaHadissadathnooriAinda não há avaliações

- Pradhan Mantri JanDocumento1 páginaPradhan Mantri JansadathnooriAinda não há avaliações

- Financial Stability Review enDocumento226 páginasFinancial Stability Review enZerohedgeAinda não há avaliações

- Chapter 8 - Working CapitalDocumento4 páginasChapter 8 - Working CapitalAngelica Joy ManaoisAinda não há avaliações

- Project On Banking Sector in IndiaDocumento45 páginasProject On Banking Sector in IndiaPunit Rao77% (13)

- Press Release: YFC Projects Private LimitedDocumento6 páginasPress Release: YFC Projects Private Limitedlalit rawatAinda não há avaliações

- Inside Job 2010 BDRip XviD-DEFACEDDocumento143 páginasInside Job 2010 BDRip XviD-DEFACEDBrendan SmithAinda não há avaliações

- Topic 4 & 5 - Bond Yields and Prices (STU)Documento67 páginasTopic 4 & 5 - Bond Yields and Prices (STU)Thanh XuânAinda não há avaliações

- SPECIALIZED FABM2 Module 05 Week 05 - Statement of Changes in EquityDocumento8 páginasSPECIALIZED FABM2 Module 05 Week 05 - Statement of Changes in Equitylams.ronaldsunigaAinda não há avaliações

- Financial Reporting: J. Haslam and D. ChowDocumento357 páginasFinancial Reporting: J. Haslam and D. Chowmandy YiuAinda não há avaliações

- Mex - 12141 Peso 05312023-3-082-Gimsa Automotriz-1vp-On Holding AcctDocumento6 páginasMex - 12141 Peso 05312023-3-082-Gimsa Automotriz-1vp-On Holding AcctStefan ElenoAinda não há avaliações

- Financial Statement Analysis ThesisDocumento5 páginasFinancial Statement Analysis Thesisjeanarnettrochester100% (2)

- Test Bank For Intermediate Accounting 11th Edition NikolaiDocumento21 páginasTest Bank For Intermediate Accounting 11th Edition Nikolaichoiceremit.reuiei100% (48)

- Credit Access Gramin LimitedDocumento6 páginasCredit Access Gramin LimitedNayan patidarAinda não há avaliações

- MR - Pawan Kumar: Account Details - InrDocumento2 páginasMR - Pawan Kumar: Account Details - InrAbhishek PandeyAinda não há avaliações

- Uday Reddy1Documento81 páginasUday Reddy1Hanu DonAinda não há avaliações

- Financial Accounting 4th Edition Spiceland Solutions Manual 1Documento132 páginasFinancial Accounting 4th Edition Spiceland Solutions Manual 1richard100% (34)

- Lesson 1Documento93 páginasLesson 1Trần Hữu Kỳ DuyênAinda não há avaliações

- Mode of PaymentDocumento73 páginasMode of PaymentKomal MansukhaniAinda não há avaliações

- Bba 312 Quiz 1Documento2 páginasBba 312 Quiz 1Divine DanielAinda não há avaliações

- Killinghall (Malaysia) BHD.: (Incorporated in Malaysia) Company No.: 40622-UDocumento47 páginasKillinghall (Malaysia) BHD.: (Incorporated in Malaysia) Company No.: 40622-UJonathan OngAinda não há avaliações

- Introduction To Financial ManagementDocumento24 páginasIntroduction To Financial ManagementAeris StrongAinda não há avaliações

- Financial Performance of HDFC BankDocumento51 páginasFinancial Performance of HDFC Bankabhasa50% (6)

- 000001111841513Documento3 páginas000001111841513adam sandsAinda não há avaliações

- Training Activity Matrix NEWDocumento10 páginasTraining Activity Matrix NEWKyah PengAinda não há avaliações

- Series XXII-Fixed Income Securities-Ver-May 2021Documento182 páginasSeries XXII-Fixed Income Securities-Ver-May 2021RyAinda não há avaliações

- Summer Internship 2013-14: Amity Business School, Amity University, Lucknow Campus 1Documento10 páginasSummer Internship 2013-14: Amity Business School, Amity University, Lucknow Campus 1Deepak Singh NegiAinda não há avaliações

- Deferred AnnuityDocumento13 páginasDeferred AnnuitySteven Baculanta100% (2)

- Banking - Latest Trends - New SyllabusDocumento6 páginasBanking - Latest Trends - New SyllabusNaaz AliAinda não há avaliações

- XI Revision Notes On BRSDocumento6 páginasXI Revision Notes On BRSJay muthaAinda não há avaliações

- Practical Accounting 1Documento6 páginasPractical Accounting 1Myiel AngelAinda não há avaliações

- Amendment of Application SunLifeDocumento1 páginaAmendment of Application SunLifeJevin Yao M0% (1)