Escolar Documentos

Profissional Documentos

Cultura Documentos

Financial Statement Analysis

Enviado por

HàMềmDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Financial Statement Analysis

Enviado por

HàMềmDireitos autorais:

Formatos disponíveis

HA.T.

N Page 1

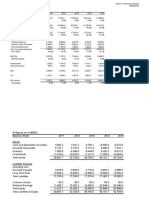

Financial Statement Analysis

Identify the Industry

Since opportunities and constraints tend to be different across industries, companies in

different industries tend to make different investment, dividend, and financing decisions.

Thus, firms in different industries exhibit different financial characteristics. These companies

have been categorized into five groups with broadly similar attributes. They are:

Financial industry

Retail industry

High technology industry

Service industry

Capital intensive industry

I. Financial Industry

1. General Characteristics

High Receivables and Payables: Because primary activities of commercial bank are

lending and borrowing money, receivable and payable figures which definitely

indicate its loans and deposits will be so much higher than other firms.

Little Inventory: Bank is the entity providing service to customer not a manufacturing

or trading concern that could have inventory.

High gross profit: Due to doing business on money, the cost of goods sold figure of

commercial bank is much lower than other industries; hence, the gross profit is

higher.

Large ratio of assets to stockholders equity: deposit always constitutes roughly 90%

of Commercial banks Capital while owners equity just makes up 10%. Therefore,

the proportion of stockholders equity to total assets is very small.

Low assets turnover ratio: Providing financial services to customers, financial

industry requires little assets than a manufacturing organization which requires large

manufacture facilities, plant and equipment.

2. Who Is Who?

The 2

nd

company will be analyzed as Commercial Banking because their index in Financial

Statements match with typical financial features described above:

High receivables (45.93) & High Payables (50.78)

High gross profit (88.89)

Equity multiplier is very high because the shareholders equity is very low compared

to other firms.

Total assets Turnover = Sales/ Total assets = 0.07 (lower than other industries)

II. Retail industry

1. General Characteristics

Inventory is always higher than others because this type of firm needs to reserve a

lot of goods for later sales retail.

HA.T.N Page 2

Receivables and Payables are approximate because retail stores usually use

deferred payments then resell for customers by collecting money later.

Small gross profit margin and large cost of goods sold because goods are bought

back from the other suppliers then resell for customers

Low return on sales, normally less than 4%, is caused by increased sales. Retail

firms have many sales transactions each day, then revenue obtained from sales is

much high; however earnings of each transaction is always small.

High Asset turnover ratios: reflect the productivity of an organizations assets. Many

retail stores have the higher ratio because they use their assets to products sales

effectively.

2. Who Is Who?

The 1

st

company will be analyzed as Retail grocery stores because their index in Financial

Statements match with typical financial features described above:

High inventory level (11.78)

Receivables and Payables are approximate (Receivables = 10.16 , Payables =

15.26)

Gross Profit Ratio is the lowest one in the Ex.4 (0.21) because its cost of goods sold

accounts for the largest percentage of sales compared to other firms.

Return on sales = Earnings before Interests and Taxes/ Sales = 0.01 = 1% < 4%

Total Assets Turnover = Sales/ Total Assets = 2.24 (highest figure in comparison with

other industries)

III. High-technology Industry

1. General Characteristics

Research and Development expenditures is the highest one among groups of

industry

High return on sales

Low debt ratio.

Net Property, Plant and Equipment is very high

Compare with the requirement, there are 3 industries belong to high-tech industry

group: Computer software, pharmaceutical preparations and semiconductor

manufacturer.

As we can see, computer software, pharmaceutical preparations and semiconductor

manufacturer have the highest R&D expenditures among 10 companies

2. Who Is Who?

The 6

th

company belongs to semiconductor manufacturing because:

High R&D expenditures (14.61%)

High return on sale (0.2%)

Low debt ratio (0.3% and 0.4%)

A lot of property, plant and equipment (factory, big machines ) because of

producing ingredients of medicines and also lots of materials to produce

semiconductor so they must have highest cost of goods sold (43.81%) and prop,

plant & equip assets (90.48%) among 3 companies.

HA.T.N Page 3

The 8

th

company is computer software because:

High gross profit because they need nothing but human force to write software

(lowest COGS 17.03%).

Computer software can be stored on virtual sever and users can buy and download

them via internet, so the cost of inventory is lowest among 3 companies (1.09%).

Because writing software do not need big complex machines or big factory, so

computer software company have lowest prop, plant and equip assets among 3

companies (8.75%)

Raw materials is the lowest (0.31%)

Specification of this industry is to have no work on the assembly line, so Work in

Progress is the lowest (0.00) among three hi-tech firms.

The 7

th

company is the remaining company among 6, 7, and 8, which belongs to

pharmaceutical preparations because:

High R&D expenditures (20.01%)

High return on sale (0.15%).

PP&E is quite high (55.18%), the second one among three firms.

Raw materials (0.59), work in progress (5.9%) and finished goods (2.58%)

Compared to Semiconductor Manufacturer, this industry usually has higher intangible

assets (9.41) because of patents, licenses related to production.

IV. Service industry:

1. Characteristics of Service industry

No or little Inventories, no raw material, no or little finished goods.

Receivables and Payables are high

Products from this industry are services; it means that there is no defined value for service.

Tangible products such as hi-tech devices, it is quite easy to identify its value basing on

quality and producing cost, while the value of services bases on the perception and

evaluation of customers. At the standpoint as financial analysts, service or trading may have

large amounts of intangible assets such as knowledge assets or a large and loyal customer

base, and, hence, have low leverage ratios because growth options can evaporate.

2. Who Is Who?

The 5

th

company belongs to mobile phone service provider because:

No inventory, raw material, works in process and finished good. It implies that this

firm operates its business in service sector

Cash is very high (35.47%) because it can collect payments for customers mobile

phone bills.

Receivables are high compared to other firms which accounts for 19.77%, while its

current liabilities are also the same with high percentage of 26.94%. The days

receivable is quite large, about 71.39 days.

HA.T.N Page 4

The 10

th

company is IT service provider because:

Main asset is intangible assets; this accounts for 61.39%, which is prominent over

the others. Normally, the intangible assets of the IT firm are brand name, intellectual

property and so on which create significant value for the firm.

Its inventory is very low, about 0.28%.

Receivables and payables of IT service firm are quite high (although other accounts

like intangible assets and capital surplus occupy very large amount, receivables and

payables still much more compared to other firms).

V. Capital intensive industry

1. General Characteristics

Require substantial amount of capital for the production of goods. Proportion of

capital involved is much higher than the proportion of labor. This is because the

industrial structure and industry type require high value investments in capital Assets.

The large amount of capital invested in these industries produce high rate of return

and this in turn leads to more capital.

High level of fixed cost, so involve higher degree of risk.

Requires large inventory. Because of high level of fixed cost and capital for

producing, so the reserves capital has to be at high volume. As a result, the volume

of inventory will be high.

Cost for producing one piece of product high, so the cost of inventory will be high.

Because inventory are not only finished goods but also materials and unfinished

good, so high cost of materials can lead to high cost of inventory.

Following to the formula: inventory turnover = Cost of good sold/ inventory; when

inventory high, so the inventory turnover is low. Moreover, with the formula: Days

sales in inventory = 365/inventory turnover, inventory turnover low so the days sale

in inventory will be high.

Require large administrative expense. It means large capital investment for starting

up the business and to run the business as well. The benefit of capital intensive

industry is that it promises high level of productivity because the capital investments

are used to equip the industry with essential tools and high tech machinery and this

use of advanced technology raises the productivity of labor resulting in greater

output. As the capital intensity of capital intensive industries result in higher level of

productivity, these industries possess the power to generate more income and thus

more profit.

2. Who Is Who?

The 3

rd

company is Liquor producer and distributor because:

The highest raw materials (11.13%)

The highest days inventory (260.56 days)

The highest inventories (based on Exhibit 3: 20.12%)

The selling & administrative expense is ranked the 2nd position among

others (39.91%).

The 4

th

company is integrated oil & gas because:

The highest property, plant and equipment (119.29%) (Boring rig, oil filter,

factory, production line, etc.)

HA.T.N Page 5

High accumulated depreciation (66.32)

R& D Expenditures (0.32)

Raw materials (0.73) and finished goods (4.01%)

The 9

th

company is commercial airline because:

High property, plant and equipment (99.65%) for runways, variety of planes.

Deferred charges (0.00%) because customers usually book tickets as well as

pay money immediately.

No finished goods

No R&D expenditures

VI. Conclusion

1 = Retail grocery store

2 = Commercial bank

3 = Liquor producer and distributor

4 = Integrated oil and gas

5 = Mobile phone service provider

6 = Semiconductor manufacturer

7 = Pharmaceutical preparation

8 = Computer software

9 = Commercial airline

10 = IT service provider

Você também pode gostar

- Your Basic Banking Plan Account Summary: Here's What Happened in Your Account This Statement PeriodDocumento5 páginasYour Basic Banking Plan Account Summary: Here's What Happened in Your Account This Statement PeriodLao TruongAinda não há avaliações

- Wk8 Laura Martin REPORTDocumento18 páginasWk8 Laura Martin REPORTNino Chen100% (2)

- Buckeye Bank CaseDocumento7 páginasBuckeye Bank CasePulkit Mathur0% (2)

- Midland Energy Resources Case Study: FINS3625-Applied Corporate FinanceDocumento11 páginasMidland Energy Resources Case Study: FINS3625-Applied Corporate FinanceCourse Hero100% (1)

- Partnership: San Beda College of LawDocumento41 páginasPartnership: San Beda College of LawFk TnccAinda não há avaliações

- Group Assignement No. 2Documento4 páginasGroup Assignement No. 2afzaljamilAinda não há avaliações

- Sealed Air CaseDocumento5 páginasSealed Air CaseGagandeep Singh BaliAinda não há avaliações

- Starbucks Delivering Customer Service Case Solution PDFDocumento2 páginasStarbucks Delivering Customer Service Case Solution PDFRavia SharmaAinda não há avaliações

- This Study Resource WasDocumento4 páginasThis Study Resource WasRAinda não há avaliações

- CH 17Documento4 páginasCH 17HàMềm0% (1)

- The Case of The Unidentified Industries 2006Documento4 páginasThe Case of The Unidentified Industries 2006sherry1317967% (3)

- Upscale Dept Store Chain ProductsDocumento11 páginasUpscale Dept Store Chain Productslouiegoods2450% (2)

- Polyphonic HMI's Hit Song Science MarketingDocumento27 páginasPolyphonic HMI's Hit Song Science MarketingchasesunnyAinda não há avaliações

- Identify The Industry Analysis of Financial Statement DataDocumento3 páginasIdentify The Industry Analysis of Financial Statement DataJIAXUAN WANGAinda não há avaliações

- Sealed Air Case CommentsDocumento5 páginasSealed Air Case CommentsAshish AgarwalAinda não há avaliações

- Sealed AirDocumento6 páginasSealed AirAmitrajit SettAinda não há avaliações

- Management AgreementDocumento6 páginasManagement AgreementButch KhanAinda não há avaliações

- The Case of The Unidentified IndustriesDocumento12 páginasThe Case of The Unidentified Industriesjloup123Ainda não há avaliações

- Course: International Business Strategies ECCO. Strategic Analysis ExampleDocumento6 páginasCourse: International Business Strategies ECCO. Strategic Analysis ExampleAbdul SattarAinda não há avaliações

- Solution Manual For Auditing and Assurance Services 17th Edition Alvin A Arens Randal J Elder Mark S Beasley Chris e HoganDocumento31 páginasSolution Manual For Auditing and Assurance Services 17th Edition Alvin A Arens Randal J Elder Mark S Beasley Chris e HoganMeredithFleminggztay100% (79)

- Intel's Strategic Transition from Memory to MicroprocessorsDocumento30 páginasIntel's Strategic Transition from Memory to MicroprocessorsBappa P M BaruaAinda não há avaliações

- CM Strat YipDocumento9 páginasCM Strat Yipmeherey2kAinda não há avaliações

- The US Current Account DeficitDocumento5 páginasThe US Current Account DeficitturbolunaticsAinda não há avaliações

- Apple Case Study Competitive StrategyDocumento2 páginasApple Case Study Competitive StrategyNaman HegdeAinda não há avaliações

- Sealed Air CorporationDocumento7 páginasSealed Air CorporationMeenal MalhotraAinda não há avaliações

- Business Analysis Using Financial Statement: Boston Chicken, Inc. Case AnalysisDocumento20 páginasBusiness Analysis Using Financial Statement: Boston Chicken, Inc. Case Analysisritesh11dangoreAinda não há avaliações

- Synthes SolDocumento1 páginaSynthes SolAshish KumarAinda não há avaliações

- Financial Statement Analysis Test Bank Part 1Documento14 páginasFinancial Statement Analysis Test Bank Part 1Judith67% (9)

- Spyder Student ExcelDocumento21 páginasSpyder Student ExcelNatasha PerryAinda não há avaliações

- Saku Brewery Discusion Questions (Answers)Documento7 páginasSaku Brewery Discusion Questions (Answers)Miguel Santo AmaroAinda não há avaliações

- Adecco SA's Acquisition of Olsten CorpDocumento1 páginaAdecco SA's Acquisition of Olsten CorpBeQa Gelashvili100% (1)

- Mixing Music and Math Polyphonic HMIDocumento3 páginasMixing Music and Math Polyphonic HMIRohan RawatAinda não há avaliações

- Target Canada Paper - v3Documento33 páginasTarget Canada Paper - v3dagreenman1850% (2)

- Par Inc.Documento6 páginasPar Inc.HàMềm71% (7)

- Consumer Behaviour Towards AppleDocumento47 páginasConsumer Behaviour Towards AppleAdnan Yusufzai69% (62)

- The Case of The Unidentified IndustriesDocumento1 páginaThe Case of The Unidentified Industrieshideow82Ainda não há avaliações

- Strategic Marketing Plan for SemboniaDocumento34 páginasStrategic Marketing Plan for SemboniaTahsin IslamAinda não há avaliações

- GROUP 5: Ratios Tell A Story 2019: Assignment - 4Documento11 páginasGROUP 5: Ratios Tell A Story 2019: Assignment - 4Ritika SharmaAinda não há avaliações

- Case of Unidentified IndustriesDocumento1 páginaCase of Unidentified IndustriesGerlie BonleonAinda não há avaliações

- Pinkerton (A) - Assignment and Questions For ConsiderationDocumento1 páginaPinkerton (A) - Assignment and Questions For ConsiderationFarrah ZhaoAinda não há avaliações

- Identifying Unknown Companies from Financial StatementsDocumento1 páginaIdentifying Unknown Companies from Financial StatementsLynnard Philip Panes0% (1)

- The Unidentified Industries - Residency - CaseDocumento4 páginasThe Unidentified Industries - Residency - CaseDBAinda não há avaliações

- Ross CorpFin Casemap1Documento44 páginasRoss CorpFin Casemap1alokkuma05Ainda não há avaliações

- Ch01 5th Ed Narayanaswamy Financial AccountingDocumento20 páginasCh01 5th Ed Narayanaswamy Financial AccountingDeepti Agarwal100% (1)

- California Choppers 1Documento3 páginasCalifornia Choppers 11z2x3c4vAinda não há avaliações

- PESTEL Analysis of Mother EarthDocumento9 páginasPESTEL Analysis of Mother EarthSreyasAinda não há avaliações

- Analyse The Structure of The Personal Computer Industry Over The Last 15 YearsDocumento7 páginasAnalyse The Structure of The Personal Computer Industry Over The Last 15 Yearsdbleyzer100% (1)

- 17020841116Documento13 páginas17020841116Khushboo RajAinda não há avaliações

- Analysis Butler Lumber CompanyDocumento3 páginasAnalysis Butler Lumber CompanyRoberto LlerenaAinda não há avaliações

- Case of Unidentified IndustriesDocumento1 páginaCase of Unidentified IndustriesUmer IqbalAinda não há avaliações

- Amazon Question 2Documento1 páginaAmazon Question 2Kshitij KJ JoshiAinda não há avaliações

- Adolph Coors in The Brewing IndustryDocumento12 páginasAdolph Coors in The Brewing Industryzchanna100% (3)

- Relative Valuation Notes, Cases and Examples by Rahul KrishnaDocumento44 páginasRelative Valuation Notes, Cases and Examples by Rahul KrishnaSiddhant BanjaraAinda não há avaliações

- Barriers To ExitDocumento3 páginasBarriers To ExitSubhajit RoyAinda não há avaliações

- Note On Cola Wars Case - KiranDocumento4 páginasNote On Cola Wars Case - KiranAbhinav Tiwari100% (1)

- Alibaba, A Trailblazing Chinese Internet Giant, Will Soon Go PublicDocumento24 páginasAlibaba, A Trailblazing Chinese Internet Giant, Will Soon Go PublicHui XiuAinda não há avaliações

- Maru Betting Center Excel SheetDocumento16 páginasMaru Betting Center Excel SheetRohan ShahAinda não há avaliações

- Channel Conflict at Samsung IndiaDocumento14 páginasChannel Conflict at Samsung IndiaAkash RanjanAinda não há avaliações

- Super Project FinalDocumento29 páginasSuper Project FinalSamuel ChuquistaAinda não há avaliações

- Arauco Case DiscDocumento3 páginasArauco Case DiscoscarzurichAinda não há avaliações

- Crown Cork and Seal CompanyDocumento5 páginasCrown Cork and Seal CompanyShijin Mathew EipeAinda não há avaliações

- Tata Elxsi: Stock Pitch Presentation - Akash GedamDocumento9 páginasTata Elxsi: Stock Pitch Presentation - Akash GedamAkash GedamAinda não há avaliações

- Japan's Automakers Face Endaka: How Appreciating Yen Impacted Auto IndustryDocumento7 páginasJapan's Automakers Face Endaka: How Appreciating Yen Impacted Auto IndustryNot RealAinda não há avaliações

- Talbots Harvard Case AnsDocumento4 páginasTalbots Harvard Case AnsChristel Yeo0% (1)

- Orascom Telecom ResearchDocumento12 páginasOrascom Telecom ResearchHesham TabarAinda não há avaliações

- ARAUCO SpeechDocumento12 páginasARAUCO SpeechSpizspizAinda não há avaliações

- BAD 306-Case 1Documento8 páginasBAD 306-Case 1ritamalianAinda não há avaliações

- Industry AnalysisDocumento5 páginasIndustry Analysissaad.asifAinda não há avaliações

- The Case of The Unidentified Industries-2006 Case 1Documento6 páginasThe Case of The Unidentified Industries-2006 Case 1rohanAinda não há avaliações

- Drivers of Industry Financial Structure and Be Our GuestDocumento2 páginasDrivers of Industry Financial Structure and Be Our GuestWeishu Guo50% (4)

- C3 Evaluating Companys External EnvironmentDocumento64 páginasC3 Evaluating Companys External EnvironmentSyahid AshariAinda não há avaliações

- Specialty Toys Case Study Recommends 18,784 Unit OrderDocumento10 páginasSpecialty Toys Case Study Recommends 18,784 Unit OrderHàMềmAinda não há avaliações

- IELTS Reading Practice Test 01Documento11 páginasIELTS Reading Practice Test 01HàMềmAinda não há avaliações

- Book 1Documento1 páginaBook 1HàMềmAinda não há avaliações

- Case Study 2Documento9 páginasCase Study 2HàMềm100% (2)

- DeAnhD DHDocumento7 páginasDeAnhD DHlyly1995Ainda não há avaliações

- 19e CaseAsssignmentQuestionsTNCase 17 PDFDocumento1 página19e CaseAsssignmentQuestionsTNCase 17 PDFHàMềmAinda não há avaliações

- IPPTChap 002Documento58 páginasIPPTChap 002HàMềmAinda não há avaliações

- Business Strategy and PolicyDocumento47 páginasBusiness Strategy and PolicyHàMềmAinda não há avaliações

- 51 de Speaking Moi Va CuDocumento13 páginas51 de Speaking Moi Va CuHàMềmAinda não há avaliações

- Executive SummaryDocumento12 páginasExecutive SummaryHàMềmAinda não há avaliações

- Draft Circular Stipulating Minimum Safety Limits and RatiosDocumento5 páginasDraft Circular Stipulating Minimum Safety Limits and RatiosHàMềmAinda não há avaliações

- Accounting standards and principles in SingaporeDocumento5 páginasAccounting standards and principles in SingaporeHàMềmAinda não há avaliações

- CH 18Documento4 páginasCH 18HàMềmAinda não há avaliações

- Applications A+BDocumento1 páginaApplications A+BHàMềmAinda não há avaliações

- 2009-07-16 030945 Ex ParDocumento2 páginas2009-07-16 030945 Ex ParHàMềmAinda não há avaliações

- What ZDocumento5 páginasWhat ZHàMềmAinda não há avaliações

- Chap 001Documento52 páginasChap 001HàMềmAinda não há avaliações

- Tin 1Documento84 páginasTin 1HàMềmAinda não há avaliações

- Statistics Group3Documento36 páginasStatistics Group3HàMềmAinda não há avaliações

- Multiple Choice Questions: Answer: DDocumento41 páginasMultiple Choice Questions: Answer: Dlichelles82% (11)

- Business Plan ReportDocumento19 páginasBusiness Plan ReportHàMềmAinda não há avaliações

- ReferenceDocumento5 páginasReferenceHàMềmAinda não há avaliações

- Quiz 1 K53Documento4 páginasQuiz 1 K53HàMềmAinda não há avaliações

- A2.Abcd ThanhHaDocumento9 páginasA2.Abcd ThanhHaHàMềmAinda não há avaliações

- Perceptions and Influences of Online AdvertisingDocumento41 páginasPerceptions and Influences of Online AdvertisingHàMềmAinda não há avaliações

- Perception Towards Online Advertising & Its Influences Consumer BehaviorDocumento12 páginasPerception Towards Online Advertising & Its Influences Consumer BehaviorHàMềmAinda não há avaliações

- 1993Documento1 página1993HàMềmAinda não há avaliações

- Ey European Digital Operational Resilience DoraDocumento14 páginasEy European Digital Operational Resilience Doraphenhomenal ecommerceAinda não há avaliações

- Philippine Standards On Auditing (Psas)Documento2 páginasPhilippine Standards On Auditing (Psas)Levi Emmanuel Veloso BravoAinda não há avaliações

- (Ust-Jpia) Quiz 1 Financial Accounting and Reporting Solution ManualDocumento9 páginas(Ust-Jpia) Quiz 1 Financial Accounting and Reporting Solution ManualRENZ ALFRED ASTREROAinda não há avaliações

- 2018 Lehi PrepDocumento6 páginas2018 Lehi PrepEmilyAinda não há avaliações

- Ppe Unit-5Documento22 páginasPpe Unit-5Kalai Selvan BaskaranAinda não há avaliações

- Indus Group Profile Updated Final1Documento19 páginasIndus Group Profile Updated Final1aqsa imranAinda não há avaliações

- Sistem Informasi Operasional Apotek Berbasis Customer: Relationship Management (CRM)Documento12 páginasSistem Informasi Operasional Apotek Berbasis Customer: Relationship Management (CRM)Riza Septian Agus ArisandyAinda não há avaliações

- Barcorelube 4604Documento1 páginaBarcorelube 4604sofiaasm353Ainda não há avaliações

- Chapter Ii: Management and OrganizationDocumento6 páginasChapter Ii: Management and OrganizationBrenNan ChannelAinda não há avaliações

- Law Req.1Documento2 páginasLaw Req.1Ruhani KimpaAinda não há avaliações

- A Seminar Report OnDocumento26 páginasA Seminar Report OnPrashant SinghAinda não há avaliações

- Unit 5: Decision Making SystemDocumento11 páginasUnit 5: Decision Making SystemShreyansh JainAinda não há avaliações

- 294 Feati VS BautistaDocumento5 páginas294 Feati VS BautistaManz Edam C. JoverAinda não há avaliações

- Corporation Law ReviewerDocumento77 páginasCorporation Law ReviewerAnna Angelica AbarquezAinda não há avaliações

- DOCUMENTS DDB MudraDocumento24 páginasDOCUMENTS DDB MudraVivekAinda não há avaliações

- Ad AsDocumento17 páginasAd AsArijit DasAinda não há avaliações

- BFF 12Documento5 páginasBFF 12Maria MeranoAinda não há avaliações

- Savings Interest CalculatorDocumento7 páginasSavings Interest Calculatorعمر El KheberyAinda não há avaliações

- Chapter Eleven: Pricing StrategiesDocumento47 páginasChapter Eleven: Pricing StrategiesBhaneka CreationsAinda não há avaliações

- 2018 Equinix Analyst Day AppendixDocumento11 páginas2018 Equinix Analyst Day AppendixdushibastardoAinda não há avaliações

- 5th Schedule Disclosure Checklist for Year Ended June 30, 2013Documento9 páginas5th Schedule Disclosure Checklist for Year Ended June 30, 2013HamzaIqbalAinda não há avaliações

- Unit 2 (Income From House Property)Documento13 páginasUnit 2 (Income From House Property)Vijay GiriAinda não há avaliações