Escolar Documentos

Profissional Documentos

Cultura Documentos

MBA 504 Ch8 Solutions

Enviado por

pheeyona0 notas0% acharam este documento útil (0 voto)

115 visualizações11 páginasMBA 504 Ch8 Solutions

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoMBA 504 Ch8 Solutions

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

115 visualizações11 páginasMBA 504 Ch8 Solutions

Enviado por

pheeyonaMBA 504 Ch8 Solutions

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 11

Chapter 8

Pricing Decisions, Analyzing Customer Profitability,

and Activity-Based Pricing

QUESTIONS

1. The manager would estimate the quantity that could be sold at various prices. The

quantities would then be multiplied by the contribution margin per unit and fixed costs

would be subtracted from the total contribution margin, yielding an estimate of profit at

each price. The price that yields the highest profit is the profit maximizing price.

2. The cost-plus price is based on full cost per unit. However, to determine full cost per unit,

one must first estimate the quantity that can be sold. But the quantity that can be sold

depends on the price!

3. The target cost depends on price, and marketing staff is needed to determine product

features and price. Engineers are needed to determine efficient production methods given

the product features. And cost accountants are needed to estimate costs given the

production process. A cross functional team helps ensure good communication among

these various parties, increasing the likelihood that a product will be put into production

that can be produced for the target cost.

4. In customer profitability analysis, indirect costs are grouped into cost pools (e.g., the cost

pool related to processing fax orders, the cost pool related to processing Internet orders, the

cost pool related to shipping, etc.). The costs are then allocated to customers using various

cost drivers (allocation bases) to determine customer profitability.

5. With activity-based pricing, customers are charged for various services. For example, there

might be separate charges for delivery, for rush orders, and for returns. This way,

customers that impose high costs on a supplier will pay for the services they demand.

Jiambalvo Managerial Accounting 8-2

EXERCISES

E1. While the computers may be a commodity, the business processes used by

Bell to produce and sell computers are a source of competitive advantage.

Assuming Bell is better at these business processes than its competitors, it

may make sense to lower prices and gain market share. While Bell may be

able to generate significant profit even at lower prices, the lower prices may

be ruinous for competitors.

E2. The marketing vice-president may, in fact, be worried that some customers

really will be dropped. This will reduce sales and may have a negative effect

on his bonus (which is based on sales rather than profit). However, if no

customers are going to be dropped and prices to less profitable customers are

not going to be changed, then there is, indeed, no point in conducting the

customer profitability study.

E3. At the Web site Destination CRM, there was an article by Tom

Richenbacher on The Art of Customer Profitability Analysis.

http://www.destinationcrm.com/articles/default.asp?ArticleID=3038

According to this article, to perform customer profitability analysis,

marketing, and service, costs must be traced to individual customers. Unless

this is done, profitable customers may be lost through overpricing,

unprofitable customers won by underpricing, and unprofitable customers

subsidized by profitable ones.

In activity-based costing, indirect costs are allocated to products. In customer

profitability analysis, indirect costs are allocated to customers.

Chapter 8 Pricing Decisions, Analyzing Customer Profitability, and Activity-Based Pricing 8-3

E4.

Price Quantity

Variable

Cost

per Unit

Contribution

Margin

per Unit

Total

Contribution

Margin

Fixed

Costs Profit

6.95 20,000 1.50 5.45 109,000 80,000 29,000

5.95 25,000 1.50 4.45 111,250 80,000 31,250

4.95 32,000 1.50 3.45 110,400 80,000 30,400

A price of $5.95 yields the largest monthly profit.

E5. Accepting the order will result in $110,000 of incremental profit.

Incremental revenue

$100 x 2,000 $ 200,000

Incremental costs:

Material $25 x 2,000 $ 50,000

Labor $15 x 2,000 30,000

Variable overhead $5 x 2,000 10,000 90,000

Incremental profit $ 110,000

E6. a.

Variable cost per unit $ 50

Fixed costs per unit (100,000 1,000) 100

150

Markup of 20% 30

Price $ 180

Jiambalvo Managerial Accounting 8-4

b.

Variable cost per unit $ 50

Fixed costs per unit (100,000 500) 200

250

Markup of 20% 50

Price $ 300

c. The company will not be able to sell 500 units at a price of $300. After all,

the company could only sell 500 units at a price of $180.

E7. a. The target cost per unit is $1,600 ($2,000 .2 ($2,000)).

b. If the product cannot be manufactured for $1,600, the company should

consider increasing the price or modifying features so that the target cost

can be achieved.

E8. Sales $ 53,800

Less:

Cost of good sold .9 x $53,800 $ 48,420

Order processing 200 x $5.00 1,000

Rush handling .6 x 200 x $8.50 1,020

Customer service 140 x $10.00 1,400

Relationship management costs 2,000 53,840

Profitability of Johnson Brands account $ (40)

Chapter 8 Pricing Decisions, Analyzing Customer Profitability, and Activity-Based Pricing 8-5

E9. a.

Revenue

Sales $ 53,800

Order processing fee 200 x $6 1,200

Rush order fee .6 x 200 x $10 1,200

Customer service fee 140 x $15 2,100 $ 58,300

Total revenue

Less costs:

Cost of good sold .9 x $53,800 $ 48,420

Order processing 200 x $5.00 1,000

Rush handling .6 x 200 x $8.50 1,020

Customer service 140 x $10.00 1,400

Relationship management costs 2,000 53,840

Profitability of Johnson Brands account $ 4,460

Jiambalvo Managerial Accounting 8-6

PROBLEMS

P1. a.

Price Quantity

Variable

Cost* CM/Unit Total CM Fixed Costs Profit

69.99 10,000 36.50 33.49 334,900 120,000 214,900

59.99 15,000 35.00 24.99 374,850 120,000 254,850

49.99 25,000 33.50 16.49 412,250 120,000 292,250

39.99 40,000 32.00 7.99 319,600 120,000 199,600

29.99 60,000 30.50 -0.51 (30,600) 120,000 (150,600)

* Equals 15% of price + $20 + $6

b. The profit maximizing price is $49.99, which yields a profit of $292,250.

P2. This approach does not seem unethical. Consumers in certain zip codes are

apparently willing to pay higher prices and the company is simply identifying

them. Consumers who are in the same zip code but unwilling to pay the 3%

higher prices are not forced to make purchases.

Chapter 8 Pricing Decisions, Analyzing Customer Profitability, and Activity-Based Pricing 8-7

P3. a.

Price of

Rover

Quantity

of Rover

Price of

Royal

Quantity

of Royal

Total

Revenue

1

Cost of

Rover

2

Cost of

Royal

3

Profit

4

8.99 35,000 16.99 11,000 501,540 210,000 99,000 192,540

9.99 34,500 16.99 11,300 536,642 207,000 101,700 227,942

10.99 34,000 16.99 11,500 569,045 204,000 103,500 261,545

11.99 33,000 16.99 12,000 599,550 198,000 108,000 293,550

12.99 30,000 16.99 13,000 610,570 180,000 117,000 313,570

13.99 25,000 16.99 14,000 587,610 150,000 126,000 311,610

14.99 15,000 16.99 15,000 479,700 90,000 135,000 254,700

15.99 10,000 16.99 19,000 482,710 60,000 171,000 251,710

16.99 5,000 16.99 21,000 441,740 30,000 189,000 222,740

N/A 16.99 25,000 424,750 225,000 199,750

1. Revenue equals price of Rover times quantity of Rover plus price of Royal

times quantity of Royal.

2. Cost of Rover equals $6 times quantity of Rover.

3. Cost of Royal equals $9 times quantity of Royal.

4. Profit equals total revenue minus cost of Rover minus cost of Royal.

The profit maximizing price of RoverPlus is $12.99.

b. At the profit maximizing price, profit is $313,570. Without the RoverPlus

brand, profit was $199,750. Thus, profit is $113,820 higher with

RoverPlus.

Jiambalvo Managerial Accounting 8-8

P4. a.

Variable cost per unit $ 2,000

Fixed cost per unit

($10,000,000 5,000) 2,000

Total 4,000

Markup of 30% 1,200

Price $ 5,200

b. Price influences the quantity demanded, but the estimated quantity

demanded is being used to determine the price!

c.

Variable cost per unit $ 2,000

Fixed cost per unit

($10,000,000 4,000) 2,500

Total 4,500

Markup of 30% 1,350

Price $ 5,850

d. The number of units sold will not equal 4,000 at a price of $5,850 since

only 4,000 units were sold at a lower price of $5,200.

e. To mark-up full cost, a manufacturing firm must first estimate the quantity

that will be sold so that it can determine the fixed manufacturing cost per

unit. But price influences the quantity that can be sold, so the process is

inherently circular.

Chapter 8 Pricing Decisions, Analyzing Customer Profitability, and Activity-Based Pricing 8-9

P5. a.

Price $ 3,500

Desired profit of 25% 875

Target cost $ 2,625

b. $2,000 + ($1,500,000 x) = $2,625

x = 2,400

c.

Price $ 3,000

Desired profit of 25% 750

Target cost $ 2,250

Variable cost per unit $ 1,400

Fixed cost per unit

($1,500,000 2,500) 600

Total 2,000

The revised target cost will be $2,250 and, after dropping the steam feature,

the cost per unit will only be $2,000 (with sales of 2,500 units). Therefore, the

company will be able to produce the item at less than the new target cost.

Jiambalvo Managerial Accounting 8-10

P6. a.

Cost per change order

($175,000 700) $ 250

Cost per return

($63,750 850) $ 75

Cost per design meeting hour

($60,000 1,200) $ 50

Indirect cost related to Orvieto job

Change orders

20 x $250 $ 5,000

Returns

25 x $75 1,875

Design hours

30 x $50 1,500

Total $ 8,375

b. Lauden should consider adopting activity-based pricing and charging

companies like Orvieto for the indirect costs it imposes.

Chapter 8 Pricing Decisions, Analyzing Customer Profitability, and Activity-Based Pricing 8-11

P7. a.

Mark-up of product cost and installer salary $208,000

Charges for indirect services

Change orders 20 x $300 6,000

Charge for returns 25 x $100 2,500

Charge for design time 30 x $75 2,250

Total revenue and charges 218,750

Less costs

Product costs 140,000

Installer salaries 20,000

Change orders

20 x $250 5,000

Returns

25 x $75 1,875

Design time

30 x $50 1,500

Total costs 168,375

Profit $ 50,375

b. Use of activity-based pricing will discourage customers from imposing

indirect costs on the company. On the other hand, some customers may

find the pay for service plan to be offensive (arent we paying for service

in the bid price?) and take their business elsewhere.

Você também pode gostar

- Section C Part 2 MCQDocumento344 páginasSection C Part 2 MCQSaiswetha BethiAinda não há avaliações

- Break Even AnalysisDocumento18 páginasBreak Even AnalysisSMHE100% (10)

- Chapter 7Documento10 páginasChapter 7Eki OmallaoAinda não há avaliações

- The Profit Zone (Review and Analysis of Slywotzky and Morrison's Book)No EverandThe Profit Zone (Review and Analysis of Slywotzky and Morrison's Book)Ainda não há avaliações

- Cost Accounting Test Bank CKDocumento12 páginasCost Accounting Test Bank CKLeo Tama67% (9)

- Assignment 2Documento6 páginasAssignment 2Devesh MauryaAinda não há avaliações

- 02 CVP Analysis For PrintingDocumento8 páginas02 CVP Analysis For Printingkristine claire50% (2)

- Student Sol10 4eDocumento38 páginasStudent Sol10 4eprasad_kcp50% (2)

- The Key to Higher Profits: Pricing PowerNo EverandThe Key to Higher Profits: Pricing PowerNota: 5 de 5 estrelas5/5 (1)

- b5 Life Cycle (Q&A 2018Documento11 páginasb5 Life Cycle (Q&A 2018Issa Adiema100% (1)

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageNo EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageNota: 5 de 5 estrelas5/5 (1)

- Cost Volume Profit Analysis - With KEYDocumento8 páginasCost Volume Profit Analysis - With KEYPatricia AtienzaAinda não há avaliações

- TNK BP RussiaDocumento16 páginasTNK BP RussiapheeyonaAinda não há avaliações

- Bill French CaseDocumento6 páginasBill French CaseAnthonyTiuAinda não há avaliações

- MBA 504 Ch4 SolutionsDocumento25 páginasMBA 504 Ch4 SolutionsPiyush JainAinda não há avaliações

- Target Costing Presentation FinalDocumento57 páginasTarget Costing Presentation FinalMr Dampha100% (1)

- Solution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 12Documento34 páginasSolution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 12jasperkennedy078% (27)

- Chapter 1Documento9 páginasChapter 1Ifye Abdulrashiid MohammedAinda não há avaliações

- Strategic Management and AccountingDocumento10 páginasStrategic Management and AccountingHassaan HunaidAinda não há avaliações

- Managerial Accounting Module 2 ActivityDocumento7 páginasManagerial Accounting Module 2 ActivityDesy Joy UrotAinda não há avaliações

- RCA Solutions Mod5Documento5 páginasRCA Solutions Mod5Danica Austria DimalibotAinda não há avaliações

- Marginal CostingDocumento10 páginasMarginal CostingNishant ModiAinda não há avaliações

- Introduction To CostsDocumento7 páginasIntroduction To CostsLisaAinda não há avaliações

- Chapter 18 Solutions ManualDocumento46 páginasChapter 18 Solutions ManualLan Anh0% (1)

- Objectives of Cost-Volume-Profit AnalysisDocumento7 páginasObjectives of Cost-Volume-Profit AnalysisAnonAinda não há avaliações

- I. Questions:: Let's Check!Documento15 páginasI. Questions:: Let's Check!Santiago BuladacoAinda não há avaliações

- Quiz Management AccountingDocumento8 páginasQuiz Management AccountingLouise Kyle NgoAinda não há avaliações

- AC 203 Principles of Accounting III Final Exam WorksheetDocumento6 páginasAC 203 Principles of Accounting III Final Exam WorksheetLương Thế CườngAinda não há avaliações

- Material CostingDocumento23 páginasMaterial CostingGanesh somvanshiAinda não há avaliações

- 18 5 18 7 18 8 18 9 18 10Documento11 páginas18 5 18 7 18 8 18 9 18 10ReyhanAinda não há avaliações

- Working Capital, Pricing & Performance Management: Afzal Ahmed, Fca Finance Controller NagadDocumento26 páginasWorking Capital, Pricing & Performance Management: Afzal Ahmed, Fca Finance Controller NagadsajedulAinda não há avaliações

- Accounting 2Documento7 páginasAccounting 2vietthuiAinda não há avaliações

- Chapter 4 CVP AnalysisDocumento40 páginasChapter 4 CVP Analysisthrust_xone100% (1)

- Solutions To Week 3 Practice Text ExercisesDocumento6 páginasSolutions To Week 3 Practice Text Exercisespinkgold48Ainda não há avaliações

- 4 Cvpbe PROB EXDocumento5 páginas4 Cvpbe PROB EXjulia4razoAinda não há avaliações

- Analyze Cost Allocation Methods and Overhead VariancesDocumento73 páginasAnalyze Cost Allocation Methods and Overhead VariancesPiyal Hossain100% (1)

- Engineering Economics Lecture Sheet - 4 CVPDocumento41 páginasEngineering Economics Lecture Sheet - 4 CVPebrahimbutexAinda não há avaliações

- CVP Analysis No AnswerDocumento9 páginasCVP Analysis No AnswerAybern BawtistaAinda não há avaliações

- Chapter 7 Pricing SVDocumento27 páginasChapter 7 Pricing SVGayan AkilaAinda não há avaliações

- Week 9 - Appendix A - Pricing Products and ServicesDocumento15 páginasWeek 9 - Appendix A - Pricing Products and ServicesAnh Thư PhạmAinda não há avaliações

- Case 1Documento6 páginasCase 1Oscar VilcapomaAinda não há avaliações

- f5 September - December 2015 - Sample AnswersDocumento8 páginasf5 September - December 2015 - Sample AnswersNeel KostoAinda não há avaliações

- C.MGT Relevant of Chapter 2 STBCDocumento12 páginasC.MGT Relevant of Chapter 2 STBCNahum DaichaAinda não há avaliações

- 3.2 PM Target Costing 260622Documento18 páginas3.2 PM Target Costing 260622abhijit tikekarAinda não há avaliações

- MODULE 1.exercises - Answers OnlyDocumento6 páginasMODULE 1.exercises - Answers OnlykonyatanAinda não há avaliações

- Practice of Cost Volume Profit Breakeven AnalysisDocumento4 páginasPractice of Cost Volume Profit Breakeven AnalysisHafiz Abdulwahab100% (1)

- SolutionsDocumento12 páginasSolutionsRox31Ainda não há avaliações

- ABM AssignmentDocumento7 páginasABM AssignmentSoma BanikAinda não há avaliações

- Session 08: Tactical Decision MakingDocumento18 páginasSession 08: Tactical Decision MakingFrancisco Pedro SantosAinda não há avaliações

- CVP AnalysisDocumento5 páginasCVP AnalysisAnne BacolodAinda não há avaliações

- Islamic Univ. of Gaza Advanced Managerial Accounting Final Exam Break-Even AnalysisDocumento3 páginasIslamic Univ. of Gaza Advanced Managerial Accounting Final Exam Break-Even AnalysisRabah ElmasriAinda não há avaliações

- Part 1 - Decision MakingDocumento174 páginasPart 1 - Decision Makingkodaikart786Ainda não há avaliações

- Target Costing and Consumer Profitability AnalysisDocumento32 páginasTarget Costing and Consumer Profitability AnalysisMuhammad AsadAinda não há avaliações

- Ch. 2 Directed Reading GuideDocumento9 páginasCh. 2 Directed Reading GuideOtabek KhamidovAinda não há avaliações

- Selecting A Pricing MethodDocumento5 páginasSelecting A Pricing MethodNicole B. TaganahanAinda não há avaliações

- Green Tea Crème Brûlée 抹茶クレームブリュレDocumento1 páginaGreen Tea Crème Brûlée 抹茶クレームブリュレpheeyonaAinda não há avaliações

- MBA507Documento10 páginasMBA507pheeyonaAinda não há avaliações

- CASE05 BlockbusterDocumento18 páginasCASE05 BlockbusterpheeyonaAinda não há avaliações

- Capital Budgeting Decisions ChapterDocumento24 páginasCapital Budgeting Decisions Chapterpheeyona100% (1)

- Case - Euro Disney Disucssion QuestionsDocumento1 páginaCase - Euro Disney Disucssion QuestionspheeyonaAinda não há avaliações

- MBA 504 Ch5 SolutionsDocumento12 páginasMBA 504 Ch5 SolutionspheeyonaAinda não há avaliações

- Analyzing Blockbuster's Strategic Challenges in a Disrupted MarketDocumento2 páginasAnalyzing Blockbuster's Strategic Challenges in a Disrupted MarketpheeyonaAinda não há avaliações

- Case 1 ToyotaDocumento5 páginasCase 1 Toyotapheeyona0% (1)

- Examplary QuestionsDocumento2 páginasExamplary QuestionspheeyonaAinda não há avaliações

- Analyzing Blockbuster's Strategic Challenges in a Disrupted MarketDocumento2 páginasAnalyzing Blockbuster's Strategic Challenges in a Disrupted MarketpheeyonaAinda não há avaliações

- MBA 504 Ch8 SolutionsDocumento11 páginasMBA 504 Ch8 SolutionspheeyonaAinda não há avaliações

- CafeDocumento4 páginasCafepheeyonaAinda não há avaliações

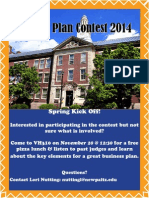

- Business Plan Kickoff ContestDocumento1 páginaBusiness Plan Kickoff ContestpheeyonaAinda não há avaliações

- Syllabus (BUS 536)Documento9 páginasSyllabus (BUS 536)pheeyonaAinda não há avaliações

- Marketing Analytics PresentationDocumento40 páginasMarketing Analytics PresentationpheeyonaAinda não há avaliações

- Website For Asian Movie, HK Movie, Korean Movie, Indian Movie, JapaneseDocumento2 páginasWebsite For Asian Movie, HK Movie, Korean Movie, Indian Movie, JapanesepheeyonaAinda não há avaliações

- Case SolutionDocumento7 páginasCase SolutionpheeyonaAinda não há avaliações

- Country DataDocumento1 páginaCountry DatapheeyonaAinda não há avaliações

- Gamma Gamma FinaDocumento11 páginasGamma Gamma FinapheeyonaAinda não há avaliações

- N01799857@hawkmail Newpaltz EduDocumento4 páginasN01799857@hawkmail Newpaltz EdupheeyonaAinda não há avaliações

- Action Plan Template GuidanceDocumento4 páginasAction Plan Template GuidanceJanith DushyanthaAinda não há avaliações

- Business Plan Kickoff ContestDocumento1 páginaBusiness Plan Kickoff ContestpheeyonaAinda não há avaliações

- Barclay CaseDocumento7 páginasBarclay CasepheeyonaAinda não há avaliações

- Global Business TODAY GBVDocumento8 páginasGlobal Business TODAY GBVpheeyona33% (6)

- MOIT Project 1Documento24 páginasMOIT Project 1pheeyonaAinda não há avaliações

- Beer in NYDocumento12 páginasBeer in NYpheeyonaAinda não há avaliações

- CASE05 BlockbusterDocumento18 páginasCASE05 BlockbusterpheeyonaAinda não há avaliações

- BBCaseDocumento10 páginasBBCasepheeyonaAinda não há avaliações