Escolar Documentos

Profissional Documentos

Cultura Documentos

Lo 1up

Enviado por

Akshat Kumar SinhaTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Lo 1up

Enviado por

Akshat Kumar SinhaDireitos autorais:

Formatos disponíveis

1

A CFA Institute Production

www.cfainstitute.org

Slides provided by speaker

The Journey Matters: Using Behavioral Finance in the

Management of Client Portfolios

Peter Brooks, Ph.D.

Behavioural Finance Specialist, Asia

May 2013

Securitizing a Cure for Cancer

Andrew W. Lo

Charles E. and Susan T. Harris Professor and

Director of the MIT Laboratory for Financial Engineering

MIT Sloan School of Management

17 October 2013

2

A CFA Institute Production

www.cfainstitute.org

Slides provided by speaker

Conundrum

Genuine Breakthroughs In Biopharma:

2001: Gleevec, first of a new class of drugs based on molecular biology

(tyrosine kinase inhibitor)

2004: Avastin, angiogenesis inhibitor (VEGF)

2006: Sutent, approved for RCC and GIST simultaneously

2008: First cancer genome (leukemia) sequenced by Wash U. Genome

Institute, Nature 456 (2008):6672.

2012: Dr. Lukas Wartman, Wash U. cured of acute lymphoblastic leukemia

via RNA analysis and Sutent

2012: David Aponte cured of same type of leukemia using immunotherapy (T-

cells targeting CD19)

3

A CFA Institute Production

www.cfainstitute.org

Slides provided by speaker

Conundrum (2)

Weak Performance In Biopharma Investments

January 2002 to January 2012, NYSE/ARCA Pharma Index return:

1.2%

2001 to 2010 VentureXpert average biotech IRR: 1.0%

-10%

0%

10%

20%

30%

40%

-25%

5%

35%

65%

95%

125%

1

2

/

3

1

9

8

6

1

2

/

3

1

/

9

0

1

2

/

3

1

/

9

4

1

2

/

3

1

/

9

8

1

2

/

3

1

/

0

2

1

2

/

3

1

/

0

6

1

2

/

3

1

/

1

0

1 yr IRR (LHS) 10 yr trailing IRR (RHS)

4

A CFA Institute Production

www.cfainstitute.org

Slides provided by speaker

Conundrum (3)

Why??

Conjecture: biopharma business model may be broken

As we get smarter, business risk increases (why?)

Additional uncertainty due to recent economic events

VC, private equity, and public equity are not ideal

Funding is declining despite/because of better science

Financial Engineering May Offer A Solution

Portfolio theory: multiple shots on goal

Securitization: long-term debt, tranches, guarantees,

5

A CFA Institute Production

www.cfainstitute.org

Slides provided by speaker

Lessons from the Financial Crisis?

0

100

200

300

400

500

600

700

800

900

1000

0

50

100

150

200

250

1880 1900 1920 1940 1960 1980 2000 2020

P

o

p

u

l

a

t

i

o

n

i

n

M

i

l

l

i

o

n

s

R

e

a

l

H

o

m

e

P

r

i

c

e

I

n

d

e

x

U.S. Real Home Price Index, 18902012

Source: Robert J. Shiller

Home Prices

Population

How Did This Happen??

6

A CFA Institute Production

www.cfainstitute.org

Slides provided by speaker

497

613

1,149

1,027

685

1,693

2,338

3,173

1,917

2,230

2,110

2,204

1,404

2,041

1,976

1,660

2,056

0

500

1,000

1,500

2,000

2,500

3,000

3,500

1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Lessons from the Financial Crisis? (2)

U.S. Mortgage-Related Debt Issuance ($Billions)

Source: SIFMA

What could possibly

go wrong?

7

A CFA Institute Production

www.cfainstitute.org

Slides provided by speaker

How Could This Have Happened?

Who Benefited From This Trend?:

Commercial banks

Credit rating agencies (S&P, Moodys, Fitch)

Economists

Government sponsored enterprises

Homeowners

Insurance companies (multiline, monoline)

Investment banks and other issuers of MBSs, CDOs, and CDSs

Investors (hedge funds, pension funds, mutual funds, others)

Mortgage lenders, brokers, servicers, trustees

Politicians

Regulators (CFTC, Fed, FDIC, FHFA, OCC, OTS, SEC, etc.)

A Rising Tide Lifts All Boats

8

A CFA Institute Production

www.cfainstitute.org

Slides provided by speaker

How Could This Have Happened? (2)

Innovation Requires Financial Infrastructure!

Private investment

Accounting, legal, regulatory structures

Systemic stability

Well-functioning capital markets

Proper design of securities

Incentives Are Needed To Motivate Action

Fear Works Faster; Greed Is More Sustainable

Greed and altruism need not be incompatible

9

A CFA Institute Production

www.cfainstitute.org

Slides provided by speaker

The Power of Global Capital Markets

0

100

200

300

400

500

600

700

800

900

1000

0

50

100

150

200

250

1880 1900 1920 1940 1960 1980 2000 2020

P

o

p

u

l

a

t

i

o

n

i

n

M

i

l

l

i

o

n

s

R

e

a

l

H

o

m

e

P

r

i

c

e

I

n

d

e

x

U.S. Real Home Price Index, 18902012

Source: Robert J. Shiller

Population

E = mc

2

10

A CFA Institute Production

www.cfainstitute.org

Slides provided by speaker

Investment Problem

Consider The Following Investment Opportunity:

$200MM investment, 10-year horizon

Probability of positive payoff is 5%

If successful, annual profits of $2B for 10-year patent

11

A CFA Institute Production

www.cfainstitute.org

Slides provided by speaker

Investment Problem (2)

Consider The Following Investment Opportunity:

$200MM investment, 10-year horizon

Probability of positive payoff is 5%

If successful, annual profits of $2B for 10-year patent

$200MM

p = 5%

1 p = 95%

100.0%

+51.0%

E[R] = 11.9%

SD[R] = 423.5%

12

A CFA Institute Production

www.cfainstitute.org

Slides provided by speaker

What If We Invest In 150 Programs Simultaneously?:

Requires $30B of capital

Assume programs are IID (can be relaxed)

Diversification changes the economics of the business:

But can we raise $30B??

Investment Problem (3)

E[R] = 11.9%

SD[R] = 423.5% / 150 = 34.6%

____

13

A CFA Institute Production

www.cfainstitute.org

Slides provided by speaker

What If We Invest In 150 Programs Simultaneously?:

Given the reduction in risk, debt-financing is possible!

$17B of high-quality 10-year debt can be issued

With securitization (RBOs) and third-party guarantees (CDS), debt

capacity is even larger

Investment Problem (4)

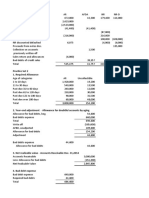

Event Probability

Minimum

Year-10

NPV

Maximum Year-0

Proceeds at

3.75% (10-Yr Aa

as of 9/13/13)

Maximum Year-0

Proceeds at

4.06% (10-Yr A

as of 9/13/13)

At least 1 hit: 99.95% $12,289 $8,504 $8,254

At least 2 hits: 99.59% $24,578 $17,009 $16,509

At least 3 hits: 98.18% $36,867 $25,513 $24,763

At least 4 hits: 94.52% $49,157 $34,017 $33,017

At least 5 hits: 87.44% $61,446 $42,522 $41,272

14

A CFA Institute Production

www.cfainstitute.org

Slides provided by speaker

Simulating A Cancer Megafund

Fernandez, Stein, Lo (Nature Biotech, Oct 2012)

Tufts Medical School CSDD + Deloitte/RECAP cancer compounds database from

19902011

2,000+ compounds 733 after cleaning data

Cost and revenue assumptions from historical data and literature (e.g., Bloomberg,

DiMasi et al. 2003, etc.)

Estimate transition probability matrix and valuations

Fagnan, Fernandez, Lo, Stein (AER, May 2013)

Pricing and impact of third-party guarantees on debt capacity and investment

performance

15

A CFA Institute Production

www.cfainstitute.org

Slides provided by speaker

Simulating A Cancer Megafund (2)

Simulation Results: Matlab and R Software Available

16

A CFA Institute Production

www.cfainstitute.org

Slides provided by speaker

What About Personalized/Precision Medicine?

Fagnan, Gromatzky, Fernandez, Stein, and Lo (2013)

Orphan Diseases: smaller population, urgent need, higher prices,

lower development costs, higher success rates (20%), faster time

to approval (37 years)

Simulating A Cancer Megafund (3)

17

A CFA Institute Production

www.cfainstitute.org

Slides provided by speaker

What About Personalized/Precision Medicine?

Simulation results for funds of $135 million and $225 million are

even more attractive!

Simulating A Cancer Megafund (4)

18

A CFA Institute Production

www.cfainstitute.org

Slides provided by speaker

Is This Realistic?

Is There Capacity From Investors? In 2012:

U.S. bond market: $38.1T

Mutual funds: $13.1T

Money-market funds: $2.7T

Norwegian sovereign wealth fund: $683B

CalPERS: $237B (as of June 30, 2012)

Target return of 126 public funds (2012): 8%

In 2012, the Size of the Entire VC Industry Was:

$199B

7.5%

19

A CFA Institute Production

www.cfainstitute.org

Slides provided by speaker

Is This Realistic? (2)

With Some Imagination, Megafunds Are Viable!

Imagine creating a $30B Cure For Cancer megafund

Imagine creating an advisory board of experts:

Imagine corporate pension funds, foundations, endowments,

insurance companies investing as well

Imagine 10MM households investing $3,000 each

Imagine government tax incentives, credit enhancement, etc. (think

Fannie Mae, Freddie Mac!)

George Demetri, Eric Lander, Bob Langer, Mark Levin, Frank McCormick, Larry

Norton, Phil Sharp; Warren Buffett, Bill Gates, Jacob Goldfield, Bob Merton, Jim

Simons, George Soros, Bill Sharpe

20

A CFA Institute Production

www.cfainstitute.org

Slides provided by speaker

There Are Many Potential Challenges

Size and Business Model: managing large portfolios of complex R&D projects

may require new management and governance structures (e.g., Manhattan

Project)

Centralization: must preserve the benefits of diversity as scale increases

Capacity: is the talent pool large enough to match the scale of this venture?

Complexity: can investors understand the risks and rewards of RBOs?

Excesses: if successful, the potential for abuse will also increase

Ethics: how to balance profit motive vs. social objectives for cures?

Is This Realistic? (3)

21

A CFA Institute Production

www.cfainstitute.org

Slides provided by speaker

Next Steps

Expose each stakeholder group to the tools, challenges, and

opportunities of other groups in the biomedical ecosystem

Clinicians, researchers, biopharma professionals, VCs, insurance

companies, regulators, investors, financial engineers, patients

Identify major obstacles to private-sector funding of translational

medical R&D

Propose some potential solutions to these obstacles (see

http://cancerx.mit.edu)

22

A CFA Institute Production

www.cfainstitute.org

Slides provided by speaker

Conclusion

Dont Declare War On

CancerPut A Price Tag

On Its Head Instead!

With Sufficient Scale, We Can Do Well By Doing Good

Finance does not always have to be a zero-sum game

Você também pode gostar

- Econ 118 Syllabus - Aut08Documento6 páginasEcon 118 Syllabus - Aut08Rakesh KumarAinda não há avaliações

- Smart Thinking Skills For Critical Understanding and Writing 2nd Ed - Matthew AllenDocumento207 páginasSmart Thinking Skills For Critical Understanding and Writing 2nd Ed - Matthew Allenfreeplump3100% (41)

- Floating Rate CMOsDocumento12 páginasFloating Rate CMOsUresh ShethAinda não há avaliações

- Dynamics of Swaps SpreadsDocumento32 páginasDynamics of Swaps SpreadsAkshat Kumar SinhaAinda não há avaliações

- The Yield Curve of Bond and Yield To MaturityDocumento8 páginasThe Yield Curve of Bond and Yield To MaturityFebrianty Amirah PratamaAinda não há avaliações

- Pitch Book SampleDocumento58 páginasPitch Book SampleThomas Kyei-BoatengAinda não há avaliações

- Customer Perception Towards TupperwareDocumento6 páginasCustomer Perception Towards TupperwareAkshat Kumar Sinha100% (1)

- VA+Tech+Wabag Inititating+coverageDocumento32 páginasVA+Tech+Wabag Inititating+coverageAkshat Kumar Sinha0% (1)

- Lessons From The Financial Crisis For Teaching EconomicsDocumento36 páginasLessons From The Financial Crisis For Teaching EconomicsAkshat Kumar SinhaAinda não há avaliações

- Niranjan - A Page From History - 70 Years Before The Brics Bank - 230714Documento2 páginasNiranjan - A Page From History - 70 Years Before The Brics Bank - 230714Akshat Kumar SinhaAinda não há avaliações

- PP 290 Migration Spring 2013 Syllabus AkeeDocumento6 páginasPP 290 Migration Spring 2013 Syllabus AkeeAkshat Kumar SinhaAinda não há avaliações

- Lecture 8Documento5 páginasLecture 8Akshat Kumar SinhaAinda não há avaliações

- The Specific Features of Marketing Channel DesignDocumento11 páginasThe Specific Features of Marketing Channel DesignAkshat Kumar Sinha100% (1)

- Judicial Meanderings in Patriarchal Thickets Litigating Sex Discrimination in IndiaDocumento11 páginasJudicial Meanderings in Patriarchal Thickets Litigating Sex Discrimination in IndiaAkshat Kumar SinhaAinda não há avaliações

- Secular Stagnation: Facts, Causes and CureseDocumento179 páginasSecular Stagnation: Facts, Causes and Curesemarioturri100% (2)

- Rules of The GameDocumento45 páginasRules of The GameAkshat Kumar SinhaAinda não há avaliações

- Niranjan - A Page From History - 70 Years Before The Brics Bank - 230714Documento2 páginasNiranjan - A Page From History - 70 Years Before The Brics Bank - 230714Akshat Kumar SinhaAinda não há avaliações

- San Krit IzationDocumento6 páginasSan Krit IzationAkshat Kumar SinhaAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (120)

- Doing Business in UAEDocumento16 páginasDoing Business in UAEHani SaadeAinda não há avaliações

- Jeans Business PlanDocumento34 páginasJeans Business PlanNancy Goel ッ67% (3)

- At January 2008 IssueDocumento68 páginasAt January 2008 IssuejimfiniAinda não há avaliações

- Kumpulan Quiz UAS AkmenDocumento23 páginasKumpulan Quiz UAS AkmenPutri NabilahAinda não há avaliações

- UT Dallas Syllabus For Fin7310.001 05f Taught by Nina Baranchuk (nxb043000)Documento5 páginasUT Dallas Syllabus For Fin7310.001 05f Taught by Nina Baranchuk (nxb043000)UT Dallas Provost's Technology GroupAinda não há avaliações

- Summative Test in Math (Part Ii) Quarter 1Documento1 páginaSummative Test in Math (Part Ii) Quarter 1JAY MIRANDAAinda não há avaliações

- Raymundo S. de Leon v. Benita T. Ong.Documento10 páginasRaymundo S. de Leon v. Benita T. Ong.anneAinda não há avaliações

- Lithuanian Association of Basketball CoachesDocumento1 páginaLithuanian Association of Basketball CoachesLietuvos Krepšinio Trenerių AsociacijaAinda não há avaliações

- Company Law SummerisedDocumento15 páginasCompany Law SummerisedOkori PaulAinda não há avaliações

- Supply Chain Management Filipino SmeDocumento22 páginasSupply Chain Management Filipino Smeshekaina huidemAinda não há avaliações

- Security Agreement - Secured PartyDocumento7 páginasSecurity Agreement - Secured PartyCo100% (33)

- Sweetheart Loan - Florendo Vs CADocumento2 páginasSweetheart Loan - Florendo Vs CAErmeline TampusAinda não há avaliações

- Essentials of Budgetary ControlDocumento13 páginasEssentials of Budgetary ControlShashiprakash SainiAinda não há avaliações

- Flow Bill Explanation (Papiamentu)Documento2 páginasFlow Bill Explanation (Papiamentu)Shanon OsborneAinda não há avaliações

- STANDARD BANK Co Applicant Application FormDocumento4 páginasSTANDARD BANK Co Applicant Application Formpokipanda69100% (1)

- Week 4 Solutions To ExercisesDocumento5 páginasWeek 4 Solutions To ExercisesBerend van RoozendaalAinda não há avaliações

- Wire Transfer Form 08Documento2 páginasWire Transfer Form 08eghideafesumeAinda não há avaliações

- InvoiceDocumento1 páginaInvoiceshiv kumarAinda não há avaliações

- Call For Expression of Interest Ip Selection Co Financing Initiative Migration Governance 0Documento27 páginasCall For Expression of Interest Ip Selection Co Financing Initiative Migration Governance 0lightnorth96Ainda não há avaliações

- Acquisition of Merrill Lynch by Bank of AmericaDocumento26 páginasAcquisition of Merrill Lynch by Bank of AmericaNancy AggarwalAinda não há avaliações

- NeekiDocumento2 páginasNeekiRamAinda não há avaliações

- Brand ExtensionDocumento6 páginasBrand Extensionmukhtal8909Ainda não há avaliações

- FINS1612 Tutorial 2 - BanksDocumento5 páginasFINS1612 Tutorial 2 - BanksRuben CollinsAinda não há avaliações

- Management Letter Mattsenkumar Services PVT LTD 2021-22Documento12 páginasManagement Letter Mattsenkumar Services PVT LTD 2021-22Sudhir Kumar DashAinda não há avaliações

- Worksheet 1.2 Simple and Compound Interest: NameDocumento6 páginasWorksheet 1.2 Simple and Compound Interest: NameRenvil Igpas MompilAinda não há avaliações

- Summary of Angelina Hernandez Defendant Estafa CaseDocumento1 páginaSummary of Angelina Hernandez Defendant Estafa CaseJay Mark Albis SantosAinda não há avaliações

- Assertions of Compliance With Accountability RequirementsDocumento2 páginasAssertions of Compliance With Accountability RequirementslouvelleAinda não há avaliações

- Practice Set 1Documento6 páginasPractice Set 1moreAinda não há avaliações

- Overview of Premium Financed Life InsuranceDocumento17 páginasOverview of Premium Financed Life InsuranceProvada Insurance Services100% (1)

- Arthakranti 12 MinutesDocumento26 páginasArthakranti 12 Minutesmadhusri002Ainda não há avaliações