Escolar Documentos

Profissional Documentos

Cultura Documentos

Price Vibration

Enviado por

loshudeDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Price Vibration

Enviado por

loshudeDireitos autorais:

Formatos disponíveis

PRICE SCALE VIBRATION

By Robert Giordano

The importance of changing the price scale vibration.

After spending 9 years testing many different technical forecasting applications

based on the works of George Bayer, W.D Gann, and R.N Elliots works it

became apparent that a very important technique may have been overlooked

until now!

It was only after a prototype of the New Gann Grids Printing Program had been

developed that the changing of the price scale vibration application became

apparent.

It was only when the proper price scale vibration was found first did Ganns price

and time overlays of 144, 90 and 52 highlight almost flawlessly many of the

pivotal time and price periods within the unique pattern.

What are Ganns price and time square overlays used for?

The special geometrical pattern plastic sheets were used by Gann as overlays

on his special geometrical grid charts. The pattern overlays would show at a

glance the correct support and resistance levels hidden within the stocks,

commodity or indexes historical price and time fluctuations.

Found only through trial and error research this price scale vibration research

could quite possibly be one of the most important mathematical forecasting

applications hidden until now!

Once the proper price scale vibration was found which worked in harmony with

the New Gann Grids Ultras main tool applications such as the geometrical

overlays, numerical squares, half square and quarter squares, the cycle tool,

Gann angles and the rest would the program then potentially project the future

course of both the time and price fluctuations of the stock, commodity or index

being researched.

This concept took many years to uncover due to the fact that in the early phase

of my research all the different stocks, commodities, and indexes being explored

had to be hand drawn on the special grids per square inch sheets. As you could

imagine drafting all this technical work by hand was an extremely difficult project

to say the least. Even drawing just one single chart on a single price scale setting

literally took days to complete and was next to impossible to do on multiple price

and time scale settings. It just took way too long to finish.

The New Gann Grids Printing Program developed over time did however put and

end to this tedious grid by hand drafting. In turn this left me with much more time

for further cycle research. The printing version of the Gann Grids program really

is an ideal program for the beginner who just wants blank charts to learn the very

basics from Ganns price and time overlays. However for a more thorough cycle

research project a more advanced program was needed.

Unfortunately a more advanced program at that time was nowhere to be found.

None gave the features of allowing me to view on screen the changing of the

price scale vibration, the changing of the grid size format while at the same time

giving me other Gann, Bayer, and Elliot type forecasting applications with an on

screen view.

This Concept is now a Reality with the New Gann Grids Ultra advanced

Program!

The New Gann Grids Ultra program is a BRAND NEW computer research

program that has taken me well over two years to develop. It will not only plot the

stock commodity or index of your choice on a large number of harmonically

perfect grid chart sizes just like the Gann Grids printing program, but will also

draw most of the Gann, Bayer and Elliot price and time research tools,

personally tested and used on screen with just the click of a button!

Days, weeks or even months of forecasting research can now be done in just a

few seconds with this new, improved, and impressive version of Gann Grids.

Just imagine researching the stocks, commodities or indexes of your choice,

placing it on any one of the several grids per square inch settings, and then

changing around the price scale vibration until the proper price scale vibration is

found. Once found, this unique setting will work in harmony with the programs

other included tools such as:

The Gann square tool with user defined settings, Time bar count, Price bar

count, AB range division of 8, Square of nine square root angle tool, User

defined angle tool, Cycle research tool, Fibonacci number overlay Numerical

squares, half squares, and quarter squares overlay tool, along with the most

important User defined price scale and grid size functions plus much more.

There are also seven extremely user friendly astrological/astronomical

research tools used by Gann and Bayer such as:

The Astro fingerprint tool

Ephemeris tool

Aspect date locater tool

Specific zodiac degree aspect tool

Zodiac hot spot locater tool

Planetary price channel overlay tool

and Planet progression tool

This section of the program was specifically developed to find hot aspects and

degrees of the zodiac present around most major, medium and minor trend

change periods. Once found, the dates could then be highlighted on screen with

the click of a button thus isolating many potential turning dates into its future.

The ephemeris tool is also used to find many natural and mundane energy date

clusters found to be useful by many leading astro- technical researchers.

EXAMPLE #1

PRICE SCALE VIBRATION ON 90 OVERLAY

General Electric monthly chart set at $0.50 cents on a grid per square inch

setting of 24:

As you can see, many of the stock price fluctuations held remarkably well on the

black horizontal lines of the square of 90. If you also look closely, you will see that

many of the vertical lines show several time changes as well.

EXAMPLE # 2

NUMERICAL SQUARES, HALF SQUARES AND PRICE SCALE VIBRATION

Gann also felt that his numerical square overlays are to be used to find time and

price balancing points that coincide with natural squares.

But what exactly are natural squares?

Natural squares are the points in price and time that count up in price and over in

time the exact number of grids equal to squares of a number starting from 2x2=4,

3x3=9, 4x4=16,5x5=25, etc., all the way through a progressive series of numbers.

Gann however, felt that the square of 144 was a very important one as he stated

in his courses: Within the 144 overlay all the natural squares can be seen up to

144.

FULL SQUARES

Half Squares

The same could be said for half squares.

The half squares are set up the same way as the full squares but instead of using

only a whole number, we use a half number as well.

Example: 2.5x2.5=6.25, 3.5x3.5=12.25, 4.5x4.5=20.5, 5.5x5.5=30.25, etc.

HALF SQUARES

What do Natural Squares and Half Squares have to do with forecasting the

stock market?

Gann found through his unique research that the squares were important places to

watch for changes in trend both in the price support and resistance levels, as well

as in time increments. However, what was discovered through my research was

the price scale vibration needed to be found first through trial and error research in

order to find the best fit.

EXAMPLE # 3

STOCK HET SQUARE, HALF SQUARE SET ON A GRID SIZE OF 24 AND A

PRICE SCALE OF $.65 CENTS, ALONG WITH A FIXED CYCLE OF 29 WITH +/-

2 VARIANCE STARTING FROM THE NOVEMBER 9, 1998 LOW

Just look how the black and green lines (squares and half squares) held most of

the major and medium price swings tops and bottoms throughout its history.

Within this example we see that the proper price scale vibration for this stock is $0

.65 cents, as most of its past price support and resistance levels are being held

within the numerical squares and half square parameters. You can also see that

the places where the black and black, or black and green lines cross are the

places where both the price and time points are in balance. Many trend change

periods can be calculated using this tool, as can be seen above along with

projecting into its future

The Gann Grids Ultra method of forecasting, using the proper price scale

vibration, the numerical squares and half squares, can further be enhanced when

all the other tools such as the time cycle research tool are incorporated.

The time cycle research tool, as also seen in Example #3, starts a 29- week cycle

with a +/- variance at a major low on November 9, 1998. This cycle follows within

its color setting of blue (user defined) along with many of the stocks, major and

medium weekly trend change periods.

I found this cycle to work after only 20 minutes of research and the rest in about

an hour. In the past this mini research project would have taken me well over a

week to complete by hand if not longer!

The following is an updated HET chart.

As we can see the 29-week cycle, the numerical squares, half squares, and

quarter square are pointing to the weeks of January 9, 2007 through February 16,

2007. These dates can further be isolated and narrowed down by using the astro

tools incorporated within the advanced version of the Gann Grids Ultra Program.

(Not mentioned within this article.)

For a complete explanation of the New Gann Grids Ultra

advanced programs features, download the power point

presentation given at the Traders World online expo found at

www.pvtpointmktres.com or on the traders world web page.

Thank you

Robert Giordano

www.pvtpointmktres.com

HET Update!

The above research was done in late December of 06 for this Traders World

article. We can now see the exact weekly top was on 2/15/07

Another geometrical overlay application projecting price movements for over 5 years

On a weekly chart I use my Astro timing research to narrow down the dates even more!!

Você também pode gostar

- Pattern, Price and Time: Using Gann Theory in Technical AnalysisNo EverandPattern, Price and Time: Using Gann Theory in Technical AnalysisAinda não há avaliações

- Time and Price Squares PDFDocumento9 páginasTime and Price Squares PDFsurjansh50% (2)

- WD Gann Golden RulesDocumento1 páginaWD Gann Golden Rulesbenjah2Ainda não há avaliações

- Rudiments of Gann TheoryDocumento15 páginasRudiments of Gann TheoryCharles Barony100% (1)

- Gann Grids Ultra 6Documento141 páginasGann Grids Ultra 6владимир иванов100% (1)

- Orolo WD GannDocumento24 páginasOrolo WD GannCarl ZackAinda não há avaliações

- Gann's Instruction On SQ9Documento3 páginasGann's Instruction On SQ9futuresignsb4100% (1)

- Yte1 PDFDocumento2 páginasYte1 PDFJim BaxterAinda não há avaliações

- SCFjan 11Documento8 páginasSCFjan 11baraib7tyAinda não há avaliações

- Gann Calculator ExplainedDocumento5 páginasGann Calculator ExplainedKaaran Thakker100% (1)

- Another MethodDocumento1 páginaAnother Methodisaaccourt100% (1)

- W D Gann Course PathDocumento5 páginasW D Gann Course PathchirakiAinda não há avaliações

- Squaring The HighDocumento2 páginasSquaring The Highvijnanabhairava100% (5)

- A Summary of W D Gann MindsetDocumento8 páginasA Summary of W D Gann MindsetpolAinda não há avaliações

- FerreraDocumento5 páginasFerreraJessePhipps0% (1)

- Sam PDFDocumento48 páginasSam PDFAnil Varughese100% (8)

- Shrader OptionsManualDocumento11 páginasShrader OptionsManualOm Prakash100% (2)

- Turning Point AnalysisDocumento9 páginasTurning Point AnalysisGokuAinda não há avaliações

- Astronomy Trading - William GannDocumento8 páginasAstronomy Trading - William Gannpietrod21100% (1)

- Jones, Billy - MARKET VIBRATIONDocumento4 páginasJones, Billy - MARKET VIBRATIONalex111966Ainda não há avaliações

- W.D. Gann - Angles CourseDocumento32 páginasW.D. Gann - Angles CourseVibhats Vibhor100% (6)

- Gann AnglesDocumento3 páginasGann AnglesMohamed Wahid100% (1)

- William Gann Method PDFDocumento1 páginaWilliam Gann Method PDFchandra widjajaAinda não há avaliações

- Harley, S. (2007) - Squaring Price With Time (3 P.)Documento4 páginasHarley, S. (2007) - Squaring Price With Time (3 P.)Chirag Shetty100% (1)

- SQ of 9 FormulaDocumento8 páginasSQ of 9 FormulaJeff Greenblatt100% (2)

- Annual Forecasts PDFDocumento24 páginasAnnual Forecasts PDFpjwillisAinda não há avaliações

- ABC Trading Plan Pressure Points Road Map: Entry Stop Exit Stop 376.70Documento16 páginasABC Trading Plan Pressure Points Road Map: Entry Stop Exit Stop 376.70vasanth3675% (8)

- Principles of W D Gann Law of VibrationDocumento5 páginasPrinciples of W D Gann Law of VibrationqwertyjoseAinda não há avaliações

- Time Price Research - George BayerDocumento41 páginasTime Price Research - George BayerGoku67% (3)

- Applied1 GANNDocumento2 páginasApplied1 GANNMauro PolifroniAinda não há avaliações

- Ferrera Gann Angles FormulaDocumento29 páginasFerrera Gann Angles FormulaNeoHooda100% (2)

- Market Strategy Part IIDocumento2 páginasMarket Strategy Part IIJon Vincent Deacon100% (1)

- Tbonds and Gann S Square of 144: by Phyllis KahnDocumento26 páginasTbonds and Gann S Square of 144: by Phyllis Kahndevoe.mark6844100% (1)

- The Square of Nine PDFDocumento9 páginasThe Square of Nine PDFbooks6179100% (2)

- Gann's Market Vibration & SQ9Documento14 páginasGann's Market Vibration & SQ9stickan100% (19)

- Gann LettersDocumento5 páginasGann LettersKirtan Balkrishna Raut80% (5)

- Walker, Myles Wilson - Super Timing Trading With Cycles (2003)Documento5 páginasWalker, Myles Wilson - Super Timing Trading With Cycles (2003)fsolomonAinda não há avaliações

- Who Was OroloDocumento20 páginasWho Was Orolopierce033033100% (1)

- Master of TimeDocumento112 páginasMaster of TimeVincent Sampieri90% (21)

- Order Your Copy of Super Timing And/or Profitable Forecasting NOW!Documento1 páginaOrder Your Copy of Super Timing And/or Profitable Forecasting NOW!Salim Marchant50% (2)

- Barry GummDocumento190 páginasBarry GummMehtaab Singh100% (7)

- Sacrescience - ICE STUDY GUIDES PDFDocumento14 páginasSacrescience - ICE STUDY GUIDES PDFcannizzo4509150% (2)

- Using Gann With Astrophysics To Validate Turning Points.: by Hans Hannula, Ph.D.Documento37 páginasUsing Gann With Astrophysics To Validate Turning Points.: by Hans Hannula, Ph.D.Kostas Zante100% (13)

- OROLO & W. D. GannDocumento56 páginasOROLO & W. D. GannGaurav Garg100% (1)

- Gann's Master Mathematical Formula For Market PredictionsDocumento5 páginasGann's Master Mathematical Formula For Market Predictionschandra widjajaAinda não há avaliações

- Cowan, Bradley - Letter BaumringDocumento4 páginasCowan, Bradley - Letter BaumringTang Yiming80% (5)

- The Incredible Analysis of W D GannDocumento79 páginasThe Incredible Analysis of W D GannJohn Kent97% (31)

- William D. Gann's Simplified Stock Market TheoriesNo EverandWilliam D. Gann's Simplified Stock Market TheoriesNota: 4.5 de 5 estrelas4.5/5 (12)

- The Simplified Theory of The Time Factor in Forex TradingNo EverandThe Simplified Theory of The Time Factor in Forex TradingAinda não há avaliações

- Quantum Trading: Using Principles of Modern Physics to Forecast the Financial MarketsNo EverandQuantum Trading: Using Principles of Modern Physics to Forecast the Financial MarketsNota: 5 de 5 estrelas5/5 (2)

- Secrets of Bharani NakshatraDocumento4 páginasSecrets of Bharani NakshatraloshudeAinda não há avaliações

- R - Date ClassDocumento2 páginasR - Date ClassloshudeAinda não há avaliações

- R - Time Intervals - DifferencesDocumento3 páginasR - Time Intervals - DifferencesloshudeAinda não há avaliações

- R - Combine Values Into A Vector or ListDocumento2 páginasR - Combine Values Into A Vector or ListloshudeAinda não há avaliações

- R - Functions To Manipulate Connections (Files, URLs, ... )Documento10 páginasR - Functions To Manipulate Connections (Files, URLs, ... )loshudeAinda não há avaliações

- R - Numeric VersionsDocumento2 páginasR - Numeric VersionsloshudeAinda não há avaliações

- R - Environment AccessDocumento3 páginasR - Environment AccessloshudeAinda não há avaliações

- Dplyr Mutate in RDocumento2 páginasDplyr Mutate in RloshudeAinda não há avaliações

- Datatable Cheat Sheet RDocumento1 páginaDatatable Cheat Sheet RloshudeAinda não há avaliações

- Dplyr Case When in RDocumento2 páginasDplyr Case When in RloshudeAinda não há avaliações

- Dplyr Arrange in RDocumento2 páginasDplyr Arrange in RloshudeAinda não há avaliações

- Geltner Liquidity Adjusted Return SeriesDocumento2 páginasGeltner Liquidity Adjusted Return SeriesloshudeAinda não há avaliações

- IBM System X UPS Guide v1.4.0Documento71 páginasIBM System X UPS Guide v1.4.0Phil JonesAinda não há avaliações

- Case AnalysisDocumento25 páginasCase AnalysisGerly LagutingAinda não há avaliações

- Annexure 8: Medical Certificate (To Be Issued by A Registered Medical Practitioner) General ExpectationsDocumento1 páginaAnnexure 8: Medical Certificate (To Be Issued by A Registered Medical Practitioner) General ExpectationsMannepalli RamakrishnaAinda não há avaliações

- United States Court of Appeals, Third CircuitDocumento1 páginaUnited States Court of Appeals, Third CircuitScribd Government DocsAinda não há avaliações

- #6 Decision Control InstructionDocumento9 páginas#6 Decision Control InstructionTimothy King LincolnAinda não há avaliações

- Essay EnglishDocumento4 páginasEssay Englishkiera.kassellAinda não há avaliações

- Paediatrica Indonesiana: Sumadiono, Cahya Dewi Satria, Nurul Mardhiah, Grace Iva SusantiDocumento6 páginasPaediatrica Indonesiana: Sumadiono, Cahya Dewi Satria, Nurul Mardhiah, Grace Iva SusantiharnizaAinda não há avaliações

- Sample Midterm ExamDocumento6 páginasSample Midterm ExamRenel AluciljaAinda não há avaliações

- Reflection On Harrison Bergeron Society. 21ST CenturyDocumento3 páginasReflection On Harrison Bergeron Society. 21ST CenturyKim Alleah Delas LlagasAinda não há avaliações

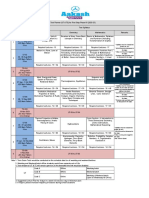

- UT & TE Planner - AY 2023-24 - Phase-01Documento1 páginaUT & TE Planner - AY 2023-24 - Phase-01Atharv KumarAinda não há avaliações

- Exercise No.2Documento4 páginasExercise No.2Jeane Mae BooAinda não há avaliações

- CRM - Final Project GuidelinesDocumento7 páginasCRM - Final Project Guidelinesapi-283320904Ainda não há avaliações

- Aspects of The Language - Wintergirls Attached File 3Documento17 páginasAspects of The Language - Wintergirls Attached File 3api-207233303Ainda não há avaliações

- ACCA Advanced Corporate Reporting 2005Documento763 páginasACCA Advanced Corporate Reporting 2005Platonic100% (2)

- 2009 Annual Report - NSCBDocumento54 páginas2009 Annual Report - NSCBgracegganaAinda não há avaliações

- Percy Bysshe ShelleyDocumento20 páginasPercy Bysshe Shelleynishat_haider_2100% (1)

- Hercules Industries Inc. v. Secretary of Labor (1992)Documento1 páginaHercules Industries Inc. v. Secretary of Labor (1992)Vianca MiguelAinda não há avaliações

- GAJ Mod 18 Ace Your InterviewDocumento12 páginasGAJ Mod 18 Ace Your InterviewAnjela SantiagoAinda não há avaliações

- Diode ExercisesDocumento5 páginasDiode ExercisesbruhAinda não há avaliações

- SEx 3Documento33 páginasSEx 3Amir Madani100% (4)

- Chapter One Understanding Civics and Ethics 1.1.defining Civics, Ethics and MoralityDocumento7 páginasChapter One Understanding Civics and Ethics 1.1.defining Civics, Ethics and Moralitynat gatAinda não há avaliações

- Nursing Care Plan: Pt.'s Data Nursing Diagnosis GoalsDocumento1 páginaNursing Care Plan: Pt.'s Data Nursing Diagnosis GoalsKiran Ali100% (3)

- Conversation Between God and LuciferDocumento3 páginasConversation Between God and LuciferRiddhi ShahAinda não há avaliações

- GB BioDocumento3 páginasGB BiolskerponfblaAinda não há avaliações

- AASW Code of Ethics-2004Documento36 páginasAASW Code of Ethics-2004Steven TanAinda não há avaliações

- K9G8G08B0B SamsungDocumento43 páginasK9G8G08B0B SamsungThienAinda não há avaliações

- Diploma Pendidikan Awal Kanak-Kanak: Diploma in Early Childhood EducationDocumento8 páginasDiploma Pendidikan Awal Kanak-Kanak: Diploma in Early Childhood Educationsiti aisyahAinda não há avaliações

- Basic Translation TerminologyDocumento7 páginasBasic Translation TerminologyHeidy BarrientosAinda não há avaliações

- 2018080, CRPC Research PaperDocumento23 páginas2018080, CRPC Research Paperguru charanAinda não há avaliações

- MasterMind 1 Unit 5 Extra LifeSkills Lesson 2Documento2 páginasMasterMind 1 Unit 5 Extra LifeSkills Lesson 2Hugo A FEAinda não há avaliações