Escolar Documentos

Profissional Documentos

Cultura Documentos

Legal Maxims

Enviado por

Jera CaballesDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Legal Maxims

Enviado por

Jera CaballesDireitos autorais:

Formatos disponíveis

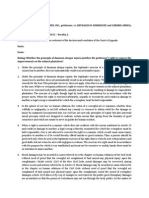

Statutory Construction

Midterm Project

Legal Maxims Case Digest

AVES. Mariannejoy R.

CABALLES, Jeramie M.

FERNANDO, Kristin Jomafer C.

SANTOS, Justinne Marie D.

TICKE, Kathlene Fyle B.

ID 2014

Atty. Balboa-Cahig

1D 2014

Midterm Project

Legal Maxims Case Digests

1

Absoluta sententia expositore non indigent

When the language of the law is clear, no explanation of it is required

Gan vs. Reyes

G.R. No. 145527

May 28, 2002

Bellosillo, J.

FACTS:

Bernadette C. Pondevida instituted on behalf og her daughter, Francheska Joy S. Pondevida, private

respondent, a complaint against Augustus Caezar R. Gan, petitioner, for support with prayer for support pendent

lite.

Petitioner, denying paternity of the child, moved to dismiss the case but was denied by the trial court.

After finding that the claim of filiation and support was adequately proved, the trial court rendered its Decision on

12 May 2000 ordering petitioner to recognize private respondent Francheska Joy S. Pondevida as his illegitimate

child and support her with P20,000.00 every month to be paid on or before the 15th of each month starting 15

April 2000. Private respondent moved for execution of the judgment of support, which the trial court granted by

issuing a writ of execution, citing as reason therefor private respondent's immediate need for schooling.

On 9 June 2000 petitioner filed a petition for certiorari and prohibition with the Court of Appeals imputing

grave abuse of discretion to the trial court for ordering the immediate execution of the judgment.

On 31 August 2000 the Court of Appeals dismissed the petition on the ratiocination that under Sec. 4,

Rule 39 of the 1997 Rules of Civil Procedure judgments for support are immediately executory and cannot be

stayed by an appeal.

ISSUE:

Can judgment for support be executed despite absence of good reasons for its immediate execution?

RULING:

Yes. Section 4, Rule 39, of the Rules of Court clearly states that, unless ordered by the trial court,

judgments in actions for support are immediately executory and cannot be stayed by an appeal. The aforesaid

provision peremptorily calls for immediate execution of all judgments for support and makes no distinction

between those which are the subject of an appeal and those which are not. Petitioner is reminded that to the

plain words of a legal provision we should make no further explanation. Absoluta sententia expositore non indiget.

Indeed, the interpretation which petitioner attempts to foist upon us would only lead to absurdity, its acceptance

negating the plain meaning of the provision subject of the petition. Therefore, judgments in actions for support are

immediately executory and cannot be stayed by an appeal.

1D 2014

Midterm Project

Legal Maxims Case Digests

2

Actus me invito factus non est meus actus

An act done by me against my will is not my act

People vs. Dimapanan

G.R. No. 177570

January 19, 2011

Leonardo-De Castro, J.

FACTS:

Accused-appellants Nelida D. Dequina (Dequina), Joselito J. Jundoc (Jundoc), and Nora C. Jingabo (Jingabo)

were charged before the Regional Trial Court (RTC) of Manila, Branch 27, with Violations of Section 4, in relation to

Section 21, paragraphs (e-l), (f), (m), and (o) of Republic Act No. 6425, otherwise known as the Dangerous Drugs

Act of 1972, as amended by Republic Act No. 7659.

In order to exonerate herself from criminal liability, Dequina contends that she transported the marijuana

under the compulsion of an irresistible fear. Jundoc and Jingabo, on the other hand, claim that they went along to

accommodate Dequina, a trusted childhood friend.

ISSUE:

Is Dequina exempt form criminal liability because she acted under the compulsion of an irresistible force?

RULING:

No. A person who acts under the compulsion of an irresistible force, like one who acts under the impulse

of an uncontrollable fear of equal or greater injury, is exempt from criminal liability because he does not act with

freedom. Actus me invito factus non est meus actus. An act done by me against my will is not my act. The force

contemplated must be so formidable as to reduce the actor to a mere instrument who acts not only without will

but against his will. The duress, force, fear or intimidation must be present, imminent and impending, and of such

nature as to induce a well-grounded apprehension of death or serious bodily harm if the act be done. A threat of

future injury is not enough. The compulsion must be of such a character as to leave no opportunity for the

accused for escape or self-defense in equal combat. Therefore, Dequina is not exempt from criminal liability.

1D 2014

Midterm Project

Legal Maxims Case Digests

3

Actus non facit reum, nisi mens sit rea

The act itself does not make a man guilty unless his intentions were so

People vs. Ojeda

G.R. No. 104238-58

June 3, 2004

Corona, J.

FACTS:

Appellant Cora Abella Ojeda was charged in 21 separate Informations for estafa in and for violation of

Batas Pambansa (BP) 22. On November 5, 1983, appellant purchased from Chua various fabrics and textile

materials worth P228,306 for which she issued 22 postdated checks bearing different dates and amounts. Chua

later presented to the bank for payment check no. 033550 dated November 5, 1983 in the amount of P17,100 but

it was dishonored due to Account Closed. On April 10, 1984, Chua deposited the rest of the checks but all were

dishonored for the same reason. Demands were allegedly made on the appellant to make good the dishonored

checks, to no avail.

With the exception of six checks which did not bear her signature, appellant admitted that she issued the

postdated checks which were the subject of the criminal cases against her. She, however, alleged that she told

Chua not to deposit the postdated checks on maturity as they were not yet sufficiently funded. Appellant also

claimed that she made partial payments to Chua in the form of finished garments worth P50,000. This was not

rebutted by the prosecution.

In her Second and Urgent Motion for Reconsideration, appellant attached an Affidavit of Desistance of

complainant Ruby Chua which stated in part that the defendant Mrs. Cora Ojeda has already fully paid her

monetary obligation to me in the amount of P228,306.00 which is the subject of the aforementioned cases.

ISSUE:

Was there good faith on the part of the appellant? If yes, does this constitute a valid defense against

estafa?

RULING:

Yes. Under paragraph 2 (d) of Article 315 of the RPC, as amended by RA 4885,[20] the elements of estafa

are: (1) a check is postdated or issued in payment of an obligation contracted at the time it is issued; (2) lack or

insufficiency of funds to cover the check; (3) damage to the payee thereof. Deceit and damage are essential

elements of the offense and must be established by satisfactory proof to warrant conviction. It must be noted that

our Revised Penal Code was enacted to penalize unlawful acts accompanied by evil intent denominated as crimes

mala in se. The principal consideration is the existence of malicious intent. There is a concurrence of freedom,

intelligence and intent which together make up the criminal mind behind the criminal act. Thus, to constitute a

crime, the act must, generally and in most cases, be accompanied by a criminal intent. Actus non facit reum, nisi

mens sit rea. No crime is committed if the mind of the person performing the act complained of is innocent.

Therefore, appellant acted in good faith and should be acquitted for estafa and for violation of BP 22.

1D 2014

Midterm Project

Legal Maxims Case Digests

4

Ad proximum antecedens fiat relation nisi impediatur sentencia

Relative words refer to the nearest antecedents, unless the context otherwise requires

Mapa vs. Arroyo

G.R. No. 78585

July 5, 1989

Regalado, J.

FACTS:

Mapa bought lots from Labrador Development Corporation (Labrador) payable in ten years. Mapa

defaulted to pay the installment dues and continued to do so despite constant reminders by Labrador. The latter

informed Mapa that the contracts to sell the lots were cancelled, but Mapa invoked Clause 20 of the four

contracts. Said clause obligates Labrador to complete the development of the lots, except those requiring the

services of a public utility company or the government, within 3 years from the date of the contract. Petitioner

contends that P.D. 957 requires Labrador to provide the facilities, improvements, and infrastructures for the lots,

and other forms of development if offered and indicated in the approved subdivision plans.

ISSUE:

Do the provisions of PD 957 and its implementing rules form part of the contracts to sell executed by

petitioner and respondent corporation?

RULING:

No. The complete and applicable rule is ad proximum antecedens fiat relatio nisi impediatur sentencia.

Relative words refer to the nearest antecedent, unless it be prevented by the context. In the present case, the

employment of the word "and" between "facilities, improvements, infrastructures" and "other forms of

development," far from supporting petitioner's theory, enervates it instead since it is basic in legal hermeneutics

that "and" is not meant to separate words but is a conjunction used to denote a joinder or union. Thus, if ever

there is any valid ground to suspend the monthly installments due from petitioner, it would only be based on non-

performance of the obligations provided in Clause 20 of the contract, particularly the alleged non-construction of

the cul-de-sac.

1D 2014

Midterm Project

Legal Maxims Case Digests

5

Argumentum a contrario

Negative-opposite doctrine

Chung Fook vs. White

264 U.S. 443

April 7, 1924

Sutherland, J.

FACTS:

Chung Fook is a native-born citizen of the United States. Lee Shee, his wife, is an alien Chinese woman,

ineligible for naturalization. In 1922 she sought admission to the United States, but was refused and detained at

the immigration station, on the ground that she was an alien, afflicted with a dangerous contagious disease.

ISSUE:

Is Lee Shee entitled to admission under Section 22 of the Immigration Act of February 5, 1917?

RULING:

No. The pertinent words of the proviso are that if the person sending for wife or minor child is

naturalized, a wife to whom married or a minor child born subsequent to such husband or father's naturalization

shall be admitted without detention for treatment in hospital. xxx" The measure of the exemption is plainly stated

and, in terms, extends to the wife of a naturalized citizen only. The Court is inclined to

1D 2014

Midterm Project

Legal Maxims Case Digests

6

Casus omissus pro omisso habendus est

A person, object or thing omitted from an enumeration must be held to have been omitted intentionally

COA vs. Province of Cebu

G.R. No. 141386

November 29, 2001

Ynares-Santiago, J.

FACTS:

The provincial governor of the province of Cebu, as chairman of the local school board, under Section 98

of the Local Government Code, appointed classroom teachers who have no items in the DECS plantilla to handle

extension classes that would accommodate students in the public schools.

In the audit of accounts conducted by the Commission on Audit (COA) of the Province of Cebu, for the

period January to June 1998, it appeared that the salaries and personnel-related benefits of the teachers

appointed by the province for the extension classes were charged against the provincial Special Education Fund

(SEF). Likewise charged to the SEF were the college scholarship grants of the province. Consequently, the COA

issued Notices of Suspension to the province of Cebu, saying that disbursements for the salaries of teachers and

scholarship grants are not chargeable to the provincial SEF.

ISSUE:

May the expenses for college scholarship grants be charged to the SEF?

RULING:

No. A reading of the pertinent laws of the Local Government Code reveals that said grants are not among

the projects for which the proceeds of the SEF may be appropriated. It should be noted that Sections 100 (c) and

272 of the Local Government Code substantially reproduced Section 1, of R.A. No. 5447. But, unlike payment of

salaries of teachers which falls within the ambit of establishment and maintenance of extension classes and

operation and maintenance of public schools, the granting of government scholarship to poor but deserving

students was omitted in Sections 100 (c) and 272 of the Local Government Code. Casus omissus pro omisso

habendus est. A person, object, or thing omitted from an enumeration in a statute must be held to have been

omitted intentionally. It is not for this Court to supply such grant of scholarship where the legislature has omitted

it. Therefore, the expenses for college scholarship grants cannot be charged to the SEF.

1D 2014

Midterm Project

Legal Maxims Case Digests

7

Cessante ratione legis, cessat ipsa lex

When the reason of the law ceases, the law itself ceases

Comendador vs. De Villa

G.R. No. 96948

August 2, 1991

Cruz, J.

FACTS:

The petitioners are officers of the Armed Forces of the Philippines facing prosecution for their alleged

participation in the failed coup d etat that took place on December 1 to 9, 1989. The charges against them are

violation of Articles of War (AW) 67 (Mutiny), AW 96 (Conduct Unbecoming an Officer and a Gentleman) and AW

94 (Various Crimes) in relation to Article 248 of the Revised Penal Code (Murder).

At the hearing of May 15, 1990, the petitioners manifested that they were exercising their right to raise

peremptory challenges against the president and members of General Court-Martial (GCM) No. 14. They invoked

Article 18 of Com. Act No. 408 for this purpose. GCM No. 14 ruled, however, that peremptory challenges had been

discontinued under P.D. No. 39.

ISSUE:

Can the petitioners exercise the right of peremptory challenge under Article 18 of the Articles of War?

RULING:

Yes. P.D. No. 39 was issued to implement General Order No. 8, which empowers the Chief of Staff of the

Armed Forces to create military tribunals to try and decide cases of military personnel and such other cases as

may be referred to them. With the termination of martial law and the dissolution of the military tribunals created

thereunder, the reason for the existence of P.D. No. 39 ceased automatically. When the reason of the law ceases,

the law itself ceases. Cessante ratione legis, cessat ipsa lex. The withdrawal of the right to peremptory challenge

in P.D. No. 39 became ineffective when the apparatus of martial law was dismantled with the issuance of

Proclamation No. 2045, proclaiming the termination of the state of martial law throughout the Philippines. As a

result, the old rule embodied in Article 18 of Com. Act No. 408 was automatically revived and now again allows the

right to peremptory challenge. Therefore, petitioners should be allowed to exercise the right of peremptory

challenge under Article 18 of the Articles of War.

1D 2014

Midterm Project

Legal Maxims Case Digests

8

Contemporanea expositia est est optima et fortissimo in lege

The contemporary construction is strongest in law

People vs. Puno

G.R. No. 97941

February 17, 1993

Regalado, J.

FACTS:

The accused, Isabelo Puno y Guevarra, was the temporary driver of Mrs. Maria Socorro Mutuc-Sarmiento.

When they were about to go home, while the car was stopped, the accused, Enrique Amurao y Puno, boarded the

car and sat next to Socorro and poked a gun at her. Isabelo then announced that they want to get money from her.

This occurred while the car was travelling on the North superhighway. They were adjudged by the Regional Trial

Court to be guilty of robbery with extortion committed on a highway, punishable under P.D. No. 532.

ISSUE:

Are the accused guilty of violating P.D. No. 532?

RULING:

No. Harking back to the origin of our law on brigandage (bandolerismo), we find that a band of brigands,

is more than a gang of ordinary robbers. Jurisprudence on the matter reveals that during the early part of the

American occupation of our country, roving bands were organized for robbery and pillage and since the then

existing law against robbery was inadequate to cope with such moving bands of outlaws, the Brigandage Law was

passed. The purpose of brigandage is, inter alia, indiscriminate highway robbery. If the purpose is only a particular

robbery, the crime is only robbery, or robbery in band if there are at least four armed participants. The martial law

legislator, in creating and promulgating Presidential Decree No. 532 for the objectives announced therein, could

not have been unaware of that distinction and is presumed to have adopted the same, there being no indication to

the contrary. This conclusion is buttressed by the rule on contemporaneous construction, since it is one drawn

from the time when and the circumstances under which the decree to be construed originated. Contemporaneous

exposition or construction is the best and strongest in the law. Therefore, the accused are not guilty of violating

P.D. No. 532.

1D 2014

Midterm Project

Legal Maxims Case Digests

9

Disingue tempora et concordabis jura

Distinguish times and you will harmonize laws

The Commissioner of Customs vs. Superior Gas And Equipment Co.

G.R. No. L-14115

May 25, 1960

Bengzon, J.

FACTS:

In August 1956, the steamship "Chi Chung" arrived in Manila, from Formosa, carrying 1,200 metric tons of

industrial salt consigned to Superior Gas & Equipment Co. (Sugeco). With official permit, the cargo was discharged

and delivered shipside, within the harbor sea wall but outside the breakwater, into four lighters of the Luzon

Stevedoring Co. for final unloading at the private wharf of Atlantic Gulf & Pacific Co. at Punta, Sta. Ana, Manila.

Sugeco was required to pay and did pay the sum of P2,400.00 as wharfage fee on August 23, 1956.

Respondent contends that its importation should not pay wharfage fees because it made no use of the

facilities of government wharves or piers, the cargo having been discharged through the private wharf of Atlantic

Gulf Co.

Petitioner-appellant, invoking the decision under the Tariff Act of 1909 in the Sugar Centrals case, claims

that even if not loaded from a Government wharf, goods exported (or imported) shall pay wharfage fees.

ISSUE:

Is Sugeco required to pay the wharfage fees?

RULING:

No. Distingue tempora et concordabis jura. We have laws enacted at different times, under dissimilar

circumstances. At the time the Tariff of Act of 1909 was approved, the Government had no wharves of its own;

therefore, the wharfage fee imposed by it could not have meant charges for the use of Government wharves,

which was the generally accepted idea; so this Court in view of the surrounding circumstances believed and held

(in the Sugar Centrals case) that the charges were payable even if no Government wharf be used, because they

were meant to be used as a trust fund "for the purpose of acquiring and constructing wharves by the Government

of the Philippine Islands." However, at the time Republic Act 1371 was approved, the Government had wharves;

and the discussions in the Legislature showed the intention not to levy wharfage fees on merchandise unloaded at

places other than Government wharves or without making use of pier facilities. Therefore, Sugeco is not required

to pay the wharfage fees.

1D 2014

Midterm Project

Legal Maxims Case Digests

10

Dura lex sed lex

The law may be harsh, but that is the law

Romarico J. Mendoza vs. People of the Philippines

G.R. No. 183891

October 19, 2011

Brion, J.

FACTS:

Petitioner has a pending case of failure to remit SSS premium contribution of his employees. During the

pendency, then President Gloria Macapagal-Arroyo signed RA No. 9903 into law. RA No. 9903 mandates the

effective withdrawal of all pending cases against employers who would remit their delinquent contributions to the

SSS within a specified period, viz., within six months after the laws effectivity. The petitioner claims that in view of

RA No. 9903 and its implementing rules, the settlement of his delinquent contributions in 2007 entitles him to an

acquittal. He invokes the equal protection clause in support of his plea.

ISSUE:

Is the petitioner covered by R.A. No. 9903?

RULING:

No. The clear intent of the law is to grant condonation only to employers with delinquent contributions or

pending cases for their delinquencies and who pay their delinquencies within the six (6)-month period set by the

law. Mere payment of unpaid contributions does not suffice; it is payment within, and only within, the six (6)-

month availment period that triggers the applicability of RA No. 9903. Unfortunately for him, he paid his

delinquent SSS contributions in 2007. By paying outside of the availment period, the petitioner effectively placed

himself outside the benevolent sphere of RA No. 9903. This is how the law is written: it condones employers

and only those employers with unpaid SSS contributions or with pending cases who pay within the six (6)-month

period following the laws date of effectivity. Dura lex, sed lex. Therefore, petitioner is not covered by R.A. No.

9903.

1D 2014

Midterm Project

Legal Maxims Case Digests

11

Ejusdem generis

Of the same kind or specie

Parayno vs. Jovellanos

G.R. No. 148408

July 14, 2006

Corona, J.

FACTS:

Petitioner was the owner of a gasoline filling station in Calasiao, Pangasinan. In 1989, some residents of

Calasiao petitioned the Sangguniang Bayan (SB) of said municipality for the closure or transfer of the station to

another location. The SB then recommended to the Mayor the closure or transfer of location of petitioners

gasoline station and issued Resolution No. 50, which stated, among others, that the existing gasoline station is in

violation of The Official Zoning Code of Calasiao, Art. 6, Section 44, which states: In business or industrial zones, no

gasoline service station x x x shall be allowed within one hundred (100) meters away from any public or private

school, public library, playground, church, and hospital x x x.

Petitioner claimed that her gasoline station was not covered by Section 44 of the Official Zoning Code

since it was not a gasoline service station but a gasoline filling station governed by Section 21 thereof.

ISSUE:

Is the petitioners gasoline station covered by Section 44 of the Official Zoning Code of Calasiao?

RULING:

No. The zoning ordinance of respondent municipality made a clear distinction between gasoline service

station and gasoline filling station. Section 21 pertains to filling stations while Section 42 pertains to service

stations. It is evident that the ordinance intended these two terms to be separate and distinct from each other.

Respondent municipality thus could not find solace in the legal maxim of ejusdem generis which means of the

same kind, class or nature. Under this maxim, where general words follow the enumeration of particular classes

of persons or things, the general words will apply only to persons or things of the same general nature or class as

those enumerated. Hence, because of the distinct and definite meanings alluded to the two terms by the zoning

ordinance, respondents could not insist that gasoline service station under Section 44 necessarily included

gasoline filling station under Section 21. Indeed, the activities undertaken in a gas service station did not

automatically embrace those in a gas filling station. Therefore, petitioners gasoline station is not covered by

Section 44 of the Official Zoning Code of Calasiao.

1D 2014

Midterm Project

Legal Maxims Case Digests

12

Exceptio firmat regulam in casibus non exceptis

A thing not being excepted must be regarded as coming within the purview of the general rule

Hodges vs. Municipal Board of the City of Iloilo

G.R. No. L-18276

January 12, 1967

Castro, J.

FACTS:

The petitioner C. N. Hodges, engaged in the business of buying and selling real estate in the city and the

Province of Iloilo, was subjected to the tax imposed in Ordinance 31 of the City of Iloilo. Petitioner contends that

the ordinance was beyond the corporate powers of the respondent City.

The respondents justified the enactment of the ordinance not only under the city charter but also upon

the authority vested in the respondent City by section 2 of the Local Autonomy Act.

ISSUE:

Is the ordinance beyond the corporate powers of the City of Iloilo?

RULING:

No. The grant of the power to tax to chartered cities under section 2 of the Local Autonomy Act is

sufficiently plenary to cover "everything, excepting those which are mention" therein, subject only to the

limitation that the tax so levied is for "public purposes, just and uniform." There is no showing that the tax levied

comes under any of the specific exceptions listed in section 2 of the Local Autonomy Act. Not being excepted, it

must be regarded as coming within the purview of the general rule. Exceptio firmat regulam in casibus non

exceptis. Since its public purpose, justness and uniformity of application are not disputed, the tax so levied must be

sustained as valid. Therefore, the ordinance is within the corporate powers of the City of Iloilo.

1D 2014

Midterm Project

Legal Maxims Case Digests

13

Ex dolo malo non oritur action

No man can be allowed to found a claim upon his own wrongdoing

Bough v. Cantiveros

G.R. No. 13300

September 29, 1919

Malcolm, J.

FACTS:

Matilde Cantiveros was among the richest in the town of Carigara, Leyte owning parcels of realty

amounting to more than P30,000.00. She is separated from her husband Jose Vasquez, and is living with a cousin

closed to her, Basilia Hanopol, with the latters husband, Gustavus Bough.

The presence of her husband in town was brought to her attention by Bough who made her believe that

the ex-husband might contest the contract for separation of their conjugal property. She was induced to sign a

fictitious contract of sale of all her property to Basilia Bough for the amount P10,000.00 instead of P30,000.00

actual value. Cantiveros remained in possession of the property since Bough prepared and signed another

document, which is a donation by them to Cantiveros of all the property to be effective in case of the death of

themselves and their children before the death of Cantiveros.

Petitioner, then sought that they will be put in possession of the property covered by the Deed of Sale.

Cantiveros denied and asked that the contract made between herself and Basilia be declared null and void.

ISSUE:

Is there an effect of illegality in the contract?

RULING:

In this instance, the grantor, reposing faith in the integrity of the grantee, and relying on a suggested

occurrence, which did not in fact take place, was made the dupe of the grantee, and led into an agreement against

public policy. The party asking to be relieved from the agreement which she was induced to enter into by means of

fraud, was thus in delicto, but not in pari delicto with the other party. The deed was procured by

misrepresentation and fraud sufficient to vitiate the transaction. The rights of creditors are not affected. We feel

that justice will be done if we place the grantor in the position in which she was before these transactions were

entered into.

It is further well settled, that a party to an illegal contract cannot come into a court of law and ask to have

his illegal objects carried out. The rule is expressed in the maxims: Ex dolo malo non oritur actio, and In pari

delicto potior est conditio defendentis. The law will not aid either party to an illegal agreement; it leaves the

parties where it finds them. (Article 1306, Civil Code; Perez vs. Herranz [1907], 7 Phil., 693.) Where, however, the

parties to an illegal contract are not equally guilty, and where public policy is considered as advanced by allowing

the more excusable of the two to sue for relief against the transaction, relief is given to him.

1D 2014

Midterm Project

Legal Maxims Case Digests

14

Expressio unius est exclusion alterius

The express mention of one person, thing or consequence implies the exclusion of all others.

Malinias v. Comelec

G.R. No. 146943

October 4, 2002

Carpio, J.

FACTS:

Petitioners Sario Malinias and Roy Pilando were candidates for governor and congress representatives

respectively during the May 15, 1998 elections in Mountain Province. Petitioners filed a complaint with COMELEC

against private respondents Governor Dominguez, and Provincial Director Corpuz and Police Chief Tangilag for

alleged violations of:

Section 25 of Republic Act No. 6646 and,

Section 232 of B.P. Blg. 881, respectively.

Petitioners alleged that on May 15, 1998, an illegal police checkpoint set-up at Nacagang, Sabangan,

Mountain Province blocked their supporters who were on their way to Bontoc Provincial Capitol Building for the

canvassing of votes. They likewise alleged that the Provincial Board of Canvassers never allowed the canvassing to

be made public and consented to the exclusion of the public or representatives of other candidates except those

of Dominguez. To support their claims, their supporters executed so-called mass affidavits

Private respondents submitted counter-affidavit stating that the checkpoint was not a sole case and that

it was set-up to enforce COMELECs gun ban and that no group will disrupt the canvass proceedings which

happened several times in the past.

After investigation was conducted, the COMELEC En Banc dismissed the case against the private

respondents for lack of probable cause.

ISSUE:

Can COMELEC prosecute private respondents for alleged violation of Sections 25 of RA 6646 and 232 of

B.P. Blg. 881?

RULING:

No. The alleged violation of the respondents of Sec. 25 of R.A. 6646 and Sec. 232 of B.P. Blg. No. 881 are

not included in the acts defined as punishable criminal election offenses under Sec. 27 of R.A. 6646 and Sec. 261

and 262 of B.P. Blg. No. 881, respectively.

The COMELEC and private respondents overlooked that Section 232 of B.P. Blg. 881 is not one of the

election offenses explicitly enumerated in Sections 261 and 262 of B.P. Blg. 881. While Section 232 categorically

states that it is unlawful for the persons referred therein to enter the canvassing room, this act is not one of the

election offenses criminally punishable under Sections 261 and 262 of B.P. Blg. 881. Thus, the act involved in

Section 232 of B.P. Blg. 881 is not punishable as a criminal election offense. Though not a criminal election offense,

a violation of Section 232 certainly warrants, after proper hearing, the imposition of administrative penalties.

Under the rule of statutory construction of expressio unius est exclusio alterius, there is no ground to

order the COMELEC to prosecute private respondents for alleged violation of Section 232 of B.P. Blg. 881 precisely

because this is a non-criminal act. It is a settled rule of statutory construction that the express mention of one

person, thing, or consequence implies the exclusion of all others.

1D 2014

Midterm Project

Legal Maxims Case Digests

15

Expressum facit cessare tacitum

What is expressed puts an end to that which is implied

CHREA V. CHR

G.R. No. 155336

November 25, 2004

Chico-Nazario, J.

FACTS:

Congress passed the General Appropriations Act of 1998 which provided special provisions applicable to

Constitutional Offices enjoying fiscal autonomy. In this light, CHR upgraded or raised the salaries (A98-0555

October 1998) reclassified selection positions (Resolution No. A98-047 September, 1998) and collapsed vacant

positions (A98-062 November 1998) which were later denied by DBM.

Consequently, the CSC Regional Office ordered the Central Office to reject pending appointments owing

to the disapproval issued by DBM.

The petitioners Commission on Human Rights Employees Association (CHREA) who found the

reorganization favorable only to top-ranking employees and detrimental to rank-and-file employees requested

Central Office to honor the directive of the Regional Office. The Central Office denied the request. Petitioner

elevated the matter to Court of Appeals but it upheld the validity of the upgrading, retitling, and reclassification

scheme in the CHR on the justification that such action is within the ambit of CHRs fiscal autonomy.

ISSUE:

Can the CHR validly implement an upgrading, reclassification, creation, and collapsing of plantilla positions

in the Commission without the prior approval of the Department of Budget and Management?

RULING:

No. From the 1987 Constitution and the Administrative Code, it is abundantly clear that the CHR is not

among the class of Constitutional Commissions which are granted independence and fiscal autonomy. The

Constitution provides that only the CSC, the COMELEC, and the COA shall belong to Constitutional Commissions. As

expressed in the oft-repeated maxim expressio unius est exclusio alterius, the express mention of one person,

thing, act or consequence excludes all others. Thus, not being expressly mentioned, the CHR does not have the

authority to reclassify, upgrade, and create positions without approval of the DBM.

While CHR is a constitutional creation, it is not included in the genus of offices accorded fiscal autonomy

by constitutional or legislative fiat.

1D 2014

Midterm Project

Legal Maxims Case Digests

16

Ex necessitate legis

By necessary implication of law

Pepsi-Cola Products Phils. v Secretary of Labor

G.R. No. 96663

10 August 1999

Purisima, J.

FACTS:

Supervisors of Pepsi Cola Philippines filed certification election for Pepsi-Cola Employees Organization-

UOEF (PCEU) to act as its exclusive bargaining agent. Three unions under Pepsi, two of which consist of rank-and-

file unions will be affiliated to PCEU.

Pepsi filed a petition for cancellation and suspension of certification election against PCEU because they

are consist of managers, and that supervisors union cannot mix with another union whose composition are rank

and file employees.

PCEU avers that the Labor Code does not prohibit a union composed of supervisory employees from being

affiliated with one whose members are rank-and-file. Likewise inclusion of managerial employees in a union

cannot be a ground for cancellation of registration of a labor union. On Sept. 1, 1992, the Union issued a resolution

withdrawing themselves from the Federation.

ISSUE:

Can a union such as PCEU composed of supervisory employees be affiliated with rank-and-file unions?

RULING:

The limitation is not confined to a case of supervisors' wanting to join a rank-and-file union. The

prohibition extends to a supervisors' local union applying for membership in a national federation the members of

which include local unions of rank and file employees. The intent of the law is clear especially where, as in this case

at bar, the supervisors will be co-mingling with those employees whom they directly supervise in their own

bargaining unit.

Likewise, the court ruled that Credit and Collection managers and Accounting Managers are regarded as

highly confidential employees in nature and must not be deemed eligible to join such supervisors union. The court

asserts that while Article 245 of the Labor Code singles out managerial employee as ineligible to join, assist or form

any labor organization, under the doctrine of necessary implication, confidential employees are similarly

disqualified. According to the doctrine of necessary implication, what is impelled in a statue is as much a part

thereof as that which is expressed.

1D 2014

Midterm Project

Legal Maxims Case Digests

17

Falsa demonstratio non nocet, cum de corpore constat

False description does not preclude construction nor vitiate the meaning of the statute

1D 2014

Midterm Project

Legal Maxims Case Digests

18

Favores ampliandi sunt; odia restringenda

Penal laws which are favorable to the accused are given retroactive effect

Estioca v. People

G.R. No. 173876

June 27, 2008

Chico- Nazario, J.

FACTS:

A number of persons were accused of conspiring and robbing an elementary school. One of which is

Boniao who was 14 years old at the time of the commission of the crime. They were found guilty by the lower

court. When the case was appealed to the CA, RA 9344 took effect and Boniao was acquitted since he was a minor

at the time of the crime but without prejudice to his civil liability. Custody was given to his parents.

ISSUE:

Can RA 9344 be given retroactive effect to Boniaos case?

RULING:

Yes, the reckoning point in considering minority is the time of the commission of the crime. In this case

Boniao is 14 years old hence exempted from criminal liability without prejudice to his civil liability. Art 22 of the

Revised Penal Code provides that penal laws may be given retroactive effect if they are in favor of the accused.

1D 2014

Midterm Project

Legal Maxims Case Digests

19

Generali dictum genaliter est interpretandum

A general statement is understood in a general sense

Macalintal v. Comelec

G.R. No. 157013

10 July 2003

Austria- Martinez, J.

FACTS:

Romulo Macalintal, a member of the Philippine Bar, sought the declaration of certain provisions of the

Overseas Absentee Voting Act of 2003 as unconstitutional. He said that a lawyer and a taxpayer, he has actual and

material legal interest in the case and in ensuring that public funds are properly appropriated.

ISSUES:

Whether or not Section 18.5 of the same law empowering the COMELEC to order the proclamation of the

winning candidates violate the constitutional mandate under Section 4, Article VII of the Constitution that the

winning candidates for President and the Vice-President shall be proclaimed as winners by Congress?

RULING:

The judge reiterated the majority opinion the phrase proclamation of winning candidates used in the

assailed statute is a sweeping statement, which thus includes even the winning candidates for the presidency and

vice-presidency. Following a basic principle in statutory construction, generali dictum genaliter est interpretandum

(a general statement is understood in a general sense), the said phrase cannot be construed otherwise. To uphold

the assailed provision of Rep. Act No. 9189 would in effect be sanctioning the grant of a power to the COMELEC,

which under the Constitution, is expressly vested in Congress; it would validate a course of conduct that the

fundamental law of the land expressly forbids.

1D 2014

Midterm Project

Legal Maxims Case Digests

20

Generalia verba sunt generaliter intelligenda

What is generally spoken shall be generally understood.

Diaz v. IAC

G.R. No. L-66574

February 21, 1990

Paras, J.

FACTS:

Pablo Santero was a legitimate son of Simona and Pascual. The petitioner had four (4) illegitimate children

with the Pablo so that when Pablo died, the petitioner invoked the right to inheritance of her illegimitate children

to the intestate estate of the late Simona Pamuti Vda. de Santero. The respondent refuted this claim saying that

she was the lone heir to such estate as provided in the Art. 922 of the New Civil Code. The said provision states

that An illegitimate child has no right to inherit ab intestato from the legitimate children or relatives of his father

or mother.

ISSUE:

Can illegitimate children of Pablo Santero inherit from Simona Santero, by right of representation of their

father Pablo Santero who is a legitimate child of Simona?

RULING:

Supreme Court ruled that the determining factor is the legitimacy or illegitimacy of the person to be

represented. If the person to be represented is an illegitimate child, then his descendants, whether legitimate or

illegitimate, may represent him; however, if the person to be represented is legitimate, his illegitimate

descendants cannot represent him because the law provides that only his legitimate descendants may exercise

right of representation by reason of the barrier imposed Article 992. Amicus curiae Prof. Ruben Balane has this to

say: The term relatives, although used many times in the Code, is not defined by it. In accordance therefore with

the canons of statutory interpretation, it should be understood to have a general and inclusive scope, inasmuch as

the term is a general one. Generalia verbasunt generaliter intelligenda. Thus, the word "relatives" is a general

term and when used in a statute it embraces not only collateral relatives but also all the kindred of the person

spoken of, unless the context indicates that it was used in a more restrictive or limited sense. The court declared

the respondent as the sole legitimate heir

1D 2014

Midterm Project

Legal Maxims Case Digests

21

Generalia specialibus non derogant

A general law does not nullify a specific or special law.

Laureano v. CA

G.R. No. 114776

February 2, 2000

Quisumbing, J.

FACTS:

Menandro Laureano was hired by Singaporean Airlines (SAL) as pilot in 1978. When the company was hit

by recession, Laureano was relieved. This prompted the petitioner to file labor case against illegal dismissal of SAL.

He then withdrew this motion and instead filed a civil case for damages due to illegal termination of his contract.

SAL moved for the dismissal of the case for lack of jurisdiction, non-applicability of Philippine laws and estoppel. It

also asserts that the termination was valid pursuant to the Singaporean Law. The trial court denied the request

and ruled in favor of Laureano. This decision, however, was reversed by the Court of Appeals.

ISSUE:

Is Singaporean law applicable to this case?

RULING:

No. The specific Singaporean Law which holds valid the dismissal of Laureano is not proved in court. The

particular law was not pointed out. As such, the trial court cannot make a determination if the termination is

indeed valid under Singaporean Law. Philippine courts do not take judicial notice of the laws of Singapore. Failure

to prove such law, the Philippine laws shall apply in this case.

Under our laws, all money claims arising from employer-employee relationships must be filed within three

years from the time the cause of action accrued. Laureanos cause of action accrued in 1982 when he was

terminated but he only filed the money claim in 1987 or more than three years from 1982. Hence he is already

barred by prescription

1D 2014

Midterm Project

Legal Maxims Case Digests

22

Hoc quidem per quam durum est sed ita lex scripta est

The law may be exceedingly hard, but so the law is written

People V. Palermo

G.R. No. 120630

June 28, 2001

Per curiam

FACTS:

On September 9, 1994, an Information was filed in RTC of Boac, Marinduque involving a case of

incestuous rape committed by Marcelo Palermo to his 14- year old daughter, Merly Palermo. On the night of April

2, 1992, Marcelo succeeded in having carnal knowledge with her daughter Merly against her will and to her

damage and prejudice. Two months thereafter, Merly suffered vaginal bleeding which caused her to be confined in

the hospital. Medico legal results showed that the bleeding was in fact an incomplete abortion. Merly accounted

that from that date, Marcelo succeeded in forcing her to have sexual intercourse for about ten times.

During the direct examination question, Marcelo admitted having raped his daughter. He cited as an

excused his drunkness. The Trial Court rendered its decision imposing death penalty upon the Marcelo.

The appellant Marcelo Palermo, thru counsel, claims that the trial court "erred in sentencing (him) the

maximum penalty of death despite his voluntary admission of guilt. They further argued that the apellant

deserves a reduction of penalty for the sake of compassionate justice.

ISSUE:

Does Marcelos confession of his guilt a mitigating circumstance to reduce the sentence from death

penalty to reclusion perpetua?

HELD:

No. To be considered a mitigating circumstance, Article 13 (7) of the RPC requires that the offender "had

voluntarily confessed his guilt before the court prior to the presentation of the evidence for the prosecution. In

the case at bar, it was only during his turn to present evidence that apellant confessed having committed the crime

charged.

It may now be trite, but nonetheless apt, to restate the legal maxim "Hoc quidem per quam durum est

sed ita lex scripta est." (The law may be exceedingly hard, but so the law is written.). Appellant himself knows he is

facing the death penalty for his crime, but he is ready for it because, as he, said, "Ako po'y nagkasala.".

1D 2014

Midterm Project

Legal Maxims Case Digests

23

Impossibilium nulla obligation est

There is no obligation to do an impossible thing.

Chui v. Posadas

G.R. No. L-23487

February 11, 1925

Malcolm, J.

FACTS:

Petitioner is a Chinese alien residing in Manila. He owned three (3) dry good stores located the same city.

His tax for the 3

rd

quarter amounting to P507.13 was due October 20, 2014. However, that day, was the height of

riot being waged against Chinese. It started since October 18. As part of mutual agreement, they decided to close

their stores and stay home as it is not safe for the Chinese to stay outside.

Due to the circumstances, the petitioner managed to bring his tax payment a day after the due date which

was on October 21. It is mandatory for late payment to pay a surcharge of 25%. The petitioner requested the

respondent to waive the penalty owing to the circumstances. The respondent refused for he lacked power to grant

the request, although admitting that the additional tax of twenty-five per cent "seems unjust and excessive."

The court was asked to declare that the Collector of Internal Revenue has discretionary power to remit

additional percentage taxes and that the said Collector can exercise his discretion.

ISSUE:

Can the petitioner be exempt from 25% surcharge for late payment on the discretion of the respondent?

HELD:

Yes. It may be possible that there might be excuses for non-payment. The maxim is: Impossibilium nulla

obligatio est. There is no obligation to do impossible things. But here, there is no allegation in the complaint that

the inability of the Chinese to pay their taxes on time was due to any order by the Government or to any action

taken by the Government, and no allegation that the delay in payment was caused by the fault of him to whom it

was to be paid.

The demurrer is sustained, and unless the petitioner shall within a period of five days so amend his

complaint as to state a cause of action, it shall be dismissed with costs against him.

1D 2014

Midterm Project

Legal Maxims Case Digests

24

Index animi sermo est

Speech is the index of intention

Victoria v. COMELEC

G.R. No. 109005

January 10, 1994

Quiason, J.

FACTS:

The petitioner sought to set aside the resolution issued by COMELEC certifying the private respondent as

the highest ranking member of the Sangguniang Panlalawigan of the Province of Albay. Both the petitioner and

respondent rank number 1 in their respective districts during May 11, 1992 elections.

Due to the suspension of the then Albay Governor Romeo Salalima, the vice-governor assumed the

powers and functions of the governor. The seat of the vice-governor, now being vacant, shall be occupied by the

highest ranking member of the Sangguniang Panlalawigan. The petitioner contends that he should be declared as

the highest ranking member and not the respondent. He said that in determining the percentage, the number of

votes garnered must be divided with the actual number of people who voted in the district (not on the total

number of registered voters per district). If such is the case, he will get 25.84% and the respondent, 23.40%. He

believed the formula will prejudice candidates in districts where there were low number of people who actually

voted.

Sec. 44 of the Local Government Code provides for the guidelines stating that ranking in the Sanggunian

shall be determined on the basis of the proportion of votes obtained by each winning candidate to the total

number of registered voters in each district in the immediately preceding local election.

ISSUE:

Can the Court honor the formula provided by the petitioner in determining the ranking of Sangguniang

Panliligawan members as substantiated by his arguments?

HELD:

No. Petitioners contention is untenable. The law is clear that the ranking in the Sanggunian shall be

determined on the basis of the proportion of the votes obtained by each winning candidate of the total number of

registered voters who actually voted. In such a case, the Court has no recourse but to merely apply the law.

Index animi sermo est (speech is the index of intention) rests on the valid presumption that the words

employed by the legislature in a statute correctly express its intent or will and preclude the court from construing

it differently.

1D 2014

Midterm Project

Legal Maxims Case Digests

25

In eo quod plus sit, semper inest et minus

The greater includes the lesser

ELISEO F. SORIANO vs MA. CONSOLIZA P. LAGUARDIA

ELISEO F. SORIANO versus MTRCB

G.R. No. 164785

G.R. No. 165636

April 29, 2009

Corona, J.

FACTS:

Petitioner Eliseo F. Soriano utters indecent, scandalous, insulting and offensive words in his television

program Ang Dating Daan. MTRCB receives complaints arising from such statements. Subsequently, MTRCB

suspended the airing of the program for 20 days and eventually suspended the petitioner for three months. Hence,

this petition assailing his suspension as a violation of his right to free speech.

ISSUE:

Whether or not MTRCB has the power , granted by law, to suspend a program or a host.

RULING:

Yes, MTRCB has the implied and necessary power to suspend a program or a host.

To begin with, Section 3(d) of PD 1986 explicitly gives the MTRCB the power to supervise and regulate the

television broadcast of all television programs. Under Section 3(e) the MTRCB is also specifically empowered to

classify television programs. In the effective implementation of these powers, the MTRCB is authorized under

Section 3(a) *t+o promulgate such rules and regulations as are necessary or proper for the implementation of *PD

1986+. Finally, under Section 3(k), the MTRCB is warranted *t+o exercise such powers and functions as may be

necessary or incidental to the attainment of the purposes and objectives of *PD 1986+.

Clearly, the law intends to give the MTRCB all the muscle to carry out and enforce the law effectively. In

consonance with this legislative intent, we uphold the implied and necessary power of the MTRCB to order the

suspension of a program or a host thereof in case of violation of PD 1986 and rules and regulations that implement

it.

The grant of a greater power necessarily includes the lesser power. In eo quod plus sit, semper inest et

minus. The MTRCB has the power to cancel permits for the exhibition or television broadcast of programs

determined by the said body to be objectionable for being immoral, indecent, contrary to law or good customs x x

x.This power is a power to impose sanctions. The MTRCBs power to cancel permits is a grant of authority to

permanently and absolutely prohibit the showing of a television program that violates MTRCB rules and

regulations. It necessarily includes the lesser power to temporarily and partially prohibit a television program that

violates MTRCB rules and regulations by suspending either the showing of the offending program or the

appearance of the programs offending host.

Clearly, therefore, in case of violation of PD 1986 and its implementing rules and regulations, it is within

the authority of the MTRCB to impose the administrative penalty of suspension to the erring broadcaster. A

contrary stance will emasculate the MTRCB and render illusory its supervisory and regulatory powers, make

meaningless the public trustee character of broadcasting and afford no remedy to the infringed fundamental rights

of viewers.

1D 2014

Midterm Project

Legal Maxims Case Digests

26

Interest republicae ut sit finis litium

Public interest requires that by the very nature if things there must be an end to a legal controversy

MERALCO vs PCFI

G.R. No. 101783

January 23, 2002

SANDOVAL-GUTIERREZ, J

FACTS:

Presidential Decree No. 551 was promulgated on 1974. This decree provides for the reduction from 5% to

2% of the franchise tax paid by electric companies. Philippine Consumers Foundation, Inc., (PCFI) filed with the

Board of Energy (BOE) a petition for violation of P. D. No. 551 against the Manila Electric Company (Meralco). PCFI

sought for the immediate refund by Meralco to its customers of all the savings it realized under P.D. No. 551. The

petition was dismissed. Meralco was authorized by the BOE to retain its savings. PCFI elevated the case before the

Supreme Court docketed as G.R. No. 63018 but was again dismissed. After four years, PCFI and private

respondents filed a petition with the same subject/ issue before the RTC docketed as Civil Case No. Q-89-3659. RTC

grant the petition of respondents declaring the decision of the SC in the case G.R. No. 63018 null and void. Hence,

petitioners Meralco filed a petition for review on certiorari before the SC.

ISSUE:

Whether or not Civil Case No. Q-89-3659 is already barred by prior judgements Courts Resolution

in G.R. No. 63018 sustaining the BOE's Decision in BOE Case No. 82-198.

RULING:

Yes, Case No. Q-89-3659 is already barred by prior judgements. The issue - whether or not Meralco is duly

authorized to retain the savings resulting from the reduction of the franchise tax under P.D. No. 551 as long as its

rate of return falls below the 12 % allowable rate recognized in this jurisdiction has long been settled. Thus, the

relitigation of the same issue in Civil Case No. Q-89-3659 cannot be sanctioned under the principle of res judicata.

Interest republicae ut sit finis litium - it is to the interest of the public that there should be an end to litigation by

the same parties and their privies over a subject fully and fairly adjudicated. From this overwhelming concern

springs the doctrine of res judicata an obvious rule of reason according stability to judgments.

In res judicata, the judgment in the first action is considered conclusive as to every matter offered and

received therein, as to any other admissible matter which might have been offered for that purpose, and all other

matters that could have been adjudged therein. For a claim of res judicata to prosper, the following requisites

must concur: 1) there must be a final judgment or order; 2) the court rendering it must have jurisdiction over the

subject matter and the parties; 3) it must be a judgment or order on the merits; and 4) there must be, between the

two cases identity of parties, subject matter and causes of action. All these requisites are present and beyond

dispute on the case at bar.

The subject matters of BOE Case No. 82-198 and Civil Case No. Q-89-3659 are likewise identical since both

refer to the savings realized by Meralco from the reduction of the franchise tax under P.D. No. 551. As can be

gleaned from the records, private respondents arguments in Civil Case No. Q-89-3659 bear extreme resemblance

with those raised in BOE Case No. 82-198.

In fine, we stress that the rights of Meralco under P.D. No. 551, as determined by the BOE and sustained by this

Court, have acquired the character of res judicata and can no longer be challenged.

1D 2014

Midterm Project

Legal Maxims Case Digests

27

Interpotare et concodare legibus est optimus interpotandi modus

Every statute must be so construed and harmonized with other statutes as to form a uniform system of law

IN THE MATTER OF APPLICATION FOR THE ISSUANCE OF A WRIT OF HABEAS CORPUS RICHARD BRIAN

THORNTON for and in behalf of the minor child SEQUEIRA JENNIFER DELLE FRANCISCO THORNTON vs. ADELFA

FRANCISCO THORNTON

G.R. No. 154598

August 16, 2004

Corona, J.

FACTS:

Respondent left the family home with her daughter Sequiera without notifying her husband (petitioner).

Petitioner filed a petition for habeas corpus in the designated Family Court in Makati City but this was dismissed,

claiming that they dont have jurisdiction because of the allegation that the child was in Basilan. Then, petitioner

filed another petition for habeas corpus, this time in the Court of Appeals which could issue a writ of habeas

corpus enforceable in the entire country. However, the petition was denied by the Court of Appeals on the ground

that it did not have jurisdiction over the case. It ruled that since RA 8369 (The Family Courts Act of 1997) gave

family courts exclusive original jurisdiction over petitions for habeas corpus, it impliedly repealed RA 7902 (An Act

Expanding the Jurisdiction of the Court of Appeals) and Batas Pambansa 129 (The Judiciary Reorganization Act of

1980). Hence, the petition for review.

ISSUE:

Whether or not the Court of Appeals has jurisdiction to issue writs of habeas corpus in cases involving

custody of minors.

RULING:

Yes. Court of Appeals has jurisdiction to issue writs of habeas corpus in cases involving custody of minors.

Language is rarely so free from ambiguity as to be incapable of being used in more than one sense. Sometimes,

what the legislature actually had in mind is not accurately reflected in the language of a statute, and its literal

interpretation may render it meaningless, lead to absurdity, injustice or contradiction. In the case at bar, a literal

interpretation of the word "exclusive" will result in grave injustice and negate the policy "to protect the rights and

promote the welfare of children" under the Constitution and the United Nations Convention on the Rights of the

Child. This mandate must prevail over legal technicalities and serve as the guiding principle in construing the

provisions of RA 8369.

Moreover, settled is the rule in statutory construction that implied repeals are not favoured. The two laws

must be absolutely incompatible, and a clear finding thereof must surface, before the inference of implied repeal

may be drawn. The rule is expressed in the maxim, interpretare et concordare leqibus est optimus

interpretendi, i.e., every statute must be so interpreted and brought into accord with other laws as to form a

uniform system of jurisprudence. The fundament is that the legislature should be presumed to have known the

existing laws on the subject and not have enacted conflicting statutes. Hence, all doubts must be resolved against

any implied repeal, and all efforts should be exerted in order to harmonize and give effect to all laws on the

subject."

The provisions of RA 8369 reveal no manifest intent to revoke the jurisdiction of the Court of Appeals and

Supreme Court to issue writs of habeas corpus relating to the custody of minors. Further, it cannot be said that the

provisions of RA 8369, RA 7092 and BP 129 are absolutely incompatible since RA 8369 does not prohibit the Court

of Appeals and the Supreme Court from issuing writs of habeas corpus in cases involving the custody of minors.

Thus, the provisions of RA 8369 must be read in harmony with RA 7029 and BP 129 that family courts have

concurrent jurisdiction with the Court of Appeals and the Supreme Court in petitions for habeas corpus where the

custody of minors is at issue.

1D 2014

Midterm Project

Legal Maxims Case Digests

28

Interpretatio fienda est ut res magis valeat quam pereat

A law should be interpreted with a view to upholding rather than destroying it

MATRIANO vs. NLRC and SIA

G.R. No. L-65786

July 16, 1984

GUTIERREZ, JR., J.

FACTS:

Petioner, Cecilia Matriano, underwent a caesarian operation. Thereafter, Matriano filed a claim to her

employer, Singapore Airlines (SIA), for reimbursement of hospital, medical, and surgical fees incurred. This is

pursuant to a Collective Bargaining Agreement (CBA) entered into by SIAs Employees Association and SIA which

provides for reimbursement of hospitalization and medical care expenses incurred by employees. Respondent SIA

refused to reimburse her contending that maternity expenses are not included in the term hospitalization and

medical care expenses. SIAs Employees Association charged SIA of unfair labor practice in violation of the CBA

before the Labor Arbiter. The Labor Arbiter dismissed the charges. Petitioner also filed a case before the NLRC but

was also dismissed. Hence, the present petition for certiorari.

ISSUE:

Whether or not under the CBA petitioner Matriano is entitled to reimbursement of her hospitalization

expenses as a result of her caesarian operation.

RULING:

Yes. Petitioner, Matriano, is entitled to reimbursement of her hospitalization expenses as a result of her

caesarian operation under the CBA. The provisions of the CBA in question are clear and from them we gather the

intent of the contracting parties.

The disputed CBA provision states that the "Company will meet expenses up to P9,000 per calendar year for ward

expenses and surgical fees in respect of each employee ..." Undoubtedly, the hospitalization expenses of petitioner

for her caesarian operation are covered by the very wordings of the provision, as it involves surgery. To adopt

respondent's strained interpretation would be to create an absurd situation whereby an employee may no longer

avail of the benefits under Article XI when one is on vacation, sick, or compassionate leave, which are also

separated granted in the same way that maternity leave benefits are provided as distinct privileges. Such a

construction would, of course, be absurd, and yet the respondents would apply it to another form of leave.

Reasonable and practical interpretation must be placed on contractual provisions. Interpretatio fienda est ut res

magis valeat quam pereat. Such interpretation is to be adopted, that the thing may continue to have efficacy

rather than fail.

Hence, the petitioner is entitled to reimbursement of her hospitalization expenses.

1D 2014

Midterm Project

Legal Maxims Case Digests

29

Interpretatio talis in ambiguis simper fienda est ut evitetur inconveniens et absurdum

Where there is ambiguity, such interpretation as will avoid inconvenience and absurdity is to be adopted

CIR vs TMX Sales and CTA

G.R. No. 83736

January 15, 1992

GUTIERREZ, JR., J

FACTS:

Private respondent TMX Sales filed its quarterly income tax return for the first quarter of 1981, declaring

an income of P571,174.31, and consequently paying an income tax thereon of P247,010.00 on May 15, 1981.

During the subsequent quarters, however, TMX Sales, Inc. suffered losses so that when it filed on April 15, 1982 its

Annual Income Tax Return for the year ended December 31, 1981, it declared a net loss of P6,156,525. Thereafter,

on July 9, 1982, TMX Sales filed with BIR a claim for refund of the overpaid income tax. CIR ruled that the

petitioner (TMX Sales) is already barred from claiming the same considering that more than two (2) years had

already elapsed between the payment (May 15, 1981) and the filing of the claim in Court (March 14, 1984).

Respondent, TMX Sales, however, elevated the case to the Court of Tax Appeals. CTAs decision is in favour of TMX

Sales. Hence, CIR filed a petition before the Supreme Court seeking reversal of the decision of the CTA.

ISSUE:

Does the two-year period to claim a refund of erroneously collected tax provided for in Section 292 (now

Section 230) of the National Internal Revenue Code (NIRC) commence to run from the date the quarterly income

tax was paid or from the date the filing of the Final Adjustment Return?

RULING:

The two-year period to claim a refund of erroneously collected tax provided for in Section 292 (now

Section 230) of the NIRC should be counted from the date of filing of the Final Adjustment Return.

Section 292 (now Sec 230) of the NIRC should be interpreted in relation to the other provisions of the Tax Code in

order to give effect to legislative intent and to avoid an application of the law which may lead to inconvenience

and absurdity. In the case of People vs. Rivera (59 Phil 236 [1933]), this Court stated that statutes should receive a

sensible construction, such as will give effect to the legislative intention and so as to avoid an unjust or an absurd

conclusion. INTERPRETATIO TALIS IN AMBIGUIS SEMPER FRIENDA EST, UT EVITATUR INCONVENIENS ET

ABSURDUM. Where there is ambiguity, such interpretation as will avoid inconvenience and absurdity is to be

adopted. Furthermore, courts must give effect to the general legislative intent that can be discovered from or is

unraveled by the four corners of the statute, and in order to discover said intent, the whole statute, and not only a

particular provision thereof, should be considered. Every section, provision or clause of the statute must be

expounded by reference to each other in order to arrive at the effect contemplated by the legislature. The

intention of the legislator must be ascertained from the whole text of the law and every part of the act is to be

taken into view.

The most reasonable and logical application of the law would be to compute the two-year prescriptive

period at the time of filing the Final Adjustment Return or the Annual Income Tax Return, when it can be finally

ascertained if the taxpayer has still to pay additional income tax or if he is entitled to a refund of overpaid income

tax. A literal application of Section 292 (now Section 230) would thus pose no problem as the two-year prescriptive

period reckoned from the time the quarterly income tax was paid can be easily determined. However, if the

quarter in which the overpayment is made, cannot be ascertained, then a literal application of Section 292 (Section

230) would lead to absurdity and inconvenience.

TMX Sales, Inc. filed a suit for a refund on March 14, 1984. Since the two-year prescriptive period should be

counted from the filing of the Adjustment Return on April 15, 1982, TMX Sales, Inc. is not yet barred by

prescription.

1D 2014

Midterm Project

Legal Maxims Case Digests

30

Legis interpretatio legis vim obtinet

The authoritative interpretation of the court of a statute acquires the force of law by becoming a part thereof

People vs Jabinal

G.R. No. L-30061

February 27, 1974

Antonio, J.

FACTS:

Jose Jabinal, appellant, was found guilty of the crime of Illegal Possession of Firearm and Ammunition in

the Municipal Court of Batangas. He was convicted on the ground that the rulings of the Supreme Court in the

cases of Macarandang and Lucero were reversed and abandoned in People vs. Mapa, supra. The court considered

as mitigating circumstances the appointments of the accused as Secret Agent and Confidential Agent. An appeal

from above judgement was filed raising in issue the validity of his conviction based on a retroactive application of

Supreme Courts ruling in People v. Mapa.

ISSUE:

Should appellant be acquitted on the basis of rulings in Macarandang and Lucero, or should his conviction

stand in view of the complete reversal of the Macarandang and Lucero doctrine in Mapa?

RULING:

The appellant, Jose Jabinal, should be acquitted on the basis of rulings in Macarandang and Lucero. It will

be noted that when appellant was appointed Secret Agent by the Provincial Government in 1962, and Confidential

Agent by the Provincial Commander in 1964, the prevailing doctrine on the matter was that laid down by the

Supreme Court in People v. Macarandang (1959) and People v. Lucero (1958). The decision in People v.

Mapa reversing the aforesaid doctrine came only in 1967.

Decisions of Supreme Court, although in themselves not laws, are nevertheless evidence of what the laws

mean, and this is the reason why under Article 8 of the New Civil Code "Judicial decisions applying or interpreting

the laws or the Constitution shall form a part of the legal system ... ." The interpretation upon a law by this Court

constitutes, in a way, a part of the law as of the date that law originally passed, since this Court's construction

merely establishes the contemporaneous legislative intent that law thus construed intends to effectuate. The

settled rule supported by numerous authorities is a restatement of legal maxim "legis interpretatio legis vim

obtinet" the interpretation placed upon the written law by a competent court has the force of law. The doctrine

laid down in Lucero andMacarandang was part of the jurisprudence, hence of the law, of the land, at the time

appellant was found in possession of the firearm in question and when he arraigned by the trial court. It is true

that the doctrine was overruled in the Mapa case in 1967, but when a doctrine of this Court is overruled and a

different view is adopted, the new doctrine should be applied prospectively, and should not apply to parties who

had relied on the old doctrine and acted on the faith thereof. This is especially true in the construction and

application of criminal laws, where it is necessary that the punishability of an act be reasonably foreseen for the

guidance of society.

It follows, therefore, that considering that appellant conferred his appointments as Secret Agent and

Confidential Agent and authorized to possess a firearm pursuant to the prevailing doctrine enunciated

in Macarandang andLucero, under which no criminal liability would attach to his possession of said firearm in spite

of the absence of a license and permit therefor, appellant must be absolved. Certainly, appellant may not be

punished for an act which at the time it was done was held not to be punishable.

1D 2014

Midterm Project

Legal Maxims Case Digests

31

Leges posteriores priores contrarias abrogant

A later law repeals a prior law on the same subject which is repugnant thereto

Carabao, Inc. vs Agricultural Productivity Commission

G.R. No. L-29304

September 30, 1970

TEEHANKEE, J

FACTS:

Plaintiff ,Carabao Inc., had filed in the Court of First Instance of Rizal its complaint to recover the sum of

money representing the unpaid price of goods sold and delivered by it to defendant Agricultural Productivity

Commission. It alleged that it had presented a claim for payment of the sum with the Auditor General, but that

since the latter had failed to decide the claim within two (2) months from date of its presentation, it had acquired

the right under Act No. 3083 to file the original action for collection in the lower court. The case was dismissed on

the grounds of lack of jurisdiction due to the implied repeal of Act 3083 by C.A. 327. Hence, the present appeal.

ISSUE:

Whether or not Act No. 3083 was repealed by C.A. 327.

RULING:

Yes, Act No. 3083 was effectively repealed by C.A. 327.

The corresponding provisions of Act 3083 which are utterly incompatible with those of Commonwealth

Act must therefore be deemed superseded and abrogated, under principle of "leges posteriores priores contrarias

abrogant" a later statute which is repugnant to an earlier statute is deemed to have abrogated the earlier one

on the same subject matter.

Inaction by the Auditor General for the sixty-day period now provided by Commonwealth Act 327

(exclusive of Sundays and holidays) and of time consumed in referring the matter to other persons or officers no

longer entitles the claimant to file a direct suit in court, as he was formerly authorized under Act 3083 in the event

of the Auditor General's failure to decide within a flat period of two months. Since the Constitution and

Commonwealth Act 327 expressly enjoin the Auditor General to act on and decide the claim within the fixed 60-

day period, a claimant's remedy is to institute mandamus proceedings to compel the rendition of a decision by the

Auditor General in the event of such inaction.

The courts of first instance no longer have the original jurisdiction to act on such claims, which actions,

under section 4 of Act 3083 now discarded, "shall be governed by the same rules of procedure, both original and

appellate, as if the litigants were private parties" since exclusive original jurisdiction under Article XI of the

Constitution and the implementing Act, Commonwealth Act 327 is vested in the Auditor General, and appellate

jurisdiction is vested in the President in cases of accountable officers, and in the Supreme Court in cases of private

persons and entities upon proper and timely petitions for review.

In the case at bar, no error was committed, therefore, by the lower court dismissing the case and declaring itself

without jurisdiction over the same.

1D 2014

Midterm Project

Legal Maxims Case Digests

32

Lex de futuro, judex de praeterito

The law provides for the future, the judge for the past

PDIC vs Stockholders of Intercity Bank

G.R. No. 181556

December 14, 2009

CARPIO MORALES, J

FACTS:

Intercity Savings and Loan Bank, Inc. (Intercity Bank) was found insolvent and Petitioner Philippine Deposit

Insurance Corporation (PDIC) was assigned as the petitioner, liquidator of Intercity Bank. Creditors were paid in

their principal claim in 2002. In July 27, 2004, Republic Act No. 9302 (RA 9302) was approved. Section 12 of this act

entitles creditors to surplus dividends. PDIC later filed a Motion for Approval of the Final Distribution of Assets and

Termination of the Liquidation Proceedings. Makati RTC granted the motion except the parts giving authority to

PDIC to act as trustee of the liquidating and surplus dividends allocated for creditors of Intercity Bank. PDIC

assailed the decision of RTC and elevated the case to the Court of Appeals but the appeal was dismissed. Hence,

the present petition for review on certiorari.

ISSUE: