Escolar Documentos

Profissional Documentos

Cultura Documentos

Icai

Enviado por

rambabu.mTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Icai

Enviado por

rambabu.mDireitos autorais:

Formatos disponíveis

Structure

The Institute of Chartered Accountants of India periodically reviews the scheme of Education and

Training to remain in tandem with developments in the field of education and other changes at national

and global level. Evolving business also demands newer skills from the accounting professionals.

Accordingly, the existing scheme was revamped and the new scheme was launched on 13th September,

2006.

Different levels of Chartered Accountancy Course

1. Entry Level Test Common Proficiency Test

2. First Stage of Theoretical Education Professional Competence Course

3. Final Stage of Theoretical Education Final Course

The Entry level test is named as Common Proficiency Test (CPT) which is designed in the pattern of entry

level test for engineering, medical and other professional courses. It is a test of 4 hours duration

comprising of two sessions of 2 hours each with a break between two sessions. The test comprises of

objective type questions only with flexible negative marking for choosing wrong options. The Common

Proficiency Test (CPT) has replaced Professional Education (Course-I) effective from September 13, 2006.

The last Professional Education (Examination I) was held in November, 2007.

The Professional Competence Course with an upgraded syllabus has replaced Professional Education

(Course -II) effective from September 13, 2006. The last Professional Education (Examination II) for all

the students of Professional Education (Course II), irrespective whether such students have exhausted

5 consecutive attempts or not, will be held in May, 2009.

The last leg of the Chartered Accountancy is Final Course, designed to impart expert knowledge in

financial reporting, auditing and professional ethics, taxation, corporate laws, system control, strategic

finance and advanced management accountancy. The Final (New) Course was launched in February

2007 and first examination under new scheme will be held in November, 2008. The last Final (Old)

Course examination will be held in November, 2009.

Updated syllabus is benchmarked to chartered accountancy courses available around the globe and is

fully compliant to International Education Standards issued by the International Federation of

Accountants.

Under the new scheme the period of articled training has been enhanced from 3 years to 3 years.

New upgraded 100 Hours of Information Technology Training replaced 250 Hours Compulsory Computer

Training in December, 2006

Objective of the New Scheme

The new scheme has emphasized on

Elimination of prolonged entry norm through Professional Education (Course-I) route but instituting a

uniform entry level test the Common Proficiency Test;

After passing 10th standard examination a student can register with the Board of Studies and prepare

for entry level test while pursuing 10+2 level study;

To encourage young talented students having aptitude for accounting education to make an early entry

to the profession;

Balanced approach towards theory and training by way of emphasizing commencement of the training

at the beginning of the chartered accountancy curriculum;

Complementing theoretical education by appropriate modules of practical training;

Providing quality classroom education through efficient accredited institutions;

Linking an upgraded Information Technology Training;

Facilitating additional courses of study during articleship training;

Globalizing chartered accountancy education through organisation of education and training abroad;

To help students in acquiring professional ethical values and attitudes; and

To inculcate analytical ability among the students through case studies.

Articled Training / Audit Training

The unique requirement of practical training is instrumental in shaping a well -rounded professional to

ensure that students have an opportunity to acquire on-the-job work experience of a professional

nature. Such a practical training:

Inculcates a disciplined attitude for hard work;

Develops necessary skills in applying theoretical knowledge to practical situations;

Provides exposure to overall socio-economic environment in which organisations operate; and

Develops ethical values.

Under the New Scheme of Education & Training 3 years of articleship training has been designed to

strike a balance between theoretical education and practical training.

A student can also undergo audit training. Eight months of audit trainin g is treated as equivalent to six

months of articleship training.

Common Proficiency Test

Eligibility

A student who has passed the Class 10 examination conducted by an examining body constituted by law

in India or (an examination recognized by the Central Government as equivalent thereto ) may register

for Common Proficiency Test.

A registered student may appear in Common Proficiency Test after he has appeared in the Senior

Secondary Examination (10+2 examination) conducted by an examining body constituted by law in India

or an examination recognised by the Central Government as equivalent thereto and has complied with

such requirements as may be specified by the Council from time to time.

A student who has got himself registered for Common Proficiency Test 60 days prior to the first day of

the month in which CPT examination is to be held can appear in the examination i.e. on or before 1st

April and 1st October for appearing in CPT examination to be held in June and December respectively.

Common Proficiency Test examinations are held in June & December every year.

Registration

A student should register with the Board of Studies by submitting the prescribed filled in form which

can be obtained from the addresses given below. Prospectus for CPT, A Simplied Entry to the

Chartered Accountancy Course contains an application form which can be obtained on payment of

Rs.100. The form can also be downloaded from the website www.icai.org and Rs.100 can be remitted

through Credit Card/Debit Card.

The application form is to be submitted in consonance with the address of the student as stated below:

Gujarat, Maharashtra, Goa and Union Territories of

Daman & Diu and Dadra & Nagar Haveli

Western India Regional Council

The Institute of Chartered Accountants of India

ICAI, BHAWAN

Anveshak 27 Cuffe Parade, Colaba,

Post Box No. 6081, Mumbai 400 005

Phone: 022-39893989

Fax: 022-39802953

E-mail: wro@icai.org

Andhra Pradesh, Kerala, Karnataka, Tamil Nadu and

the Union Territories of Pondicherry and Lakshadweep

Islands

Southern India Regional Cou ncil

The Institute of Chartered Accountants of India

ICAI, BHAWAN

122, M.G. Road, Post Box No. 3314,

Nungambakkam, Chennai 600 034

Phone: 044-39893989

Fax: 044-30210355

E-mail: sro@icai.org

Assam, Meghalaya, Nagaland, Orissa, West Bengal,

Manipur, Tripura, Sikkim, Arunachal Pradesh, Mizoram,

Andaman-Nicobar Islands

Eastern India Regional Council

The Institute of Chartered Accountants of India

ICAI, BHAWAN, 7, Anandilal Poddar Sarani,

(Russell Street) Kolkata 700 071

Phone: 033-39893989

Fax: 033-30211145

E-mail: ero@icai.org

Uttar Pradesh, Bihar, Madhya Pradesh, Rajasthan,

Uttaranchal, Chhatisgarh and Jharkhand

Central India Regional Council

The Institute of Chartered Accountants of India

ICAI, BHAWAN

Post Box No. 314, 16/77B, Civil Lines,

Kanpur 208 001

Phone: 0512-3989398

Fax: 0512-3011173

E-mail: cro@icai.org

Delhi, Haryana, Himachal Pradesh, Jammu & Kashmir,

Punjab and Union Territory of Chandigarh

Northern India Regional Council

The Institute of Chartered Accountants of India

ICAI, BHAWAN, 52-54, Vishwas Nagar, Delhi 110032

Phone: 011-39893990

Fax: 011-30210680

E-mail: nro@icai.org,

Registration and tuition fee

1 2

Fess for:

(i) Indian Students residing in India and other

SAARC countries and Bhutan; and

(ii) Students belonging to other SAARC

countries and Bhutan

(In Rs.)

3,500

Students other than stated in Column 1 i.e.

(i) The students of foreign countries other than

SAARC countries and Bhutan; and

(ii) Indian students residing abroad other than

SAARC countries and Bhutan

US$

200

Students of Professional Education (Course-I) who opt for CPT course: Rs.100.

The student should make the draft payable accordingly to Mumbai, Chennai, Kolkata, Kanpur and New

Delhi respectively. Students, who are submitting application form online, are advised to take a print

out of the filled in application form, affix the photograph, sign the application form and despatch to the

appropriate office of the Institute as stated above. A copy of the prospectus will be sent to such

students along with the study package.

1

THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA

COMMON PROFICIENCY TEST

SYLLABUS

One Paper, Two Sessions 200 Marks

Session I:

Section A: Fundamentals of Accounting 60 Marks

Section B: Mercantile Laws 40 Marks

Session II:

Section C: General Economics 50 Marks

Section D: Quantitative Aptitude 50 Marks

2

Common Proficiency Test (CPT)

(One paper Four hours 200 Marks)

Level of Knowledge: Basic knowledge

SESSION I

(Two Sections Two hours 100 Marks)

Section A: Fundamentals of Accounting ( 60 Marks )

Objective:

To develop conceptual understanding of the fundamentals of financial accounting system.

Contents

1. Theoretical Framework

(i) Meaning and Scope of accounting

(ii) Accounting Concepts, Principles and Conventions

(iii) Accounting Standards concepts, objectives, benefits

(iv) Accounting Policies

(v) Accounting as a measurement discipline valuation principles, accounting estimates

2. Accounting Process

Books of Accounts leading to the preparation of Trial Balance, Capital and revenue expenditures,

Capital and revenue receipts, Contingent assets and contingent liabilities, Fundamental errors

including rectifications thereof.

3. Bank Reconciliation Statement

4. Inventories

Basis of inventory valuation and record keeping.

5. Depreciation accounting

Methods, computation and accounting treatment of depreciation, Change in depreciation

methods.

6. Preparation of Final Accounts for Sole Proprietors

7. Accounting for Special Transactions

(a) Consignments

(b) Joint Ventures

(c) Bills of exchange and promissory notes

(d) Sale of goods on approval or return basis.

3

8. Partnership Accounts

Final accounts of partnership firms Basic concepts of admission, retirement and death of a partner

including treatment of goodwill.

9. Introduction to Company Accounts

Issue of shares and debentures, forfeiture of shares, re-issue of forfeited shares, redemption of

preference shares.

Section B: Mercantile Laws ( 40 Marks )

Objective:

To test the general comprehension of elements of mercantile law

Contents

1. The Indian Contract Act , 1872: An overview of Sections 1 to 75 covering the general nature of

contract , consideration , other essential elements of a valid contract , performance of contract and

breach of contract.

2. The Sale of Goods Act, 1930: Formation of the contract of sale Conditions and Warranties

Transfer of ownership and delivery of goods Unpaid seller and his rights.

3. The India Partnership Act, 1932: General Nature of Partnership Rights and duties of partners

Registration and dissolution of a firm.

SESSION II

(Two Sections Two hours 100 Marks)

Section C: General Economics ( 50 Marks )

Objective:

To ensure basic understanding of economic systems, economic behaviour of individuals and

organizations.

Contents

(I) Micro Economics

1. Introduction to Micro Economics

(a) Definition, scope and nature of Economics

(b) Methods of economic study

(c) Central problems of an economy and Production possibilities curve.

2. Theory of Demand and Supply

(a) Meaning and determinants of demand, Law of demand and Elasticity of demand Price, income and

cross elasticity

(b) Theory of consumer s behaviour Marshallian approach and Indifference curve approach

(c) Meaning and determinants of supply, Law of supply and Elasticity of supply.

3. Theory of Production and Cost

(a) Meaning and Factors of production

(b) Laws of Production The Law of variable proportions and Laws of returns to scale

(c) Concepts of Costs Short-run and long-run costs, Average and marginal costs, Total, fixed and

variable costs.

4. Price Determination in Different Markets

(a) Various forms of markets Perfect Competition, Monopoly, Monopolistic Competition and Oligopoly

(b) Price determination in these markets.

4

(II) Indian Economic Development

5. Indian Economy A Profile

(a) Nature of the Indian Economy

(b) Role of different sectors Agriculture, Industry and Services in the development of the Indian

economy, their problems and growth

(c) National Income of India Concepts of national income, Different methods of measuring national

income, Growth of national income and per capita income in various plans.

(d) Basic understanding of tax system of India Direct and Indirect Taxation

6. Select Aspects of Indian Economy

(a) Population Its size, rate of growth and its implication for growth

(b) Poverty Absolute and relative poverty and main programs for poverty alleviation

(c) Unemployment Types, causes and incidence of unemployment

(d) Infrastructure Energy, Transportation, Communication, Health and Education

(e) Inflation

(f) Budget and Fiscal deficits

(g) Balance of payments

(h) External debts.

7. Economic Reforms in India

(a) Features of economic reforms since 1991

(b) Liberalisation, Privatisation and Disinvestment

(c) Globalisation.

8. Money and Banking

(a) Money Meaning and functions

(b) Commercial Banks Role and functions

(c) Reserve Bank of India Role and functions, Monetary policy.

Section D: Quantitative Aptitude ( 50 Marks )

Objective:

To test the grasp of elementary concepts in Mathematics and Statistics and application of the same as

useful quantitative tools.

Contents

1. Ratio and proportion, Indices, Logarithms

2. Equations

Linear simultaneous linear equations up to three variables, quadratic and cubic equations in one

variable, equations of a straight line, intersection of straight lines, graphical solution to linear equations.

3. Inequalities

Graphs of inequalities in two variables common region.

4. Simple and Compound Interest including annuity Applications

5. Basic concepts of Permutations and Combinations

6. Sequence and Series Arithmetic and geometric progressions

7. Sets, Functions and Relations

8. Limits and Continuity Intuitive Approach

5

9. Basic concepts of Differential and Integral Calculus (excluding trigonometric functions)

10. Statistical description of data

(a) Textual, Tabular & Diagrammatic representation of data.

(b) Frequency Distribution.

(c) Graphical representation of frequency distribution Histogram, Frequency Polygon, Ogive

11. Measures of Central Tendency and Dispersion

Arithmetic Mean, Median Partition Values, Mode, Geometric Mean and Harmonic, Mean, Standard

deviation, Quartile deviation

12. Correlation and Regression

13. Probability and Expected Value by Mathematical Expectation

14. Theoretical Distributions

Binomial, Poisson and Normal.

15. Sampling Theory

Basic Principles of sampling theory , Comparison between sample survey and complete enumeration ,

Errors in sample survey , Some important terms associated with sampling , Types of sampling , Theory of

estimation , Determination of sample size .

16. Index Numbers

CPT EXAMINATION MARKING PATTERN

It is proposed to increase the negative marking in the CPT Examination from percent

to percent for each wrong answer given by the student.

This is only at the proposal stage and is given to the students for advance information.

For more details candidates are advised to refer to the CPT examination application form

for the CPT examination scheduled to be held in June, 2008. The examination application

forms are likely to be made available from 4th April, 2008.

INTEGRATED PROFESSIONAL COMPETENCE COURSE (IPCC)

In this IPCC curriculum only working knowledge of core and allied subjects to accountancy profession is covered,

while at the Final (New) course, advanced application knowledge of core and allied subjects to accountancy

profession has been intended to be inculcated. The unique feature of the entire theoretical education of the Chartered

Accountancy curriculum is the supportive and complementary practical training. A student would undergo

theoretical education and 3 years of practical training after passing Group-I of IPCC/Accounting Technician (Level-

1). This balanced approach will help the students to appreciate the underlying practical applications of the

theoretical education scheme.

Neither a stand-alone theory nor a practice without theoretical knowledge would make a professional successful.

Moreover, there is a need to develop proper understanding of the business environment and information technology

which acts as an important business process driver. It is also essential to sharpen communication skills to be able to

work successfully in the competitive business environment.

Accordingly, the existing scheme is being revamped and a new scheme is launched on December 10, 2008.

Objective of the new scheme:

The new scheme has emphasized on

Instituting a uniform entry level test the Common Proficiency Test compulsory for all the students joining

IPCC/ATC.

After passing 10th standard examination a student can register for CPT with the Board of Studies and prepare for

entry level test while pursuing 10+2 level study;

To encourage young talented students having aptitude for accounting education to make an early entry to the

profession;

Introduction of orientation programme and 100 Hours ITT during 9 months of study course & before appearing in

the IPCE/ATE.

Balanced approach towards theory and training by way of emphasizing commencement of the training after passing

Group I of IPCC/ATC curriculum;

Complementing theoretical education by appropriate modules of practical training;

Providing quality classroom education through efficient accredited institutions;

Providing lecutures through Gyan Darshan Channel in colloboration of IGNOU.

Linking an upgraded Information Technology Training;

Facilitating additional courses of study during articleship training;

Globalizing chartered accountancy education through organisation of education and training abroad;

To help students in acquiring professional ethical values and attitudes; and

To inculcate analytical ability among the students through case studies.

Eligibility & Registration

ELIGIBILITY REQUIREMENT FOR REGISTRATION

A student who has passed Common Proficiency Test and senior secondary examination (10+2 examination)

conducted by an examining body constituted by law in India or an examination recognized by the Central

Government as equivalent thereto may join the Integrated Professional Competence Course or may opt for

Accounting Technician Course.

Simultaneously, student will also registered for practical training depending upon whether he is opting for ATC or

IPCC.

In addition, a student has to register and undergo orientation progrmme & 100 hours ITT before appearing in

Integrated Professional Competence Examination/ Accounting Technician Examination.

ELIGIBILITY QUALIFICATION/ REQUIREMENT TO ENTROL FOR ATC/ IPCC:

A candidate is eligible for enrolment to any of the level(s) of the Integrated Professional Competence Course (IPCC)

on passing the Common Proficiency Test and Senior Secondary Examination (10+2 examination) conducted by an

examining body constituted by law in India or an examination recognised by the Central Government as equivalent

thereto.

A candidate who has already passed Entrance Examination or Foundation Examination or Professional Education

(Examination-I) shall be eligible for enrolment to Integrated Professional Competence Course subject to complying

with relevant conditions.

A candidate who was already registered for erstwhile Intermediate Examination or of Professional Education

(Course-II) or Professional Competence Examination cum articleship shall be eligible for enrolment/conversion to

Integrated Professional Competence Course subject to complying with relevant conditions.

REGISTRATION PROCEDURE

A student should submit filled in registration Forms for Integrated Professional Compitance Course or Accounting

Technician Course supplied along with Prospectus available at sales counter of decentralised offices, the cost of

Prospectus is Rs. 100/-. These forms can also be downloaded from Institute's website www.icai.org. On receipt of

filled in form and requisite fee, the appropriate decentralized office will issue study materials for Group I and/or

Group II or IPCC/ATC. The decentralized office will also issue registration letter. While taking admission to 100

hours ITT with regional/branch office, a student is required to produce a copy of the registration letter.

Você também pode gostar

- Flight InputDocumento1 páginaFlight Inputrambabu.mAinda não há avaliações

- Soa26719792 PDFDocumento1 páginaSoa26719792 PDFrambabu.mAinda não há avaliações

- Flight InputDocumento1 páginaFlight Inputrambabu.mAinda não há avaliações

- TestStrategyTemplatev1.1 (ProjectName) (Ver) (YYYYMMDD)Documento12 páginasTestStrategyTemplatev1.1 (ProjectName) (Ver) (YYYYMMDD)rambabu.mAinda não há avaliações

- STLCDocumento1 páginaSTLCrambabu.mAinda não há avaliações

- Dinakar (Icwai)Documento2 páginasDinakar (Icwai)rambabu.mAinda não há avaliações

- Aptitude 1Documento16 páginasAptitude 1ratneshAinda não há avaliações

- Dinakar (Icwai)Documento2 páginasDinakar (Icwai)rambabu.mAinda não há avaliações

- Sample Test StrategyDocumento14 páginasSample Test Strategyrambabu.mAinda não há avaliações

- OsDocumento1 páginaOsrambabu.mAinda não há avaliações

- Vocabulary 6Documento8 páginasVocabulary 6itsmechakri4uAinda não há avaliações

- Simple TencesDocumento2 páginasSimple Tencesrambabu.mAinda não há avaliações

- Serial NoDocumento1 páginaSerial Norambabu.mAinda não há avaliações

- OsDocumento1 páginaOsrambabu.mAinda não há avaliações

- Mca I Year II Sem (18!2!11)Documento162 páginasMca I Year II Sem (18!2!11)rambabu.m0% (1)

- OsDocumento1 páginaOsrambabu.mAinda não há avaliações

- DMDocumento10 páginasDMrambabu.mAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (120)

- Programme Structure For Two Years MSC Degree Programme in Mathematics L - Lecture, T-Tutorial, P - Practical (Lab), CR - Credits. First SemesterDocumento30 páginasProgramme Structure For Two Years MSC Degree Programme in Mathematics L - Lecture, T-Tutorial, P - Practical (Lab), CR - Credits. First SemesterprashunAinda não há avaliações

- Hysteresis Loop Tracer.: TitleDocumento7 páginasHysteresis Loop Tracer.: TitleSubhrajit SamantaAinda não há avaliações

- Rural Poverty and Inequality in EthiopiaDocumento20 páginasRural Poverty and Inequality in EthiopiaSemalignAinda não há avaliações

- 1990 - 7 - Calendar ProblemsDocumento5 páginas1990 - 7 - Calendar ProblemsJim BoudroAinda não há avaliações

- Cam Profile AnalysisDocumento4 páginasCam Profile AnalysisPremjeetSingh100% (1)

- Final Examination: 1 Rules (Requires Student Signature!)Documento9 páginasFinal Examination: 1 Rules (Requires Student Signature!)Hernan Kennedy Ricaldi PorrasAinda não há avaliações

- Optimization of Machining Parameters For Surface Roughness in Milling OperationDocumento5 páginasOptimization of Machining Parameters For Surface Roughness in Milling OperationArmando Rosas GonzalitosAinda não há avaliações

- Body in White Architecture For An Electric Vehicle ConceptDocumento54 páginasBody in White Architecture For An Electric Vehicle ConceptJosue Enriquez Eguiguren100% (1)

- Solving Problems by SearchingDocumento56 páginasSolving Problems by SearchingDagim AbaAinda não há avaliações

- Course Dairy For V Semester PDFDocumento84 páginasCourse Dairy For V Semester PDFPiyushm JainAinda não há avaliações

- Further Maths Week 9 Notes For SS2 PDFDocumento11 páginasFurther Maths Week 9 Notes For SS2 PDFsophiaAinda não há avaliações

- Circular PlatformDocumento6 páginasCircular PlatformRamzi GameelAinda não há avaliações

- Ok Assessmente of PV Modules Shunt Resistence PDFDocumento9 páginasOk Assessmente of PV Modules Shunt Resistence PDFOscar ChilcaAinda não há avaliações

- NonLinear EquationsDocumento40 páginasNonLinear EquationsAnonymous J1Plmv8Ainda não há avaliações

- MTH374: Optimization: Master of MathematicsDocumento21 páginasMTH374: Optimization: Master of MathematicsMaheen BalouchAinda não há avaliações

- Stability of Tapered and Stepped Steel Columns With Initial ImperfectionsDocumento10 páginasStability of Tapered and Stepped Steel Columns With Initial ImperfectionskarpagajothimuruganAinda não há avaliações

- Diffusion CoefficientDocumento5 páginasDiffusion CoefficientAbhishek Kumar0% (1)

- Two-Step Equations Standardized Test PrepDocumento1 páginaTwo-Step Equations Standardized Test PrepE. Ryan PlankAinda não há avaliações

- Tutorial Week 10 - Internal Bone RemodellingDocumento13 páginasTutorial Week 10 - Internal Bone RemodellingHussam El'SheikhAinda não há avaliações

- Solution To Tutorial 5Documento8 páginasSolution To Tutorial 5Chong-jinAinda não há avaliações

- MartingalesDocumento40 páginasMartingalesSidakpal Singh SachdevaAinda não há avaliações

- Math 4 Quarter 1 Week 2Documento25 páginasMath 4 Quarter 1 Week 2Jefferson MacasaetAinda não há avaliações

- Assignment: MBA 1 Semester Statistics For Management (Mb0040)Documento10 páginasAssignment: MBA 1 Semester Statistics For Management (Mb0040)Niranjan VijayaraghavanAinda não há avaliações

- Visualize RF Impairments - MATLAB & Simulink - MathWorks IndiaDocumento15 páginasVisualize RF Impairments - MATLAB & Simulink - MathWorks Indiatiblue.black.36Ainda não há avaliações

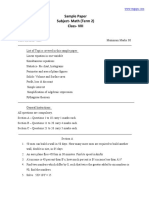

- Sample Paper Subject-Math (Term 2) Class - VIIIDocumento3 páginasSample Paper Subject-Math (Term 2) Class - VIIIGayathiri BalajiAinda não há avaliações

- OS-Kings College Unit WiseDocumento8 páginasOS-Kings College Unit WisePradeep KumarAinda não há avaliações

- HydraulicsDocumento5 páginasHydraulicsbakrichodAinda não há avaliações

- Problem Set D: Attempt HistoryDocumento10 páginasProblem Set D: Attempt HistoryHenryAinda não há avaliações

- MUNAR - Linear Regression - Ipynb - ColaboratoryDocumento30 páginasMUNAR - Linear Regression - Ipynb - ColaboratoryTRISTAN JAYSON MUNARAinda não há avaliações

- Problems and Solutions For Complex AnalysisDocumento259 páginasProblems and Solutions For Complex AnalysisMete Torun91% (34)