Escolar Documentos

Profissional Documentos

Cultura Documentos

Adjudication Order Against 27 Entities in The Matter of Spectacle Infotek Ltd.

Enviado por

Shyam Sunder0 notas0% acharam este documento útil (0 voto)

56 visualizações42 páginasGemstone Investments Limited was found to be in breach of the Securities and Exchange Board of India ACT, 1992. It was also found to have breached the provisions of the Securities and Exchange Board of India (see section 15 I of the aaebi) in respect of two of its directors. The other was a director of sri lanka-based gemstone investments Ltd. The order was passed by the adjudicating officer of the

Descrição original:

Título original

Adjudication Order against 27 entities in the matter of Spectacle Infotek Ltd.

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

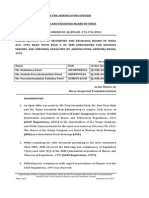

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoGemstone Investments Limited was found to be in breach of the Securities and Exchange Board of India ACT, 1992. It was also found to have breached the provisions of the Securities and Exchange Board of India (see section 15 I of the aaebi) in respect of two of its directors. The other was a director of sri lanka-based gemstone investments Ltd. The order was passed by the adjudicating officer of the

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

56 visualizações42 páginasAdjudication Order Against 27 Entities in The Matter of Spectacle Infotek Ltd.

Enviado por

Shyam SunderGemstone Investments Limited was found to be in breach of the Securities and Exchange Board of India ACT, 1992. It was also found to have breached the provisions of the Securities and Exchange Board of India (see section 15 I of the aaebi) in respect of two of its directors. The other was a director of sri lanka-based gemstone investments Ltd. The order was passed by the adjudicating officer of the

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 42

Page 1 of 42

BEFORE THE ADJUDICATING OFFICER

SECURITIES AND EXCHANGE BOARD OF INDIA

[ADJUDICATION ORDER NO. EAD-2/AO/DSR/RG/222- 248 /2014]

UNDER SECTION 15 I OF SECURITIES AND EXCHANGE BOARD OF INDIA

ACT, 1992 READ WITH RULE 5 OF SECURITIES AND EXCHANGE BOARD OF

INDIA (PROCEDURE FOR HOLDING INQUIRY AND IMPOSING PENALTIES BY

ADJUDICATING OFFICER) RULES, 1995

In respect of:

1. Gemstone Investments Limited [PAN: AAACG1483A]

2. Shri Ketan Babulal Shah [PAN: AACPS0667F]

3. Shri Bharat Shantilal Thakkar (PAN:AAZPT9542R)

4. Shri Bipin Jayant Thaker (PAN: ABYPT4984H)

5. Shri Bharat G Vaghela (PAN: ADYPV0844N )

6. Shri Chirag Rajnikant Jariwala (PAN: AFMPJ7543L)

7. Shri Kishore Chauhan (PAN: AFPPC9703G)

8. Shri Bipin Kumar Gandhi [PAN: AJHPG6989J]

9. Shri Bhavesh Pabari (PAN: AKGPP8679N)

10. Shri Prem Mohanlal Parikh (PAN: ALHPP3489N )

11. Shri Santosh Maruti Patil [PAN: AMAPP2722N]

12. Shri Hemant Madhusudan Sheth (PAN: ANOPS8607E)

13. Shri Jigar Praful Ghoghari (PAN: ASFPG8598L )

14. Shri Vipul Hiralal Shah (PAN: AZCPS9537P)

15. Ms Mala Hemant Sheth (PAN: AZXPS0694J)

16. Shri Ankit Sanchaniya (PAN: BLNPS3316L)

17. Shri Vivek Kishanpal Samant (PAN:BRSPS0294N)

18. Shri Bhupesh Rathod [PAN: AACPR3785K]

19. Rajnandi Yarns Private Limited [PAN: AADCR0099J]

20. Shri Vasudev Ramchandra Kamat (PAN: ADCPK2552N)

21. Shri Narendra Prabodh Ganatra [PAN: AEMPG4315C]

22. Shri Manish Suresh Joshi [PAN: AFTPJ5897A]

23. Shri Santosh Vishram Ghadshi [PAN: AHNPG0002C]

24. Shri Kaushik Karsanbhai Patel [PAN: AKOPP9620R]

25. Shri Kaushik Rajnikant Mehta [PAN: ANNPM6298A]

26. Shri Gaurang Ajit Seth (PAN: BGEPS6596Q)

27. M/s Arcadia Share & Stock Brokers Pvt. Ltd. (PAN:AAACA4562G)

In the matter of

SPECTACLE INFOTEK LIMITED

Brought to you by http://StockViz.biz

Page 2 of 42

1. Securities and Exchange Board of India (hereinafter referred to as SEBI),

pursuant to the detection of a huge rise in the traded volumes and/or price of

the shares of Spectacle Infotek Limited (hereinafter referred to as

SIL/company), a company listed at Bombay Stock Exchange Limited (BSE)

and the National Stock Exchange (NSE), conducted an investigation into the

alleged irregularity in the trading in the shares of SIL and into the possible

violation of the provisions of the Securities and Exchange Board of India Act,

1992 (hereinafter referred to as the Act) and various Rules and Regulations

made there under during the period from May 29, 2009 to April 30, 2010. It

was observed that the price of the scrip unusually increased from ` 41.00 to `

122.62 and the daily high-low traded volume was 36,724 shares to 23,45,153

shares.

2. SEBI vide its interim order dated February 02, 2011 had restrained 39

persons/entities from accessing the securities market and further, had

prohibited them from buying, selling or dealing in securities in any manner

whatsoever, till further directions. The said interim order was later confirmed

by SEBI vide order dated July 08, 2011.

3. The investigation, inter alia, revealed that certain entities namely,

1) Gemstone Investments Limited, 2) Ketan Babulal Shah, 3) Bharat Shantilal

Thakkar, 4) Bipin Jayant Thaker, 5) Bharat G Vaghela, 6) Chirag Rajnikant

Jariwala, 7) Kishore Chauhan, 8) Bipinkumar Gandhi, 9) Bhavesh Pabari,

10) Prem Mohanlal Parikh, 11) Santosh Maruti Patil, 12) Hemant

Madhusudan Sheth, 13) Jigar Praful Ghoghari, 14) Vipul Hiralal Shah,

15) Mala Hemant Sheth, 16) Ankit Sanchaniya, 17) Vivek Kishanpal Samant,

18) Bhupesh Rathod, 19) Rajnandi Yarns Pvt. Ltd, 20) Vasudev Ramchandra

Kamat, 21) Narendra Prabodh Ganatra, 22) Manish Suresh Joshi,

23) Santosh Vishram Ghadshi, 24) Kaushik Karsanbhai Patel, 25) Kaushik

Rajnikant Mehta, 26) Gaurang Ajit Seth (hereinafter referred to as Noticee

Nos. 1 to 26 and collectively referred to as the Noticees), connected to each

other by one way or the other, had dealt in the scrip of SIL through multiple

Brought to you by http://StockViz.biz

Page 3 of 42

brokers, in a fraudulent and manipulative manner, without real change in

ownership of shares, by indulging in number of synchronized trades and

heavily traded amongst themselves thereby, creating artificial volumes and

price rise in the scrip. The Noticee Nos. 1 to 26 were also observed to have

done off-market transactions among themselves for the purpose of meeting

the settlement obligations of one another.

4. It was further observed that certain Noticees had also indulged in trades

which were self trades in nature, while trading on both the exchanges i.e.

BSE and NSE, through multiple brokers one of them being Arcadia Share

and Stock Brokers Private Limited (hereinafter referred to as Noticee No. 27),

a registered intermediary with SEBI thereby, creating artificial volumes which

gave a false and misleading appearance of trading in the scrip of SIL on the

exchanges.

5. SEBI has, therefore initiated adjudication proceedings against Noticee Nos. 1

to 26 for the alleged violation of the provisions of Regulation 3(a), (b), (c), (d),

4(1) and 4(2)(a), (b), (e) & (g) of the SEBI (Prohibition of Fraudulent and

Unfair Trade Practices relation to Securities market) Regulations, 2003

(hereinafter referred to as the PFUTP Regulations) and against Noticee No.

27 for the alleged violation of the provisions of Clause A(1), (2) & (3) of the

Code of Conduct as specified under Schedule II of the SEBI (Stock Brokers

and Sub-Brokers) Regulations, 1992 (hereinafter referred to as Broker

Regulations) read with Regulation 7 of the said Regulations.

Appointment of Adjudicating Officer

6. I have been appointed as the Adjudicating Officer, in place of the previous

Adjudicating Officer, vide order dated August 29, 2013 under section 15 I of

the SEBI Act read with Rule 3 of the SEBI (Procedure for Holding Inquiry and

Imposing Penalties by Adjudicating Officer) Rules, 1995 (hereinafter referred

to as the Rules) to inquire into and adjudge under Section 15HA of the Act

against the Noticee Nos. 1 to 26 for the alleged violation of the provisions of

Brought to you by http://StockViz.biz

Page 4 of 42

PFUTP Regulations and under Section 15HB of the Act against Noticee No.

27 for the alleged violation of the Broker Regulations.

Show Cause Notice, Reply and Personal Hearing

7. The Noticees were issued a common show cause notice (hereinafter to as

SCNs) dated October 10, 2013 in terms of Rule 4(1) of the Rules to show

cause as to why an inquiry should not be held and why penalty be not

imposed on them for the aforesaid violations. The SCNs were sent by

Registered Post Ack. Due and were duly delivered to the Noticees except in

case of Noticee Nos. 5, 8, 19 and 24 as the same were returned undelivered.

In view of the same, vide letter dated December 18, 2013, the SCNs were

sent again to Noticee Nos. 19 and 24. The same were delivered in the

second attempt. Further, with respect to Noticee Nos. 5 and 8, attempts were

made to deliver the SCNs and finally were affixed at the last known address/s

of the said Noticees, reports thereof are available on record.

8. Vide letter dated October 22, 2013 one Ms. Rupal K. Chauhan, wife of

Noticee No. 7 informed that the Noticee No. 7 had passed away on May 29,

2013 and enclosed certified copy of death certificate of Noticee No. 7 as

issued by the Department of Health and Family Welfare, Government of

Gujarat, in support thereof. In view of the same, the adjudication proceeding

initiated against Noticee No. 7 stands abated. However, I shall examine the

role of Noticee No. 7 for the limited purpose of examining the role and

findings against the other Noticees in the matter.

9. Vide letter dated October 21, 2013, Noticee No. 26 filed its reply to the SCN.

Further, vide letter dated November 01, 2013, Noticee No. 27 requested for 3

weeks time to file its reply in the matter and accordingly, vide letter dated

November 21, 2013, Noticee No. 27 replied to the SCN. With respect to

Noticee Nos. 1 and 21, vide separate individual letters dated May 23, 2014

and June 04, 2014 respectively, the said Noticees filed their replies to the

SCN. The other Noticees did not file any replies in the matter.

Brought to you by http://StockViz.biz

Page 5 of 42

10. Thereafter, in the interest of natural justice and in order to conduct an inquiry

as per Rule 4(3) of the Rules, an opportunity of personal hearing was granted

to the Noticee Nos. 5 and 8 on April 07, 2014 vide separate notices dated

March 07, 2014. The said notices were also affixed at the last known

addresses of the said Noticees and report of affixture is available on record.

However, the Noticee Nos. 5 and 8 did not attend the said hearing on the

scheduled date. Also, an opportunity of personal hearing was granted to

Noticee No. 24 on April 10, 2014 vide notice dated March 12, 2014. The said

notice was duly delivered to Noticee No. 24, however, he did not attend the

hearing on the scheduled date. Further, all the Noticees, including Noticee

Nos. 5, 8 and 24, were granted an opportunity of personal hearing on August

11, 2014 vide separate notices dated July 24, 2014. Vide separate letters

dated August 05, 2014, Noticee Nos. 23 and 25 stated that vide their

respective letters dated November 21, 2013 and December 07, 2013, they

had filed their replies in the matter and enclosed a copy of the said replies for

records. Further, with respect to Noticee Nos. 5, 8, 11 and 19 the hearing

notices were returned undelivered and therefore, the same were affixed at

the last known addresses of the said Noticees, the report thereof is available

on record.

11. With respect to Noticee No. 1, the Authorized Representative attended the

hearing on the scheduled date and reiterated the submissions made by the

Noticee in its reply dated May 23, 2014. Further, Noticee Nos. 9 and 12

attended the hearing in person and submitted their separate replies dated

August 11, 2014. Further, the said Noticees requested for time to file their

additional replies in the matter. Accordingly, they were advised to file their

replies on or before August 19, 2014. Vide letters dated August 17&18,

2014, respectively, the said Noticees filed their detailed replies in the matter.

With respect to Noticee Nos. 23 and 25, a common authorised representative

attended the hearing on the scheduled date for the said Noticees and

requested for one week time to file detailed replies in the matter. Accordingly,

time till August 19, 2014 was granted to the Noticees to file their replies and

vide separate letters dated August 19, 2014, the said Noticees filed their

detailed replies in the matter. The Authorised representative for Noticee No.

Brought to you by http://StockViz.biz

Page 6 of 42

27 attended the hearing on the scheduled date and reiterated the

submissions made by the Noticee in its reply dated November 21, 2013.

12. Noticee Nos. 14 and 22 did not avail the opportunity of personal hearing

granted to them on August 11, 2014 nor did they make any correspondence

in the matter. With respect to Noticee Nos. 3, 4, 6, 10, 13, 16 and 17, it is

noted that the said Noticees did not attend the hearing but vide separate but

identical letters dated August 08, 2014 they all filed their preliminary replies

denying the charges and further requested time to file detailed replies in the

matter. However, only Noticee No. 13 filed his detailed reply vide letter dated

August 14, 2014. With respect to Noticee Nos. 2, 15, 18, 19, 20 and 26, the

said Noticees vide their separate letters dated August 11, 2014 filed their

replies in the matter. Further, Noticee No. 19 filed its additional reply vide

letter dated August 22, 2014. Also, Noticee No. 21 vide his letter dated

August 12, 2014 filed reply in the matter.

13. In view of the above, with respect to Noticee Nos. 5 and 8, I note that ample

opportunities and time was granted to them for filing their replies and to

present their case in the matter. Further, with respect to Noticee Nos. 3, 4, 6,

10, 16 and 17, I note that the said Noticees have been granted sufficient time

to file their replies in the matter as the SCN in the present case was issued

on October 10, 2013 i.e. appx more than 10 months back. Therefore, I am

proceeding further against the said Noticees on the basis of material

available on record in the matter.

Consideration of Issues, Evidence and Findings

14. I have carefully perused the charges levelled against the Noticees in the

SCN, written submissions made and all the documents available on the

record. In the instant matter, the following issues arise for consideration and

determination:

a) Whether the Noticee Nos. 1 to 6 and 8 to 26 have violated

Regulations 3(a), (b), (c), (d), 4(1) and 4(2)(a), (b), (e) & (g) of the

PFUTP Regulations?

Brought to you by http://StockViz.biz

Page 7 of 42

b) Whether the Noticee No. 27 has violated Clauses A(1), (2) and (3) of

the Code of Conduct for Stock Brokers as specified under Schedule

II read with Regulation 7 of Broker Regulations?

c) Does the violations, if any, on the part of the Noticees attract

monetary penalty under Sections 15HA and 15HB of the SEBI Act?

d) If so, what would be the quantum of monetary penalty that can be

imposed on the Noticees taking into consideration the factors as

mentioned under Section 15J of the SEBI Act?

15. Before proceeding forward, I would like to refer to the relevant provisions of

the PFUTP Regulations and the Brokers Regulations, which read as under:

Relevant provisions of PFUTP Regulations

3. Prohibition of certain dealings in securities

No person shall directly or indirectly

(a) buy, sell or otherwise deal in securities in a fraudulent manner;

(b) use or employ, in connection with issue, purchase or sale of any

security listed or proposed to be listed in a recognized stock exchange,

any manipulative or deceptive device or contrivance in contravention of

the provisions of the Act or the rules or the regulations made there

under;

(c) employ any device, scheme or artifice to defraud in connection with

dealing in or issue of securities which are listed or proposed to be listed

on a recognized stock exchange;

(d) engage in any act, practice, course of business which operates or

would operate as fraud or deceit upon any person in connection with

any dealing in or issue of securities which are listed or proposed to be

listed on a recognized stock exchange in contravention of the provisions

of the Act or the rules and the regulations made there under

4. Prohibition of manipulative, fraudulent and unfair trade

practices

() !ithout pre"udice to the provisions of regulation #, no person shall

indulge in a fraudulent or an unfair trade practice in securities

(!) $ealing in securities shall be deemed to be a fraudulent or an unfair

trade practice if it involves fraud and may include all or any of the

following, namely%

(a) indulging in an act which creates false or misleading appearance of

trading in the securities market;

Brought to you by http://StockViz.biz

Page 8 of 42

(b) dealing in a security not intended to effect transfer of beneficial

ownership but intended to operate only as a device to inflate, depress

or cause fluctuations in the price of such security for wrongful gain or

avoidance of loss;

&c'

&d'

(e) any act or omission amounting to manipulation of the price of a scrip

(g) entering into a transaction in securities without intention of

performing it or without intention of change of ownership of such

security;

Relevant provisions of the "ro#er Regulations

$toc# bro#ers to abide b% &ode of &onduct.

'. (he stock broker holding a certificate shall at all times abide by the

)ode of )onduct as specified in *chedule ++

$&()*U+) ,,

&-*) -F &-.*U&T F-R $T-&/ "R-/)R$

0Regulation '1

2. 3eneral.

() +ntegrity% A stock,broker, shall maintain high standards of integrity,

promptitude and fairness in the conduct of all his business

(!) -xercise of due skill and care% A stock,broker shall act with due

skill, care and diligence in the conduct of all his business

(3).anipulation% A stock,broker shall not indulge in manipulative,

fraudulent or deceptive transactions or schemes or spread rumours

with a view to distorting market e/uilibrium or making personal gains

16. I find from the SCN that SIL is a company listed on the BSE and NSE. On

analysis of the trading activity in the scrip of SIL on BSE, it was noticed that a

group of 28 entities identified as the Pabari-Parikh group in the investigation

report, including Noticee Nos. 1 to 26, who were all connected to each other

in one way or the other, had traded heavily in the scrip of SIL through multiple

brokers, one of them being Noticee No. 27. The relationship between the 28

entities is detailed as under:

Client

Name

KYC Relation Fund

Move

ment

Share

moveme

nt

through

Client

Name

KYC Relation Fund

Movem

ent

Share

movem

ent

through

Brought to you by http://StockViz.biz

Page 9 of 42

off

market

off

market

1.Gemston

e

Investment

s Ltd

Sl. no.10 is the

director in sl. No.1.

Sl. no.10 & 17 have

common office

address.

Sl. no.10 introduced

sl. no.17 for trading

a/c.

15.Santos

h

Vishram

Ghadshi

Has off market

share and fund

movement with

Amar Premchand

Walmiki, who has

off market share

and fund

movement with sl.

no. 17.

2.Bhupesh

Rathod

Introduced sl. no.22,

19, 17, 12 for trading

a/c and knows sl.

No. 25

With

Sl. No.

27

16.Bipink

umar

Gandhi

With sl.

no. 17.

3.Ketan

Babulal

Shah

With sl.

no.19

17.Bhave

sh Pabari

Sl. no.10 & 17

have common

office address.

Sl. no.10

introduced sl.

no.17 for trading

a/c.

Sl. no. 5 is his

uncle & sl. no. 28

is his brother in

law.

Sl. no. 19 is cousin

of sl. no.17

Sl. no. 17 & 22

both directors of

Rajnandi Yarns

Pvt. Ltd.(sl.no.4)

Share common

Tel. no. with sl. no.

27, 28, 6.

Sl. no. 2

introduced him for

trading a/c.

BR* with sl. no. 6,

11, 12, 19, 22, 25,

27

With sl.

no. 19,

22, 4, 5,

6, 27,

28, 16,

4.Rajnandi

Yarns

Private

Limited

Sl. no. 17 & 22 both

directors of Rajnandi

Yarns Pvt.

Ltd.(sl.no.4)

With sl.

no. 5, 6,

11, 12,

17, 19,

22, 23,

27, 28,

18.Kaushi

k

Karsanbh

ai Patel

With sl.

no. 17.

With sl.

no. 28.

5.Bharat

Shantilal

Thakkar

Sl. no. 17 is his

nephew.

Same address with

sl. no.17.

Sl. no. 17 is his

nominee.

Joint a/c with sl. no.

17.

BR* with sl. no. 6,

11, 12, 19, 22, 27,

28

With

sl. no.

17, 19,

27

With sl.

no. 17, 7,

4,

19.Prem

Mohanlal

Parikh

Sl. no. 19 is cousin

of sl. no.17.

Common email

with sl. 27, 19 &

28.

Sl. no. 22 is

nominee of sl.

no.19.

BR* with sl. no. 5,

6, 11, 12, 17, 22,

27, 28.

With sl.

no. 17,

22, 12.

With sl.

no. 17,

22, 12,

4, 5, 6,

22, 23,

27, 28.

Brought to you by http://StockViz.biz

Page 10 of 42

6.Bipin

Jayant

Thaker

Same Tel. no. with

sl. no. 17.

BR* with sl. no. 5,

11, 12, 17, 19, 22,

27, 28,

With

sl. no.

4, 17.

With sl.

no. 4, 23,

11, 17,

19, 22. 20.Santos

h Maruti

Patil

Sl. no.10

introduced sl.

no.20 for opening

a/c with the

member Comfort

Securities.

With sl.

no. 10.

7.Vasudev

Ramchand

ra Kamat

Sl. no. 5 share the

same address with

sl. no.17.

With sl.

no.5

21.Kaushi

k

Rajnikant

Mehta

With sl.

no. 24,

15.

With sl.

no. 17,

24.

8.Bharat G

Vaghela

Same address &

Tel.no. as sl. no. 16

who share

movement with sl.no.

17.

Sl. No. 11 is nephew

of sl. no. 17 and

shares same Tel. no.

with sl. no. 17.

With

sl. no.

11.

22.Heman

t

Madhusu

dan

Sheth

Sl. no. 17 & 22

both directors of

Rajnandi Yarns

Pvt. Ltd.

Same email with

sl. no. 28.

BR* with 2, 5, 19,

27, 28, 6, 11, 12,

& sl. no. 25 is his

wife & sl. no. 26 is

his nephew.

With sl.

no. 17,

19, 12.

With sl.

no. 17,

19, 12,

4, 25,

27, 28,

23, 6,

9.Sagar

Janak

Vyas

Similar address as

sl.no. 19.

23.Jigar

Praful

Ghoghari

With sl.

no. 4, 6,

19, 22,

27.

10.Narendr

a Prabodh

Ganatra

Sl. no.10 is the

director in sl. No.1.

Sl. no.10 was a

director in Spectacle

(resigned from the

said company on

June 01, 2010).

Sl. no.10 & 17 have

common office

address.

Sl. no.10 introduced

sl. no.17 for trading

a/c.

24.Vipul

Hiralal

Shah

Sl. No. 21 has off-

market transaction

with sl. No. 17.

With sl.

No. 21.

With sl.

no.17.

11.Chirag

Rajnikant

Jariwala

Same Tel. no. with

sl.no.17.

Sl. no. 17 is his

uncle.

BR* with sl. no. 5, 6,

12, 17, 22, 27, 28.

With

sl. no.

17, 22,

8, 4

With sl.

no. 4, 6

25.Mala

Hemant

Sheth

Sl. no. 25 is the

wife of sl. no. 22

and sl. no. 26 is

the nephew.

With sl.

no. 17,

19..

With sl.

no. 22,

12.Kishore

Chauhan

Joint a/c with sl. no.

17

Sl. no. 17 & 22 are

witness for demat

a/c.

BR* with sl. no. 5, 6,

11, 17, 19, 22, 27.

With

sl. no.

17, 19,

22

With sl.

no. 4, 17,

19, 22,

28,

26.Gaura

ng Ajit

Seth

Has common

address & Tel. no.

with sl. no. 22. &

sl. no. 22 and 17

both directors of

Rajnandi Yarns

Pvt. Ltd.(sl.no.4)

13.Manish

Suresh

Joshi

Sl. no.10 introduced

sl. no.13 for trading

a/c.

27.Ankit

Sanchani

ya

Same Tel. no. with

sl. no. 19 and also

shares Tel. no.

with sl. no. 17 who

is the nominee for

With sl.

no. 17,

19.

With sl.

no. 4,

17, 19,

22, 11,

23, 28.

Brought to you by http://StockViz.biz

Page 11 of 42

his a/c.

BR* with sl. no.5,

6, 11, 12, 17, 19,

22, 28,

14.Kaushik

Gangaram

Rathod

Same Tel. no. with

sl. no. 16.

Sl. no.

16 has

fund

move

ment

with

sl.no.

17.

Sl. no. 16

has off-

market

transfers

with sl.

no. 17.

28.Vivek

Kishanpal

Samant

Sl. no. 17 is the

brother in law &

shares common

Tel. no. & sl.no. 17

is the nominee of

sl. no. 28 for

trading a/c & bank

a/c.

Shares email with

sl. no. 22.

Shares email with

sl. no. 19.

With sl.

no. 22.

With sl.

no. 4,

17, 22,

11, 12,

19, 27.

*BR - Business relation.

17. In addition to the above, it was revealed that the Pabari-Paikh Group entities,

including Noticee Nos. 1 to 26, had indulged in certain off-market transfers for

5,53,54,390 shares of SIL amongst themselves during the period January 01,

2009 and January 31, 2011. These off-market transfers among the group

further confirmed the relationship / connection between the said group.

18. From the trade log analysis, I find that the group of entities, as mentioned in

above paras, had purchased 12,91,93,874 shares and sold 10,61,95,225

shares, respectively. Out of the 28 Pabari-Parikh Group entities, Noticee Nos.

1 to 26 had traded for 8,82,03,123 shares (i.e. 52.28% of the market volume)

accounting for 68.27 % of the total purchases of the group and 83.06 % of

the total sales of the group within Pabari-Parikh Group entities and 52.28% of

the market volume from within the group entities. Out of 8,82,03,123 shares

traded within the group entities, the buy and sell orders for 3,25,89,257

shares, accounting for 19.32% of the market volume, were placed within one

minute time difference. Further, it was noted that 3,25,89,257 shares

constituted for 25.23% of the total purchases and 30.69% of the total sales of

the Pabari-Parikh Group entities.

19. Further, out of 3,25,89,257 shares, for 46,50,808 shares, which accounted for

2.76% of the total market volume, the buy and sell orders were placed in a

synchronized manner (i.e. difference between placement of order by buyer

and seller within one minute and order rate as well as order quantity of buy

Brought to you by http://StockViz.biz

Page 12 of 42

side and sale side being same) by Noticee Nos. 1 to 17. The volume of

46,50,808 shares constituted 5.27% of the total purchases and 4.38% of the

total sales of the Pabari-Parikh Group entities. The summary of the said

synchronized trades entered into by the Noticee Nos. 1 to 17 while trading on

BSE is as under:

PANNO Client Name

Synchronised

!y trade

" o#

$ar%et

&ol!me

" o#

sync

to

total

!y

y

client

Synchronised

sale trade

" o#

$ar%et

&ol!me

" o#

sync

to

total

sale

y

client

AAACG1483A

Gemstone

Investments Ltd

(Noticee No. 1) 0.00 0.00 0.00 1000 0.00 0.28

AACPS0!"

#etan $a%&'a' S(a(

(Noticee No. 2) 1)00 0.00 3.)8 0 0.00 0.00

AA*P+,)42-

$(a.at S(anti'a'

+(a//a.

(Noticee No. 3) 4!2)!, 0.28 !.8 03!!! 0.3 .3)

A$0P+4,841

$i2in 3a4ant +(a/e.

(Noticee No. 4) 340208 0.20 !.1) 123!,0 0.0! 3.24

A50P60844N

$(a.at G 6ag(e'a

(Noticee No. )) 43203 0.2 10.,0 4)020 0.38 ,.1!

A"7P3!)43L

C(i.ag -a8ni/ant

3a.i9a'a

(Noticee No. ) 18400 0.01 0.!) )4380 0.03 3.0!

A"PPC,!03G

#is(o.e C(a&(an

(Noticee No. !) 2881 0.1! 4.84 !)83, 0.40 8.3,

A31PG,8,3

$i2in/&ma. Gand(i

(Noticee No. 8) 14,8 0.01 2.4) 113!) 0.01 1.18

A#GPP8!,N

$(aves( Pa%a.i

(Noticee No. ,) 48)21 0.2, ).20 ))01!! 0.33 2.

AL1PP348,N

P.em 7o(an'a'

Pa.i/(

(Noticee No. 10) 3)13, 0.21 3.88 31)428 0.1, 4.11

A7APP2!22N

Santos( 7a.&ti Pati'

(Noticee No. 11) !)84 0.00 3.04 143, 0.01 ).00

AN:PS80!;

1emant

7ad(&s&dan S(et(

(Noticee No. 12) 8)3)1 0.)1 4.2! 84)!4 0.41 3.0

AS"PG8),8L

3iga. P.af&' G(og(a.i

(Noticee No. 13) 433)) 0.03 4.3 2!400 0.02 4.!1

A*CPS,)3!P

6i2&' 1i.a'a' S(a(

(Noticee No. 14) 2)000 0.01 .8) 24800 0.01 10.48

A*<PS0,43

7a'a 1emant S(et(

(Noticee No. 1)) 28,00 0.02 ).!, 8!2! 0.01 1.3,

$LNPS331L An/it Sanc(ani4a )!220, 0.34 ).)0 2,)844 0.18 2.,

Brought to you by http://StockViz.biz

Page 13 of 42

(Noticee No. 1)

$-SPS02,4N

6ive/ #is(an2a'

Samant

(Noticee No. 1!) ,3)4) 0.41 ).)3 12238 0.3 ).08

G.and +ota' 4)0808 2.! ).2! 4)0808 2.! 4.38

20. I also find that Noticee Nos. 3 to 14, 16 and 17 had indulged in certain trades

which were self trades in nature while trading through their multiple brokers

including Noticee No. 27. The details of the said fictitious trades indulged into

on BSE by the said Noticees are as under:

PANNO Client Name 'otal (!y 'otal Sale

Sel#

trade

)ty

" o#

'otal

(!y

"

'otal

Sale

" o#

$ar%et

&ol!me

No o#

Sel#

trades

AA*P+,)42-

$(a.at S(anti'a'

+(a//a.

(Noticee No. 3) 104!03)! ,)02811 23)3!4 2.2) 2.48 0.14 11)

A$0P+4,841

$i2in 3a4ant +(a/e.

(Noticee No. 4) 3181 3822,2 2232 3.41 ).,2 0.13 )!

A50P60844N

$(a.at G 6ag(e'a

(Noticee No. )) )3232) !033, !!008 1.3! 1.0, 0.0) ,4

A"7P3!)43L

C(i.ag -a8ni/ant

3a.i9a'a

(Noticee No. ) 30,0!81 1!,2,0 3,!00 1.28 2.24 0.02 2

A"PPC,!03G

#is(o.e C(a&(an

(Noticee No. !) ,!21840 80)83) 1,!023 2.03 2.44 0.12 102

A31PG,8,3

$i2in/&ma. Gand(i

(Noticee No. 8) 13,328 ,2338 ,121 0.) 0.,) 0.01 3!

A#GPP8!,N

$(aves( Pa%a.i

(Noticee No. ,) 1408)43 20!0!340 120384 11.)0 !.83 0., 430

AL1PP348,N

P.em 7o(an'a'

Pa.i/(

(Noticee No.1 0) 12!232) !!044) )3118 4.18 .,3 0.32 1)2

A7APP2!22N

Santos( 7a.&ti Pati'

(Noticee No. 11) 328)1 328)1 1333 4.0! 4.0! 0.01 4

AN:PS80!;

1emant

7ad(&s&dan S(et(

(Noticee No. 12) 2,,2411 223)1!3 32!42! 10.,3 14.) 1.,4 !1

AS"PG8),8L

3iga. P.af&'

G(og(a.i

(Noticee No. 13) ,4!!18 )8220 ,,,0 1.0) 1.!2 0.01 1

A*CPS,)3!P

6i2&' 1i.a'a' S(a(

(Noticee No. 14) 43,11, 2300 24800 ).) 10.48 0.01 1

$LNPS331L

An/it Sanc(ani4a

(Noticee No. 1) 1)4!81,, ,,84834 4!1282 3.04 4.!2 0.28 4!0

$-SPS02,4N

6ive/ #is(an2a'

Samant 13))1) 120),,8 1028!) .2, 8.)3 0.1 102

Brought to you by http://StockViz.biz

Page 14 of 42

(Noticee No. 1!)

G.and +ota' 12!20!02 10)0!)841 !!),408 .10 !.38 4.0 23!0

21. For the above fictitious trades, it was noted that the brokers mentioned in the

table below were appearing on both the sides of the trade i.e. acted as broker

and counter party broker. The number of instances wherein the Noticee No.

27 had executed self trades on behalf of its clients was significant and the

details of the same are as under:

Buy and Sale Member Name Client Name Traded Quantity

No. of

Trades

Ami Stoc/ and S(a.e $.o/e.s Pvt. Ltd.

$i2in/&ma. Gand(i

(Noticee No. 8) ,121 3!

Ami Stock and Share Brokers Pvt. Ltd. Total !"! #$

A.cadia S(a.e = Stoc/ $.o/e.s Pvt. Ltd

An/it -a8end.a Sanc(ani4a

(Noticee No. 1) 10282 21

$(a.at G 6ag(e'a

(Noticee No. )) !!008 ,4

$(a.at S(anti'a' +(a//a.

(Noticee No. 3) 8413, !1

$(aves( Pa%a.i

(Noticee No. ,) ,8!) 1)

$i2in 3a4ant +(a/e.

(Noticee No. 4) 8)3 1

1emant 7ad(&s&dan S(et(

(Noticee No. 12) ,2)0 1)

#is(o.e C(a&(an

(Noticee No. !) )2233 84

Arcadia Share % Stock Brokers Pvt. Ltd Total "&!#&' #!(

Comfo.t Sec&.ities Pvt. Ltd.

Santos( 7a.&ti Pati'

(Noticee No. 11) 1!,8

Comfort Securities Pvt. Ltd. Total !$) (

"ai.9ea't( Sec&.ities Ltd.

An/it -a8end.a Sanc(ani4a

(Noticee No. 1) )211 12

*air+ealth Securities Ltd. Total &"!! !"

-e'iga.e Sec&.ities Ltd.

6ive/ #is(an2a' Samant

(Noticee No. 1!) )000 1

,eli-are Securities Ltd. Total &''' !

S.P.3ain Sec&.ities Pvt. Ltd.

$i2in 3a4ant +(a/e.

(Noticee No. 4) 10000 1

S.P..ain Securities Pvt. Ltd. Total !'''' !

S(.i.am Insig(t S(a.e $.o/e.s Ltd.

Santos( 7a.&ti Pati'

(Noticee No. 11) 30! 1,

Shriram /nsi-ht Share Brokers Ltd. Total #'$( !

+.ans2a.ent S(a.es = Sec&.ities Pvt.

Ltd.

C(i.ag -a8ni/ant 3a.i9a'a

(Noticee No. ) 1)000 1

Brought to you by http://StockViz.biz

Page 15 of 42

Trans0arent Shares % Securities Pvt. Ltd. Total !&''' !

1rand Total #''&&( ##

22. From the price volume data analysis at BSE, I note that the scrip of SIL was

traded on 228 trading days on BSE. Out of 228 trading days, the group

entities, including the Noticee Nos. 1 to 26, had traded among themselves on

223 days, i.e. 98% of the total number of days the scrip was traded during the

period under investigation. It was noted that the Group entities had

contributed to the daily market volume of the scrip in the range from 4.94%

on May 29, 2009 to 81.15% on April 30, 2010. It was further alleged in the

SCN that out of 223 trading days, on 130 trading days the Pabari-Parikh

Group entities, including the Noticee Nos. 1 to 26, had traded among

themselves, thereby, contributing more than 50% to the total market volume

in the scrip during the relevant period.

23. On further examination, I find that out of 223 trading days on which the

Pabari-Parikh Group had entered into trades in the scrip of SIL, on 215

trading days, both the buy and sell orders were placed within time difference

of one minute. It was, therefore, alleged in the SCN that the Pabari-Parikh

Group entities, including the Noticee Nos. 1 to 26, had contributed to daily

market volume of the scrip in the range from 3.52% on May 29, 2009 to

83.56% on March 09, 2010. Out of 215 trading days, on 149 trading days, the

trades executed by the Pabari-Parikh Group entities, including the Noticee

Nos. 1 to 26, were synchronized in nature. By executing synchronised trades

among the group entities, the Pabari-Parikh Group entities including Noticee

Nos. 1 to 26 had contributed to total market volume of the scrip in the range

from 0.73% on May 29, 2009 to 28.69% on March 18, 2010.

24. I further find that the price of the scrip opened at ` 73.50 and touched a high

of ` 130.00 i.e. there was an increase of ` 56.50. I note that out of 21

occasions, on 9 occasions (i.e. on 4 days out of 5 days), Noticee Nos. 3, 5,

12 and 16, had contributed to the increase in the price by ` 0.55 (out of a

total increase of ` 56.50).

Brought to you by http://StockViz.biz

Page 16 of 42

25. I find from the analysis of the trading activity in the scrip of SIL on NSE that a

group of 14 Pabari-Parikh Group entities i.e. Noticee Nos. 3 to 10, 12, 13, 15

to 17 and 19, connected to one another in one way or the other and dealing

through multiple brokers, had purchased 1,70,31,741 shares which

accounted for 75.55% of the total volume traded and sold 1,84,78,829 shares

which accounted for 81.97% of the total volume traded in the scrip of SIL

during the period under investigation. Further, as mentioned in para 17

above, the group entities had also done certain off-market transactions which

further confirm the nexus between the said entities. The relationship between

the 14 entities i.e. Noticee Nos. 3 to 10, 12, 13, 15 to 17 and 19, is detailed

as under:

Client

Name

KYC Relation Fund

Move

ment

Share

moveme

nt

through

off

market

Client

Name

KYC Relation Fund

Movem

ent

Share

movem

ent

through

off

market

1.Rajnan

di Yarns

Private

Limited

Sl. no. 8 & 10 both

directors of Rajnandi

Yarns Pvt. Ltd.

With sl.

no. 2, 3,

5, 6, 8, 9,

10, 11,

13, 14,

8.Bhave

sh

Pabari

Sl. no. 2 is his uncle

& sl. no. 14 is his

brother in law.

Sl. no. 9 is cousin of

sl. no.8.

Sl. no. 8 & 10 both

directors of

Rajnandi Yarns Pvt.

Ltd.(sl.no.1)

Share common Tel.

no. with sl. no. 13,

14, 3.

BR* with sl. no. 3, 5,

6, 9, 10, 12, 13.

With sl.

no. 9,

10, 1, 2,

3, 13,

14, 7.

2.Bharat

Shantilal

Thakkar

Sl. no. 8 is his

nephew.

Same address with sl.

no.8.

Sl. no. 8 is his

nominee.

Joint a/c with sl. no. 8.

BR* with sl. no. 3, 5,

6, 9, 10, 13, 14

With

sl. no.

8, 9,

13.

With sl.

no. 8, 1.

9.Prem

Mohanla

l Parikh

Sl. no. 9 is cousin of

sl. no.8.

Common email with

sl. 13, 9 & 14.

Sl. no. 10 is

nominee of sl. no.9.

BR* with sl. no. 2, 3,

5, 6, 8, 10, 13, 14.

With sl.

no. 8,

10, 6.

With sl.

no. 8,

10, 6, 1,

2, 3, 10,

11, 13,

14.

3.Bipin

Jayant

Thaker

Same Tel. no. with sl.

no. 8.

BR* with sl. no. 2, 5,

6, 8, 9, 10, 13, 14.

With

sl. no.

1, 8.

With sl.

no. 1, 11,

5, 8, 9,

10.

10.Hema

nt

Madhus

udan

Sheth

Sl. no. 8 & 10 both

directors of

Rajnandi Yarns Pvt.

Ltd.(sl.no.1)

Same email with sl.

no. 14.

BR* with 2, 9, 13,

14, 3, 5, 6 & sl. no.

12 is his wife.

With sl.

no. 8, 9,

6.

With sl.

no. 8, 9,

6, 1, 12,

13, 14,

11, 3.

4.Bharat

G

Same address &

Tel.no. as sl. no. 7

With

sl. no.

11.Jigar

Praful

With sl.

no. 1, 3,

Brought to you by http://StockViz.biz

Page 17 of 42

Vaghela who has share

movement with sl.no.

8.

Sl. No. 5 is nephew of

sl. no. 8 and shares

same Tel. no. with sl.

no. 8.

5. Ghoghar

i

9, 10,

13.

5.Chirag

Rajnikant

Jariwala

Same Tel. no. with

sl.no. 8.

Sl. no. 8 is his uncle.

BR* with sl. no. 2, 3,

6, 8, 10, 13, 14.

With

sl. no.

8, 10,

4, 1

With sl.

no. 1, 3.

12.Mala

Hemant

Sheth

Sl. no. 12 is the wife

of sl. no. 10.

With sl.

no. 8, 9.

With sl.

no. 10.

6.Kishore

Chauhan

Join a/c with sl. no. 8.

Sl. no. 8 & 10 are

witness for demat a/c.

BR* with sl. no. 2, 3,

5, 8, 9, 10, 13.

With

sl. no.

8, 9,

10.

With sl.

no. 1, 8,

9, 10, 14.

13.Ankit

Sanchan

iya

Same Tel. no. with

sl. no. 9 and also

shares Tel. no. with

sl. no. 8 who is the

nominee for his a/c.

BR* with sl. no.2, 3,

5, 6, 8, 9, 10, 14.

With sl.

no. 8, 9.

With sl.

no. 1, 8,

9, 10, 5,

11, 14.

7.Bipinku

mar

Gandhi

With sl.

no. 8.

14.Vivek

Kishanp

al

Samant

Sl. no. 8 is the

brother in law &

shares common

Tel. no. & sl.no. 8 is

the nominee of sl.

no. 14 for trading

a/c & bank a/c.

Shares email with

sl. no. 10.

Shares email with

sl. no. 9.

With sl.

no. 10.

With sl.

no. 1, 8,

10, 5, 6,

9, 13.

*BR - Business relation.

26. I find that during the relevant period, the abovementioned 14 group entities

had purchased and sold a total of 17031741 shares and 18478829 shares,

respectively on NSE. Out of 14 Pabari-Parikh Group entities, 13 Pabari-

Parikh Group entities i.e. Noticee Nos. 3 to 10, 12, 13, 16, 17 and 19 had

traded for 1,52,05,631 shares (i.e. 67.45% of the total market volume),

accounting for 89.28% of the total purchases of the group and 82.29% of the

total sales of the group, within the group entities. Out of 1,52,05,631 shares

traded in the scrip of SIL within the group entities, for 68,08,891 shares

constituting 30.20% of the market volume, the buy and sell orders were

placed within one minute time difference. 68,08,891 shares constituted for

39.98% of the total purchases and 36.85% of the total sales of the 14 Pabari-

Parikh Group entities. Further, it was noted that out of 68,08,891 shares, for

Brought to you by http://StockViz.biz

Page 18 of 42

15,63,314 shares constituting 6.93% of the total market volume, the buy and

sell orders were placed in synchronized manner (i.e. difference between

placement of order by buyer and seller within one minute and order rate as

well as order quantity of buy side and sale side being same). 15,63,314

shares constituted for 9.18% of the total purchases and 8.46% of the total sell

of the 14 Pabari-Parikh Group entities. The summary of the said

synchronized trades entered into by the stated Noticees while trading on NSE

is as under:

PANNO Client Name

Synchronised

!y trade

" o#

$ar%et

&ol!me

" o#

sync

to

total

!y

y

client

Synchronised

sale trade

" o#

$ar%et

&ol!me

" o#

sync

to

total

sale

y

client

AA5C-00,,3

-a8nandi 0a.ns

P.ivate Limited

(Noticee No. 1,) 488) 0.22 32.03 0 0.00 0.00

AA*P+,)42-

$(a.at S(anti'a'

+(a//a.

(Noticee No. 3) 1)0328 0.! 18.! 28,, 0.12 4.02

A$0P+4,841

$i2in 3a4ant +(a/e.

(Noticee No. 4) !)0) 0.33 4.00 8!22 0.30 3.48

A50P60844N

$(a.at G 6ag(e'a

(Noticee No. )) 380)!8 1., 12.)4 22)))) 1.00 .!1

A"7P3!)43L

C(i.ag -a8ni/ant

3a.i9a'a

(Noticee No. ) 8,123 0.40 !.4) 44!34 0.20 3.))

A"PPC,!03G

#is(o.e C(a&(an

(Noticee No. !) 1)!814 0.!0 13., 100,)) 0.4) ,.),

A31PG,8,3

$i2in/&ma. Gand(i

(Noticee No. 8) 0 0.00 0.00 0000 0.2! 24.1

A#GPP8!,N

$(aves( Pa%a.i

(Noticee no. ,) 1034,1 0.4 3,.! 28120 0.12 !.44

AL1PP348,N

P.em 7o(an'a'

Pa.i/(

(Noticee No. 10) 2,10 0.28 .1 ),!0 0.2 13.22

AN:PS80!;

1emant

7ad(&s&dan S(et(

(Noticee No. 12) 12!1! 0.) ).0 3)41, 1.)! 12.88

AS"PG8),8L

3iga. P.af&' G(og(a.i

(noticee No. 13) 343,, 0.1) ).,3 !8! 0.34 13.11

$LNPS331L

An/it Sanc(ani4a

(Noticee No. 1) 1,242 0.8! ,.1 1,,28, 0.88 8.8

$-SPS02,4N

6ive/ #is(an2a'

Samant 13!)12 0.1 ).), 31!8!) 1.41 ,.38

Brought to you by http://StockViz.biz

Page 19 of 42

(Noticee No. 1!)

G.and +ota' 1)3314 .,3 ,.18 1)3314 .,3 8.4

27. It was also observed that Noticee Nos. 3, 4, 7, 10, 12, 13 and 16 had

indulged in certain trades which were self trades in nature while trading

through their multiple brokers including Noticee No. 27. The details of the

said fictitious trades indulged into on NSE by the said Noticees are as under:

PANNO Client Name 'otal (!y

'otal

Sale

Sel#

trade

)ty

" o#

'otal

(!y

"

'otal

Sale

" o#

$ar%et

&ol!me

No o#

Sel#

trades

AA*P+,)42-

$(a.at S(anti'a' +(a//a.

(Noticee No. 3) 80)11, 8,38 48)) 0.0 0.!3 0.02 8

A$0P+4,841

$i2in 3a4ant +(a/e.

(Noticee No. 4) 18!!18! 1,!!2)! ))03, 2.,3 2.!8 0.24 24

A50P60844N

$(a.at G 6ag(e'a

(Noticee No. )) 3033!2, 33),143 4881 0.1 0.1) 0.02 32

A"PPC,!03G

#is(o.e C(a&(an

(Noticee No. !) 11)2)4 10)2,8, 1120 0.,! 1.0 0.0) 18

AL1PP348,N

P.em 7o(an'a' Pa.i/(

(Noticee no. 10) ,)142! 4)1)00 1)000 1.)8 3.32 0.0! 2

AN:PS80!;

1emant 7ad(&s&dan

S(et(

(Noticee No. 12) 2)11!3 2!)3!43 )834 0.23 0.21 0.03 3

AS"PG8),8L

3iga. P.af&' G(og(a.i

(Noticee No. 13) )!,,! )82)0 10000 1.!3 1.!1 0.04 1

$LNPS331L

An/it Sanc(ani4a

(Noticee No. 1) 2042411 22)0)38 1321 .4, ).8, 0.), 33

G.and +ota' 12,)38,! 131003)8 23,431 1.8) 1.83 1.0 121

28. For the above fictitious trades, it was noted that the brokers mentioned in the

table below were appearing on both the sides of the trade i.e. acted as broker

and counter party broker. The number of instances wherein the Noticee No.

27 had executed self trades on behalf of its clients was significant and the

details of the same are as under:

Buy and Sale Member Name Client Name Total Traded Qty No. of Trades

A.cadia S(a.e = Stoc/ $.o/e.s Pvt.

Ltd.

An/it -a8end.a Sanc(ani4a

(Noticee No. 1) 18, 11

$(a.at G 6ag(e'a

(Noticee No. )) 4881 32

$(a.at S(anti'a' +(a//a.

(Noticee No. 3) !2 3

$i2in 3a4ant +(a/e.

(Noticee No. 4) 300, 14

Brought to you by http://StockViz.biz

Page 20 of 42

1emant 7ad(&s&dan S(et(

(Noticee No. 12) 34 1

#is(o.e C(a&(an

(Noticee No. !) 3!0 14

Arcadia Share % Stock Brokers Pvt. Ltd. Total !2')! $&

1rand Total !2')! $&

29. From the price volume data analysis on NSE, I note that the scrip of SIL was

traded on 36 trading days at NSE. Out of 36 trading days, the group entities

had traded among themselves on all the days the scrip was traded. By

trading amongst themselves, the group entities had contributed to daily

market volume traded in the scrip in the range from 91.87% on March 09,

2010 to 84.33% on April 30, 2010. Out of 36 trading days on which the group

entities traded among themselves, on 27 trading days the 14 Pabari-Parikh

Group entities contributed for more than 50% to the total market volume of

the scrip during the relevant period.

30. Further, out of 36 trading days on which the 14 Pabari-Parikh Group traded, I

note that on all the trading days both buy and sell orders were placed within

time difference of one minute. By trading amongst themselves, the group

entities contributed to daily market volume of the scrip in the range from

88.56% on March 09, 2010 to 20.39% on April 30, 2010. I also note that out

of 36 trading days, on 4 trading days the Pabari-Parikh Group entities

contributed for more than 50% to the total market volume by placing both buy

and sell order within one minute time difference. On further examination, it

was also noted that out of 36 trading days, on 30 trading days the trades

executed by the Pabari-Parikh Group entities were synchronized in nature.

By executing synchronized trades among themselves, Pabari-Parikh Group

entities contributed to total market volume in the ranged from 13.97% on

March 09, 2010 to 0.37% on April 29, 2010.

31. It was, therefore, alleged in the SCN that the Noticee Nos. 1 to 26, by

indulging in the manipulative trade practices as mentioned above, had

violated Regulations 3(a), (b), (c), (d), 4(1) and 4(2)(a), (b), (e) & (g) of the

PFUTP Regulations thereby, created artificial volumes and price in the scrip

of SIL and further alleged that the Noticee No. 27, by executing the

Brought to you by http://StockViz.biz

Page 21 of 42

manipulative trades on behalf of Noticee Nos. 1 to 26, had violated Clauses

A(1), (2) and (3) of the Code of Conduct for Stock Brokers as specified under

Schedule II read with Regulation 7 of the Broker Regulations.

Submissions made by the Noticees:

Noticee No. 1:

32. The Noticee No. 1 vide its reply dated May 23, 2014 submitted that it is into

the business of investing in stock market and consulting major companies on

merger and acquisition, financing, buy-out and capital placement. Further, it

denied having any connection with the Pabari-Parikh Group except that Shri

Narendra Ganatra i.e. Noticee No. 21 is its Director. Further, it also stated

that vide SEBI order dated July 08, 2013 the Noticee is still debarred from

trading in the securities market. It is submitted by the Noticee that by initiating

adjudication proceedings in the matter although the earlier debarment is still

in force, the same amounts to multiple proceedings and therefore, it is

prejudicial.

33. Further, the Noticee No. 1 submitted that during the relevant period it had

bought 6,26,395 shares and sold 3,51,395 shares of SIL. However, out of the

said traded quantity, merely 3,99,286 shares on the buy side and 3,47,193

shares on the sell side had allegedly matched with the Pabari -Parikh group

entities. The said volume of shares constituted for 0.24% on the buy side and

0.21% on the sell side to the total market volume which was a miniscule

percentage to the market volume of shares traded in the scrip of SIL. It is the

case of the Noticee that at the time of placing orders, it was not aware of the

counter party broker / client with whom its shares were getting matched. It is

submitted by the Noticee that the type, nature and pattern of its trading in the

scrip of SIL during the investigation period was similar to and in lines with the

trading carried out by it in various other scrips and therefore, the trading

activity cannot be treated as manipulative in nature. Further, on August 28,

2009, 1000 shares had got matched with one Mr. Bipin Gandhi i.e. Noticee

No. 8 out of the total 30,000 shares sold by the Noticee No. 1 on the trading

platform. The transactions carried out in the scrip of SIL were all delivery

based and therefore, were genuine in nature.

Brought to you by http://StockViz.biz

Page 22 of 42

Noticee No. 2:

34. Vide letter dated August 11, 2014, the Noticee No. 2 submitted that he is

basically a goldsmith and a small time investor in the capital market. The

decision of trading and investment is completely taken independently by the

Noticee and is not influenced by any other person. The Noticee denied being

part of the Pabari-Parikh Group. Further, he submitted that all the trades

were executed by him through one broker viz. Globe Capital Market Limited

and were delivery based and therefore, there cannot be any question of the

said trades being synchronised or circular in nature. He had bought 1,11,045

shares in his account and sold 18,045 shares of SIL. The said transactions

were delivery based.

35. The Noticee further submitted that in the course of his goldsmith business he

had come across one Mr. Prem Parikh i.e. Noticee No. 10 and he used to get

the ornaments sample for sale in the market as broker from various

manufacturers from various sectors. During the relevant period as the

Noticee No. 2 had to make payment to Noticee No. 10 for the sample

ornaments, he had done a barter system of payment by giving 93,000 shares

of SIL to Noticee No. 10 in an off market transfer.

Noticee No. 3, 4, 6, 10, 13, 16 and 17:

36. Vide separate but identical letters dated August 08, 2014, the Noticee Nos. 3,

4, 6, 10, 13, 16 and 17 submitted that they have been debarred from buying,

selling and dealing in the securities market vide SEBI order dated February

02, 2011. Further, the said Noticees stated that as the investigation period is

4 years old, they are in a process of collating the data and will be filing their

detailed reply in the matter. However, no replies were received from the said

Noticees till date except Noticee No. 13.

37. The Noticee No. 13 vide letter dated August 14, 2014, submitted that he is

into the business of jobbing and arbitrage activities in the market. Further, the

Brought to you by http://StockViz.biz

Page 23 of 42

Noticee admitted the off market transactions done by him with Noticee Nos.

4, 10, 12, 16 & 19. The Noticee stated that it was a mere coincidence that

few of his orders in the scrip of SIL had got synchronized with the group

entities and that he had no knowledge of the counter party broker / client with

whom the orders were getting matched. Out of his total buy volume of

9,47,718 shares, only 43,355 shares were synchronised and out of the total

sell volume of 5,82,260 shares only 27,400 shares were synchronised. The

volume of the synchronized trade was also insignificant if compared to the

total volume which was traded in the scrip of SIL during the relevant period.

The Noticee further denied having any linkages / connection with the Pabari-

Parikh entities.

38. With respect to the self trades alleged to have been indulged in by Noticee

No. 13, he submitted that 10,000 shares had coincidentally got matched on a

single day. On perusal of the order log file, he stated that instead of putting

another buy order of 10,000 shares he had punched in a sell order by

mistake and therefore, it got matched.

Noticee No. 9:

39. Vide letter dated August 11, 2014, the Noticee No. 9 submitted that he has

been debarred from buying, selling and dealing in the securities market vide

SEBI order dated February 02, 2011. Further, the Noticee stated that as the

investigation period is 4 years old, he is in a process of collating the data and

file his detailed reply in the matter. Accordingly, vide letter dated August 17,

2014, the Noticee No. 9 submitted his detailed reply and stated that he had

dealt in the shares of SIL in the normal and ordinary course of business and

had carried out trading in various other scrips during the period under

investigation. The Noticee further submitted that he is basically a cloth

merchant and his main motto is to earn brokerage or commission by dealing

in huge volumes of trade in cloth. Only in 1996 the Noticee joined the stock

market as an investor, jobber cum trader and arbitrager. The Noticee also

stated the fact that he has been debarred from buying, selling and dealing in

the securities market vide SEBI order dated February 02, 2011.

Brought to you by http://StockViz.biz

Page 24 of 42

40. While denying being part of the Pabari-Parikh group, with respect to the

allegation of synchronised trading carried out by the Noticee No. 9, he stated

that the said trades were miniscule in volumes when compared to the total

volume traded in the scrip of SIL during the relevant period. As submitted by

him, on BSE the buy side synchronised trades entered into by him

constituted 0.29% and on NSE the same constituted 0.46% of the market

volume traded in the scrip. Further, with respect to sell side synchronised

trades, the same constituted 0.33% on BSE and 0.12% on NSE of the

market volume traded in the scrip. The said transactions were delivery based

on net basis on both the exchanges. The Noticee admits being a director of

Noticee No. 19 along with Noticee No. 12. However, the investment

decisions taken by the Noticee are independent and not influenced by any

other person. The Noticee further submitted that the relationship with

Noticee No. 18 is because of his name filled in as introducer while filing KYC

document by one of the brokers through whom Noticee No. 9 had traded.

Therefore, Noticee No. 9 denied being related to Noticee No. 18.

41. With regard to off market dealings with some of the group entities, the

Noticee submitted that the same were carried out for meeting urgent fund

requirements. With regard to the off market transaction carried out with

Noticee No. 12 and 19, the Noticee stated that the same was in the nature of

temporary loans. The Noticee submitted that he had not manipulated the

price of the scrip and had sold all the shares available with him during the

investigation period. He denied making any gains or taking advantage of

fluctuations of the price in the scrip.

Noticee No. 12:

42. Vide letter dated August 11, 2014 the Noticee No. 12 submitted that he has

been debarred from buying, selling and dealing in the securities market vide

SEBI order dated February 02, 2011. Further, the Noticee stated that as the

investigation period is 4 years old, he is in a process of collating the data and

file his detailed reply in the matter. Accordingly, vide letter dated August 18,

Brought to you by http://StockViz.biz

Page 25 of 42

2014 the Noticee No. 12 submitted his detailed reply and stated that he is

into the business of jobbing and arbitrage activities on the stock market.

43. With respect to the off market transactions carried out by the Noticee, he

stated that the off market deals with Noticee No. 19, 10 , 16, 4 & 15 were

carried out by paying and receiving consideration. He had carried out an off

market deal with his wife i.e. Noticee No. 15 which was a family arrangement.

The Noticee admitted being a Director of Noticee No. 19 along with Noticee

No. 9. However, it is the case of the Noticee that the investment decisions

are taken independently by him without any influence. Therefore, Noticee No.

12 denied being related to any of the group entities. Further, with respect to

the synchronised trades, the Noticee submitted that the same were mere

coincidence and without knowledge of counterparty broker / client. The

synchronised volume of shares traded by the Noticee on BSE is stated to be

8,65,351 shares on the buy side accounting to 0.51% and 6,84,574 shares

on the sell side accounting to 0.41% of the market volume. Further, the

synchronised trade volume traded by the Noticee on NSE is stated to be

1,27,167 shares on the buy side accounting to 0.56% and 3,54,619 shares

on the sell side accounting to 1.57% of the market volume traded in the scrip

of SIL. Therefore, the Noticee stated that volume of the said synchronised

trades was insignificant if compared to the total volume traded in the scrip.

44. With respect to the self trades, Noticee No. 12 submitted that the same were

executed by different brokers during the course of his arbitrage and jobbing

business. The Noticee further submitted that when buying member, selling

member, order quantity, order time, order rate were different from executed

traded quantity, trade time, trade rate and only small quantity resulted into

self trade, it would not have disturbed the market equilibrium. The

transactions carried out by the Noticee were all delivery based on both

exchanges.

Brought to you by http://StockViz.biz

Page 26 of 42

Noticee No. 15:

45. The Noticee No. 15 vide letter dated August 11, 2014 submitted that during

the investigation period she had traded in the scrip of SIL along with many

other scrips. The Noticee further stated that she has been debarred from

buying, selling and dealing in the securities market vide SEBI order dated

February 02, 2011 and that by initiating adjudication proceedings in the

matter, although the earlier debarment is still in force, it amounts to "double

jeopardy". The Noticee further stated that she is the wife of Noticee No. 12

but denies having any business / professional connection with him. The

Noticee also denied fund transactions with Noticee Nos. 5 & 10. The off

market transfer of shares between Noticee No. 15 and Noticee No. 12 was

carried out to meet urgent fund requirements. She stated that she had bought

8,18,384 shares and sold 6,25,863 shares which constituted only 0.49% and

0.39%, respectively, of the total market volume traded in the scrip of SIL

during the relevant period. The said volumes were miniscule and therefore,

the same cannot be considered to have created artificial volumes in the scrip.

46. She further submitted that her buy volume within the group was only 0.30%

of the total market volume and sell volume within the group was 0.29% of the

market volume. Very few trades out of the total trades were carried out

wherein the time difference was less than one minute and in majority of the

trades the time difference was more than one minute. With regard to the

synchronised trading carried out by the Noticee, she submitted that her buy

trade volume which synchronised accounted to 0.02% of the market volume

and the sell trade volume accounted to 0.01% of the market volume. With

respect to her trading on NSE in the scrip of SIL, she stated that she had

bought 400 shares and sold 1,03,574 shares which were insignificant in

volume.

Noticee No. 18:

47. Vide letter dated August 11, 2014, the Noticee No. 18 submitted that he does

not belong to any of the Pabari-Parikh Group entities and had traded in his

account independently. The relationship of Noticee No. 18 with Noticee No. 9

Brought to you by http://StockViz.biz

Page 27 of 42

was merely because of Noticee No. 18's name being filled in as introducer

while filling KYC document by one of the brokers through whom Noticee No.

18 had traded. Therefore, Noticee No. 18 denied being related to Noticee No.

9. The Noticee further submitted that he is basically a cloth merchant and

earns brokerage or commission by dealing in huge volumes of trade in cloth

and has dealership of many reputed textile companies. Further, in the course

of his cloth business he had come across one Mr. Ankit R. Sanchaniya i.e.

Noticee No. 16 and had business dealings for cloth.

48. The Noticee's trading in the scrip of SIL was insignificant and therefore, could

not have created any artificial volume in the scrip. Further the Noticee denied

carrying out any circular / synchronised / reverse trades and stated that all

the transactions were delivery based. The said transactions were carried out

at prevailing market price and therefore, he was not a party to price

manipulation in the said scrip.

Noticee No. 19:

49. Vide letter dated August 11, 2014 the Noticee No. 19 submitted that it has

been debarred from buying, selling and dealing in the securities market vide

SEBI order dated February 02, 2011. Further, the Noticee stated that as the

investigation period is 4 years old, it is in a process of collating the data and

file his detailed reply in the matter. Accordingly, vide letter dated August 22,

2014, the Noticee submitted its additional reply in the matter. The Noticee

reiterated the submissions made by it in the previous reply and further stated

that its demat account is still frozen. The Noticee further stated that by

initiating adjudication proceedings in the matter, although the earlier

debarment being still in force, is nothing but "double jeopardy". The Noticee

admitted that the Noticee Nos. 9 & 12 are its Directors and the company had

carried out certain off market transfers with the said Directors. The Noticee

denied being connected to any of the entities in Pabari-Parikh group.

Further, at BSE the Noticee had bought 50,500 shares through one broker

i.e. Religare Securities Ltd which constituted 0.03% of the total market

volume traded in the scrip. It is the Noticee's contention that the said volume

Brought to you by http://StockViz.biz

Page 28 of 42

cannot be treated to have created artificial volumes. Further the Noticee

denied entering into any circular / synchronised / reverse trades and stated

that all the transactions were delivery based. At NSE, the Noticee stated that

it had bought 1,52,000 shares which accounted for 0.67% of the total market

volume which again was a miniscule percentage.

Noticee No. 20:

50. The Noticee No. 20 submitted his reply vide letter dated August 11, 2014.

The Noticee stated that he is a doctor by profession and Noticee No. 3

(Bharat Shantilal Thakkar), being one of his patients, had advised him to deal

in capital markets. Noticee No. 20 and 3 were clients of the broker Angel

Share Broking but the investment decisions were taken independently by

him. The Noticee No. 20 denied being part of the alleged Pabari-Parikh

Group. Further, he stated that he had received 2,500 shares and 20,000

shares of SIL in off market transaction from Noticee No. 3 on September 10,

2009 against which consideration was paid by Noticee No. 20 to Noticee No.

3. The details of cheque payments made have been listed by the Noticee.

51. During the relevant period, the Noticee No. 20 had bought 20,000 shares of

SIL from Noticee No. 3 which were sold in the market during the period from

November 23, 2009 to December 09, 2009 in various tranches. Thereafter,

only on March 08, 2010 he had purchased 3,000 shares from the market.

The said transaction was the only transaction carried out by Noticee No. 20 in

the scrip of SIL during the relevant period. The Noticee also stated that his

dealing was negligible in volume to have created artificial volume in the scrip.

Noticee No. 21

52. Vide letter dated June 04, 2014 Noticee No. 21 denied being connected to

the Pabari-Parikh Group except that he was the Director of Noticee No. 1.

The Noticee further stated that he and Noticee No. 9 i.e. Mr. Bhavesh Pabari

have common office address and that Noticee No. 21 had introduced Noticee

No. 9 to his broker while opening the trading account. The Noticee, therefore,

Brought to you by http://StockViz.biz

Page 29 of 42

submitted that the same amounted to a mere introduction of a person and

nowhere in the KYC form it was stated or mentioned or declared that he was

related /group/connected person which is a normal practice in case of related

/ connected / group accounts opened by the broker. With respect to the

common address shared by the Noticee No. 21 with Noticee No. 9, it is

clarified that the said common address was the office of Stock Broker Ami

Stock and Share Brokers Pvt. Ltd and neither belongs to Noticee No. 21 nor

does he have any office at the said premises. Noticee No. 21 also stated that

he was a director of SIL.

53. Noticee No. 21 was also appointed as an Independent Director of Noticee

No. 1 on August 01, 2007. Incidentally on August 27, 2008, Mr. Premchand

Shah, the then Managing Director of Noticee No. 1 resigned due to ill health

and to fill in the vacancy, Noticee No. 21 was appointed as an Managing

Director of Noticee No. 1 by passing special resolution in the Annual general

Meeting held on September 29, 2008. Noticee No. 21 resigned as a Director

of Noticee No. 1 w.e.f January 19, 2012. He was the Director of SIL for a

limited period i.e. from September 05, 2009 to June 2010.

54. With respect to the trading in the scrip of SIL, the Noticee stated that on BSE,

during the relevant period, he had bought and sold 13,538 shares constituting

0.01% of the market volume. The said volume was negligible and cannot be

treated to be manipulated to create artificial volume in the scrip. Merely

because Noticee no. 21's single sell order for 307 shares got matched with

Noticee No. 9 the said allegation has been framed against the Noticee. It is

the case of the Noticee that out of his buy and sell quantity of 13,538 shares

only 307 shares got matched with the group entities. He stated that he was

not aware of the names of the counter party brokers / clients and the said

matching of order took place while trading online. He further submitted that

none of his trades in the scrip of SIL were synchronized or self trades in

nature. Additionally, he also stated that he has not done any off market

transaction in the scrip of SIL. Further, the Noticee submitted that he had

placed orders only at the then prevailing market price and hence, his trading

in SIL did not result in any new high price or new low price. All the

Brought to you by http://StockViz.biz

Page 30 of 42

transactions were carried out through the Stock Exchange mechanism during

trading hours. Vide letter dated August 12, 2014 the Noticee reiterated the

submission made by him vide his previous reply.

Noticee No. 23

55. Vide letter dated November 21, 2013, the Noticee No. 23 submitted that he

had not executed any synchronised and self trades in the scrip as alleged in

the SCN. The Noticee further submitted that he had traded only for 199

shares in the scrip of SIL during the investigation period. Vide letter dated

August 19, 2014 the Noticee submitted his detailed reply wherein he stated

that he had bought and sold 500 shares of SIL during the relevant period.

The said transaction was not synchronised in nature. Out of the 500 shares

traded in the said scrip, only 199 shares on the sell side were traded within

the group which were minuscule in nature. The Noticee submitted that he had

not done any off market transfers with any of the Pabari-Parikh group entities

in the scrip of SIL.

Noticee No. 25

56. Vide letter dated August 05, 2014 the Noticee stated that he had filed a reply

dated December 07, 2013 to the SCN. Further, upon perusal of the said

letter it is noted that the Noticee had made a request to provide all the

documents which were relied upon while issuing the said SCN including the

investigation report. Vide letter dated August 19, 2014, the Noticee No. 25

submitted his detailed reply in the matter. The Noticee while denying all the

allegations levelled against him in the SCN stated that he had bought and

sold 10,000 shares in the scrip of SIL during the investigation period. The

said volume of shares was insignificant if compared to the total traded

volume in the said scrip. Further, he stated that only on the basis of off

market shares movement with Noticee No. 9 and 14 it has been alleged in

the SCN that he is a part of the group entities. Therefore, the Noticee denied

being connected with the so called Pabari-Parikh Group entities.

Brought to you by http://StockViz.biz

Page 31 of 42

Noticee No. 26

57. Vide letter dated October 21, 2013, the Noticee No. 26 submitted his

preliminary reply stating that he is not sharing his address with any of the

alleged entities and therefore, cannot be clubbed with the Pabari-Parikh

group. Further, vide letter dated August 11, 2014 the Noticee submitted his

detailed reply and stated that he had bought 18,087 shares and sold 15,042

shares in the scrip of SIL during the period from May 29, 2009 to April 30,

2010. The Noticee denied carrying out any off market transfer of shares with

any of the group entities. Further, he submitted that he has not indulged in

synchronized or self trades in the scrip. The transactions in the scrip of SIL

were carried out in the normal and ordinary course of trading and executed at

the then prevailing market price.

Noticee No. 27:

58. Vide letter dated November 21, 2013, the Noticee No. 27 submitted that it is

a stock broker and had traded in the scrip of SIL in the normal and ordinary

course of the stock broking business. The trades were executed in the then

existing clients account on receipt of their instructions and authorization. The

Noticee submitted that it had no knowledge of any pattern or method of

placing orders and that the clients were inter connected with each other. As

on date, the Noticee submitted that it has stopped dealing for the said clients

and has improved its monitoring, control and surveillance systems to ensure

that no such activities are carried out by its clients through any of its

terminals. Further, the Noticee vide letter dated September 02, 2014 stated

that the transactions mentioned in the SCN were carried out through SEBI

registered sub broker Mr. Chirag R Jariwala affiliated with the Noticee since

March 2008.

FINDINGS:

59. I find from the SCN and the material available on record that during the

relevant period the Noticee Nos. 1 to 26 along with other entities, who were

all connected to each other and referred to as the Pabari-Parikh Group

entities in the investigation report, had traded significantly in the shares of SIL

Brought to you by http://StockViz.biz

Page 32 of 42

i.e. purchased 12,91,93,874 shares and sold 10,61,95,225 shares,

respectively on BSE and the Noticee Nos. 3 to 10, 12, 13, 15 to 17 and 19,

connected to one another in one way or the other and dealing through

multiple brokers, had purchased 1,70,31,741 shares which accounted for

75.55% of the total volume traded and sold 1,84,78,829 shares which

accounted for 81.97% of the total volume traded in the scrip of SIL on NSE. I

find that the relationship table as mentioned in para 16 and 25 above clearly

shows that the said Noticees were connected to each other either by way of

having similar addresses / telephone numbers, relatives, business associates

and/or having fund movements between themselves. Further, the relationship

of the Noticee Nos. 1 to 26 is established by way of off market transactions

between them as mentioned in para 17 above.

60. I note that the Noticee Nos. 1 to 26 had traded for 8,82,03,123 shares (i.e.

52.28% of the market volume) accounting for 68.27 % of the total purchases

of the group and 83.06 % of the total sales of the group, within Pabari-Parikh

Group entities and 52.28% of the market volume from within the group

entities on the BSE. Out of 8,82,03,123 shares traded on BSE within the

group entities, the buy and sell orders for 3,25,89,257 shares, accounting for

19.32% of the market volume, were placed within one minute time difference.

I note that 3,25,89,257 shares constituted for 25.23% of the total purchases

and 30.69% of the total sales of the Pabari-Parikh Group entities.

61. Further, on NSE, I note that Noticee Nos. 3 to 10, 12, 13, 16, 17 and 19 had