Escolar Documentos

Profissional Documentos

Cultura Documentos

Siemens 2020 Vision

Enviado por

Sudeep KeshriDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Siemens 2020 Vision

Enviado por

Sudeep KeshriDireitos autorais:

Formatos disponíveis

Joe Kaeser, President and CEO Ralf P.

Thomas, CFO

Siemens Vision 2020

Q2 FY 2014, Analyst and Press Conference y

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Safe Harbour Statement Safe Harbour Statement

This document contains statements related to our future business and financial performance and future events or developments involving Siemens that may

constitute forward-looking statements. These statements may be identified by words such as expect, look forward to, anticipate, intend, plan, believe,

seek estimate will project or words of similar meaning We may also make forward looking statements in other reports in presentations in material seek, estimate, will, project or words of similar meaning. We may also make forward-looking statements in other reports, in presentations, in material

delivered to shareholders and in press releases. In addition, our representatives may from time to time make oral forward-looking statements. Such statements

are based on the current expectations and certain assumptions of Siemens management, and are, therefore, subject to certain risks and uncertainties. A variety

of factors, many of which are beyond Siemens control, affect Siemens operations, performance, business strategy and results and could cause the actual results,

performance or achievements of Siemens to be materially different from any future results, performance or achievements that may be expressed or implied by

such forward-looking statements or anticipated on the basis of historical trends. These factors include in particular, but are not limited to, the matters described in

Item 3: Key informationRisk factors of our most recent annual report on Form 20-F filed with the SEC, in the chapter C.9.3 Risks of our most recent annual

report prepared in accordance with the German Commercial Code, and in the chapter C.7 Risks and opportunities of our most recent interim report.

Further information about risks and uncertainties affecting Siemens is included throughout our most recent annual and interim reports, as well as our most recent

earnings release, which are available on the Siemens website, www.siemens.com, and throughout our most recent annual report on Form 20-F and in our other

filings with the SEC, which are available on the Siemens website, www.siemens.com, and on the SECs website, www.sec.gov. Should one or more of these risks

or uncertainties materialize, or should underlying assumptions prove incorrect, actual results, performance or achievements of Siemens may vary materially from

those described in the relevant forward-looking statement as being expected, anticipated, intended, planned, believed, sought, estimated or projected. Siemens g g p , p , , p , , g , p j

neither intends, nor assumes any obligation, to update or revise these forward-looking statements in light of developments which differ from those anticipated.

All underlying margins are calculated by adjusting margins for the effects reported for the respective businesses in the relevant period. These effects are provided

to assist in the analysis of the businesses' results year-over-year and may vary from period to period. Underlying margins are not necessarily indicative of future

performance. Other companies may calculate similar measures differently.

Due to rounding, numbers presented throughout this and other documents may not add up precisely to the totals provided and percentages may not precisely

reflect the absolute figures.

The financial measures identified in this document are in part transitional figures attained by comparison, classification, appreciation and rounding of historical

financial measures; these financial measures and their transitional basis must be regarded as preliminary.

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 2 Q2 FY 2014, Analyst and Press Conference

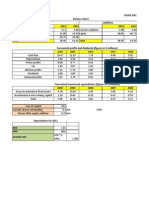

Q2 FY 2014 Key figures Q2 FY 2014 Key figures

Siemens (continuing operations in m) Q2 FY 13 Q2 FY 14 Change Siemens (continuing operations, in m) Q2 FY 13 Q2 FY 14 Change

Orders 21,235 18,430 -10%

1)

Revenue 17,779 17,449 1%

1)

Book-to-bill ratio 1.19x 1.06x

Total Sectors profit 1,348 1,566 16%

Net income 1,030 1,153 12%

Basic earnings per share net income (in ) 1.20 1.33 11%

Free cash flow 1,360 1,390 2%

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 3 Q2 FY 2014, Analyst and Press Conference

1) Change is adjusted for portfolio and currency translation effects

Energy Performance held back by lower revenues and

execution challenges execution challenges

Key Figures Energy Main developments in Q2

Book-to-bill at 1.09 despite sharp order decline

in Europe/CAME region

Market environment remains challenging

-23%

m

Profit

2)

bn

Orders

1)

Revenue

1)

Market environment remains challenging

Power Generation Positive gains

overcompensate lower contribution due to

decreasing revenue mainly from gas turbine

6.1

8.5

-6%

5.6

6.3

551

4.6%

8.6%

8.8%

10.5%

g y g

business

Wind Significantly lower contribution from

offshore business and charges related to

U d l

Q2 14 Q2 13 Q2 14 Q2 13

255

Q2 14 Q2 13

defective components

Transmission Substantial execution

challenges at two Canadian turnkey projects

result in charges of 287m; further low margin

Division

Orders

y-o-y

1)

Revenue

y-o-y

1)

Profit

margin

Underl.

profit

margin

Power

Generation

-14% -8% 18.4% 14.4%

result in charges of 287m; further low margin

projects

Wind Power -46% 13% -4.3% -0.2%

Power

Transmission

7% -14% -24.2% 1.1%

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 4 Q2 FY 2014, Analyst and Press Conference

1) Comparable, i.e. adjusted for currency translation and portfolio effects

2) for underlying margin calculation please refer to Flashlight document

% Profit margin

% Underlying Profit margin

Healthcare Continued excellent performance on high

level despite currency headwinds level despite currency headwinds

Key Figures Healthcare Main developments in Q2

Order growth supported by strong service

business and improvement in Europe while

revenue growth is broad based

m

Profit

2)

bn

Orders

1)

Revenue

1)

Strong profit margin 66m gain from

expected sale of particle therapy installation

compensates for strongly adverse FX effects

+1%

3.2 3.3

+5%

3.3 3.3

531

445

13.6%

15.3%

16.3%

15.5%

Diagnostics Solid growth and profit

development

U d l

Q2 14 Q2 13 Q2 14 Q2 13

531

Q2 14 Q2 13

445

Division

Orders

y-o-y

1)

Revenue

y-o-y

1)

Profit

margin

Underl.

profit

margin

Diagnostics 3% 3% 10.8% 15.2%

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 5 Q2 FY 2014, Analyst and Press Conference

1) Comparable, i.e. adjusted for currency translation and portfolio effects

2) for underlying margin calculation please refer to Flashlight document

% Profit margin

% Underlying Profit margin

Industry Profit climbs as short cycle businesses

continue stabilizing continue stabilizing

Key Figures Industry Main developments in Q2

Short cycle markets show continuing

stabilization, with positive order growth

particularly in Germany and China

m

Profit

2)

bn

Orders

1)

Revenue

1)

Industry Automation Margin improvement

due to higher capacity utilization

Drive Technologies Improved cost position

+12%

4.8

4.4

+5%

4.4 4.4

456

7.9%

10.5%

10.3%

13.2%

g p p

and volume growth support gross margins

Metals Technologies burdened by a project in

the US; Joint venture with Mitsubishi-Hitachi

U d l

Q2 14 Q2 13 Q2 14 Q2 13 Q2 14 Q2 13

345

456

Heavy Machinery signed

Division

Orders

y-o-y

1)

Revenue

y-o-y

1)

Profit

margin

Underl.

profit

margin

Industry

Automation

11% 6% 15.8% 18.1%

Drive

Technologies

14% 5% 9.5% 9.9%

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 6 Q2 FY 2014, Analyst and Press Conference

1) Comparable, i.e. adjusted for currency translation and portfolio effects

2) for underlying margin calculation please refer to Flashlight document

% Profit margin

% Underlying Profit margin

Infrastructure & Cities Higher profit on improvements

in execution mix and productivity in execution, mix and productivity

Key Figures Infrastructure & Cities Main developments in Q2

Positive book-to-bill of 1.05 on tough comps

due to major rail orders

Transportation & Logistics Improved project

m

Profit

2)

bn

Orders

1)

Revenue

1)

Transportation & Logistics Improved project

execution of large rolling stock orders

Power Grid Solutions & Products Mainly

benefitting from favourable mix and Siemens

-12%

4.7

5.2

+7%

4.4

4.1

0 2%

4.7%

7.3%

7.2%

g

2014 related productivity improvements

Building Technologies Continued

improvement from successful implementation

U d l

Q2 14 Q2 13 Q2 14 Q2 13

325

Q2 14 Q2 13

6

0.2%

of 'Siemens 2014' measures

Division

Orders

y-o-y

1)

Revenue

y-o-y

1)

Profit

margin

Underl.

profit

margin

Transportation

& Logistics

-29% 21% 7.0% 8.3%

g

Power Grid

Solutions

& Products

9% 1% 8.2% 8.2%

Building

T h l i

-6% -1% 6.9% 6.9%

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 7 Q2 FY 2014, Analyst and Press Conference

1) Comparable, i.e. adjusted for currency translation and portfolio effects

Technologies

6% 1% 6.9% 6.9%

2) for underlying margin calculation please refer to Flashlight document

% Profit margin

% Underlying Profit margin

Lower volume from large orders in Europe while

China shows strength China shows strength

Regional business split Purchasing Managers Index

Q2 FY 14 Order growth y-o-y

1)

Europe/C.I.S./Africa/ME

(therein Germany) -38%

-26%

55

60

65

Eurozone Mfg PMI US ISM Mfg PMI

Index

53.7

2)

Expanding economy

Asia/Australia +20%

Americas

(therein USA) +6%

+10%

( y) 38%

30

35

40

45

50 53.3

Contracting economy

Q2 FY 14 Revenue growth y-o-y

1)

Asia/Australia

(therein China) +22%

+20%

China Industry Value Added

01 00 13 12 11 10 09 08 07 06 05 04 03 02 14 (Apr)

2) US as of March; flash reading for EZ in April

Americas 1%

Europe/C.I.S./Africa/ME

(therein Germany) -1%

-2%

15

20

In %

Asia/Australia

(therein China) 19%

9%

(therein USA) -2%

5

10

15

8.8%

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 8 Q2 FY 2014, Analyst and Press Conference

1) Change is adjusted for currency translation and portfolio effects

13 12 11 10 09 08 07 06 05 04 03 02 01 00 14 (Mar)

Outlook Fiscal 2014 Outlook Fiscal 2014

We expect our markets to remain

challenging in Fiscal 2014

Basic earnings per share (Net income)

challenging in Fiscal 2014

Our short cycle businesses are not

anticipating a sustainable recovery until

late in the fiscal year

In

6.55

At least 15%

growth

late in the fiscal year

We expect orders to exceed revenue,

for a book-to-bill ratio above 1

A i th t i b i

5.08

4.74

Assuming that revenue on an organic basis

remains level year-over-year, we expect

basic earnings per share (Net Income) for

Fiscal 2014 to grow by at least 15% from

5 08 i Fi l 2013 5.08 in Fiscal 2013

This outlook is based on shares outstanding

of 843 million as of September 30, 2013

Furthermore it excludes impacts related

to legal and regulatory matters

FY 2014e FY 2013 FY 2011 FY 2012

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 9 Q2 FY 2014, Analyst and Press Conference

FY 2014e FY 2013 FY 2011 FY 2012

Siemens Vision 2020: Strategic focus Siemens Vision 2020: Strategic focus

Long-term growth agenda in attractive fields

1

Align portfolio along strategic imperatives

2

3

2

Cost reduction and business excellence

3

Ownership culture and leadership based on common values

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 10 Q2 FY 2014, Analyst and Press Conference

Siemens Innovating the Electrical World Siemens Innovating the Electrical World

Global trends

Market development (illustrative)

Digital

transformation

Digitalization

Market growth: ~7-9%

Networked world of

complex and hetero-

geneous systems

Globalization

Automation

Digitalization

Market growth: ~4-6%

Global competition

driving productivity &

localization

geneous systems

Urbanization

Electrification Market growth: ~2-3%

Infrastructure invest-

ment needs of urban

agglomerations

localization

Demographic

change

Today

Mid term-2020

Decentralized

demand of a growing

d i l ti

agglomerations

Climate

change Efficient Energy

Application

Power

Transmission,

Distribution &

Smart Grid

Power

Generation

Imaging

& In-Vitro

Diagnos-

tics

and aging population

Higher resource

efficiency in an all-

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 11 Q2 FY 2014, Analyst and Press Conference

electric world

Stringent resource allocation for growth fields in

Electrification Automation and Digitalization Electrification, Automation and Digitalization

Selected growth fields

Digitalization

Business Analytics & Data-driven Services Software & IT solutions

8%

Automation

Flexible &

Small GT

Distribution

Grid

Automation

& Software

Road & City

Mobility,

tolling

'Digital twin'

Software

Key

Verticals

e.g.

O&G F&B

Image

guided

Therapy,

Molecular

Diagnostics,

etc.

Small GT

8%

7%

6%

7%

O&G, F&B

8 10%

Electrification

Offshore

8%

7%

6%

8-10%

Power to

last

Drive energy

management

Efficient

urban

Shape

Industrie

Grow in

Process

Next

Generation

18%

x%

Est. market growth

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 12 Q2 FY 2014, Analyst and Press Conference

g

mobility 4.0 Industries Healthcare

2013-2020 (CAGR)

Acquisition of Rolls-Royce's Aero Derivative Gas

Turbine business offers great value Turbine business offers great value

Transaction scope Transaction rationale

3)

Acquisition of 100% of Rolls-Royce's aero-derivative gas

turbine (ADGT) and compressor business including

related services business

Only part of Rolls-Royce's Energy Business

Excellent fit complementary technologies 1

Strengthens focus area Oil & Gas and

Decentralized Power

2

Innovation leader with ''best in breed'' gas turbines

ADGT's are an attractive power

supply option e.g. for offshore

oil & gas and for decentralized

power generation

Innovation leader with ''best in breed'' gas turbines

supported by access to aero-technology

3

World-class global service platform 4

Significant synergies and enabling business 5

Transaction facts

Selected Rolls-Royce ADGT business financials

(2013)

Purchase price of 785m

1)

Additional 200m for 25 years exclusive access to future

Sales: 871m, thereof ~60% service

Installed fleet: ~2,500 ADGT

Rolls-Royce aero-technology developments and

preferred access to supply and engineering services

Ramp up to 50m+ annual gross cost synergies until

FY2017

2)

(~2/3 of long-term run-rate gross cost synergies)

EVA accretive in FY2020

,

EBIT: 72m (~8.3% EBIT margin)

Employees: ~2,400

Portfolio completion with key aero-derivative gas turbine technology for growth

in the oil & gas industry and in decentralized power supply

Closing expected by end of December 2014 subject to

regulatory approvals

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 13 Q2 FY 2014, Analyst and Press Conference

in the oil & gas industry and in decentralized power supply

1) On a cash-and-debt-free basis; 2) Pre integration & transformation cost 3) Transaction rationale details see slides in appendix

Automation is key to success Automation is key to success

Decentral generation

e g Wind

Nano grids

Intelligent grid

Industrial,

Data centers, etc.

Utilities Commercial &

P bli

e.g. Wind,

Photovoltaics

Grid storage

e.g. batteries

Micro grids

Campus with island

function (generation &

Intelligent grid

in one building

Public

Grid operators

Controllable

transformers

Grid coupling

Grid automation

Transmission and

distribution

function (generation &

consumption)

Grid stabilization

Voltage regulation

Grid coupling

Connect grids with

different operating

parameters

distribution

While power electronics is a key enabler, integration and automation make the difference

Integration of renewables such as PV, Wind and storage systems

Mitigation of negative effects on power quality by mass renewable integration

Enabling semi/full autonomous prosumers ranging from large campuses to buildings

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 14 Q2 FY 2014, Analyst and Press Conference

Better utilization of existing power grid infrastructure

Digitalization: From data to business Digitalization: From data to business

Digitalization

Attractive market in Siemens verticals Substantial profit margins achievable Attractive market in Siemens verticals Substantial profit margins achievable

100

Market (bn)

1

Software

IT enhanced

Services

S ft

>30%

Automation

56

2012 2020

So t a e

&

Vertical IT

Solutions

Software

products

Combined SW

& HW solutions

>20%

>15%

CAGR

+8%

Innovative business models Key enablers

Meter data management

i th l d

Cloud strategy

Electrification

Business

model

innovation

in the cloud

Data Analytics enriched

plant control

Siemens remote service

Data analytics platform

Applications on top of platforms

Strong partnerships

platform across divisions

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 15 Q2 FY 2014, Analyst and Press Conference

1) Source internal: Siemens market for vertical IT

Unconventional Oil & Gas opportunities in North

America remain very attractive America remain very attractive

Global unconventional O&G supply development

Production in Mbbl/d

Regional capex split for unconventionals,

top 5 countries in 2025 USD billion

Production, in Mbbl/d

top 5 countries in 2025, USD billion

40

+3%

272 4.1%

1.1%

257

35

30

25

+7%

210

9.3%

110

257

119

190

25

20

15

+17%

+9%

99

147

78

51

7

8

52

118

10

5

20

2

6

46

12

5

36

5

5

6

7

7

88

45

60

13

8

5

2

32

75%

0

2000 2025 2020 2015 2010 2005

17

2011

15

12

2025

2

2015

32

2013 2020

China Australia United States

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 16 Q2 FY 2014, Analyst and Press Conference

Source: Rystad Ucube 2014

Unconventional gas Unconventional liquids Venezuela Sum Others Canada

Healthcare with higher entrepreneurial flexibility

separately managed under the Siemens umbrella separately managed under the Siemens umbrella

Strong position, resilient performance Distinct trends at work

16.3%

14.6%

12 0%

Customer & market structures in tran-

sition (e.g. value-based reimbursement,

convergence of diagnosis & therapy)

Long-term paradigm shifts:

Margin

range

15-19%

Profit

excl. ppa

in % of

12.0%

Long-term paradigm shifts:

Potential disruptive technological

changes (e.g. Big data analytics,

knowledge based HC, molecular DX)

Point of Care/Mobile HC

13.6

12.5

3-5% p.a.

13.6

in % of

revenue

Point of Care/Mobile HC

FY 2012 FY 2011 FY 2020e FY 2013

Revenue

in bn

Healthcare with individual set-up to succeed in changing environment

Focus flexibly on market requirements

Invest in growth opportunities to respond to paradigm shifts in the system

Focus resource allocation to address distinct Healthcare industry characteristics

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 17 Q2 FY 2014, Analyst and Press Conference

Going public of Audiology

Going public of Hearing Aids business

creates an opportunity creates an opportunity

Att ti k t

Success factors

in place

Attractive market:

Secular growth, good margins

Strong Siemens performance

Competitive technological basis

Attractive market

Timing is right:

Receptive stock

markets, com-

petitive position

p g

Highly respected brand

However, no synergetic value

business can better realize full

i d t t ti l t id f

bn

petitive position

Story is right:

Leading global

pure-play hearing

industry potential outside of

Siemens

Distinct customers and go-to-market

Hearing aids growth areas far from

3.3 3.2 3.1

4.0

bn

4% CAGR

aids player

Execution

is right:

Siemens e perience

g g

Siemens core: Implants, retail,

consumer electronics

Independently listed company

Build on strengths of the business

FY2020e FY2014e FY2013 FY2012

Profit Pool 17-22% EBIT

Main competitors Revenue reported

1)

1 Sonova CHF 1.8bn

Siemens experience,

determined to succeed

Build on strengths of the business

Focus management attention

Raise capital dedicated to build

business

1.5bn

2 WDH DKK 7.9bn

1.0bn

3 GN Resound DKK 4.2bn

0 6bn

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 18 Q2 FY 2014, Analyst and Press Conference

1) WDH and GN ReSound-Hearing Aids CY2013; Sonova as of FY12/13

0.6bn

In depth analysis of businesses

has led to specific conclusions has led to specific conclusions

Portfolio analysis Conclusions

Fix underperforming businesses

starting with 'bottom 10' businesses

Cumulated

Profit

Focus

Decide along the Strategic Imperatives

Organic structural realignment

Strategic partnerships

Divestment (best owner concept)

Cumulated

Revenue

Stringent resource allocation supported by

performance culture and One Siemens

framework

3 Wh Si ?

2. Potential profit pool?

1. Areas of growth?

framework

5. Paradigm shifts in

3. Why Siemens?

4. Synergetic value?

'Siemens Vision 2020'

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 19 Q2 FY 2014, Analyst and Press Conference

technology/markets?

JV with Mitsubishi-Hitachi Heavy Machinery creates

a global prime supplier of metals technologies a global prime supplier of metals technologies

Siemens Metals Technologies Transaction Structure

One of the world's leading life-cycle partners to the

metallurgical industry, headquartered in Linz (Austria)

FY 2013 revenues of 2bn and ~8,900 employees

B siness mainl acq ired b Siemens as part of

MHI Hitachi IHI

Siemens

56% 34% 10%

Business mainly acquired by Siemens as part of

VA Technologie AG in 2005

Siemens contributes whole business unit MT excl.

the services business for Electrics/Automation

MHMM

HoldCo

Board:

2 Siemens/3 MHMM

The Joint Venture

Mitsubishi Heavy Industry (MHI), Hitachi and IHI Metaltech

contribute their metals machinery JV MHMM

49% NewCo

(HQ in England)

51%

MHMM focuses on the hot and cold rolling mills and

processing lines metals machinery business with

revenues of ~550m in 2013

MT and MHMM with complementary regional footprint

and product portfolio

MT MHMM

and product portfolio

The JV will become a full-line supplier of metals

technologies products and services on a global scale

Strategic supply agreements between JV and Siemens

(e g Components automation)

Siemens to receive 49% ownership in the JV

51% of the JV shares to be held by the HoldCo MHMM

Closing expected by the end of calendar year 2014

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 20 Q2 FY 2014, Analyst and Press Conference

(e.g. Components, automation)

Simplification leads to reduction

of overhead and support function cost by ~1bn of overhead and support function cost by ~1bn

Key actions Target Key actions Target

Remove additional layers (Cluster, Sectors)

Combine certain Divisions and Businesses

Functional cost reduction

Combine certain Divisions and Businesses

Stringent management governance through

all levels of the organization (Corporate Core)

~1bn

Optimization of Corporate Services on

highest possible level

Full savings to mainly materialize in FY 2016

T t FY 2014

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 21 Q2 FY 2014, Analyst and Press Conference

Target FY 2014e

Flat and market driven organization along the value

chain will capture growth opportunities chain will capture growth opportunities

r

k

e

t

Market

Americas

Global

Healthcare

Middle

East, CIS

1)

Asia,

Australia

Europe,

Africa

Separately

managed

G

o

-

t

o

-

m

a

r

Financial

Services

Power

and Gas

Wind

Power and

Renewables

Mobility Energy

Manage-

ment

Building

Techno-

logies

Digital

Factory

Process

Industries

and Drives

Healthcare

managed

G

l

o

b

a

l

P

&

L

)

PG WP

Power Generation

Services

i

v

i

s

i

o

n

s

(

G

PG WP

D

i

Managing Board Corporate Core Corporate Services

MO PS EM BT DF PD HC SFS

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 22 Q2 FY 2014, Analyst and Press Conference

1) Commonwealth of Independent States

The Management model drives resource allocation

and Ownership culture makes the difference and Ownership culture makes the difference

Customer and business focus Customer and business focus

Ownership

culture

People and leadership Governance

Management model g

Financial framework

One Siemens

People

excellence

and care

Business

excellence

Innovation

Customer

proximity

Operating system Corporate Memory

Sustainability and Citizenship

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 23 Q2 FY 2014, Analyst and Press Conference

Sustainability and Citizenship

One Siemens Financial Framework

sets the aspiration sets the aspiration

One Siemens One Siemens

Financial Framework

Siemens

Capital efficiency Capital structure Capital efficiency

(ROCE

2)

)

Capital structure

(Industrial net debt/EBITDA)

15-20% up to 1.0x

Growth:

Siemens > most

relevant competitors

1)

Total cost productivity

3)

3-5% p.a.

Dividend payout ratio

40-60%

4)

Profit Margin ranges of businesses (excl PPA)

5)

(Comparable revenue growth)

Profit Margin ranges of businesses (excl. PPA)

5)

PG

11-15%

EM

7-10%

MO

6-9%

PD

8-12%

SFS

6)

15-20%

WP

5-8%

BT

8-11%

DF

14-20%

HC

15-19%

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 24 Q2 FY 2014, Analyst and Press Conference

1) ABB, ALSTOM, GE, Rockwell and Schneider, weighted 2) Based on continuing and discontinued operations 3) Productivity measures divided by functional costs (cost of sales,

R&D-, SG&A-expenses) of the group 4) Of net income excluding exceptional non-cash items 5) excl. acquisition related amortization on intangibles

6) SFS based on Return on equity after tax

Rigorous Operating System reinforces

business excellence

Enabler Priorities & Results (by metrics)

business excellence

Customer proximity

Key account management

Market development boards

Innovation

Software architecture and platforms

New technology driven growth areas

Business excellence

Mandatory elements of top

+

framework

(Benchmarking, productivity programs)

Lean management

Ownership culture

g

Project risk management

Service platforms

People excellence

and care

Ownership culture

Continuous development & learning,

employability

Integrity & compliance

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 25 Q2 FY 2014, Analyst and Press Conference

g y p

Corporate Memory for Project Management Corporate Memory for Project Management

Lessons

l d f

Actions for

j t bid &

Learnings applied: BORWIN 3

Extended project duration (5 years)

Typical risks and

learned from

legacy projects

project bid &

execution phase

g pp

Offshore grid-connection platform

Focus on HVDC grid not a steel

platform

Partner accountable for platform;

E l i

Typical risks and

root causes

identified

High Speed Trains

cable separately tendered

Experience based pricing and

contract design

Early warning

mechanisms

defined

High Speed Trains

g

Avoid the 'resource trap'

Mitigation

measures

identified

Offshore Grid conn.

Concept for

Corporate Memory

Particle Therapy

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 26 Q2 FY 2014, Analyst and Press Conference

py

Foster ownership culture through equity ownership

and leadership based on shared values and leadership based on shared values

Foster equity ownership

Leadership based

h d l

Foster equity ownership

on shared values

It is not the

Employees owning shares from Siemens Share plans

(in thousand)

>50%

strategy which

makes the

difference, but the

culture of a

140

92

52%

>50%

culture of a

company, its

values and what it

stands for"

Ownership

culture

Target FY 2013 FY 2009

" Always act as

>3% of shares are held by current employees

~107k employees participated in share matching

plan 2014, up 5% from 2013

Always act as

if it were your

own company"

Broad implementation of a Siemens Profit Sharing

Pool (share based) planned

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 27 Q2 FY 2014, Analyst and Press Conference

Pool (share based) planned

Siemens Vision 2020

Value creation & Cultural change Value creation & Cultural change

Siemens Vision 2020

1. Stringent company governance with effective

support functions (cost reduction ~1bn)

2. 'Underperforming' businesses fixed

3. Solid execution of our financial target system

Capital efficiency: ROCE 15-20%

Growth > most relevant competitors

4. Global and decentralized management

structures: more than 30% of Division and BU

management outside Germany

5 P t f h i f t (NPS 20%) 5. Partner of choice for customers (NPS up 20%)

6. Employer of choice (Siemens Engagement

Survey: Employee Engagement Index,

Leadership and Diversity Index: >75%) p y )

7. Ownership culture: Increase number of

employee shareholders by at least 50%

Innovating the electrical world

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 28 Q2 FY 2014, Analyst and Press Conference

Innovating the electrical world

NPS: Net Promoter Score

Siemens Vision 2020

Clear milestones until 2016 Clear milestones until 2016

Until Execution steps p

Q4 2014

Execution of Siemens 2014 measures

Implementation of new organization, start in new structure on Oct 1 p g ,

Introduction of Incentive System 2015

Sharpening brand message starting in Oct 2014 p g g g

Q2 2015

Update on cost reduction (stringent governance, efficient support functions)

Progress update on portfolio optimization og ess update o po t o o opt at o

Q4 2015

Update on cost reduction (stringent governance, efficient support functions)

Update on performance in growth fields Update on performance in growth fields

Share buy-back executed (up to 4bn)

Q4 2016

Update on portfolio optimization and cost reduction

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 29 Q2 FY 2014, Analyst and Press Conference

Update on portfolio optimization and cost reduction

Appendix Appendix

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 30 Q2 FY 2014, Analyst and Press Conference

Overview of businesses (I) Overview of businesses (I)

~14bn

1)

~5bn

1)

Power and Gas Wind Power and Renewables

14bn 5bn

CEO: Markus Tacke CEO: Roland Fischer

Strongly positioned in core markets:

Gas Turbines, Generators,

Products

Unique competitive position:

Clear #1 position in fast growing Offshore Wind Gas Turbines, Generators,

Steam Turbines, Solutions,

Compressors,

Instrumentation & Electrical

40%

Service

20%

Solutions

40%

Products

Clear #1 position in fast growing Offshore Wind

Onshore Wind with selective approach on

profitable projects

(S lit ti t d b d

Priorities

Maintain leading position with superior business model

Strengthen competitiveness through operational excellence

and cost out programs

Priorities

Remain world leader in sustainable offshore business through

innovation and industrialization (e.g., new offshore facility in

Hull/GB)

(Split estimated based on

FY 2013 revenues)

Technology leadership throughout portfolio via focused

innovation and selective M&A

Strong local presence to secure market proximity and

customer care

High market share and solid profit margin

In offshore further drive down Levelized Cost of Energy

(LCoE) to reach <0.1 EUR/kWh by 2020; onshore to reach

grid parity

Onshore: Margin improvement and consecutive growth

Manage backlog execution thoroughly across value chain

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 31 Q2 FY 2014, Analyst and Press Conference

g p g

1) Estimated revenue based on FY 2013 financials (incl. Service)

Overview of businesses (II) Overview of businesses (II)

~12bn

1)

Energy Management

12bn

CEO: Ralf Christian, Jan Mrosik

Power Generation Service

CEO: Randy Zwirn

Seamless offering

Transmission (High Voltage Products, Solutions) (T)

High margin/constant flow of revenue:

Service, modernization and upgrades of Transmission (High Voltage Products, Solutions) (T)

Transformers (T)

Low and Medium Voltage (LMV)

Energy Automation (SG)

Software Solutions & Services (SG)

Service, modernization and upgrades of

Large Gas Turbines, Large Steam Turbines,

Generators, Industrial Turbines (e.g. Oil&Gas)

and Wind Turbines (onshore/offshore)

Priorities

Optimized go-to-market addressing all types of customers

seamlessly

Extend leadership in digitalization

Priorities

Continuously building up highly profitable backlog by strong

increase in growth regions (e.g., Middle East, South Korea)

Grow footprint in Oil & Gas industry

Transform to win productivity program until 2015:

Stabilize execution of legacy projects

Continue optimization of LMV

Expand power electronics business to distribution grid

applications

R&D investment to make fleet more valuable for customers

(e. g., condition based maintenance through data analytics)

Expand flexible value added service portfolio for

Wind Power

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 32 Q2 FY 2014, Analyst and Press Conference

pp

1) Estimated revenue based on FY 2013 financials ( ) Organizational home division of business until Sep 2014

Overview of businesses (III) Overview of businesses (III)

~6bn

1)

~7bn

1)

Mobility Building Technologies

6bn 7bn

CEO: Johannes Milde CEO: Jochen Eickholt

Strong technology base and integrated solutions

Products & Systems

Strengthened portfolio

Mobility Management (Rail Automation, Road and Products & Systems

Solutions & Services

Building Performance & Business Continuity

Mobility Management (Rail Automation, Road and

City Mobility) (MOL)

Turnkey Projects (MOL) and Electrification (SG)

Mainline Transport (High Speed, Commuter Rail,

Locomotives) (RL)

Urban Transport (RL) Urban Transport (RL)

Priorities

Selective country approach (products in emerging countries

to solutions/services in mature markets)

Focus on organic growth in China

Priorities

Ensure stringent project execution of order backlog

Expand on market leadership in Rail Automation,

deliver on synergies of 100m until 2018

Advanced Services through IT and SW-based analytics

Expand joint go-to-market with Energy Management

(e.g., LMV for Data Centers)

Integrated turnkey projects with high Siemens product

content

Grow services e.g., remote monitoring

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 33 Q2 FY 2014, Analyst and Press Conference

1) Estimated revenue based on FY 2013 financials ( ) Organizational home division of business until Sep 2014

Overview of businesses (IV) Overview of businesses (IV)

~11bn

1)

~9bn

1)

Digital Factory Process Industries and Drives

11bn 9bn

CEO: Peter Herweck CEO: Anton Huber

Shaping future of manufacturing

Factory Automation (IA)

Bundling process know-how

Large Drives, Mechanical Drives (DT) Factory Automation (IA)

Motion Control (DT)

Product Life-cycle Management (IA)

Services (CS)

Large Drives, Mechanical Drives (DT)

Process Automation (IA)

Upstream and Midstream (P)

Metals Technologies (MT)

Services (CS)

Priorities

Digital Revolution changes product development and

manufacturing process (Industrie 4.0)

Secure customer retention by leveraging PLM software

Priorities

Growth momentum due to focused approach on strong

growing key verticals such as O&G, F&B, chemicals

Invest in growth with life-cycle business

and automation product offering

Ongoing expansion of the product portfolio and

installed base

Develop business in data-driven services

service capabilities and local set-up

Expand software offering for digital engineering and

operations

Further optimize efficiency and cost position

(field devices and drive train)

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 34 Q2 FY 2014, Analyst and Press Conference

1) Estimated revenue based on FY 2013 financials ( ) Organizational home division of business until Sep 2014

Overview of businesses (V) Overview of businesses (V)

~13.6bn

1)

18.7bn

2)

Financial Services

CEO: Roland Chalons-Browne

Healthcare

CEO: Hermann Requardt

13.6bn 18.7bn

Combine industrial and financial logic

Commercial Finance

Personalized and affordable Healthcare

Imaging Commercial Finance

Project & Structured Finance

Insurance

Financing & Investment Management

Venture Capital

Treasury

Imaging

Clinical Products

Diagnostics

Customer Solutions

Audiology

Treasury

Priorities

Financing as strategic differentiator and earnings

contributor

Close alignment with Divisions to offer a joint customer

Priorities

Individual set-up to succeed in changing environment

React more flexibly to customers' requirements and

improve market penetration

and market approach

Sound financial risk management and portfolio diversity

Respected partner to the financial markets

Invest in growth opportunities to respond to paradigm

shifts

Focus resource allocation to address distinct

Healthcare industry characteristics

Going public of Audiology

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 35 Q2 FY 2014, Analyst and Press Conference

1) Revenue FY 2013; 2) Total Assets Sep 30, 2013

g p gy

( ) Organizational home division of business until Sep 2014

One Siemens cockpit H1 FY 2014

ROCE in target corridor despite impact on Energy margins ROCE in target corridor despite impact on Energy margins

Financial target system

Energy 8 5% 10-15%

Growth

1)

Margins compared to industry benchmarks

EBITDA Margins (H1 FY 2014) Revenue growth (rolling 4 quarters Q2 FY 14)

Industry 14.0%

Healthcare 20.2%

Energy 8.5% 10-15%

15-20%

11-17% -4.3%

-1.9%

Siemens

Infrastr. & Cities 9.0%

EBITDA margins of respective markets throughout business cycles

8-12%

C it l ffi i C it l t t

2.4%

Competitors

1.0x

0 5 1 0

15-20% 16.4%

13.9%

Capital efficiency Capital structure

ROCE adjusted (continuing operations) Adjusted industrial net debt/EBITDA

Q2 FY 14

0.6x

Q2 FY 13

0.5-1.0x

13.9%

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 36 Q2 FY 2014, Analyst and Press Conference

Q2 FY 14 Q2 FY 13

H1 FY 14 H1 FY 13

1) As reported

Free Cash Flow

Decent performance in Q2 after a weak start in Q1 Decent performance in Q2 after a weak start in Q1

m

Operating Working Capital (OWC) turns

4,700

5,328

m

Operating Working Capital (OWC) turns

Total Sector

7.1

7.7

9.0

Q2 FY 2014 FY 2013 FY 2012

992

703

-1,204

-676

291

-61

-699

703

FY 2012

FY 2013

FY 2014

-1,395

O N D J F b M A M J J l A S

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 37 Q2 FY 2014, Analyst and Press Conference

Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep

Excellent fit complementary technologies

1

Excellent fit complementary technologies

Product portfolio with full power output range

for both technologies

Complementary technology strengths

1

for both technologies

Only on-site service possible

G d f l fl ibilit

MW 20 40 0 60

Good gas fuel flexibility

Stable proven DLE systems

Designed for efficient

combined cycle power plants

IGT

(Siemens)

SGT-

300

SGT-

500

SGT-700

SGT-750

SGT-

100

SGT-800

SGT-600

SGT-

400

SGT-

200

Main application:

Industrial power generation

Light cores and fast core

change for service g

(changeable within 24h)

Quality level inherited from

aero engines

Designed for high number

ADGT

(Rolls-

Royce)

501 RB211 G62

RB211 GT61

TRENT 60

Customers can choose from different technologies in the full output range

Joint portfolio will be strong alternative for customers compared to other players in the sector

Designed for high number

of cycles with high efficiency

Main application:

Offshore production platforms

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 38 Q2 FY 2014, Analyst and Press Conference

DLE = Dry Low Emissions: Emissions combustion system to minimize the emissions to atmosphere

Joint portfolio will be strong alternative for customers compared to other players in the sector

Strengthens focus area Oil & Gas and

Decentralized Power

2

Decentralized Power

Rolls-Royce ADGT Business Siemens

Siemens new equipment revenue by sector Rolls-Royce ADGT Business' new equipment

1)

revenue by sector

Industrial

Power

Oil & G

Improved access for

Siemens to the Oil &

Gas sector and the

field of decentralized

Power

Generation

~1/4

Oil & Gas

~1/3

power generation

Improved

opportunities to sell

into industrial power

generation sector

~3/4

~2/3

Industrial

generation sector

Rolls-Royce acting mainly in the Oil & Gas sector Siemens acting mainly in the IPG sector

3/

Oil & Gas

Industrial

Power

Generation

Complementary strengths in different sectors

Improved coverage to both Oil & Gas and industrial power generation sectors

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 39 Q2 FY 2014, Analyst and Press Conference

1) Excluding aftermarket services business

Innovation leader with ''best in breed'' gas turbines

supported by access to aero technology

3

supported by access to aero technology

Rolls-Royce: ADGTs

Industrialisation

of ADGTs:

Improved competitiveness

through industrial instead

Significant innovation

potential through

combined technology

through industrial instead

of aero parts

Siemens: IGTs

combined technology

know-how to develop

'best in breed' hybrid

gas turbines

Application of aero

technology to IGTs: technology to IGTs:

Improved competitiveness

through increased efficiency

Access to aero derivative technology for Siemens and significant innovation potential

of combining leading technologies

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 40 Q2 FY 2014, Analyst and Press Conference

of combining leading technologies

World class global service platform

4

World-class global service platform

4

Strong combined service platform Large installed fleet

Small & medium

industrial gas

turbines Compressors

Aero derivative

gas turbines

Sites over 5 FTEs

~5,600 employees in total

>1,700 units

~2,500 units ~2,250 units

>10,000 units

Siemens

~4,600 service employees (Siemens Oil and Gas Service),

Rolls-Royce fleet Siemens fleet

Rolls-Royce

ADGT Business

Siemens

4,600 service employees (Siemens Oil and Gas Service),

thereof ~1,700 employees within transaction scope

~1,000 service employees

Transaction strongly utilizes Siemens' world-class sales and service organization

Customers benefit from powerful global platform with further improved customer proximity

Focus on long-term relationship with customers regarding service benefits both customers

and service business

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 41 Q2 FY 2014, Analyst and Press Conference

and service business

Significant synergies and enabling business

5

Cost

Purchasing synergies: Savings through higher

purchase volume and broader supplier base

Significant synergies and enabling business

5

synergies

purchase volume and broader supplier base

Process optimisation & design to cost: Industrialisation

of ADGT parts

Manufacturing synergies: Implementing operational

50m+ annual gross

cost synergies in

FY2017 with further

upside thereafter

1)

S

Manufacturing synergies: Implementing operational

excellence

Integration of sales force and service sites

upside thereafter

1)

(in FY2017 ~2/3 of

long-term run-rate

gross cost synergies

Siemens' sales force and industrial power generation

Sales

synergies

gross cost synergies

reached)

Significant

additional upside

Siemens sales force and industrial power generation

sector access to place ADGT products

Siemens to improve access to Oil & Gas sector

through comprehensive product range and the Rolls-

G

additional upside

from sales synergies

Royce ADGT Business' sector access

New equipment sales synergies will drive

corresponding service synergies

The scope and scale of Siemens' Energy business will enable the acquired business

to realize significant profit potential

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 42 Q2 FY 2014, Analyst and Press Conference

1) Pre integration & transformation cost, synergy investments and allocations

to realize significant profit potential

Financial calendar Financial calendar

May May 7, 2014 May May 7, 2014

Q2 Earnings Release and Strategy Update (Berlin)

May 21, 2014

Roadshow France (Paris) Roadshow France (Paris)

May 22, 2014

Roadshow Germany (Frankfurt)

May 28 2014 May 28, 2014

Roadshow Canada (Montreal)

May 29, 2014

Bernstein Conference (New York)

June

June 12, 2014

JP Morgan Conference (London)

Bernstein Conference (New York)

July

g ( )

July 31, 2014

Q3 Earnings Release and Analyst Call

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 43 Q2 FY 2014, Analyst and Press Conference

Siemens press contacts Siemens press contacts

Marc Langendorf +49 89 636-41360 Marc Langendorf +49 89 636 41360

Alexander Becker +49 89 636-36558

I J h l 49 89 636 33929 Ivonne Junghnel +49 89 636-33929

Wolfram Trost +49 89 636-34794

Internet: www.siemens.com/press

Email: press@siemens com Email: press@siemens.com

Phone: +49 89 636-33443

Fax: +49 89 636-35260

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 44 Q2 FY 2014, Analyst and Press Conference

Siemens Investor Relations contact data Siemens Investor Relations contact data

IR H tli +49 89 636 32474 IR-Hotline: +49-89-636-32474

Internet:

Fax: +49-89-636-32830

Internet:

http://www.siemens.com/investorrelations

Email: investorrelations@siemens.com

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 45 Q2 FY 2014, Analyst and Press Conference

Reconciliation and Definitions for

Non GAAP Measures Non-GAAP Measures

This document includes supplemental financial measures that are or may be non-GAAP financial measures.

Orders and order backlog; adjusted or organic growth rates of revenue and orders; book-to-bill ratio; Total Sectors profit; return on equity (after tax), or ROE (after

tax); return on capital employed (adjusted), or ROCE (adjusted); Free cash flow, or FCF; adjusted EBITDA; adjusted EBIT; adjusted EBITDA margins, earnings

effects from purchase price allocation, or PPA effects; net debt and adjusted industrial net debt are or may be such non-GAAP financial measures.

These supplemental financial measures should not be viewed in isolation or as alternatives to measures of Siemens net assets and financial positions or results of

operations as presented in accordance with IFRS in its Consolidated Financial Statements. Other companies that report or describe similarly titled financial

measures may calculate them differently.

Definitions of these supplemental financial measures, a discussion of the most directly comparable IFRS financial measures, information regarding the usefulness

of Siemens supplemental financial measures the limitations associated with these measures and reconciliations to the most comparable IFRS financial measures of Siemens supplemental financial measures, the limitations associated with these measures and reconciliations to the most comparable IFRS financial measures

are available on Siemens Investor Relations website at www.siemens.com/nonGAAP. For additional information, see supplemental financial measures and the

related discussion in Siemens most recent annual report on Form 20-F, which can be found on our Investor Relations website or via the EDGAR system on the

website of the United States Securities and Exchange Commission.

Revenue growth - Performance against competition (Fiscal 2014)

To illustrate managements perspective on the Companys performance against competition Siemens compares its own revenue growth rate with the weighted To illustrate management s perspective on the Company s performance against competition, Siemens compares its own revenue growth rate with the weighted

average revenue growth rate of its Sectors most relevant competitors, including, among others, ABB, GE, Philips, Rockwell and Schneider. Revenue growth for

Siemens and its competitors is calculated as the actual growth rate over a rolling four quarter period compared to the same period a year earlier. Siemens

competitors revenue growth is derived as the weighted average growth rate of dedicated competitor baskets defined for each Siemens Sector. Each Sector

basket's growth rate is based upon the most recent reported competitor revenues publicly available at the time of calculation. The Sector competitor baskets

revenue growth rates are weighted by the revenue of the respective Siemens Sector.

This meas re ma pro ide sef l information to in estors ith respect to managements ie on Siemens gro th compared to competitor gro th Ho e er e This measure may provide useful information to investors with respect to managements view on Siemens growth compared to competitor growth. However, we

caution investors, that this measure is subject to certain limitations, which include the following: The metric is defined by Siemens and, as such, is not based on a

generally accepted framework that is also relevant for other companies; accordingly, other companies may define a similarly titled measure differently. In

calculating this measure, Siemens relies on data published by its competitors for which Siemens assumes no responsibility. In addition, the data may not be

directly comparable as a result of differing presentation currencies and reporting standards being used by our competitors in the datas presentation. Furthermore,

subject to limited exceptions, no adjustments are made for currency translation effects, portfolio changes and changes in reporting structure for either the Siemens

or the competitor data Because the public availability of relevant competitors data at the time of calculation may not coincide with the availability of Siemens data or the competitor data. Because the public availability of relevant competitors data at the time of calculation may not coincide with the availability of Siemens data,

some competitor data used may relate to a different time period than the Siemens data.

Berlin, May 7, 2014

Siemens AG 2014. All rights reserved.

Page 46 Q2 FY 2014, Analyst and Press Conference

Você também pode gostar

- Productivity and Reliability-Based Maintenance Management, Second EditionNo EverandProductivity and Reliability-Based Maintenance Management, Second EditionAinda não há avaliações

- Marketing Report With Reference To Sainsbury'sDocumento17 páginasMarketing Report With Reference To Sainsbury'sAdnan Yusufzai100% (2)

- ITJEGAN's Option PPT - Dec 22 - Chennai PDFDocumento71 páginasITJEGAN's Option PPT - Dec 22 - Chennai PDFrahul.ztb80% (10)

- Hult Case Study BMWDocumento7 páginasHult Case Study BMWKevinAinda não há avaliações

- Introduction To Globalization-Contemporary WorldDocumento29 páginasIntroduction To Globalization-Contemporary WorldBRILIAN TOMAS0% (1)

- Marketing Strategy For Gillette IndonesiaDocumento6 páginasMarketing Strategy For Gillette Indonesiaapi-267116420Ainda não há avaliações

- Pim05 2012 Pmw1131812shuangzhouDocumento16 páginasPim05 2012 Pmw1131812shuangzhouShu ZhouAinda não há avaliações

- ALDI Financial PerspectiveDocumento10 páginasALDI Financial PerspectiveJessica JessAinda não há avaliações

- Vodafone Case StudyDocumento10 páginasVodafone Case StudyUnpredictable FarhanAinda não há avaliações

- Case 1 ToyotaDocumento5 páginasCase 1 Toyotapheeyona0% (1)

- Opelika Train Depot HistoryDocumento4 páginasOpelika Train Depot HistoryeastalabamaartsAinda não há avaliações

- Reeby Sports SARY1Documento13 páginasReeby Sports SARY1Santanu DasAinda não há avaliações

- Exercícios Fundamento de FinançasDocumento8 páginasExercícios Fundamento de FinançasTayná TeixeiraAinda não há avaliações

- Nº Nemotécnico Razón Social Isin: Instrumentos Listados en MILA - CHILEDocumento10 páginasNº Nemotécnico Razón Social Isin: Instrumentos Listados en MILA - CHILEWilson DiazAinda não há avaliações

- Air Malta Case StudyDocumento8 páginasAir Malta Case StudygraphicallegianceAinda não há avaliações

- Case StudyDocumento13 páginasCase StudyChristian PalconAinda não há avaliações

- Case Discussion Questions Fall 2010Documento6 páginasCase Discussion Questions Fall 2010j_zaikovskayaAinda não há avaliações

- A3 Problemsolving Trainingtemplate Tcm36-68772Documento2 páginasA3 Problemsolving Trainingtemplate Tcm36-68772rahul sharmaAinda não há avaliações

- RCFA Mar'19Documento9 páginasRCFA Mar'19T ThirumuruganAinda não há avaliações

- International Business Case StudyDocumento21 páginasInternational Business Case StudyPratik K JainAinda não há avaliações

- Case Study - Failure Brand in International BusinessDocumento6 páginasCase Study - Failure Brand in International BusinessPrabhamohanraj MohanrajAinda não há avaliações

- BusinBusiness Case Studiesess Case StudiesDocumento14 páginasBusinBusiness Case Studiesess Case StudiesAbid Al Reza100% (1)

- International Business Case Study Javed KalangadeDocumento4 páginasInternational Business Case Study Javed Kalangadeshahv789Ainda não há avaliações

- OSD Siemens Case StudyDocumento15 páginasOSD Siemens Case StudyAnurag SatpathyAinda não há avaliações

- Toyota Case StudyDocumento22 páginasToyota Case StudySavinder SachdevAinda não há avaliações

- Case StudyDocumento26 páginasCase StudyNyl Ecoj ReamicoAinda não há avaliações

- Business Essentials Case StudyDocumento11 páginasBusiness Essentials Case StudyHadi Alnaher50% (2)

- Week Case StudyDocumento5 páginasWeek Case Studyapachie86Ainda não há avaliações

- Key Performance Indicator (Kpi) : Visualization Tools For Lean Manufacturing FacilitiesDocumento5 páginasKey Performance Indicator (Kpi) : Visualization Tools For Lean Manufacturing FacilitieshendelhaddadAinda não há avaliações

- Case Study - ALDI & HomePlusDocumento3 páginasCase Study - ALDI & HomePlusgiemansitAinda não há avaliações

- A&D Supply ChainDocumento12 páginasA&D Supply ChainVeera Lokesh AyireddyAinda não há avaliações

- Discussion Questions TemsaDocumento5 páginasDiscussion Questions Temsafirinaluvina100% (1)

- American Apparel Case StudyDocumento10 páginasAmerican Apparel Case StudyELIZABETHAinda não há avaliações

- Data Science SyllabusDocumento3 páginasData Science Syllabusmohammed habeeb VullaAinda não há avaliações

- Ikea PDFDocumento51 páginasIkea PDFShivam MathurAinda não há avaliações

- Unit 6 Waiting Lines/ Queuing Theory OutlineDocumento17 páginasUnit 6 Waiting Lines/ Queuing Theory OutlineHadiBiesAinda não há avaliações

- Final Project - Basic Managerial Finance PDFDocumento7 páginasFinal Project - Basic Managerial Finance PDFAndré Felipe de MedeirosAinda não há avaliações

- 1898 Ford Operations ManagementDocumento8 páginas1898 Ford Operations ManagementSanthoshAnvekarAinda não há avaliações

- 2000 Operation Manual Transmile PDFDocumento208 páginas2000 Operation Manual Transmile PDFShahrul Izwan100% (1)

- Dells Just in Time Inventory Management SystemDocumento19 páginasDells Just in Time Inventory Management SystemThu HươngAinda não há avaliações

- Wisner Case 13Documento8 páginasWisner Case 13Nabaneeta SahanaAinda não há avaliações

- Presentation - American Business and Public PolicyDocumento23 páginasPresentation - American Business and Public PolicyMensah Kwame JamesAinda não há avaliações

- What Is Strategy and Why Is It Important?Documento17 páginasWhat Is Strategy and Why Is It Important?Anonymous nD4KwhAinda não há avaliações

- Dissertation On Industry 4.0 and Digitalization - Giulio LicitraDocumento9 páginasDissertation On Industry 4.0 and Digitalization - Giulio LicitraGiulio LicitraAinda não há avaliações

- Abhishek Kumar Singh - Roll No-01 - TETRA TECH EC CASEDocumento7 páginasAbhishek Kumar Singh - Roll No-01 - TETRA TECH EC CASEscribdabhisheksingh0% (1)

- Marketing Mix of LLoydsDocumento8 páginasMarketing Mix of LLoydsAmit SrivastavaAinda não há avaliações

- Buyer Supplier Relationship Case Study 'AIRBUS A380'.Documento14 páginasBuyer Supplier Relationship Case Study 'AIRBUS A380'.abhijitsamanta1100% (3)

- AssignmentDocumento2 páginasAssignmentkingofdeal0% (3)

- Women EntrepreneurDocumento28 páginasWomen EntrepreneurShiv YadavAinda não há avaliações

- Graph 1. Tesco 3-PillarDocumento4 páginasGraph 1. Tesco 3-PillarKathyAinda não há avaliações

- The Bullwhip Effect in Intra Organisational EchelonsDocumento29 páginasThe Bullwhip Effect in Intra Organisational EchelonsSword78Ainda não há avaliações

- Global Corporate Strategy - PGBM16 - 1011 - TRM2Documento5 páginasGlobal Corporate Strategy - PGBM16 - 1011 - TRM2Nisar AhmedAinda não há avaliações

- TescoDocumento5 páginasTescoAnwar IqbalAinda não há avaliações

- The Implementation of Quality Management Systems in HospitalsDocumento2 páginasThe Implementation of Quality Management Systems in HospitalsSourav Jain100% (1)

- Starting Technology Based New Venture: Chapter TwoDocumento37 páginasStarting Technology Based New Venture: Chapter TwoAnuka YituAinda não há avaliações

- Imporetance of Case StudiesDocumento11 páginasImporetance of Case StudiesArnav SinghaniaAinda não há avaliações

- Lean Six Sigma and The DMAIC ModelDocumento1 páginaLean Six Sigma and The DMAIC ModelJuan Coasaca PortalAinda não há avaliações

- 1-800-Flowers Com United StatesDocumento435 páginas1-800-Flowers Com United StatesDataGroup Retailer Analysis100% (1)

- Project LeadershipDocumento5 páginasProject LeadershipandinahaniefAinda não há avaliações

- Assignment On Feasibility Study of A SunDocumento7 páginasAssignment On Feasibility Study of A SunI Tech Services KamranAinda não há avaliações

- TESCODocumento9 páginasTESCOMike BreeAinda não há avaliações

- Developing Leaders in Your CompanyDocumento2 páginasDeveloping Leaders in Your CompanySyElfredGAinda não há avaliações

- Biggest R&D SpendersDocumento1 páginaBiggest R&D SpendersSudeep KeshriAinda não há avaliações

- 10 Key Amendments That Shaped IndiaDocumento1 página10 Key Amendments That Shaped IndiaSudeep KeshriAinda não há avaliações

- Adani Debt BreakdownDocumento3 páginasAdani Debt BreakdownSudeep KeshriAinda não há avaliações

- Manufacturing Up in Apr Amid High InflationDocumento1 páginaManufacturing Up in Apr Amid High InflationSudeep KeshriAinda não há avaliações

- 90% of Dedicated Freight Corridor To Be Over in A YrDocumento1 página90% of Dedicated Freight Corridor To Be Over in A YrSudeep KeshriAinda não há avaliações

- Agriculture Sector Adds 11 Million Workers in 3 Years - CMIE DataDocumento1 páginaAgriculture Sector Adds 11 Million Workers in 3 Years - CMIE DataSudeep KeshriAinda não há avaliações

- Aggregate NPA Provisioning in Q4 Halves, Private Banks Lead WayDocumento1 páginaAggregate NPA Provisioning in Q4 Halves, Private Banks Lead WaySudeep KeshriAinda não há avaliações

- Direct Vs Indirect Tax & Tax To GDP RatioDocumento1 páginaDirect Vs Indirect Tax & Tax To GDP RatioSudeep KeshriAinda não há avaliações

- Form No. 15H: Part - IDocumento2 páginasForm No. 15H: Part - Itoton33Ainda não há avaliações

- India's Battery Market SizeDocumento1 páginaIndia's Battery Market SizeSudeep KeshriAinda não há avaliações

- Food Grain Production Over The YearsDocumento1 páginaFood Grain Production Over The YearsSudeep KeshriAinda não há avaliações

- Indians Earning and Consumption Trend Over The YearsDocumento5 páginasIndians Earning and Consumption Trend Over The YearsSudeep KeshriAinda não há avaliações

- MCap To GDP Ratio of Different CountriesDocumento1 páginaMCap To GDP Ratio of Different CountriesSudeep KeshriAinda não há avaliações

- Economic Survey 2022 FindingsDocumento2 páginasEconomic Survey 2022 FindingsSudeep KeshriAinda não há avaliações

- Exports of Smartphones Soar 80% To $5.6bn in FY22Documento1 páginaExports of Smartphones Soar 80% To $5.6bn in FY22Sudeep KeshriAinda não há avaliações

- BMC Budget Over YearsDocumento1 páginaBMC Budget Over YearsSudeep KeshriAinda não há avaliações

- Budget 2022 Breakup of Revenue & ExpensesDocumento1 páginaBudget 2022 Breakup of Revenue & ExpensesSudeep KeshriAinda não há avaliações

- US Prez Visit To IndiaDocumento1 páginaUS Prez Visit To IndiaSudeep KeshriAinda não há avaliações

- China Should Shut Down Zombie Businesses To Help The Economy - The New York TimesDocumento3 páginasChina Should Shut Down Zombie Businesses To Help The Economy - The New York TimesSudeep KeshriAinda não há avaliações

- 7 Quick Fix Recipes For The Fast You - TimesCityTimescity BlogDocumento6 páginas7 Quick Fix Recipes For The Fast You - TimesCityTimescity BlogSudeep KeshriAinda não há avaliações

- SUB PRIME BhanuMurthy KV Deb AshisDocumento24 páginasSUB PRIME BhanuMurthy KV Deb AshisChristine GreenAinda não há avaliações

- How Baba Ramdev Has Built A Rs 2,000 Crore Ayurvedic FMCG Empire & Plans To Take On Multinational Giants - The Economic TimesDocumento6 páginasHow Baba Ramdev Has Built A Rs 2,000 Crore Ayurvedic FMCG Empire & Plans To Take On Multinational Giants - The Economic TimesSudeep KeshriAinda não há avaliações

- Micro IrrigationDocumento43 páginasMicro IrrigationAvinash VasudeoAinda não há avaliações

- AP White Paper On Agri. and Allied DeptsDocumento46 páginasAP White Paper On Agri. and Allied DeptsSudeep KeshriAinda não há avaliações

- Forage and GrassesDocumento65 páginasForage and GrassesDinkar RaiAinda não há avaliações

- Booking ID: TVCE0003241030: Other ChargesDocumento1 páginaBooking ID: TVCE0003241030: Other ChargesSudeep KeshriAinda não há avaliações

- Area and Production of Major Horticulture Crops - 2012-2013: Area: Hectares Prodn: M.T.SDocumento9 páginasArea and Production of Major Horticulture Crops - 2012-2013: Area: Hectares Prodn: M.T.SSudeep KeshriAinda não há avaliações

- Giacomelli Technology LevelsDocumento53 páginasGiacomelli Technology LevelsSudeep KeshriAinda não há avaliações

- 5.3 Containerized Bedding Plants, Perennials, Ornamentals, Shrubs and TreesDocumento6 páginas5.3 Containerized Bedding Plants, Perennials, Ornamentals, Shrubs and TreesSudeep KeshriAinda não há avaliações

- Urban Transition India - IUSSP 2013Documento13 páginasUrban Transition India - IUSSP 2013Sudeep KeshriAinda não há avaliações

- Industry: Full List of Nifty 50 CompaniesDocumento6 páginasIndustry: Full List of Nifty 50 CompaniesDeepak RahejaAinda não há avaliações

- First Philippine International Bank vs. CADocumento2 páginasFirst Philippine International Bank vs. CAMichelle Vale CruzAinda não há avaliações

- Revision Pack and AnsjjwersDocumento34 páginasRevision Pack and AnsjjwersShree Punetha PeremaloAinda não há avaliações

- EntrapreneurshipDocumento42 páginasEntrapreneurshipDanny Watcher100% (1)

- Investment Portfolio Diversification:: Diversify Our Company InvestmentsDocumento4 páginasInvestment Portfolio Diversification:: Diversify Our Company Investmentsfiza akhterAinda não há avaliações

- Karunanidhi Rule and Family Wealth EstimationDocumento17 páginasKarunanidhi Rule and Family Wealth EstimationVaseegaran Scientist100% (1)

- Chapter 2 - Capital Structure - Student's Copy FinalDocumento78 páginasChapter 2 - Capital Structure - Student's Copy FinalJulie Mae Caling MalitAinda não há avaliações

- Calibrating Custody Transfer Gas Meter PDFDocumento18 páginasCalibrating Custody Transfer Gas Meter PDFzohaibjamilAinda não há avaliações

- Managerial Finance Reviewer (Prelims)Documento4 páginasManagerial Finance Reviewer (Prelims)Kendall JennerAinda não há avaliações

- Spark Research 18 June 2018 PDFDocumento37 páginasSpark Research 18 June 2018 PDFAdroit WaterAinda não há avaliações

- Business PlanDocumento16 páginasBusiness PlanGovinda JaiswalAinda não há avaliações

- Enterpreneurship Chapter-7 GrowthDocumento12 páginasEnterpreneurship Chapter-7 GrowthBantamkak FikaduAinda não há avaliações

- Money Market-2Documento84 páginasMoney Market-2aurorashiva1Ainda não há avaliações

- New Age Tourism: A Passage For India'S Economic DevelopmentDocumento21 páginasNew Age Tourism: A Passage For India'S Economic Developmentabbi_UandMEAinda não há avaliações

- 2016 Global Vs SchedularDocumento1 página2016 Global Vs SchedularClarissa de VeraAinda não há avaliações

- Diageo PLCDocumento13 páginasDiageo PLCRitika BasuAinda não há avaliações

- MicroCap Review Winter/Spring 2017Documento96 páginasMicroCap Review Winter/Spring 2017Planet MicroCap Review MagazineAinda não há avaliações

- 2017 Infrastructure Report CardDocumento112 páginas2017 Infrastructure Report CardAngel J. AliceaAinda não há avaliações

- Reviewer in Partnership: SolutionsDocumento14 páginasReviewer in Partnership: SolutionsCasper John Nanas MuñozAinda não há avaliações

- RAK Bangladesh PDFDocumento2 páginasRAK Bangladesh PDFMasnun RahmanAinda não há avaliações

- Financial Management: Project ONDocumento32 páginasFinancial Management: Project ONUsman Ali100% (1)

- 12 05 04 ALPonz DI Matt Bradford's Promise Not To Investigate Any of My Unrebuttable Evidence of A Ponzi SchemeDocumento3 páginas12 05 04 ALPonz DI Matt Bradford's Promise Not To Investigate Any of My Unrebuttable Evidence of A Ponzi SchemeTom CahillAinda não há avaliações

- SFM Compiler 4.0 - Ca Final - by Ca Ravi AgarwalDocumento613 páginasSFM Compiler 4.0 - Ca Final - by Ca Ravi Agarwalaella shivani100% (1)

- CN 20190801 6HGQ26 Bse65887 0 PDFDocumento8 páginasCN 20190801 6HGQ26 Bse65887 0 PDFVenu MadhavAinda não há avaliações

- Paper HR 2nd ReactionDocumento5 páginasPaper HR 2nd ReactionClint Jan SalvañaAinda não há avaliações