Escolar Documentos

Profissional Documentos

Cultura Documentos

Case 06 - Final

Enviado por

littlemissjacey0 notas0% acharam este documento útil (0 voto)

33 visualizações5 páginasThis document discusses the key considerations in analyzing an investment project's cash flows and profitability. It addresses how to handle various costs like rehabilitation costs, interest expenses, and opportunity costs. It also discusses how the analysis would differ for replacement projects versus expansion projects. The document considers the impact of inflation on cash flows and indicators like NPV, IRR, payback period. It analyzes several example projects and recommends the most profitable one based on these metrics. Inflation is found to potentially improve or worsen a project's viability depending on how costs and prices are impacted.

Descrição original:

Case 6

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOC, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoThis document discusses the key considerations in analyzing an investment project's cash flows and profitability. It addresses how to handle various costs like rehabilitation costs, interest expenses, and opportunity costs. It also discusses how the analysis would differ for replacement projects versus expansion projects. The document considers the impact of inflation on cash flows and indicators like NPV, IRR, payback period. It analyzes several example projects and recommends the most profitable one based on these metrics. Inflation is found to potentially improve or worsen a project's viability depending on how costs and prices are impacted.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOC, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

33 visualizações5 páginasCase 06 - Final

Enviado por

littlemissjaceyThis document discusses the key considerations in analyzing an investment project's cash flows and profitability. It addresses how to handle various costs like rehabilitation costs, interest expenses, and opportunity costs. It also discusses how the analysis would differ for replacement projects versus expansion projects. The document considers the impact of inflation on cash flows and indicators like NPV, IRR, payback period. It analyzes several example projects and recommends the most profitable one based on these metrics. Inflation is found to potentially improve or worsen a project's viability depending on how costs and prices are impacted.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOC, PDF, TXT ou leia online no Scribd

Você está na página 1de 5

Case 6

Robert Montoya, Inc.

Submitted to:

Ms. Balcos

Fin 105

Submitted by:

Rea Mae Caracena

Aimee Flordeliza

Christopher unsalan

Sarah !. Ro"as

1. #ncremental cash $o%s is de&ned as the additional cash $o% brou'ht about by a

pro(ect. More speci&cally it is the cash $o%s attributable to the pro(ect itsel).

#nterest e"penses are not included in the cash $o% statement* because i) it %as*

then the cost o) debt %ould be double counted. !his is because the discountin'

process already reduces the cash $o%s to account )or the pro(ect+s capital cost. #)

interest e"pense %as also subtracted )rom the cash $o%* then the cost o) debt

%ould be double counted.

,. !he -.00*000 that %as spent to rehabilitate the plant should not be included in

the analysis because it is already a sun/ cost that can no lon'er be reco0ered. 1e

are only interested in incremental CF+s

.. #) this %as true* the -.0*000 should be considered as an opportunity cost. !his

must be char'ed a'ainst the pro(ect* because it %ould ha0e been the cash $o%

'enerated i) the &rm didn+t proceed %ith the pro(ect.

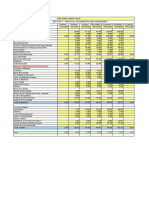

2. !he net in0estment outlay is -,*500*000. !he terminal 0alue is -130*000. 4See

computations 2.15

5. 6pon computin' the pro(ect+s #RR* 78* and M#RR* it can be seen that the

pro(ect %on+t be pro&table. 1ith a net present 0alue belo% zero 49:;*<1;.;35* this

pro(ect %on+t create 0alue )or the company+s shareholders. Moreo0er* it+s #RR and

M#RR* :..,= and 3.0,=* respecti0ely* are belo% its cost o) capital. !hat means

this pro(ect doesn+t e0en ma/e enou'h to 'o o0er its hurdle rate. 4See

computations 2.15

<. !he de&nition o) incremental cash $o% %ould be di>erent i) the pro(ect in0ol0ed

a replacement rather than e"pansion. #n e"pansion* incremental CF is de&ned as

pro(ect+s cash in$o%s and out$o%s. !he company is comparin' the 0alue %ith and

%ithout the proposed pro(ect. #n replacement* incremental CF is de&ned as the

&rm+s additional in$o%s and out$o%s that result )rom in0estin' in the ne%

pro(ect. !he company is comparin' the 0alue i) it ta/es the ne% pro(ect 0ersus the

0alue i) it continues on e"istin' assets.

An e"ample %ould be seen in replacin' e?uipment* in doin' this* the 0alue o) the

old e?uipment should also be ta/en into account. @epreciation %ould be ne%ly

de&ned as the chan'e o) depreciation bet%een the installment o) ne% machine

0ersus continuin' the usa'e o) old machine. !his in e>ect %ould chan'e the cash

$o%s o) the pro(ect.

;. 1e belie0e the pro(ect+s CF+s are in nominal terms because they are too lar'e.

Assumin' a 5= in$ation* the latter CF+s %ould normally be less than the earlier

CF+s* but in our case they are relati0ely e?ual. !his can )urther be (usti&ed

because ta" shields on depreciation 4i) e0er there are5 do not increase %ith

in$ation and stay constant in nominal terms because most ta" la%s only allo% the

ori'inal cost o) the asset to be depreciated. !here)ore* the 1ACC should also be

in nominal terms.

!he 78 is biased because it o0erstates %hat may actually happen. !he economy

may $uctuate and decrease the real 0alue o) the CF+s because o) in$ation.

Ao%e0er* considerin' that it is only a 29year pro(ect* usin' nominal CF+s may not

really be a poor estimation o) %hat may actually happen.

:. 1hen in$ation is ta/en into account* the pro(ect+s 78* #RR* M#RR and paybac/

are the )ollo%in': -5<<*:5<.:,* 13.:.=* 15.;;= and ,.<2 years 4See !able :.19

:..5. 1e can see that the indicators ha0e impro0ed. !hese &'ures imply that the

pro(ect becomes more 0iable %hen in$ation is considered.

3. !he sin'le cycle 78 o) ro(ects S and B are -1<*5,:.3. and -,2*;<1.3; 4!able

3.15. Because the 78s are computed %ith di>erent time spans* these 0alues

cannot be used to assess the pro(ects. C0en %ith di>erent li0es* ma/in' the

necessary ad(ustments can ma/e the t%o pro(ects comparable. 6sin' the

replacement chain approach* the 78 o) ro(ects S and B are -.0*1:3.13 and

-,2*;<1.3; 4!able 3..5. !he e?ui0alent annuities o) the pro(ects are -3*5,..:1 and

-;*:11.<:* respecti0ely 4!able 3.,5.

Based on these indicators* ro(ect S is the better option %hen the cost o) rene%in'

the pro(ect is the same. #t yields a hi'her 78* -5*2,;.,, more than ro(ect B.

1hen the pro(ects are e"tended to a common li)e o) )our years* ro(ect S %ill yield

-1*;1,.1. more in terms o) annuities.

But i) the cost o) rene%in' ro(ect S is -2*,00*000* ro(ect B is more pro&table

%ith an 78 that 'i0es -11*101.;0 more than ro(ect S 4!able 3.25.

10. #) the truc/ is used )or three years* its 78 is - 4.*,3<.;;5. #) it is used )or t%o

years and sold* its 78 is -;<0.... #n the same %ay* the 78 o) the truc/ is -

45*030.315 i) used only )or a year and then sold. 4see !ables 10.1 and 10.,5 !hese

0alues are computed assumin' that the Cnd9o)9Dear 7et Abandonment Cash Flo%s

pro0ided are a)ter9ta" &'ures. !his means that it is best to use the truc/ only )or

t%o years and sell it. A)ter t%o years* the &rm has earned enou'h )rom the truc/

and at the same time* is able to sell it at a reasonable price. !he economic li)e o)

the truc/ is , years. !his is because it is only at this time %hen the pro(ect %ill

turn out to be pro&table )or the company. Cconomic li)e is de&ned as the span o)

years it ta/es )or an in0estment to brea/ e0en.

11.

a. 4See !able 11.15. 6pon ta/in' into account the said cash cost and sales price

in$ation o) 5= per year* the pro(ect+s net present 0alue is no% positi0e at

-10,*.53* thus ma/in' the pro(ect )a0orable to the &rm+s shareholders. !he

positi0e net present 0alue is due to the hi'her net cash $o%s at the end o) years ,

to 2. !his increase in the cash $o%s also causes the pro(ect+s #RR to become

11.30=. !hus* e"ceedin' the pro(ect+s cost o) capital. !he pro(ect+s M#RR also

increases to 11.11=* also abo0e the 10= cost o) capital. Moreo0er* a)ter in$ation*

the pro(ect+s paybac/ period decreased to ..0<. Aence* the neutral in$ation

increased the pro(ect+s pro&tability.

b. #) this happens* the pro(ect %ould be e0en more unpro&table than it %as %ithout

the in$ation. #ts net present 0alue %ould )urther decrease to 92;:*,<...0*

indicatin' that it %ould pull the &rm do%n instead o) addin' 0alue to it. Moreo0er*

its un9pro&tability can also be seen %ith its #RR o) 0.02=* %hich is %ay belo% the

pro(ect+s cost o) capital. #ts M#RR o) 2..1= %hich is belo% its M#RR %ithout

in$ation 43.0,=5* also indicates that the pro(ect is %orse o> than it %as %ithout

in$ation. !his happens because %ith the increase in the cash costs* the pro(ect+s

pro&t mar'in decreases* thus pullin' the net cash $o%s do%n%ard.

1,.

a. #) in$ation rates %ere 5= on prices and ,= on cash costs* the company could

sell the units at -.3 each in order to brea/9e0en. 4See !able 1,.15

b. #) cash costs increase by 5= annual in$ation %ithout a correspondin' increase in

sales prices* the company %ould ha0e to sell 113*0:< units in order to brea/9e0en.

4See !able 1,.,5

Você também pode gostar

- FM11 CH 16 Mini-Case Cap Structure DecDocumento11 páginasFM11 CH 16 Mini-Case Cap Structure DecAndreea VladAinda não há avaliações

- CH 10 IMDocumento46 páginasCH 10 IMAditya Achmad Narendra WhindracayaAinda não há avaliações

- Fubuki Case Assignment FINALDocumento4 páginasFubuki Case Assignment FINALnowgamiAinda não há avaliações

- Bar Chart: Turn-Over in Rupees Hundred Lakhs in A Certain YearDocumento3 páginasBar Chart: Turn-Over in Rupees Hundred Lakhs in A Certain YearSushobhan SanyalAinda não há avaliações

- CHAPTER 10 Plant Assets and Intangibles: Objective 1: Measure The Cost of A Plant AssetDocumento9 páginasCHAPTER 10 Plant Assets and Intangibles: Objective 1: Measure The Cost of A Plant AssetAhmed RawyAinda não há avaliações

- Chap 014Documento87 páginasChap 014limed1100% (1)

- Chapter 14 Capital Structure and Financial Ratios: 1. ObjectivesDocumento17 páginasChapter 14 Capital Structure and Financial Ratios: 1. Objectivessamuel_dwumfourAinda não há avaliações

- Suggested Answers: May 2005 Final Course: Group 1 Paper - 2: Management Accounting and Financial AnalysisDocumento20 páginasSuggested Answers: May 2005 Final Course: Group 1 Paper - 2: Management Accounting and Financial AnalysisQueasy PrintAinda não há avaliações

- Chapter 16 Capital Structure: Answer - Test Your Understanding 1Documento16 páginasChapter 16 Capital Structure: Answer - Test Your Understanding 1samuel_dwumfourAinda não há avaliações

- Chapter 14 Capital Structure and Financial Ratios: Answer 1Documento12 páginasChapter 14 Capital Structure and Financial Ratios: Answer 1samuel_dwumfourAinda não há avaliações

- Concept Questions: NPV and Capital BudgetingDocumento23 páginasConcept Questions: NPV and Capital BudgetingGianni Stifano P.Ainda não há avaliações

- Mg2451 Engineering Economics and Cost Analysis Questions and AnswersDocumento11 páginasMg2451 Engineering Economics and Cost Analysis Questions and AnswersVijayakumarBaskarAinda não há avaliações

- Credit Appraisal TechniquesDocumento35 páginasCredit Appraisal TechniquesDilip RkAinda não há avaliações

- Karpagam Institute of Technology Mca Continuous Assessment Internal Test-IDocumento5 páginasKarpagam Institute of Technology Mca Continuous Assessment Internal Test-IanglrAinda não há avaliações

- University of Mauritius: Faculty of Law and ManagementDocumento14 páginasUniversity of Mauritius: Faculty of Law and ManagementKlaus MikaelsonAinda não há avaliações

- Corpfinance AmchemDocumento11 páginasCorpfinance AmchemSantanu DasAinda não há avaliações

- Case #84 Risk and Rates of Return - Filmore EnterprisesDocumento9 páginasCase #84 Risk and Rates of Return - Filmore Enterprises3happy3100% (5)

- Revision 5 - Cost of Capital: Answer 1Documento14 páginasRevision 5 - Cost of Capital: Answer 1samuel_dwumfourAinda não há avaliações

- SM Chapter 06Documento42 páginasSM Chapter 06mfawzi010Ainda não há avaliações

- Nike - Discussion and Analysis 1108Documento3 páginasNike - Discussion and Analysis 1108lisahunAinda não há avaliações

- Session 10 Cash Flow EsimationDocumento52 páginasSession 10 Cash Flow EsimationAsselek AskarovaAinda não há avaliações

- Categories of RatiosDocumento6 páginasCategories of RatiosNicquainCTAinda não há avaliações

- Consolidated Financial Statements After Acquisition: Complete Equity Method On Books of InvestorDocumento5 páginasConsolidated Financial Statements After Acquisition: Complete Equity Method On Books of Investorsalehin1969Ainda não há avaliações

- Chap 016Documento77 páginasChap 016limed1100% (1)

- Shapiro CHAPTER 2 SolutionsDocumento14 páginasShapiro CHAPTER 2 SolutionsPradeep HemachandranAinda não há avaliações

- MAS - Cost of Capital 11pagesDocumento11 páginasMAS - Cost of Capital 11pageskevinlim186100% (1)

- Financial Management Part 2 RN 12.3.2013 JRM Capital Budgeting Decisions C CDocumento7 páginasFinancial Management Part 2 RN 12.3.2013 JRM Capital Budgeting Decisions C CQueenielyn TagraAinda não há avaliações

- Chap 013Documento56 páginasChap 013saud1411100% (10)

- BUS785 in Class Work No. 1 First Name - Last NameDocumento5 páginasBUS785 in Class Work No. 1 First Name - Last Namedineshmech225Ainda não há avaliações

- BEC 0809 AICPA Newly Released QuestionsDocumento22 páginasBEC 0809 AICPA Newly Released Questionsrajkrishna03Ainda não há avaliações

- Answers To Practice Questions: The Value of Common StocksDocumento11 páginasAnswers To Practice Questions: The Value of Common StocksAndrea RobinsonAinda não há avaliações

- Professional Accounting College of The Caribbean (Pacc) : Ratio Analysis / Performance AppraisalDocumento4 páginasProfessional Accounting College of The Caribbean (Pacc) : Ratio Analysis / Performance AppraisalNicquainCTAinda não há avaliações

- Shapiro CHAPTER 2 SolutionsDocumento14 páginasShapiro CHAPTER 2 Solutionsjimmy_chou1314100% (1)

- Revision Progress Test 1 - Investment Appraisal: Answer 1Documento7 páginasRevision Progress Test 1 - Investment Appraisal: Answer 1samuel_dwumfourAinda não há avaliações

- Leach TB Chap09 Ed3Documento8 páginasLeach TB Chap09 Ed3bia070386Ainda não há avaliações

- Cost of CapitalDocumento10 páginasCost of CapitalRobinvarshneyAinda não há avaliações

- Ratio Analysis: OV ER VIE WDocumento40 páginasRatio Analysis: OV ER VIE WSohel BangiAinda não há avaliações

- Ross 9e FCF SMLDocumento425 páginasRoss 9e FCF SMLAlmayayaAinda não há avaliações

- Answers To Practice Questions: Capital Budgeting and RiskDocumento9 páginasAnswers To Practice Questions: Capital Budgeting and RiskAndrea RobinsonAinda não há avaliações

- CHAPTER 1: Quantitative Methods - Introduction: Series 66: Textbooks, Software & VideosDocumento38 páginasCHAPTER 1: Quantitative Methods - Introduction: Series 66: Textbooks, Software & VideosLeeAnn MarieAinda não há avaliações

- Conclusion: Bpmm6013 Marketing ManagementDocumento22 páginasConclusion: Bpmm6013 Marketing ManagementEmellda MAAinda não há avaliações

- Weighted Average Cost of CapitalDocumento13 páginasWeighted Average Cost of CapitalAkhil RupaniAinda não há avaliações

- Practical Accounting 1: La Consolacion University PhilippinesDocumento7 páginasPractical Accounting 1: La Consolacion University PhilippinesAnjo EllisAinda não há avaliações

- Amity AssignmentDocumento16 páginasAmity AssignmentAnkita SrivastavAinda não há avaliações

- NBG Format-20.11.13Documento6 páginasNBG Format-20.11.13Srinivas MaheshwariAinda não há avaliações

- Shapiro CHAPTER 5 SolutionsDocumento11 páginasShapiro CHAPTER 5 Solutionsjimmy_chou13140% (1)

- Sporting Goods Division:: RequiredDocumento3 páginasSporting Goods Division:: RequiredAmy HurleyAinda não há avaliações

- Capital Budgeting: Exclusive Projects or Independent ProjectsDocumento6 páginasCapital Budgeting: Exclusive Projects or Independent ProjectsMaria TariqAinda não há avaliações

- Balakrishnan MGRL Solutions Ch05Documento67 páginasBalakrishnan MGRL Solutions Ch05deeAinda não há avaliações

- Exam 1 KeyFinanceDocumento7 páginasExam 1 KeyFinancepoojasoni06Ainda não há avaliações

- Capital BudgetingDocumento34 páginasCapital BudgetingHija S YangeAinda não há avaliações

- Topic 7. Cash Flows From Investment Activity ProcessDocumento8 páginasTopic 7. Cash Flows From Investment Activity ProcessCristina LupascuAinda não há avaliações

- Revision Progress Test 1 - Investment AppraisalDocumento5 páginasRevision Progress Test 1 - Investment Appraisalsamuel_dwumfourAinda não há avaliações

- Solution - Problems and Solutions Chap 10Documento6 páginasSolution - Problems and Solutions Chap 10سارة الهاشميAinda não há avaliações

- An Illustration of Five Levels of Competence in Using Ratios To Analyse A Hardware StoreDocumento2 páginasAn Illustration of Five Levels of Competence in Using Ratios To Analyse A Hardware StoreLinhdaica Vo DoiAinda não há avaliações

- Chap 009Documento127 páginasChap 009limed1100% (1)

- Applied Corporate Finance. What is a Company worth?No EverandApplied Corporate Finance. What is a Company worth?Nota: 3 de 5 estrelas3/5 (2)

- The Entrepreneur’S Dictionary of Business and Financial TermsNo EverandThe Entrepreneur’S Dictionary of Business and Financial TermsAinda não há avaliações

- Hi166 Syllabus 1st Sem. 2015 - 2016Documento12 páginasHi166 Syllabus 1st Sem. 2015 - 2016littlemissjaceyAinda não há avaliações

- Lumen Gentium 40, Familia Consortio 11Documento1 páginaLumen Gentium 40, Familia Consortio 11littlemissjaceyAinda não há avaliações

- Chicago Valve TemplateDocumento5 páginasChicago Valve TemplatelittlemissjaceyAinda não há avaliações

- Case 05 FinalDocumento11 páginasCase 05 FinallittlemissjaceyAinda não há avaliações

- Case 05 FinalDocumento5 páginasCase 05 FinallittlemissjaceyAinda não há avaliações

- Fractions Lesson PlanDocumento1 páginaFractions Lesson PlanlittlemissjaceyAinda não há avaliações

- Reviewer in AccountingDocumento22 páginasReviewer in AccountingMIKASAAinda não há avaliações

- Polaroid Corporation 1996Documento22 páginasPolaroid Corporation 1996Mukesh Ranjan100% (1)

- Premier University: Term Paper On "Stock Market in Bangladesh"Documento51 páginasPremier University: Term Paper On "Stock Market in Bangladesh"Kamrul HasanAinda não há avaliações

- Assignment #1 Jordan Hardware & Construction SupplyDocumento9 páginasAssignment #1 Jordan Hardware & Construction SupplyME Valleser100% (1)

- Principles & Practices of BankingDocumento63 páginasPrinciples & Practices of BankingP SwapnaAinda não há avaliações

- BookkeepingDocumento14 páginasBookkeepingCristel TannaganAinda não há avaliações

- NGNGNDocumento2 páginasNGNGNshera48Ainda não há avaliações

- 63 Bus Law 729Documento33 páginas63 Bus Law 729tjbealeAinda não há avaliações

- Cubot Valuation Report Draft 1109.Documento20 páginasCubot Valuation Report Draft 1109.Bhavin SagarAinda não há avaliações

- 2020 Intrinsic Value CalculatorDocumento4 páginas2020 Intrinsic Value CalculatorManas BhatnagarAinda não há avaliações

- TD2&CORRECTIONDocumento17 páginasTD2&CORRECTIONYassmine DAinda não há avaliações

- Journal EntriesDocumento12 páginasJournal Entriesg81596262Ainda não há avaliações

- Chapter 16 - Managing Bond PortfoliosDocumento68 páginasChapter 16 - Managing Bond PortfoliosTRANG NGUYỄN THUAinda não há avaliações

- What Is The Market Interest Rate On Harry Davis S DebtDocumento1 páginaWhat Is The Market Interest Rate On Harry Davis S DebtAmit PandeyAinda não há avaliações

- PR - Order in The Matter of M/s. Phenix Properties LimitedDocumento2 páginasPR - Order in The Matter of M/s. Phenix Properties LimitedShyam SunderAinda não há avaliações

- Unit 4Documento22 páginasUnit 4Hemanta PahariAinda não há avaliações

- Lorico - Quiz For Inventory Estimation - Acc124Documento4 páginasLorico - Quiz For Inventory Estimation - Acc124maica G.Ainda não há avaliações

- Chap2 Case 1Documento1 páginaChap2 Case 1Xyza Faye RegaladoAinda não há avaliações

- Course Outline Iapm-Prof.p.saravananDocumento6 páginasCourse Outline Iapm-Prof.p.saravananNicholas DavisAinda não há avaliações

- Investment Scenario: Savings and Investment - Two Sides of A CoinDocumento37 páginasInvestment Scenario: Savings and Investment - Two Sides of A CoinLokesh GowdaAinda não há avaliações

- FM RL 1.1.1Documento10 páginasFM RL 1.1.1anandakumarAinda não há avaliações

- Larry Williams True Seasonal IndexDocumento4 páginasLarry Williams True Seasonal IndexS K HegdeAinda não há avaliações

- Capital Structure ManagementDocumento12 páginasCapital Structure ManagementRentsenjugder NaranchuluunAinda não há avaliações

- The Same As It Would Have Been If The Original Payment Had Been Debited Initially To An Expense AccountDocumento37 páginasThe Same As It Would Have Been If The Original Payment Had Been Debited Initially To An Expense AccountNolyne Faith O. VendiolaAinda não há avaliações

- ACC 430 Assignment 2 SU12020Documento2 páginasACC 430 Assignment 2 SU12020Shannon100% (1)

- International Finance Final ProjectDocumento2 páginasInternational Finance Final ProjectAshna KoshalAinda não há avaliações

- The Dividend Policy in Europe - The Cases of The UK, Germany, France and ItalyDocumento285 páginasThe Dividend Policy in Europe - The Cases of The UK, Germany, France and ItalyOre.AAinda não há avaliações

- Traditional Approaches in MarketingDocumento24 páginasTraditional Approaches in MarketingGina DiwagAinda não há avaliações

- CMA Data Analysis - BranchDocumento9 páginasCMA Data Analysis - BranchKunal SinghAinda não há avaliações

- British Pound, Cubed (Redux) Dmi Stochastic Intermarket Checkup Chartmill Value Interview Review, Quick-ScanDocumento82 páginasBritish Pound, Cubed (Redux) Dmi Stochastic Intermarket Checkup Chartmill Value Interview Review, Quick-ScanJohn Green100% (1)