Escolar Documentos

Profissional Documentos

Cultura Documentos

Sippican

Enviado por

Matija KaraulaDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Sippican

Enviado por

Matija KaraulaDireitos autorais:

Formatos disponíveis

Individual Paper: Activity-Based Costing

Matija Karaula

Individual Paper: Activity-Based Costing

Sippican Corporation

Course: B2B Pricing: Negotiation, Calculation, and Strategy

Matija Karaula

B2B Pricing: Negotiation, Calculation, and Strategy

Individual Paper: Activity-Based Costing

1) Defining the problem

The main problem of a Sippican corporation was a low pre-tax operating income (1.8%). To

solve that problem, a cause had to be found. Sippican reported gross margins of 35% on valves,

5% on pumps and 38% on flow controllers. After looking at a gross margins of the three product

lines, one would think that pumps were an issue to work on, and a main cause for a low

operating income, because the pump sales accounted for 47,36% of a total sales in March with

just 5% operating margin. However, the method of measuring the product profitability had to

be questioned. To be more accurate, the method of assigning the overhead costs to each product

line was the reason for inaccurate gross margins of the Sippicans product lines.

The method of calculating the manufacturing overhead used by Sippican would be accurate if

every of their three product lines was of the same or similar complexity. More complex

products require more indirect work so one cannot simply assign the overhead costs to the

products proportionally to direct labor working hours on each of them. However, that was

exactly what Sippican was doing and what resulted in overvaluing the flow controllers (the

most complex product line of Sippican), and undervaluing the pumps and valves. Moreover,

that created the wrong image of Sippicans product profitability which led to an inappropriate

pricing strategy.

2) Overhead assignment to products entirely or a contribution margin approach?

It is obvious that overhead assignment to products entirely is very inaccurate in this particular

case and that executives should abandon it, but the question is should they replace it with a

method which is even more simple and which does not even include overhead costs in

measuring the product profitability? The answer is yes, because by not including the overhead

costs in the product profitability, executives will not get a wrong idea on which pricing strategy

to impose. They would be just deducting direct costs from sales so they would not be getting

the wrong picture of overhead costs. For example, by using the overhead assignment to

products entirely, the following happens:

If the executives take a look at the gross margins calculated with the overhead costs

assignment to products entirely (the figures at the top of exhibit 2), they will get an

impression that pumps have a really low margin, and that there is no more space for

their price decrease, even though competitors are constantly decreasing prices. So

executives will get under a lot of pressure and probably make a wrong strategic move.

Wrong assignment of overhead

costs

Innacurate product

profitability

Inappropriate product

pricing strategy

Lower operating income

Exhibit 1 Result of a wrong overhead cost assignment

Matija Karaula

B2B Pricing: Negotiation, Calculation, and Strategy

P

a

g

e

1

Individual Paper: Activity-Based Costing

On the other hand, when they take a look at a contribution margin, they cannot get a

wrong picture (just an incomplete one) because one cannot get a lot of information from

looking just at the contribution margin (and the range of those figures is low so. So at

least they wont make a wrong choice because of the wrong picture of product

profitability. Contribution margin approach is simpler and the picture is incomplete but

at least it is not wrong.

Exhibit 2 - Product profitability by contribution approach and by gross margins

To conclude, it is better not to include overhead costs, then to include them and get the

completely different picture of the real product profitability. Both methods are inaccurate but

the latter is less inaccurate and simpler so that is the reason to adopt the contribution margin

approach in which manufacturing overhead is treated as a period expense. The best way would

be to use the time driven ABC method but if one is left to choose between the two choices

offered, than the contribution margin approach would be better.

3) Practical capacity and capacity cost rate

Exhibit 3 - Practical capacity

1

and capacity cost rates

2

Workers/machines

Shifts per

day

Productive

working

hours

Working

days

Practical

capacity

(hours)

Overhead

expenses

(March

2006)

Cost per

time unit

of

capacity

Production employees 45 2 6 20 10800 $351,000 $32.50

Setup employees 15 2 6 20 3600 $117,000 $32.50

Machine 62 2 6 20 14880 $334,800 $22.50

Receiving and production control 2 2 6.5 20 520 $15,600 $30.00

Engineering 8 1 6 20 960 $78,000 $81.25

Shipping and packaging employees 14 2 6.5 20 3640 $109,200 $30.00

1

Receiving, production, shipping and packaging employees have a little bit more productive hours per day (6.5)

then a production and setup employees (6) because they do not spend extra 30 minutes on preventive

maintenance and minor repairs.

2

Capacity cost rates were calculated by dividing the expense of each cost driver by its practical capacity in

hours per month, so the cost per time unit of capacity represented the hourly cost of Sippicans overhead cost

drivers.

35%

43%

64%

5%

20%

48%

38%

-4%

63%

-10% 0% 10% 20% 30% 40% 50% 60% 70%

Flow Controllers Pumps Valves

Matija Karaula

B2B Pricing: Negotiation, Calculation, and Strategy

P

a

g

e

2

Individual Paper: Activity-Based Costing

4) Differences in costs and profitability and the cause of their shifts

Revised cost assignment revealed a big differences in product profitability. Gross margins were

significantly different after revision because of the overhead costs that were unevenly

distributed and flow controllers were the most responsible for such a huge difference between

the costs and profitability margins. The complexity of flow controllers resulted in revised

overhead costs of $63.42 per unit ($39.37, or 164% more than in previous calculations). Valves

and pumps costs were undervalued by 26% and 34%, respectively. The amount of setup hours

contributed the most to those high overhead costs. The problem was in following: for every

hour of setup performing, there was a cost for laborers ($32.5) as well as the cost for machines

($22.5), because machines could have been working instead of being idle. Exhibit 4 shows the

impact of flow controllers on the total overhead costs distribution.

The following categories were the main cost drivers of flow controllers:

1. Production runs the product needed a lot more runs per unit then the other two

because it consisted of lot more parts

2. Machines on setup for every unit produced, machine was working for 18 minutes,

and it was on setup for 40 minutes and 30 seconds

3. Setup labor because of the large amount of time to setup the machine for the

production, flow controllers were responsible for almost 80% of all setup costs

4. Engineers were spending more than 60% of their time just on flow controllers

In Exhibit 5, it is visible how very high overhead costs per unit of flow controllers caused a

change in product profitability after measuring them with an appropriate method. Flow

controllers actual gross margin was negative (-4%) and pumps had a gross margin of 20% (15

percentage points more than with previous analysis) so there was still a space for price decrease

in pumps if it becomes necessary to react to market pushing of prices.

Exhibit 4 - Manufacturing overhead costs distribution

Matija Karaula

B2B Pricing: Negotiation, Calculation, and Strategy

P

a

g

e

3

Individual Paper: Activity-Based Costing

3

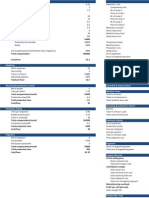

Exhibit 5 - Income statement with product profitability and cost analysis

Valves Pumps

Flow

Controllers Reported Practical

1. Sales $592,500 $875,000 $380,000 $1,847,500 $1,847,500

1. Sales (%) 32.07% 47.36% 20.57% 100.00%

2. Direct costs $212,625 $453,125 $140,000 $809,000 $805,750

*per unit $28.35 $36.25 $35.00

2.1. Direct Labor Expense $92,625 $203,125 $52,000 $351,000 $347,750

2.2. Direct Labor Expense (%) 26.39% 57.87% 14.81% 100.00%

2.3. Direct Materials Expense $120,000 $250,000 $88,000 $458,000 $458,000

2.4. Direct Materials Expense (%) 26.20% 54.59% 19.21% 100.00%

3. Contribution Margin (1-2) $379,875 $421,875 $240,000 $1,038,500 $1,041,750

3. Contribution Margin (%) 64.11% 48.21% 63.16% 56.21%

4. Manufacturing Overhead $126,500 $249,375 $253,688 $654,600 $629,563

*per unit $16.87 $19.95 $63.42

*Old manufacturing overhead

(@185%) $22.85 $30.06 $24.05

*Difference $5.98 $10.11 -$39.37

4.1. Machine expenses total $86,625 $154,125 $87,750 $334,800 $328,500

4.1.1. Machine-related expenses $84,375 $140,625 $27,000 $334,800 $252,000

4.1.2. Machine expense on setup $2,250 $13,500 $60,750 $76,500

4.2. Setup labor $3,250 $19,500 $87,750 $117,000 $110,500

4.3. Receiving and production control $750 $3,750 $8,438 $15,600 $12,938

4.4. Engineering $4,875 $19,500 $48,750 $78,000 $73,125

4.5. Packaging and shipping $31,000 $52,500 $21,000 $109,200 $104,500

5. Gross Margin

$253,375.0

0

$172,500.0

0 -$13,687.50

$383,900.0

0

$412,187.5

0

5. Revised gross Margin (%) 43% 20% -4% 21% 22%

*Gross margin before 35% 5% 38%

*Difference 8% 15% -42%

6. General, Selling & Administrative

Expenses

$350,000.0

0

$350,000.0

0

7. Operating Income (pre-tax) $33,900.00 $62,187.50

7. Operating Income (pre-tax) (%) 1.83% 3.37%

To conclude, shifts in costs and profitability were caused by practical capacity that could have

been utilized better. The actual capacity was lower than the practical so the costs could have

been lower if the workers and machines were more productive

4

.

5) Actions to improve the company's profitability

Based on the revised figures, executives should take the following action plan:

a) Change the method of product profitability calculation - In the future, they should

implement the time driven ABC method and assign the overhead costs to products to

calculate the product profitability they should then decide on pricing and other strategies.

3

Revised manufacturing overhead per unit was calculated by using a time driven ABC method. First, every

figure from monthly production report (exhibit 4 in the case study) was expressed in time units and multiplied

by respective capacity cost rate to get the total overhead cost for each product line. Finally, total costs for each

product were divided by the products unit number.

4

For example, the manufacturing overhead in the income statement from March 2006 was $654,600, but if the

practical capacity was utilized, the costs would have been $629,563 so the company would save $25,038

Matija Karaula

B2B Pricing: Negotiation, Calculation, and Strategy

P

a

g

e

4

Individual Paper: Activity-Based Costing

b) Different pricing Based on the revised figures and facts from the case, it is clear that

executives should adopt a different pricing strategy for flow controllers.

Valves: revised margin is 43% it is a sign that valves are doing good and that the

prices should stay at the same level.

Pumps: 20% margin there is still space for further price reductions if necessary.

Executives should leave the prices at the same level and react to the market because

pumps act as a commodity so further reductions could cause an unnecessary price war.

Flow controllers: on a negative margin (-4%) previous price reductions did not result

in a demand decrease so executives should definitely raise the prices. Flow controllers

are highly complex and hard to produce, moreover, there are lot of different types of

them so there are probably not many competitors who could produce them. Therefore,

Sippican should aim for a margin of 30% at least and increase the prices to reach that.

So to reach a margin of 30%, prices should be set at $140 (price increase of 47%) on

the condition that demand stays at the same level (which is highly unlikely).

Challenge: Hard to predict the right price increase detailed market analysis is

necessary. Price volume compromise has to be respected by the price-volume

compromise analysis

5

made, for 1% of price increase, the volume should not

decrease by more than 1.56% in order to achieve the same profitability at least.

However, if the volume decreases by less than 1.56%, profitability will rise

higher iso-profit line will be reached.

c) Develop an incentive program to workforce for higher productivity Executives

should organize the teaching of the workforce the basics of TDABC in order for them to

understand how to contribute their company. In return, a certain percentage (for example

30%) per every dollar saved should be offered as an increase in salary at the end of the

month.

Benefits: Better working atmosphere, satisfaction, higher motivation and a win-win

situation for executives and a workers.

Challenges: It is impossible to offer the perfectly fair incentive to every worker,

basically the total labor savings would be divided by the number of workers and a

certain percentage would be shared equally. That could cause unhappiness among

those who consider themselves more productive than others.

5

Analysis was made using the following formula:

Matija Karaula

B2B Pricing: Negotiation, Calculation, and Strategy

P

a

g

e

5

Você também pode gostar

- Sippican CatarinaRodrigues 1Documento5 páginasSippican CatarinaRodrigues 1Catarina RodriguesAinda não há avaliações

- Sippican Case Analysis ReportDocumento3 páginasSippican Case Analysis Reportfelipecalvette100% (2)

- Sippican A Case Study PDFDocumento9 páginasSippican A Case Study PDFAlex G. PichliavasAinda não há avaliações

- 241485467-Sippican Case PDFDocumento6 páginas241485467-Sippican Case PDFSylviaZambranoSorianoAinda não há avaliações

- Outsourcing Manifold ProductionDocumento8 páginasOutsourcing Manifold Productionaliraza100% (2)

- Sippican CorporationDocumento3 páginasSippican CorporationSaswata Banerjee0% (1)

- Sippican CorporationDocumento2 páginasSippican CorporationManikandan Swaminathan100% (3)

- Full Report Case 4Documento13 páginasFull Report Case 4Ina Noina100% (4)

- Sippican CoDocumento5 páginasSippican CoMagali Thibaut67% (3)

- 18 4 Sippican CorporationDocumento2 páginas18 4 Sippican CorporationamitkrhpcicAinda não há avaliações

- Colorscope ExcelDocumento11 páginasColorscope ExcelPriyabrat Mishra100% (1)

- Sippican Case ReviewDocumento9 páginasSippican Case ReviewDavid KijadaAinda não há avaliações

- Company CASE 4 Analyzes Activity-Based Costing to Improve Profit Margins/TITLEDocumento24 páginasCompany CASE 4 Analyzes Activity-Based Costing to Improve Profit Margins/TITLECik Beb Gojes100% (1)

- Colorscope 1Documento6 páginasColorscope 1Oca Chan100% (2)

- Import Distributors Case Analysis: Television Dept ContinuationDocumento3 páginasImport Distributors Case Analysis: Television Dept ContinuationKram Olegna Anagerg0% (1)

- Estimate break-even quantity for iPhone 4 using cost dataDocumento1 páginaEstimate break-even quantity for iPhone 4 using cost dataAnkit VermaAinda não há avaliações

- DEVELOPING AN ABC MODEL FOR CLASSIC PEN COMPANYDocumento16 páginasDEVELOPING AN ABC MODEL FOR CLASSIC PEN COMPANYSambit Dash100% (4)

- Destin BrassDocumento5 páginasDestin Brassdamanfromiran100% (1)

- Colorscope Inc. Case Solution Cost AllocationDocumento2 páginasColorscope Inc. Case Solution Cost Allocationaq50% (2)

- Wilkerson CompanyDocumento26 páginasWilkerson CompanyChris Vincent50% (2)

- Wilkerson Case Study FinalDocumento5 páginasWilkerson Case Study Finalmayer_oferAinda não há avaliações

- 15.963 Managerial Accounting at MITDocumento11 páginas15.963 Managerial Accounting at MITabhishekbehal50120% (1)

- Destin Brass Costing ProjectDocumento2 páginasDestin Brass Costing ProjectNitish Bhardwaj100% (1)

- Case Analysis - Rosemont Hill Health Center - V3Documento8 páginasCase Analysis - Rosemont Hill Health Center - V3thearpan100% (2)

- Project - Rosemont Hill Health CenterDocumento9 páginasProject - Rosemont Hill Health CenterDamian G. James100% (3)

- Classic Pen Company: Case Analysis - Activity Based Cost System Group - 07Documento16 páginasClassic Pen Company: Case Analysis - Activity Based Cost System Group - 07Anupriya Sen100% (1)

- Case Analysis of Dakota Office ProductsDocumento12 páginasCase Analysis of Dakota Office ProductsAditi2303100% (2)

- Wilkerson ABC Costing Case StudyDocumento8 páginasWilkerson ABC Costing Case StudyParamjit Singh100% (4)

- Costing Systems Reveal True Product MarginsDocumento1 páginaCosting Systems Reveal True Product Marginsfelipevwa100% (1)

- Destin Brass Case Study SolutionDocumento5 páginasDestin Brass Case Study SolutionKaushal Agrawal100% (1)

- Danshui Plant 2 - 2019Documento19 páginasDanshui Plant 2 - 2019louie florentine Sanchez67% (3)

- Wilkerson Company ABC Cost System Exhibit 1.a Cost Pool Cost DriverDocumento2 páginasWilkerson Company ABC Cost System Exhibit 1.a Cost Pool Cost DriverLeonardoGomez100% (1)

- Dakota Office Products Activity-Based Costing Case StudyDocumento5 páginasDakota Office Products Activity-Based Costing Case StudyAriyo Roberto Carlos BanureaAinda não há avaliações

- Wilkerson Case Assignment Questions Part 1Documento1 páginaWilkerson Case Assignment Questions Part 1gangster91Ainda não há avaliações

- Dakota Office ProductsDocumento10 páginasDakota Office ProductsMithun KarthikeyanAinda não há avaliações

- Wilkerson Company Full ReportDocumento9 páginasWilkerson Company Full ReportFatihahZainalLim100% (1)

- OPIM101 - Spring 2009 - Exam 1 - SolutionsDocumento12 páginasOPIM101 - Spring 2009 - Exam 1 - Solutionsjoe91bmwAinda não há avaliações

- Dakota Office ProductsDocumento17 páginasDakota Office Productsamitdas200867% (3)

- DakotaDocumento5 páginasDakotaMadhavi SerenityAinda não há avaliações

- Case ColorscopeDocumento7 páginasCase ColorscopeRatin MathurAinda não há avaliações

- Kreative Kasuals Case StudyDocumento2 páginasKreative Kasuals Case StudyBitan Banerjee100% (1)

- Colorscope Inc - Solution F16Documento12 páginasColorscope Inc - Solution F16Varisha AlamAinda não há avaliações

- Colorscope IncDocumento14 páginasColorscope IncAbdul Khan100% (1)

- Team 1Documento4 páginasTeam 1Prakash Jeswani100% (1)

- Color ScopeDocumento12 páginasColor Scopeprincemech2004100% (1)

- Colorscope Case - Operational Advantages and Cost AnalysisDocumento2 páginasColorscope Case - Operational Advantages and Cost AnalysisstevenAinda não há avaliações

- Destin Brass Faces Pricing Pressure and Needs Costing InsightsDocumento2 páginasDestin Brass Faces Pricing Pressure and Needs Costing InsightsGlenn HengAinda não há avaliações

- Cost Accounting ReportDocumento12 páginasCost Accounting ReportSYED WAFIAinda não há avaliações

- Precision Motors Division CaseDocumento9 páginasPrecision Motors Division CaseAliza Rizvi50% (2)

- Kreative Kasuals Woeking NotesDocumento3 páginasKreative Kasuals Woeking NotesAashima GroverAinda não há avaliações

- Wilkerson Case Study Final1Documento5 páginasWilkerson Case Study Final1mayer_ofer95% (22)

- Cost Breakdown for T-Shirts, Boxers, Coveralls and Cargo Pants ManufacturingDocumento2 páginasCost Breakdown for T-Shirts, Boxers, Coveralls and Cargo Pants ManufacturingBitan BanerjeeAinda não há avaliações

- Danshui Plant 2 - Group 6 - Section BDocumento13 páginasDanshui Plant 2 - Group 6 - Section BSoumyajit Lahiri100% (8)

- WilkersonDocumento4 páginasWilkersonmayurmachoAinda não há avaliações

- Case Study: Danshui Plant No2Documento3 páginasCase Study: Danshui Plant No2Abdelhamid JenzriAinda não há avaliações

- Wilkerson Case SubmissionDocumento5 páginasWilkerson Case Submissiongangster91100% (2)

- Accounting 2Documento7 páginasAccounting 2vietthuiAinda não há avaliações

- Student Sol10 4eDocumento38 páginasStudent Sol10 4eprasad_kcp50% (2)

- Economic Analysis of Industrial Projects: Allied Technical CorporationDocumento4 páginasEconomic Analysis of Industrial Projects: Allied Technical CorporationJoselito DaroyAinda não há avaliações

- SolutionDocumento5 páginasSolutionNur Aina Safwani ZainoddinAinda não há avaliações

- AAU Prospective Graduates of 2020 PDFDocumento343 páginasAAU Prospective Graduates of 2020 PDFyakadimaya4388% (17)

- MGL - Acg - QuizDocumento1 páginaMGL - Acg - Quizgmurali_179568Ainda não há avaliações

- A Better India, A Better World": N R Narayana MurthyiDocumento8 páginasA Better India, A Better World": N R Narayana MurthyiMansi KhandelwalAinda não há avaliações

- 2ND TERM EXAMINATION KEY FINANCIAL CONCEPTSDocumento9 páginas2ND TERM EXAMINATION KEY FINANCIAL CONCEPTSKhamil Kaye GajultosAinda não há avaliações

- CH 13 Exchange Rate Adjustments and The Balance-of-PaymentsDocumento4 páginasCH 13 Exchange Rate Adjustments and The Balance-of-PaymentsBethari LarasatiAinda não há avaliações

- HOW MONEY GROWTH DRIVES INFLATIONDocumento48 páginasHOW MONEY GROWTH DRIVES INFLATIONNhược NhượcAinda não há avaliações

- Uganda Vision 2040 DraftDocumento84 páginasUganda Vision 2040 DraftTusiime Wa Kachope Samson100% (1)

- Global Capital Market & Their EffectsDocumento22 páginasGlobal Capital Market & Their EffectsJay KoliAinda não há avaliações

- Production and CostsDocumento7 páginasProduction and CostsViswanatha Rao TAinda não há avaliações

- 2Documento2 páginas2akhil107043Ainda não há avaliações

- Marginal Costing PROJECTDocumento38 páginasMarginal Costing PROJECTvenkynaidu67% (9)

- Banana Computer Company Sells Banana Computers in Both The DomesticDocumento2 páginasBanana Computer Company Sells Banana Computers in Both The Domestictrilocksp SinghAinda não há avaliações

- Introduction To Business-1Documento27 páginasIntroduction To Business-1ddssAinda não há avaliações

- The Gist of NCERT - Indian Economy PDFDocumento141 páginasThe Gist of NCERT - Indian Economy PDFmadhuAinda não há avaliações

- 1539-Article Text-3127-2-10-20180430Documento17 páginas1539-Article Text-3127-2-10-20180430Juliany Helen Das GraçasAinda não há avaliações

- Econometrics Definition and Methodology Under 40 CharactersDocumento2 páginasEconometrics Definition and Methodology Under 40 CharactersDebojyoti Ghosh86% (7)

- Solution Manual For Managerial Economics 6th Edition For KeatDocumento11 páginasSolution Manual For Managerial Economics 6th Edition For KeatMariahAndersonjerfn100% (25)

- Micro & Macro Env. ReadingDocumento12 páginasMicro & Macro Env. ReadingMr. Sailosi KaitabuAinda não há avaliações

- What Is Political EconomyDocumento10 páginasWhat Is Political EconomyayulatifahAinda não há avaliações

- Public Finance Chapter 4Documento36 páginasPublic Finance Chapter 4LEWOYE BANTIEAinda não há avaliações

- Example 2: 759 Store: Rationale of DesignDocumento11 páginasExample 2: 759 Store: Rationale of DesignW.t. LamAinda não há avaliações

- Hedging With OptionsDocumento4 páginasHedging With OptionsboletodonAinda não há avaliações

- MGI A Future That Works in BriefDocumento2 páginasMGI A Future That Works in Briefvudsri000Ainda não há avaliações

- Revised ss2 Term 1 Curriculum Map 2014 - 2015Documento5 páginasRevised ss2 Term 1 Curriculum Map 2014 - 2015api-288515796Ainda não há avaliações

- ALKO Case Final ReportDocumento7 páginasALKO Case Final ReportSamarth Jain100% (1)

- Modeli Ocene Performansi Portfolija Investicionih Fondova - Šarpov, Trejnorov I Jensenov IndeksDocumento26 páginasModeli Ocene Performansi Portfolija Investicionih Fondova - Šarpov, Trejnorov I Jensenov IndeksJingyin YanAinda não há avaliações

- Mil Lesson 6Documento23 páginasMil Lesson 6Demmy chanAinda não há avaliações

- Tutorial 8Documento1 páginaTutorial 8amalia izzati50% (2)

- International Business Assignment-1 On Globalization: (IB BUS606)Documento4 páginasInternational Business Assignment-1 On Globalization: (IB BUS606)Mehnaz Tabassum Shanta100% (1)

- Developing Pricing Strategies and Programs: Marketing Management, 13 EdDocumento19 páginasDeveloping Pricing Strategies and Programs: Marketing Management, 13 EdAkshay karthikAinda não há avaliações