Escolar Documentos

Profissional Documentos

Cultura Documentos

Year Ended December 31, 2013 2012 (In Thousands) Balance Sheet Data

Enviado por

loltoy0 notas0% acharam este documento útil (0 voto)

20 visualizações1 páginaAssignment for Uni

Título original

The Assignment

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoAssignment for Uni

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

20 visualizações1 páginaYear Ended December 31, 2013 2012 (In Thousands) Balance Sheet Data

Enviado por

loltoyAssignment for Uni

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 1

(1)

(2)

(3)

!"#$% '( )'*!%*!+

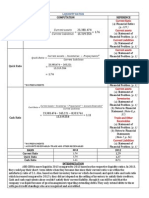

Year ended December 31,

2013 2012

(in thousands)

BaIance Sheet Data

Cash, Cash Equivalents, Short Term Deposits and

Marketable Securities $ 124,284 $ 60,940

nventories 11,354 9,275

Long-Term Assets 12,997 9,681

Total Assets $ 168,228 $ 89,994

Long-Term Liabilities 9,715 7,118

Accumulated Deficit (100,887) (120,807)

Total Shareholders' Equity 142,638 71,568

Year ended December 31,

2013 2012 2011

(in thousands)

Other FinanciaI Data

Net ncome (Loss) Before Share-Based Compensation

(3)

$ 33,051 $ 1,802 $ (12,268)

12

Prior to this offering and the Share Recapitalization, our issued share capital has been composed of Class A

ordinary shares (with no liquidation preference), ordinary shares (with liquidation preference), Class B, C, D, E,

F1 and F2 Shares, all at EUR 0.01 par value. The only class of outstanding shares without a liquidation

preference is the Class A ordinary shares. Therefore, under U.S. GAAP, earnings per share must be computed

based on the outstanding Class A ordinary shares. Basic and diluted loss per share has been restated as

described in Note 2(x) to our consolidated financial statements included elsewhere in this prospectus. For

additional information, see Notes 8 and 9 to our consolidated financial statements included elsewhere in this

prospectus and see "Management's Discussion and Analysis of Financial Condition and Results of Operations

Comparison of Results of Operations for 2013, 2012 and 2011 Earnings Per Share.

The pro forma earnings per share calculation for the year ended December 31, 2013 assumes the conversion

of all outstanding shares (including Class A ordinary shares) to ordinary shares with no liquidation preferences

on a one-to-one basis as set forth in our articles of association. See Note 9 to our consolidated financial

statements included elsewhere in this prospectus.

We prepare this non-GAAP measure to eliminate the impact of items that we do not consider indicative of our

overall operating performance. To arrive at our non-GAAP net income (loss), we exclude share-based

compensation expense from our GAAP net income (loss). We believe that this non-GAAP measure is useful to

investors in evaluating our operating performance for the following reasons:

We believe that elimination of share-based compensation expense is appropriate because treatment of

this item may vary for reasons unrelated to our overall operating performance;

We use this non-GAAP measure in conjunction with our GAAP financial measure for planning purposes,

including the preparation of our annual operating budget, as a measure of operating performance and the

effectiveness of our business strategies and in communications with our board of directors concerning

our financial performance;

We believe that this non-GAAP measure provides better comparability with our past financial

performance, facilitates better period-to-period comparisons of operational results and may facilitate

comparisons with similar companies, many of which may also use similar non-GAAP financial measures

to supplement their GAAP reporting; and

We anticipate that, after consummating this offering, our investor presentations and those of securities

analysts will include non-GAAP measures to evaluate our overall operating performance.

Page 17 oI 178

11/08/2014 http://www.secinIo.com/$/SEC/Filing.asp?H1FU76.n2D1&OSW

Você também pode gostar

- Rich Dad's Guide To Becoming Rich... Without Cutting Up Your Credit CardsDocumento101 páginasRich Dad's Guide To Becoming Rich... Without Cutting Up Your Credit CardsYouert RayutAinda não há avaliações

- Project Two Chainz (Dual Process - Marry or Stay Single)Documento10 páginasProject Two Chainz (Dual Process - Marry or Stay Single)TucsonTycoonAinda não há avaliações

- Chapter 12Documento11 páginasChapter 12Kim Patrice NavarraAinda não há avaliações

- Hedge Funds-Case StudyDocumento20 páginasHedge Funds-Case StudyRohan BurmanAinda não há avaliações

- Adamjee InsuranceDocumento80 páginasAdamjee InsuranceMohsan SheikhAinda não há avaliações

- WE Audit 2013Documento18 páginasWE Audit 2013AdityaKapoorAinda não há avaliações

- Proactive CPA and Consulting FirmDocumento23 páginasProactive CPA and Consulting FirmPando DailyAinda não há avaliações

- 4 ACE LTD., 2012 Annual Report (Form 10-K), at 27Documento1 página4 ACE LTD., 2012 Annual Report (Form 10-K), at 27urrwpAinda não há avaliações

- Financial StatementDocumento115 páginasFinancial Statementammar123Ainda não há avaliações

- FXCM Q3 Slide DeckDocumento20 páginasFXCM Q3 Slide DeckRon FinbergAinda não há avaliações

- 4Q12 Financial StatementsDocumento64 páginas4Q12 Financial StatementsJBS RIAinda não há avaliações

- Document Research: MorningstarDocumento52 páginasDocument Research: Morningstaraaa_13Ainda não há avaliações

- Online Presentation 11-1-11Documento18 páginasOnline Presentation 11-1-11Hari HaranAinda não há avaliações

- ZPI Audited Results For FY Ended 31 Dec 13Documento1 páginaZPI Audited Results For FY Ended 31 Dec 13Business Daily ZimbabweAinda não há avaliações

- TMX Cds Annual Report 2013 enDocumento56 páginasTMX Cds Annual Report 2013 enbhagathnagarAinda não há avaliações

- Glosario de FinanzasDocumento9 páginasGlosario de FinanzasRaúl VargasAinda não há avaliações

- Bank of IrelandDocumento381 páginasBank of IrelandArvinLedesmaChiongAinda não há avaliações

- Universal Tech - Final Result Announcement For The Year Ended 31 December 2012 PDFDocumento27 páginasUniversal Tech - Final Result Announcement For The Year Ended 31 December 2012 PDFalan888Ainda não há avaliações

- Financial Statement of GS Engineering & ConstructionDocumento71 páginasFinancial Statement of GS Engineering & ConstructionManish KumarAinda não há avaliações

- CH All Access - Annual Results Announcement For The Year Ended 31 December 2012 PDFDocumento29 páginasCH All Access - Annual Results Announcement For The Year Ended 31 December 2012 PDFalan888Ainda não há avaliações

- Matahari Department StoreDocumento59 páginasMatahari Department StoreResti0805_DyoAinda não há avaliações

- Can000034744 2013 1 00 e 03 31Documento15 páginasCan000034744 2013 1 00 e 03 31Srikanth JutruAinda não há avaliações

- CNY Community Foundation 2013 AuditDocumento22 páginasCNY Community Foundation 2013 Auditjobrien1381Ainda não há avaliações

- 2013 SMC FinancialsDocumento57 páginas2013 SMC Financialsstraywolf0Ainda não há avaliações

- USD $ in MillionsDocumento8 páginasUSD $ in MillionsAnkita ShettyAinda não há avaliações

- 174.ASX IAW Feb 27 2013 17.36 Half Yearly Report and AccountsDocumento28 páginas174.ASX IAW Feb 27 2013 17.36 Half Yearly Report and AccountsASX:ILH (ILH Group)Ainda não há avaliações

- 2020 Bao Cao TCDocumento93 páginas2020 Bao Cao TChienys huynhAinda não há avaliações

- 2013 Financial StatementsDocumento45 páginas2013 Financial StatementsMuhammad Riezhall Van HouttenAinda não há avaliações

- Balance Sheet As at 31st March 2012 (Rs in Lakhs)Documento20 páginasBalance Sheet As at 31st March 2012 (Rs in Lakhs)Ranu SinghAinda não há avaliações

- B26 (Official Form 26) (12/08) : RLF1 6305283v. 1Documento15 páginasB26 (Official Form 26) (12/08) : RLF1 6305283v. 1Chapter 11 DocketsAinda não há avaliações

- CMB Financials 10 05 2013Documento84 páginasCMB Financials 10 05 2013Siddharth Shekhar100% (1)

- Chapter 03 PenDocumento27 páginasChapter 03 PenJeffreyDavidAinda não há avaliações

- FIDL Audited Results For FY Ended 31 Dec 13Documento1 páginaFIDL Audited Results For FY Ended 31 Dec 13Business Daily ZimbabweAinda não há avaliações

- Samsung C&T 2014 - Consolidated Financial StatementsDocumento126 páginasSamsung C&T 2014 - Consolidated Financial StatementsJinay ShahAinda não há avaliações

- Reference Form (Free Translation of Formulário de Referência)Documento186 páginasReference Form (Free Translation of Formulário de Referência)MillsRIAinda não há avaliações

- 28 Consolidated Financial Statements 2013Documento47 páginas28 Consolidated Financial Statements 2013Amrit TejaniAinda não há avaliações

- Balance Sheet (Projected) : Enter Your Company Name HereDocumento1 páginaBalance Sheet (Projected) : Enter Your Company Name Hereapi-278198042Ainda não há avaliações

- Ausenco 2012 Preliminary Final ReportDocumento101 páginasAusenco 2012 Preliminary Final ReportMuhammad SalmanAinda não há avaliações

- Annual Report 2013 ShoppersDocumento70 páginasAnnual Report 2013 ShoppersRaj PatelAinda não há avaliações

- IFC AnnRep2013 Volume2 PDFDocumento134 páginasIFC AnnRep2013 Volume2 PDFcarlonewmannAinda não há avaliações

- Ennia Financial Highlights 2014 Met Accountantsverklaring KPMGDocumento1 páginaEnnia Financial Highlights 2014 Met Accountantsverklaring KPMGKnipselkrant CuracaoAinda não há avaliações

- Danish - FinancialDocumento5 páginasDanish - FinancialAtul GirhotraAinda não há avaliações

- Laporan Keuangan - Mki IchaDocumento6 páginasLaporan Keuangan - Mki IchaSempaks KoyakAinda não há avaliações

- Negros Navigation Co., Inc. and SubsidiariesDocumento48 páginasNegros Navigation Co., Inc. and SubsidiarieskgaviolaAinda não há avaliações

- Q1 2013 Investor Presentation Unlinked FINALDocumento14 páginasQ1 2013 Investor Presentation Unlinked FINALMordechai GilbertAinda não há avaliações

- Profit and Loss Account For The Year Ended 31 March, 2012Documento6 páginasProfit and Loss Account For The Year Ended 31 March, 2012Sandeep GalipelliAinda não há avaliações

- Pre q12013fsDocumento27 páginasPre q12013fsKatie SanchezAinda não há avaliações

- HW Due 022213Documento8 páginasHW Due 022213xxshoopxxAinda não há avaliações

- C Preciousmetal - Annual Results Announcement For The Year Ended 31 December 2012 PDFDocumento28 páginasC Preciousmetal - Annual Results Announcement For The Year Ended 31 December 2012 PDFalan888Ainda não há avaliações

- Consolidated Financial Statements: Auditor's ReportDocumento29 páginasConsolidated Financial Statements: Auditor's ReportPankaj DuggalAinda não há avaliações

- WCL Annual Report 2011 - 12Documento92 páginasWCL Annual Report 2011 - 12shah1703Ainda não há avaliações

- Answers March2012 f2Documento10 páginasAnswers March2012 f2Dimuthu JayawardanaAinda não há avaliações

- Sadlier WH 2009 Annual ReportDocumento17 páginasSadlier WH 2009 Annual ReportteriksenAinda não há avaliações

- FY2014 - HHI - English FS (Separate) - FIN - 1Documento88 páginasFY2014 - HHI - English FS (Separate) - FIN - 1airlanggaputraAinda não há avaliações

- Gujarat State Petronet LimitedDocumento13 páginasGujarat State Petronet LimitedAmrita Rao Bhatt100% (1)

- CPG Annual Report 2013Documento50 páginasCPG Annual Report 2013Anonymous 2vtxh4Ainda não há avaliações

- Entah LerDocumento62 páginasEntah LerNor Azizuddin Abdul MananAinda não há avaliações

- ASX Appendix 4E Results For Announcement To The Market: Ilh Group LimitedDocumento14 páginasASX Appendix 4E Results For Announcement To The Market: Ilh Group LimitedASX:ILH (ILH Group)Ainda não há avaliações

- Liquidity Ratios: Current RatioDocumento7 páginasLiquidity Ratios: Current RatioClarisse PoliciosAinda não há avaliações

- Standard Chartered PLC - Half Year 2013 Press ReleaseDocumento187 páginasStandard Chartered PLC - Half Year 2013 Press ReleaseSu JitdumrongAinda não há avaliações

- 1Q2013 AnnouncementDocumento17 páginas1Q2013 AnnouncementphuawlAinda não há avaliações

- Topic 3 Financial Statement and Financial Ratios AnalysisDocumento23 páginasTopic 3 Financial Statement and Financial Ratios AnalysisMardi Umar100% (1)

- ZVI AFS 2022 As of 03-30-2023Documento16 páginasZVI AFS 2022 As of 03-30-2023Mike SyAinda não há avaliações

- Banking Digest - IBPS ClerkDocumento37 páginasBanking Digest - IBPS ClerkSaikrupaVempatiAinda não há avaliações

- Mba 1 Sem Management Accounting 4519201 S 2019 Summer 2019 PDFDocumento4 páginasMba 1 Sem Management Accounting 4519201 S 2019 Summer 2019 PDFDeepakAinda não há avaliações

- United States Court of Appeals, Fifth CircuitDocumento10 páginasUnited States Court of Appeals, Fifth CircuitScribd Government DocsAinda não há avaliações

- Account Entries in p2p CycleDocumento2 páginasAccount Entries in p2p CycleNikhil SharmaAinda não há avaliações

- Final ExamDocumento5 páginasFinal ExamSultan LimitAinda não há avaliações

- Using The Following Instructions, Perform Accuracy Check of Lecture SlideDocumento3 páginasUsing The Following Instructions, Perform Accuracy Check of Lecture SlideAshish BhallaAinda não há avaliações

- Paper 11 PDFDocumento6 páginasPaper 11 PDFKaysline Oscar CollinesAinda não há avaliações

- CFR Full NotesDocumento84 páginasCFR Full Notespooja sonu100% (1)

- Monetary Policy and Fiscal PolicyDocumento5 páginasMonetary Policy and Fiscal PolicySurvey CorpsAinda não há avaliações

- Hola Kola Case StudyDocumento8 páginasHola Kola Case StudyAbhinandan Singh100% (1)

- Theories of Exchange RateDocumento47 páginasTheories of Exchange RateRajesh SwainAinda não há avaliações

- Tax - Dealings in PropertyDocumento18 páginasTax - Dealings in PropertyErik Paul PonceAinda não há avaliações

- Rockefeller File, TheDocumento150 páginasRockefeller File, TheElFinDelFinAinda não há avaliações

- CH 10 SM FinalcaDocumento55 páginasCH 10 SM FinalcaDania Sekar WuryandariAinda não há avaliações

- Act of 3135, As Amended by RDocumento20 páginasAct of 3135, As Amended by RRalph ValdezAinda não há avaliações

- Universiti Teknologi Mara Common Test 1: Confidential 1 AC/JAN 2017/FAR320Documento5 páginasUniversiti Teknologi Mara Common Test 1: Confidential 1 AC/JAN 2017/FAR320NURAISHA AIDA ATANAinda não há avaliações

- Vodafone Idea LTD.: Detailed QuotesDocumento21 páginasVodafone Idea LTD.: Detailed QuotesVachi VidyarthiAinda não há avaliações

- Sbi & HDFC MBA PROJECTDocumento7 páginasSbi & HDFC MBA PROJECTKartik PahwaAinda não há avaliações

- 4 - Notes Receivable Problems With Solutions: ListaDocumento21 páginas4 - Notes Receivable Problems With Solutions: Listabusiness docAinda não há avaliações

- Thrifts by StateDocumento5 páginasThrifts by StateCrypto SavageAinda não há avaliações

- JIO 102 JUNE BILL - CompressedDocumento1 páginaJIO 102 JUNE BILL - CompressedRANDHIR SINGHAinda não há avaliações

- Notes To Financial Statements Urdaneta City Water DistrictDocumento8 páginasNotes To Financial Statements Urdaneta City Water DistrictEG ReyesAinda não há avaliações

- 802818Documento2 páginas802818isabisabAinda não há avaliações

- Form Credit Application NewDocumento2 páginasForm Credit Application NewRSUD AnugerahAinda não há avaliações

- Philippine Airlines, Inc. (Pal) : General Sales Agent (Gsa) Application QuestionnaireDocumento2 páginasPhilippine Airlines, Inc. (Pal) : General Sales Agent (Gsa) Application QuestionnaireSenda SyuAinda não há avaliações

- Sandesh Stores AuditedDocumento7 páginasSandesh Stores AuditedManoj gurungAinda não há avaliações