Escolar Documentos

Profissional Documentos

Cultura Documentos

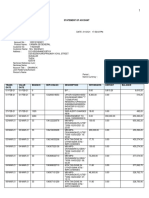

RF RM Beta Ri Actual Var RIO WES

Enviado por

Heraa22Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

RF RM Beta Ri Actual Var RIO WES

Enviado por

Heraa22Direitos autorais:

Formatos disponíveis

1

Wesfarmer invests in a wide range of markets thus make its portfolio more diversified which

explain the considerably lower Beta than Rio Tinto

Nature of business of Rio Tinto make it metals and mining which means there is considerably

more inherent risks than Wesfarmers which is Australia largest retail group

Those above factors explains Wesfarmers lower volatility which translate into lower

earnings expectation and this is an anticipated result

2

Formula: Ri = Rf + Beta * (Rm-Rf)

As we can see above, both these stocks are performing better than they are expected to, therefore

they lie above the SML and are undervalued stocks. According to this analysis, investors should buy

these shares

3

Rio Tinto is expected to generate: Ri = Rf + Beta * (Rm-Rf) = 15% return p.a

Using Dividend Discount Model to valuate Rio Tinto, the company share price is at $11.29 which is a

huge gap to the actual share price of $61 in March 2014. This variance can be explained by the

drawbacks that are inherent in the model itself:

- Not directly linked to value creation process

- Dividend decision is at Board of Directors discretion and could very well be volatile

- When used for longer-term analysis, the valuations provided by dividend discount models

take no account of the possibility of a deliberate change to a companys dividend policy. This

can further compromise the usefulness of dividend discount models over the longer term.

2/2014 1/2015 2/2015 1/2016 2/2016 1/2017 2/2017 1/2018 2/2018 1/2019 2/2019

Dividend Discount Model

1. Di vi dend

(cents) 120.14 155.20 200.48 258.98 334.56 432.18 558.29 721.20 931.64 1203.50 1554.68

2. Esti mated cost of capi tal for equi ty 15.00% 1.08 1.15 1.23 1.32 1.42 1.52 1.64 1.76 1.89 2.03

3. Di vi dend growth pattern 29.18% 29.18% 29.18% 29.18% 29.18% 29.18% 12.00% 12.00% 12.00% 12.00%

4. Termi nal Val ue of Di vi dend 31,054.79

5. Di scount di vi dend stream 1,897.16 144.37 174.33 211.42 254.05 305.29 366.86 440.84

Di scount TV 18,982.73

Equi ty Val ue ($m) 20,879.89

Total No. of Share Outstandi ng (m) 1,849.67

Share pri ce 11.29 $

Rio Tinto Valuation

Rf 0.08

Rm 0.15

Beta Ri Actual Var

RIO 1.29 0.1703 0.174 0.37%

WES 0.68 0.1276 0.138 1.04%

- Dividend discount models rely heavily on the validity of the data inputs, making them of

questionable value given the challenges associated with accurately forecasting growth rates

beyond five or so years.

Você também pode gostar

- Beyond Smart Beta: Index Investment Strategies for Active Portfolio ManagementNo EverandBeyond Smart Beta: Index Investment Strategies for Active Portfolio ManagementAinda não há avaliações

- Derivatives and Risk ManagementDocumento136 páginasDerivatives and Risk Managementabbas ali100% (3)

- The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsNo EverandThe Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsNota: 4.5 de 5 estrelas4.5/5 (4)

- Valuationtemplatev6 0Documento47 páginasValuationtemplatev6 0Quofi SeliAinda não há avaliações

- Valuationtemplatev6 0Documento66 páginasValuationtemplatev6 0nschanderAinda não há avaliações

- Marriott Corporation: The Cost of CapitalDocumento43 páginasMarriott Corporation: The Cost of CapitalShamsuzzaman SunAinda não há avaliações

- Deutsche VerificationDocumento1 páginaDeutsche VerificationtobyallchurchAinda não há avaliações

- Mergers and AquisationsDocumento10 páginasMergers and AquisationsNeeraj KumarAinda não há avaliações

- Dividend Decesion: A Strategic PerspectiveDocumento34 páginasDividend Decesion: A Strategic PerspectivePrashant MittalAinda não há avaliações

- Sears, Roebuck and Co. vs. Wal-Mart Stores, IncDocumento2 páginasSears, Roebuck and Co. vs. Wal-Mart Stores, IncJBAinda não há avaliações

- The Dupont Chart As An Analysis and Reporting Tool: Click Mouse To View SlidesDocumento5 páginasThe Dupont Chart As An Analysis and Reporting Tool: Click Mouse To View SlidesTilakAinda não há avaliações

- Finding The Right Financing Mix: The Capital Structure DecisionDocumento27 páginasFinding The Right Financing Mix: The Capital Structure DecisionSebastian HungAinda não há avaliações

- 21IB334 Shivanshu Sharma MMDocumento5 páginas21IB334 Shivanshu Sharma MMSHIVANSHUAinda não há avaliações

- TTK Prestige Research ReportDocumento22 páginasTTK Prestige Research Reportsujay85Ainda não há avaliações

- STOCKS TO WATCH 2023-09-1 v1Documento8 páginasSTOCKS TO WATCH 2023-09-1 v1Solomon MainaAinda não há avaliações

- FXCM Q1 2014 Earnings PresentationDocumento21 páginasFXCM Q1 2014 Earnings PresentationRon FinbergAinda não há avaliações

- Earnings Presentation Q3 FY20Documento26 páginasEarnings Presentation Q3 FY20Bruno Enrique Silva AndradeAinda não há avaliações

- Tax Assessment Hearing PresentationDocumento15 páginasTax Assessment Hearing PresentationJamesOddoAinda não há avaliações

- Financial Analysis (Detail)Documento68 páginasFinancial Analysis (Detail)Paulo NascimentoAinda não há avaliações

- Wealth MaximisationDocumento4 páginasWealth MaximisationSanthosh MathewAinda não há avaliações

- (FINANCE) Gabungan Solution Damodaran Book PDFDocumento115 páginas(FINANCE) Gabungan Solution Damodaran Book PDFJarjitUpinIpinJarjitAinda não há avaliações

- AnswersDocumento7 páginasAnswersasus.mediahubAinda não há avaliações

- FullertonDocumento15 páginasFullertonSuman MandalAinda não há avaliações

- Q2 2022 LLIN CommentaryDocumento6 páginasQ2 2022 LLIN CommentaryTay YisiongAinda não há avaliações

- Walmart Case: II. Estimate The Weighted Average Cost of Capital (WACC) of WalmartDocumento4 páginasWalmart Case: II. Estimate The Weighted Average Cost of Capital (WACC) of Walmartburin0609Ainda não há avaliações

- Invt Chapter 2Documento29 páginasInvt Chapter 2Bayaan AhmedAinda não há avaliações

- ValuEngine Weekly NewsletterDocumento14 páginasValuEngine Weekly NewsletterValuEngine.comAinda não há avaliações

- Gurgoan: Gurgoan College of EngineeringDocumento40 páginasGurgoan: Gurgoan College of Engineeringriya0yadavAinda não há avaliações

- American Vanguard Corporation (Security AnaylisisDocumento18 páginasAmerican Vanguard Corporation (Security AnaylisisMehmet SahinAinda não há avaliações

- Saunders & Cornnet Solution Chapter 2 Part 1Documento5 páginasSaunders & Cornnet Solution Chapter 2 Part 1Mo AlamAinda não há avaliações

- Fbe 421: Financial Analysis & Valuation: Leveraged Buyouts (Lbos)Documento40 páginasFbe 421: Financial Analysis & Valuation: Leveraged Buyouts (Lbos)Dinhkhanh NguyenAinda não há avaliações

- Chapter 8 - Financial AnalysisDocumento36 páginasChapter 8 - Financial AnalysisSameh EldosoukiAinda não há avaliações

- Indian Derivative Markets Future Prospects: CAPAM 2003 August 7, 2003Documento27 páginasIndian Derivative Markets Future Prospects: CAPAM 2003 August 7, 2003api-19739167Ainda não há avaliações

- SiTime - 회사소개서 Investor Presentation - 2023Documento29 páginasSiTime - 회사소개서 Investor Presentation - 2023천일계전Ainda não há avaliações

- FTSE-100 Valuation ReportDocumento16 páginasFTSE-100 Valuation ReportSumantha SahaAinda não há avaliações

- CF FinalDocumento9 páginasCF FinalRaniAinda não há avaliações

- MonmouthDocumento25 páginasMonmouthPerci LunarejoAinda não há avaliações

- Financial Ration Analysis: 2. Trend Analysis: 3. Comparative Analysis: VNM - Summary of Financial Ratios in 2020Documento4 páginasFinancial Ration Analysis: 2. Trend Analysis: 3. Comparative Analysis: VNM - Summary of Financial Ratios in 2020Nguyễn Hoàng ĐiệpAinda não há avaliações

- By: Kevin Yee Goh Jian JunDocumento20 páginasBy: Kevin Yee Goh Jian JunYong RenAinda não há avaliações

- Equity ValuationDocumento53 páginasEquity ValuationDevanshi ShahAinda não há avaliações

- Final Practice Questions and SolutionsDocumento12 páginasFinal Practice Questions and Solutionsshaikhnazneen100Ainda não há avaliações

- Titan Company by Anuj GuptaDocumento25 páginasTitan Company by Anuj GuptaHIMANSHU RAWATAinda não há avaliações

- MS Fins & REITs Morning BrewDocumento6 páginasMS Fins & REITs Morning BrewLuanAinda não há avaliações

- IT Sector Update 24-09-12Documento20 páginasIT Sector Update 24-09-12Pritam WarudkarAinda não há avaliações

- Case 2Documento5 páginasCase 2Karina Taype NunuraAinda não há avaliações

- Conservative Composite 2QTR 2012Documento2 páginasConservative Composite 2QTR 2012jai6480Ainda não há avaliações

- FSA Sears Vs WalmartDocumento8 páginasFSA Sears Vs WalmartAbhishek Maheshwari100% (2)

- Systematically Trading FX Mean Reversion in The Long Run 1680234492Documento32 páginasSystematically Trading FX Mean Reversion in The Long Run 1680234492Jaehyun KimAinda não há avaliações

- Effect of Liquidity On Size PremiumDocumento39 páginasEffect of Liquidity On Size PremiumfulconAinda não há avaliações

- American Airline Case StudyDocumento10 páginasAmerican Airline Case StudyFathi Salem Mohammed Abdullah100% (5)

- Risk ReturnDocumento27 páginasRisk ReturnPrasaad TayadeAinda não há avaliações

- PL FM S15 STUDENT Mark Plan WEBDocumento8 páginasPL FM S15 STUDENT Mark Plan WEBJusefAinda não há avaliações

- Corporate Valuation Mod IDocumento29 páginasCorporate Valuation Mod IRavichandran RamadassAinda não há avaliações

- Martingale Bet Sizing in DrawdownsDocumento4 páginasMartingale Bet Sizing in DrawdownsBuzz GordonAinda não há avaliações

- SSRN Id1930018Documento6 páginasSSRN Id1930018Brian LoAinda não há avaliações

- DissertationDocumento37 páginasDissertationpoorvibht12Ainda não há avaliações

- The Examiner's Answers For Financial Strategy: Section ADocumento18 páginasThe Examiner's Answers For Financial Strategy: Section Amagnetbox8Ainda não há avaliações

- Dmp3e Ch05 Solutions 02.28.10 FinalDocumento37 páginasDmp3e Ch05 Solutions 02.28.10 Finalmichaelkwok1Ainda não há avaliações

- Assignment - VaR - Final VersionDocumento10 páginasAssignment - VaR - Final VersionLalitAinda não há avaliações

- ValuEngine Weekly Newsletter March 30, 2010Documento15 páginasValuEngine Weekly Newsletter March 30, 2010ValuEngine.comAinda não há avaliações

- FINM400 Finance Assignment and Instructions T2 2014Documento10 páginasFINM400 Finance Assignment and Instructions T2 2014Heraa22Ainda não há avaliações

- Violence in Sport PDFDocumento54 páginasViolence in Sport PDFFPOLOAinda não há avaliações

- 18 98Documento89 páginas18 98Heraa22Ainda não há avaliações

- Bank Reconciliation PerdiscoDocumento8 páginasBank Reconciliation Perdiscoabhii10238% (24)

- Perdisco WEEK2Documento4 páginasPerdisco WEEK2Heraa22100% (1)

- Perdisco WEEK3Documento5 páginasPerdisco WEEK3malhar11100% (2)

- Perdisco WEEK2Documento4 páginasPerdisco WEEK2Heraa22100% (1)

- Professional AuthorityDocumento1 páginaProfessional AuthorityHeraa22Ainda não há avaliações

- Sexual Violenc and Primary PreventionDocumento16 páginasSexual Violenc and Primary PreventionHeraa22Ainda não há avaliações

- Allied Food Products Capital Budgeting and Cash Flow Estimation Case SolutionDocumento23 páginasAllied Food Products Capital Budgeting and Cash Flow Estimation Case SolutionAsad Sheikh89% (18)

- Accounts ReceivableDocumento23 páginasAccounts ReceivableAbby MendozaAinda não há avaliações

- ASSESSMENT Two ContempoDocumento7 páginasASSESSMENT Two ContempoJackie Lou RomeroAinda não há avaliações

- Banking Amendment Act 2012Documento26 páginasBanking Amendment Act 2012jaspreet444Ainda não há avaliações

- Delta Brac Housing Profitability AnalysisDocumento22 páginasDelta Brac Housing Profitability AnalysisRezoan FarhanAinda não há avaliações

- FIE400E 2016 Spring SolutionsDocumento4 páginasFIE400E 2016 Spring SolutionsSander Von Porat BaugeAinda não há avaliações

- Assignment 4Documento2 páginasAssignment 4Cheung HarveyAinda não há avaliações

- Macroeconomics: Case Fair OsterDocumento26 páginasMacroeconomics: Case Fair OsterMikhel BeltranAinda não há avaliações

- Chapter 08 Aggregate Demand and Supply HW Attempt 4Documento5 páginasChapter 08 Aggregate Demand and Supply HW Attempt 4PatAinda não há avaliações

- Brigham & Ehrhardt: Financial Management: Theory and Practice 14eDocumento53 páginasBrigham & Ehrhardt: Financial Management: Theory and Practice 14eSamah Refa'tAinda não há avaliações

- The Rich FoolDocumento26 páginasThe Rich FoolSTEVEN TULAAinda não há avaliações

- Delivery Address Billing Address: Invoice Number Invoice Date Order Reference Order DateDocumento1 páginaDelivery Address Billing Address: Invoice Number Invoice Date Order Reference Order DateTaj Md SunnyAinda não há avaliações

- Abbott Company and Its Financial Statement Analysis Using Ratios Abbott CompanyDocumento17 páginasAbbott Company and Its Financial Statement Analysis Using Ratios Abbott CompanyMaryam EjazAinda não há avaliações

- Sample SM Cases CF Ross 13Documento4 páginasSample SM Cases CF Ross 13Daniel Alonso Ochoa GordónAinda não há avaliações

- Report - Solar Power Plant - Financial Modeling PrimerDocumento48 páginasReport - Solar Power Plant - Financial Modeling Primeranimeshsaxena83100% (3)

- Risk Management - Tutorial 4Documento7 páginasRisk Management - Tutorial 4chziAinda não há avaliações

- Pakistan Data Sheet - Ecomm 2020Documento5 páginasPakistan Data Sheet - Ecomm 2020Meekal AAinda não há avaliações

- Unit 1Documento10 páginasUnit 1AlfatihahAinda não há avaliações

- SecuritizationDocumento15 páginasSecuritizationAnkit LakhotiaAinda não há avaliações

- Revision Question Mid Semester Exam (Lecturer Copy)Documento14 páginasRevision Question Mid Semester Exam (Lecturer Copy)ntyn1904Ainda não há avaliações

- Basic Concept of Macro Economics: Unit 1Documento31 páginasBasic Concept of Macro Economics: Unit 1Roxanne OsalboAinda não há avaliações

- Howework 1 FFMDocumento7 páginasHowework 1 FFMparikshat7Ainda não há avaliações

- Investment Banking Using ExcelDocumento2 páginasInvestment Banking Using Excelrex_pprAinda não há avaliações

- Trading System in Stock ExchangeDocumento19 páginasTrading System in Stock ExchangeMohan KumarAinda não há avaliações

- Citibank: Launching The Credit Card in Asia Pacific: Erica Baumann Paul Davis Nathan Hahn Rebecca Leeds Lauren LettieriDocumento30 páginasCitibank: Launching The Credit Card in Asia Pacific: Erica Baumann Paul Davis Nathan Hahn Rebecca Leeds Lauren Lettierisiddus1Ainda não há avaliações

- Tutorial 4 (4.2,4.3,4.4), 5, and 6Documento6 páginasTutorial 4 (4.2,4.3,4.4), 5, and 6Syahirah IibrahimAinda não há avaliações

- Financial Statement Analysis and Security Valuation: - September 28, 2022 Arnt VerriestDocumento89 páginasFinancial Statement Analysis and Security Valuation: - September 28, 2022 Arnt VerriestfelipeAinda não há avaliações

- It-Form 2020 GPF S.samuel Selvaraj B.SC, M.a.,b.ed., Science BT, Coimbatore-38 DownloadDocumento16 páginasIt-Form 2020 GPF S.samuel Selvaraj B.SC, M.a.,b.ed., Science BT, Coimbatore-38 DownloadMurugesan UmaAinda não há avaliações

- Statement of AccountDocumento5 páginasStatement of Accountmutaia pandian100% (1)