Escolar Documentos

Profissional Documentos

Cultura Documentos

Solution Chap 2 and 3

Enviado por

maylee01050 notas0% acharam este documento útil (0 voto)

146 visualizações20 páginas“Accounting for Governmental and Nonprofit Entities”, 16th ed., 2013, by Reck, Lowensohn and Wilson, McGraw-Hill-Irwin

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documento“Accounting for Governmental and Nonprofit Entities”, 16th ed., 2013, by Reck, Lowensohn and Wilson, McGraw-Hill-Irwin

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

146 visualizações20 páginasSolution Chap 2 and 3

Enviado por

maylee0105“Accounting for Governmental and Nonprofit Entities”, 16th ed., 2013, by Reck, Lowensohn and Wilson, McGraw-Hill-Irwin

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 20

Acct 522 81 E September 16 Fall, 2014 Wilson

Chapter Three: Q 2; and, E 5, 6, and 7, and Chapter Four: E 4, 5, 6, 7, 9, and 10.

3-2. Using the net (expense) or revenue format recommended by GASB standards requires reporting

of expenses that are directly related to a function or program on the same line as that function or

program. Indirect expenses, those that are not directly related to a function or program, such as

interest on long-term debt, should be reported on a separate line. It is important to correctly

identify the nature of the expenses so they will be reported on the line of the right function or

program, or as a separate line item. Otherwise, incorrect amounts will be reported for particular

functions/program costs.

3-5. City of Jackson

a. Estimated revenues totalFY 2014 $ 4,650,000

Appropriations totalFY 2014 4,850,000

Therefore, unassigned fund balances at the

end of FY 2013 must be at least $ (200,000)

or else the fund would be thrown into a deficit.

General Ledger Subsidiary Ledger

Debits Credits Debits Credits

b. ESTIMATED REVENUES 4,650,000

BUDGETARY FUND

BALANCE 200,000

APPROPRIATIONS 4,850,000

Estimated Revenues Ledger:

TAXES 3,000,000

INTERGOVERNMENTAL REVENUES 1,000,000

LICENSES AND PERMITS 400,000

FINES AND FORFEITS 150,000

MISCELLANEOUS REVENUES 100,000

Appropriations Ledger:

GENERAL GOVERNMENT 1,000,000

PUBLIC SAFETY 2,000,000

PUBLIC WORKS 950,000

HEALTH AND WELFARE 850,000

MISCELLANEOUS 50,000

3-6. City of Jackson (Contd)

General Ledger Subsidiary Ledger

Debits Credits Debits Credits

a. ENCUMBRANCES2014 395,000

ENCUMBRANCES

OUTSTANDING2014 395,000

Encumbrances Ledger:

GENERAL GOVERNMENT 50,000

PUBLIC SAFETY 200,000

PUBLIC WORKS 75,000

HEALTH AND WELFARE 65,000

MISCELLANEOUS 5,000

b. Purchase orders issued by a governmental fund have the effect of using all or a portion of one

or more appropriations for that fund. Issuance of purchase orders or other commitment

documents is a step in the expenditure of an appropriation; administrators may be subject to

legal penalties if they expend more resources than were appropriated. Recording

encumbrances helps administrators avoid over-expending appropriations.

The same legal issues do not exist in business organizations, although a well-managed business

should certainly keep track of outstanding purchase orders and contracts to have a clear

understanding of what transactions are in process that will result in the acquisition of assets,

the incurring of expenses, and the incurring of liabilities.

3-7.

General Ledger Subsidiary Ledger

Debits Credits Debits Credits

a. ESTIMATED REVENUES 2,700,000

BUDGETARY FUND

BALANCE 50,000

APPROPRIATIONS 2,650,000

Estimated Revenues Ledger:

TAXES 1,900,000

LICENSES AND PERMITS 350,000

FINES AND FORFEITS 250,000

INTERGOVERNMENTAL

REVENUES 200,000

Appropriations Ledger:

GENERAL GOVERNMENT 500,000

PUBLIC SAFETY 1,600,000

PUBLIC WORKS 350,000

PARKS AND RECREATION 150,000

MISCELLANEOUS 50,000

b.

General Ledger Subsidiary Ledger

Debits Credits Debits Credits

1. CASH 43,000

REVENUES 43,000

Revenues Ledger:

LICENSES AND PERMITS 31,000

FINES AND FORFEITS 12,000

General Ledger Subsidiary Ledger

Debits Credits Debits Credits

2. ENCUMBRANCES2014 29,900

ENCUMBRANCES

OUTSTANDING2014 29,900

Encumbrances Ledger:

GENERAL GOVERNMENT 7,400

PUBLIC SAFETY 11,300

PUBLIC WORKS 6,100

PARKS AND RECREATION 4,200

MISCELLANEOUS 900

3. ENCUMBRANCES

OUTSTANDING2014 29,100

ENCUMBRANCES2014 29,100

EXPENDITURES2014 29,200

CASH 29,200

Encumbrances Ledger:

GENERAL GOVERNMENT 7,400

PUBLIC SAFETY 10,700

PUBLIC WORKS 5,900

PARKS AND RECREATION 4,200

MISCELLANEOUS 900

Expenditures Ledger:

GENERAL GOVERNMENT 7,300

PUBLIC SAFETY 10,800

PUBLIC WORKS 6,100

PARKS AND RECREATION 4,100

MISCELLANEOUS 900

c. CALCULATION OF BUDGETED BUT UNREALIZED REVENUES

AS OF JULY 31, 2013

UNREALIZED

SOURCE BUDGETED ACTUAL REVENUE

PROPERTY TAXES $1,900,000 $ -0- $1,900,000

LICENSES AND PERMITS 350,000 31,000 319,000

FINES AND FORFEITS 250,000 12,000 238,000

INTERGOVERNMENTAL 200,000 -0- 200,000

TOTAL $2,700,000 $43,000 $2,657,000

d. CALCULATION OF AVAILABLE APPROPRIATIONS, AS OF JULY 31, 2013

AVAILABLE

APPROPRIATIONS ENCUMBRANCES EXPENDITURES APPROPRIATIONS

GENERAL GOVERNMENT $ 500,000 $ -0- $ 7,300 $ 492,700

PUBLIC SAFETY 1,600,000 600 10,800 1,588,600

PUBLIC WORKS 350,000 200 6,100 343,700

PARKS AND RECREATION 150,000 -0- 4,100 145,900

MISCELLANEOUS 50,000 -0- 900 49,100

TOTAL $2,650,000 $800 $29,200 $2,620,000

Chapter Four: E 4, 5, 6, 7, 9, and 10.

4-4. Village of Darby

a. Revenues = levy (.03 X levy) = .97 X levy = $2,660,000

Levy = $2,660,000 .97 = $2,742,268 (rounded to nearest dollar)

Rate X (assessed valuation 100) = levy

Rate = levy (assessed valuation 100)

Rate = $2,742,268 1,357,143 = $2.02 per $100 of assessed valuation

Debits Credits

b. TAXES RECEIVABLECURRENT 2,742,268

ESTIMATED UNCOLLECTIBLE CURRENT TAXES 82,268

REVENUES 2,660,000

c. CASH 2,540,000

TAXES RECEIVABLECURRENT 2,540,000

TAXES RECEIVABLEDELINQUENT 202,268

TAXES RECEIVABLECURRENT 202,268

ESTIMATED UNCOLLECTIBLE CURRENT TAXES 82,268

ESTIMATED UNCOLLECTIBLE DELINQUENT

TAXES 82,268

INTEREST AND PENALTIES RECEIVABLE 12,136

ESTIMATED UNCOLLECTIBLE INTEREST

AND PENALTIES 1,214

REVENUES 10,922

4-5. a. City of Troy

Calculation of Estimated Required

Tax Anticipation Financing

Estimated Expenditure Requirements:

Budgeted expenditures, remainder of FY 2014 $2,500,000

Current liabilities payable 830,000 $3,330,000

Estimated Resources Available:

Cash on hand, April 1, 2014 770,000

Collections of budgeted FY 2014 revenues

and delinquent property taxes, including

interest and penalties 1,100,000 1,870,000

Estimated Amount of Required Tax

Anticipation Note Financing $1,460,000

b. General Fund and Governmental Activities: Debits Credits

CASH 1,460,000

TAX ANTICIPATION NOTES PAYABLE 1,460,000

b. General Fund:

TAX ANTICIPATION NOTES PAYABLE 1,460,000

EXPENDITURES2014 43,800

CASH 1,503,800

Governmental Activities:

TAX ANTICIPATION NOTES PAYABLE 1,460,000

EXPENSESGENERAL GOVERNMENT 43,800

CASH 1,503,800

(Note: Interest on notes is $1,460,000 X .06 X 6/12

=$43,800)

4-6. CITY OF MARSHALL

GENERAL JOURNAL

Debits Credits

a. General Fund:

INVENTORY OF SUPPLIES 12,000

FUND BALANCENONSPENDABLE

INVENTORY OF SUPPLIES 12,000

b. General Fund:

APPROPRIATIONS 6,224,000

ESTIMATED OTHER FINANCING USES 2,776,000

ESTIMATED REVENUES 7,997,000

BUDGETARY FUND BALANCE 1,003,000

REVENUES 7,980,000

FUND BALANCEUNASSIGNED 982,000

EXPENDITURES 6,192,000

OTHER FINANCING USES 2,770,000

4-7. CITY OF SMITHTON

GENERAL JOURNAL

(1) May 1, 2014

Debits Credits

DUE FROM STATE GOVERNMENT 200,000

DEFERRED REVENUES 200,000

(Note: There are no eligibility requirements stipulated in the

grant. Thus, the grant can be recorded upon

notification. There are, however, time requirements

that half of the grant is to be used in each of the

2015 and 2016 fiscal years. Therefore, revenues

cannot be recognized until the period for which

use of the grant is intended.)

(2) July 1, 2014

CASH 100,000

DUE FROM STATE GOVERNMENT 100,000

DEFERRED REVENUES 100,000

REVENUES 100,000

(3) During FY 2015

EXPENDITURES 90,000

VOUCHERS PAYABLE (or CASH) 90,000

(4) July 1, 2015

Same entries as part (2).

4-9. a. CITY OF ATWATER

Debits Credits

1. General Fund:

EXPENDITURES 100,000

CASH 100,000

Governmental Activities:

EXPENSESPUBLIC SAFETY 100,000

CASH 100,000

Enterprise Fund:

CASH 100,000

REVENUES 100,000

2. General Fund:

CASH 500

EXPENDITURES 500

Governmental Activities:

A

CASH 500

EXPENSESGENERAL GOVERNMENT 500

Note A: There is no business-type activities ledger since the government-wide data

will be the same as that of the enterprise fund.

Debits Credits

Enterprise Fund:

SUPPLIES EXPENSE 500

CASH 500

3. General Fund:

INTERFUND LOANS RECEIVABLE

NONCURRENT 50,000

CASH 50,000

FUND BALANCEUNASSIGNED 50,000

FUND BALANCENONSPENDABLE

NONCURRENT INTERFUND LOANS

RECEIVABLE 50,000

Governmental Activities: NO EFFECT

Internal Service Fund:

CASH 50,000

INTERFUND LOANS PAYABLE

NONCURRENT 50,000

4. General Fund:

OTHER FINANCING USESINTERFUND

TRANSFERS OUT 100,000

CASH 100,000

Governmental Activities: NO EFFECT

Debt Service Fund:

CASH 100,000

OTHER FINANCING SOURCES

INTERFUND TRANSFERS IN 100,000

)

Debits Credits

5. General Fund:

CASH 5,000

OTHER FINANCING SOURCES

INTERFUND TRANSFERS IN 5,000

Governmental Activities:

NO EFFECT

Capital Projects Fund:

OTHER FINANCING USES

INTERFUND TRANSFERS OUT 5,000

CASH 5,000

b. Proprietary funds, such as the enterprise fund, measure total economic resources using the

accrual basis of accounting. Since this is the same measurement focus and basis of accounting

used at the government-wide level, there would be no difference between entries in the

enterprise fund and a business-type activities journal. Note that although the internal service

funds are proprietary funds focusing on total economic resources using the accrual basis of

accounting, they are combined with governmental activities if they predominantly provide

services to departments within the government rather than to enterprise funds.

4-10. a. CITY OF HINTON

JOURNAL ENTRIES FY 2014

Debits Credits

General Fund:

(1) ESTIMATED REVENUES 3,140,000

APPROPRIATIONS 3,100,000

BUDGETARY FUND BALANCE 40,000

General Fund:

(2) CASH 490,000

EXPENDITURES2014 10,000

TAX ANTICIPATION NOTES PAYABLE 500,000

(COMPUTATION OF DISCOUNT: $500,000 X .06 X 1/3 YEAR = $10,000.)

Governmental Activities:

CASH 490,000

EXPENSESGENERAL GOVERNMENT 10,000

TAX ANTICIPATION NOTES PAYABLE 500,000

Debits Credits

General Fund:

(3) TAXES RECEIVABLECURRENT 2,150,000

ESTIMATED UNCOLLECTIBLE CURRENT

TAXES 64,500

REVENUES 2,085,500

(COMPUTATIONS: $43,000,000 ASSESSED VALUATION X $5 TAX RATE PER $100 = $2,150,000 GROSS

LEVY; $2,150,000 GROSS LEVY X .03 = $64,500 ESTIMATED UNCOLLECTIBLE.)

Governmental Activities:

TAXES RECEIVABLECURRENT 2,150,000

ESTIMATED UNCOLLECTIBLE CURRENT

TAXES 64,500

GENERAL REVENUESPROPERTY TAXES 2,085,500

General Fund:

(4) ENCUMBRANCES2014 2,060,000

ENCUMBRANCES OUTSTANDING2014 2,060,000

General Fund and Governmental Activities:

(5) TAXES RECEIVABLECURRENT 25,000

REVENUES (General Revenues in Governmental Activities) 25,000

($500,000 X $5 PER $100 OF VALUATION)

General Fund and Governmental Activities:

(6) CASH 2,364,840

TAXES RECEIVABLECURRENT 1,961,000

TAXES RECEIVABLEDELINQUENT 383,270

INTEREST AND PENALTIES RECEIVABLE 20,570

)

Debits Credits

General Fund:

(7) INTEREST AND PENALTIES RECEIVABLE 38,430

ESTIMATED UNCOLLECTIBLE INTEREST

AND PENALTIES 11,529

REVENUES 26,901

Governmental Activities:

INTEREST AND PENALTIES RECEIVABLE 38,430

ESTIMATED UNCOLLECTIBLE INTEREST

AND PENALTIES 11,529

GENERAL REVENUESINTEREST AND

PENALTIES ON DELINQUENT TAXES 26,901

General Fund:

(8) BUDGETARY FUND BALANCE 80,000

ESTIMATED REVENUES 80,000

(THIS ENTRY ADJUSTS THE ORIGINAL BUDGETARY INCREASE OF $40,000 IN BUDGETARY FUND BALANCE

TO A NET DECREASE OF $40,000.)

General Fund:

(9) EXPENDITURES2014 819,490

DUE TO FEDERAL GOVERNMENT 166,400

DUE TO STATE GOVERNMENT 34,400

CASH 618,690

Governmental Activities:

EXPENSES (function details omitted) 819,490

DUE TO FEDERAL GOVERNMENT 166,400

DUE TO STATE GOVERNMENT 34,400

CASH 618,690

Debits Credits

General Fund:

(10) EXPENDITURES2014 62,690

DUE TO FEDERAL GOVERNMENT 62,690

Governmental Activities:

EXPENSES(function details omitted) 62,690

DUE TO FEDERAL GOVERNMENT 62,690

General Fund:

(11) CASH 947,000

REVENUES 947,000

Governmental Activities:

CASH 947,000

REVENUES(itemize as program

or general and by source) 947,000

General Fund and Governmental Activities:

(12) DUE TO FEDERAL GOVERNMENT 288,580

DUE TO STATE GOVERNMENT 34,400

VOUCHERS PAYABLE 322,980

General Fund:

(13) ENCUMBRANCES OUTSTANDING2014 1,988,040

ENCUMBRANCES2014 1,988,040

EXPENDITURES2014 1,987,570

VOUCHERS PAYABLE 1,987,570

Governmental Activities:

EXPENSES(function details omitted) 1,987,570

VOUCHERS PAYABLE 1,987,570

Debits Credits

General Fund:

(14) VOUCHERS PAYABLE 2,301,660

CASH 2,293,630

EXPENDITURES2014 8,030

Governmental Activities:

VOUCHERS PAYABLE 2,301,660

CASH 2,293,630

EXPENSES(function detail omitted) 8,030

General Fund and Governmental Activities:

(15) TAX ANTICIPATION NOTES PAYABLE 500,000

CASH 500,000

General Fund and Governmental Activities:

(16) TAXES RECEIVABLEDELINQUENT 214,000

TAXES RECEIVABLECURRENT 214,000

ESTIMATED UNCOLLECTIBLE CURRENT

TAXES 64,500

ESTIMATED UNCOLLECTIBLE

DELINQUENT TAXES 64,500

General Fund:

(17) INVENTORY OF SUPPLIES 3,000

FUND BALANCENONSPENDABLE

INVENTORY OF SUPPLIES 3,000

Governmental Activities:

INVENTORY OF SUPPLIES 3,000

EXPENSES (Function details omitted) 3,000

Debits Credits

b. CLOSING ENTRIES, APRIL 30, 2014

General Fund:

APPROPRIATIONS 3,100,000

ESTIMATED REVENUES 3,060,000

BUDGETARY FUND BALANCE 40,000

REVENUES 3,084,401

EXPENDITURES2014 2,871,720

FUND BALANCEUNASSIGNED 212,681

Governmental Activities:

(Not closed here since the governmental activities general ledger includes operating

statement transactions related to all governmental funds, not just those of the General Fund.

See Chapter 9 for an example of closing the governmental activities temporary accounts.)

c.

CITY OF HINTON

GENERAL FUND BALANCE SHEET

AS OF APRIL 30, 2014

ASSETS

CASH $ 486,520

TAXES RECEIVABLEDELINQUENT $413,730

LESS: ESTIMATED UNCOLLECTIBLE

TAXESDELINQUENT 253,500 160,230

INTEREST AND PENALTIES RECEIVABLE 44,140

LESS: ESTIMATED UNCOLLECTIBLE

INTEREST AND PENALTIES 22,689 21,451

INVENTORY OF SUPPLIES 19,100

TOTAL ASSETS $ 687,301

LIABILITIES AND FUND BALANCES

LIABILITIES:

VOUCHERS PAYABLE $157,390

FUND BALANCES:

NONSPENDABLEINVENTORY

OF SUPPLIES $ 19,100

UNASSIGNED 510,811

TOTAL FUND BALANCES 529,911

TOTAL LIABILITIES AND FUND BALANCES $ 687,301

d. CITY OF HINTON

GENERAL FUND

STATEMENT OF REVENUES, EXPENDITURES, AND

CHANGES IN FUND BALANCE

FOR THE YEAR ENDED APRIL 30, 2014

REVENUES

TAXES $2,110,500

INTEREST AND PENALTIES ON TAXES 26,901

OTHER SOURCES 947,000

TOTAL REVENUES 3,084,401

EXPENDITURES

SALARIES AND WAGES 882,180

INTEREST ON NOTE PAYABLE 10,000

OTHER 1,979,540

TOTAL EXPENDITURES 2,871,720

EXCESS OF REVENUES OVER EXPENDITURES 212,681

INCREASE IN INVENTORY OF SUPPLIES 3,000

FUND BALANCES, MAY 1, 2013 314,230

FUND BALANCES, APRIL 30, 2014 $ 529,911

Computations:

Taxes = [4-10(3) 2,085,500 + 4-10(5) 25,000]

Interest and Penalties on Taxes = [4-10(7) 26,901]

Other Sources = [4-10(11) 946,700]

Salaries and Wages = [4-10(9) 819,490 + 4-10(10) 62,690]

Interest on Notes Payable = [4-10(2) $10,000]

Other = [4-10(13) 1,987,570 - 4-10(14) 8030]

NOTE: The Governmental Activities general ledger is not shown here.

CITY OF HINTON

General Fund

General Ledger (Not Required)

Cash Interest and Penalties Rec.__ ____

5/1/2013 Bal. 97,000 4-10(9) 618,690 5/1/2013 Bal.26,280 4-10(6) 20,570

4-10(2) 490,000 4-10(14) 2,293,630 4-10(7) 38,430

4-10(6) 2,364,840 4-10(15) 500,000 4/30/2014 Bal 44,140

4-10(11) 947,000

4/30/2014 Bal. 486,520

Taxes ReceivableCurrent Est. Uncollectible Interest & Penalties _

4-10(3) 2,150,000 4-10(6) 1,961,000 5/1/2013 Bal. 11,160

4-10(5) 25,000 4-10(16) 214,000 4-10(7) 11,529

4/30/2014 Bal. -0- 4/30/2014 Bal. 22,689

Est. Uncollectible Current Taxes Inventory of Supplies_________

4-10(16) 64,500 4-10(3) 64,500 5/1/2013 Bal.16,100

4/30/2014 Bal. -0- 4-10(17) 3,000

4/30/2014 Bal. 19,100

Taxes ReceivableDelinquent

5/1/2013 Bal. 583,000 4-10(6) 383,270

4-10(15) 214,000

4/30/2014 Bal. 413,730

Est. Uncollectible Delinquent Taxes Vouchers Payable___________

5/1/2013 Bal.189,000 4-10(14) 2,301,660 5/1/2013 Bal 148,500

4-10(16) 64,500 4-10(12) 322,980

4/30/2014 Bal. 253,500 4-10(13) 1,987,570 4-10(13) 1,987,570

4/30/2014 Bal. 157,390

Due to Federal Government Revenues____________

4-10(12) 288,580 5/1/2013 Bal. 59,490 4-10. b 3,084,401 4-10(3) 2,085,500

4-10(9) 166,400 4-10(5) 25,000

4-10(10) 62,690 4-10(7) 26,901

4/30/2014 Bal. -0- 4-10(11) 947,000

Due to State Government Expenditures2014_________

4-10(12) 34,400 4-10(9) 34,400 4-10(2) 10,000 4-10(14) 8,030

4/30/2014 Bal. -0- 4-10(9) 819,490 4-10. b 2,871,720

4-10(10) 62,690

4-10(13) 1,987,570

Tax Anticipation Notes Payable

4-10 (15) 500,000 4-10 (2) 500,000

4/30/2014 Bal. -0-

Fund BalanceNonspendable

Fund BalanceUnassigned ____Inventory of Supplies _

5/1/2013 Bal. 298,130 5/1/2013 Bal. 16,100

4-10. b 212,681 4-10(17) 3000

4/30/2014 Bal. 510,811 4/30/2014 Bal. 19,100

Estimated Revenues ____ Encumbrances2014__________

4-10(1) 3,140,000 4-10(8) 80,000 4-10(4) 2,060,000 4-10(13) 1,988,040

4-10. b 3,060,000 4/30/2014 Bal. 71,960

Appropriations Encumbrances Outstanding2014___

4-10. b 3,100,000 4-10(1) 3,100,000 4-10(13) 1,988,040 4-10(4) 2,060,000

4/30/2014 Bal. 71,960

Budgetary Fund Balance

4-10(8) 80,000 4-10(1) 40,000

4-10. b 40,000

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Chapter 10 - Accounting For Governmental and Nonprofit Entities - 16th - SMDocumento16 páginasChapter 10 - Accounting For Governmental and Nonprofit Entities - 16th - SMmaylee01050% (2)

- Assignment 1 For ACCT 540Documento4 páginasAssignment 1 For ACCT 540maylee0105Ainda não há avaliações

- Accounting for Agency and Trust Funds in GovernmentDocumento19 páginasAccounting for Agency and Trust Funds in Governmentmaylee0105Ainda não há avaliações

- Chapter 1. Accounting For Governmental and Nonprofit Entities - 16th - SMDocumento7 páginasChapter 1. Accounting For Governmental and Nonprofit Entities - 16th - SMmaylee010550% (2)

- Chapter 9 - Accounting For Governmental and Nonprofit Entities - 16th - SMDocumento18 páginasChapter 9 - Accounting For Governmental and Nonprofit Entities - 16th - SMmaylee0105100% (4)

- 2011 Becker CPA PassMaster A1 1 PDFDocumento3 páginas2011 Becker CPA PassMaster A1 1 PDFmaylee0105Ainda não há avaliações

- ACCT. 525 Chapter 4 ExhibitsDocumento2 páginasACCT. 525 Chapter 4 Exhibitsmaylee0105Ainda não há avaliações

- Sample Project Coke PepsiDocumento31 páginasSample Project Coke Pepsimaylee0105Ainda não há avaliações

- Blank Hundred ChartDocumento3 páginasBlank Hundred ChartMenkent Santisteban BarcelonAinda não há avaliações

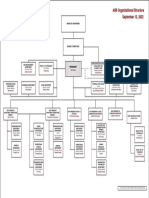

- AIIB Organizational StructureDocumento1 páginaAIIB Organizational StructureHenintsoa RaAinda não há avaliações

- SupermarketsDocumento20 páginasSupermarketsVikram Sean RoseAinda não há avaliações

- Asset Quality, Credit Delivery and Management FinalDocumento21 páginasAsset Quality, Credit Delivery and Management FinalDebanjan DasAinda não há avaliações

- 0 - 265454387 The Bank of Punjab Internship ReportDocumento51 páginas0 - 265454387 The Bank of Punjab Internship Reportفیضان علیAinda não há avaliações

- Tiong, Gilbert Charles - Financial Planning and ManagementDocumento10 páginasTiong, Gilbert Charles - Financial Planning and ManagementGilbert TiongAinda não há avaliações

- Syllabus For Departmental Examination of The Manipur Finance Service Grade-IIIDocumento1 páginaSyllabus For Departmental Examination of The Manipur Finance Service Grade-IIIDuma DumaiAinda não há avaliações

- Ch04 Consolidation TechniquesDocumento54 páginasCh04 Consolidation TechniquesRizqita Putri Ramadhani0% (1)

- Maintainance Contract FormatDocumento3 páginasMaintainance Contract Formatnauaf101Ainda não há avaliações

- Executive SummaryDocumento32 páginasExecutive SummaryMuhammad ZainAinda não há avaliações

- Evaluation of Print and Digital AdvertisementsDocumento23 páginasEvaluation of Print and Digital AdvertisementsAshish KumarAinda não há avaliações

- Marketing Research and MISDocumento20 páginasMarketing Research and MISMithun KanojiaAinda não há avaliações

- Nueva Ecija Elwctric Coop vs. NLRCDocumento2 páginasNueva Ecija Elwctric Coop vs. NLRCJholo AlvaradoAinda não há avaliações

- SEED Experiment 5 PartaDocumento6 páginasSEED Experiment 5 PartaDhaval GamechiAinda não há avaliações

- Gender Race and Class in Media A Critical Reader 5th Edition Dines Test Bank 1Documento34 páginasGender Race and Class in Media A Critical Reader 5th Edition Dines Test Bank 1christopherfergusonsxzjbowrdg100% (26)

- Hill V VelosoDocumento3 páginasHill V VelosoChaii CalaAinda não há avaliações

- Internship Report of State Bank of Pakistan KarachiDocumento180 páginasInternship Report of State Bank of Pakistan KarachixavanahAinda não há avaliações

- Chapter07 - AnswerDocumento18 páginasChapter07 - AnswerkdsfeslAinda não há avaliações

- Travel Procedure Module #3Documento9 páginasTravel Procedure Module #3Salvatore VieiraAinda não há avaliações

- Recommended Reading List For Operation ManagementDocumento1 páginaRecommended Reading List For Operation ManagementHakanAinda não há avaliações

- NJ Exemption CertificatesDocumento19 páginasNJ Exemption CertificatesKeith LeeAinda não há avaliações

- Chapter 1 EntrepreneurDocumento34 páginasChapter 1 Entrepreneursamritigoel100% (3)

- Summary of BRC Global Food Safety Standard Issue 6 Changes Landscape 110111Documento28 páginasSummary of BRC Global Food Safety Standard Issue 6 Changes Landscape 110111Poulami DeAinda não há avaliações

- PAS 27 Separate Financial StatementsDocumento16 páginasPAS 27 Separate Financial Statementsrena chavez100% (1)

- 2performant Terms of Services, Privacy Policy and Data Processing Appendix As Joint ControllerDocumento20 páginas2performant Terms of Services, Privacy Policy and Data Processing Appendix As Joint ControllerGabitaGabitaAinda não há avaliações

- Division (GR No. 82670, Sep 15, 1989) Dometila M. Andres V. Manufacturers HanoverDocumento6 páginasDivision (GR No. 82670, Sep 15, 1989) Dometila M. Andres V. Manufacturers HanovervivivioletteAinda não há avaliações

- Using Job Design To Motivate Employees To Improve Hi - 2019 - Journal of Air TraDocumento7 páginasUsing Job Design To Motivate Employees To Improve Hi - 2019 - Journal of Air Tragizem akçaAinda não há avaliações

- FM11 CH 10 Capital BudgetingDocumento56 páginasFM11 CH 10 Capital Budgetingm.idrisAinda não há avaliações

- Chapter 5, Problem 5.: Common Multiple of The Lives of The AlternativesDocumento7 páginasChapter 5, Problem 5.: Common Multiple of The Lives of The AlternativesMishalAinda não há avaliações

- Transfer Pricing of Tivo and Airbag Division: RequiredDocumento7 páginasTransfer Pricing of Tivo and Airbag Division: RequiredajithsubramanianAinda não há avaliações