Escolar Documentos

Profissional Documentos

Cultura Documentos

Agency & Trust Cases

Enviado por

Marlon Rey AnacletoDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Agency & Trust Cases

Enviado por

Marlon Rey AnacletoDireitos autorais:

Formatos disponíveis

1. LOADMASTERS CUSTOMS SERVICES, INC., vs.

GLODEL BROKERAGE

CORPORATION and R&B INSURANCE CORPORATION, / G.R. No. 179446 /

January 10, 2011

FACTS:

The case is a petition for review on certiorari under Rule 45 of the Revised Rules

of Court assailing the August 24, 2007 Decision of the Court of Appeals (CA) in CA-G.R.

CV No. 82822.

On August 28, 2001, R&B Insurance issued Marine Policy No. MN-00105/2001

in favor of Columbia to insure the shipment of 132 bundles of electric copper cathodes

against All Risks. On August 28, 2001, the cargoes were shipped on board the vessel

"Richard Rey" from Isabela, Leyte, to Pier 10, North Harbor, Manila. They arrived on the

same date.

Columbia engaged the services of Glodel for the release and withdrawal of the

cargoes from the pier and the subsequent delivery to its warehouses/plants. Glodel, in

turn, engaged the services of Loadmasters for the use of its delivery trucks to transport

the cargoes to Columbias warehouses/plants in Bulacan and Valenzuela City.

The goods were loaded on board twelve (12) trucks owned by Loadmasters,

driven by its employed drivers and accompanied by its employed truck helpers. Of the

six (6) trucks route to Balagtas, Bulacan, only five (5) reached the destination. One (1)

truck, loaded with 11 bundles or 232 pieces of copper cathodes, failed to deliver its

cargo.

Later on, the said truck, was recovered but without the copper cathodes.

Because of this incident, Columbia filed with R&B Insurance a claim for insurance

indemnity in the amount ofP1,903,335.39. After the investigation, R&B Insurance

paidColumbia the amount ofP1,896,789.62 as insurance indemnity.

R&B Insurance, thereafter, filed a complaint for damages against both

Loadmasters and Glodel before the Regional Trial Court, Branch 14, Manila (RTC), It

sought reimbursement of the amount it had paid to Columbia for the loss of the subject

cargo. It claimed that it had been subrogated "to the right of the consignee to recover

from the party/parties who may be held legally liable for the loss."

On November 19, 2003, the RTC rendered a decision holding Glodel liable for

damages for the loss of the subject cargo and dismissing Loadmasters counterclaim for

damages and attorneys fees against R&B Insurance.

Both R&B Insurance and Glodel appealed the RTC decision to the CA.

On August 24, 2007, the CA rendered that the appellee is an agent of appellant

Glodel, whatever liability the latter owes to appellant R&B Insurance Corporation as

insurance indemnity must likewise be the amount it shall be paid by appellee

Loadmasters. Hence, Loadmasters filed the present petition for review on certiorari.

ISSUE:

Whether or not Loadmasters and Glodel are common carriers to determine their liability

for the loss of the subject cargo.

RULING:

The petition is PARTIALLY GRANTED. Judgment is rendered declaring petitioner

Loadmasters Customs Services, Inc. and respondent Glodel Brokerage Corporation

jointly and severally liable to respondent

Under Article 1732 of the Civil Code, common carriers are persons, corporations, firms,

or associations engaged in the business of carrying or transporting passenger or goods,

or both by land, water or air for compensation, offering their services to the public.

Loadmasters is a common carrier because it is engaged in the business of transporting

goods by land, through its trucking service. It is a common carrier as distinguished from

a private carrier wherein the carriage is generally undertaken by special agreement and

it does not hold itself out to carry goods for the general public. Glodel is also considered

a common carrier within the context of Article 1732. For as stated and well provided in

the case of Schmitz Transport & Brokerage Corporation v. Transport Venture, Inc., a

customs broker is also regarded as a common carrier, the transportation of goods being

an integral part of its business.

Loadmasters and Glodel, being both common carriers, are mandated from the nature of

their business and for reasons of public policy, to observe the extraordinary diligence in

the vigilance over the goods transported by them according to all the circumstances of

such case, as required by Article 1733 of the Civil Code. When the Court speaks of

extraordinary diligence, it is that extreme measure of care and caution which persons of

unusual prudence and circumspection observe for securing and preserving their own

property or rights. With respect to the time frame of this extraordinary responsibility, the

Civil Code provides that the exercise of extraordinary diligence lasts from the time the

goods are unconditionally placed in the possession of, and received by, the carrier for

transportation until the same are delivered, actually or constructively, by the carrier to

the consignee, or to the person who has a right to receive them.

The Court is of the view that both Loadmasters and Glodel are jointly and severally liable

to R & B Insurance for the loss of the subject cargo. Loadmasters claim that it was

never privy to the contract entered into by Glodel with the consignee Columbia or R&B

Insurance as subrogee, is not a valid defense.

For under ART. 2180. The obligation imposed by Article 2176 is demandable not only for

ones own acts or omissions, but also for those of persons for whom one is responsible.

x x x x

Employers shall be liable for the damages caused by their employees and household

helpers acting within the scope of their assigned tasks, even though the former are not

engaged in any business or industry.

It is not disputed that the subject cargo was lost while in the custody of Loadmasters

whose employees (truck driver and helper) were instrumental in the hijacking or robbery

of the shipment. As employer, Loadmasters should be made answerable for the

damages caused by its employees who acted within the scope of their assigned task of

delivering the goods safely to the warehouse.

Glodel is also liable because of its failure to exercise extraordinary diligence. It failed to

ensure that Loadmasters would fully comply with the undertaking to safely transport the

subject cargo to the designated destination. Glodel should, therefore, be held liable with

Loadmasters. Its defense of force majeure is unavailing.

For the consequence, Glodel has no one to blame but itself. The Court cannot come to

its aid on equitable grounds. "Equity, which has been aptly described as a justice

outside legality, is applied only in the absence of, and never against, statutory law or

judicial rules of procedure." The Court cannot be a lawyer and take the cudgels for a

party who has been at fault or negligent.

2. Westmont Investment Corporation vs Amos Francia, Jr. et al

Business Organization Partnership, Agency, Trust Existence of Agency Lack of

Authorization

In 1999, Amos Francia was convinced by the bank manager of Westmont Bank to make an

investment in Westmont Investment. Since the interest rate offered was impressive, Amos

was convinced, he invited his siblings to join in the investment and so they invested an

aggregate amount of P3.9 million. When the investment matured, the Francia siblings

demanded the retirement of their investment but Westmont Investment advised them they

have no funds. Westmont Investment then requested for an extension. At the same time,

Westmont Investment advised the Francias that their money was borrowed by Pearlbank.

When the extension asked by Westmont expired, they again were not able to pay up and so

the Francias sued Westmont Investment. Pearlbank was impleaded in the complaint.

In its defense, Westmont Investment alleged that it was merely acting as an agent of

Pearlbank; that Pearlbank authorized Westmont Investment to borrow money on its behalf;

that Westmont Investment merely brokered a loan transaction between Pearlbank and the

Francias. To support its claim, Westmont provided documents showing that Pearlbank

borrowed an amount equivalent to the investment of the Francias.

ISSUE: Whether or not Westmont Investment is an agent of Pearlbank.

HELD: No. The evidence presented is not sufficient to prove that an agency existed

between Pearlbank and Westmont Investment hence, only Westmont Investment is liable to

pay the Francias. Pearlbank did not authorize Westmont Investment to borrow money for

it. Neither was there a ratification, expressly or impliedly, that it had authorized or

consented to said transaction. In fact, Pearlbank questioned Westmont Investments practice

of naming Pearlbank as a borrower of certain investments made by other investors with

Westmont Investment. Also, the Francias had no personal knowledge if Pearlbank was

indeed the recipient/beneficiary of their investments. The Francias have always maintained

that they only transacted with Westmont Investment and never with Pearlbank. The fact

that the Francias impleaded Pearlbank in their suite is understandable (it does not defeat

their suit) because they only impleaded Pearlbank to protect their interest when they found

out that Westmont was already bankrupt.

3.

Você também pode gostar

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- An Examination of The Civil Code On Human Relations P. 1-46Documento46 páginasAn Examination of The Civil Code On Human Relations P. 1-46Rose Ann100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Superlines Transpo v. Philippine ConstuctionDocumento2 páginasSuperlines Transpo v. Philippine ConstuctionMarlon Rey AnacletoAinda não há avaliações

- Aboitiz Shipping Corporation vs. CA 188 Scra 387Documento7 páginasAboitiz Shipping Corporation vs. CA 188 Scra 387Paolo Mendioro0% (1)

- BASCOS V CADocumento2 páginasBASCOS V CATintin CoAinda não há avaliações

- Batch 2 - Transpo - Case DigestDocumento31 páginasBatch 2 - Transpo - Case DigestRaniele MarquezAinda não há avaliações

- R Transport Corp vs. E Pante 599 SCRA 747Documento1 páginaR Transport Corp vs. E Pante 599 SCRA 747Hortense VarelaAinda não há avaliações

- Edgar Cokaliong V UCPBDocumento2 páginasEdgar Cokaliong V UCPBShane Fulgueras100% (1)

- Ynchausti Steamship Co. v. DexterDocumento1 páginaYnchausti Steamship Co. v. Dexterrgtan3Ainda não há avaliações

- American PetroLog, LLC Broker-Carrier Agreement 1-15-16 PDFDocumento7 páginasAmerican PetroLog, LLC Broker-Carrier Agreement 1-15-16 PDFAnonymous rYe0gZWAinda não há avaliações

- Case Digest Compilation On Corporation LawDocumento50 páginasCase Digest Compilation On Corporation LawMarlon Rey AnacletoAinda não há avaliações

- First Phil Industrial Corp Vs CADocumento4 páginasFirst Phil Industrial Corp Vs CAKristine NavaltaAinda não há avaliações

- 09 Maritime Company vs. CADocumento10 páginas09 Maritime Company vs. CAKris Dela CruzAinda não há avaliações

- Tiu vs. Arriesgado Case Digest Tiu vs. Arriesgado G.R. No. 138060, September 1, 2004Documento2 páginasTiu vs. Arriesgado Case Digest Tiu vs. Arriesgado G.R. No. 138060, September 1, 2004mario navalezAinda não há avaliações

- Master Copy Utopia LMT 2022 CommDocumento13 páginasMaster Copy Utopia LMT 2022 CommChristian TajarrosAinda não há avaliações

- Case Digest On CopyrightsDocumento4 páginasCase Digest On CopyrightsMarlon Rey AnacletoAinda não há avaliações

- Spouses Pereña V Spouses ZarateDocumento2 páginasSpouses Pereña V Spouses ZarateJohnny English100% (1)

- Transportation Law Reviewer FinalsDocumento10 páginasTransportation Law Reviewer FinalsDanica Depaz100% (1)

- Contract of Lease SampleDocumento4 páginasContract of Lease SampleMarlon Rey AnacletoAinda não há avaliações

- Profiling QuestionnaireDocumento2 páginasProfiling QuestionnaireMarlon Rey AnacletoAinda não há avaliações

- The Test Prior To The BARDocumento1 páginaThe Test Prior To The BARMarlon Rey AnacletoAinda não há avaliações

- YearningDocumento1 páginaYearningMarlon Rey AnacletoAinda não há avaliações

- A Special BrotherDocumento1 páginaA Special BrotherMarlon Rey AnacletoAinda não há avaliações

- A Special BrotherDocumento1 páginaA Special BrotherMarlon Rey AnacletoAinda não há avaliações

- DiamondsDocumento2 páginasDiamondsMarlon Rey AnacletoAinda não há avaliações

- Leg Med CasesDocumento52 páginasLeg Med CasesMarlon Rey AnacletoAinda não há avaliações

- Profiling QuestionnaireDocumento2 páginasProfiling QuestionnaireMarlon Rey AnacletoAinda não há avaliações

- Profiling QuestionnaireDocumento2 páginasProfiling QuestionnaireMarlon Rey AnacletoAinda não há avaliações

- Tax Cases FinalDocumento78 páginasTax Cases FinalMarlon Rey AnacletoAinda não há avaliações

- AbakadaDocumento41 páginasAbakadaMarlon Rey AnacletoAinda não há avaliações

- Labor Midterm CD Is GestDocumento13 páginasLabor Midterm CD Is GestMarlon Rey AnacletoAinda não há avaliações

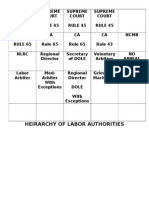

- Labor HeirarchyDocumento1 páginaLabor HeirarchyMarlon Rey AnacletoAinda não há avaliações

- Maranao Case DigestDocumento3 páginasMaranao Case DigestMarlon Rey AnacletoAinda não há avaliações

- Natres Case DigestDocumento11 páginasNatres Case DigestMarlon Rey AnacletoAinda não há avaliações

- GoCC's CodalDocumento15 páginasGoCC's CodalMarlon Rey AnacletoAinda não há avaliações

- Radiotherapy NursingDocumento35 páginasRadiotherapy NursingMarlon Rey AnacletoAinda não há avaliações

- YearningDocumento1 páginaYearningMarlon Rey AnacletoAinda não há avaliações

- Labor HeirarchyDocumento1 páginaLabor HeirarchyMarlon Rey AnacletoAinda não há avaliações

- Copyright Case DigestDocumento1 páginaCopyright Case DigestMarlon Rey AnacletoAinda não há avaliações

- 04BAROPS - SecuritiesRegulationCode - 163to183 4Documento22 páginas04BAROPS - SecuritiesRegulationCode - 163to183 4Marlon Rey AnacletoAinda não há avaliações

- Vallacar Transit - Hambala v. YapDocumento2 páginasVallacar Transit - Hambala v. YapMarlon Rey AnacletoAinda não há avaliações

- Legal Med Case Digest CompilationDocumento6 páginasLegal Med Case Digest CompilationMarlon Rey AnacletoAinda não há avaliações

- Exploitation of Nurses: Human FactorDocumento1 páginaExploitation of Nurses: Human FactorMarlon Rey AnacletoAinda não há avaliações

- CORP Lecture NotesDocumento15 páginasCORP Lecture NotesMarlon Rey AnacletoAinda não há avaliações

- Dismantling of APM: Case Law Before PNGRB: Reliance Industries Limited Vs IOCL and Others, Complaint No 4 of 2008, Decision On 2 July 2012Documento9 páginasDismantling of APM: Case Law Before PNGRB: Reliance Industries Limited Vs IOCL and Others, Complaint No 4 of 2008, Decision On 2 July 2012Härîsh KûmärAinda não há avaliações

- Transportation Law Case DigestDocumento3 páginasTransportation Law Case DigestQueenie QuerubinAinda não há avaliações

- DIGESTED Assignment 2 - Chestercaro - Oct1Documento6 páginasDIGESTED Assignment 2 - Chestercaro - Oct1Mai MomayAinda não há avaliações

- Lu Du, Et Al. vs. BinamiraDocumento6 páginasLu Du, Et Al. vs. BinamiraAMAinda não há avaliações

- The Carriage of Goods and The Liability of Air and Sea CarriersDocumento15 páginasThe Carriage of Goods and The Liability of Air and Sea CarriersPREETHIAinda não há avaliações

- Group 2 - Obligations of The Common CarrierDocumento45 páginasGroup 2 - Obligations of The Common CarrierMohammad AmpasoAinda não há avaliações

- FPIC v. CA - DigestDocumento2 páginasFPIC v. CA - DigestAngelette BulacanAinda não há avaliações

- Hanover Insurance Company v. Shulman Transport Enterprises, Inc., 581 F.2d 268, 1st Cir. (1978)Documento11 páginasHanover Insurance Company v. Shulman Transport Enterprises, Inc., 581 F.2d 268, 1st Cir. (1978)Scribd Government DocsAinda não há avaliações

- Cruz vs. Sun HolidaysDocumento5 páginasCruz vs. Sun HolidaysChristineAinda não há avaliações

- De Guzman vs. Court of Appeals, 168 SCRA 612, December 22, 1988Documento13 páginasDe Guzman vs. Court of Appeals, 168 SCRA 612, December 22, 1988Jane Bandoja0% (1)

- Common Carriers Under The Law ExplainedDocumento2 páginasCommon Carriers Under The Law ExplainedJoshua EmmanuelAinda não há avaliações

- Mendoza vs. PALDocumento5 páginasMendoza vs. PALCristóbal Jara HödarAinda não há avaliações

- Loadstar Shipping Co Inc Vs CA - 131621 - September 28, 1999 - C. J. Davide Jr. - First DivisionDocumento6 páginasLoadstar Shipping Co Inc Vs CA - 131621 - September 28, 1999 - C. J. Davide Jr. - First DivisionGloria Diana DulnuanAinda não há avaliações

- Gatchalian v. DelimDocumento13 páginasGatchalian v. DelimMGLVAinda não há avaliações

- Transpo Actions and DamagesDocumento17 páginasTranspo Actions and DamagesKelvin CulajaráAinda não há avaliações

- Alitalia Airways, Inc v. CADocumento14 páginasAlitalia Airways, Inc v. CAJosiah DavidAinda não há avaliações