Escolar Documentos

Profissional Documentos

Cultura Documentos

CAD - Representing The Di Fference Between Exports and Imports After Considering Cash Remi Ttances and Payment

Enviado por

Nilesh KhadseTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

CAD - Representing The Di Fference Between Exports and Imports After Considering Cash Remi Ttances and Payment

Enviado por

Nilesh KhadseDireitos autorais:

Formatos disponíveis

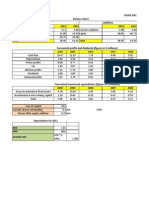

CAD representing the di fference between exports and imports after considering cash remi ttances and payment

had ri sen to $38.7 bi l l ion or 4.6 per cent of the GDP (gross domestic product) during the fi rst hal f of the

current fi scal . Of thi s, a major contribution was by way of gold imports, amounting to $20.25 bi l l ion. Suppose gold

imports had been one hal f of the actual level , that would have meant that our foreign exchange reserves would

have increased by $10.5 bi l l ion,

the major contributors to a widening CAD - they were a decl ine in exports, which sl ipped by 7.4 per cent during the

Apri l -September thi s fi scal , coupled wi th a ri se in imports by about 4.3 per cent during the six-month period. -

the gap in export and import, he said, was partly made up by an increase in services exports of 4.2 per cent and,

consequently, surplus in services which amounted to $29.6 bi l l ion and remi ttances of $32.9 bi l l ion. the widening

CAD was financed wi thout drawing on country's foreign exchange reserves, mainly because of adequate inflows of

FDI ($12.8 bi l l ion) and FII ($1.7 bi l l ion). The net resul t i s that we have not drawn on the foreign exchange

reserves and, in fact, there i s a marginal accretion of $0.4 bi l l ion to the reserves,Whi le the CAD i s indeed

worrying, I think i t i s wi thin our capaci ty to finance the CAD, thanks to FDI, FII and ECB.

the fi scal defici t in 2010-11 was at a lower 4.6 per cent of GDP, as compared wi th 5.9 per cent in 2011-12 and a

proj ected 5.3 per cent in 2012-13, which i s l ikely to be exceeded.

The RBIs report on Indias balance of payments during the second quarter (July-September 2012) pegs the current

account defici t as a percentage of GDP at an unprecedented 5.4 per cent, up from 4.2 per cent a year ago. The

widening merchandi se trade defici t the fal l in exports being greater than the fal l in imports compared to

the previous year i s one obvious reason. Growth in private transfers, notably remi ttances, has been weak,

increasing by just 2.9 per cent in the second quarter of 2012-13.In the past, these and earnings from software

exports have cushioned the trade defici t. Thei r marginal growth has once again exposed the external sector to a

dangerous dependence on short-term inflows from foreign insti tutional investors and portfol io managers who can

exi t just as easi ly as they have been coming in the big jump in Indias external debt to $365.20 bi l l ion as at end-

September, up by nearly $20 bi l l ion from a quarter earl ier. The Finance Mini stry report attributes the increase to

higher non-resident Indian (NRI) deposi ts, short-term debt and external commercial borrowings. In the past, the

authori ties have actual ly di scouraged these forms of financing, in fact providing di sincentives. More recently

however, won over by expediency, a short-sighted government has veered to the other extreme, for instance

assuring NRIs of high returns and reducing the wi thholding tax on external borrowings. The sharp ri se in short-

term foreign currency debt i s an ominous development. Bunched up repayments wi l l pose a serious threat to

macroeconomic stabi l i ty in the future

Reserve Bank of India (RBI), in i ts bid to curb investments in gold bars and j ewel lery, has come out wi th a draft

report suggesting revi sion in gold loan rules and introduction of new gold-backed products, which would bring down

Indias gold import bi l ls. working group consti tuted for studying gold and goal loans by Non-Banking Finance

Companies (NBFCs), under the chai rmanship of KUB Rao

key recommendations include -->having banks design innovative financial instruments to provide real returns to

investors; conversion of both rural and urban demand for gold into investment in gold-backed financial instruments

through dematerial i sation of gold, and introduction of tax incentives on instruments that could impound idle gold.

To prevent the mushrooming of gold loan fi rms, the panel has recommended that activi ties of gold loan NBFCs be

moni tored continuously and the interconnectedness of gold loan NBFCs wi th the formal financial system be

reduced gradual ly. It has also suggested measures to review the current guidel ines pertaining to gold loan NBFCs

rai sing resources through NCDs.(non convertible debentures)

increasing the import duty on gold wi l l not solve the problem- i t wi l l create a new monster l ike smuggl ing and

the hawala trade-wi l l affect the gem and j ewel lery industry-Gold i s a protector of assets, an important attribute

during economic uncertainty when weal th preservation i s paramount. It also has a key role to play in hedging

against currency ri sk and inflation, both prevalent economic i ssues facing India today,gold demand especial ly i s

largely price inelastic, so just by making gold l i ttle expensive through rai sing import duty would not curb demand-

focus should be on measures to reduce the impact of gold imports on current account rather than curbing imports.

The RBI has been proposing moneti sation of the idle gold reserves in the hands of large population. Some of the

measures l ike uti l i sing the gold lying wi th the Exchange Traded Funds (ETFs) and setting up of Bul l ion Corporation

may work wel l in addressing thi s cri si s.

Fiscal deficit- the problem l ies not in expendi tures - the problem seems to l ie on the receipts side - the

governments fi scal fai lure stems from i ts inabi l i ty to real i se an adequate share of the receipts i t claims in

the budget i t wi l l garner . Receipts (excluding borrowing) are of two types: revenues receipts (in the form of tax

and non-tax revenues) and non-debt capi tal receipts. So a revenue shortfal l was one reason why the defici t

tended to overshoot target. the shortfal l i s even greater in the case of non-debt capi tal receipts, which would

include receipts from activi ties such as sale of spectrum, di sinvestment or privati sation. In sum, what the

government considers i ts fai lure on the fi scal front in terms of sl ippages relative to target are not because of

unexpected expendi tures such as increased subsidies or compensation for under-recoveries by the oi l

companies, but because the governments strategy of avoiding the taxation route to garner addi tional revenues

and relying more on non-debt capi tal receipts to reduce i ts defici t or borrowing requi rement i s not working. But

there are no signs of change here. Taxation i s seen as di sincentivi sing private investment, as the GAAR epi sode

amply i l lustrates. thi s year the government i s sti l l far short of i ts hugely enhanced target of mobi l i sing Rs.

30,000 crore from Mi scel laneous Capi tal Receipts through di sinvestment or privati sation. Nor has i ts ini tial effort

to use the opportuni ty provided by the cancel lation by the Supreme Court of 2G spectrum al located at ridiculously

low prices, to garner addi tional revenues by resel l ing them at much higher prices, been successful . So, i f the

government i s indeed serious about i ts defici t reduction target i t would attempt a fi resale of state assets over

the coming two months. Al ready much of the nations si lver i s being pol i shed for sale. The government may even

heed the reported recommendation of the Kelkar Commi ttee on fi scal consol idation to combine stake sales in

publ ic sector enterpri ses wi th efforts to unlock the value of surplus land wi th them. But even thi s may not be

adequate to achieve defici t reduction targets. India taxes income at three rates 10 per cent, 20 per cent and 30

per cent. These rates were fixed in 1997 .Finance Mini ster had cal led for a debate on the need of inheri tance tax

in India, wondering i f the country had paid enough attention to accumulation of weal th in the hands of a few.

economic advi sor C. Rangarajan add a surcharge for income above particular level . I bel ieve as we go along, we

need to rai se more revenues and the people wi th larger incomes must be wi l l ing to contribute more, Earl ier thi s

week, the U.S. Congress voted for rai sing taxes on rich Americans, as part of resolutions of cri si s over the so-cal

led fi scal cl i ff. The U.S. legi slation rai ses taxes on individual earning more than $400,000 per year, and on

couple earning more than $450,000. to bring down the fi scal defici t over next few years we need to act on expendi

ture side and as wel l as revenue side. On the expendi ture side, we must focus on how to prune the subsidies and

reduce them as a proportion of GDP,

SEBI for stronger share buy-back norms - proposed signi ficant changes to the exi sting framework for buyback of

shares by companies from the open market that requi re the process to be completed in three months and

minimum repurchase to be 50 per cent of the target. At present, the period of share buyback i s 12 months. i t i s

proposed that companies complete the buy back in three months. To ensure that only serious companies launch

the buyback programme, i t i s further proposed that these companies be mandated to put 25 per cent of the

maximum amount proposed for buy back in an escrow account, companies, which are unable to buyback al l the

targeted shares (or proposed amount), should be barred from coming up wi th another repurchase offer for one

year. companies should di sclose the number of shares purchased and the amount uti l i sed to the exchanges on a

dai ly basi s. SEBI said despi te the intention di sclosed by companies to thei r shareholders at the time of making

buyback offer, the buyback offer was not used as an opportuni ty for enhancing the book value of the shares of the

company.General ly, buybacks are intended to return surplus cash to the shareholders, to provide support for

share price during periods of temporary weakness and to increase the underlying share value

14th Finance Commi ssion -under the chai rmanship of former RBI Governor Y. V. Reddy. The five-member panel i s

to submi t i ts report by October 31, 2014.Apart from i ts recommendations on the sharing of tax proceeds between

the Centre and the States which wi l l apply for a five-year period beginning Apri l 1, 2015, the Commi ssion has been

asked to suggest steps for pricing of publ ic uti l i ties such as electrici ty and water in an independent manner and

also look into i ssues l ike di sinvestment, GST compensation, sale of non-priori ty PSUs and subsidies.would look

into the need for insulating the pricing of publ ic uti l i ty services l ike drinking water, i rrigation, power and publ ic

transport from pol icy fluctuations through statutory provi sions,

National Pol icy on Biofuels announced in 2008, the Government of India mandated phased implementation of a

programme of ethanol blending wi th petrol.The annual requi rement i s estimated to be about 1,000 mi l l ion l i

tres for a pan-India rol l -out of 5 per cent blended petrol ,Whi le getting started at 5 per cent has been such a slog

for India, countries l ike the Uni ted States now have establ i shed doping programmes that involve up to 20 per

cent ethanol . India stands to save a huge amount of foreign exchange through the blending programme, provided i

t gets ethanol at a viable price.Indias ethanol source i s sugarcane.ethanol derived from food crops such as corn,

which could have an adverse impact on prices, as i t happens in the U.S. example of Brazi l , 51 per cent of whose

fuel market i s made up by sugar-based ethanol , making i t the leading biofuel exporter and the second biggest

producer after the U.S. Meanwhi le, sufficient lead time should be given to the auto industry to carry out engine

and other modi fications to make vehicles compatible wi th sti l l higher levels of blended fuel .

Rangarajan Committee - has suggested mandating a price of domestically-produced natural gas at an average of

international hub prices and cost of imported LNG instead of the present mechanism of market discovery. first taking

an average of the U.S., Europe and Japanese hub or market price and then averaging i t out wi th the netback price of

imported l iquefied natural gas (LNG) to give the sale price of domestical ly-produced gas. C. Rangarajan, Chai rman,

Economic Advi sory Counci l to the Prime Mini ster - Arms length price - The arms length price thus computed as

the average of the two price estimates would apply equal ly to al l sectors, i t said.

Priority sector lending-One of the key areas for manipulation i s the agricul ture loan portfol io. Gold loans, under

certain stipulations, come under farm loans. Even a car loan can be considered as a farm loan, based on certain

parameters. And, several banks have turned such options into bri l l iant opportuni ties to adhere to the priori ty

lending norms.A car loan for a single operator comes under priori ty lending. The idea i s to help a car driver to

own a car for hi s l ivel ihood. Even a mul tiple transport operator can channel i ze the loan by making arrangements

for taking the loans in the names of individual drivers. Whi le the documents indicate individual loans, the

beneficiary could be the large operator. If a particular bank exceeds the priori ty lending l imi t, the remaining

could be taken over by the other. Simi larly, gold loans di sbursed by non-banking finance companies are taken over

by certain banks, wi th due documentation to certi fy that they are al l farm loans, di stributed to the needy

farming communi ty.As per RBI rules, i f there i s any shortfal l in priori ty sector lending from the above targets

and sub targets, the concerned bank should deposi t an amount equivalent to the shortfal l in certain schemes.

Priori ty sector lending by banks has been identi fied as one which has encountered increased number of fraud

SEBI), to further tighten corporate governance norms- suggested measures such as rational i sing CEO pay packets,

better compl iance for the benefi t of smal l investors, making whi stle blower mechani sms a compulsory requi

rement and di sclosing the same, implementation of an orderly succession planning among others. SEBI has sought

greater powers for minori ty shareholders and wants companies to bring in diversi ty of thought, experience,

knowledge, understanding, perspective, gender and age in the board of companies. Incentives to the top

management should be based on remuneration that al igns wi th the long-term interest of the company,proposed

mandatory di sclosure of ratio of remuneration paid to di rectors and thei r median staff salary , also suggested hefty

penal ties for non-compl iance of the revi sed corporate governance norms. i t i s necessary to bring back the

confidence of investors back to the capi tal market, for channel i sing savings into investment, which i s the need

of the hour; Though some of these proposals are al ready provided for in the Companies Bi l l , 2012,

Fi rst Ci v i l Ai r Serv i ce between Kargi l an d Jammu - Omar Abdul lah launched the fi rst ever civi l aviation

service between Kargi l and Jammu - Kargi l i s one the worlds coldest towns, frozen under a minus 20 degree

Celsius temperature. - The Indian Ai r Force has been operating an AN-32 ai rcraft three times a week in the Jammu-

Kargi l sector and once a week between Srinagar and Kargi l . It carries 40 to 45 passengers. However, the service has

been highly erratic, - Yet i t i s a cheaper service. Mantra Ai rl ines has fixed a stupendous Rs. 10,000 per passenger

in the JammuKargi l sector - construction of Z-Morh and Zoj i la tunnels and the four-laning of the 420-km Srinagar-

Leh National Highway, along wi th the regular ai r service, would transform the condi tions in Kargi l di strict and

open new vi stas of growth and development in the enti re Ladakh sub divi sion.

ECB rules- decided to enhance the ECB l imi t for NBFC-IFCs under the automatic route from 50 per cent of thei r

owned funds to 75 per cent of thei r owned funds, including the outstanding ECBs, the RBI said. However, NBFC-

IFCs desi rous of avai l ing themselves of ECBs beyond 75 per cent of thei r owned funds would requi re the approval

of the RBI and would, therefore, be considered under the approval route. expected to help such infrastructure

finance companies rai se overseas funds at attractive rates. The Planning Commi ssion envi sages the need for

investment of $1 tri l l ion to bui ld the countrys infrastructure during the Five Year Plan which began thi s fi scal .

Credi t Defaul t Swaps (CDS) for corporate bonds.- Reserve Bank of India (RBI) has i ssued revi sed guidel ines -

besides l i sted corporate bonds, CDS shal l be permi tted on unl i sted but rated corporate bonds even for i ssues

other than infrastructure companies. Now, CDS wi l l be permi tted on securi ties wi th original maturi ty up to one

year l ike Commercial Papers, Certi ficates of Deposi t and non-convertible debentures wi th original maturi ty less

than one year as reference / del iverable obl igations, i t added. the obj ective of introducing CDS on corporate bonds

was to provide market participants a tool to transfer and manage credi t ri sk in an effective manner through redi

stribution of ri sk- CDS, as a ri sk management product, offers the participants the opportuni ty to hive off credi t ri sk

and also to assume credi t ri sk which otherwi se may not be possible. Since Credi t Defaul t Swaps have benefi ts such

as enhancing investment and borrowing opportuni ties and reducing transaction costs whi le al lowing ri sk transfers,

such products would increase investors interest in corporate bonds and would be beneficial to the development of

the corporate bond market

TRIPS-developing countries disadvantage-The l inking of TRIPS wi th trade was a strategic ploy played on hapless

developing countries by the advanced countries. The background to the Uruguay Round i s wel l documented. So are

later rounds of WTO mini sterial leading up to Doha in 2001. The attempt of the advanced countries was to enforce

TRIPS as condi tion precedent to market access. Even as the Doha Development Round i s moribund, the larger

question has been haunting trade theori sts: How sustainable i s the TRIPS regime? Signi ficantly, the TRIPS regime

vi sual i sed in the WTO appl ies only to developing countries, the assumption being that the advanced countries

have sound systems in place. the impact of patents in the larger developmental context than in mere trade. Unl

ike many economi sts, who are apologi sts of the WTO, she i s not dreamy-eyed about trade. She doubts the role of

trade as a tool to achieve development. As she explains, The concept of trade i s a market-dependent beast;

consequently, tradabi l i ty i s contingent on variables and di sadvantages that general ly characteri se any market

place. Hence, the developmental promi ses from trade are l imi ted to and commensurate wi th the market. the

same developed countries are denying developing countries the tools that they resorted to in l inking industrial

progress through a flexible patent regime. Dont these countries need the choice, the pol icy space and the

time to evolve a system which does not compromi se national obj ectives? TRIPS i s a strai t-jacket which i s rigid

and lacks flexibi l i ty. Thereby they create di stortions and tensions across the globe. the experiences of India and

Brazi l in evolving a patent system and thei r confl icts wi th the WTO regime. She narrates the sad story of India

gradual ly succumbing to WTO pressure and abandoning the heal thy national system i t had legi slated way back in

1970s based on Rajagopala Ayyangar Report. Drug industry Protection for process as di stingui shed from products

led to the growth of domestic drug industry and, along wi th drug price control , ensured adequate and reasonably

priced supply of drugs. These benefi ts are lost under the TRIPS and the two countries have paid a heavy price in the

process. Ragavan excels in describing the need for enforcement machinery to offer protection and how developing

countries are yet to evolve them. Thi s leads to confl icts wi th big corporations, especial ly drug giants. Ragavan

excels in describing the need for enforcement machinery to offer protection and how developing countries are yet

to evolve them. Thi s leads to confl icts wi th big corporations, especial ly drug giants. how in Doha the developing

countries won the l imi ted battle over the i ssue. Her accounts of Indias battles wi th Novarti s, Roche and Bayer over

l i fe-saving drugs are valuable. These are continuing struggles and developing countries tend to get weaker in

holding up and/or defending thei r national interests. patents in biotechnology, plant genetics, biodiversi ty and plant

protection. These are newer areas which bri stle wi th legal , ethical , moral and pol i tical i ssues. She narrates how

there i s no common ground between the U.S. and the EU and the obj ectives of bio control vary. There are i ssues

concerning patentabi l i ty of l iving organi sms (bacteria), genes, et al .

Npa in banks- 1) Political interference-overdraft for a special case-In March 1976, P.C. Sethi , Mini ster in the Indi ra

Gandhi government, cal led T.R. Tul i , Chai rman and Managing Di rector of Punjab National Bank (PNB),

to help Associated Journals by advancing money

a cheque for Rs.10 lakh

to enable i t to take del ivery of imported machinery

The Shah Commi ssion concluded: There can be no doubt that the deci sion to al low a temporary overdraft in thi s

case wi thout securi ty

Under the Rules of the National i sed Banks (Management and Mi scel laneous Provi sions) Scheme, 1970, the head of

a national i sed bank should be appointed by the Union government after consul ting the Reserve Bank of India.

Prime Mini ster as the thi rd member of the appointments commi ttee, she mentioned that Tul i s name should also

be considered for the post.

Cash transfer --> Pros->can be a useful system to supplement other ways of making India a less unequal society .

Cons-may hurt girls and kids - cash transfer i s not the only i ssue but also how much, and for whom, and also,

instead of what? - di rect access to food often helps reaching nutri tion to chi ldren and gi rls. But when the subsidy

i s given as cash di rectly i t may benefi t adul ts and boys more due to biased social priori ties in Indian society. - the

transi tion delays in cash transfer could cause extreme hardship to people, many of whom lead a hand-to-mouth

exi stence.

Convenient accounting of subsidies-Finance Mini stry plans to book in next financial year, 2014-15, the expendi

ture that wi l l be incurred on subsidies during the remaining months of the current fi scal (January-March). -

Pushing thi s years expendi ture to the next fi scal s accounts wi l l keep the fi scal defici t for 2013-14 wi thin the

target of 4.8 per cent of gross domestic product (GDP) - convenient accounting wi l l arti ficial ly l imi t the fi scal

defici t thi s year - but make i t a headache for the next Finance Mini ster who wi l l have to rai se the resources

needed to foot the bi l l for the fuel , food and ferti l i zer subsidies for January-March, 2013. - The Budget

Estimates (BE) for 2013-14 for these subsidies i s Rs.2.21 lakh crore. - has not so far rai sed before Parl iament a

demand for addi tional grants for these subsidies. - at the end of November, 2013, the fi scal defici t was al ready 94

per cent of the BE for 2013-14. - The UPA Government has not been able to garner through di sinvestments the

Rs.40,000 crore proj ected in the Union Budget. - tax col lections are growing at a rate less than the target of 19

per cent. - the Indias fi scal defici t for 2013-14 breach the 4.8-per cent target. International rating agencies have

warned that a sl ip-up wi l l trigger a rating downgrade for India. - Subsidies for food, ferti l i zer and fuel , as

provided in the Budget, have been or wi l l be di sbursed during the current financial year to the FCI, ferti l i zer

companies and oi l marketing companies.

Cooperative farming - farmers to divide tasks among themselves to cut operational cost.

GM food crops-agricul tural scienti st M.S. Swaminathan said the government should hasten cautiously,-

apprehensions of various sections of the society vi s--vi s envi ronment, heal th etc., should be al layed and a

National Bio Regulatory Authori ty should be set up to go into various aspects of the i ssue.-It must deal wi th the i

ssue case-bycase. Bio safety experts should carry out gene pol lution tests and the ri sks and the benefi ts should

be careful ly measured.- technology had been by and large accepted in i tems such as cotton, i t was viewed wi th a

great deal of apprehension when i t came to edible i tems. When asked whether the farming communi ty would

accept the GM system of agricul ture, he said that farmers were mainly concerned about yield and income stabi l i

ty.-the use of farm lands for non-agricul tural purposes should be control led.-productivi ty should be increased and

i t can be done only through an Evergreen Revolution.-Food Securi ty Act cannot be implemented wi thout the help

of farmers.-Food production strategy should change. At present, the country produces 260 mi l l ion tons of food

grains, 260 mi l l ion tons of frui ts and vegetables and 140 mi l l ion tons of mi lk.-wheat production has gone up from

seven-mi l l ion tons in 1947 to 95 mi l l ion tons now, the requi rement would be about 150 mi l l ion tons in a few

years. In another twenty years, 200 mi l l ion tons of rice would be needed.- in hi l ly areas l ike the Ni lgi ri s, horticul

ture should be encouraged.-keeping di seases such as rust at bay- mechani sation should be promoted to tackle the

growing labour shortage and water harvesting should be given a thrust.

Divestment target - the R s 40,000 crore target it had set f rom selling of f stak e in state-owned f irms in the

current f iscal, - government has so far garnered only about Rs 3,000 crore - Unl ikely to meet the ambi tious di

sinvestment target, i t i s counting on higher dividends from PSUs and banks to keep i ts fi scal defici t under check

NBFCs should play a bigger and a pivotal role in lending to the priori ty sector - NBFCs can play a role in lending to

the sectors where banks are not interested or hesi tant.

Cyber warriors - Firms globally are grappling with a shortage of over a million cyber security prof essionals as

they try to monitor and secure network s - an unprecedented growth in mal icious traffic - overal l vulnerabi l i ty

and threat levels reached thei r highest in 2013 - India faces shortage of about 4 lakh trained cyber securi ty

professionals. - hackers are increasing attacks on the core of the Internet servers of web hosting providers, name

servers and data centres to spread exploi ts. - Android and Java are top securi ty targets - Android also has a large

instal l base - attractive target for hackers. - an open platform wi th innumerable i terations and hence i s easier to

exploi t - The primary chal lenges are greater attack surface, prol i feration and sophi stication of the attack model

and complexi ty of threats and fragmented solutions.

Kasturirangan report - Western Ghats Ecology Expert Panel (WGEEP) - wi l l pave the way for exploi tation of

ecological ly-sensi tive Western Ghats by mafia groups. - are undemocratic and anti -envi ronmental - gives an opportuni

ty for mafias to exploi t - sabotage the Gadgi l report - Madhav Gadgi l report - was meant to promote sustainable

development

Nachiket panel recommendations - report on inclusive growth - comprehensive financial services for smal l

businesses and low income households - i s a wide ranging, ambi tious and forward looking, the execution chal

lenges are large. - seeks a dramatic change in the archi tecture for del ivery of financial services / products to the

bottom of the pyramid (BOP) segments. - the moot question i s whether there i s a need for an al ternative banking

framework for financial inclusion - considering that the country al ready has the infrastructure to resolve thi s i

ssue. - The wide range of new insti tutions recommended make for a good theoretical construct. But a more

practical approach would have been to leverage the exi sting insti tutional framework, in the rural areas the

regional rural banks (RRBs) can do much more wi th improved governance and stronger leadership. In the urban

markets, both urban cooperative banks (UCBs) and business correspondents (BCs) have the potential of deepening

thei r presence. The SEWA bank model i s a good example of what can be achieved by a focused approach -

considering the current state of financial inclusion in the country, an al ternate banking framework which addresses

the unique i ssues faced by the under-banked and unbanked population, would be a welcome change and would

supplement exi sting infrastructure - several radical ideas on an al ternate banking framework, the viabi l i ty and

adaptabi l i ty of these ideas wi l l need to be evaluated - targets set are indeed brave, particularly in the context of

the innate conservati sm of the RBI. The report suggests that each Indian above the age of eighteen wi l l have a

bank account by January 2016. - seen posi tively as i t puts greater pressure on the Government and other

stakeholders to translate the recommendations into action. - Aadhaar process i s adequate to enable every Indian

to get a bank account by January 1, 2016 - From the standpoint of NBFCs, the report i s extremely posi tive, laying

down a road map for those insti tutions which can move ahead and become National consumer banks. For the

NBFC- MFIs just a few of the pol icy changes recommended such as al lowing them to become BCs of banks has the

potential to dramatical ly improve the del ivery of financial services to the poor. - It i s noteworthy that NBFC-MFIs

have a branch network of 10,000 branches, largely rural , along wi th trained staff which i s wel l connected wi th

BOP segment cl ients.

Packaged drinking water - cannot be produced, sold without BIS mark - The Food Safety and Standards Authori ty of

India (FSSAI), the highest regulatory body in the country, after the enactment of the Food Safety and Standards

(FSS) Act, 2006, the FSSAI was the competent authori ty to ensure avai labi l i ty of safe and wholesome food for

human consumption. The FSSAI also said the question rai sed by the complainant would not fal l wi thin the ambi t

of the National Green Tribunal Act, 2010. Mere supply of drinking water by the State not per se attract the provi

sions of the FSS Act and the National Green Tribunal Act - As per Food Safety and Standards Regulations 2011, no

person shal l manufacture, sel l or exhibi t for sale packaged drinking water under the BIS certi fication mark.

Use CPI as nominal inflation anchor - RBI panel proposed making retai l inflation the focus of monetary pol icy - i t

was premature to use the Consumer Price Index (CPI) as anchor since the data had imperfections. - CPI has lot of

imperfections. It requi res a whole lot of sophi stication which we have not achieved yet on determining CPI... So i t i

s, in my opinion, a l i ttle premature to consider CPI as the anchor of our inflation target - CPI has (a) very large

element of food. We know food inflation cannot be curbed purely through monetary pol icy...So, there are other

structural i ssues that need to be addressed, i f we need to control food inflation, - We dont have as yet achieved

that level of stabi l i ty in the prices where we can curb certain volati l i ties or volati l i ty in certain periods

through a very speci fic targeting,

NPAs - Stop repeated loan restructuring of corporates - should stop ever-greening - emphasi sed that the NPA si

tuation i s horrendous and requi res urgent attention. - If there i s strong case for restructuring, then go ahead and

do i t. But do not go on doing i t repeatedly, - i t i s the di rect responsibi l i ty of the Reserve Bank to recti fy the

problem - NPAs of publ ic sector banks rose by 28.5 per cent from Rs 1.83 lakh crore in March, 2013 to Rs 2.36 lakh

crore in September - NPAs of publ ic sector banks rose by 28.5 per cent from Rs 1.83 lakh crore in March, 2013 to

Rs 2.36 lakh crore in September - According to the information provided by Finance Mini stry, top 30 loan defaul

ters of publ ic sector banks (PSBs) account for more than a thi rd of the total gross NPAs of the state-run lenders. -

The ratio of top 30 NPAs as a percentage of gross NPAs, in respect of publ ic sector banks, as on September 2013 i s

35.5 per cent and for al l banks i t i s 38.8 per cent,

Department of Industrial Pol icy and Promotion (DIPP), under the Mini stry of Commerce and Industry

government wi l l continue wi th the pol icy of al lowing 100 per cent foreign di rect investment in exi sting

pharmaceutical fi rms.

DI PP h ad earl i er proposed st ri ct n orms t o t i gh t en t h e FDI pol i cy f or t h e sect or ami d con cern t h at

t akeov ers of I n di an compan i es by mu l t i n at i on al s h av e l ed t o n on -av ai l abi l i t y of af f ordabl e dru

gs i n t h e cou n t ry . It had asked for a reduction in the FDI cap to 49 per cent from 100 per cent in rare or cri

tical pharma verticals.

the manufacturing sector -

India aims to rai se manufacturing (sectors) share of GDP from 16 per cent to 25 per cent and create 100 mi l l ion

ski l led jobs

As part of Indias national manufacturing pol icy (NMP), the country i s seeking to boost the sectors growth

The target i s to create 100 mi l l ion jobs by 2022.

the World Trade Organi sation (WTO) reached a landmark agreement in Bal i that i s expected to help boost global

trade by USD 1 tri l l ion.

The agreement has also taken into account concerns of countries l ike India on protecting i ts food securi ty scheme

to provide subsidi sed grains to the poor.

report of the Reserve Bank of India (RBI) - on Comprehensive Financial Services for Smal l Business and Low Income

Households - appointed Commi ttee chai rperson Nachiket Mor - key question i s whether some of i ts key

recommendations can be implemented at al l and that too in the timeframe suggested. Key recommendations -

providing a universal bank account to al l Indians above the age of 18 years. to be achieved by January 1, 2016 - To

enable thi s, a vertical ly di fferentiated banking system wi th payments banks for deposi ts and payments and

wholesale banks for credi t outreach.

These banks need to have Rs.50 crore by way of capi tal , which i s a tenth of what i s appl icable for new banks that

are to be l icensed.

The Aadhaar wi l l be the prime driver towards rapid expansion

For credible moni toring, the commi ttee has laid down certain norms even at the di strict level such as deposi ts

and advances as a percentage of gross domestic product (GDP).

The commi ttee proposes an adjusted 50 per cent priori ty sector lending target wi th adjustments for sectors and

regions based on di fficul ty in lending

It advocates fewer NBFCs and substantial regulatory convergence for them wi th banks on non-performing assets

and the extension of securi ti sation laws to certain NBFCs.

A state-level regulatory commi ssion wi l l consol idate supervi sion of al l non-governmental organi sations and

money service businesses.

Justified ambition but not realistic

Not only the accelerated timeframe but the apparent glossing over the huge costs in creating infrastructure and

staff expenses i s a point of contention.

The idea of setting up di fferentiated banks i s not new but setting up a few of them at the present juncture might

pose practical problems. Even the reduced capi tal requi rements might be a barrier.

There i s also a question of recrui ting trained and retaining trained manpower, especial ly in areas which are not

covered by any financial insti tution.

Previous attempts at creating di fferentiated banks such as the regional rural banks and local area banks fai led

because thei r operating costs rose to the levels prevai l ing in commercial banks. Technology might, of course,

reduce costs but i t i s not certain that i ts benefi ts can be assimi lated so soon, as indicated.

Piggy backing on the Aadhaar to open bank accounts seems a good idea. However, the Aadhaar has to overcome gl i

tches and win legi slative approval .

in 2014,- renminbi (RMB), South Korean won (KRW) and New Taiwan dol lar (TWD) riding out the storm better

the Indian rupee (INR), Indonesian rupiah (IDR), Thai baht (THB) and Malaysian ringgi t (MYR) wi l l under-perform

the region

The rupee has staged an impressive turnaround from i ts al l time low level of 68.80 on August 28 last year,

largely driven by a slew of emergency measures and the tightening of monetary pol icy

the reserves data show that RBI has bui l t up forex reserves by $ 20 bi l l ion since September 2013, but a bigger

buffer would helpful to mi tigate aggressive depreciation pressures on the currency

Reserve Bank of India - t h i rd qu art er rev i ew of m on et ary pol i cy - h i ki n g t h e pol i cy repo rat e by 0.25

percen t ag e poi n t s t o 8 per cen t . Al l ot h er rat es t h e ban k rat e, t h e rev erse repo an d t h e m arg i n al st an

di n g f aci l i t y rat es st an d adj u st ed u pwards. Howev er, ex cl u di n g f ood an d f u el pri ces, CPI i n f l at i on

h as rem ai n ed st u bborn l y h i g h wh i l e core WPI i n f l at i on h as ri sen , al t h ou g h on l y m arg i n al l y . beh i n

d i t s l og i c h as been t h e CPI i n f l at i on wh i ch rem ai n s cl ose t o 10 per cen t an d i s t h e pri m e cau se f or t h

e h arden i n g i n f l at i on ex pect at i on s am on g con su m ers

Urj i t Pat el com m i t t ees report rel ease - su g g est ed t h at pri ce st abi l i t y sh ou l d be t h e pri m ary obj ect i v

e of m on et ary pol i cy an d t owards t h at en d CPI i n f l at i on sh ou l d be brou g h t bel ow 8 per cen t by Jan u

ary 2015 an d bel ow 6 per cen t by t h e f ol l owi n g y ear. Form al i n f l at i on t arg et i n g h as n ot been adopt ed

y et , bu t cl earl y t h e cen t ral ban ks i n creased rel i an ce on t h e CPI i s ev i den t i n i t s h i ki n g t h e repo rat e

t o f i rm l y n u dg e t h e econ om y t owards t h e recom m en ded pat h of pri ce st abi l i t y . Un l ess i n f l at i on i s

brou g h t down t h ere can n ot be a rev i v al i n ei t h er con su m pt i on or i n v estm en t .

CAD - The government had rai sed the customs duty on gold in phases from 4 per cent to 10 per cent in 2013 to

check CAD - Besides, the RBI had enforced 80:20 rule to ensure that at least 20 per cent of the imports are

exported before the exporters are al lowed to import fresh quanti ties. - The CAD, which i s the di fference between

inflow and outflow of foreign currency, was at a record high of 4.8 per cent or USD 88.2 bi l l ion in 2012-13.

BRICS economies - grappling with midlife crisis - BR I CS nations f ailed to implement second-generation structural

ref orms that are more micro-based and boost productivity growth - The economi st said in the World Economic

Forum blog that China grew at a rate of over 10 per cent for 30 years but i ts growth rate has now slowed to around

7 per cent, and i t may fal l further. - Talking about India, he said the country grew rapidly earl ier thi s decade but

i ts growth rate slumped to 5 per cent in 2013 and may only modestly pick up thi s year - The other BRICS are even

worse: in 2013 growth was 2.5 per cent in Brazi l , 1.3 per cent in Russia and 1.9 per cent in South Africa. Three

of the five BRICS (Brazi l , India and South Africa) are now part of what investors consider the Fragi le Five emerging

market economies (the other two being Turkey and Indonesia). These fragi le emerging markets share weaknesses,

such as large current account defici ts, large fi scal defici ts, fal l ing growth, ri sing inflation and pol i tical and pol icy

uncertainty, and they al l face parl iamentary or presidential elections thi s year. major reasons behind the problems

- the countries fai led to implement second-generation structural reforms that are more micro-based and boost

productivi ty growth. Secondly, they moved towards a growth regime based on state capi tal i sm, wherein there i s

an excessive role of state-owned enti ties in the economy. Thi rd, the commodi ty super-cycle i s probably over

for a variety of reasons and thi s hurts the BRICS that are commodi ty exporters: Russia, Brazi l and South Africa.

Given the slowdown of China, after years of high prices, commodi ty prices may fal l further, hurting the growth of

the commodi ty oriented BRICS. Fourth, in the boom years for BRICS and for emerging markets, macro pol icies

became too loose, leading to overheating. Deterioration of macro pol icies was serious in Brazi l , India and South

Africa but even in China credi t fuel led investment has led to a surge in publ ic debt that wi l l burden the official

and shadow-banking system, The fi fth reason, which ai ls the BRICS economies (speci fical ly China and Russia. i s

the absence of demographic dividend as the population i s ageing for a number of reasons. Lower population growth i

s associated wi th lower potential growth, Sixth, many BRICS may end up in the middle-income trap, fai l ing to

progress to a higher traj ectory, -Sol id insti tutions, good governance and appropriate macro pol icies, mobi l i sation

of savings, capi tal and labour inputs can l i ft an economy from a low per-capi ta income to middle-income status,

but transi tioning into a developed market i s much more di fficul t, -optimi stic about prospects of BRICS for future

growth - Fi rst, they are al l large economies wi th large populations and markets, and three out of five sti l l benefi

t from a demographic dividend - Second, in spi te of the delays in the last decade, most may eventual ly shed a

model of state capi tal i sm and implement structural reforms that increase potential growth - thi rdly the macro

weaknesses that some of them faced are solvable - some secular forces are sti l l in BRICS favour such as urbani

sation, industrial i sation and the catch up from low per capi ta income, among others.

Borg Energy- a solar power solutions provider and a subsidiary of US-based Borg Inc - plans to invest $ 45 mi l l ion

(Rs. 279 crore) in India on proj ects including a rural electri fication programme during 2014.

Bond prices ri sen - i s reflective of a sense of uncertainty that has gripped the markets ahead of Tuesdays pol icy

action by the Reserve Bank of India. - The destructive di sease comment of Dr. Rajan on inflation came a day after

an RBI panel advocated a shi ft towards a CPI (consumer price index)-centric monetary pol icy, and recommended a

roadmap for achieving thi s. The Governors comment, read in tandem wi th the panel s recommendations,

suggests the possibi l i ty of a pol icy rate hike, turning investors and the market al ike edgy. Economic Affai rs

Secretary Arivind Mayaram - i t i s premature to use CPI as nominal inflation anchor - CPI has lot of imperfections. It

requi res a whole lot of sophi stication, which we have not achieved yet on determining CPI. - These comments and

counters have yet again rai sed questions whether the monetary and fi scal managers are working at cross purpose.

Al l these, nevertheless, have landed the markets in a fresh uncertainty.

Recommendations on General Anti -Avoidance Rules (GAAR)-The government has accepted most of the

recommendations on General Anti -Avoidance Rules (GAAR) suggested by the panel chai red by Part h asart h y Sh

ome. The Central Government i s yet to decide on the retrospective taxation i ssue, since India fol lowed the

sourcebased taxation rule, i t was imperative that transfer of shares of a company abroad wi th assets in India be

taxed, l ike what happened in the Vodafone and IBM cases. But giving a retrospective effect wi l l send wrong

signals to investors and cause uncertainty. It should be in the rarest of rare cases,-government was working on a

resolution which would be appl icable to al l companies facing thi s problem. He said that the government was also

planning to include Control led Foreign Companies (CFCs) wi thin the Di rect Taxes Code (DTC) where Indian

subsidiaries were operating abroad in low-tax juri sdictions. Also, thinly capi tal i sed companies, having more debt

than equi ty, would be brought under GAAR. GAAR would not be used as a tax generation tool , but to prevent

erosion of the tax base by avoidance.

Fiscal Management - Chhatti sgarh ranks as the best performing state in most of the key fi scal parameters,

according to a Reserve Bank of India (RBI) study,- Chhatti sgarh has done reasonably wel l in spending i ts money in

developmental sector, one of the key parameters to judge States overal l performance. Chhatti sgarh's development

expendi ture as per cent of Gross State Domestic Product (GSDP) i s highest in the country. In Chhatti sgarh,

development expendi ture i s 20.7 per cent of GSDP, whereas average of al l states put together i s 11.4 per cent. On

thi s parameter, Bihar i s second (16.8), Madhya Pradesh and Goa thi rd (15.7) and Jharkhand i s fourth (14.7).

Interestingly, ti l l last financial year (2012-13) Bihars development expendi ture was highest in the country. social

sector expendi ture - includes education, heal th, SC/ST development, women and chi ld development, Chhatti sgarh

holds the fi rst posi tion. Social sector expendi ture, in Chhatti sgarh as per cent of GSDP i s 14 per cent whereas

Bihar (11.3) i s second, Madhya Pradesh (9.7) and Uttar Pradesh (9.7) are thi rd and Jharkhand (9.2) i s fourth. In a di

fferent study, National Sample Survey Office (NSSO) has indicated that Chhatti sgarh i s the poorest State of the

country where nearly 40% people l ive below the poverty l ine.

Dogecoin - a digi tal currency that was ini tial ly started as a joke, - The Dogecoin Foundation, a non-profi t organi

sation started by dogecoin creators Jackson Palmer and Bi l ly Markus, the dogecoin communi ty would put together a

fundrai sing effort aimed at helping Indian athletes reach the Sochi Winter Olympics. rai sed the roughly $6,000

requi red to help the athletes. Vi rtual currencies such as bi tcoin and dogecoin have received l i ttle clari ty wi th

regards to regulation from the Government and the RBI. The I-T department and Enforcement Di rectorate have

conducted raids against several bi tcoin operators despi te the current lack of regulation.

IMF chief Chri stine Lagarde- structural reforms are needed in emerging market economies also. They would have to

do away wi th bottlenecks and protective barriers to unleash the potential they have, the key news today was that

advanced economies were growing at rates sl ightly better than expected whi le growth of emerging economies had

been slower than what was previously thought. More interestingly, the debate has begun on new ri sks, such as

how tapering takes place, at what speed and how i t i s communicated and what would be the spi l lover effects

especial ly on emerging economies. Thi s i s a new ri sk on the hori zon and needs to be watched,Noting that another

emerging ri sk i s deflation, Ms. Lagarde said monetary pol icies have to be re-formulated after some time. Debating

what should be on top of the agenda for global economy in the year ahead, other panel i sts said that nearly seven

years after the cri si s surfaced in 2007, the mood was general ly posi tive today.

Disinvestment- proposal to sel l the 13 per cent stake held by the Speci fied Undertaking of the Uni t Trust of India

(SUUTI) in Axi s Bank reveals the anxiety of the Government to step up the pace of di sinvestment process. the

Rs.40,000 crore targeted from di sinvestment appears a di stant dream. So far, the Centre has managed to garner a

measly Rs.1,325 crore alone through the di sinvestment. The move to sel l equi ty stake in IOC to a ONGC and OIL

shows a sense of desperation. The CAD number has indeed calmed the nerves of an embattled government. What i s

buried inside the better CAD number though i s a deep malai se weakening demand in the economy. Headl ine

inflation (measured by wholesale price index)- the IIP (index of industrial production) number continues to cause

serious concern. Factory output growth (IIP index) decl ined by 2.1 per cent in November. Thi s decl ine must be seen

in the context of a negative base in the year-ago period.- the IIP (index of industrial production) number continues

to cause serious concern. Factory output growth (IIP index) decl ined by 2.1 per cent in November. Thi s decl ine

must be seen in the context of a negative base in the year-ago period.

Iran - Iran i s exploring new ways of expanding i ts trade basket wi th India - Apart from oi l , apples, touri sm and

software education are high on Irans trade agenda

BRICS bank - asking Rel iance-supported think-tank Observer Research Foundation (ORF) to draft strategy papers for

Indias posi tion in the G20 on the BRICS (Brazi l , Russia, India China, South Africa) Development Bank. The structure,

location of i ts headquarters, membership, authori sed capi tal stock and di stribution of voting rights across member

countries of the BRICS Development Bank wi l l be taken up at the next BRICS Mini sterial summi t due to take place

in Brazi l . At the Durban Summi t in March 2013, the BRICS countries had decided to set up a Development Bank for

funding infrastructure proj ects. The BRICS Development Bank wi l l also create a Contingency Reserve Arrangement

worth $100 bi l l ion that member countries wi l l be able to tap should they have to counteract financial shocks in

future such as the one caused by the Lehman Brothers col lapse. ORF strategy paper wi th the Finance Mini stry

proposes four options for Indias posi tion on the structure and ownership model for the BRICS Development Banks.

Two of these include al lowing private sector companies to own part of i t alongside owner countries. Private

sector companies owning a part of a mul ti lateral international body alongside sovereign countries would be odd

though not completely unheard of, - The option wi l l open avenues for investing in real development proj ects for

private companies, - the downside of al lowing private enti ties or individual investors and giving them voting

rights rai ses the ri sk of these players voting for personal or private gain.

new natural gas pricing guidel ines - The Petroleum and Natural Gas Mini stry - under the Rangarajan formula that

wi l l lead to almost doubl ing of prices for al l domestical ly produced gas including conventional , shale, coal bed

methane (CBM) - Domestic Natural Gas Pricing Guidel ines, 2014 - gas from Apri l wi l l be priced at an average price

of l iquefied natural gas (LNG) imports into India and benchmark global gas rates. Thi s formula wi l l be appl icable

ti l l March 31, 2019. The new rates, which wi l l change every quarter, based on the 12-month average of global

rates and LNG import price wi th a lag of one quarter. exi sting fields - MA in the KG D6 block - R-Series and satel l i te

in the KG Basin block - North East Coast block NEC-25. - D1&D3 gas fields in KG-D6 - i f i t i s proved that the

company hoarded gas or del iberately suppressed production at the main D1&D3 fields in the Eastern offshore KG-D6

block since 2010-11.

Eu ropean Cen t ral Ban k-Draghi , the President of European Central Bank, said that Europe i s on the road to

recovery but governments must remain commi tted to structural reforms.Noting that growth remains fragi le and

uneven, he said recovery which started wi th exports i s now moving to consumption.Even whi le appreciating

Greece, Portugal , Spain and Italy for implementing some structural reforms, Mr. Draghi said they cannot relax

thei r efforts whi le other countries too must make progress on thi s front-Fi scal consol idation must not be unravel

led-The upcoming stress tests would further improve confidence in the banking system by increasing transparency-

the aim i s to have one supervi sor and one regulator for al l banks in Europe in the future.

International Monetary Fund (IMF) - i s sl ightly more optimi stic about the global and U.S. economies thi s year-

the global lending organi sation forecasts that the world economy wi l l grow 3.7 per cent in 2014, and that the U.S.

economy wi l l grow 2.8 per cent.

India and Paki stan - Paki stan i s di scussing on non-di scriminatory access (NDA). In a way, he has vi rtual ly ruled out

grant of MFN tag to India. New Delhi has granted thi s status to Islamabad in 1996. Regarding the M word, let

us just say that we have shi fted i t one letter down to N and now we are di scussing NDA. The idea of course i s

(that) instead of getting caught or rather stranded in nomenclature, we should work sincerely towards proving

substantial market access to each other whatever nomenclature we use,- However, ti l l now India has not yet clari

fied i ts stand on NDA =Paki stan had mi ssed the deadl ine of granting MFN status to India. It was to grant in

December 2012 by el iminating the negative l i st of 1,209 i tems. - The bi lateral trade between the countries stood

at $2.60 bi l l ion in 2012-13

india-Paki stan - to find ways of establ i shing reciprocal Non-Di scriminatory Market Access (NDMA) by February-

end. Thi s includes i ssuing bank l icences to al low banks to function in each others country. - Mr. Khan said hi s

elected government had requested India to replace the term Most Favoured Nation (MFN) wi th NDMA. There

are minori ties on both sides who do not desi re peace between the two countries, - For thi s, India needs to open up

to Paki stan 614 i tems. Paki stan, on the other hand, needs to open up to India two l i sts compri sing 936 and 1209

i tems

India-China trade - record $ 31 bn deficit in 2013 - en t ry gat e at Nat h u La wh i ch al l ow t h e I n di an t raders'

v eh i cl es en t er Ch i n a - wi th two-way trade decl ining last year by 1.5 per cent on account of a sharp decl ine in

Indian exports, - Indian exports to China last year total led $ 17.03 bi l l ion - a 9.4 per cent fal l from last year -

out of $ 65.47 total bi lateral trade, - Bi lateral trade reached a record $ 74 bi l l ion in 2011, when China became

Indias largest trading partner. Trade decl ined to $ 66.5 bi l l ion the fol lowing year, on account of the global

slowdown and a 20 per cent drop in Indian exports. The fal l in exports was largely due to curbs on the export of i

ron ore, which had emerged as Indias single biggest export to resource-hungry China.

SEBI- taken several steps wi th respect to requi rements and protection of investors-These measures include e-IPO,

cal l auction on the opening day of an IPO, di sclosure requi rements, expansion of investor grievance redressal

mechani sm, certain obl igations on merchant bankers, and simpl i fied adverti sement code as wel l as product label l

ing for mutual funds.- label l ing of products, but we want sustainable growth in the market and to generate trust in

the market-BSE Managing Di rector & CEO Ashi sh Kumar Chauhan-NSE Managing Di rector & CEO Chi tra Ramkri shna-

for deepening and widening the investor base one has to focus on growth of financial products such as Exchange

Trades Funds, derivatives and fixed income products.-the government i s launching the CPSE ETF as a product wi th

the right composi tion and returns. It wi l l be a very good product for both retai l and insti tutional investors.-

there are three game changers for the markets to sustain and accelerate growth: bringing in pension funds,

encouraging funds l ike ETFs and fi l l ing the gaps by bringing in mi ssing products in the derivatives segment.

Você também pode gostar

- When One Plus One Doesn't Make Two - Asad UmarDocumento20 páginasWhen One Plus One Doesn't Make Two - Asad UmarSinpaoAinda não há avaliações

- Ministerial MeetingDocumento7 páginasMinisterial MeetingaghaandmazaAinda não há avaliações

- Monetary Policy Statement: State Bank of PakistanDocumento32 páginasMonetary Policy Statement: State Bank of Pakistanbenicepk1329Ainda não há avaliações

- Global Q3Documento11 páginasGlobal Q3seahbryantyAinda não há avaliações

- Presented By: Nisha Vineeta SapnaDocumento19 páginasPresented By: Nisha Vineeta SapnaNisha MalikAinda não há avaliações

- Assignment On India's Current Account DeficitDocumento6 páginasAssignment On India's Current Account DeficitdebojyotiAinda não há avaliações

- Fiscal Policy of PakistanDocumento9 páginasFiscal Policy of PakistanRehanAdil100% (1)

- 22nd Loan Earmarked For Debt Servicing: Current State of The EconomyDocumento5 páginas22nd Loan Earmarked For Debt Servicing: Current State of The EconomyWaqas SaeedAinda não há avaliações

- The Causes of Economic Crisis in PakistanDocumento6 páginasThe Causes of Economic Crisis in PakistanHaris Arif100% (1)

- Nigeria Budget 2012Documento6 páginasNigeria Budget 2012Mark allenAinda não há avaliações

- Economic Outlook: Table 1.1: Macroeconomic IndicatorsDocumento9 páginasEconomic Outlook: Table 1.1: Macroeconomic IndicatorsBilal SolangiAinda não há avaliações

- Fiscal PolicyDocumento49 páginasFiscal PolicyAnum ImranAinda não há avaliações

- Barbados InsolvencyDocumento7 páginasBarbados InsolvencyGeorgeConnollyAinda não há avaliações

- Key Macro-Economic Challenges For India, at Present, Include: InflationDocumento5 páginasKey Macro-Economic Challenges For India, at Present, Include: InflationAmita SinwarAinda não há avaliações

- Roshaane IntDocumento6 páginasRoshaane IntRoshaane GulAinda não há avaliações

- Balance of Payments and Trade Regimes: Dr. Abdul Salam LodhiDocumento14 páginasBalance of Payments and Trade Regimes: Dr. Abdul Salam LodhiHamza KhanAinda não há avaliações

- What Is Fiscal Deficit? What Causes It ? and How Can We Bring Our Fiscal Deficit Down?Documento23 páginasWhat Is Fiscal Deficit? What Causes It ? and How Can We Bring Our Fiscal Deficit Down?Ghanwa AsifAinda não há avaliações

- Lebanon Economic SummaryDocumento3 páginasLebanon Economic SummaryGerard ArabianAinda não há avaliações

- Name: Efshal Ateeq Roll No: B-23232 Project: Ict Submitted To: Sir Rahat BukhariDocumento5 páginasName: Efshal Ateeq Roll No: B-23232 Project: Ict Submitted To: Sir Rahat BukhariEfshal AtiqueAinda não há avaliações

- Department of Accountancy & Finance Faculty of Management StudiesDocumento16 páginasDepartment of Accountancy & Finance Faculty of Management Studieslakshanherath123Ainda não há avaliações

- Balance of Payments INDIA 2006-12: Course - Organizational Behaviour PGDM - PTDocumento19 páginasBalance of Payments INDIA 2006-12: Course - Organizational Behaviour PGDM - PTVarun GandhiAinda não há avaliações

- Crux 3.0 - 12Documento10 páginasCrux 3.0 - 12Neeraj GargAinda não há avaliações

- Fiscal Policy Strategy StatementDocumento11 páginasFiscal Policy Strategy StatementPriya RaviAinda não há avaliações

- Opinion Columns C.R.L. Narasimhan: Worrying Numbers Compound ProblemsDocumento2 páginasOpinion Columns C.R.L. Narasimhan: Worrying Numbers Compound ProblemsSourabh SharmaAinda não há avaliações

- By: Akshaya (1020734) Amala Gadde (1020735) B. Madhulika (1020737 Mahija Reddy (1020758)Documento32 páginasBy: Akshaya (1020734) Amala Gadde (1020735) B. Madhulika (1020737 Mahija Reddy (1020758)mahijayAinda não há avaliações

- Imf Ninth Review DR Hafiz PashaDocumento2 páginasImf Ninth Review DR Hafiz PashaKamran AliAinda não há avaliações

- India GDP Growth Rate For 2019 Was 5.02%, A 1.1% Decline From 2018. India GDP GrowthDocumento11 páginasIndia GDP Growth Rate For 2019 Was 5.02%, A 1.1% Decline From 2018. India GDP GrowthDharmesh GoyalAinda não há avaliações

- Budget Analysis-2012 - T.P Ostwal & AssociatesDocumento115 páginasBudget Analysis-2012 - T.P Ostwal & AssociatesvaidheiAinda não há avaliações

- Debt Restructuring and Economic GrowthDocumento8 páginasDebt Restructuring and Economic Growthbulimiempowerment2020Ainda não há avaliações

- Sustainable Debt ManagementDocumento8 páginasSustainable Debt Managementbulimiempowerment2020Ainda não há avaliações

- MPS Oct 2012 EngDocumento2 páginasMPS Oct 2012 EngQamar AftabAinda não há avaliações

- Economic Challenges and OpportunitiesDocumento3 páginasEconomic Challenges and OpportunitiesAsif Khan ShinwariAinda não há avaliações

- MALAWIDocumento10 páginasMALAWIBóng Đá LàngAinda não há avaliações

- Balance of Payments ThesisDocumento4 páginasBalance of Payments Thesiselizabethsnyderdesmoines100% (2)

- Financing For EthiopiaDocumento10 páginasFinancing For EthiopiaHabtamu TeshomeAinda não há avaliações

- Pakistan's Economy in DoldrumsDocumento3 páginasPakistan's Economy in DoldrumsAsif Khan ShinwariAinda não há avaliações

- SL Debt Trap (30april2017)Documento4 páginasSL Debt Trap (30april2017)Jagath SenaAinda não há avaliações

- Budget For FY 2011-12 in BDDocumento7 páginasBudget For FY 2011-12 in BDNazmul HaqueAinda não há avaliações

- MPS Apr 2012 EngDocumento3 páginasMPS Apr 2012 Engbeyond_ecstasyAinda não há avaliações

- August 2019Documento2 páginasAugust 2019Kiran MAinda não há avaliações

- ForeignDocumento5 páginasForeignMd Saiduzzaman shilonAinda não há avaliações

- Credit Rating, Downgrade and SolutionsDocumento16 páginasCredit Rating, Downgrade and SolutionsArjun ChadhaAinda não há avaliações

- September Dossier 2Documento8 páginasSeptember Dossier 2...Ainda não há avaliações

- 11 Finance and DevelopmentDocumento6 páginas11 Finance and DevelopmentM IshaqAinda não há avaliações

- Indian Economy - Nov 2019Documento6 páginasIndian Economy - Nov 2019Rajeshree JadhavAinda não há avaliações

- Current Account DeficitDocumento16 páginasCurrent Account Deficitjainudit212Ainda não há avaliações

- Economy of Pakistan-1Documento15 páginasEconomy of Pakistan-1Leo MessiAinda não há avaliações

- Overcoming COVID-19 in Bhutan: Lessons from Coping with the Pandemic in a Tourism-Dependent EconomyNo EverandOvercoming COVID-19 in Bhutan: Lessons from Coping with the Pandemic in a Tourism-Dependent EconomyAinda não há avaliações

- Final Exam HamidDocumento7 páginasFinal Exam HamidHome PhoneAinda não há avaliações

- Directors Report To The Shareholders of Idlc Finance Limited 2019 944529Documento9 páginasDirectors Report To The Shareholders of Idlc Finance Limited 2019 944529sajibarafatsiddiquiAinda não há avaliações

- SARS Revenue Shortfall ArticleDocumento5 páginasSARS Revenue Shortfall ArticleGarethvanZylAinda não há avaliações

- HE Conomic Imes: It Isn't Big, But It's Full of BangDocumento1 páginaHE Conomic Imes: It Isn't Big, But It's Full of Bangsmdali05Ainda não há avaliações

- Fiscal Crisis, Economic Prospects: The Imperative For Economic Cohesion in The Palestinian TerritoriesDocumento28 páginasFiscal Crisis, Economic Prospects: The Imperative For Economic Cohesion in The Palestinian TerritoriesGeorge HaleAinda não há avaliações

- Budget 2015-16Documento100 páginasBudget 2015-16bazitAinda não há avaliações

- Unit. 18 India'S Balance Payments: 18.0 ObjectivesDocumento16 páginasUnit. 18 India'S Balance Payments: 18.0 ObjectivesRobert SkidelskyAinda não há avaliações

- Bevan 2012 Working Paper 1Documento47 páginasBevan 2012 Working Paper 1Ellis ElliseusAinda não há avaliações

- Outlook For Banks 2010Documento6 páginasOutlook For Banks 2010khabis007Ainda não há avaliações

- CommentDocumento2 páginasCommentshanikayani_20103758Ainda não há avaliações

- Budget of Bangladesh FINALDocumento4 páginasBudget of Bangladesh FINALSumaiya HoqueAinda não há avaliações

- Provincial Facilitation for Investment and Trade Index: Measuring Economic Governance for Business Development in the Lao People’s Democratic Republic-Second EditionNo EverandProvincial Facilitation for Investment and Trade Index: Measuring Economic Governance for Business Development in the Lao People’s Democratic Republic-Second EditionAinda não há avaliações

- Land Reform in India - Role of Indian National Congress 4UPSCDocumento23 páginasLand Reform in India - Role of Indian National Congress 4UPSCNilesh KhadseAinda não há avaliações

- General Studies Mains Indian Economy Indias Economic Interaction With The WorldDocumento8 páginasGeneral Studies Mains Indian Economy Indias Economic Interaction With The Worldujj04Ainda não há avaliações

- Brand Equity Based Akers ModelDocumento8 páginasBrand Equity Based Akers ModelNilesh KhadseAinda não há avaliações

- Economy Current For 2014-15Documento15 páginasEconomy Current For 2014-15Nilesh KhadseAinda não há avaliações

- Land Reforms in India - Peasant Revolts in British-Raj 4UPSCDocumento32 páginasLand Reforms in India - Peasant Revolts in British-Raj 4UPSCNilesh KhadseAinda não há avaliações

- New Banking Licenses - Impact On Indian BankingDocumento20 páginasNew Banking Licenses - Impact On Indian BankingNilesh KhadseAinda não há avaliações

- Land Reforms in India - Bhoodan Movement & Vinoba BhaveDocumento23 páginasLand Reforms in India - Bhoodan Movement & Vinoba BhaveNilesh KhadseAinda não há avaliações

- General Studies Geography of India PhysiograhpyDocumento5 páginasGeneral Studies Geography of India Physiograhpyujj04Ainda não há avaliações

- Land ReformsDocumento4 páginasLand ReformsNilesh KhadseAinda não há avaliações

- ScienceDocumento7 páginasScienceNilesh KhadseAinda não há avaliações

- Financial StabilityDocumento2 páginasFinancial StabilityRavinder SinghAinda não há avaliações

- DefinitionDocumento2 páginasDefinitionNilesh KhadseAinda não há avaliações

- Capital PunishmentDocumento3 páginasCapital PunishmentPriyatam BolisettyAinda não há avaliações

- 2.600 Bce-600ceDocumento34 páginas2.600 Bce-600ceNilesh KhadseAinda não há avaliações

- Mughals Vijayanagara Kings Bahamani Kings Marathas Rule in IndiaDocumento3 páginasMughals Vijayanagara Kings Bahamani Kings Marathas Rule in IndiaNilesh KhadseAinda não há avaliações

- Ethics and IntegrityDocumento16 páginasEthics and IntegrityNilesh KhadseAinda não há avaliações

- Making of The ConstitutionDocumento10 páginasMaking of The ConstitutionRavinder SinghAinda não há avaliações

- Sbi Po Descriptive Paper - 21 June Morning ShiftDocumento6 páginasSbi Po Descriptive Paper - 21 June Morning ShiftNilesh KhadseAinda não há avaliações

- 02Documento15 páginas02Raja ManiAinda não há avaliações

- EnvironmentDocumento6 páginasEnvironmentNilesh KhadseAinda não há avaliações

- Factor Influencing World Distribution of Plants and AnimalsDocumento14 páginasFactor Influencing World Distribution of Plants and AnimalsNilesh Khadse75% (4)

- 19 - Origin and Concept of Sustainable DevelopmentDocumento15 páginas19 - Origin and Concept of Sustainable DevelopmentshanujssAinda não há avaliações

- 31BDocumento21 páginas31BDinesh MehtaAinda não há avaliações

- EcosystemDocumento19 páginasEcosystemNilesh KhadseAinda não há avaliações

- Mineral and Power ResourcesDocumento7 páginasMineral and Power ResourcesNilesh KhadseAinda não há avaliações

- CultreDocumento53 páginasCultreNilesh KhadseAinda não há avaliações

- BiomesDocumento14 páginasBiomesNilesh KhadseAinda não há avaliações

- Regional Planning Part II Types of Regions & Regionalization of IndiaDocumento24 páginasRegional Planning Part II Types of Regions & Regionalization of IndiaS.Rengasamy91% (58)

- Soil GenesisDocumento8 páginasSoil GenesisNilesh KhadseAinda não há avaliações

- Dell DnaDocumento5 páginasDell DnaArshad AbbasAinda não há avaliações

- Basic Accounting Concepts, Conventions, Bases & Policies, Concept of Balance SheetDocumento44 páginasBasic Accounting Concepts, Conventions, Bases & Policies, Concept of Balance SheetVivan Menezes86% (7)

- Assess Your Information and Make An Action PlanDocumento20 páginasAssess Your Information and Make An Action Planeozzypoggy100% (1)

- Life Cycle CostingDocumento17 páginasLife Cycle CostingKumaar GuhanAinda não há avaliações

- Department of Accountancy: Investment in Equity SecuritiesDocumento4 páginasDepartment of Accountancy: Investment in Equity SecuritiesAiza S. Maca-umbosAinda não há avaliações

- Reeby Sports SARY1Documento13 páginasReeby Sports SARY1Santanu DasAinda não há avaliações

- Restructuring Public Entities in Pakistan - Establish An Appointment Commission FirstDocumento7 páginasRestructuring Public Entities in Pakistan - Establish An Appointment Commission Firstsmzafar101Ainda não há avaliações

- Bancolombia Sa: Company Benchmarking Scorecard Corporate Sustainability Assessment 2010Documento2 páginasBancolombia Sa: Company Benchmarking Scorecard Corporate Sustainability Assessment 2010Luis RiosAinda não há avaliações

- De Beers and The US Antitrust LawDocumento13 páginasDe Beers and The US Antitrust Lawआशिमा DhullAinda não há avaliações

- 20-1 To 20-13Documento16 páginas20-1 To 20-13Jesica Vargas0% (2)

- 2022 Ebmv301 TM2 MemoDocumento7 páginas2022 Ebmv301 TM2 MemoSouthAinda não há avaliações

- Options I UploadDocumento3 páginasOptions I UploadManav DhimanAinda não há avaliações

- Chapter 7 Primary and Secondary MarketsDocumento3 páginasChapter 7 Primary and Secondary MarketsLeonard CañamoAinda não há avaliações

- Air BlueDocumento15 páginasAir BlueMashal BabarAinda não há avaliações

- 07 Activity 2Documento3 páginas07 Activity 2marcusAinda não há avaliações

- Nigeria Fact SheetDocumento5 páginasNigeria Fact SheetEbby OnyekweAinda não há avaliações

- Assignment # 4 Submitted By: Registration #: Submitted ToDocumento10 páginasAssignment # 4 Submitted By: Registration #: Submitted ToASAD ULLAHAinda não há avaliações

- Capital StructureDocumento57 páginasCapital StructureRao ShekherAinda não há avaliações

- A Framework For Risk ManagementDocumento16 páginasA Framework For Risk ManagementSimon JosephAinda não há avaliações

- Let's Talk Stocks! - Teacher's VersionDocumento6 páginasLet's Talk Stocks! - Teacher's Versiongkjw897hr4Ainda não há avaliações

- Chapter 9Documento30 páginasChapter 9desy adawiyahAinda não há avaliações

- Bbclocalradio MyersDocumento21 páginasBbclocalradio MyersTarca AndreiAinda não há avaliações

- ICC Publication List1103Documento3 páginasICC Publication List1103Hitendra Nath BarmmaAinda não há avaliações

- RudanaDocumento2 páginasRudanaNyaks GoetieAinda não há avaliações

- F3 Chapter 8Documento12 páginasF3 Chapter 8Ali ShahnawazAinda não há avaliações

- Genmath Las Week1-2Documento13 páginasGenmath Las Week1-2Aguila AlvinAinda não há avaliações

- Lountzis Asset Management Annual Letter 2013Documento31 páginasLountzis Asset Management Annual Letter 2013CanadianValue100% (1)

- MFS Syllabus - April 2024Documento3 páginasMFS Syllabus - April 2024akila vickramAinda não há avaliações

- List of Investment BanksDocumento10 páginasList of Investment BanksSKNYUYAinda não há avaliações

- TIDSOSMDocumento9 páginasTIDSOSMMáté Dániel CsöndesAinda não há avaliações