Escolar Documentos

Profissional Documentos

Cultura Documentos

F Cashflow

Enviado por

RioChristianGultom0 notas0% acharam este documento útil (0 voto)

17 visualizações3 páginascashflow

Título original

f Cashflow

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

XLS, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentocashflow

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato XLS, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

17 visualizações3 páginasF Cashflow

Enviado por

RioChristianGultomcashflow

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato XLS, PDF, TXT ou leia online no Scribd

Você está na página 1de 3

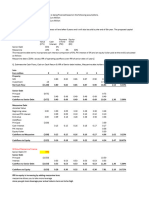

FREE CASH FLOW VS.

CASH FLOWS TO SHAREHOLDERS

DATA

Cost of debt 10% EBIT 6.00

Tax rate 40% Investment 12.00

Cost of equity 12% Amount borrowed 4.00

CASH FLOWS TO SHAREHOLDERS

Year 0 1 2 3 Goes on forever

EBIT 6.00 6.00 6.00

Less interest (0.40) (0.40) (0.40)

Earnings before taxes 5.60 5.60 5.60

Taxes (2.24) (2.24) (2.24)

Net income 3.36 3.36 3.36

Investment by shareholders (8.00) - - -

Net cash flow to shareholders (8.00) 3.36 3.36 3.36

NPV at cost of equity 20.00

Market value of equity 28.00

WEIGHTED AVERAGE COST OF CAPITAL

Proportion Weighted

Cost of of Market Cost of

Capital Value Capital

Debt (after-tax) 6.0% 12.5% 0.8%

Equity 12.0% 87.5% 10.5%

Weighted average cost of capital 11.3%

FREE CASH FLOW

Year 0 1 2 3 Goes on forever

EBIT 6.00 6.00 6.00

Taxes (2.40) (2.40) (2.40)

EBIAT 3.60 3.60 3.60

Investment (12.00) - - -

Free cash flow (12.00) 3.60 3.60 3.60

NPV at WACC 20.00

AFTER-TAX CASH FLOWS FROM LENDERS

Year 0 1 2 3 Goes on forever

Interest (0.40) (0.40) (0.40)

Interest tax shield 0.16 0.16 0.16

After-tax interest (0.24) (0.24) (0.24)

Principal receipt (repayment) 4.00 - - -

Principal plus after-tax interest 4.00 (0.24) (0.24) (0.24)

NPV at after-tax cost of debt -

CONCLUSION

Cash flows to shareholders (8.00) 3.36 3.36 discount at cost of equity

After-tax cash flows to lenders

(4.00) 0.24 0.24 discount at after-tax cost of debt

Free cash flow (12.00) 3.60 3.60 discount at WACC

NPV of cash flows to shareholders = NPV of free cash flows

+ NPV of after-tax cash flows from lenders

Page 1

FREE CASH FLOW VS. CASH FLOWS TO SHAREHOLDERS

DATA

Cost of debt 10% EBIT 6.00

Tax rate 40% Investment 12.00

After-tax cost of debt 6% Amount borrowed 4.00

Cost of equity 12% Subsidized interest rate 5%

Market value of debt 2.00

CASH FLOWS TO SHAREHOLDERS

Year 0 1 2 3 Goes on forever

EBIT 6.00 6.00 6.00

Less interest (0.20) (0.20) (0.20)

Earnings before taxes 5.80 5.80 5.80

Taxes (2.32) (2.32) (2.32)

Net income 3.48 3.48 3.48

Investment by shareholders (8.00) - - -

Net cash flow to shareholders (8.00) 3.48 3.48 3.48

NPV at cost of equity 21.00

Market value of equity 29.00

WEIGHTED AVERAGE COST OF CAPITAL

Proportion Weighted

Cost of of Market Cost of

Capital Value Capital

Debt (after-tax) 6.0% 6.5% 0.4%

Equity 12.0% 93.5% 11.2%

Weighted average cost of capital 11.6%

FREE CASH FLOW

Year 0 1 2 3 Goes on forever

EBIT 6.00 6.00 6.00

Taxes (2.40) (2.40) (2.40)

EBIAT 3.60 3.60 3.60

Investment (12.00) - - -

Free cash flow (12.00) 3.60 3.60 3.60

NPV at WACC 19.00

AFTER-TAX CASH FLOWS FROM LENDERS

Year 0 1 2 3 Goes on forever

Interest (0.20) (0.20) (0.20)

Interest tax shield 0.08 0.08 0.08

After-tax interest (0.12) (0.12) (0.12)

Principal receipt (repayment) 4.00 - - -

Principal plus after-tax interest 4.00 (0.12) (0.12) (0.12)

NPV at after-tax cost of debt 2.00

CONCLUSION

Free cash flow (12.00) 3.60 3.60 discount at WACC

After-tax cash flows from lenders 4.00 (0.12) (0.12) discount at after-tax ordinary cost of debt

Cash flows to shareholders (8.00) 3.48 3.48 discount at cost of equity

NPV of cash flows to shareholders = NPV of free cash flows

+ NPV of after-tax cash flows from lenders

Page 2

FREE CASH FLOW VS. CASH FLOWS TO SHAREHOLDERS

We seldom encounter perpetuities. This shows how to calculate the PV of after-tax cash

flows from bonds when the subsidized loan is a bullet loan (principal repaid only at maturity).

DATA

Cost of debt 10% Amount borrowed 4.00

Tax rate 40% Subsidized rate 5%

After-tax cost of debt 6%

AFTER-TAX CASH FLOWS FROM BONDS

Year 0 1 2 3 4

Interest (0.20) (0.20) (0.20) (0.20)

Interest tax shield 0.08 0.08 0.08 0.08

After-tax interest (0.12) (0.12) (0.12) (0.12)

Principal receipt (repayment) 4.00 - - - (4.00)

Principal plus after-tax interest 4.00 (0.12) (0.12) (0.12) (4.12)

PV factor at after-tax cost of debt 100% 94% 89% 84% 79%

PV of cash flow 4.00 (0.11) (0.11) (0.10) (3.26)

Cumulative PV 4.00 3.89 3.78 3.68 0.42

NPV 0.42

Page 3

Você também pode gostar

- Time Value of MoneyDocumento8 páginasTime Value of Moneytanmaydaulatwal18021998Ainda não há avaliações

- Anwar Group of IndustriesDocumento1 páginaAnwar Group of IndustriesMoment RevealersAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- 9 Cash Flow Navneet EnterpriseDocumento5 páginas9 Cash Flow Navneet EnterpriseChanchal MisraAinda não há avaliações

- Financial Planning and ForecastingDocumento3 páginasFinancial Planning and ForecastingPrima FacieAinda não há avaliações

- Gross Profit/net Sales Gross Profit/revenue Net Income/Total AssetsDocumento85 páginasGross Profit/net Sales Gross Profit/revenue Net Income/Total AssetsMaria Dana BrillantesAinda não há avaliações

- Case 1 - Tutor GuideDocumento3 páginasCase 1 - Tutor GuideKAR ENG QUAHAinda não há avaliações

- AnalysisDocumento9 páginasAnalysismonikparmar1Ainda não há avaliações

- Case Analysis 1Documento1 páginaCase Analysis 1Abhi AbhiAinda não há avaliações

- Chapter 6 - Section 2 The Baldwin Company: An Example: Year 1 Year 2 Year 3Documento11 páginasChapter 6 - Section 2 The Baldwin Company: An Example: Year 1 Year 2 Year 3Meghana ErapagaAinda não há avaliações

- Salary Slip NovDocumento1 páginaSalary Slip NovRahul RajawatAinda não há avaliações

- Quiz 3Documento2 páginasQuiz 3Jaypee BignoAinda não há avaliações

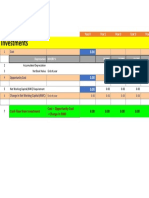

- Investments: Cash Flow From Investment Cost + Opportunity Cost + Change in NWCDocumento1 páginaInvestments: Cash Flow From Investment Cost + Opportunity Cost + Change in NWCAbhi AbhiAinda não há avaliações

- Chapter 12. Tool Kit For Cash Flow Estimation and Risk AnalysisDocumento4 páginasChapter 12. Tool Kit For Cash Flow Estimation and Risk AnalysisHerlambang PrayogaAinda não há avaliações

- LOCAL SOURCES (11+15) TAX REVENUE (12+13+14) : Original Budget Final BudgetDocumento5 páginasLOCAL SOURCES (11+15) TAX REVENUE (12+13+14) : Original Budget Final BudgetJomidy MidtanggalAinda não há avaliações

- FR 2 Full SolutionDocumento16 páginasFR 2 Full SolutionAAinda não há avaliações

- Barangay Fs BambadDocumento1 páginaBarangay Fs BambadCherry BepitelAinda não há avaliações

- Skill Developmetn Instituter Project RepotDocumento7 páginasSkill Developmetn Instituter Project RepotPriyotosh DasAinda não há avaliações

- Itemized: Gross Income From OperationsDocumento9 páginasItemized: Gross Income From OperationsLyka RoguelAinda não há avaliações

- Salary Slip OctDocumento1 páginaSalary Slip OctRahul RajawatAinda não há avaliações

- ABC Company, Inc. Recapitalization AnalysisDocumento10 páginasABC Company, Inc. Recapitalization AnalysisMarcAinda não há avaliações

- 11.1 Mezzanine Finance SolvedDocumento1 página11.1 Mezzanine Finance SolvedShubhangi JainAinda não há avaliações

- Cma DataDocumento9 páginasCma Datapk9079885245Ainda não há avaliações

- LeasingDocumento14 páginasLeasingSana SarfarazAinda não há avaliações

- CF Assignment 3 (B)Documento13 páginasCF Assignment 3 (B)Just Some EditsAinda não há avaliações

- Capital Budgeting Seatwork 1 MWF SolutionDocumento2 páginasCapital Budgeting Seatwork 1 MWF SolutionTrizia Bermudo TibesAinda não há avaliações

- Solution To Mini Case (SAPM)Documento8 páginasSolution To Mini Case (SAPM)Snigdha IndurtiAinda não há avaliações

- ECF 1 StudentsDocumento6 páginasECF 1 StudentsAniruddh MadrewarAinda não há avaliações

- Income Tax Calculation For The Period 01/04/2021 To 07/07/2021Documento4 páginasIncome Tax Calculation For The Period 01/04/2021 To 07/07/2021Srinath AllaAinda não há avaliações

- Business Plan: Product DescriptionDocumento7 páginasBusiness Plan: Product DescriptionNikhil BirajAinda não há avaliações

- WPC Assignment - FM CaseDocumento6 páginasWPC Assignment - FM CaseAhmed AliAinda não há avaliações

- Revised Financial Results For December 31, 2016 (Result)Documento4 páginasRevised Financial Results For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- KKTiwari - 18214263 - Worldwide Paper Company-2016Documento5 páginasKKTiwari - 18214263 - Worldwide Paper Company-2016KritikaPandeyAinda não há avaliações

- Free Cash Flow Initial Equity Dividend Change in Cash BalanceDocumento6 páginasFree Cash Flow Initial Equity Dividend Change in Cash BalanceAbhinav SinhaAinda não há avaliações

- Finance and Project Management AssignmentDocumento22 páginasFinance and Project Management AssignmentMashaal FAinda não há avaliações

- Chapter 9 Making Capital Investment DecisionsDocumento32 páginasChapter 9 Making Capital Investment Decisionsiyun KNAinda não há avaliações

- Answer To Prelim QuizzerDocumento4 páginasAnswer To Prelim QuizzerLouina YnciertoAinda não há avaliações

- GensetDocumento5 páginasGensetdhkn9t8btgAinda não há avaliações

- Week 1 - Broadway ProformaDocumento34 páginasWeek 1 - Broadway ProformashivangiAinda não há avaliações

- British American Tobacco Bangladesh: Internal Credit Risk Scoring SystemDocumento4 páginasBritish American Tobacco Bangladesh: Internal Credit Risk Scoring SystemSadia HossainAinda não há avaliações

- The Forecast For A Company's P&L Is Provided Below. Forecast The Operating Cash Flow For 2021Documento11 páginasThe Forecast For A Company's P&L Is Provided Below. Forecast The Operating Cash Flow For 2021ShivamAinda não há avaliações

- Case 2 Marking SchemeDocumento22 páginasCase 2 Marking SchemeHello100% (1)

- 2 Case1 1bFinPlannNEWFashionSHOPS2022 23SolutionTemplateDocumento8 páginas2 Case1 1bFinPlannNEWFashionSHOPS2022 23SolutionTemplatesantiagoAinda não há avaliações

- Surbhi Devi: W/o Sourabh Kumar College Road Khesmi P.O-Gomoh, DhanbadDocumento15 páginasSurbhi Devi: W/o Sourabh Kumar College Road Khesmi P.O-Gomoh, DhanbadPawan KumarAinda não há avaliações

- Thoma Pharmaceutical Company-Capital Budgeting and Estimating Cash Flows-Part V-Chapter 12Documento3 páginasThoma Pharmaceutical Company-Capital Budgeting and Estimating Cash Flows-Part V-Chapter 12Rajib Dahal75% (8)

- Problems: Problem 12 - 2Documento9 páginasProblems: Problem 12 - 2Jein PAinda não há avaliações

- Asset Turnover Sales Asset Sales Birr 160,000Documento3 páginasAsset Turnover Sales Asset Sales Birr 160,000Abdi Z leaderAinda não há avaliações

- Reading 23 Residual Income Valuation - AnswersDocumento47 páginasReading 23 Residual Income Valuation - Answerstristan.riolsAinda não há avaliações

- Name: Course: SEGI Course Code: UCLAN Module Code: Registration Number Institution: Lecturer: Due Date: Student SignatureDocumento8 páginasName: Course: SEGI Course Code: UCLAN Module Code: Registration Number Institution: Lecturer: Due Date: Student SignatureErick KinotiAinda não há avaliações

- Numbers Sheet Name Numbers Table Name Excel Worksheet NameDocumento15 páginasNumbers Sheet Name Numbers Table Name Excel Worksheet NameSridhar KatnamAinda não há avaliações

- Tax Chapter 3 AssignmentDocumento5 páginasTax Chapter 3 AssignmentAriin TambunanAinda não há avaliações

- Spreadsheet Template CourseraDocumento4 páginasSpreadsheet Template Courserarutvik55% (11)

- PRC - Amiya Rosa 2 Carmine Standard Sample Computation - Bank Financing PsbankDocumento1 páginaPRC - Amiya Rosa 2 Carmine Standard Sample Computation - Bank Financing Psbankapi-239586063Ainda não há avaliações

- Traditional Theory Approach: Illustrations 1Documento7 páginasTraditional Theory Approach: Illustrations 1PRAMOD VAinda não há avaliações

- Lecture 24 Working SheetDocumento2 páginasLecture 24 Working Sheetsobian356Ainda não há avaliações

- Shail End RaDocumento24 páginasShail End Rabharat khandelwalAinda não há avaliações

- Capital Budgeting Sample ProblemsDocumento10 páginasCapital Budgeting Sample ProblemsMark Gelo WinchesterAinda não há avaliações

- Final Report - Financial ModelDocumento10 páginasFinal Report - Financial ModelDrishti SrivatavaAinda não há avaliações

- Practice Q (WACC)Documento3 páginasPractice Q (WACC)Divyam GargAinda não há avaliações

- +incest Wife PDFDocumento55 páginas+incest Wife PDFSandeep Chowdhury50% (4)

- +incest Schoolgirls PDFDocumento61 páginas+incest Schoolgirls PDFSandeep Chowdhury0% (1)

- +into Sister, Into Incest PDFDocumento56 páginas+into Sister, Into Incest PDFSandeep ChowdhuryAinda não há avaliações

- +in Sexual Pursuit PDFDocumento62 páginas+in Sexual Pursuit PDFSandeep ChowdhuryAinda não há avaliações

- +hungry For Sister PDFDocumento79 páginas+hungry For Sister PDFSandeep Chowdhury100% (1)

- +hot Pants Weather Girl PDFDocumento63 páginas+hot Pants Weather Girl PDFSandeep ChowdhuryAinda não há avaliações

- +in Bondage Schoolgirl PDFDocumento53 páginas+in Bondage Schoolgirl PDFSandeep ChowdhuryAinda não há avaliações

- +hero's Mistress PDFDocumento51 páginas+hero's Mistress PDFDarko VrhovacAinda não há avaliações

- +homespun FunDocumento76 páginas+homespun FunAna-Maria Ignat0% (1)

- +hot & Horny Weekend PDFDocumento68 páginas+hot & Horny Weekend PDFSandeep ChowdhuryAinda não há avaliações

- +horny Voyeur Schoolgirls PDFDocumento51 páginas+horny Voyeur Schoolgirls PDFSandeep ChowdhuryAinda não há avaliações

- +horny Balling Mother PDFDocumento55 páginas+horny Balling Mother PDFSandeep Chowdhury100% (1)

- FCFF 2 STDocumento15 páginasFCFF 2 STSandeep ChowdhuryAinda não há avaliações

- Implied Risk Premium Calculator: Sheet1Documento2 páginasImplied Risk Premium Calculator: Sheet1Sandeep ChowdhuryAinda não há avaliações

- Workbook1 2Documento73 páginasWorkbook1 2Sandeep ChowdhuryAinda não há avaliações