Escolar Documentos

Profissional Documentos

Cultura Documentos

Acct. Bonus #1

Enviado por

robdombroskiDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Acct. Bonus #1

Enviado por

robdombroskiDireitos autorais:

Formatos disponíveis

Ac2001

SPRING 2014

BONUS PROBLEM #1

MAXIMUM 3 POINTS

PLEASE ANSWER THE QUESTIONS BELOW USING THESE DIRECTIONS:

Bonus Problem due in-class only. See your class schedule for date due.

(Papers will NOT be accepted after class)

Answers MUST BE TYPED in space provided. (Handwritten NOT accepted)

To make your answer easy to grade, please use the answer sheet provided at the start of

the bonus problem. Turn in ONLY the answer sheet.

Hand in the ANSWER SHEET ONLY (no supporting work).

SIGN YOUR NAME TO STATE THAT YOU DID YOUR OWN WORK.

You can work together BUT, each person must do their own solution.

***************************************************************************************

ANSWER SHEET FOR BONUS #1 (TO HAND IN)

(

TYPE BOTH NAME AND PEOPLESOFT NUMBER BELOW)

NAME: ___Brenna Coughlin_____ Peoplesoft ID # ___1927441______

CLASS TIME: __11am__

SIGNATURE: ____________________

******************************************************************

1.

Credit to

For

____Rent Expense_____ (Account Title)

$____6,600_______ (Amount)

2.

Credit to

For

__Earned Rent Revenue____ (Account Title)

$__30,000______ (Amount)

3.

Credit to

For

__Prepaid Insurance____ (Account Title)

$_____16,000_____ (Amount)

4.

Debit to

Credit to

___Accounts Recievable __ (Account Title)

__Service Revenue_____ (Account Title)

5.

Percentage increase in revenues from 2011 to 2013 is _41.3___%

Percentage increase in revenues from 2012 to 2013 is __167___%

6.

$__1,075,000_______ (Amount)

7.

$__(18,000)______ (Amount)

___(Net Loss)__ Net Income OR (Net Loss)

8.

$___643,000______ (Amount)

9.

$__706,000_______ (Amount)

10.

$___236,000______ (Amount)

BONUS 1 SPRING 2014

1.

On June 1, 2014, ten months' rent totaling $22,000 was paid on an office rental. The payment of cash was originally

recorded by a debit to Rent Expense. The adjusting entry at December 31, 2014 would require a

Credit to _______________ (Account Title)

For

$_______________ (Amount)

2.

On July 1, 2014, ten months' rent income totaling $50,000 was received on an office rental. The receipt of cash was

originally recorded by a credit to Unearned Rent Revenue. The adjusting entry at December 31, 2014 would require a

Credit to _______________ (Account Title)

For

$_______________ (Amount)

3.

The unadjusted trial balance amount for Prepaid Insurance on December 31, 2014, was $24,000. The insurance policy

was purchased on May 1, 2014 and is effective for 12 months starting on that date. The adjusting entry on December 31,

2014 would require a

Credit to _______________ (Account Title)

For

$_______________ (Amount)

4.

On December 27, 2014 Vivian Company completes Service Revenue on account for a client in the amount of $78,000.

No entry was ever made for this transaction as of December 31, 2014. Vivian Company ends it reporting year on December

31, 2014. On December 31, 2014, Vivian Company needs to make an entry for $78,000 which debits and credits the

following accounts:

Debit to _______________ (Account Title)

Credit to _______________ (Account Title)

5.

Total revenues for Sarah Company over a three year period (in millions) were:

2012

$364,000

2013

$688,000

2014

$972,000

The percentage increase in revenues from 2013 to 2014 is _________%

The percentage increase in revenues from 2012 to 2014 is _________%

(For Question 5, ROUND YOUR ANSWERS TO NEAREST WHOLE PERCENT)

** PLEASE SEE QUESTIONS 6-10 ON THE NEXT PAGE **

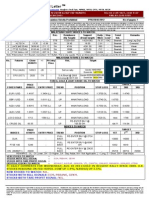

QUESTIONS 6-10 ARE BASED ON THE FOLLOWING INFORMATION:

(Hint: do a complete set of financial statements before answering these questions)

Vernon Company has the following adjusted account balances at December 31, 2014:

Equipment

Salaries Expense

Unearned Revenue

Accounts Receivable

Cash

Rent Expense

Depreciation Expense

Accounts Payable

Office Supplies

Dividends

Land

Revenues

Office Supplies Expense

Common Stock ($1 par)

Prepaid Rent

Salaries Payable

Accumulated Depreciation- Equipment

Retained Earnings (1/1/2014)

$290,000

180,000

10,000

95,000

80,000

115,000

5,000

42,000

1,000

11,000

220,000

300,000

18,000

590,000

60,000

11,000

40,000

82,000

6. A Trial Balance prepared on December 31, 2014 using the account balances above would balance at:

$____________.

7. The income statement prepared at December 31, 2014, would report net income or (net loss) of:

$____________.

____________.

Indicate net income OR (net loss)

8. The balance sheet prepared at December 31, 2014, would report total owners equity of:

$____________.

9. The balance sheet prepared at December 31, 2014, would report total assets of:

$____________.

10. The balance sheet prepared at December 31, 2014, would report total current assets of:

$____________.

Você também pode gostar

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Monthly Price Data Between 1999 To 2012 of DSEDocumento241 páginasMonthly Price Data Between 1999 To 2012 of DSEKuraf NawzerAinda não há avaliações

- How Mintoff Killed The NBMDocumento4 páginasHow Mintoff Killed The NBMsevee2081Ainda não há avaliações

- A Manulife TranscriptDocumento19 páginasA Manulife TranscriptPierreAinda não há avaliações

- ACCOR 2010 ResultsDocumento5 páginasACCOR 2010 Resultsp.bedi9734Ainda não há avaliações

- Yongnam Holdings LTD: Good Results As ExpectedDocumento5 páginasYongnam Holdings LTD: Good Results As Expectedsagger09Ainda não há avaliações

- National Income Determination: (Three Sector Model)Documento12 páginasNational Income Determination: (Three Sector Model)Yash KumarAinda não há avaliações

- Life Insurance Company The Whole Life Policy-Single PremiumDocumento13 páginasLife Insurance Company The Whole Life Policy-Single PremiumNazneenAinda não há avaliações

- Types of Portfolio ManagementDocumento3 páginasTypes of Portfolio ManagementaartiAinda não há avaliações

- Semi Auto TradingDocumento3 páginasSemi Auto TradingkonosubaAinda não há avaliações

- FCCB Project by - Ankit BhansaliDocumento39 páginasFCCB Project by - Ankit BhansaliAnkit BhansaliAinda não há avaliações

- Journal of Business Research: Christoph Burmann, Marc Jost-Benz, Nicola RileyDocumento8 páginasJournal of Business Research: Christoph Burmann, Marc Jost-Benz, Nicola Rileykikiki123Ainda não há avaliações

- M16 Gitm4380 13e Im C16 PDFDocumento17 páginasM16 Gitm4380 13e Im C16 PDFGolamSarwar100% (2)

- A Study On Financial Derivatives (Futures & Options)Documento93 páginasA Study On Financial Derivatives (Futures & Options)Vinod Ambolkar100% (2)

- Financial Management Project BbaDocumento54 páginasFinancial Management Project BbaMukul Somgade100% (6)

- Investement AvenuesDocumento82 páginasInvestement AvenuesSunil RawatAinda não há avaliações

- PG ValidationDocumento10 páginasPG ValidationDerwin DomiderAinda não há avaliações

- Atlantic Tours General Journal Date: Account Titles and Explanation Ref: Debits Credits 2003Documento4 páginasAtlantic Tours General Journal Date: Account Titles and Explanation Ref: Debits Credits 2003babe447Ainda não há avaliações

- Direct Tax Article Taxation of Agricultural LandDocumento7 páginasDirect Tax Article Taxation of Agricultural LandmanishdgAinda não há avaliações

- Economic Analysis of Indian Construction IndustryDocumento23 páginasEconomic Analysis of Indian Construction Industryaishuroc100% (2)

- Guidelines and Procedures For Entering Into Joint Venture (JV) Agreements Between Government and Private EntitiesDocumento25 páginasGuidelines and Procedures For Entering Into Joint Venture (JV) Agreements Between Government and Private EntitiesPoc Politi-ko ChannelAinda não há avaliações

- Group 3 Thaco Case Study Report Edited Version 2Documento21 páginasGroup 3 Thaco Case Study Report Edited Version 2Lương Vân Trang100% (2)

- Brief Note ASCI TrainingDocumento21 páginasBrief Note ASCI Trainingpkmisra1965Ainda não há avaliações

- Fred Tam News LetterDocumento7 páginasFred Tam News LetterTan Lip SeongAinda não há avaliações

- SF GRP 01 SecCDocumento49 páginasSF GRP 01 SecCUjjwal ChandraAinda não há avaliações

- FInal Black Book VISHAKAHA PROJECTDocumento46 páginasFInal Black Book VISHAKAHA PROJECTrutuja ambreAinda não há avaliações

- Review of LiteratureDocumento7 páginasReview of LiteratureAshish KumarAinda não há avaliações

- Fund Factsheets - IndividualDocumento57 páginasFund Factsheets - IndividualRam KumarAinda não há avaliações

- Comparison Between Traditional Plan &ULIP's AT ICICIDocumento70 páginasComparison Between Traditional Plan &ULIP's AT ICICIBabasab Patil (Karrisatte)100% (1)

- Money ManagementDocumento13 páginasMoney ManagementHorace Cheng100% (3)