Escolar Documentos

Profissional Documentos

Cultura Documentos

Offshore201403 DL

Enviado por

Rachel FloresTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Offshore201403 DL

Enviado por

Rachel FloresDireitos autorais:

Formatos disponíveis

Houston London Paris Stavanger Aberdeen Singapore Moscow Baku Perth Rio de Janeiro Lagos Luanda

World Trends and Technology for Of

echnology for Offshore Oil and Gas Operations

Connect with Offshore magazine on social media for

the latest news, discussions, and expert analysis.

Connect with Offshore:

Tweet with Offshore now:

Polar Duchess prepares for Nerites 3D

survey offshore South Australia

http://ow.ly/s1rDI

Heerema rolls out frst North Sea

Cygnus topsides http://ow.ly/rY1nj

First gas fows from North Sea cross-

border Orca project ow.ly/rTFwy

The Offshore editors have made

their choices for top 5 offshore feld

development projects for 2013:

http://bit.ly/1hRI6K9

WWW. OFFSHORE- MAG. COM

Follow us at @Offshoremgzn to get offshore

news throughout the day.

Like Offshore magazine on Facebook for news

updates, to exchange photos, and hear about

coverage at trade shows and events.

Join the Offshore magazine LinkedIn group

to discuss the latest news with other industry

experts and professionals.

OS60Yrs_PetroRM_i_140108 1 1/8/14 11:16 AM

March 2014

Houston London Paris Stavanger Aberdeen Singapore Moscow Baku Perth Rio de Janeiro Lagos Luanda

World Trends and Technology for Offshore Oil and Gas Operations

For continuous news & analysis

www.offshore-mag.com

I

N

S

I

D

E

:

S

u

b

s

e

a

b

o

o

s

t

i

n

g

&

p

r

o

c

e

s

s

i

n

g

p

o

s

t

e

r

Seismic vessels adapt

to changing demands

Asia/Pacific

shipyard review

Coiled tubing

case study

Dual gradient

drilling update

1403OFF_C1 1 2/28/14 5:03 PM

| baker hughes. com

We can sit around and debate whats possible.

Or we can invent the rst multizone single-trip completion system

that reduces risk and costs on a 26,586 ft well in 8,149 ft of water.

Because talking is easy but doing is hard.

Learn more at www.bakerhughes.com/thepayzoneleader

Man on the moon

Leaders do

while others talk.

2014 Baker Hughes Incorporated. All Rights Reserved. 38682 01/2014

1403OFF_C2 2 2/28/14 5:03 PM

1403OFF_1 1 2/28/14 4:50 PM

42

38

International Edition

Volume 74, Number 3

March 2014

C O N T E N T S

Offshore (ISSN 0030-0608) is published 12 times a year, monthly by PennWell, 1421 S. Sheridan Road, Tulsa, OK 74112. Periodicals class postage paid at Tulsa, OK, and additional offices.

Copyright 2014 by PennWell. (Registered in U.S. Patent Trademark Office.) All rights reserved. Permission, however, is granted for libraries and others registered with the Copyright Clearance

Center, Inc. (CCC), 222 Rosewood Drive, Danvers, MA 01923, Phone (508) 750-8400, Fax (508) 750-4744 to photocopy articles for a base fee of $1 per copy of the article plus 35 per page.

Payment should be sent directly to the CCC. Requests for bulk orders should be addressed to the Editor. Subscription prices: US $112.00 per year, Canada/Mexico $ 145.00 per year, All

other countries $184.00 per year (Airmail delivery: $257.00). Worldwide digital subscriptions: $112.00 per year. Single copy sales: US $11.00 per issue, Canada/Mexico $13.00 per issue, All

other countries $15.00 per issue (Airmail delivery: $24.00). Return Undeliverable Canadian Addresses to: P.O. Box 122, Niagara Falls, ON L2E 6S4. Back issues are available upon request.

POSTMASTER send form 3579 to Offshore, P.O. Box 3264, Northbrook, IL 60065-3264. To receive this magazine in digital format, go to www.offshoresubscribe.com.

Celebrating 60 Years of Trends, Tools, and Technology

ASIA/PACIFIC

Sembcorp to integrate Singapore yards

at new mega shipyard ........................................................... 38

Sembcorp Marine has set up a mega shipyard in Singapore to service

the global oil and gas and marine sectors, and to maintain a competitive

edge in the construction of exploration rig and production platforms, ship

conversion, repairs, and maintenance. Prime Minister Lee Hsien Loong

opened the frst phase of Sembmarine Integrated Yard @ Tuas on Nov.

6, 2013, 50 years after the industry began in 1963 as part of Singapores

industrialization program to support its then fedgling economy.

Innovation keeps Keppel

at the forefront of rig design ................................................... 42

Singapore rig builder Keppel continues to take on the challenges of

operating in a high-risk offshore oil and gas sector by using innovative

designs, effciency-driven capabilities, and close working relationships

with its customers. Pressure is always felt. And we treat all our com-

petitors, including the Chinese shipyards, very seriously, says Tong

Chong Heong, CEO of Keppel Offshore & Marine. But he is quick to

point out the advantage of being strategically located in the worlds

major hydrocarbon producing regions such as Brazil, the US, Caspian

Sea, and Southeast Asia, as well as China.

60 YEARS OF OFFSHORE

From the archives: U.S. rig makes

a gas strike in the North Sea ................................................... 48

Selected from the July 1964 issue of Of fshore, the article describes

how, after making a historic gas strike in the North Sea, Reading &

Bates mobile drilling unit Mr. Louie was forced to abandon the location

because of gas cratering the seafoor near the Nordsee B-1 well.

1403OFF_2 2 2/28/14 4:50 PM

MD-2

DUAL-DECK SHALE SHAKER WITH

DURAFLO COMPOSITE SCREEN TECHNOLOGY

Mark of M-I L.L.C

One unbeatable combination.

The MD-2

dual-motion at-deck shale shaker with patented DURAFLO

full-contact composite

screen technology ensures uid quality, protects wellbore integrity, and preserves equipment life.

This unique package recently enabled a South Texas operator to process drilling uid at 658

gallons per minute (GPM), more than twice the combined capacity of two rig-owned shakers.

The MD-2 shaker consistently handled 100% of the uid returns, maximizing ow rate and ROP.

For throughput and efciency the MD-2 shale shaker using DURAFLO composite screens

makes one unbeatable combination.

www.miswaco.com/MD2

1403OFF_3 3 2/28/14 4:50 PM

50

20

62

International Edition

Volume 74, Number 3

March 2014

C O N T E N T S

4 Of fshore March 2014 t www.offshore-mag.com

Celebrating 60 Years of Trends, Tools, and Technology

GEOLOGY & GEOPHYSICS

Seismic vessel survey expands

to include additional vessel types .......................................... 50

The 2014 Worldwide Seismic Vessel Survey lists 179 vessels. This is

an increase if directly compared to the 2013 tally, but that is deceiving.

There are two signifcant changes this year. The listing adds Geokinet-

ics and its 43 transition zone/shallow water/OBC vessels for the frst

time, and the two electromagnetic survey vessels of EMGS.

2014 Worldwide seismic vessel survey .................................. 52

Get the latest comprehensive listing of the capabilities and features of

the worldwide seismic vessel feet.

Seismic LWD reduces time, risk

in remote ultra-deepwater well .............................................. 58

The Schlumberger seismicVISION seismic-while-drilling service used

real-time measurements to update the velocity model in a wildcat well

off the coast of West Africa and enabled the well target objectives to be

achieved with confdence while reducing risk and time to drill the well. In

one well section with a challenging mud weight window, SWD was used

alongside the Schlumberger StethoScope FPWD service to more accu-

rately calibrate the pre-drill pore pressure model. The acquired formation

pressures, coupled with while-drilling petrophysical data, facilitated cali-

bration of a velocity-to-pore-pressure transform and normal compaction

trend lines, providing reduced uncertainty in the pore pressure model.

DRILLING & COMPLETION

Advances in dual gradient drilling

will facilitate deepwater development ................................... 62

When drilling conventionally, the column of wellbore annulus returns

(mud and cuttings) presents a single depth-versus-pressure gradient. Dual

gradient drilling technology involves creating two or more depths versus

pressure gradients in the returns path. DGD is particularly suitable for ad-

dressing a number of offshore drilling challenges because it enables a well-

bore pressure profle to more closely match the pressures presented by

nature, reducing or eliminating the impact of water depth on well design.

1403OFF_4 4 2/28/14 4:50 PM

Q

A

Formation Evaluation

|

Well Construction

|

Completion

|

Production

2

0

1

4

W

e

a

t

h

e

r

f

o

r

d

.

A

l

l

r

i

g

h

t

s

r

e

s

e

r

v

e

d

.

We have eight wells with a combined

281 days of NPT. The most common

problems are unstable formations,

lost circulation, and stuck pipe.

Weve been unable to reach TD in

four of the previous wells. How can

we ecouomicall] oriug these feld

developments back on track?

Our Well Engineering and Project

Management team delivered a drilling

and mitigation program that safely

drilled and completed several problem

wells. Our collaborative engineered

solutions spanned the well-construction

cycle, including managed-pressure

drilling (MPD), reaming with casing,

solid expandables, zonal isolation,

and managed pressure cementing.

USD

$

80MM

saved in reduced

drilling-related NPT

Contact and collaborate with us at

wellintegrity@weatherford.com

Delivered Results

100

%

of the uustaole or fuid-loss zoues were

drilled with our engineered MPD solutions

An offshore operator in Latin America

asked us to collaborate on solutions

for a series of problem wells.

CASE IN POINT

4 hole sections

delivered in multiple

wells previously

deemed undrillable

1403OFF_5 5 2/28/14 4:50 PM

CAROUSELS

Think CarouselsThink

All SizesAll Umbilical

ApplicationsThink Again

Umbilical Carousels

Remember

From 200 mt. to 9000 mt.

We can design, fabricate,

commission, then spool

and install your umbilical,

or fying leads!

Deep Down provides subsea

engineering, fabrication,

installation, commissioning,

maintenance, and more

subsea services!

Flying leads, umbilicals, SIT

testing, UTA, buoyancy, etc.

Deep Down is YOUR

Subsea Solution Source

Call us for details +1-281-862-2201

Visit our website

www.deepdowninc.com

15473 East Freeway

Houston,Texas.77530 USA

ISO-9001

Our 17th Year

D E P A R T M E N T S

6 Of fshore March 2014 t www.offshore-mag.com

International Edition

Volume 74, Number 3

March 2014

PRODUCTION OPERATIONS

Compact coiled tubing unit makes

small facility completion interventions feasible ....................................................... 66

Baker Hughes has developed Micro CT Coiled Tubing service, a more compact, lighter weight,

and modular system using a combination of equipment and proprietary intervention modeling

software to circumvent the deployment challenges of larger CT equipment. The unit effectively

bridges the gap between traditional capillary and CT services to allow operators to economically

service wells that might otherwise have to be shut in or abandoned.

SUBSEA

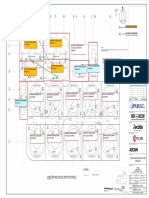

Subsea processing retains innovation, moves toward standardization .................. 68

This issue of Of fshore contains the 2014 Worldwide Survey of Subsea Processing Systems, the

seventh installment of this industry resource, a joint effort between INTECSEA and Of fshore

magazine. The primary aims of this poster are to chronicle the development and the developers

of these systems, and to document the continued commitment of oil companies to the applica-

tion of these technologies.

Online .................................................... 8

Comment ............................................. 10

Data ..................................................... 12

Global E&P .......................................... 14

Offshore Europe .................................. 20

Gulf of Mexico ..................................... 22

Subsea Systems ................................. 24

Vessels, Rigs, & Surface Systems ...... 26

Drilling & Production .......................... 28

Geosciences ........................................ 30

Offshore Automation Solutions .......... 32

Regulatory Perspectives ..................... 34

Business Briefs ................................... 70

Advertisers Index ............................... 71

Beyond the Horizon ............................ 72

COVER: Seismic data acquisi-

tion on the open seas has evolved,

as work moves into deeper waters

and remote, and often harsh, environ-

ments. Purpose-built, high-capacity

seismic vessels will be sailing out of

shipyards over the next few years to

meet demand for increasingly complex

data acquisition techniques. Many of

those vessels will be powered by hy-

brid propulsion systems, as geophysi-

cal companies focus on fuel effciency.

In the photo, a worker unhooks a

workboat from a CGG mother vessel,

which is shown towing a seismic array.

(Image courtesy CGG)

1403OFF_6 6 2/28/14 4:50 PM

1403OFF_7 7 2/28/14 4:50 PM

PennWell

1455 West Loop South, Suite 400, Houston, TX 77027 U.S.A.

Tel: (01j 713 621-9720 Fax: (01j 713 963-6296

SALES

WORLDWIDE SALES MANAGER

HOUSTON AREA SALES

David Davis davidd@pennwell.com Tel: (713) 963-6206

Shelley Cohen shelleyc@pennwell.com

CUSTOM PUBLISHING

Roy Markum roym@pennwell.com

Tel: (713) 963-6220

PRODUCTION MANAGER

Kimberlee Smith ksmith@pennwell.com

Tel. (O18) 882O252 Fax. (O18) 881O415

REPRINT SALES

Rhonda Brown rhondab@fosterprinting.com

Tel. (21O) 878GOO4 Fax. (21O) 5G12O28

SUBSCRIBER SERVICE

To start a free subscription, visit www.offshoresubscribe.com.

Contact us for subscription questions,

address changes and back issues

Tel. (847) 7G8O54O Fax. (847) 7G8OGO7

Email: os@halldata.com

OFFSHORE EVENTS

David Paganie (Houston) davidp@pennwell.com

Russell McCulley (Houston) russellm@pennwell.com

Gail Killough (Houston) gailk@pennwell.com

Niki Vrettos (London) nikiv@pennwell.com

Jenny Phillips (London) jennyp@pennwell.com

CORPORATE HEADQUARTERS

Fennwell, 1421 S. Sheridan Rd., Tulsa, 0K 74112

Member

All Rights reserved

0llshore SShOO8OOGO8

Frinted in the u.S.A. ST ho. 12G818158

CHAIRMAN:

Frank T. Lauinger

PRESIDENT/CHIEF EXECUTIVE OFFICER:

Robert F. Biolchini

CHIEF FINANCIAL OFFICER:

Mark C. Wilmoth

Publications Mail Agreement Number 40052420

GST No. 126813153

CONTRIBUTING EDITORS

Dick Ghiselin (Houston)

Doug Gray (Rio de Janeiro)

Nick Terdre (London)

Gurdip Singh (Singapore)

Wendy Laursen (Australia)

TECHNOLOGY EDITOR,

SUBSEA & SEISMIC

Gene Kliewer

genek@pennwell.com

EDITOR-EUROPE

Jeremy Beckman

jeremyb@pennwell.com

ASSISTANT EDITOR

Jessica Tippee

jessicat@pennwell.com

SENIOR TECHNICAL EDITOR/

DOMESTIC CONFERENCES

EDITORIAL DIRECTOR

Russell McCulley

russellm@pennwell.com

POSTER EDITOR

E. Kurt Albaugh, P.E.

Kurt.albaugh@yahoo.com

PRESENTATION EDITOR

Josh Troutman

josht@pennwell.com

VICE PRESIDENT and GROUP PUBLISHER

Mark Peters

markp@pennwell.com

CHIEF EDITOR/CONFERENCES EDITORIAL DIRECTOR

David Paganie

davidp@pennwell.com

MANAGING EDITOR

Bruce A. Beaubouef

bruceb@pennwell.com

8 Of fshore March 2O14 www.offshore-mag.com

Available at

Offshore-mag.com

1403OFF_8 8 2/28/14 4:51 PM

2012 - 2013 ShawCor Ltd. All rights reserved.

Engineering Services

Pipe and Joint

Coating Design

Coating System

Validation

Logistics Management

Pipe Coating

Application

Field Joint Coating

When line pipe and eld joint coatings work perfectly together, project schedules

are promptly met. And only one company makes sure of it Bredero Shaw. We offer

Complete Coating Assurance, a new approach for meeting todays more complex

offshore challenges.

Our model combines line pipe and eld joint coating into a full package of integrated

services. Up front, our experts design the coatings to interface properly in the

eld. We then draw upon the worlds largest validation, production and logistics

infrastructure to get the job done. This includes 24 line pipe coating plants, storage in

key ports, and extensive eld joint coating expertise. Plus we take full responsibility for

our work with a strong warranty.

Today the stakes are higher and the jobs are tougher. But with Complete Coating

Assurance your schedule wont falter. Lets talk.

Todays model for offshore success.

How do you know the

coating interface wont delay

your offshore project?

Heres a sign.

1403OFF_9 9 2/28/14 4:51 PM

IADC Well Control

(Drilling, Workover/Completion,

Coiled Tubing, Snubbing, Wireline)

GAP Analysis Program

Benefits

Cost Efective

On-Demand Training

24/7 Tech Support

Globally Available

Register today:

www.wcsonlineuniversity.com

WCS Training Centers

Home Office Rig or Job Location

+1.713.849.7400

www.wellcontrol.com

COMMITTED TO QUALITY...

DELIVERING VALUE!

-LEARNING

COURSES

FOLLOW US

TM

10 Of fshore March 2014 t www.offshore-mag.com

To respond to articles in Of fshore, or to of fer articles for publication,

contact the editor by email (davidp@pennwell.com).

COMMENT

%BWJE 1BHBOJF t )PVTUPO

Setting the standard

for subsea processing

The possible benefts of subsea processing and boosting are well known, yet the

industry has been slow to adopt the technology. While slow adoption indeed is stan-

dard protocol in this industry, a common explanation I hear from industry operators

is the lack of a standardized approach to system supply and integrity management.

Recently formed API Committee 17x aims to flls this void for the boosting element of

the process.

Chaired by John Vicic, Technology Program Manager of Deepwater & Arctic

for ConocoPhillips, the committee is tasked to develop a guide to enable operators,

contractors, and suppliers to reach a common goal for the design of subsea pumps,

thereby standardizing the design

process. It will provide specifc

guidance on the design, qualifca-

tion, and factory testing of subsea

pumping systems. A draft Recom-

mended Practice is expected to be

available by the end of this year,

with the fnal version slated for

late 2015.

The formation of this committee

is timely in that the industry is ag-

gressively pursuing new methods

to improve the viability of deepwa-

ter development. Rising costs are

stretching project economics, and

it is thought that the implementa-

tion of subsea boosting could

improve recovery to a point that

justifes the investment.

The developers of the World-

wide Survey of Subsea Processing

Systems poster in their annual

technology review highlight the trending focus on technology implementation. Sub-

sea boosting is more of a matter of course for many operators, and efforts have shifted

towards effective implementation, they suggest.

The evolution of separator technology is another noteworthy trend identifed by the

poster team. Concerns over cost, size and weight continue to drive interest in alterna-

tives to the conventional technology. The full report by */5&$4&"T -BSSZ 'PSTUFS

.BD .D,FF BOE +PIO "MMFO begins on page 68.

The 7th edition of the poster, inside this issue, chronicles the evolution of subsea

processing technologies and their respective applications. For online access to view

and download all seven posters, please visit www.offshore-mag.com/maps-posters.

Meanwhile, Statoil is closing in on implementation of the worlds frst subsea gas

compression system (compressor pictured above, courtesy MAN Diesel & Turbo),

slated for the sgard feld in the Norwegian Sea. Subsea compression on sgard

is expected to improve recovery from the Mikkel and Midgard felds by about 280

MMboe, beginning in 2015. Proving subsea gas compression would mark an important

milestone in the application of a complete subsea processing and boosting system.

Still, other elements of subsea processing require further qualifcation. These

include advanced manifolds for multi-feld tie-ins, storage for oil and chemicals, more

sophisticated separation and processing equipment, and ft-for-purpose IMR concepts.

1403OFF_10 10 2/28/14 4:51 PM

You are looking at the subsea factory oil and gas

production facilities located directly on the seabed. Its

an ingenious response to todays challenges of declining

reservoir pressures and longer step-outs, and the next

frontier in offshore engineering.

Operating 24/7, its a factory that runs continually throughout

the life of the feld, making long-term reliability and

maintainability a critical part of every subsea component.

Welcome to

the factory floor

Subsea production and processing systems

Today only Aker Solutions offers the right subsea

technology portfolio, multidisciplinary knowledge and

large-scale project experience required to build, run

and maintain a production system on the seafoor.

We are making the subsea factory vision a welcome reality.

www.akersolutions.com/subsea

1403OFF_11 11 2/28/14 4:51 PM

Worldwide offshore rig count & utilization rate

December 2011 January 2014

950

850

750

650

550

450

350

100

90

80

70

60

50

40

N

o

.

o

f

r

i

g

s

F

l

e

e

t

u

t

i

l

i

z

a

t

i

o

n

r

a

t

e

%

D

e

c

1

1

M

a

r

c

h

1

2

J

u

n

e

1

2

S

e

p

t

1

2

D

e

c

1

2

M

a

r

c

h

1

3

J

u

n

e

1

3

S

e

p

t

1

3

D

e

c

1

3

Contracted fleet utilization Total fleet Contracted Working

S

o

u

r

c

e

:

I

H

S

Operator capex share (%) in Asia/Pacifc 2009-2018

100

90

80

70

60

50

40

30

20

10

0

Others

Reliance

Inpex

ExxonMobil

PTTEP

Woodside

Shell

ONGC

CNOOC

Chevron

Petronas

2009

Source: Infield Systems

2010 2011 2012 2013 2014 2015 2016 2017 2018

O

p

e

r

a

t

o

r

c

a

p

e

x

(

%

)

Worldwide day rates

Year/Month Minimum Average Maximum

Drillship

2013 Feb $50,000 $451,005 $678,000

2013 Mar $50,000 $446,902 $678,000

2013 Apr $50,000 $454,798 $678,000

2013 May $50,000 $459,773 $678,000

2013 June $50,000 $464,803 $678,000

2013 July $151,000 $466,410 $678,000

2013 Aug $151,000 $465,170 $678,000

2013 Sept $151,000 $459,947 $678,000

2013 Oct $151,000 $464,995 $678,000

2013 Nov $151,000 $472,646 $678,000

2013 Dec $151,000 $477,618 $678,000

2014 Jan $151,000 $480,302 $678,000

Jackup

2013 Feb $30,000 $120,170 $361,000

2013 Mar $30,000 $121,039 $361,000

2013 Apr $30,000 $120,186 $361,000

2013 May $30,000 $122,553 $361,000

2013 June $30,000 $123,140 $361,000

2013 July $30,000 $123,997 $361,000

2013 Aug $30,000 $125,495 $361,000

2013 Sept $30,000 $126,438 $361,000

2013 Oct $30,000 $128,141 $361,000

2013 Nov $30,000 $127,766 $361,000

2013 Dec $30,000 $130,269 $361,000

2014 Jan $30,000 $132,719 $361,000

Semi

2013 Feb $145,000 $362,730 $656,662

2013 Mar $145,000 $364,283 $656,662

2013 Apr $145,000 $373,919 $656,662

2013 May $145,000 $381,672 $656,662

2013 June $145,000 $380,276 $656,662

2013 July $145,000 $384,420 $656,662

2013 Aug $145,000 $386,314 $656,662

2013 Sept $145,000 $386,531 $656,662

2013 Oct $145,000 $382,071 $656,662

2013 Nov $145,000 $395,145 $656,662

2013 Dec $145,000 $394,124 $656,662

2014 Jan $145,000 $394,016 $656,662

Source: Rigzone.com

GLOBAL DATA

12 Of fshore March 2014 t www.offshore-mag.com

Asia/Pacific is one of the most diverse regions in the

world; stretching from Pakistan and India in the west to

South Korea and Russias Sakhalin Island in the far east

and north, and Australia and New Zealand in the south.

While much of the region is dominated by shallow-water

development, recent years have seen an increase in

deepwater activity, driven by Malaysia and India. Going

forward Chevron is expected to lead deepwater invest-

ment across the region, followed by Indias ONGC and

Reliance.

The top two operators in terms of total forecast capex,

Petronas and Chevron, are each expected to account for

just over 9% of the market, while Shell, in third place, is

expected to command a 7% share of regional investment

across the 2014-2018 timeframe. In contrast to other

regions, capex spend in Asia/Pacific is characterized

by a variety of smaller operators. Outside of the top 10

operators, an additional 100 operators, equating to 42%

of regional spend, are expected to invest in the region

between 2014 and 2018. However, despite the presence of many relatively small operators, it is still the

supermajors and national oil companies that make it into the top nine companies, with Petronas, CNOOC,

ONGC, and PTTEP all present, while Chevron, Shell, and ExxonMobil are also expected to direct significant

expenditure toward the region. While Asia/Pacifics national oil companies focus primarily on their

respective home countries, the other large oil companies vary. Chevron is expected to direct the greatest

proportion of expenditure toward Australia and Indonesia, where key projects include Wheatstone and the

Gendalo-Gehem developments. Shell is expected to continue to focus on projects offshore Malaysia and

Australia where capital intensive developments such as Malikai and the giant Prelude are expected to drive

the operators investment demand. Northwest Australia is expected to remain a major area of investment

going forward for several operators, with a number large of gas projects in the planning stages.

Catarina Podevyn, Analyst, Infield Systems Ltd.

1403OFF_12 12 2/28/14 4:51 PM

RAISING PERFORMANCE. TOGETHER

No matter the challenge, no matter the environment, CAMSERV

Aftermarket Services are there

when and where you need them. Cameron has one of the industrys largest networks of worldwide

aftermarket locations, staffed by teams of technicians who use the latest technology to deliver new

levels of efciency and cost savings. CAMSERV technicians know and understand Cameron products

and are highly trained to provide expertise in maintenance, parts and service to ensure Cameron quality

for the life of your equipment. From onshore to offshore, around the globe, count on CAMSERV services

24/7 for the people, products and resources to keep your operations running at peak performance.

www.c-a-m.com/discovercameron

F L OW E QUI P ME NT L E ADE R S HI P

Expert Service and Support,

Where and When You Need Them

DISCOVER

CAMSERV AFTERMARKET SERVICES

D

I

S

C

O

V

ER C

A

M

E

R

O

N

D

I

S

C

O

V

E

R CA

M

E

R

O

N

AD01042CAM

1403OFF_13 13 2/28/14 4:51 PM

GLOBAL E&P

+FSFNZ #FDLNBO t -POEPO

14 0G GTIPSF March 2014 t www.offshore-mag.com

Americas

Statoil has opted to exit a license agree-

ment offshore the Bahamas that started in

May 2009. The applications for the Falcones,

Islamadores, and Zapata offshore conces-

sions will now revert solely to Bahamas Pe-

troleum. Recently the islands government

issued a mandate to proceed with explora-

tion drilling on existing licenses. Bahamas

Petroleum plans to drill its frst well on its

southern licenses by April 2015, if it can se-

cure fnancing via a farm-out.

ttt

Range Resources has completed a farm-in

to Niko Resources Guayaguayare block on-

shore/offshore Trinidad. Exploration plans

include an offshore well drilled from the

shore, followed by appraisal drilling if the

outcome is successful.

ttt

BG Group expects approval from Colom-

bias government to farm into 30% of the Gu-

ajira Offshore 3 block. A 3D seismic survey

is planned this year.

ttt

SAExploration has signed a three-year stra-

tegic cooperation agreement with COMESA

to jointly source, acquire, and process 2D

and 3D seismic data. SAE and COMESA will

source and conduct new transition-zone and

shallow-water projects in Mexico, along with

developing data-processing opportunities in

South America.

Under the terms of the agreement, both

companies will share expertise, resources,

and technologies to pursue and fulfll new

seismic projects in the region. All project

awards will be contracted separately from

this agreement on a project-by-project basis.

Seadrill has executed the fnal contracts with

a total value of $1.8 billion with PEMEX for the

jackup drilling units West Oberon, West Intrep-

id, West Defender, and West Courageous.

ttt

Brazils frst tension leg wellhead platform

(TLWP), P-61, has sailed from the BrasFels

shipyard to the Papa-Terra feld in the Cam-

pos basin. It will operate with the P-63 FPSO

which began producing oil in November. In

tandem, the platforms will be able to pro-

duce up to 140,000 b/d from 18 wells. P-61 is

also designed to compress 1 MMcm/d (35

MMcf/d) of natural gas. Some will be used

on the two facilities, with the remainder

injected into the reservoir. The TLWP re-

sembles a semisubmersible, but is moored

to the seafoor via vertical anchors. The ar-

rangement is designed to suppress the plat-

forms range of motions, allowing the use of

dry christmas trees.

ttt

Premier Oil and partner Rockhopper Ex-

ploration have selected a TLP for Sea Lion,

the frst planned development project off-

shore the Falkland Islands. Front-end engi-

neering design is due to start soon, with a f-

nal investment decision to follow during the

frst half of next year. The aim is to achieve

frst oil within four years of project sanction.

Phase 1 of the project, designed to recover

293 MMbbl over 25 years, will likely cost

around $5.2 billion.

West Africa

Vaalco Energy says two new production

platforms remain on schedule for installa-

tion later this year on the Etam Marine block

offshore Gabon. One will go on the Etame

feld and the other between the Southeast

Etame and North Tchibala felds. Recently

the company resumed exploration drilling on

the area with a well on the Dimba prospect,

designed to evaluate the Gamba and deeper

syn-rift formations.

ttt

All wells have been P&Ad at the decom-

missioned Azurite feld off Republic of Congo

(Brazzaville), according to partner PA Resourc-

es. Demobilization has started of the foating

drilling, production, storage, and offoading

vessel, which is expected to sail away before

mid-year. Operator Murphy Oil is negotiating a

termination of the vessels contract.

ttt

Cobalt International Energy has discov-

ered hydrocarbons with its latest presalt

deepwater exploratory well offshore Ango-

la. Bicuar #1 on block 21 intersected 56 m

(184 ft) of net pay from multiple intervals.

It was also the frst discovery in the deeper

presalt syn-rift reservoir.

In offshore block 15/06, Total has sold its

15% stake to Sonangol E&P for $750 million.

A frst production hub is expected to start up

next year, but Total says it prefers to focus

its resources on its operated block 17, which

includes the current CLOV development

and ultra-deepwater block 32.

In Cabinda offshore northern Angola, Bos-

kalis subsidiary SMIT Salvage will start work

in 2Q to raise the Saipem jackup Perro Negro 6

from the seafoor. The rig sank last July after

suffering a punch-through close to a pigging

platform while under contract to CABGOC.

Mediterranean Sea

DNO has completed a farm-in to two con-

cessions offshore Tunisia held by Eurogas

International and Atlas Petroleum Explora-

tion Worldwide. DNO has taken an 87.5% op-

erated interest in the Sfaz and Ras El Besh

permits, both in mostly shallow waters in

the Gulf of Gabes. They include three small

oil discoveries, with 29 other prospects that

could collectively contain 500-700 MMbbl.

ttt

Croatia reportedly plans to open acreage

over the southern Adriatic Sea to bidders,

possibly this spring. Spectrum Geo recently

completed a fve-month multi-client seismic

survey providing the countrys frst modern

long-offset 2D data. This will be connected

to Spectrums reprocessed seismic from the

Italian side of the Adriatic.

ttt

Woodside Energy has reached a complex

agreement with Noble Energy and its partners

in the deepwater Leviathan gas feld offshore

Israel. The company hoped to conclude nego-

tiations by the end of this month if ratifed, it

would acquire 25% of petroleum licenses 349/

Rachel and 350/Amit containing Leviathan,

and would operate any LNG development.

Noble would remain upstream operator.

Last years Tamar SW discovery could hold

up to 917 bcf (26 bcm), according to partner

Delek Group. Costs of a tie-in to the Tamar in-

frastructure will be high possibly more than

$132 million due to the distance of the well

from Tamars subsea manifold and timing is-

sues for development drilling.

Eastern Europe

Nord Stream AG has completed a feasibility

study for expanding capacity of the twin-Nord

Stream gas trunklines through the Baltic Sea.

Results suggest one or two more lines would be

technically and economically viable. Addition-

ally, the study assessed several potential routes

that will serve as the basis for further research.

Activity offshore Namibia has taken a step up

Shell has taken over exploration blocks 2913A and 2914B in the Orange basin off-

shore Namibia from Signet Petroleum, with the Anglo-Dutch group acquiring a 90%

stake in the two blocks and Namibian national oil company, Namcor, keeping its 10%

carried interest.

Investment company Polo Resources Ltd. reports that Signet Petroleum Ltd.

intends to implement a share buyback under which funds not required for ongoing

operations and new business opportunities would be returned to shareholders.

Polo says the investment in Signet Petroleum is a central part it strategy to

increase its exposure to the oil and gas sector. The last 12 months have been a trans-

formative period for Signet in which the company has acquired and interpreted 3D

seismic data over Mnazi Bay (Tanzania), which has confirmed the up-dip extension

of the BG/Ophir Chaza-1 discovery well, acquired 2D seismic over block 2914B in

Namibia, demonstrating significant prospectivity, and launched a process to examine

strategic alternatives, which is being led by First Energy Capital LLP.

1403OFF_14 14 2/28/14 4:51 PM

1403OFF_15 15 2/28/14 4:51 PM

KaMOS Gaskets for sealing and surveillance

Selected references:

BP, ExxonMobil, Total, Saipem, Shell, Hyundai, ConocoPhillips,

Chevron, PTTEP, Halliburton, AMEC Paragon, Technip Offshore UK Ltd

KaMOS Gaskets to be used, when having too many leakages in flanged connections...

KaMOS Gaskets verifies correct installation by pressure

testing the ring room in flanges.

Time, cost and safety efficient

leakagetest solutions

KaMOS Kammprofil Gasket

KaMOS RTJ Gasket

P.O.Box 484, N-4291 Kopervik, Norway Tel +47 52 84 43 40 Fax +47 52 84 43 41 offshore@kamos.no www.kamos.no

- the efficient solution for flanged connections

GLOBAL E&P

Gazprom, supplier of the gas, says South Stream Transport has

awarded frst pipe supply contracts for the South Stream gas line sys-

tem through the southern Black Sea. This will eventually comprise

four 93-km (58-mi) offshore pipelines between the Russkaya com-

pressor station on the Russian coast and a landfall on the Bulgarian

side. Each line will be 32-in. diameter, with a wall thickness of 1.5-in.,

and made from X65 steel to withstand extreme operating pressure of

28.45 MPa (4,126 psi) during installation. Germanys Europipe and

Russias United Metallurgical Co. and Severstal will manufacture all

pipes for the frst line, with construction offshore due to start this fall.

Caspian Sea

Ramboll Group is performing winterization studies for a planned off-

shore drilling complex and living quarters for Lukoils Yuri S. Kuvykin

gas/condensate feld in the Russian sector. The northern part of the

Caspian Sea is prone to severe ice build-up

in winter, when temperatures often dip to

-21C (-6F). Lukoil is targeting produc-

tion of 4 bcm/yr (141 bcf/yr) of gas and

385,000 tons/yr of condensate.

ttt

Oil production has started through the

BP-operated West Chirag platform in the

Azeri sector, the centerpiece of the $6-billion

Chirag oil project. The platform, fabricated

entirely in Azerbaijan, has been installed in

170 m (558 ft) of water between the Chirag

and Deepwater Gunashli platforms. It can process up to 183,000 b/d of

oil, exported to the Sangachal terminal via a new pipeline linked to the

existing subsea trunkline system. Its gas export capacity is 285 MMcf/d

(8 MMcm/d).

BP and its partners in the Shah Deniz gas feld in the same sector have

awarded the AMEC Tefken Azfen consortium a $974-million contract for

the two new Stage 2 production/risers and quarters/utilities platforms.

Both of the topsides will be built at the ATA yard in Bibi-Heybat near Baku.

Middle East

Abu Dhabis government has extended the Upper Zakum offshore

oilfeld concession to the end of 2041. State oil company ADNOC oper-

ates in partnership with ExxonMobil and Japan Oil Development Co.

The feld came onstream in 1982, and the partners have progressively

added new facilities to raise production. Current development involves

use of artifcial islands to raise throughput

capacity to 750,000 b/d, and the partners

are looking at ways to raise the threshold

to 1 MMb/d.

ttt

Dubai Petroleum has awarded Technip

an engineering, procurement, construction,

and installation contract for the Jalilah B feld

development in 60 m (197 ft) of water, 90 km

(56 mi) offshore Dubai. Technip will build

and install a new platform comprising a 900-

ton deck and a 500-ton jacket; install 13 new

risers on existing platforms; and lay 110 km

(68 mi) of pipelines in diameters from 6- to

24-in. using three vessels.

The new West Chirag platform offshore

Azerbaijan. (Photo courtesy BP)

1403OFF_16 16 2/28/14 4:51 PM

May 20-22, 2014

JW Marriott

Houston, TX

www.pnecconferences.com

18th International Conference on Petroleum Data

Integration, Information and Data Management

Petroleum data driven decisions for higher returns

PNEC Conferences provides a unique opportunity for meeting and

learning with your peers and colleagues that brings a signifcant

ROI to your organizations and an energized spirit for the world of

petroleum data integration and management.

Owned & Produced by: Supported by: Presented by:

INTEGRATION + INFORMATION + MANAGEMENT

WHEN WE MEET,

WE LEARN AND

DRIVE RESULTS

Go to www.ogjevents.com to sign up today! Follow us on

1403OFF_17 17 2/28/14 4:51 PM

Scan this advert with the layar

app to access exclusive content

+44 (0)116 276 8558

offshore@nylacast.com

www.nylacast.com

Insta

Di scover more about the

Nyla-Heroes by vi si ti ng:

Custom components

and materials with:

Ideal properties for use

in salt water

Exceptional resistance to

abrasion & impact

Corrosion & Chemical

resistance

Self lubricating

Lightweight - 1/7th of steel

High visibility colours

Low Coefcient of friction

25 x the life of phosphor

bronze

Custom formulation

of materials

Vist us at

Stand 2341J

GLOBAL E&P

A new ultra-lightweight conductor-supported tripod platform is in

place on the same operators Fateh feld in 50 m (164 ft) water depth.

2H offshore designed the T-02 facility for installation from a jackup. The

minimal topside/subsea structure will host an upcoming exploration

drilling/well test campaign.

ttt

Masirah Oils second well in block 50 offshore Oman has discovered

oil. Cantilever jackup Aban VII drilled the well to a depth of 3,000 m (9,842

ft) in the Cambrian formation, encountering hydrocarbons in various

intervals. This was the frst-ever discovery east of Oman, the company

claimed.

India

Indias government expects to offer 29 offshore blocks under the NELP-

10 licensing round. Fifteen will be in shallow water and 14 in deepwater.

BG Exploration has awarded Larsen & Toubro a $114-million EPCI

contract for a new wellhead platform and subsea pipelines for the Panna-

Mukta felds off northwest India. The project should be complete by

March 2015.

On the east coast, Vessel Gasifcation Services has commissioned from

Wison Offshore & Marine a barge-based foating LNG regasifcation unit

designed to export 1 bcf/d of gas. It will be moored on a jetty structure

8 km (4.97 mi) offshore Andrha Pradesh alongside a permanent foating

storage unit, which will serve as the LNG offoading station for tankers.

Asia/Pacifc

CNOOC has started production from the Liuhua 19-5 gas feld in the

Pearl River Mouth basin in the South China Sea. The two-well develop-

ment, in 185 m (607 ft) of water, is linked to the production facility on

the Panyu 30-1 gas feld. At peak Liuhua 19-5 will deliver 29 MMcf/d.

ttt

Mubadala Petroleum has commissioned production facilities for its

Nong Yao oil feld development in block G11/48 in the Gulf of Thailand,

designed to produce up to 15,000 b/d. Nippon Steel and Sumikin Engi-

neering have started fabrication at a yard close to Bangkok. Develop-

ment calls for a wellhead platform, a processing platform, and intercon-

necting sealines to an FSO, with 23 wells during the initial phase.

Elsewhere in the Gulf, Mubadala has extended its lease of Petro-

facs FPSO on the Jasmine feld by an additional four years. However,

the company has decided to sell its 60% operated interest in northern

area block G3/48 to KrisEnergy.

ttt

Dragon Oil has agreed to farm into Service Contract 63 in the

northwest Palawan basin offshore the Philippines. Initially, the com-

pany will take 40% of Nido Petroleums 50% stake in the concession,

with Nido later hoping to recover an extra 10% through another farm-

in deal with PNOC-Exploration. Nido would remain technical opera-

tor for the planned Baragatan-1 exploration well.

ttt

Lundin Petroleum aims to drill at least six exploratory wells in South-

east Asia this year. In block 307 off Peninsular Malaysia, the company

plans to appraise its 2012 Tembakau gas discovery, with another well

targeting oil in the Rengas structure. Offshore Sabah, Lundin has com-

pleted processing of the 500-sq km (193-sq mi) 3D Emerald seismic

survey in block SB307 and plans to drill two of the covered prospects,

Kitabu and Maligan.

Australia

Shell, which has reported lower profts like numerous other majors,

is looking to cut costs via asset sales. One already agreed sale is the

companys equity interests in the Wheatstone-Iago Joint Venture and

the Wheatstone LNG project offshore Western Australia to KUFPEC for

$1.135 billion. Shell CEO Ben van Beurden insisted that the company

intended to remain a major player in Australias energy industry.

1403OFF_18 18 2/28/14 4:51 PM

PH Industrie-Hydraulik GmbH & Co. KG

Stefansbecke 35-37, 45549 Sprockhvel, Germany

Tel. +49 (0) 2339 6021, Fax +49 (0) 2339 4501

info@ph-hydraulik.de, www.ph-hydraulik.de

Without fail

Stainless steel connectors

from PH.

We offer a broad spectrum of stainless steel pipe and

hose connectors for heavy-duty industrial applications.

For decades our customers have trusted the quality of

PH products.

Our products are manufactured in accordance with inter-

national standards such as DIN / EN / SAE, BS & JIS.

It goes without saying that we are certifed according to

ISO 9001; many of our products have been approved

by the American Bureau of Shipping, Lloyds Register,

Det Norske Veritas, Rina and Germanischer Lloyd.

Contact us.

1403OFF_19 19 2/28/14 4:51 PM

OFFSHORE EUROPE

+FSFNZ #FDLNBO t -POEPO

20 0G GTIPSF March 2014 t www.offshore-mag.com

Phased approach

for Johan Sverdrup

Statoil and its partners have agreed on

a development concept for Johan Sverdrup

in the central Norwegian North Sea. The

project, potentially Norways largest since

the 1980s, will deliver production of 550,000

boe/d at peak and the facilities could remain

in service for 50 years.

Under the proposed frst phase the fnal

development plan will be submitted to Nor-

ways parliament next year the partners

will commission a four-platform feld center

to be installed in 120 m (393 ft) of water, with

design capacity of 315,000 boe/d. According

to Lundin Petroleum, 45 production and in-

jection wells will be drilled in Phase 1, with a

semisubmersible rig drilling 11-17 wells pri-

or to frst oil in late 2019. New long-distance

subsea trunklines will take the oil and gas

respectively to Mongstad and Kaarst on

Norways southwest coast.

The complexs 80-MW power supply will

come from a shore-based transformer at

Kaarst delivering direct current to a con-

verter on the riser platform. Over later phas-

es, power from shore could be extended to

other feld developments in the area, once

requirements have been established.

Statoil estimates frst-phase investments

in the range $16.4-19.8 billion, although work

continues to fnd ways to lower costs. The

partners have not yet addressed the scope

and costs of future phases, although their

long-term goal is to achieve a 70% recovery

rate from the feld.

Johan Sverdrup extends over 200 sq km

(77 mi) in licenses PL265, PL501, and PL502.

Reserves boost for Skarfjell

Wintershall has doubled the potential

resources at the Skarfjell feld in the Nor-

wegian North Sea to 120-230 MMboe. This

follows analysis of an appraisal well and side

track which proved oil and gas in Jurassic

sandstones a short distance south of the dis-

covery well. No further drilling should be

needed, the company said, and studies have

started for a development. Options include a

standalone project and a tieback to the GDF

Suez-operated Gjoa platform 15 km (9.3 mi)

to the northeast.

Last year, exploration activity offshore

Norway was highest in the North Sea, ac-

cording to the Norwegian Petroleum Direc-

torate (NPD). Wells proved seven oil and

gas accumulations, with seven discoveries

in the Norwegian Sea and fve in the Barents

Sea. NPD estimates cumulative recoverable

reserves at 50-106 MMcm of oil and 30-58

bcm of gas.

Currently 13 Norwegian felds are under

development and NPD expects operators to

submit plans for a further 13 projects over

the next two years. Investments across the

Norwegian shelf could rise by $487 million

this year to $28.5 billion, it adds.

Norway allocates more blocks

Norways government has offered 65

new production licenses to a total of 48 com-

panies under the 2013 Pre-defned Areas

(APA) licensing round. Of these, 38 are in

the North Sea, 19 in the Norwegian Sea and

eight in the Barents Sea. Seventeen rank as

acreage additional to existing licenses.

NPD says interest was greatest in the

northern Norwegian North Sea and in the

central Norwegian Sea. This was probably

down to familiarity with the geology in the

area, said exploration director Sissel Erik-

sen, and a general desire to maximize tie-ins

of resources to offshore infrastructure.

Britain has opened the bidding for the

UKs 28th offshore licensing round, with

Energy Minister Michael Fallon reaffrm-

ing the governments goal to fully extract

remaining reserves of potentially up to 20

Bbbl. Oonagh Werngren, operations direc-

tor of Oil & Gas UK, hopes that more new

applicants would participate, alongside the

established players, with the sector in need

of a revival. UK offshore production con-

tinues to slide, and reserves are not being

replaced. A mere 15 exploration wells were

drilled in UK waters last year, Werngren

said, and less than 100 MMboe have been

discovered over the past two years.

ATP UK back in business

Alpha Petroleum, a subsidiary of Petroleum

Equity, has acquired ATP Oil & Gas UK for

$133 million. Parent company ATP Corp. fled

for protection in 2012 under Chapter 11 of the

US Bankruptcy Code and had been looking to

sell the UK business, which includes operated

gasfelds in the southern North Sea.

The deal clears ATP UK of all debts and

leaves the company free to resume work on

undeveloped assets. One of these is the Chev-

iot feld in the northern UK North Sea, which

has in-place oil of over 200 MMbbl. Manage-

ment had commissioned an Octabuoy semi-

submersible drilling, production, and storage

platform designed by Moss Maritime to ac-

commodate dry wellheads. Cosco in China

had started construction, but the program has

been cancelled due to the high costs. Instead,

ATP UK and its new owners will examine al-

ternatives, most likely an FPSO, and will seek

to reduce costs via a farm-out of the license.

Another troubled North American indepen-

dent, Antrim Energy, is selling its UK North

Sea subsidiary to First Oil Expro for $53 mil-

lion. This follows problems related to fnanc-

ing of the Causeway feld subsea tieback to the

North Cormorant platform, which were com-

pounded when the platform had to be shut

down last September.

First oil fows from Amstel

GDF Suez has started production from

Amstel, its frst oilfeld development in the

Dutch North Sea. Oil is produced through

the Q13a-A platform and transported through

a new 25-km (15.5-mi) subsea pipeline to

TAQAs P15 platform to the northwest. At

peak, Amstel should deliver 15,000 b/d of oil,

with a production life estimated at 10 years.

Location of the Cheviot field in the UK northern

North Sea. (Courtesy Petroleum Equity)

Johan Sverdrup will be developed with four platforms. (Image courtesy Statoil)

1403OFF_20 20 2/28/14 4:51 PM

-

C

r

d

i

t

s

p

h

o

t

o

s

:

T

O

T

A

L

,

C

o

r

b

i

s

.

ENGINEERS F/M

Junior and experienced

Total will hire 10,000 people in 2014.

An international leader in the oil, gas and chemical industry, Total is looking for talent

in almost 500 professional elds, including:

Geoscientists

Oil Installation Engineers

Drilling Engineers

Maintenance Engineers

HSEQ Engineers

R&D Engineers

Information Technology

Engineers

Learn more at

www.careers.total.com

More than 700 job openings are now online!

Site of

production

Site of

refection

1403OFF_21 21 2/28/14 4:51 PM

GULF OF MEXI CO

#SVDF #FBVCPVFG t )PVTUPO

22 0G GTIPSF March 2014 t www.offshore-mag.com

BOEM outlines Gulf

of Mexico lease sale offer

The US Department of the Interior will of-

fer more than 40 million acres for oil and gas

exploration and development in the Gulf of

Mexico in March lease sales.

Secretary of the Interior Sally Jewell and Bu-

reau of Ocean Energy Management (BOEM)

Director Tommy P. Beaudreau say Lease Sale

231 in the Central Planning Area and Lease Sale

225 in the Eastern Planning Area will be held

consecutively in New Orleans, Louisiana, on

March 19. The sales will be the fourth and ffth

offshore auctions under the Administrations

Outer Continental Shelf Oil and Gas Leasing

Program for 2012-2017 (Five-Year Program).

Sale 231 encompasses about 7,507 unleased

blocks, covering 39.6 million acres, located

from three to 230 nautical miles offshore

Louisiana, Mississippi, and Alabama, in water

depths ranging from 9 ft (3 m) to than 11,115 ft

(3,400 m). BOEM estimates the proposed sale

could result in the production of approximate-

ly 1 Bbbl of oil and 4 tcf of natural gas.

Sale 225 is the frst of only two lease sales pro-

posed for the Eastern Planning Area under the

Five-Year Program, and it is the frst sale offer-

ing acreage in that area since Sale 224 in March

of 2008. The sale encompasses 134 whole or

partial unleased blocks covering about 465,200

acres in the Eastern Planning Area. The blocks

are at least 125 mi. (201 km) offshore in water

depths ranging from 2,657 ft (810 m) to 10,213 ft

(3,113 m). The area is south of eastern Alabama

and western Florida. BOEM estimates the sale

could result in the production of 71 MMbbl of

oil and 162 bcf of natural gas.

In addition to opening bids for these two

sales, BOEM will open any pending bids sub-

mitted in Western Planning Area Sale 233 for

blocks located or partially located within three

statute miles of the maritime and continental

shelf boundary with Mexico (the Boundary

Area). Any leases awarded as a result of these

bids will be subject to the terms of the US-Mex-

ico Transboundary Hydrocarbons Agreement.

Lucius spar

installation completed

Anadarko has completed installation of the

80,000 b/d oil capacity Lucius spar in deepwa-

ter Gulf of Mexico. The topsides are expected

to be towed to location in 1Q 2014.

Lucius is on schedule toward frst oil produc-

tion in the second half of 2014, said Anadarko,

and construction on the Lucius-look-alike Hei-

delberg spar is more than 70% complete. Hei-

delberg is on schedule for frst oil production

in 2016.

Anadarkos 2013 deepwater GoM success was

highlighted by the emergence of the Shenandoah

basin. Following the Anadarko-operated Shenan-

doah-2 appraisal well, which encountered more

than 1,000 net feet of oil pay, and oil discoveries

at the nearby Coronado and Yucatan prospects,

Anadarko enhanced its ownership position in, and

will become the operator of Coronado.

Anadarko is the only company with owner-

ship in all three discoveries in the Shenandoah

basin. In addition, Anadarko and its partners

are accelerating appraisal activity in the basin

with appraisal wells under way at Coronado and

Yucatan, and a rig committed to drill a delinea-

tion well at Shenandoah beginning in 2Q 2014

Shell starts second

Mars production

Shell has started producing from the deep-

water Mars B platform in the Gulf of Mexico.

Production is going through the Olympus

installation, making this the frst deepwater

GoM project to expand an existing oil and

gas feld with signifcant new infrastructure.

Shell said this should extend the life of the

greater Mars basin production to 2050 or be-

yond. When added to future Olympus produc-

tion, the original Mars platform is expected to

deliver a total of 1 Bboe.

We safely completed construction and in-

stallation of the Olympus platform more than

six months ahead of schedule, allowing us

to begin production early from the develop-

ments frst well, said John Hollowell, execu-

tive VP for Deep Water, Shell Upstream Ameri-

cas. Olympus is the latest successful start-up

of our strong portfolio of deepwater projects,

which we expect to generate substantial value

in the coming years. Deepwater will continue

to be a core growth opportunity for Shell.

In addition to the Olympus drilling and pro-

duction platform, the Shell Mars B develop-

ment includes subsea wells at the West Boreas

and South Deimos felds, export pipelines, and

a shallow-water platform at West Delta 143.

Olympus is in approximately 945 m (3,100 ft)

of water.

Using the Olympus platform drilling rig and

a foating drill rig, additional development drill-

ing will enable ramp up to an estimated peak of

100,000 boe/d in 2016. Mars feld produced an

average of over 60,000 boe/d in 2013. Partners

in the development are operator Shell, 71.5%;

and BP, 28.5%.

BSEE, Coast Guard respond

to well control incident

On Jan. 31, the Bureau of Safety and Environ-

mental Enforcement (BSEE) announced that

along with the US Coast Guard it was respond-

ing to a loss of well control in Vermilion block

356. Vermilion block 356 is located about 108

mi (174 km) southwest of Lafayette, Louisiana.

EnVen Energy Ventures LLC reported a

natural gas fow while drilling from the Rowan

Louisiana, at the A production platform. The

gas was diverted overboard and work began

immediately to shut in the well. No visible

sheen was reported. Personnel were evacu-

ated, no injuries were reported, and all oil and

gas production at the platform was shut in.

BSEE approved EnVens plan to kill the well

with mud, and pumping began the afternoon

of Jan. 31. By Feb. 3, the well control incident

had been resolved. The BSEE reported that

weighted drilling fuids had been pumped into

well A-7 to stop the uncontrolled fow. The

agency said that it will require additional work

at the site, including setting of barriers to en-

sure no further gas release.

Shell says production from the deepwater Mars B platform has begun, marking the first deepwa-

ter GoM project to expand an existing oil and gas field with significant new infrastructure. (Photo

courtesy Shell)

Anadarko says it has completed installation of

the 80,000 b/d of oil capacity Lucius spar in Ke-

athley Canyon block 875 in the Gulf of Mexico.

Last year, Dockwise transported the spar on

its semisubmersible heavy-lift vessel Mighty

Servant from Pori, Finland, to Ingleside, Texas.

(Photo courtesy Dockwise)

1403OFF_22 22 2/28/14 4:51 PM

PROVEN EXPERIENCE. TRUSTED RESULTS.

WWW.CUDD.COM

MODULAR INNOVATION.

HDU DELIVERS OFFSHORE DRILLING SOLUTIONS ON A COMPACT SCALE.

Cudd Energy Services hydraulic drilling unit (HDU) provides an adaptable, economical, and safe

alternative to offshore platform and jack-up rigs.

Built on an adaptable platform, the HDU seamlessly accommodates the space limitations of offshore

platforms. ts compact design enables most components to ft in standard shipping containers, which

helps reduce crane load requirements and mobilization expenses.

Our patented vertical racking feature allows multi-well intervention operations to be performed

without laying down works string or rigging down the unit. This functionality leads to reduced trip

times, increased personnel safety, and smoother marine transport, compared to traditional platform

and jack-up rigs.

To learn more about the advantages of the HDU, visit us at www.cudd.com today.

1403OFF_23 23 2/28/14 4:51 PM

SUBSEA SYSTEMS

(FOF ,MJFXFS t )PVTUPO

24 0G GTIPSF March 2014 t www.offshore-mag.com

sgard gets power distribution units

Schneider Electric has delivered to Aker Solutions three control

power distribution units (CPDU) for the sgard subsea compres-

sion station project. Two CPDUs will be installed on the subsea tem-

plate, with the third being a spare. The sgard CPDUs will provide

fully redundant low voltage power for the worlds frst subsea gas

compression station.

The three CPDUs have been delivered to Egersund, Norway,

where the mechanical, electrical, and automation integration and

fnal testing of the complete subsea unit are being performed.

sgard feld, in 300 m (984 ft) water depth offshore Norway, is op-

erated by Statoil with partners Eni, ExxonMobil, Petoro, and Total.

Ceona to install umbilicals

for Bennu in Gulf of Mexico

Bennu Oil and Gas has contracted Ceona to work on the Clipper

Contingency Umbilical Installation Project in the Gulf of Mexico.

The project is to install 1.1 mi (1.77 km) of dymanic umbilical and

two 15-mi (24-km) electrical quad cables in more than 3,000 ft (914

m) of water.

Offshore work is planned to commence in May 2014 using the

Normand Pacifc. The vessel is chartered by Ceona and, once de-

livered in April 2014, it will be ftted with a 75 metric ton (82 ton)

vertical lay tower and two new high-specifcation Work Class ROVs

for deepwater fexible installation and subsea construction. The ves-

sel is 122 m (400 ft) long by 23 m (75 ft) in beam and also has a 200

ton knuckle boom crane.

Delta SubSea buys ROVs

from Schilling Robotics

As part of Delta SubSeas frame agreement with FMC Schilling

Robotics, DSS has fnalized an order to receive an additional feet of

four work-class ROV systems to be delivered in February-to-April.

Schilling Robotics is to supply two additional Schilling HD 150-hp

work-class ROV systems and two Schilling UHD 200-hp work-class

ROV systems.

DSS will add the new ROVs to its feet to service the global oil and

gas offshore drilling support, construction, and inspection, mainte-

nance, and repair (IMR) markets.

Shell agrees to sell interest

in BC-10 offshore Brazil

Shell has agreed to sell a 23% interest in the BC-10 deepwater devel-

opment offshore Brazil to Qatar Petroleum International for $1 billion.

Shell will continue to operate BC-10 with a 50% working interest.

The transaction is subject to approval by the National Petroleum

and Gas Agency (ANP) and the Administrative Council for Econom-

ic Defense (Brazils anti-trust authority).

BC-10 produces approximately 50,000 boe/d. Since coming on-

stream in 2009, BC-10 has produced more than 80 MMboe. Phase 2

of the project, to tie-in the Argonauta O-North feld, came online on

Oct. 1, 2013, with an expected peak production of 35,000 boe/d. The

fnal investment decision for Phase 3 of the BC-10 project was taken

in July 2013 and once online is expected to reach a peak production

of 28,000 boe/d.

Martin Linge platform

hookup awarded

Technip has awarded Rosenberg WorleyParsons a hookup and

commissioning contract for Totals Martin Linge platform in the

Norwegian North Sea.

Estimated value of the contract is $92 million.

Onshore preparations start with mobilization to France and sub-

sequently South Korea, with a project team to be established at

some point at Rosenberg WorleyParsons facilities in Stavanger.

The contractor expects main offshore activity to be executed dur-

ing mid-2016.

gotnes-based Atlantic Offshores newest offshore support ves-

sel Ocean Marlin will operate at the Martin Linge feld.

The hull recently was launched at the Astilleros Zamakona Pasaia

shipyard in San Sebastian, northern Spain.

Currently the vessel is undergoing painting, drydocking, and out-

ftting. It is expected to be delivered by end-July.

The Martin Linge development will consist of a production fxed

platform, a foating storage offoading vessel, 50 MW AC electric

power from shore through a 160-km (100-mi) subsea cable, a 24-in.

gas export pipeline, and an offshore control center in Stavanger.

Martin Linge is 180 km (112 mi) west of Bergen, Norway, in a

water depth of 115 m (377 ft).

MAN Diesel & Turbo is installing its first-ever hermetically

sealed compressor on an offshore production platform. The

HOFIM (High-Speed, Oil Free, Integrated Motor) compressor

is going onto Det norske oljeselskaps Ivar Aasen develop-

ment in the North Sea. The Ivar Aasen installation comprises

a multi-stage radial compressor (1x100%) arranged in tandem

around a centrally positioned 9.5 MW high-speed electrical

motor. The compressor is used to export produced gas into a

subsea pipeline to shore.

Deepwater spending to grow 130%

Deepwater expenditure is expected to increase by 130%,

compared to the preceding five-year period, reaching $260 bil-

lion from 2014 to 2018, forecasts Douglas-Westwood.

As production from mature onshore basins and in shal-

low water declines, development of deepwater reserves has

become increasingly vital. Robust oil prices support the in-

vestment as sustained high oil prices over the past few years

increase confidence in the sector.

Africa and the Americas continue to dominate deepwater

capex, with $213 billion to be spent over the next five years.

Africa is forecast to experience the greatest growth among the

three regions, as East African natural gas developments begin

production and become more prominent in the latter years

of the forecast period. Latin America will remain the largest

market and North America is expected to experience the least

growth.

Douglas-Westwood has identified a temporary trough in

global expenditure in 2015 primarily driven by delays to deliv-

ery of FPS units in Latin America. African projects have also

experienced delays resulting in a surge in capex from 2016

onward.

1403OFF_24 24 2/28/14 4:51 PM

operating hours.

And counting.

Delivering increased recovery requires a reliable subsea processing solution that is designed on the

premise of the reservoir. OneSubsea

presents the most comprehensive suite of products providing

scalable subsea processing and boosting system solutions for all environments, including extreme

conditions up to 15,000 psi and 3000 meters water depth.

With more than 30 operating systems in subsea regions from the North Sea to Australia, West Africa

to Brazil, OneSubsea has a portfolio of proven, reliable boosting and pumping systems successfully

increasing production rates from 30% up to 100% for operators.

Visit www.onesubsea.com/pumping

Up to 100% increased production rate from the

industrys only subsea multiphase boosting systems

A

D

0

0

6

4

2

O

S

S

1403OFF_25 25 2/28/14 4:51 PM

VESSELS, RI GS, & SURFACE SYSTEMS

3VTTFMM .D$VMMFZ t )PVTUPO

26 0G GTIPSF March 2014 t www.offshore-mag.com

Fecon taps Keppel for frst jackups

Keppel FELS has won contracts worth $650 million to build three

high-specifcation jackups for startup Fecon International Corp. The

KFELS B Class rigs are scheduled for delivery in 2H 2016. Fecon,

a new offshore player with Russian roots, is targeting markets in

Africa, the Middle East, and Southeast Asia, and has identifed off-

shore drilling in Russia as a strategic market with good growth op-

portunities, Keppel said.

Keppel FELS also reported a $218-million contract with UMW

Drilling 8 for a KFELS B Class rig to be delivered in 3Q 2015. The

shipyard has another jackup, UMW NAGA 5, under construction for

the Malaysian driller, and in early 2013 delivered they UMW NAGA

4, which is currently working offshore Malaysia.

CIMC builds backlog

Yantai CIMC Raffes Offshore Ltd. has secured orders for a new-

build drillship and a harsh environment semisubmersible, with op-

tions for an additional four drilling rigs. The drillship, for Norwegian

drilling contractor Norshore, will be a small multi-purpose vessel

designed for riserless drilling and well intervention. Delivery is

scheduled for 2H 2016. Norshore has options to build up to three

similar drillships.

CIMC also received an order from Beacon Holdings Group Ltd.

for an ice class semisubmersible based on the GM4-D design.

Dubbed the Beacon Atlantic, the rig will be capable of drilling to

8,000 m (26,247 ft) in water depths up to 500 m (1,640 ft). The con-

tract carries an option for one additional semisub. CIMC has sched-

uled delivery of the Beacon Atlantic in 4Q 2016.

Ensco divests idle rigs

Ensco has sold its two remaining cold-stacked jackups for $33

million. The rigs, ENSCO 69 and Wisconsin, both date to 1976. The

London-based company has been undergoing a feet upgrade over

the past four years, having sold 13 older rigs and taken delivery of

12 high-performance units, including fve ultra-deepwater drillships,

fve ENSCO 8500 series semisubmersibles, and two harsh-environ-

ment jackups. Ensco has three more drillships and three premium

jackups under construction.

Wison to build second foating regas unit

EXMAR and Pacifc Rubiales have placed an order with Wison

Offshore & Marine for a barge-based foating LNG regasifcation

unit, to be delivered in 4Q 2015. Wison will build the unit at its Nan-

tong, China, shipyard. The companies have collaborated on the Pa-

cifc Rubiales-operated Caribbean FLNG project offshore Colombia,

which is scheduled to begin processing gas from an onshore feld

in 2Q 2015. In January, Wison announced that it will supply a barge-

based regasifcation unit to VGS for an LNG import project offshore

Andhra Pradesh, India.

Seadrill inks Pemex contracts

Seadrill has fnalized a set of contracts with Mexicos Pemex for

the West Oberon, West Intrepid, West Defender and West Courageous

jackup drilling units. A ffth contract for the recently acquired Pros-

pector 3 jackup, renamed West Titania, is expected to be fnalized in

2Q 2014. Each contract is for about six years. Seadrill said the total

value of the Pemex deal could exceed $1.8 billion.

The company also announced that it had formed a 50/50 joint

venture with investment company Fintech Advisory. The new part-

nership, SeaMex Ltd., was formed to own and manage the jackups

working for Pemex and to develop and pursue further opportuni-

ties in Mexico and other Latin American countries, Seadrill said.

Kraken contract inked

Deltamarin will provide basic design for the FPSO to be installed

at EnQuests Kraken feld in the UK North Sea. EnQuest approved

the 4-billion ($6-billion) project in November 2013, and announced

that Malaysias Bumi Armada would supply the FPSO. Deltamarin

had earlier provided Bumi Armada with technical support during

the tanker conversions front-end engineering and design stage. The

turret-moored FPSO will have a storage capacity of 600,000 bbl and

measure more than 285 m (935 ft) in length. Production is sched-

uled to begin in 2016 or 2017 and peak at a daily rate of more than

50,000 bbl.

Maersk Drilling held a naming ceremony at the Samsung Heavy

Industries yard in South Korea for the companys second and third

ultra-deepwater drillships, Maersk Valiant and Maersk Venturer. Maersk

has invested roughly $2.6 billion in four ultra-deepwater drillships to

be delivered by SHI by the end of this year. Maersk Valiant will go to

work for ConocoPhillips and Marathon Oil in the Gulf of Mexico under a

three-year, $694-million contract with an option to extend for two years.

Maersk Venturer and the fourth rig, which is scheduled for delivery in

3Q 2014, are not yet under contract.

Boskalis subsidiary Dockwise landed a contract with Statoil for the

transportation of two Cat-J jackup drilling rigs from South Korea to Nor-

way. Dockwise plans to deploy the Blue Marlin transport vessel (pictured

delivering the Noble Jim Day in 2010) and sister vessel White Marlin,

which Dockwise plans to put into service this year. The Statoil rigs are

scheduled to leave the Samsung Heavy Industries yard in late 2016 or

early 2017, and will be deployed to the Gullfaks and Oseberg fields.

1403OFF_26 26 2/28/14 4:52 PM

Email: qualitytubing@nov.com

2

0

1

3

N

a

t

i

o

n

a

l

O

i

l

w

e

l

l

V

a

r

c

o

A

l

l

r

i

g

h

t

s

r

e

s

e

r

v

e

d

D

3

9

2

0

0

5

0

2

4

-

M