Escolar Documentos

Profissional Documentos

Cultura Documentos

9-Important Provisions of N.I

Enviado por

raghav4231Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

9-Important Provisions of N.I

Enviado por

raghav4231Direitos autorais:

Formatos disponíveis

I MPORTANT PROVI SI ONS OF

N.I .ACT

DR.S.C.BIHARI

Presented by

I B S, HYDERABAD I B S, HYDERABAD

NEGOTI ABLE I NSTRUMENTS AS NEGOTI ABLE I NSTRUMENTS AS

PER N.I .ACT PER N.I .ACT

The Act does not define a negotiable The Act does not define a negotiable

instrument. instrument.

Section 13states, Section 13states, " a negotiable " a negotiable

instrument means a promissory note, instrument means a promissory note,

bill of exchange or Cheque payable to bill of exchange or Cheque payable to

order or bearer." order or bearer."

This section does not rule out any

other instrument that satisfies the

essential features of negotiability.

I MPORTANT PROVI SI ONS OF I MPORTANT PROVI SI ONS OF

N.I .ACT,1881 N.I .ACT,1881

Promissory Note Promissory Note - - A A promissory note promissory note is is

an instrument in writing (not being a bank an instrument in writing (not being a bank- -

note or note or a currency a currency- -note) note)

containing an unconditional under containing an unconditional under taking, taking,

signed by the maker, signed by the maker,

to pay a certain sum of money to pay a certain sum of money

onl y to, or to the order of, a certain person,

or to the bearer of the instrument. [Section or to the bearer of the instrument. [Section

4]. 4].

I MPORTANT PROVI SI ONS OF

N.I .ACT,1881

Bill of Exchange Bill of Exchange It is an instrument It is an instrument

in writing containing an unconditional in writing containing an unconditional

order, signed by the maker, directing order, signed by the maker, directing

a certain person to pay a certain sum a certain person to pay a certain sum

of money onl y to, or to the order of, a of money onl y to, or to the order of, a

certain person or to the bearer of the certain person or to the bearer of the

instrument. [section 5]. instrument. [section 5].

A Cheque is a special type of Bill of A Cheque is a special type of Bill of

Exchange. It is drawn on banker and Exchange. It is drawn on banker and

is required to be made payable on is required to be made payable on

demand. demand.

I MPORTANT PROVI SI ONS OF

N.I .ACT,1881

Provisions in respect of Cheques Provisions in respect of Cheques - -

Cheque Cheque includes electronic image of includes electronic image of

a truncated Cheque and a Cheque in a truncated Cheque and a Cheque in

electronic form. [section 6]. electronic form. [section 6].

This definition is amended by This definition is amended by

Negotiable Instruments Amendment Negotiable Instruments Amendment

Act, 2002, making provision for Act, 2002, making provision for

electronic submission and clearance electronic submission and clearance

of Cheque. of Cheque.

I MPORTANT PROVI SI ONS OF

N.I .ACT,1881

Section.09.Holder in due course : Section.09.Holder in due course :

A person who for consideration, A person who for consideration,

Became the possessor of a promissory Became the possessor of a promissory

note, bill of exchange or Cheque if payable note, bill of exchange or Cheque if payable

to bearer or the payee or the endorse if to bearer or the payee or the endorse if

payable to order payable to order

Before the amount mentioned became Before the amount mentioned became

payable and payable and

Without having sufficient cause to believe Without having sufficient cause to believe

that any defect existed in the title of the that any defect existed in the title of the

person from whom he derived his title. person from whom he derived his title.

I MPORTANT PROVI SI ONS OF

N.I .ACT,1881

Section.10.Payment in due course: Section.10.Payment in due course:

payment In accordance with the

apparent tenor of the instrument.

In good faith and without negligence. In good faith and without negligence.

To any person in possession of the To any person in possession of the

instrument. instrument.

Under circumstances which do not afford

a reasonable ground to believe that the

person receiving the payment is not

entitled for the same.

DUTI ES OF PAYI NG BANKER

As per Sec. 31 of N.I Act, As per Sec. 31 of N.I Act,

The drawee of a Cheque: The drawee of a Cheque:

(i) having sufficient funds of the drawer (i) having sufficient funds of the drawer

in his hands in his hands

(ii) properl y applicable to the payment (ii) properl y applicable to the payment

of such Cheque of such Cheque

(iii) must pay the Cheque when duly (iii) must pay the Cheque when duly

required to do so and required to do so and

(iv) in default of such payment must (iv) in default of such payment must

compensate the drawer for any loss compensate the drawer for any loss

or damage by such default. or damage by such default.

PROTECTI ON TO COLLECTI NG BANKER

As per Sec.131 of the Act As per Sec.131 of the Act

A banker who has A banker who has

(i) in good faith and without negligence

(ii) received payment for a customer (ii) received payment for a customer

(iii) of a Cheque crossed generally or

specifically to himself shall not, in

case the title of the Cheque proves

defecti ve, incur any liability to the

true owner of the Cheque, by reason

only of having received the

payment .

BOUNCI NG OF CHEQUES CRI MI NAL

LI ABI LI TY (Sec t i on 138 142)

Section138 Section138- -Punishment Punishment imprisonment up to 2 imprisonment up to 2

years or penalty up to double the amount of the years or penalty up to double the amount of the

cheque or both. cheque or both.

Section 139 Section 139 The cheque in question is deemed The cheque in question is deemed

to have been received for consideration. to have been received for consideration.

Section 140 Section 140 The defence of the drawer in the The defence of the drawer in the

Court of Law regarding intention would not be Court of Law regarding intention would not be

considered by the Court considered by the Court

Section 141 Section 141 When a cheques issued by a When a cheques issued by a

Company is bounced, all the persons responsible Company is bounced, all the persons responsible

for conducting the business of the Company are for conducting the business of the Company are

liable on the bounced cheques liable on the bounced cheques

Section 142 Cognizance of offences Normall y

Courts take cognizance of a criminal offence only

when it is routed through police.

Thank s f or your

at t ent i on

Dr. S. C. Bihari

Tell:08417-236660 to 65(Extn: 6214)

Mail:scbihari@gmail.com

Você também pode gostar

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Hersey K Delynn PayStubDocumento1 páginaHersey K Delynn PayStubSharon JonesAinda não há avaliações

- Common Law Distress On Third PartiesDocumento7 páginasCommon Law Distress On Third Partiesnorris1234Ainda não há avaliações

- SAS® Financial Management 5.5 Formula GuideDocumento202 páginasSAS® Financial Management 5.5 Formula Guidejohannadiaz87Ainda não há avaliações

- Teaching Market Making with a Game SimulationDocumento4 páginasTeaching Market Making with a Game SimulationRamkrishna LanjewarAinda não há avaliações

- 8-Banker Customer RelationshipDocumento20 páginas8-Banker Customer Relationshipraghav4231Ainda não há avaliações

- 6 Deposit ManagementDocumento33 páginas6 Deposit Managementraghav4231Ainda não há avaliações

- 11-Cash and Liquidity Management in BanksDocumento23 páginas11-Cash and Liquidity Management in Banksraghav4231Ainda não há avaliações

- Presentation1 121023042438 Phpapp02Documento26 páginasPresentation1 121023042438 Phpapp02raghav4231Ainda não há avaliações

- RBI KYC guidelines for banks on customer identification and due diligenceDocumento14 páginasRBI KYC guidelines for banks on customer identification and due diligenceraghav4231Ainda não há avaliações

- Factor Analysis ProblemDocumento1 páginaFactor Analysis Problemraghav4231Ainda não há avaliações

- Online Banking by Raghav Maheshwari 13BSPHH010980 Section FDocumento25 páginasOnline Banking by Raghav Maheshwari 13BSPHH010980 Section Fraghav4231Ainda não há avaliações

- Net Working Capital 104,117.00 108,685.00 111,333.00 121,138.00Documento2 páginasNet Working Capital 104,117.00 108,685.00 111,333.00 121,138.00raghav4231Ainda não há avaliações

- RBI NotificationDocumento2 páginasRBI Notificationnahar_sv1366Ainda não há avaliações

- Indian Financial System OverviewDocumento25 páginasIndian Financial System OverviewShaswat RaiAinda não há avaliações

- 2-The Origin & Growth of BankingDocumento25 páginas2-The Origin & Growth of Bankingraghav4231Ainda não há avaliações

- Sources and Uses-IcmrDocumento22 páginasSources and Uses-Icmrraghav4231Ainda não há avaliações

- Sas Installation Steps - Imp PDFDocumento7 páginasSas Installation Steps - Imp PDFraghav4231Ainda não há avaliações

- TZPDocumento8 páginasTZPraghav4231Ainda não há avaliações

- MS Access BasicsDocumento42 páginasMS Access Basicsraghav4231Ainda não há avaliações

- Hero Honda DataDocumento4 páginasHero Honda Dataraghav4231Ainda não há avaliações

- Ob Skit PoliticsDocumento16 páginasOb Skit Politicsraghav4231Ainda não há avaliações

- Tie-Up Between Jet - Etihad AirwaysDocumento12 páginasTie-Up Between Jet - Etihad Airwaysraghav4231Ainda não há avaliações

- Setting Product StrategyDocumento24 páginasSetting Product Strategyraghav4231Ainda não há avaliações

- Work Place Politics SkitDocumento17 páginasWork Place Politics Skitraghav4231Ainda não há avaliações

- BMW (Chapter7)Documento15 páginasBMW (Chapter7)raghav4231Ainda não há avaliações

- BC Editorial Presentation (Food Security Bill)Documento5 páginasBC Editorial Presentation (Food Security Bill)raghav4231Ainda não há avaliações

- Airtel (Chapter9)Documento20 páginasAirtel (Chapter9)raghav4231Ainda não há avaliações

- Session Plan For Preparatory Course in Quantitative Methods Section - L (Class of 2015)Documento1 páginaSession Plan For Preparatory Course in Quantitative Methods Section - L (Class of 2015)raghav4231Ainda não há avaliações

- Depreciation Accounting AS6Documento18 páginasDepreciation Accounting AS6SumitAinda não há avaliações

- Raghav ResumeDocumento2 páginasRaghav Resumeraghav4231Ainda não há avaliações

- Analyzing Business MarketsDocumento10 páginasAnalyzing Business Marketsraghav4231Ainda não há avaliações

- As 26Documento47 páginasAs 26Sujit ChakrabortyAinda não há avaliações

- Sahil Mittal: Career ObjectiveDocumento2 páginasSahil Mittal: Career Objectiveraghav4231Ainda não há avaliações

- Application For Provident Benefits Claim (HQP-PFF-040, V02.1) PDFDocumento2 páginasApplication For Provident Benefits Claim (HQP-PFF-040, V02.1) PDFPhilip Floro0% (1)

- Office Stationery Manufacturing in The US Industry ReportDocumento40 páginasOffice Stationery Manufacturing in The US Industry Reportdr_digital100% (1)

- Home Activity 3Documento6 páginasHome Activity 3Don LopezAinda não há avaliações

- Zillow 2Q22 Shareholders' LetterDocumento17 páginasZillow 2Q22 Shareholders' LetterGeekWireAinda não há avaliações

- Act 248 Innkeepers Act 1952Documento10 páginasAct 248 Innkeepers Act 1952Adam Haida & CoAinda não há avaliações

- Annual Report 2019Documento228 páginasAnnual Report 2019Rohit PatelAinda não há avaliações

- Impact of The Tax System On The Financial Activity of Business EntitiesDocumento6 páginasImpact of The Tax System On The Financial Activity of Business EntitiesOpen Access JournalAinda não há avaliações

- Technopreneurship in Small Medium EnterprisegrouptwoDocumento50 páginasTechnopreneurship in Small Medium EnterprisegrouptwoKurt Martine LacraAinda não há avaliações

- Construction Budget: Project InformationDocumento2 páginasConstruction Budget: Project InformationAlexandruDanielAinda não há avaliações

- Xisaab XidhDocumento1 páginaXisaab XidhAbdiAinda não há avaliações

- Gram Yojana (Gram Priya) 10 Years Rural Postal Life Insurance Age at Entry Yrs Annual Rs Halfyearly Rs Quarterly Rs Monthly Age at Entry YrsDocumento2 páginasGram Yojana (Gram Priya) 10 Years Rural Postal Life Insurance Age at Entry Yrs Annual Rs Halfyearly Rs Quarterly Rs Monthly Age at Entry YrsPriya Ranjan KumarAinda não há avaliações

- INVESTMENT MANAGEMENT-lakatan and CondoDocumento22 páginasINVESTMENT MANAGEMENT-lakatan and CondoJewelyn C. Espares-CioconAinda não há avaliações

- Part-1-General - and - Financial - Awareness Set - 1Documento4 páginasPart-1-General - and - Financial - Awareness Set - 1Anto KevinAinda não há avaliações

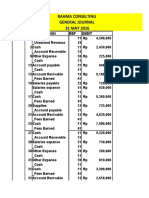

- Rahma ConsutingDocumento6 páginasRahma ConsutingEko Firdausta TariganAinda não há avaliações

- A Study On Investors Buying Behaviour Towards Mutual Fund PDF FreeDocumento143 páginasA Study On Investors Buying Behaviour Towards Mutual Fund PDF FreeRathod JayeshAinda não há avaliações

- ACST101 Final Exam S1 2015 QuestionsDocumento20 páginasACST101 Final Exam S1 2015 Questionssamathuva12Ainda não há avaliações

- CDP Revised Toolkit Jun 09Documento100 páginasCDP Revised Toolkit Jun 09kittu1216Ainda não há avaliações

- Sebi Grade A Exam: Paper 2 Questions With SolutionsDocumento34 páginasSebi Grade A Exam: Paper 2 Questions With SolutionsnitinAinda não há avaliações

- Bharti Airtel Services LTD.: Your Account Summary This Month'S ChargesDocumento4 páginasBharti Airtel Services LTD.: Your Account Summary This Month'S ChargesVinesh SinghAinda não há avaliações

- Fundamentals of Corporate Finance, 2/e: Robert Parrino, Ph.D. David S. Kidwell, Ph.D. Thomas W. Bates, PH.DDocumento50 páginasFundamentals of Corporate Finance, 2/e: Robert Parrino, Ph.D. David S. Kidwell, Ph.D. Thomas W. Bates, PH.DThành NguyễnAinda não há avaliações

- Cash Flow and Financial PlanningDocumento64 páginasCash Flow and Financial PlanningKARL PASCUAAinda não há avaliações

- Coops CPPP Unit Vision Support Collectively Owned EnterprisesDocumento17 páginasCoops CPPP Unit Vision Support Collectively Owned EnterprisesJeremy RakotomamonjyAinda não há avaliações

- ESCHEATS AND TRUSTEE RULESDocumento6 páginasESCHEATS AND TRUSTEE RULESJames Ibrahim AlihAinda não há avaliações

- Banking - HL - CBA 0979 - GOROKAN (01 Jan 23 - 28 Feb 23)Documento5 páginasBanking - HL - CBA 0979 - GOROKAN (01 Jan 23 - 28 Feb 23)Adrianne JulianAinda não há avaliações

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocumento2 páginasIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsAinda não há avaliações