Escolar Documentos

Profissional Documentos

Cultura Documentos

A&F Assignment (Compiled) FINAL

Enviado por

vincentwks88Descrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

A&F Assignment (Compiled) FINAL

Enviado por

vincentwks88Direitos autorais:

Formatos disponíveis

Table of Contents

Chapter 1 ......................................................................................................................................... 1

1.0 Introduction....................................................................................................................... 1

1.1 Profitability ....................................................................................................................... 4

1.2 Net Profit Margin .............................................................................................................. 5

1.3 Gross Profit Margin .......................................................................................................... 7

1.4 Return on Capital Employed ............................................................................................ 8

Chapter 2 ....................................................................................................................................... 10

2.0 Liquidity (Short-Term Stability) ..................................................................................... 10

2.1 Current Ratio .................................................................................................................. 11

2.2 Quick Ratio (Acid Test) ..................................................................................................... 13

2.3 Gearing Ratio (Long-Term Stability) ................................................................................. 14

Chapter 3 ....................................................................................................................................... 16

3.0 Efficiency ........................................................................................................................ 16

3.1 Account Receivable Turnover ....................................................................................... 18

3.2 Account Receivables Average Collection Period ........................................................... 20

3.3 Inventory Turnover ......................................................................................................... 22

3.4 Number of Days in Inventory ......................................................................................... 24

3.5 Fixed Assets Turnover .................................................................................................... 25

Chapter 4 ....................................................................................................................................... 27

4.0 Leverage Ratio ................................................................................................................ 27

4.1 Debt to equity Ratio ........................................................................................................ 28

4.2 Time Interest Earned ....................................................................................................... 29

Chapter 5 ....................................................................................................................................... 30

5.0 Cash Flow Ratios ............................................................................................................ 30

5.2 Cash Flow Adequacy ...................................................................................................... 32

Chapter 6 ....................................................................................................................................... 33

6.0 Conclusion ...................................................................................................................... 33

Appendix ........................................................................................................................................ 34

1

Chapter 1

1.0 Introduction

The companies that were chosen by the team to study are Ibraco Group of

Companies, Mudajaya Group Berhad as well as Hock Seng Lee Berhad. All 3 companies

are property development companies that have aced the development of Kuching City.

Furthermore, all 3 companies were listed in Bursa Malaysia, which means these

companies financial statements and information were all available for public view,

hence greatly aided the team in the execution of the assignment.

IbracoBerhad (Ibraco) was first established on 30 August 1971 as a private

limited company under the name of Ibraco Realty Development Sdn Bhd. The company

converted into a public limited company in preparation for its listing on the Main Board

of Bursa Malaysia Securities Berhad (Bursa Securities). On 28 July 2003 it was

converted into a public limited company in order to get listed on the Main Board of Bursa

Malaysia Securities Berhad, hence changing its name to Ibraco Berhad.

Ibraco Group has been involved in real estate and property development

comprising mainly residential, commercial and industrial properties since 1974. With its

distinguished track record of over 38 years of experiences in the property development

industry, Ibraco has established itself as the premier property developer in Sarawak.

Being the pioneer property developer in Kuching, with over 30 years of experiences, it

had set itself as the Premiere property developer in Sarawak. Tabuan Jaya, a renowned

and established township which is situated 7 kilometers south of Kuching City, is one of

the best examples of Ibraco Groups success as they were responsible for the really

successful growth of that township. Besides property development, Ibraco is also

involved in landscape as well as construction projects. Ibraco Construction Sdn Bhd and

Ibraco Spectrum Sdn Bhd (landscape) are both wholly owned by Ibraco Berhad. Some of

their current projects are Tabuan Tranquility and Stutong Apartments, and as fortheir

latest projects, these include The Park Residence as well as the Town Square of Bintulu.

2

On the other hand, another company that had created its own fame in the Sarawak

developers network is Hock Seng Lee Berhad (HSL). Hock Seng Lee Berhad is a

subsidiary of Hock Seng Lee Construction Sendirian Berhad (HSL Construction). HSL

commenced business in property development in the year 2000, having acquired a

strategic land bank in a successful corporate exercise in June 2000. Besides property

development, HSL is also involved in other different kinds of field, such as building

construction, marine engineering, civil engineering and etc.

HSL has launched several very successful residential and commercial projects all

around Kuching. In recent years, it has taken on construction contracts ranging from

residential housings to hospitals, educational institutions and some other commercial and

public administrative buildings. In addition, HSL had always been quite reputable for

being innovative in their designs and value-for-money products.

Initially, property development was not HSLs main focus and forte. However,

the company saw an opportunity in it, hence expanding into this field. HSL moving into

property development is seen as synergistic in its construction and engineering business

and has enlarged their operations and earnings base ever since.

Besides, with HSL's strong financial standings, it has enabled the company to

offer flexible payment terms to clients or even negotiate contracts on cash-kind

combination terms. By accepting payments in the form of land, HSL is continuing to

boost its land bank which in turn will generate more new projects for property

development. Subsequently, property development is expected to be a

substantialenduring contributor to the companys bottom line going forward with many

innovative and exciting projects in the pipeline.

In addition, another property development company that had also made a mark in

Kuching is Mudajaya Group Berhad via its subsidiaries Mudajaya Land Sdn Bhd

(formerly known as Angsana Fajar Sdn Bhd or MLand). MJC was established in

Malaysia under the name of Chye Hin Construction Company Limited on 9 December

1965 as a private limited company, but changed its name to Chye Hin Construction

Company Sdn Bhd on 15 April 1966. On 19 August 1972, its name was further changed

to Mudajaya Construction Sdn Bhd and subsequently to Mudajaya Corporation Sdn Bhd

(MJC) on 19 May 1997. On 10 June 1997, it was converted into a public limited

3

company with the same name. Some of the other business activities they are involved in

were construction, manufacturing, trading as well as power sector. Similar to the previous

two companies mentioned, MJC is also involved in other business activities, such as

construction, manufacturing, trading as well as power sector.

The company first ventured into property development with its maiden project,

the Villa Angsana Condominium in Kuala Lumpur whereby their project comprises of

756 units of apartments which were successfully launched in 1996 in four phases and

were all sold out. Subsequently in the year 1997, the company via its subsidiary MJC

City Development Sdn Bhd (MCity), embarked on the Batu Kawah New Township

project in Kuching. The Batu Kawah New Township is situated 7 KM from Kuching City

Centre. The project consists of a new satellite township to be built on 265 acres of land.

The completion of the project is estimated to be around the year 2020 and is expected to

generate a total Gross Development Value of more than RM1.3 billion.

4

1.1 Profitability

Profitability represents a class of financial metrics that are used to assess a

business's ability to generate earnings as compared to its expenses and other relevant

costs incurred during a specific period of time. Table 1 below shows the comparison

between Ibraco Berhad, Hock Seng Lee Berhad (HSL) and Mudajaya Berhad over a five

years term. A breakdown comparison will be discussed in detail at next section. For

calculation, please refer to Appendix Table A-1.

Profitability ratio: 2012 (%) 2011 (%) 2010 (%) 2009 (%) 2008 (%)

Net Profit Margin

Ibraco Berhad

HSL

Mudajaya Berhad

11.53

15.03

19.1

11.07

15.00

13.55

27.44

15.04

27.23

14.16

15.02

16.52

4.10

13.53

21.82

Gross Profit Margin

Ibraco Berhad

HSL

Mudajaya Berhad

23.41

21.51

18.31

21.30

21.69

24.90

47.63

22.29

32.96

59.93

23.32

24.92

15.01

21.96

19.82

Return On Capital

Employed (ROCE)

Ibraco Berhad

HSL

Mudajaya Berhad

7.46

23.71

25.7

6.64

26.42

29.15

5.43

26.36

36.6

(2.44)

24.15

39.67

(1.78)

22.08

21.48

Table 1: Profitability Ratio Comparison

5

0

5

10

15

20

25

30

2008 2009 2010 2011 2012

N

e

t

P

r

o

f

i

t

M

a

r

g

i

n

Years

Net Profit Margin

Ibraco Berhad

Hock Seng Lee Berhad

Mudajaya Berhad

1.2 Net Profit Margin

The net profit margin ratio can be defined as a companys total amount of revenue

which keeps as company net income and conveysit in a percentage form. In simple words,

net profit margin shows the amount of sales which were left over after deducting all the

expenses and indicating how effective a company is in cost control. Besides, net profit

margin is very useful in comparing the profitability of different companies in the same

industries. Other than that, higher net profit margin shows the company efficiency in

converting the sales to actual profit. However, lower net profit margin indicates a low

margin of safety whereby the risk of sales decline may affect the profit or resulting in a

negative margin. Thus, the company would have to increase the operation expenses

which in return may decrease the net profit margin.

Figure 1.1: Net Profit Margin

6

Based on the table, Mudajaya Berhad reveals the highest net profit margin in the

year 2012, 19.1%, being the highest amongst the competitors. The second highest was

Hock Seng Lee Berhadwith a net profit margin of 15.03% and the one achieving the

lowest net profit margin was IBRACO Berhad. The acceptable ratio is varied from

industry to industry. However, the appropriate or recommended ratio for net profit

margin is 5 percent or greater. Thus, from the figure shown above, all three companies

are in the acceptance level and are growing in a stable condition. However, there are a

few indicators thatthese companies should be aware ofwhich are the possible influences

on the net profit margin which areprice, inventory, variable business costs and business

fixed costs.

7

0

10

20

30

40

50

60

70

2008 2009 2010 2011 2012

G

r

o

s

s

P

r

o

f

i

t

M

a

r

g

i

n

Years

Gross Profit Margin

Ibraco Berhad

Hock Seng Lee Berhad

Mudajaya Berhad

1.3 Gross Profit Margin

The gross profit margin ratio can be defined as the amount of money a company

earns from the production process. It also acts as an indicator for the company to evaluate

the profitability for the most fundamental level.

Figure 1.2: Gross Profit Margin

Figure 1.2 illustrates the gross profit margin of Ibraco Berhad, Hock Seng Lee

Berhad and Mudajaya Berhad. From the figure above, it is obvious that Ibraco has a

higher gross profit margin compared to the other two companies in the year 2012,

achieving 23.41%. However, it can also be seen that Hock Seng Lee Berhad has the

highest gross profit margin in the year 2009, achieving 23.32%, but the achievement was

short lived as the gross profit margin began to slop in the following years, reaching 21.51%

in the year 2012. The main reason for that was due to the inadequate supply in resources,

labor and materials. As for Mudajaya Berhad, its gross profit marginhas not been stable

for these 5 years and had only achieved 18.31% in the gross profit margin, losing out to

the two competitors.

8

0

5

10

15

20

25

30

35

40

45

2008 2009 2010 2011 2012

R

e

t

u

r

n

o

n

C

a

p

i

t

a

l

E

m

p

l

o

y

m

e

n

t

Years

Return On Capital Employment

Ibraco Berhad

Hock Seng Lee Berhad

Mudajaya Berhad

1.4 Return on Capital Employed

Return on capital employed (ROCE) is the financial ratio that measures the

companys efficiency as well as the profitability in capital investment. Besides, ROCE

can also be defined as the long term funds used by the company. The higher the capital

employed, the higher the efficiencyin which the company usesits capital. Other than that,

ROCE should also be higher than the capital cost employed or else it would show the

companys ineffectiveness in the capital usage, hence not generating any shareholder

value. The ROCE is usually expressed in percentageterms.

Figure 1.3: Return on Capital Employed (ROCE)

9

Based on the Figure 1.3, it can be seen that Ibraco was facing loss in the earnings

before interest and tax in the year 2008 and year 2009, hence losing much of the capital

invested. This has lead to a negative ROCE which is 1.78% in the year 2008 and 2.44%

year 2009. AlthoughIbracos ROCE has gradually increased to 7.46% in year 2012, but

its still lowwhen compared to the other two companies.

As for Hock Seng Lee Berhad, it can be seen the companys performance was

quite stable for the five consequent years when compared to the two competitors. In the

figure above, Hock Seng Lee Berhad had shown an average ROCE of 24.54% for the five

years preiod, and a particularly high ROSE in the year 2011 which is 26.42%. The results

have concluded that the management of Hock Seng Lee Berhad had efficiently managed

the capital wisely, hence the positive growth.

As we can conclude from the Figure 1.3, Mudajaya Berhad has demonstrated the

highest ROCE compared with the other two competitors. Assumptions can be made that

the company has managed the capital efficiently mainly for investment purposed.

Mudajaya breed has figured out the highest ROCE on the year 2009 which is 39.67%.

However, by the year 2012, the ROCE has dropped to 25.7%, though is still the highest

in terms of ROCE when compared to Ibraco Berhad and Hock Seng Lee Berhad.

10

Chapter 2

2.0 Liquidity (Short-Term Stability)

A liquidity ratio is defined as a company's ability to pay short-term obligations.

The ratio is mainly used to give an idea of the company's ability to pay back its short-

term liabilities (debt and payables) with its short-term assets (cash, inventory,

receivables). Table 2 below represent the comparison between Ibraco Bhd, Hock Seng

Lee Bhd (HSL) and Mudajaya Berhad for five years. A breakdown comparison will be

discussed in detail at next section. For calculation, please refer to Appendix Table A-2.

Liquidity Ratio: 2012 2011 2010 2009 2008

Current Ratio

Ibraco Berhad

HSL

Mudajaya Berhad

3.02

1.85

1.71

2.33

1.85

2.17

3.32

1.79

1.99

4.44

1.94

1.51

5.58

1.84

2.94

Quick Ratio

Ibraco Berhad

HSL

Mudajaya Berhad

3.01

1.68

1.69

2.32

1.66

2.14

3.32

1.73

1.95

4.43

1.88

0.46

5.46

1.72

2.80

Gearing Ratio (%)

Ibraco Berhad

HSL

Mudajaya Berhad

41.2

36.6

32.9

35.9

40.1

29.9

23.6

40.1

32.0

10.6

38.8

40.5

28.0

39.5

25.5

Table 2: Liquidity Table Comparison

11

2.1 Current Ratio

The current ratio measures the efficiency of a company in paying obligations or in

other words, the ratio is an indication of a firm's market liquidity and ability to meet

creditor's demands. When the current ratio of a company is less than one, it represent that

the company would not be able to pay off its obligation if they came to that point. It also

shows that the company is not in good financial health, however it does not necessarily

mean that it will go bankrupt. The current ratio can give a sense of efficiency of a

company's operating cycle or its ability to turn its product into cash. Companies that have

trouble getting paid on their receivables or have a long inventory turnover can run into

liquidity problems because they are unable to alleviate their obligations. Because

business operations differ in each industry, it is always more useful to compare

companies within the same industry.

This ratio is similar to the acid-test ratio except that the acid-test ratio does not

include inventory and prepaid as assets that can be liquidated. The components of current

ratio (current assets and current liabilities) can be used to derive working capital (the

difference between current assets and current liabilities). Working capital is frequently

used to derive the working capital ratio, which is working capital as a ratio of sales.

12

Figure 2.1: Current Ratio

Graph 2.1 illustrates the current ratio for Mudajaya Berhad, Ibraco Berhad and

Hock Seng Lee Berhad from the year 2008 to 2012. Ibraco Berhad holds the highest

liquidity ratio from year 2008 to 2012 compared to Mudajaya Berhad and Hock Seng Lee

Berhad. The ratio revealed that in year 2012 Ibraco Berhads current assets cover the

current liabilities by 3.02 times. Acceptable current ratios vary from industry to industry

and are generally between 1.5% and 3% for healthy businesses. Ibraco Berhad had the

highest current ratio of 5.58 in the year 2008. The company had improved in utilizing and

their liquid assets productively in the recent years. While Mudajaya Berhad and Hock

Seng Lee Berhad are in good health for business as the ratios are between around 2:1

ratio.

0

1

2

3

4

5

6

2008 2009 2010 2011 2012

C

u

r

r

e

n

t

R

a

t

i

o

Years

Current Ratio

Mudajaya Berhad

Ibraco Berhad

Hock Seng Lee

Berhad

13

2.2 Quick Ratio (Acid Test)

The term Acid Test ratio is also known as quick ratio. The most basic definition

of acid-test ratio is used to measures current (short term) liquidity and position of the

company. To do the analysis, accountants weigh current assets of the company against

the current liabilities which result in the ratio that highlights the liquidity of the company.

Figure 2.2: Quick Ratio

The acid test ratios for 2011 MudajayaBerhad, IbracoBerhad and Hock Seng Lee

Berhad and can be expressed as 2.14:1, 2.32:1 and 1.66:1 respectively. The ratio indicates

us that the liquid current assets are able to cover liabilities, hence reflecting that the

three companies here are having a strong base of cash flows as all the ratios are more

than 1.0.

0

1

2

3

4

5

6

2008 2009 2010 2011 2012

Q

u

i

c

k

R

a

t

i

o

Years

Quick Ratio

Mudajaya Bhd

Ibraco Bhd

Hock Seng Lee

14

2.3 Gearing Ratio (Long-Term Stability)

The gearing ratio is the proportion of a company's debt to its equity, where a high

gearing ratio represents a high proportion of debt to equity, and a low gearing ratio

represents a low proportion of debt to equity. The gearing ratio is similar to the debt to

equity ratio, except that there are a number of variations on the gearing ratio formula that

can yield slightly different results.

Generally, companies with higher leverage as determined by a leverage ratio are

thought to be more risky because they have more liabilities and less equity. A leverage

ratio is also called a gearing ratio or an equity multiplier.

Figure 2.3 Gearing Ratio

0

5

10

15

20

25

30

35

40

45

2008 2009 2010 2011 2012

G

e

a

r

i

n

g

R

a

t

i

o

Years

Gearing Ratio

Mudajaya Bhd

Ibraco Bhd

Hock Seng Lee

15

Mudajaya Group Berhad reveals a substantial increase in the level of gearing ratio

from 29.9% to 32.9% compared with the year 2011 and 2012, which only shows the

difference 3%. However, Hock Seng Lee Berhad has the same ratio of gearing for the

years 2010 and 2011 which figured 40.1%. In the year 2009, Mudajaya Group Brehad

shown the highest gearing ratio followed by Hock Seng Lee Berhad which figured 38.8%

and the least gearing ratio falls to Ibraco Berhad. There are a number of methods for

reducing a company's gearing ratio, including sell shares where the board of directors

could authorize the sale of shares in the company, which could be used to pay down debt.

Converting loans and negotiating with lenders to swap existing debt for shares in the

company. Reduce working capital. Increase the speed of accounts receivable collections,

reduce inventory levels, and/or lengthen the days required to pay accounts payable, any

of which produces cash that can be used to pay down debt. The company has to use any

methods available to increase profits, which should generate more cash with which to pay

down debt.

16

Chapter 3

3.0 Efficiency

Efficiency ratio is used to analyze how well a company uses its assets and

liabilities internally. Table 3 below represents the comparison between Ibraco Bhd, Hock

Seng Lee Bhd (HSL) and Mudajaya Berhad for five years. A detailed breakdown

comparison will be discussed in the next section. For calculations, please refer to

Appendix Table A-3.

Efficiency ratio: 2012 2011 2010 2009 2008

Receivables

Accounts Receivable Turnover (Time)

Ibraco Berhad

HSL

Mudajaya Berhad

Average Collection Period (Days)

Ibraco Berhad

HSL

MudajayaBerhad

6.37

2.72

3.98

57

134

92

1.65

2.50

2.80

221

146

130

2.56

1.77

2.87

143

176

127

0.64

2.07

3.81

570

206

96

4.16

1.84

2.96

88

198

123

17

Table 3: Efficiency Ratio

Inventory

I nventory Turnover (Times)

Ibraco Berhad

HSL

MudajayaBerhad

Number of Days in I nventory (Days)

Ibraco Berhad

HSL

MudajayaBerhad

87.51

22.51

4.52

4

16

81

144.57

25.07

3.35

3

15

109

48.48

31.54

43.28

8

12

8

9.12

33.80

36.23

40

11

10

8.36

68.53

21.42

44

5

17

Fixed assets

Fixed Asset Turnover (Times)

Ibraco Berhad

HSL

MudajayaBerhad

43.30

9.53

12.25

10.12

5.57

22.74

1.70

5.87

21.82

15.76

6.34

29.82

25.7

7.43

34.52

18

0

1

2

3

4

5

6

7

2008 2009 2010 2011 2012

A

c

c

o

u

n

t

s

R

e

c

e

i

v

a

b

l

e

T

u

r

n

o

v

e

r

Years

Accounts Receivable Turnover

Ibraco Berhad

Hock Seng Lee Berhad

Mudajaya Berhad

3.1 Account Receivable Turnover

Accounts receivable turnover is defined as the effectiveness of company in

extending the credit as well as collecting the debts from the creditor and customers. At

the same time, accounts receivable turnover also measures the efficiency of a companys

asset usage. Beside, accounts receivable turnover has indirectly given the companys

customers and clients interest free loans. A high ratio of accounts receivables means that

a company is operating on a cash basis or the time to collect back the collection is

efficient. However, the low ratio of account receivable turnover means that the company

should reconsider its credit policies and ensure that any collection is paid back on time.

Figure 3.1: Accounts Receivable Turnover

19

Based on Figure 3.1, it can be seen that Ibraco Berhad has the highest accounts

receivable turnover in the year 2012 which is 6.37 times. The number of times increased

along the years from the year 2009, 0.64 times. Ibraco Berhad had shown quite a positive

growth in this field and has enabled the company to have sufficient cash flow from time

to time as well as operate on a cash basis.

As for Hock Seng Lee Berhad, the accounts receivable turnover in the year 2008

was 1.84 times and the numbers has increased to 2.72 times in the year 2012. However it

is still the lowest compared to other competitors which means that the company took

more days than its competitors in collecting the cash back. Hock Seng Lee Berhad had

remained almost the same figure along the years. As for Mudajaya Berhad, the account

receivable turnover was 2.96 times in the year 2008 and had increased to 3.98 times in

the year 2012. Although Mudajaya Berhad is not in the last place amongst the three

companies, it does not indicate that the company is performing well as it took around 92

days on average to collect the debts. Both HSL and Mudajaya Berhad should reconsider

their policies in order to ensure efficient cash flow in the companys operation.

20

0

100

200

300

400

500

600

2008 2009 2010 2011 2012

A

c

c

o

u

n

t

R

e

c

e

i

v

a

b

l

e

A

v

e

r

a

g

e

Years

Account Receivables Average VS Times

Ibraco Berhad

Hock Seng Lee Berhad

Mudajaya Berhad

3.2 Account Receivables Average Collection Period

Account receivables average collection period can be defined as the amount of

time a business gets back or receive the payment owed by their creditors, customers and

clients. Lower average collection period tends to be of all businesses choice as they need

these cash to cover the administration and operation expenses. Nowadays, most

businesses or companies are letting their clients to pay via credit, though it can be quite

hard to predict the actual time these clients will pay. Hence, a low payback period is

crucial to a business or company.

Figure 3.2: Graph plotting Account Receivables Average Collection Period against the

times

21

Based on Figure 3.2, it is revealed that Ibraco has the lowest collection periods as

compared to other two competitors, being 57 days only in the year 2012. Compared to the

past (2009), Ibraco needed approximately 570 days to get back payments. Hence,

Ibracos business performance has shown vast improvement along the year with the

significant decrease in the collection period. Well, this is a positive sign for Ibraco

Berhad as the creditors and customers payback were all within a short period, thus

allowing the company to have sufficient cash to operate their business.

However, Hock Seng Lee Berhad has the highest account receivables in terms of

the average collection period as compared to the other two competitors whereas in the

year 2012, the companys payment payback period was 134 days. Even though the

number has started to show a sign of decrease as compared to the year 2011 but it is still

high compared to the other two competitors. In comparison with Ibraco Berhad, Hock

Seng Lee Berhad takes 77 days more than Ibraco Berhad in the collection of payment

from the creditor and customers. This clearly illustrates the HSLs poor management.

As for Mudajaya Berhad, the average number of days taken to collect payment for

the year 2012 was 92 days. Based on the Figure 3.2, there was a sign of decrease when

compared with the previous years, which took 130 days. The average collection period

varies from industry to industry and the acceptable range for an account receivables

collection period is approximately 40 days or less. Based on what was seen in Figure 3.2,

all three companies have exceeded the standardized period, though IbracoBerhaddid

come close to that mentioned period as compared to the HSL Berhad and Mudajaya

Berhad.

22

0

20

40

60

80

100

120

140

160

2008 2009 2010 2011 2012

I

n

v

e

n

t

o

r

y

T

u

r

n

o

v

e

r

Years

Inventory Turnover

Ibraco Berhad

Hock Seng Lee Berhad

Mudajaya Berhad

3.3 Inventory Turnover

Inventory turnover can be defined as the frequency of the company inventory sold

and replaced within a point in time. The lower inventory turnover ratio shows that the

company is dealing with poor sales hence facing an excess in inventory. However, higher

inventory turnover ratio sometimes may not necessarily mean that the company is having

a good growth as a high inventory turnover ratio can either be that the company is strong

in sales or is ineffective in buying. Other than that, the high inventory level also

represents the investment in a zero rate of return because once the price fall, the company

would be in trouble. Hence, high inventory levels may not necessary be healthy for a

company.

Figure 3.3 Inventory Turnover

23

Based on the Figure 3.3, Ibraco Berhad has shown the highest inventory turnover

as compared to the other two competitors competitors. Although the number of times has

declined from 144.57 times in the year 2011 to 87.51 times in the year 2012, but Ibraco

Berhad is still able to attain the top position amongst the three companies being the

company with the highest inventory turnover. As for Mudajaya Berhad, it achieved the

lowest inventory turnover in the year 2012 which figured at 4.52 times. This is due to the

ineffectiveness of the company in purchasing assets, hence causing their inventory

turnover ratio to drop immensely as well as reflecting the companys poor growth as well

as their weakness in managing their inventories. The average and acceptance ratio for

inventory turnover is in the range 5 to 7. Thus, from this we can assume that Mudajaya

Berhads inventory turnover did not reach the acceptable range, showing a lack of

demand from customers.

24

0

20

40

60

80

100

120

2008 2009 2010 2011 2012

N

u

m

b

e

r

o

f

D

a

y

s

S

a

l

e

s

I

n

I

n

v

e

n

t

o

r

y

Years

Number of Days Sales in Inventory

Ibraco Berhad

Hock Seng Lee Berhad

Mudajaya Berhad

3.4 Number of Days in Inventory

Number of days in inventory measures the average numbers of days a company

holds its inventory before selling it to the markets or in other words, it explains on how

long it takes for a company to turn its inventory into sales. Lower or shorter number of

days in inventory are certainly better, besides the average numbers of days in inventory

varies from industry to industry.

Figure 3.4: Numbers of Days in Inventory

Ibraco Berhad has revealed to have the shortest number of days to turn its

inventory to sales. Based on the figure above, it shows that Ibraco Berhad only took 4

days to turn their inventory into sales, whereas for Mudajaya Berhad, it took about 81

days, which is apparently a very long period of time as compared to the former. Based on

the Figure 3.4, the reason behind Mudajaya Berhads letdown was in a way related to

their poor inventory turnover ratios, hence affecting the overall sales period.

25

0

5

10

15

20

25

30

35

40

45

50

2008 2009 2010 2011 2012

F

i

x

e

d

A

s

s

e

t

s

T

u

r

n

o

v

e

r

Years

Fixed Assets Turnover

Ibraco Berhad

Hock Seng Lee Berhad

Mudajaya Berhad

3.5 Fixed Assets Turnover

Fixed asset turnover is to distinguish the companys ability in creating their net

sales from the fixes asset investment. Higher the fixed assets turnover ratio is better in

the sense that it determines whether the company is efficient in managing their

investment in fixed assets in order to create revenue. However, lower fixed asset turnover

indicates that a company has over-invested in the fixed assets such as equipment, plants

or others, hence not making much profit.

Figure 3.5: Fixed Assets Turnover

26

Based on the Figure 3.5 , it is revealed that Ibraco Berhad has the highest fixed

asset turnover as compared with the other two competitors in the year 2012, figuring 4.30

times. This was a good indication because the higher the fixed asset turnover for a

company, the more efficient the company is in managing their investment in fixed assets

to create revenue.

As for Hock Seng Lee Berhad, the figure above has indicated that the company

has the least fixed asset turnover in the year 2012 which is 9.53 times, which are mainly

due to the ineffectiveness or inefficiency in managing the investment in fixed assets.

Based on the figure above, it is clearly seen that Mudajaya Berhad has generated

12.25 times in the companys fixed asset turnover in the year 2012, though had decreased

10.49 times as compared to the year 2011. The sloping of the Mudajaya Berhard fixed

assets turnover ratio was mainly due to the escalating number of days in their inventory.

In conclusion, looking at the three companies, Ibraco Berhad is ahead of the other two

competitors and has generated a total revenue RM122,339,695 in the year 2012, a

significant increase of RM8,751,902 as compared to the previous year.

27

Chapter 4

4.0 Leverage Ratio

Leverage Ratio to calculate the financial leverage of a company to get an idea of

the company's methods of financing or to measure its ability to meet financial obligations.

Table 4 below represent the comparison between Ibraco Bhd, Hock Seng Lee Bhd (HSL)

and Mudajaya Berhad for five years. A breakdown comparison will be discussed in detail

at next section. For calculation, please refer to Appendix Table A-4.

Leveraging Ratio: 2012 2011 2010 2009 2008

Debt to Equity

Ibraco Berhad

HSL

Mudajaya Berhad

0.70

0.58

0.49

0.60

0.67

0.43

0.31

0.69

0.47

0.12

0.64

0.69

0.17

0.66

0.34

Timed Interest Earned

Ibraco Berhad

HSL

Mudajaya Berhad

0.20

0.26

0.21

0.19

0.26

0.29

0.57

0.26

0.48

4.39

0.26

0.31

1.45

0.24

0.19

Table 4.1: Leveraging Ratio

28

0.00

0.10

0.20

0.30

0.40

0.50

0.60

0.70

0.80

0.90

1.00

2008 2009 2010 2011 2012

D

e

b

t

T

o

E

q

u

i

t

y

Years

Debt to Equity

HSL

Mudajaya

Ibraco

4.1 Debt to equity Ratio

Figure 4.1: Debt to Equity Ratio

Debt to equity ratio is a financial tool used to measure and evaluate a companys

capital structure or stock by measuring the firms assets funded by the mixture of debt

and equity. It is also known as risk or leverage ratio which gives the financial analysts

and prospective investors in determining the financial leverage of a company is using. A

companys debt to equity ratio is recommended to be lower than two which signify that

the company fund its projects evenly with the debt and equity. A lower ratio of as low as

below 0.30 is considered good illustrating that the company has a low amount of debt

which consequently exposed to lesser risk in terms of interest rate increases or credit

rating. Looking into HSL financial performance, its debt to equity ratios are quite stable

where it ranged from 0.50 to 0.7 over the five years. Mudajayas debt to equity ratio

increased rapidly from 2008 to 2009 and remained stable after 2010 between the ratios of

0.40 to 0.50. Ibraco debt to equity ratio was increasing sharply after 2009. Though the

ratio is increasing, it is still considered acceptable because its below the ratio of 2. Thus,

the debt to equity ratio for these three companies is considered good as their ratios are

below one.

29

4.2 Time Interest Earned

Figure 4.2: Times Interest Earned

Times interest earned is a financial tool to measure how many times a company

can cover its interest charges on a pre tax basis. It is important to ensure the interests

were paid to the debtors to avoid bankruptcy of a company. In this situation, high ratio

illustrate that a company has an unpleasant lack of debt which has too much debt being

paid with the earnings that can be used for future or other projects. Both HSL and Ibraco

are performing quite well as they have a stable times interest earned ratio for the

consecutive 5 years. Ibraco has a ratio of 1.45 for 2008 and hasrapidly increased from

1.45 to 4.39 which are very hazardous as the higher the ratio for times interest earned, the

higher the possibility the company might get bankrupted. The ratio was then declined

greatly from 2009 to 2010 at the ratio of 0.57 and remained stable for the following years

which are safe from bankruptcy. Thus, a company can yield greater returns by investing

its earnings into other projects without paying all debts with its earnings to meet its debt

obligations.

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

5.00

2008 2009 2010 2011 2012

T

I

m

e

s

-

I

n

t

e

r

e

s

t

e

d

-

E

a

r

n

e

d

Years

Times - Interest - Earned

HSL

Mudajaya

Ibraco

30

Chapter 5

5.0 Cash Flow Ratios

Cash flow ratios is a revenue or expense stream that changes a cash account over

a given period. Table 5 below represent the comparison between Ibraco Bhd, Hock Seng

Lee Bhd (HSL) and Mudajaya Berhad for five years. A breakdown comparison will be

discussed in detail at next section. For calculation, please refer to Appendix Table A-5.

Cash Flow Ratio: 2012 2011 2010 2009 2008

Cash Flow to Net

Income

Ibraco Berhad

HSL

Mudajaya Berhad

0.13

0.90

2.07

0.75

1.56

0.39

0.26

0.74

0.90

0.42

0.93

1.65

20.9

1.19

0.30

Cash Flow Adequacy

Ibraco Berhad

HSL

Mudajaya Berhad

0.13

1.75

1.844

0.15

7.32

0.65

0.75

2.52

0.94

1.55

2.01

1.36

133.02

2.81

0.78

Table 5: Cash Flow Ratio

31

5.1 Cash Flow to Net Income

Figure 5.1: Cash Flow to Net Income

Cash flow to net income shows the maximum amount of cash generates by net

income in a business. HSL and Mudajaya have a steady ratio for the five consecutive

years. Ibraco has a very high cash flow to net income ratio in the year 2008 which means

the company generates quite a large amount of money from its net income. However, the

ratio dropped drastically from 2008 (20.92) to 2009 (0.42) and remained stable for the

following years. Hence, a decline in the cash flow to net income ratio signify a cash flow

problem occurs in a company.

0

5

10

15

20

25

2008 2009 2010 2011 2012

C

A

s

h

F

l

o

w

t

o

N

e

t

I

n

c

o

m

e

Years

Cash Flow to Net Income

HSL

Mudajaya

Ibraco

32

5.2 Cash Flow Adequacy

Figure 5.2 Cash Flow Adequacy

Cash flow adequacy measures how well the company can cover the annual

payments of all the long term annual debt with the cash flow from operating activities.

The performance ratio normally has a value of at least 1.0, which means the company is

able to cover its long term annual debt with their cash flow from operations. In Ibracos

case, it has an undesirable ratio up to 133.02 in the year of 2008. Nevertheless, the ratio

was declined back to normal from 2009 onwards and stay less that 1.0 after 2009.

Mudajaya is the overall most stable ratio ranging from 0.65 to 1.84 for the five

consecutive years. However, most of the ratios are less than 1.0 which are unsafe

because the companys operations produce insufficient cash to meet necessary business

obligations. HSL are performing well among these three companies as its cash flow

adequacy ratio is more than 1.0. Hence, it is important to identify the cash flow adequacy

ratio of a company to measure and identify the liquidity problems in order to take quick

actions towards the problems occurred.

0

20

40

60

80

100

120

140

2008 2009 2010 2011 2012

C

a

s

h

F

l

o

w

A

d

e

q

u

a

c

y

Years

Cash Flow Adequacy

Ibraco

Mudajaya

HSL

33

Chapter 6

6.0 Conclusion

Based on what we had analyzed, all three companies that were involved in

property development had performedparticularly well, though may not altogether be in

the same areas. They might have underperformed in certain areas, however on average,

their performance was quite fair and were still operating well in Kuching.

With more major industry player like COMTEC Solar, which will build one of the

largest solar manufacturing plant in Kuching, we can expect increase of property rate in

Kuching. The factory, to be built by SinoHydro and scheduled for completion by the end

of this year, will create 1,300 new jobs. More job vaciencis available which lead to higher

turnover property rate in Kuching. A mushrooming of mega malls (i.e. Summer Mall,

Viva City Megamall & City One) open up more business opportunity to attract

international & local investor to coming in to Kuching. This solely benefit to this three

developers (Ibraco, HSL & Muddajaya) as they can expect the higher sales in coming

years.

34

Appendix

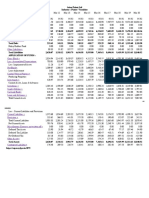

Company Ratio 2008 2009 2010 2011 2012

HSL

Net Profit

Margin

(%)

(35,613,847/277,0

81,670) 100 =

12.85

(51,237,352/345,64

1,708) 100 =

14.82

(66,085,586/457,

712,884) 100 =

14.43

(80,952,950/559,

499,746) 100 =

14.47

(90,694,457/603,2

67,262) 100 =

15.03

Gross

Profit

Margin

(%)

(58,400,854/277,0

81,670) 100 =

21.07

(79,715,757/345,64

1,708) 100 =

23.06

(98,411,086/457,

712,884) 100 =

21.50

(117,375,452/55

9,499,746) 100

= 20.98

(120,672,910/576,

056,738) 100 =

20.94

Return

On

Capital

Employed

(%)

56,457,859 /

(401,608,379-

152,435,969) +

6,530,900 =

22.08

75,568,555 /

(477,755,569-

175,227,524) +

10,367,500 =

24.15

98,419,118 /

(582,020,093-

222,710,089) +

14,067,000 =

26.36

116,598,066 /

(683,141,823+25

7,755,288) +

15,930,100 =

26.42

121,149,592 /

(757,007,214-

261,561,112) +

15,516,800 =

23,71

Mudajaya

Net Profit

Margin

(%)

(57,247,000/422,3

82,000) 100 =

13.55

(137,541,000/719,9

71,000) 100 =

19.1

(236,998,000/870

,428,000) 100 =

27.23

(293,948,000/1,3

47,059,000)

100 = 21.82

(273,553,000/1,65

5,722,000) 100 =

16.52

Gross

Profit

Margin

(%)

(83,695,000/422,3

82,000) 100 =

19.82

(179,419,000/

719,971,000) 100

=

24.92

(286,896,000/870

,428,000) 100 =

32.96

(335,329,000/1,3

47,059,000)

100 =

24.90

(303,230,000/1,65

5,722,000) 100 =

18.31

Return

On

Capital

Employed

(%)

65,432,000 /

(408,125,000-

103,737,000) +

256,000 =

21.48

167,957,000 /

(677,425,000-

254,329,000) +

256,000 =

39.67

278,386,000 /

(1,119,707,000-

359,463,000) +

256,000 =

36.6

293,948,000 /

(1,436,655,000-

428,674,000) +

256,000 =

29.15

284,116,000 /

(1,644,510,000-

540,056,000) +

621,000 =

25.7

Ibraco

Net Profit

Margin

(%)

(2,923,613/1,704,43

6) 100 =

171.53

(20,054,961/30,6

08,149) 100 =

65.52

(12,059,374/109,

730,266) 100 =

10.99

(13,135,360/122,3

39,695) 100 =

10.73

Gross

Profit

Margin

(%)

(703,875/1704,436)

100 =

41.29

(13,166,764/30,6

08,149) 100 =

43.01

(21,509,370/109,

730,266) 100 =

19.60

(27,176,676/122,3

39,695) 100 =

22.21

Return

On

Capital

Employed

(%)

(2,727,753) /

(169,375,999-

25,075,452) +

9,043,807 =

(1.78) Loss

(3,348,553) /

(152,953,830-

16,161,550) +

90,511 =

(2.44) Loss

8,690,708 /

(209,466,615-

49,443,630) +

142,926 =

5.43

16,869,919 /

(324,165,311-

99,447,898) +

29,523,682 =

6.64

18,949,302 /

(324,165,311-

133,510,350) +

63,389,123 =

7.46

Table A-1: Profitablity Calculation Table

35

Company Ratio 2008 2009 2010 2011 2012

HSL

Current

Ratio

280,120,314

/

152,435,969

= 1.84

339,903,264 /

175,227,524 =

1.94

398,500,741 /

222,710,089 =

1.79

476,480,495 /

257,755,388 =

1.85

483,798,336 /

261,561,112 =

1.85

Quick

Ratio

(280,120,314

-6,035,698) /

152,435,969

= 1.72

(339,903,264-

10,981,994) /

175,227,524 =

1.88

(398,500,741-

13,076,727) /

222,710,089 =

1.73

(476,480,495-

23,245,894)

/257,755,388

= 1.66

(483,798,336-

17,033,549) /

261,561,112 =

1.68

Gearing

Ratio

158435969 /

401608379

100 =

39.5

185595024 /

477755569

100 =

38.8

236777089 /

582020093

100 =

40.1

273685488 /

683141823

100 =

40.1

277077912 /

757007214

100 =

36.6

Mudajaya

Current

Ratio

305,271 /

103,737 =

2.94

434,056 /

287,866 =

1.51

713,560 /

359,463 =

1.99

713,560 /

359,463 =

2.17

921,698 /

540,056 =

1.71

Quick

Ratio

(305,271-

15,251) /

103,737 =

2.80

(434,250-

14,587) /

254585 =

0.46

(713,560-

12,286) /

359,463 =

1.95

(930,780-

12,812) /

428,674 =

2.14

(921,698-

6,221) /

540,056 =

1.69

Gearing

Ratio

103993 /

408125

100 =

25.5

288122 /

710962

100 =

40.5

358719 /

1119707

100 =

32.0

428930 /

1436655

100 =

29.9

540677 /

1644510

100=

32.9

Ibraco

Current

Ratio

89,427,477 /

16,031,645 =

5.58

71,370,587 /

16,071,039 =

4.44

163,837,067 /

49,300,704 =

3.32

173,198,430 /

74,444,650 =

2.33

211,870,668 /

70,121,227 =

3.02

Quick

Ratio

(89,427,477-

1,863,498) /

16,031,645 =

5.46

(71,370,587-

446,648) /

16,071,039 =

4.43

(163,837,067-

163,133) /

49,300,704 =

3.32

(168,677,996-

10,517,792) /

69,924,216 =

2.32

(211,870,668-

1,067,225) /

70,121,227 =

3.01

Gearing

Ratio

25075452 /

89427477

100 =

28.0

16161550 /

152953830

100 =

10.6

49443630 /

209466615

100 =

23.6

99447898 /

277071448

100 =

35.9

133510350 /

324165311

100 =

41.2

Table A-2: Liquidity Calculations Table

36

Company Ratio 2008 2009 2010 2011 2012

HSL

R

e

c

e

i

v

a

b

l

e

s

Account

Receivable

Turnover

(Times)

309,068,736 /

168423246.5

= 1.84

375,021,001 /

211621822

= 1.77

488,275,905 /

235600566.5

= 2.07

581,515,074 /

233052600.5

= 2.50

603,267,262 /

221680070.5

= 2.72

Average

Collection

Period

(Days)

365 / 1.84 =

198 Days

365 / 1.77 =

206 Days

365 / 2.07 =

176 Days

365 / 2.5 =

146 Days

365 / 2.72 =

134 Days

I

n

v

e

n

t

o

r

y

Inventory

Turnover

(Times)

338,687.000 /

15,814,500

= 21.42

540,552,000 /

14,919,000

= 36.23

581,532,000 /

13,436,500

= 43.28

1,011,730,000

/ 302,448.500

= 3.35

1,352,492,000

/ 299,416,000

= 4.52

Number of

Days In

Inventory

(Days)

365 / 8.36 =

44

365 / 9.12 =

40

365 / 48.48 =

8

365 / 144.57=

3

365 / 87.51 =

4

F

i

x

e

d

A

s

s

e

t

s

Fixed Asset

Turnover

(RM)

09,067,736 /

41,603,000

= RM7.43

375,021,001 /

59200462

= RM6.34

488,275.905 /

83143237.5

= RM5.87

581,515,074 /

104411214.5

= RM5.57

603,267,262 /

63276682.5

= RM9.53

Mudajaya

R

e

c

e

i

v

a

b

l

e

s

Account

Receivable

Turnover

(Times)

422,382,000 /

142,512,500

= 2.96

719,971,000 /

188,933,500

= 3.81

870,428,000 /

303,077,500

= 2.87

1,347,059,000

/ 481,073,500

= 2.80

1,655,722,00

/ 415,996,500

= 3.98

Average

Collection

Period

(Days)

365 / 2.96 =

123

365 / 3.81 =

96

365 / 2.87 =

127

365 / 2.80 =

130

365 / 3.98 =

92

I

n

v

e

n

t

o

r

y

Inventory

Turnover

(Times)

309,068,736 /

4509903 =

68.53

287,575,749 /

8508846 =

33.80

379,448,915 /

12029360.5 =

31.54

455,388,307 /

18161310.5 =

25.07

473,488,099 /

20139721.5 =

23.51

Number of

Days In

Inventory

(Days)

F

i

x

e

d

A

s

s

e

t

s

Fixed Asset

Turnover

(RM)

422,382,000 /

12,236,000 =

RM34.52

719,971,000 /

24143000 =

RM29.82

870,428,000 /

39895000 =

RM21.82

1,347,059,000

/ 59249000 =

RM22.74

717,971,000 /

58757500 =

RM12.25

37

Table A-3: Efficiency Calculation Table

Company

Ratio 2008 2009 2010 2011 2012

Ibraco

R

e

c

e

i

v

a

b

l

e

s

Account

Receivable

Turnover

(Times)

66,464,728 /

15958287 =

4.16

3,505,814 /

5512104 =

0.64

28,243,968 /

11034791.5 =

2.56

22,511,720 /

12,630,239 =

1.65

122,339,695 /

19202853.5 =

6.37

Average

Collection

Period

(Days)

365 / 4.16 =

88

365 / 0.64 =

570

365 / 2.56 =

143

365 / 1.65 =

221

365 / 6.37 =

57

I

n

v

e

n

t

o

r

y

Inventory

Turnover

(Times)

(56,511,806)

/

6758915.5=

8.36 (Loss)

(1,414,240) /

1155073 =

9.12 (Loss)

14,782,288 /

304890.5 =

48.48

89,430,551 /

618599 =

144.57

93,698,210 /

1070645 =

87.51

Number of

Days In

Inventory

(Days)

365 / 9.12 =

40

365 / 48.48 =

8

365 / 144.57 =

3

365 / 87.51 =

4

F

i

x

e

d

A

s

s

e

t

s

Fixed Asset

Turnover

(RM)

66,464,728 /

2583781 =

RM27.70

3,505,815 /

2065236 =

RM1.70

28,243.968 /

1792266.5 =

RM15.76

22,511,720 /

2225385.5 =

RM10.12

122,339,695 /

2825096.5 =

RM43.30

38

Company Ratio 2008 2009 2010 2011 2012

HSL

Debt - to

Equity

158,966,869 /

242,641,510 =

0.6552

185,595,024 /

292,160,545 =

0.6353

236,777,089 /

345,243,004 =

0.6858

273,685,488 /

409,456,335 =

0.6684

277,077,912 /

479,929,302 =

0.5773

Times -

Interest-

Earned

56,457,859

/241,199,955 =

0.2341

75,568,555 /

287,575,749 =

0.2628

98,419,118 /

379,834,701 =

0.2591

116,598,066

/455,855,991 =

0.2558

121,149,592

/474,071,061 =

0.2556

Mudajaya

Debt - to

Equity

103,993 /

304,132 =

0.3419

288,122 /

422,840 =

0.6814

358,719 /

760,988 =

0.4714

428,930 /

1,007,725 =

0.4256

540,677 /

1,103,833 =

0.4898

Times -

Interest-

Earned

65,432 /

338,687 =

0.1932

167,957 /

540,552 =

0.3107

278,386 /

583,532 =

0.4771

293,948 /

1,011,730 =

0.2905

284,116 /

1,352,492 =

0.2101

Ibraco

Debt - to

Equity

25,075,452 /

144,300,547 =

0.1738

16,161,550 /

136,792,280 =

0.1181

49,443,630 /

160,022,985 =

0.3090

99,447,898 /

177,623,550 =

0.5599

133,510,350 /

90,54,961 =

0.7002

Times -

Interest-

Earned

2,727,753 /

1,878,543 =

1.4521

3,348,553 /

763,578 =

4.3853

8,690,708 /

15,142,870 =

0.5739

16,869,919 /

90,066,348 =

0.1873

18,949,302 /

96,272,753 =

0.1968

Table A-4: Leveraging Ratio Calculation Table

39

Company Ratio 2008 2009 2010 2011 2012

HSL

Cash Flow - to

- Net Income

49,851,837 /

41,839,128 =

1.1915

52,537,638 /

56,322,991 =

0.9328

54,060,191 /

73,438,760 =

0.7361

136,120,401 /

87,268,580 =

1.5598

91,616,954 /

90,694,457 =

0.8999

Cash Flow

Adequacy

49,851,837 /

17,719,180 =

2.8134

52,538,638 /

26,117,028 =

2.0117

54,060,191 /

21,464,851 =

2.5185

136,120,401 /

18,596,976 =

7.3195

81,616,954 /

46,546,806 =

1.7534

Mudajaya

Cash Flow - to

- Net Income

17,093 /

57,247 =

0.2986

220,614 /

134,016 =

1.6462

195,738 /

217,239 =

0.9010

114,720 /

292,581 =

0.3921

512,793 /

248,076 =

2.0671

Cash Flow

Adequacy

17,093 /

(21,906) =

0.7803

220,614 /

(161,867) =

1.3629

195,738 /

(209,097) =

0.9361

114,720 /

177,746 =

0.6454

512,793 /

278,238 =

1.8430

Ibraco

Cash Flow - to

- Net Income

72,519,705 /

(3,467,278) =

20.9155

(3,127,014) /

(7,508,267) =

0.4165

1,981,110 /

7,749,671 =

0.2556

9,413,571 /

12,571,877 =

0.7488

(1,804,991) /

14,106,812 =

0.1280

Cash Flow

Adequacy

72,519,705 /

(545,183) =

133.02

(3,127,014) /

(2,024,969) =

1.5442

1,981,110 /

2,642,864 =

0.7496

9,413,571 /

(62,303,156) =

0.1511

(1,804,991) /

(13,427,588) =

0.1344

Table A-5: Cash Flow Ratio Calculation Table

Você também pode gostar

- Mind Map & SummaryDocumento13 páginasMind Map & SummaryAina Nur AleesaAinda não há avaliações

- Sqqs1013 Elementary Statistics (Group A) SECOND SEMESTER SESSION 2019/2020 (A192)Documento13 páginasSqqs1013 Elementary Statistics (Group A) SECOND SEMESTER SESSION 2019/2020 (A192)Liew Chi ChiengAinda não há avaliações

- Case Study Chapter 6 Obm345Documento1 páginaCase Study Chapter 6 Obm345Nur Amira NadiaAinda não há avaliações

- Waqf Contribution To EconomyDocumento20 páginasWaqf Contribution To EconomyazromiAinda não há avaliações

- Sugar Bun Destination CentersDocumento16 páginasSugar Bun Destination CentersHuong ZamAinda não há avaliações

- I) Ii) Iii) 5 September 2014: ACC 106/115/117/114/418 (GENERIC CODES) AssignmentDocumento4 páginasI) Ii) Iii) 5 September 2014: ACC 106/115/117/114/418 (GENERIC CODES) AssignmentBryan Villarreal20% (5)

- Ab5.49 - Report Group A - HLB2013Documento12 páginasAb5.49 - Report Group A - HLB2013alya farhana100% (1)

- Bbaw2103 Financial AccountingDocumento15 páginasBbaw2103 Financial AccountingSimon RajAinda não há avaliações

- CH6 - Case 1 KPMG Partner Shares Confidential Information With A Friend (Chapter 6, Pages 454-455)Documento2 páginasCH6 - Case 1 KPMG Partner Shares Confidential Information With A Friend (Chapter 6, Pages 454-455)zoehyhAinda não há avaliações

- ManagementDocumento13 páginasManagementsha123gurlAinda não há avaliações

- Datuk Yap Pak Leong v. Ketua Pengarah Hasil Dalam Negeri - BKI-14-1/2-2013Documento7 páginasDatuk Yap Pak Leong v. Ketua Pengarah Hasil Dalam Negeri - BKI-14-1/2-2013Vasanth TamilselvanAinda não há avaliações

- HTH 558 - Test December 2020Documento1 páginaHTH 558 - Test December 2020Ariana ArissaAinda não há avaliações

- HRM549 Set 1 Answer Dayang Nailul - Dayang Nailul Munna Abg Abdullah EditDocumento6 páginasHRM549 Set 1 Answer Dayang Nailul - Dayang Nailul Munna Abg Abdullah EditaniskhadijahsayutiAinda não há avaliações

- Final Project Report Group 13 DraftDocumento48 páginasFinal Project Report Group 13 DraftIz4ra Sofe4Ainda não há avaliações

- Create Logos Brand BusinessesDocumento3 páginasCreate Logos Brand BusinessesMuadz KamaruddinAinda não há avaliações

- Nayland Bhd investment property reportingDocumento2 páginasNayland Bhd investment property reportingChee Mei JeeAinda não há avaliações

- MC9 - Hire Purchase A202 - StudentDocumento3 páginasMC9 - Hire Purchase A202 - Studentlim qs0% (1)

- Oumh 2203 AssignmentDocumento8 páginasOumh 2203 AssignmentSaroja NathanAinda não há avaliações

- MCQ SelfDocumento11 páginasMCQ SelfFaidz FuadAinda não há avaliações

- Accounting for Manufacturing BusinessDocumento10 páginasAccounting for Manufacturing Businessamirul aizzatAinda não há avaliações

- Khind IntroductionDocumento2 páginasKhind IntroductionainaAinda não há avaliações

- PRO600 Assignment ListDocumento3 páginasPRO600 Assignment ListAisyah HusnaAinda não há avaliações

- Group Assignment 1Documento3 páginasGroup Assignment 1syarifahsuraya02Ainda não há avaliações

- Profil Yayasan Amal MalaysiaDocumento62 páginasProfil Yayasan Amal MalaysiaAhmad AfifiAinda não há avaliações

- Y BHG Dato Ameer AliDocumento4 páginasY BHG Dato Ameer AlinadiaidayuAinda não há avaliações

- Assignment/ Tugasan - BBMP1103 Mathematics For Management Matematik Untuk Pengurusan September Semester 2021Documento7 páginasAssignment/ Tugasan - BBMP1103 Mathematics For Management Matematik Untuk Pengurusan September Semester 2021ASHWIN 2629Ainda não há avaliações

- INDIVIDUAL ASSIGNMENT 1 (VIDEO REVIEW) NUR DANIA ZULAIKHA BINTI ZULKIFLI (2021833926) OriginalDocumento7 páginasINDIVIDUAL ASSIGNMENT 1 (VIDEO REVIEW) NUR DANIA ZULAIKHA BINTI ZULKIFLI (2021833926) OriginaldaniaAinda não há avaliações

- Group Project Far670 7e VS MynewsDocumento33 páginasGroup Project Far670 7e VS MynewsNurul Nadia MuhamadAinda não há avaliações

- IEB20703 Project System EasyGuard | Malaysian Institute of Information TechnologyDocumento19 páginasIEB20703 Project System EasyGuard | Malaysian Institute of Information TechnologycertifiedCrazyOZ HemaAinda não há avaliações

- Report 1Documento28 páginasReport 1ain_kaklong67% (3)

- Making sentences with Chinese wordsDocumento4 páginasMaking sentences with Chinese wordsHaziq Aris SaruAinda não há avaliações

- Understanding Statistics with Real-World ExamplesDocumento9 páginasUnderstanding Statistics with Real-World ExamplesNurul Farhan IbrahimAinda não há avaliações

- XBHM3103 Occupational Health Management September 2020: Jawab Dalam Bahasa Inggeris Atau Bahasa MalaysiaDocumento8 páginasXBHM3103 Occupational Health Management September 2020: Jawab Dalam Bahasa Inggeris Atau Bahasa MalaysiaBuffalo Soldier rimauAinda não há avaliações

- ResumeDocumento7 páginasResumeAniezmahabbah AzlanAinda não há avaliações

- Tutorial 1Documento4 páginasTutorial 1uyieeAinda não há avaliações

- Islamic Entrepreneurship Focus On Eight Principles of ThoughtsDocumento3 páginasIslamic Entrepreneurship Focus On Eight Principles of ThoughtsYufiza Mohd Yusof100% (1)

- Ent300 Individual AssignmentDocumento13 páginasEnt300 Individual Assignmentliaaddeanna100% (1)

- Report MBMMBIDocumento8 páginasReport MBMMBIAhmad KhuwarizmyAinda não há avaliações

- Mind Maps MGT 162 (Chapter 1-5)Documento4 páginasMind Maps MGT 162 (Chapter 1-5)Mohamad Norul Haziq Muzaffar Alfian100% (1)

- Ucapan Perasmian Sambutan Hari WPDocumento2 páginasUcapan Perasmian Sambutan Hari WPMohamad TaufiqAinda não há avaliações

- Trotter's Teacher Development StagesDocumento17 páginasTrotter's Teacher Development StagesNadwa Nasir100% (1)

- Controlling Material Structure for Desired PropertiesDocumento3 páginasControlling Material Structure for Desired PropertiesNorazilah YunusAinda não há avaliações

- Cara Menjawab Soalan Interview.Documento2 páginasCara Menjawab Soalan Interview.Ayen FadilahAinda não há avaliações

- Individual Assignment MGT420Documento9 páginasIndividual Assignment MGT420Nur MurfiqahAinda não há avaliações

- RHB Company ProfileDocumento5 páginasRHB Company ProfileKhaleel Khusairi100% (1)

- Abcc1103 - Introduction To CommunicationDocumento16 páginasAbcc1103 - Introduction To CommunicationSimon RajAinda não há avaliações

- NZ Crunchies: Business PlanDocumento16 páginasNZ Crunchies: Business Planikmal hakimAinda não há avaliações

- Industrial Training Final Report GuidelinesDocumento4 páginasIndustrial Training Final Report GuidelinesMaizatul AqmalAinda não há avaliações

- Sta104 Tutorial 1Documento3 páginasSta104 Tutorial 1Ahmad Aiman Hakimi bin Mohd Saifoul ZamzuriAinda não há avaliações

- Bank Management AssignmentDocumento20 páginasBank Management AssignmentAshAinda não há avaliações

- Individual Assignment: Visualization 1Documento5 páginasIndividual Assignment: Visualization 1Muhd FakhrullahAinda não há avaliações

- Johnson Appliance Company Performance AppraisalDocumento1 páginaJohnson Appliance Company Performance AppraisalNur Amira NadiaAinda não há avaliações

- Keropok Lekor - IntroductionDocumento5 páginasKeropok Lekor - IntroductionEllvina StephenAinda não há avaliações

- Faculty of Science and Technology: Financial Management I BBPW 3103Documento39 páginasFaculty of Science and Technology: Financial Management I BBPW 3103Lee See Chee StudentAinda não há avaliações

- Obm345 Individual Assignment (Nurul Syahirah)Documento3 páginasObm345 Individual Assignment (Nurul Syahirah)ZulhelmiAinda não há avaliações

- Maf651 Cpa ReportDocumento15 páginasMaf651 Cpa ReportQema Jue100% (1)

- Case Study on Marketing Forces Faced by Kamdar GroupDocumento9 páginasCase Study on Marketing Forces Faced by Kamdar GroupNatasya SyafinaAinda não há avaliações

- ISB656Documento3 páginasISB656adelia21Ainda não há avaliações

- Berjaya Corporation BerhadDocumento4 páginasBerjaya Corporation BerhadNurul NasuhaAinda não há avaliações

- Financial Management Group1Documento21 páginasFinancial Management Group1Ainul MardhiahAinda não há avaliações

- NICEHoldingsInvestorsRelations 2020 3Q ENGDocumento31 páginasNICEHoldingsInvestorsRelations 2020 3Q ENGSimonasAinda não há avaliações

- Capital GainsDocumento25 páginasCapital GainsanonymousAinda não há avaliações

- Hoas Apartment Offer - Junailijankuja 5 B 076 Room 6 PDFDocumento3 páginasHoas Apartment Offer - Junailijankuja 5 B 076 Room 6 PDFLaura Mayorga SánchezAinda não há avaliações

- Forex Literature ReviewDocumento6 páginasForex Literature Reviewafmzhpeloejtzj100% (1)

- How to Prepare a Cash Flow ForecastDocumento3 páginasHow to Prepare a Cash Flow Forecastkanika_0711Ainda não há avaliações

- New Homes For Sale in Austin, TX by KB HomeDocumento1 páginaNew Homes For Sale in Austin, TX by KB HomeNini KikabidzeAinda não há avaliações

- Comparative Study of Non Interest Income of The Indian Banking SectorDocumento30 páginasComparative Study of Non Interest Income of The Indian Banking SectorGaurav Sharma100% (3)

- Board Question Paper EconomicsDocumento18 páginasBoard Question Paper Economics9137373282abcdAinda não há avaliações

- The Exxon-Mobil Merger: An Archetype: Forthcoming Journal of Applied Finance, Financial Management AssociationDocumento49 páginasThe Exxon-Mobil Merger: An Archetype: Forthcoming Journal of Applied Finance, Financial Management AssociationIndra Bagus KurniawanAinda não há avaliações

- FinTech Frontiers Cloud Computing and Artificial Intelligence Applications For Intelligent Finance Investment and Blockchain in The Financial SectorDocumento13 páginasFinTech Frontiers Cloud Computing and Artificial Intelligence Applications For Intelligent Finance Investment and Blockchain in The Financial SectorauthoralmightyAinda não há avaliações

- Trading With Time Time SampleDocumento12 páginasTrading With Time Time SampleRasmi Ranjan100% (1)

- Comptroller Steals $53 Million From City Funds: EthicsDocumento4 páginasComptroller Steals $53 Million From City Funds: EthicsChess NutsAinda não há avaliações

- Cryptocurrency: An Analysis of Growth of Bitcoin and Its FutureDocumento4 páginasCryptocurrency: An Analysis of Growth of Bitcoin and Its FutureAnonymous izrFWiQ100% (1)

- "How Well Am I Doing?" Financial Statement AnalysisDocumento61 páginas"How Well Am I Doing?" Financial Statement AnalysisSederiku KabaruzaAinda não há avaliações

- CARSONDocumento2 páginasCARSONShubhangi AgrawalAinda não há avaliações

- Final Report Allied BankDocumento70 páginasFinal Report Allied BankIfzal Ahmad100% (6)

- PNBHFL Auction Bid FormDocumento11 páginasPNBHFL Auction Bid Formankit chauhanAinda não há avaliações

- Test 2 Financial Accounting PDFDocumento3 páginasTest 2 Financial Accounting PDFAdrian Tajmani33% (3)

- Bharti Airtel LTD (BHARTI IN) - AdjustedDocumento4 páginasBharti Airtel LTD (BHARTI IN) - AdjustedDebarnob SarkarAinda não há avaliações

- Revision Test FinalDocumento4 páginasRevision Test FinalRitaAinda não há avaliações

- Prepare for S4 HANA Finance InterviewDocumento5 páginasPrepare for S4 HANA Finance InterviewMOORTHY100% (1)

- Share Capital + Reserves Total +Documento2 páginasShare Capital + Reserves Total +Pitresh KaushikAinda não há avaliações

- DR - Ritu Sapra - Distributions To ShareholdersDocumento34 páginasDR - Ritu Sapra - Distributions To ShareholdersAdil AliAinda não há avaliações

- Problem SolvingDocumento9 páginasProblem Solvingmax p0% (2)

- Test Bank For Financial and Managerial Accounting For Mbas 4th Edition EastonDocumento36 páginasTest Bank For Financial and Managerial Accounting For Mbas 4th Edition Eastonuprightteel.rpe20h100% (45)

- Credit Transactions Case DigestDocumento6 páginasCredit Transactions Case DigestMousy GamalloAinda não há avaliações

- Clark Vs Sellner DigestDocumento1 páginaClark Vs Sellner Digestjim jim100% (1)

- Islamic Economics PDFDocumento214 páginasIslamic Economics PDFDzaky Ahmad NaufalAinda não há avaliações

- Valuing Rent-Controlled Residential PropertiesDocumento14 páginasValuing Rent-Controlled Residential PropertiesiugjkacAinda não há avaliações

- Creative Teaching PlatformDocumento36 páginasCreative Teaching Platformardee esjeAinda não há avaliações