Escolar Documentos

Profissional Documentos

Cultura Documentos

Accounting For Business 1234103659261919 3

Enviado por

WinnieOngTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Accounting For Business 1234103659261919 3

Enviado por

WinnieOngDireitos autorais:

Formatos disponíveis

10/22/2014www.

aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

1 www.afterschoool.tk AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

ACCOUNTING FOR BUSINESS

AFTERSCHOOL

DEVELOPING CHANGE MAKERS

CENTRE FOR SOCIAL ENTREPRENEURSHIP

PGPSE PROGRAMME

World Most Comprehensive programme in social

entrepreneurship & spiritual entrepreneurship

OPEN FOR ALL FREE FOR ALL

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

2 www.afterschoool.tk AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

ACCOUNTING FOR BUSINESS

Dr. T.K. Jain.

AFTERSCHOOL

Centre for social entrepreneurship

Bikaner M: 9414430763

tkjainbkn@yahoo.co.in

www.afterschool.tk, www.afterschoool.tk

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

3

Prepare necessary accounts..

A and B were partners in a firm sharing 3rofit in the ratio

of 5:3. C was admitted for1/5

th

share in the firm.

1 C is unable to bring his share of goodwill in cash Firms

goodwill was valued at Rs 130000

2 Land and Building was valued at Rs 38000 and Plant

and Machine was valued at Rs 30000

3. Provision for bad debts is to be maintained at the rate

of 4%. 4. A liability for Rs 1100 included in sundry

creditors was not likely to arise. 5. Rs. 10000 of

investments were taken over by old partners in their old

profit sharing ratio. 6. C will contribute his share of

capital on the basis of adjusted capitals of old partners

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

4

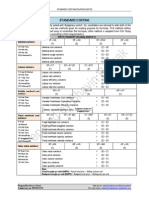

Balance sheet

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

5

Journal entries

A Dr. 3125

B dr. 1875

To Goodwill 5000

(write off goodwill)

Land & building Dr.

To revaluation 13000

(land and building

revalued)

Revaluation Ac. Dr.

To Plant & mach 5000

prov. For bad debt to

Revaluation Ac. Dr. 500

Creditors Ac dr.

To Revaluation 1100

Revaluation Dr. 9600

To A : 6000

To B: 3600

A a/c Dr. 6250

B Ac. Dr. 3750

To investment 10000

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

6

Journal entries..

Now prepare partnership

capital account of A and B:

transfer reserves to A and B.

A gets 10000 and B 6000

Now transfer goodwill of

130000 to A and B.

A gets : 81250

B gets : 48750

A : 55000+6000-6250+10000-

3125+81250 = 142875

B : 30000+3600-1875-

3750+6000+48750 = 82725

New total capital: 225600

The new capital represent 4/5

of the total capital as C is to

join with 1/5 of the capital.

Thus the capital of C will be :

56400. He will bring this capital

by cash.

Bank Ac. Dr.

To C capital ac 56400.

answer.

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

7

New balance sheet

Liabilities

A : 142875

B: 82725

C: 56400

Creditors : 12900

Outs. Exp. : 8000

Prov. For bad debt 1000

Bills payable : 2400

Total : 306300

Assets\

Land & buliding 38000

Plant & Mach 30000

Stock : 20000

Debtors : 25000

Goodwill : 130000

Investment : 4000

Cash : 59300

Total : 306300

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

8

PREFERENCE SHARE ?

These are similar to debentures as there is

fixed rate of dividend. These share holders

are issued for a fixed number of years -

say for 7 years. These shares are paid first

(before ordinary equity shares) at the time

of wind up of the company. Preference

share holders are distributed profits before

ordinary equity shares.

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

9

Redemption of preference share

Such sheres can be redeemed either out

of the profits of the company which would

otherwise available for dividend or out of

the proceeds of a fresh issue of shares

made for the purpose of redemption.

Unless the shares are fully paid they

cannot be redeemed.

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

10

Redemption of preference share

if any premium is to be payable on redemption,

such premium has to be provided out of the

profits of the company or out of the securities

premium account

No company limited by shares, shall after the

commencement of the Companies (Amendment)

Act, 1996 issue any preference shares which is

irredeemable or is redeemable after the expiry of

a period of twenty years from the date of issue

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

11

Redemption : CRRA

Where any such shares are redeemed out of

profits, a sum equal to the nominal amount of

the shares so redeemed must be transferred out

of the profits of the company which would

otherwise to be available for dividend to a

reserve fund called Capital Redemption

Reserve Account. Otherwise, the provisions

relating to the reduction of share capital of a

company will apply, as if the Capital Redemption

Reserve Account were paid-up share capital of

the company.

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

12

CRRA

The capital redemption reserve account

may be applied by the company in paying

up unissued shares of the company to be

issued to the members of the company s

fully paid bonus shares. Otherwise Capital

Redemption Account must be maintained

intact unless otherwise sanctioned by the

Court.

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

13

Redemption .

If new shares are issued for the purpose of

redemption of preference shares, it will not

be treated as increase of capital

if a company fails to comply with the legal

provisions of this section, the company

and every officer of the company who is in

default shall be punishable with fine which

may extend to ten thousand rupees.

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

14

Redemption of preference

shares

Where in pursuance of this section, a

company has redeemed or is about to

redeem any preference shares, it shall

have power to issue upto the nominal

amount of the shares redeemed or to be

redeemed as if those shares had never

been issued.

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

15

Redemption

If the redeemable preference shares are

redeemed out of the profits of the

company which would otherwise be

available for dividend, the Capital

Redemption Reserve Account will take the

place of the Redeemable Preference

Share Capital Account after the

redemption.

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

16

Prepare journal entries..

11% preference shares were due for payment

on 1st April, 2008 at a premium of 10%. The

company sent the reminders for the final call on

the remaining 300-11% preference shares and

could collect money from shareholders holding

200 shares Rs.20 per share and forfeited the

defaulting 100 shares. The company sold all

investments at 90% of the cost of such

investments. The Company issued adequate

number of new equity shares at par, to the

extent that available profits were insufficient to

back-up the redemption

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

17

Balance sheet.

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

18

Solution.

700 * 100= 70000

+ 200 * 100 = 20000

Total amount to be paid : 90000

Premium = 9000

Available fund : 60000

Security premium : 5000 + 4000 from capital

reserve account

Thus we will issue equity for Rs. 30000. ans

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

19

Prepare trading and P & L a/c

The following are the details relating to

transactions during the year ended 31M March

2007 extracted from the books of Goti who does

not maintain proper books of account:

Cash and discount credited to debtors 6, 40,000

Sales return 14,500

Bad debts 4,200

Sales (cash and credit) 7,18,100

Discount allowed by trade creditors 7,000

Purchases returns 4,000

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

20

Continued

Additional capital-paid into bank 85.000

Realisations from debtors-paid into bank 6, 25,000

Cash purchases 10,300

Cash expenses 95,700

Paid by cheque for furniture purchased 4,300

Household expenses drawn from bank 31,800

Cash paid into bank 50,000

Cash drawn from bank 92,400

Cheques issued to trade creditors 6, 02,700

marks)

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

21

Continued

The following additional information are also available:

Ist April 31 March

2006 2007

Creditors 1, 57,700 1, 24,000

Sundry expenses outstanding 6,000 3,300

Sundryassets 1,16,100 1,20,400

Stock-in-trade 80,400 1, 11,200

Cash in hand and at bank 69,600 80,800

Trade debtors ? 1,78,700

You are required to prepare the Trading and Profit and

Loss Account for the year ended 31st March, 2007 and a

balance sheet as on that date

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

22

Debtors A/c

To opening stock

337400

To Sales 500000

(837400)

By sales return 14500

By discount 15000

By bank 625000

By Bad debt 4200

By balance 178700

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

23

Trading ac

Opening stock 80400

To purchase 580000

Cash purchase 10300

To gross profit 148100

Total 818100

B sales 718100

Less : sales (cash) 14500

By purchase return

4000

Closing stock 111200

Total : 818100

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

24

Creditors a/c

To bank 602700

To purchase return

4000

To discount 7000

To balance 124000

By purchase =580000

By balance b.d. =

157700

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

25

P & L ac/

To exp. 95700

To bad debt 4200

Discount allowed

15000

To N.P. 40200

By G P 148100

By discount 7000

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

26

Balance sheet

Net profit : 40200

Creditors 124000

Outstanding exp.

3300

Additional capital

85000

Capital : 243200

Total 495700

Cash & bank 80800

Debtors 178700

Assets 120700

Furniture 4300

Closing stock 111200

Total 495700

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

27

Cash received from X and

discount allowed to him.

Cash A/c Dr.

Discount Dr.

To X a/c Credit

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

28

Cash account

To balance 69600

By Cash sales 220800

To credors 602700

To bank 92500

Total :

by outstanding exp. 2700

By bank 85000

By bank 625000

By purchase 10300

By expsnes 95700

By furniture 4300

By household exp. 31800

By bank 50000

By closing blance 80800

Total : 985600

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

29

Cash paid to V and discount

received from him.

V a/c Dr.

To Discount Ac.

To Cash Ac

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

30

Credit Sales to Z.

Z a/c dr.

To sales a/c

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

31

Cash Sales to A.

Cash Ac.

To Sales Ac

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

32

Purchases from B on credit.

Purchase Ac dr.

To B account

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

33

Salary.paid to clerk by means

of cheque.

Salary a.c. dr.

To bank ac.

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

34

Payment of cash to Landlord for

rent.

Rent A.c dr.

To cash a.c

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

35

Depreciation on furniture.

Depreciation a/c. dr

To furniture a/c

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

36

Interest on debenture due but not

yet paid.

Interest Ac/ dr.

To outstanding interest a/c

Outstanding interest ac/ dr.

To the debenture holders a/c

P & L a/c dr.

To Outstanding interest Ac.

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

37

Interest provided on capital.

Interest .a/c dr.

To Capital Ac/

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

38

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

39

A firm purchases a lease of 3 years for Rs.

60,000 on 1.4.2004. it decides to provide for

its replacement by means of an insurance

policy for Rs. 60,000. The annual premium

is Rs. 19,000. On 1.4.2006, the lease is

renewed for a further period of 3 years for

Rs. 60,000. You are required to show

necessary ledger accounts.

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

40

Solution Ist year..

Lease A/c Dr. 60000

To Bank Account 60000

--------

Insurance policy a/c dr. 19000

To bank a/c 19000

----

P & L a/c dr. 19000

To depreciation 19000

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

41

IInd year

Insurance policy a/c dr. 19000

To bank 19000

(closing balance becomes 38000)

------

P & L a/c dr. 19000

To depreciation 19000

(closing balance beomes 38000)

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

42

IIIrd year

Insurance policy dr. 19000

To bank ac/ 19000

----

P & L a/c dr. 19000

To depreciation 19000

---

Bank a/c dr. 60000

To insurance policy : 60000

---

Insurance policy a/c dr. 3000

To depreciation a/c (reserve) 3000

(profit received on insurance policy transferred to dep ac

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

43

IIIrd year continued

Depreciation a/c dr. 60000

To Lease a/c 60000

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

44

Which of these is not a preliminary

expenditure ?

1. Cost of project report

2. Stamp duty on authorised capital

3. Cost of acquisition of a running business

4. Cost of vetting of MOA and AOA and

Prospectus

Answer :

No. 1. and 3.

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

45

Which of these is a preliminary

expenditure ?

1. Consultancy fees of Goti, who is a business

consultant

2. Charges paid to Jitu for conducting market

survey of the product before its start.

3. Printing charges of letters of allotment.

4. Payment paid to Sudha, who is approved

valuer and has prepared valuation report and

accounts along with drafting necessary

documents required at start up.

Answer : 3

rd

and 4

th

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

46

Difference between financial

accounting & management

accounting ..

Financial accounting records day to day

decisions and prepares annual accounts

as per the prescribed formats for external

reporting.

Management accounting is presentation of

accounting information so that

management may take appropriate

decisions and policies.

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

47

ACCOMMODATION BILL

When one party tries to help others, they

use accommodation bill to help each

other. Suppose Kapsa needs Rs. 1 billion,

he approaches Jitu for help, Jitu accepts a

bill of Rs. 1 billion thus Kapsa can get this

amount by bill discounting from bank. On

due date Kapsa will give the money back

to Jitu so that that Jitu may make the

payment to Bank.

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

48

Holder in due course

A person who gets a bill in due course is

called holder in due course. He gets all the

authority on bill. Even if the holder get the

bill from someone who has defective title,

the holder in due course will get full

authority.

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

49

QUORUM

For any meeting, we need a quorum. It is

the minimum number of members, who

must be present for the meeting to start.

For example : if quorum is 1/10, and there

are 100 members, then the meeting can

start only if at least 10 members are

present.

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

50

Goti had entered Rs 75 in petty

cash book, but did not post it in

repairs account. What should he

do now?

Solution :

Repairs A/c debit Rs. 75

To suspense a/c credit : 75

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

51

Define a cheque?

Sec. 6 : a cheque is a bill of exchange

drawn on a specified bankder and not

expressed to be pyable otherwise thn on

demand and it includes electronic image of

a truncated cheque and a cheque in

electronic form.

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

52

Protection of a paying bak

Suppose a cheque is drawn by A on B and

is endorsed by D (by making forged

signature of B) to C. The bank makes the

payment. The bank is discharged here as

the bank does not have signature of every

one. However, bank will not be discharged

if the signatue of A are forged.

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

53

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

54

Goti maintains single entry system

of accounting. He had Rs. 3 Lakh

on 1 January 2006 following is the

details of accounts that he had

1/4/6 31/3/7

Cash in hand 2000 3000

Stock 19000 29000

Debtors 1000 2000

Creditors 5000 3000

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

55

Other details

On 1/4/6 h began drawing Rs. 700 per month for personal

expenses. His bank details are as under :

Deposited : Rs. 3 lakh on 1/1/6

Withdrew Rs. 2,23,000 from 1/1/6 to 31/3/6

Deposited Rs. 230000 from 1/4/6 to 31/3/7

Withdrew Rs. 2,70000 from 1/4/6 to 31/3/7

The above withdrawals included payments by cheques of Ps.

2,00,000 and Ps. 60,000 respectively during the period from 1st

January, 2006 to 31st March, 2006 and on 1st March, 2007 for

the purchase of machinery for the business. The deposits after

1st January, 2007 consisted wholly of sale price received from

customers by cheques.

Draw up Rameshs Statement of Affairs as at 31st March, 2006

and 31st March, 2007 respectively and work out his profit or

loss for the year ended 31st March, 2007.

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

56

Solution..

Profit = closing capital opening capital

Therefore calculate opening and closing

capitals.

Prepare a bank statement and ascertain

bank balances on 31/3/6 and 31/3/7.

Bank balance on 31/3/6 (3 2.23) = 77000

Bank balance on 31/3/7 = (77-40) = 37000

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

57

Opening capital =

Assets :

Bank : 77000

Stock = 19000

Debtors = 1000

Cash = 2000

Machinary = 200000

Total= 299000

Less : creditors : 5000

Capital = 294000 (as on 31 march 2006)

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

58

Closing capital

Assets :

Cash : 3000

Stock : 29000

Debtors : 2000

Machinary : 260000

Bank balance = 37000

Total assets = 331000

Less creditors = 3000

Capital = 328000 (as on 31 march 2007)

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

59

Profit

Closing capital = 328000

Add = drawings ( 700 * 12) 8400

Less : Opening capital : 294000

Profit during the year = 42400 answer.

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

60

Solve it

Prabhakar commenced business on 1 April, 2006 with a capital

of Rs. 90,000. He immediately purchased furniture of As.

48,000. During the year he received from his uncle a gift of As.

6,000 and he borrowed from his father a sum of Rs. 10,000. He

had withdrawn As. 1,200 per month for his household

expenses. He had no bank account and all dealings were in

cash. He did not maintain any books but following information

is given:

Sales (including cash sales ot As. 60,000) = 200000

Purchases (including cash purchases of As. 20,000) = 150000

Carriage inwards = 1400

Wages = 600

Discount allowed to debtors= 2400

Salaries = 12400

Bad debts written off : 2200

Trade exp. : 2400; advertisement = 4400

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

61

Other details

He spent Rs. 1000 for his personal

expenses, he used goods of Rs. 2600 for

personal use

On 31/3/7, his debtors were Rs. 42000,

creditors : Rs. 30000, his stocks were Rs.

20000.

Dep. on furniture : 10%.

Prepare trading & p & l account

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

62

Trading account

Opening stock =nil

Purchase 150000

Less drawings : 2600

Net purchase :

147400

Carriage inward 1400

Wages 600

Gross profit : 70600

Sales 200000

Closing stock 20000

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

63

P & L account

Discount 2400

Bad debts 2200

Salaries : 12400

Trade exp. 2400

Depreciation: 4800

Net profit : 46400

Total : 70600

Gross profit 70600

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

64

Promissory note

It is an unconditional undertaking to make

payment of certain amount to the bearer of

the instrument / or the person so named in

the instrument or to the order of such

person after sight.

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

65

Crossing of cheque..

When a cheque is crossed at its top left

corner, it cannot be paid cash, its payment

can only be through bank account. We can

also add NOT NEGOTIABLE on the

crossing making it a non-negotiable

instrument.

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

66

Accounting numericals

Goti returned to India from London after

retirement and purchased a small retail

business. He took over the business on 1st April

2006 acquiring the existing stock at a valuation

of Rs. 22,840 and the rest of the purchase

consideration was apportioned as to Rs. 30,000

for fixtures and fittings and the balance for

goodwill. He used his existing bank account and,

other than bank statements and vouchers, the

only record available was a bill book recording

cash payments from the bill. Surplus cash was

banked periodically during the year. Prepare a/c

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

67

BANK ACCOUNT

Balance 1 April, 2006

72,920

Pension from employment

19,500

Bankings from shop 3,28,540

Purchases of business

63,840

Rent 15 months to

30th June, 2007 10,000

Rates 9 months to

31st Dec., 2006 1,680

Electricity 1,840

Hire of frozen food cabinet

1,600

Purchases for resale 2,94,000

Private cheques 22,440

Balance 31 March, 2007

25,560

TOTAL = 4,20,960

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

68

Continued.

Cash purchases for resale 32,120

Staff salaries 14,840

Sundry shop expenses 3,120

Cash drawings 10,400

On 31st March, 2007 stock valued at cost amounted to

As. 30,840, amounts duo from customers Rs, 1,480, and

cash in hand amounted to Rs. 1,080. Depreciation is to

be provided on fixtures and fittings at a rate of 10%.

Accounts outstanding on 31st March, 2007 were:

purchases Rs 9,400 For the year ending 31st December,

2007= 2,400.

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

69

Solution trading a/c

Opening stock 22840

Credit Purchase

303400

Cash purchase 32120

Gross profit 64060

Total : 422420

Credit Sales : 330020

Cash sales 61560

Closing stock 30840

Total : 422420

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

70

P & L a/c

To salaries 14840

To rates 2280

To rent 8000

To electricity 1840

To hire charges 1600

To sundary exp. 3120

To dep. 3000

To net profit 29380

Total : 64060

By G.P. 64060

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

71

Balance sheet

LIABILITIES

Capital 72920

Less drawings: 32840

Add Net profit : 29380

Pension (outstanding)

19500

Net capital : 88960

Creditors : 9400

Outstanding rates 600

Total : 98960

ASSETS

Furniture : 27000

Stock 30840

Debtors 1480

Bank 25560

Cash 1080

Prepaid rent 2000

Goodwill 11000

Total : 98960

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

72

Debtors a/c

To sales : 330020 By bank 328540

By closing balance

1480

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

73

Fictitious person

Articificial persons like company, firm etc.

are called fictitious persons. They have

legal entity and can contract in their own

name.

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

74

SOLVE IT .

A company purchased 3 years lease on

1st April, 2004 for Rs. 50,000. It is decided

to provide for the replacement of the lease

at the end of 3 years by setting- up a

depreciation fund. It is expected that

investment will fetch at 12%. Sinking fund

Tables shows that Rs. 0.296349 invested

each year will produce Re. 1 at the end of

3 years at 12% per annum. The

investments are sold for rs. 28,500.

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

75

SOLUTIONlease account

To bank 50000

(at the end of thrd

year)

Dep fund ac 45645

P & L ac/ 4355

Total : 50000

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

76

Dep. Fund account

To balance 14817.45

To investment 3412

To lease a/c 45645

By dep. A/c 14817.45

IInd Year

By balance 14817.45

By dep. Ac/ 14817.45

By interest 1778

III rd year

By balance : 31412.9

By interest 3769

By dep. Ac. 14817.45

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

77

Investment account

To bank 14817.45

IInd year

To balance 14817

To bank 16595

IIIrd year :

To balance 31412

By balance 14817

By balance 16595

By bank 28000

By dep. Fund 3412

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

78

Declaration of dividend out of

reserves

The rate of dividend will not exceed 10% or

average rate of last 5 years.

First set off any previous loss before dividend

is declared

The balance of reserve after declaration of

dividend should be at least 15% of the paid up

share capital

The amount drawn from reserves should not be

more than 1/10 of the (paid up capital +

reserves).

(read section 205A of companies act).

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

79

Due to inadequacy of profit during the year,

the company proposes to declare dividend

out of the general reserves. From the

following particulars, find the amount that

can be drawn applying the Companies

(Declaration of dividend out of Reserves)

Rules, 1975:

(a) 17,500 9% preference shares of Rs. 100 each fully paid

(b) 7,00,000 equity shares of Rs. 10 each fully paid

(c) General reserves 21 lakhs

(d) Capital reserves on revaluation of assets 3.5 lakhs

(e) Share premium 3.5 lakhs

(f) Profit and loss account-credit balance 63000

(g) Net profit for the year 357000

Average rate of dividend during the last five years: 15%.

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

80

Solution

Maximum dividend that can be paid is

10%

Dividend on equity : 7,00,000

Dividend on prefernece (9%) 157500

Total : 8,57,500

Total paid up capital + reserves 10% of

(7000000+2100000+1750000) 1085000

Total amount available: 420000+ 21 lakhs

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

81

Solution

15% of equity + preference

= 1312500

(7000000+ 1750000)

Total amount payable :

857500

Less profit 420000

=437500 to be drawn from reserves. (ans.)

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

82

Goti purchases Ito Ltd. For Rs. 250000

and pays in 20000 shares of Rs. 10 +

cash. Show the entries?

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

83

Solution .. (entries in Goti ltd)

Business purchase A/c Dr. 250000

To Ito Ltd. 250000

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

84

Freehold Premises Dr. 100000

Plant and Machinery Dr. 80000

Stock 20000

Debtors 27500

Cash at Bank 75000

Goodwill A/c dr. 30000

To credtors 50000

To B.P. 30000

To Provision for bad debt : 2500

To Purchase consideration 250000

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

85

For payment

Ito Ltd 250000

To equity shares 200000

To cash 50000

(PAYMENT OF CONSIDERATION).

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

86

VALUATION OF INTANGIBLES

Intangibles means non-physical benefits from which the

organisation can expect to receive profits / benefits in

the future.

This asset is intangible therefore it has to be identified

- and amortised periodically.

Examples inclue softwares, knowledge base,

trademark, patents, etc.

There are two types : internally generated (for example

goodwill) 2: externally generated intangible assets

(for example goodwill is generally written only when

we purchase it.

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

87

Amortisation

Intangible assets include cost of

development, training, research and

development and other costs. Its useful life

is identified and then amortisation is done

over that life.

Applying the principles of impairment of

assets, impairment is provided on

intangible assets.

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

88

A company purchased 3 years lease on ist April,

2004 for Rs. 50,000. it is decided to provide for the

replacement of the lease at the end of 3 years by

setting- up a depreciation fund. It is expected that

investment will fetch at 12%. Sinking fund tables

shows that As. 0.296349 invested each year will

produce Re. 1 at the end of 3 years at 12% per

annum. The investments are sold for Rs. 28,500.

Taking approx. value.

50000*.29 = 14500

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

89

Solution..

Lease A/c Dr. 50000

To Bank 50000

----

P & L a/c dr. 14500

To Dep. 14500

-----

Dep. A/c dr. 14500

To dep fund investment a/c 14500

------

Dep. Fund Investment a/c dr. 14500

To bank 14500

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

90

Solution IInd year

P & L a/c dr. 14500

To Dep. 14500

-----

Dep. A/c dr. 14500

Interest on Dep. Fund Investment 1740

To dep fund investment a/c 16240

------

Dep. Fund Investment a/c dr. 16240

To bank 16240

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

91

Solution IIIrd year

P & L a/c dr. 14500

To Dep. 14500

-----

Dep. A/c dr. 14500

Interest on Dep. Fund Investment 3480

To dep fund investment a/c 17980

------

Bank a/c dr. 28500

To dep. Fund investment 28500

Dep fund ac. Dr. 1740

To dep fund investment ac. 2240

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

92

Dep. Fund investment a/c

Ist year 14500

----

IInd year

To balance 14500

To bank 16240

-===

Balance 30740

Balance cd. 14500

------

Balance c .d. 30740

----

III rd year

By bank : 28500

DeP. Fund a/c 2240

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

93

Dep fund a/c

To balance 14500

----

IInd year

To balance 30740

---- IIIrd year

To dep fund investment

2240

To lease a/c 45980

Total : 48220

By dep ac 14500

-----

IInd year

By balance cd 14500

By interest 1740

By dep. Ac. 14500

-- IIIrd year

By balance 30740

By intrst 3480

By dep. 14500

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

94

Lease ac/

To bank 50000

---

IInd year

To balance bd 50000

.

IIIrd year

To balance bd 50000

By balance 50000

---

IInd year

By balanc

----IIIrd year

By dep. 45980

By P & L 4020

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

95

About AFTERSCHOOL

PGPSE - Worlds most comprehensive

programme on social entrepreneurship

after class 12

th

Flexible fast changing to meet the

requirements

Admission open throughout the year

Complete support from beginning to the

end from idea generation to making the

project viable.

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

96

Branches of AFTERSCHOOL

PGPSE programme is open all over the

world as free online programme.

Those who complete PSPSE have the

freedom to start branches of

AFTERSCHOOL

A few branches have already started -

one such branch is at KOTA (Rajasthan).

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

97

Workshop on social

entrepreneurship

We conduct workshop on social

entrepreneurship all over India and out

of India also - in school, college, club,

association or any such place - just send

us a call and we will come to conduct the

workshop on social entrepreeurship.

These workshops are great moments of

learning, sharing, and commitments.

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

98

FREE ONLINE PROGRAMME

AFTERSCHOOL is absolutely free

programme available online any person can

join it. The programme has four components :

1. case studies writing and analysing using

latest tools of management

2. articles / reports writing & presentation of

them in conferences / seminars

3. Study material / books / ebooks / audio / audio

visual material to support the study

4. business plan preparation and presentations

of those plans in conferences / seminars

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

99

100% placement /

entrepreneurship

AFTERSCHOOL has the record of

100% placement / entrepreneurship till

date

Be assured of a bright career if you join

AFTERSCHOOL

10/22/2014www.aftersch

oool.tk

AFTERSCHOOL's MATERIAL

FOR PGPSE PARTICIPANTS

100

Pursue professional courses along

with PGPSE

AFTERSCHOOL permits you to pursue

distance education based professional /

vocational courses and gives you support

for that also. Many students are doing CA /

CS/ ICWA / CMA / FRM / CFP / CFA and

other courses along with PGPSE.

Come and join AFTERSCHOOL

Você também pode gostar

- Accounting for Non-Accountants: The Fast and Easy Way to Learn the BasicsNo EverandAccounting for Non-Accountants: The Fast and Easy Way to Learn the BasicsNota: 4 de 5 estrelas4/5 (5)

- Critical Financial Review: Understanding Corporate Financial InformationNo EverandCritical Financial Review: Understanding Corporate Financial InformationAinda não há avaliações

- Moa Investment ProposalDocumento4 páginasMoa Investment ProposalTim Smirnoff100% (2)

- Bill of ExchangeDocumento19 páginasBill of ExchangeKNOWLEDGE CREATORS100% (3)

- Bakry Business PlanDocumento18 páginasBakry Business Planfaisaltarar2007Ainda não há avaliações

- 21St Century Computer Solutions: A Manual Accounting SimulationNo Everand21St Century Computer Solutions: A Manual Accounting SimulationAinda não há avaliações

- LCCI - Level 3 Diploma in AccountingDocumento2 páginasLCCI - Level 3 Diploma in AccountingWinnieOngAinda não há avaliações

- 04 - Chapter 4 Cash Flow Financial PlanningDocumento68 páginas04 - Chapter 4 Cash Flow Financial Planninghunkie71% (7)

- Financial Reporting under IFRS: A Topic Based ApproachNo EverandFinancial Reporting under IFRS: A Topic Based ApproachAinda não há avaliações

- Pas 32Documento34 páginasPas 32Iris SarigumbaAinda não há avaliações

- Chapter 4 Working Capital and Cash Flow Management FinmanDocumento38 páginasChapter 4 Working Capital and Cash Flow Management FinmanCris EdrianAinda não há avaliações

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementAinda não há avaliações

- Intermediate Accounting 1 Lecture 1 PDFDocumento9 páginasIntermediate Accounting 1 Lecture 1 PDFChavey Jean V. RenidoAinda não há avaliações

- Operating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16No EverandOperating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16Ainda não há avaliações

- Derivative SuitDocumento4 páginasDerivative SuitCybill DiazAinda não há avaliações

- Delectus PersonaeDocumento59 páginasDelectus Personaeleahtabs100% (3)

- Raghav Kapoor Software Limited CaseDocumento18 páginasRaghav Kapoor Software Limited Casegarlnt100% (4)

- Standard Costing: SUPER SUMMARY (Reading Method 1) Material VarianceDocumento5 páginasStandard Costing: SUPER SUMMARY (Reading Method 1) Material VarianceWinnieOngAinda não há avaliações

- Prospectus and Allotment PRESENTATIONDocumento28 páginasProspectus and Allotment PRESENTATIONgondalsAinda não há avaliações

- Business Plan On Bio Gas PlantDocumento24 páginasBusiness Plan On Bio Gas PlantNikNitu100% (1)

- Accounting For BusinessDocumento84 páginasAccounting For BusinessKNOWLEDGE CREATORSAinda não há avaliações

- Accounting Economics and Business 13 NovDocumento84 páginasAccounting Economics and Business 13 NovKNOWLEDGE CREATORSAinda não há avaliações

- Afterscho OL: Finanacial AnalysisDocumento17 páginasAfterscho OL: Finanacial AnalysisKNOWLEDGE CREATORSAinda não há avaliações

- Final AccountsDocumento28 páginasFinal AccountsKNOWLEDGE CREATORSAinda não há avaliações

- Accounting For Business 11 SeptDocumento43 páginasAccounting For Business 11 Septapi-26674800Ainda não há avaliações

- Capital Structure Decisions in Financial Management 6 NovemberDocumento52 páginasCapital Structure Decisions in Financial Management 6 NovemberKNOWLEDGE CREATORSAinda não há avaliações

- 7 - Reporting Business Transactions Using Financial StatementsDocumento15 páginas7 - Reporting Business Transactions Using Financial StatementssurangauorAinda não há avaliações

- Accounting For Business CombinationDocumento17 páginasAccounting For Business CombinationTrace ReyesAinda não há avaliações

- 7 - Reporting Business Transactions Using Financial StatementsDocumento15 páginas7 - Reporting Business Transactions Using Financial StatementssurangauorAinda não há avaliações

- © The Institute of Chartered Accountants of IndiaDocumento38 páginas© The Institute of Chartered Accountants of IndiaSarah HolmesAinda não há avaliações

- Assignment QuestionsDocumento13 páginasAssignment QuestionsAiman KhanAinda não há avaliações

- CIE Chapter 1 The Purpose of AccountingDocumento22 páginasCIE Chapter 1 The Purpose of AccountingHsu Lae NandarAinda não há avaliações

- Partners HIP - Pretest: - Introduction and FormationDocumento38 páginasPartners HIP - Pretest: - Introduction and FormationKristia AnagapAinda não há avaliações

- Capital Structure Decisions in Financial ManagementDocumento52 páginasCapital Structure Decisions in Financial ManagementAnkit LakhaniAinda não há avaliações

- Capital Structure Decisions in Financial ManagementDocumento52 páginasCapital Structure Decisions in Financial ManagementAnkit LakhaniAinda não há avaliações

- Capital Structure Decisions in Financial Management 7 NovemberDocumento67 páginasCapital Structure Decisions in Financial Management 7 NovemberKNOWLEDGE CREATORSAinda não há avaliações

- Indian Financial System 24 NovemberDocumento41 páginasIndian Financial System 24 NovemberKNOWLEDGE CREATORSAinda não há avaliações

- Buyback of SharesDocumento22 páginasBuyback of SharesJagruti Surve100% (1)

- Income Tax of India 5 DecemberDocumento43 páginasIncome Tax of India 5 Decemberpinkypawar1992Ainda não há avaliações

- Bank Reconciliation Statement: Afterscho OLDocumento18 páginasBank Reconciliation Statement: Afterscho OLKNOWLEDGE CREATORS100% (3)

- Short-Term Financial Planning: Mcgraw-Hill/IrwinDocumento23 páginasShort-Term Financial Planning: Mcgraw-Hill/IrwinUmair Latif KhanAinda não há avaliações

- Securities & Exchange Commission of Pakistan SecpDocumento30 páginasSecurities & Exchange Commission of Pakistan SecpSyed Usman NisarAinda não há avaliações

- New Microsoft Office Word DocumentDocumento99 páginasNew Microsoft Office Word DocumentYasir KhanAinda não há avaliações

- Cash FlowsDocumento4 páginasCash FlowsJb De GuzmanAinda não há avaliações

- Final ProjectDocumento31 páginasFinal Projectanon_541766872Ainda não há avaliações

- Introduction To Financial ManagementDocumento47 páginasIntroduction To Financial ManagementNikolai MarasiganAinda não há avaliações

- Information For Prospective Lenders: Owner Loan ProgramDocumento6 páginasInformation For Prospective Lenders: Owner Loan ProgramErick JoseAinda não há avaliações

- Dividend PolicyDocumento52 páginasDividend PolicyANISH KUMARAinda não há avaliações

- DR A.P.J. Abdul Kalam Technical University Lucknow: Uttam Group of InstitutionsDocumento30 páginasDR A.P.J. Abdul Kalam Technical University Lucknow: Uttam Group of InstitutionsMayank jainAinda não há avaliações

- Income Tax Act 1961 18 NovemberDocumento36 páginasIncome Tax Act 1961 18 NovemberKNOWLEDGE CREATORSAinda não há avaliações

- Voluntary Winding Up of Companies Under IbcDocumento16 páginasVoluntary Winding Up of Companies Under IbcSher Singh YadavAinda não há avaliações

- Financial Accounting - An Ice Breaker: BY: Mohit Dhawan Asst. Prof. (Finance) & Asst. Dean (MGT.) INMANTEC, GhaziabadDocumento64 páginasFinancial Accounting - An Ice Breaker: BY: Mohit Dhawan Asst. Prof. (Finance) & Asst. Dean (MGT.) INMANTEC, GhaziabadMohit DhawanAinda não há avaliações

- Accounting Analysis (Analyzing Financing Activities)Documento19 páginasAccounting Analysis (Analyzing Financing Activities)Shubashini RajanAinda não há avaliações

- Kim Fuller: A Case Study in Managerial AccountingDocumento12 páginasKim Fuller: A Case Study in Managerial AccountingSarju MaviAinda não há avaliações

- SIP1310018 Project Eagle Final (1855) CDocumento465 páginasSIP1310018 Project Eagle Final (1855) CInvest StockAinda não há avaliações

- Final BUSINESS PLAN FOR CONNS LIMITEDDocumento66 páginasFinal BUSINESS PLAN FOR CONNS LIMITEDOwunari Adaye-Orugbani100% (1)

- WAC01 - 01 - MSC - 20150305 (Accounting Edexcel IAL 2015 January Unit 1 Question Paper)Documento21 páginasWAC01 - 01 - MSC - 20150305 (Accounting Edexcel IAL 2015 January Unit 1 Question Paper)James JoneAinda não há avaliações

- Bs Plan ChipaplipsDocumento62 páginasBs Plan ChipaplipsJhericho SalinoAinda não há avaliações

- ADL 03 Ver2+Documento6 páginasADL 03 Ver2+DistPub eLearning SolutionAinda não há avaliações

- Powerpoint Business PlanDocumento19 páginasPowerpoint Business PlanMoslimahAinda não há avaliações

- Aaca Audit of She CtaDocumento7 páginasAaca Audit of She CtaShannel Angelica Claire RiveraAinda não há avaliações

- Okay From This OnwardsDocumento4 páginasOkay From This Onwardsjerald cimafrancaAinda não há avaliações

- Cost Accounting: Level 3Documento18 páginasCost Accounting: Level 3Hein Linn KyawAinda não há avaliações

- Sample Paper For Professional Ethics in Accounting and FinanceDocumento6 páginasSample Paper For Professional Ethics in Accounting and FinanceWinnieOngAinda não há avaliações

- ASE2007 Revised Syllabus - Specimen Paper Answers 2008Documento7 páginasASE2007 Revised Syllabus - Specimen Paper Answers 2008WinnieOngAinda não há avaliações

- 02 Navitas English Pretest - Business EnglishDocumento12 páginas02 Navitas English Pretest - Business EnglishWinnieOngAinda não há avaliações

- ASE 3902 - IAS - Revised Syllabus - Answers To Specimen Paper 2008 16307Documento8 páginasASE 3902 - IAS - Revised Syllabus - Answers To Specimen Paper 2008 16307WinnieOngAinda não há avaliações

- Computerised Accounting FlyerDocumento6 páginasComputerised Accounting FlyerWinnieOngAinda não há avaliações

- Asaba Group Holdings Information - Victor EdozienDocumento2 páginasAsaba Group Holdings Information - Victor EdozienSteven MooreAinda não há avaliações

- Goldman Sachs Annual Report 2009Documento180 páginasGoldman Sachs Annual Report 2009Santiago CuetoAinda não há avaliações

- Americana Restaurants KSA Supplement Prospectus PDFDocumento580 páginasAmericana Restaurants KSA Supplement Prospectus PDFRawan SaberAinda não há avaliações

- MNC PPT On 2309Documento20 páginasMNC PPT On 2309Priya Mishra100% (1)

- MBA202Documento2 páginasMBA202Sujal SAinda não há avaliações

- Anvet SRLS Dumitru Andreea Date Registrul Comerțului ItaliaDocumento4 páginasAnvet SRLS Dumitru Andreea Date Registrul Comerțului ItaliaMihai DutaAinda não há avaliações

- Investing in The Philippine Stock MarketDocumento13 páginasInvesting in The Philippine Stock MarketJohn Carlo AquinoAinda não há avaliações

- Nike IncDocumento16 páginasNike IncRahul SttudAinda não há avaliações

- Project On ItcDocumento7 páginasProject On ItcAnonymous 6LQLwsAinda não há avaliações

- Tax - Simplified Table of RatesDocumento5 páginasTax - Simplified Table of RatesLouAinda não há avaliações

- Porsche IPO On The Table To Push "Electrification and Digitalization Offensive"Documento2 páginasPorsche IPO On The Table To Push "Electrification and Digitalization Offensive"Maria MeranoAinda não há avaliações

- Hedging For Profit - Constructing Robust Risk-Mitigating PortfoliosDocumento6 páginasHedging For Profit - Constructing Robust Risk-Mitigating Portfoliosandremdm2008Ainda não há avaliações

- This Study Resource Was: UP Junior Philippine Institute of Accountants Education and Research CommitteeDocumento7 páginasThis Study Resource Was: UP Junior Philippine Institute of Accountants Education and Research CommitteeGervinBulataoAinda não há avaliações

- The Virtue MatrixDocumento2 páginasThe Virtue MatrixMahreenAlam100% (1)

- Saint James Holding and Investment Company Announces Acquisition of Victura Construction Group and Provides Shareholder UpdateDocumento3 páginasSaint James Holding and Investment Company Announces Acquisition of Victura Construction Group and Provides Shareholder UpdatePR.comAinda não há avaliações

- ACC208 - CH 4 Prefference StockDocumento19 páginasACC208 - CH 4 Prefference StockSaja AlbarjesAinda não há avaliações

- Proposal Go Jek (Group) 2 2Documento6 páginasProposal Go Jek (Group) 2 2Ramadiany Fitrianina MarsufAinda não há avaliações

- Director's Duties NotesDocumento18 páginasDirector's Duties Notesmike_theplayerAinda não há avaliações

- XLSXDocumento10 páginasXLSXezar zacharyAinda não há avaliações

- Pe - 2Documento29 páginasPe - 2Matt KAinda não há avaliações

- IB Presentation BMWDocumento21 páginasIB Presentation BMWMayank GaurAinda não há avaliações

- Dicidend Policy in NepalDocumento42 páginasDicidend Policy in NepalMadhurendra Singh88% (8)

- SingHaiyi Group Ltd. Included in MSCI Singapore Small Cap IndexDocumento2 páginasSingHaiyi Group Ltd. Included in MSCI Singapore Small Cap IndexWeR1 Consultants Pte LtdAinda não há avaliações

- The Balance of Prepaid Expenses On January 1, 2018 Is P24,675. What Is The Balance of Prepaid Expense As of December 31, 2018?Documento3 páginasThe Balance of Prepaid Expenses On January 1, 2018 Is P24,675. What Is The Balance of Prepaid Expense As of December 31, 2018?Tahani Awar Gurar0% (1)

- Common and Preferred StockDocumento3 páginasCommon and Preferred StockChristianRuizAinda não há avaliações

- Mepal LeafDocumento8 páginasMepal LeafMuhammadArshadAinda não há avaliações