Escolar Documentos

Profissional Documentos

Cultura Documentos

Important Tables in SAP FI

Enviado por

Pavan UlkDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Important Tables in SAP FI

Enviado por

Pavan UlkDireitos autorais:

Formatos disponíveis

Important Tables in SAP FI

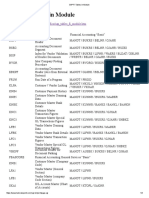

Financial Accounting

Table Name Description Important Fields

Financial Accounting

FBAS Financial Accounting Basis

BKPF Accounting Document Header BUKRS / BELNR /

GJAHR

BSEG Accounting Document Segment BUKRS / BELNR /

GJAHR / BUZEI

BSIP Index for Vendor Validation of Double BUKRS / LIFNR /

WAERS / BLDAT /

Documents XBLNR / WRBTR /

BELNR / GJAHR / BUZEI

BVOR Inter Company Posting Procedure BVORG / BUKRS /

GJAHR / BELNR

EBKPF Accounting Document Header (docs from GLSBK / BELNR /

GJHAR / GLEBK

External Systems)

FRUN Run Date of a Program PRGID

KLPA Customer / Vendor Linking NKULI / NBUKR /

NKOAR / PNTYP

/ VKULI / VBUKR /

VKOAR

KNB4 Customer Payment History KUNNR / BUKRS

KNB5 Customer Master Dunning Data KUNNR / BUKRS /

MABER

KNBK Customer Master Bank Details KUNNR / BANKS /

BANKL / BANKN

KNC1 Customer Master Transaction Figures KUNNR / BUKRS /

GJHAR

KNC3 Customer Master Special GL Transactions KUNNR / BUKRS /

GJAHR / SHBKZ

Figures

LFB5 Vendor Master Dunning Data LIFNR / BUKRS / MABER

LFBK Vendor Master Bank Details LIFNR / BANKS / BANKL / BANKN

LFC1 Vendor Master Transaction Figures LIFNR / BUKRS /

GJHAR

LFC3 Vendor Master Special GL Transactions LIFNR / BUKRS /

GJHAR / SHBKZ

Figures

VBKPF Document Header for Document Parking AUSBK / BUKRS /

BELNR / GJHAR

FBASCORE Financial Accounting General Services Basis

KNB1 Customer Master (Company Code) KUNNR / BUKRS

LFA1 Vendor Master (General Section) LIFNR

LFB1 Vendor Master (company Code Section) LIFNR / BUKRS

SKA1 G/L Account Master (Chart of Accounts) KTOPL / SAKNR

SKAT G/L Account Master (Chart of Accounts SPRAS / KTOPL /

SAKNR

Description)

MAHNS Accounts Blocked by Dunning Selection KOART / BUKRS / KONKO / MABER

MHNK Dunning Data (Account Entries LAUFD / LAUFI / KOART / BUKRS /

KUNNR / LIFNR / CPDKY / SKNRZE /

SMABER / SMAHSK / BUSAB

FI-GL-GL (FBS) General Ledger Accounting: Basic Functions- G/L Accounts

SKAS G/L Account Master (Chart of Accounts SPRAS / KTOPL / SAKNR / SCHLW

Key Word list)

SKB1 G/L Account Master (Company Code) BUKRS / SAKNR

FI-GL-GL (FBSC) General Ledger Accounting: Basic

Functions - R/3 Customizing for G/L Accounts

FIGLREP Settings for G/L Posting Reports MANDT

TSAKR Create G/L account with reference BUKRS / SAKNR

FI-GL-GL (FFE) General Ledger Accounting: Basic

Functions - Fast Data Entry

KOMU Account Assignment Templates for G/L KMNAM / KMZEI

Account items

FI-AR-AR (FBD) Accounts Receivable: Basic Functions - Customers

KNKA Customer Master Credit Management : KUNNR

Central Data

KNKK Customer Master Credit Management : KUNNR / KKBER

Control Area Data

KNKKF1 Credit Management : FI Status data LOGSYS / KUNNR / KKBER / REGUL

RFRR Accounting Data A/R and A/P RELID / SRTFD / SRTF2

Information System

FI-BL-PT Bank Accounting: Payment (BFIBL_CHECK_D) Transactions

General Sections

PAYR Payment Medium File ZBUKR / HBKID / HKTID / RZAWE /

CHECT

PCEC Pre-numbered Check ZBUKR / HBKID / HKTID / STAPL

FI-BL-PT-AP(FMZA)Bank Accounting: Payment Transactions Automatic Payments

F111G Global Settings for Payment Program for MANDT

Payment Requests

FDZA Cash Management Line Items in Payment KEYNO

Requests

PAYRQ Payment Requests KEYNO

What is the table name for G/L Master data, when we create centrally (T.Code - FS00)?

As far as general ledger master data is concerned, the following tables are involved :

Table name : SKB1 : G/L Account Master ( Company Code)

Fields:

BUKRS : Company Code

SAKNR : G/L Account

Table name : SKA1 : G/L Account Master ( Chart of Accounts )

Fields:

KTOPL : Char of Accounts

SAKNR : G/L Account

Table name : SKAT : G/L Account Master Record ( Chart of Accounts : Description )

Fields:

SPRAS : Language

KTOPL : Char of Accounts

SAKNR : G/L Account

Important Tables in SAP CO

Controlling

Table Name Description Important Fields

AUSP Characteristic Values MANDT / OBJEK / ATINN / ATZHL

CO-KBAS Overhead Cost Controlling

A132 Price per Cost Center MANDT / KAPPL / KSCHL / KOKRS

A136 Price per Controlling Area MANDT / KAPPL / KSCHL / KOKRS

A137 Price per Country / Region MANDT / KAPPL / KSCHL / KOKRS

COSC CO Objects: Assignment of Origina MANDT / OBJNR / SCTYP / VERSN

CSSK Cost Center / Cost Element MANDT / VERSN / KOKRS / GJAHR

CSSL Cost Center / Activity Type MANDT / KOKRS / KOSTL / LSTAR

KAPS CO Period Locks MANDT / KOKRS / GJAHR / VERSN

CO-KBASCORE Overhead Cost Controlling: General Services

CSKA Cost Elements (Data Dependent on MANDT / KTOPL / KSTAR

CSKB Cost Elements (Data Dependent on MANDT / KOKRS / KSTAR / DATBI

CSKS Cost Center Master Data MANDT / KOKRS / KOSTL / DATBI

CSLA Activity Master MANDT / KOKRS / LSTAR / DATBI

CO-OM (KACC) Overhead Cost Controlling

COBK CO Object: Document Header MANDT / KOKRS / BELNR

COEJ CO Object: Line Items (by Fiscal MANDT / KOKRS / BELNR / BUZEI

COEJL CO Object: Line Items for Activit MANDT / KOKRS / BELNR / BUZEI

COEJR CO Object: Line Items for SKF (by MANDT / KOKRS / BELNR / BUZEI

COEJT CO Object: Line Items for Prices MANDT / KOKRS / BELNR / BUZEI

COEP CO Object: Line Items (by Period) MANDT / KOKRS / BELNR / BUZEI

COEPL CO Object: Line Items for Activit MANDT / KOKRS / BELNR / BUZEI

COEPR CO Object: Line Items for SKF (by MANDT / KOKRS / BELNR / BUZEI

COEPT CO Object: Line Items for Prices MANDT / KOKRS / BELNR / BUZEI

COKA CO Object: Control Data for Cost MANDT / OBJNR / GJAHR / KSTAR

COKL CO Object: Control Data for Activ MANDT / LEDNR / OBJNR / GJAHR

COKP CO Object: Control Data for Prima MANDT / LEDNR / OBJNR / GJAHR

COKR CO Object: Control Data for Stati MANDT / LEDNR / OBJNR / GJAHR

COKS CO Object: Control Data for Secon MANDT / LEDNR / OBJNR / GJAHR

CO-OM-CEL (KKAL) Cost Element Accounting (Reconciliation Ledger)

COFI01 Object Table for Reconciliation L MANDT / OBJNR

COFI02 Transaction Dependent Fields for MANDT / OBJNR

COFIP Single Plan Items for Reconciliat RCLNT / GL_SIRID

COFIS Actual Line Items for Reconciliat RCLNT / GL_SIRID

CO-OM-CCA Cost Center Accounting (Cost Accounting Planning RK-S)

What is RK-S

A138 Price per Company Code MANDT / KAPPL / KSCHL

/ KOKRS

A139 Price per Profit Center MANDT / KAPPL / KSCHL

/ KOKRS

CO-OM-OPA (KABR) Overhead Orders: Application Development R/3 Cost

Accounting Settlement

AUAA Settlement Document: Receiver Seg MANDT / BELNR / LFDNR

AUAB Settlement Document: Distribution MANDT / BELNR / BUREG / LFDNR

AUAI Settlement Rules per Depreciation MANDT / BELNR / LFDNR / AFABE

AUAK Document Header for Settlement MANDT / BELNR

AUAO Document Segment: CO Objects to b MANDT / BELNR / LFDNR

AUAV Document Segment: Transactions MANDT / BELNR / LFDNR

COBRA Settlement Rule for Order Settlem MANDT / OBJNR

COBRB Distribution Rules Settlement Rul MANDT / OBJNR / BUREG / LFDNR

CO-OM-OPA (KAUF) Overhead Orders: Cost Accounting Orders

AUFK Order Master Data MANDT / AUFNR

AUFLAY0 Enttity Table: Order Layouts MANDT / LAYOUT

EC-PCA (KE1) Profit Center Accounting

CEPC Profit Center Master Data Table MANDT / PRCTR / DATBI / KOKRS

CEPCT Texts for Profit Center Master Da MANDT / SPRAS / PRCTR / DATBI

CEPC_BUKRS Assignment of Profit Center to a MANDT / KOKRS / PRCTR / BUKRS

GLPCA EC-PCA: Actual Line Items RCLNT / GL_SIRID

GLPCC EC-PCA: Transaction Attributes MANDT / OBJNR

GLPCO EC-PCA: Object Table for Account MANDT / OBJNR

GLPCP EC-PCA: Plan Line Items RCLNT / GL_SIRID

EC-PCA BS (KE1C) PCA Basic Settings: Customizing for Profit Center

Accounting

A141 Dependent on Material and Receive MANDT / KAPPL / KSCHL / KOKRS

A142 Dependent on Material MANDT / KAPPL / KSCHL / WERKS

A143 Dependent on Material Group MANDT / KAPPL / KSCHL / WERKS

Important Tables in SAP AA

FI-AA-AA (AA) Asset Accounting: Basic Functions Master Data

ANKA Asset Classes: General Data ANLKL

ANKP Asset Classes: Fld Cont Dpndnt on Chart ANLKL / AFAPL

of Depreciation

ANKT Asset Classes: Description SPRAS / ANLKL

ANKV Asset Classes: Insurance Types ANLKL / VRSLFD

ANLA Asset Master Record Segment BUKRS / ANLN1 /

ANLN2

ANLB Depreciation Terms BUKRS / ANLN1 /

ANLN2 / AFABE

/ BDATU

ANLT Asset Texts SPRAS / BUKRS /

ANLN1 / ANLN2

ANLU Asset Master Record User Fields .INCLUDE / BUKRS /

ANLN1 / ANLN2

ANLW Insurable Values (Year Dependent) BUKRS / ANLN1 /

ANLN2 / VRSLFD /

GJAHR

ANLX Asset Master Record Segment BUKRS / ANLN1 /

ANLN2

ANLZ Time Dependent Asset Allocations BUKRS / ANLN1 /

ANLN2 / BDATU

FI-AA-AA (AA2) Asset Accounting: Basic Functions Master Data 2.0

ANAR Asset Types ANLAR

ANAT Asset Type Text SPRAS / ANLAR

FI-AA-AA (AB) Asset Accounting: Basic Functions

Asset Accounting

ANEK Document Header Asset Posting BUKRS / ANLN1 /

ANLN2 / GJAHR /

LNRAN

ANEP Asset Line Items BUKRS / ANLN1 /

ANLN2 / GJAHR /

LNRAN / AFABE

ANEV Asset Downpymt Settlement BUKRS / ANLN1 /

ANLN2 / GJAHR /

LNRANS

ANKB Asset Class: Depreciation Area ANLKL / AFAPL /

AFABE / BDATU

ANLC Asset value Fields BUKRS / ANLN1 /

ANLN2 / GJAHR /

AFABE

ANLH Main Asset Number BUKRS / ANLN1

ANLP Asset Periodic Values BUKRS / GJAHR /

PERAF / AFBNR /

ANLN1 / ANLN2 /

AFABER

FI-SL-VSR (GVAL) Special Purpose Ledger: Validation, Substitution and Rules

GB03 Validation / Substitution User VALUSER

GB92 Substitutions SUBSTID

GB93 Validation VALID

MIRO Tables - Invoice Document Data

If I have a MIRO document number, in which table I could find the information for that

document?

Answer:

You can make use of the following tables:

BSIM : Secondary index - documents for material

MYMFT FIFO : Results table

MYML LIFO : material layer

MYMLM LIFO : material layer (monthly)

MYMP LIFO : period stocks, single material

MYMP1 :Receipt data LIFO/FIFO valuation

MYPL : LIFO pool layer

RBCO : Document item, incoming invoice account assignment

RBDIFFKO : Invoice Verification - conditions

RBDIFFME : Invoice verification in background -quantity differences

RBDRSEG : Invoice verification in background -invoice document items

RBKP : Document header: Incoming invoice

RBKPB : Invoice document header (invoice verification in background)

RBTX : Taxes: Incoming invoice

RBVD : Invoice document - summarization data

RBVDMAT Invoice Verification - summarization data, material

RBWT Withholding tax: Incoming invoice

RSEG : Document item: Incoming invoice

FI Errors and Probable Solutions

These are some of the issue for which probable solutions are given, hope they are

helpful :

Scenario 1:

I have configured FBZP, Fi12 for house bank. But when I am doing payment run

in F110 I am getting following error:

Company codes X1YZ/X1YZ do not appear in proposal 05/03/2006 REMI2.

Diagnosis

No data exists for the specified paying company code X1YZ and the specified

sending company code X1YZ in payment proposal 05/03/2006 REMI2.

System response

The payment proposal cannot be edited.

Procedure

Check the flow trace and payment proposal list in order to determine why the

specified company codes are not contained in the proposal

Solution :

* Thats generic error for payment run, check whether there are any due items as on

date (tcode fbl1n). You can also change the baseline date there and rerun it. if you still

get same error.. Check the proposal log, you will find the reason.

* Try to see first whether any open items exist. By using FBL1N.

Scenario 2:

How to make the payment through automatic payment program, through F-110

.What are the prerequisites?

Solution :

For Down payments to be paid using APP we have create a Down Payment request F-

47.

Scenario 3:

While doing APP, after, " the payment proposal has been created message " if

edit proposal is selected, I am getting the error as "Company code ABC/ABC do

no appear in the proposal "

Solution :

This type of error comes when your Payment proposal doesn't have any items to

process. Check the parameters and ensure invoices are due as on run date.

Scenario 4 :

While posting customer invoice (FB70) why system asks for G/L account? As per

accounting rules customer is debited and Customer reconciliation a/c is credited

that ends double entry book keeping rule. Why one more G/L account on top of

Recon a/c, which is posted automatically?

Solution :

* Entry gets posted to Customer a/c through reconciliation account. You have to give

a GL a/c for revenue.

Your entry would be

Customer (Reconciliation a/c) Dr

To Revenue Cr

* Reconciliation is a fictious entry so you cannot consider as an entry to be entered by

the user. This rule is derived from the fact that 'we cannot enter/post directly to

RECON account'.

That is why system needs a GL account to make the account balance as zero. Manual

entry could be:

Customer a/c Dr

To Domestic Sales a/c

(Sales invoiced posted)

Recon entry is automatically made once you post this entry since you have configured

your RECON in the IMG.

Scenario 5 :

I am unable to figure out how to attach my GL Accounts to my company code

[copied chart of accounts, have my own company code, assigned my company

code to the chart of accounts].

Solution :

You can attach the GL Accounts by just filling the details in the company code

segment of the GL A/c. Hence you can use that gl a/c for your co code.

But that would be individually creating the accounts. Right?? How about creating all

accounts at one shot. Create in FS00

Scenario 6 :

Difference between Standard Hierarchy and Alternate Hierarchy.

Solution :

Standard Hierarchy is basic structure of company but alternative hierarchy is just for

reporting or temporary usage.

Scenario 7:

I have created depreciation keys (diminishing balance) and assigned to asset

classes respectively. But at the time of asset master creation the system ask for

Useful Life of the asset while my understanding is that in diminishing balance

method there is useful life, just percentage is defined.

Solution :

Useful life is required for depreciation change. Normally a company with WDV

depreciation may want to write off its assets which have crossed their useful life in 2

or 3 installments. This is achieved by depreciation change, where after useful life, a

new method takes over.

Scenario 8 :

I have some conceptual problem in Internal Order.

Solution :

Internal order can only take a statistical posting & cost centre shall take a true posting

when the relevant internal order is defined as statistical I/O IN T. code

KO01(CONTROL DATA ) tab. So while making a posting in FB50 and assigning

both I/O & COST CENTRE as relevant cost object in the transaction you shall get the

stated status of these 2 cost object.

Scenario 9 :

In fb50, in the details tab, only if I tick 'calculate tax' will the tax get calculated.

Our user wants this to happen always (by default), i.e. he does not want to tick

this for each transaction. Is there any setup to be done for the tax to get

calculated always?

Solution :

Even now you are not clear. T_Code FB50 is used for posting GL account only. I fail

to understand how you can calculate tax which is generally from purchase / vendor or

Sales / Customer oriented through FB50.

In case of local distribution, if we forget to pay taxes on certain items and we need to

pass tax entries, then such a case is needed. This can be achieved thru default

parameter id for that particular user through transaction code SU3.

In SU3, in Parameters Tab put "XTX" in Parameter ID column and in Parameter

Value column put "X".

Scenario 10 :

We have an issue here where by the system is calculating the tax for an invoice

with a wrong tax base amount. How do i change the tax base amount? I get the

tax rates from VERTEX and they are showing right. Where does the system pull

this tax base amount for an Invoice and how can I change it.

Solution :

Kindly check this:

spro - financial accounting - f.a global setting - with holding setting - extended with

holding setting -- calculation -- with holding tax type .

Check your withholding tax type, go in it and check the setting.

Você também pode gostar

- SAP S/4HANA Embedded Analytics: Experiences in the FieldNo EverandSAP S/4HANA Embedded Analytics: Experiences in the FieldAinda não há avaliações

- Table Name: Description Important FieldsDocumento7 páginasTable Name: Description Important FieldsKhanAinda não há avaliações

- Customer Returns in ERP - Advanced Returns Management: PurposeDocumento5 páginasCustomer Returns in ERP - Advanced Returns Management: PurposecliffyeungAinda não há avaliações

- SAP Tips&Tricks For End UsersDocumento3 páginasSAP Tips&Tricks For End UsersPrasad NathiAinda não há avaliações

- PioneerITGuruSAPMMCourseTopics 2015Documento15 páginasPioneerITGuruSAPMMCourseTopics 2015Anonymous OjdlMM2YC7Ainda não há avaliações

- Abap Basics MaterialDocumento169 páginasAbap Basics Materialhisri01Ainda não há avaliações

- SAP Uses An User ExitDocumento36 páginasSAP Uses An User ExitManuel RobalinhoAinda não há avaliações

- Sap Delivery Change PGI by CodingDocumento3 páginasSap Delivery Change PGI by CodingNarendra TomarAinda não há avaliações

- 19 4.6fi - Credit ManagementDocumento22 páginas19 4.6fi - Credit ManagementBadri HebsurAinda não há avaliações

- Delivery Processing User ExitDocumento2 páginasDelivery Processing User ExitjeetaAinda não há avaliações

- Atp and Tor in Sap: Checking GroupDocumento5 páginasAtp and Tor in Sap: Checking Grouppraveennbs0% (1)

- Material Ledger 01Documento9 páginasMaterial Ledger 01Gopal KrishnanAinda não há avaliações

- WWW Compiricus Com Sap Treasury Finance Implementation TreasDocumento11 páginasWWW Compiricus Com Sap Treasury Finance Implementation TreasAnonymous 8DwLC6m5Ainda não há avaliações

- How To Set Up Inter Company Stock Transfer PDFDocumento13 páginasHow To Set Up Inter Company Stock Transfer PDFUfuk DoğanAinda não há avaliações

- BPC OwnershipDocumento5 páginasBPC OwnershipPushpa RajAinda não há avaliações

- ABAP Development and Naming StandardsDocumento26 páginasABAP Development and Naming StandardsSandeep RawatAinda não há avaliações

- Sap Tcodes Module CA enDocumento544 páginasSap Tcodes Module CA enjmbAinda não há avaliações

- Sap SDDocumento6 páginasSap SDAnonymous z0KUN9Ainda não há avaliações

- Important Tables For Sap SDDocumento142 páginasImportant Tables For Sap SDkarthikbjAinda não há avaliações

- Bid Ask SpreadDocumento22 páginasBid Ask SpreadMike AntolinoAinda não há avaliações

- Variant Config 1Documento26 páginasVariant Config 1mohannaiduram100% (1)

- Contract Allocation - Stand Alone Selling PriceDocumento19 páginasContract Allocation - Stand Alone Selling PricenagalakshmiAinda não há avaliações

- What Is Revenue Recognition?Documento3 páginasWhat Is Revenue Recognition?MarjorieAinda não há avaliações

- BPC System ParametersDocumento41 páginasBPC System ParametersxAinda não há avaliações

- Tables GTSDocumento1 páginaTables GTSsujitQMAinda não há avaliações

- FSCM - Credit Management (Light Implementation Solution) Manage and Collect CreditsDocumento55 páginasFSCM - Credit Management (Light Implementation Solution) Manage and Collect CreditsRajuAinda não há avaliações

- Zshow Man Fi Docs On Stock AccDocumento7 páginasZshow Man Fi Docs On Stock Accmy291287Ainda não há avaliações

- Vertex Sap Partnership 20130930Documento3 páginasVertex Sap Partnership 20130930shailu1900Ainda não há avaliações

- Sap Fico NotesDocumento1 páginaSap Fico NotesRajashekar ReddyAinda não há avaliações

- Dispersion TradingDocumento6 páginasDispersion TradingrusaxstraxstremeAinda não há avaliações

- Copy of SAP SD Tables Field Mapping Data PDFDocumento229 páginasCopy of SAP SD Tables Field Mapping Data PDFergulAinda não há avaliações

- SAP FI Tables in ModuleDocumento3 páginasSAP FI Tables in Modulessbhagat001Ainda não há avaliações

- Material Master Data: Purchasing Data Materials Planning DataDocumento17 páginasMaterial Master Data: Purchasing Data Materials Planning DataSameer SalamAinda não há avaliações

- FM-GM Troubleshooting TipsDocumento38 páginasFM-GM Troubleshooting TipsoliveAinda não há avaliações

- EHP4 RN Financials EN PDFDocumento156 páginasEHP4 RN Financials EN PDFOnur OnukAinda não há avaliações

- SAP Fiori Odata Debug For APP ErrorsDocumento8 páginasSAP Fiori Odata Debug For APP ErrorsAnand BalanAinda não há avaliações

- Building A Tax Calculation ApplicationDocumento11 páginasBuilding A Tax Calculation ApplicationMartin De LeoAinda não há avaliações

- Job Aid For The SAP Workflow Basic InformationDocumento15 páginasJob Aid For The SAP Workflow Basic InformationpradeepjadavAinda não há avaliações

- What Is An SAP CO Module - How Does The SAP Controlling Module WorkDocumento9 páginasWhat Is An SAP CO Module - How Does The SAP Controlling Module WorkPriyadharsshiniAinda não há avaliações

- SAP Solution ManagerDocumento31 páginasSAP Solution ManagerSandeep Ch0% (2)

- Sap Fi Miro Credit MemoDocumento4 páginasSap Fi Miro Credit MemoGagan100% (1)

- Accounting and Financial Close (J58)Documento14 páginasAccounting and Financial Close (J58)Ahmed Al-SherbinyAinda não há avaliações

- Shipment Cost DocumentDocumento6 páginasShipment Cost DocumentDaulath KhanAinda não há avaliações

- Sap SDDocumento40 páginasSap SDBiswajit SahooAinda não há avaliações

- PS User ManualDocumento154 páginasPS User ManualYadav AnujAinda não há avaliações

- Error FS 861 in External Tax System - SAP BlogsDocumento7 páginasError FS 861 in External Tax System - SAP BlogsbirojivenkatAinda não há avaliações

- BAdIs For The Process Integration - SAP Dispute Management Configuration Guide For FI-AR - SAP LibraryDocumento3 páginasBAdIs For The Process Integration - SAP Dispute Management Configuration Guide For FI-AR - SAP LibraryRajuAinda não há avaliações

- ASUG84373 - Is Your Organization Ready For The SAP S4HANA Transformation JourneyDocumento26 páginasASUG84373 - Is Your Organization Ready For The SAP S4HANA Transformation JourneyChakrapani GuntiAinda não há avaliações

- GTS ConnectionDocumento11 páginasGTS ConnectionRavindra ChavaAinda não há avaliações

- EPM BPC10 Exercise5 BPC Logic ScriptsDocumento24 páginasEPM BPC10 Exercise5 BPC Logic Scriptssrivatsav prasadAinda não há avaliações

- BPC Consolidation DesignDocumento4 páginasBPC Consolidation Designsshah2112Ainda não há avaliações

- Case Study Cherrytec Goods Services Tax (GST) in SAPDocumento2 páginasCase Study Cherrytec Goods Services Tax (GST) in SAPSuresh RAinda não há avaliações

- SAP-BPC Course Content at NBITSDocumento4 páginasSAP-BPC Course Content at NBITSManzar AlamAinda não há avaliações

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsAinda não há avaliações

- Implementing Integrated Business Planning: A Guide Exemplified With Process Context and SAP IBP Use CasesNo EverandImplementing Integrated Business Planning: A Guide Exemplified With Process Context and SAP IBP Use CasesAinda não há avaliações

- Questionsa and AnswersDocumento11 páginasQuestionsa and AnswersPavan UlkAinda não há avaliações

- Lokesh ResumeDocumento7 páginasLokesh ResumePavan UlkAinda não há avaliações

- S4 Hana AssetDocumento6 páginasS4 Hana AssetPavan UlkAinda não há avaliações

- S4 Hana AssetDocumento6 páginasS4 Hana AssetPavan UlkAinda não há avaliações

- Payment Methods ExampleDocumento26 páginasPayment Methods ExamplePavan UlkAinda não há avaliações

- Types From RenetaDocumento78 páginasTypes From RenetaPavan UlkAinda não há avaliações

- Kerala ExpensesDocumento5 páginasKerala ExpensesPavan UlkAinda não há avaliações

- List of Doc Types and Posting Keys CombinationDocumento10 páginasList of Doc Types and Posting Keys CombinationPavan UlkAinda não há avaliações

- Intro Erp Using Gbi Slides PP ArisDocumento61 páginasIntro Erp Using Gbi Slides PP Arisraja babuAinda não há avaliações

- Automatic Payment Program (App)Documento168 páginasAutomatic Payment Program (App)Pavan UlkAinda não há avaliações

- IDM - Requestor GuideDocumento21 páginasIDM - Requestor GuidePavan UlkAinda não há avaliações

- Types For GermanyDocumento2 páginasTypes For GermanyPavan UlkAinda não há avaliações

- Wire Transfers: Domestic - Vendor ACH Information International Wire FormDocumento1 páginaWire Transfers: Domestic - Vendor ACH Information International Wire FormPavan UlkAinda não há avaliações

- JSW Steel BBP r2r v1.2Documento32 páginasJSW Steel BBP r2r v1.2Pavan UlkAinda não há avaliações

- SAP Fi275091377345052Documento230 páginasSAP Fi275091377345052RahulAgrawalAinda não há avaliações

- Configuring The Wage Type To FinanceDocumento5 páginasConfiguring The Wage Type To FinancePavan UlkAinda não há avaliações

- Swift mt940 942Documento13 páginasSwift mt940 942Sulaiman YusufAinda não há avaliações

- Treasury mgt11248834938Documento34 páginasTreasury mgt11248834938venkatmba_dsi126Ainda não há avaliações

- Treasury mgt11248834938Documento34 páginasTreasury mgt11248834938venkatmba_dsi126Ainda não há avaliações

- FI MM SDintegration PDFDocumento25 páginasFI MM SDintegration PDFGopa Kambagiri SwamyAinda não há avaliações

- Scenarios For Ledgers in NEW GL: World of SAP SAPDocumento2 páginasScenarios For Ledgers in NEW GL: World of SAP SAPPavan UlkAinda não há avaliações

- SAP HR Payroll Posting Into FI-CODocumento18 páginasSAP HR Payroll Posting Into FI-COPavan UlkAinda não há avaliações

- SAP HR Payroll Posting Into FI-CODocumento18 páginasSAP HR Payroll Posting Into FI-COPavan UlkAinda não há avaliações

- Configuration of Leased Asset AccountingDocumento2 páginasConfiguration of Leased Asset AccountingPavan UlkAinda não há avaliações

- Chat Log C:/Users/Welcome/Documents/Chatlog Sap Fico Training 2015 - 04 - 25 07 - 04Documento1 páginaChat Log C:/Users/Welcome/Documents/Chatlog Sap Fico Training 2015 - 04 - 25 07 - 04Pavan UlkAinda não há avaliações

- 1209227Documento2 páginas1209227Pavan UlkAinda não há avaliações

- 495291Documento8 páginas495291Pavan UlkAinda não há avaliações

- Leased AssetDocumento5 páginasLeased AssetPavan UlkAinda não há avaliações

- W7beg 01uDocumento20 páginasW7beg 01uPavan UlkAinda não há avaliações

- Sap Fico Interview Questions On Fixed AssetsDocumento7 páginasSap Fico Interview Questions On Fixed AssetsPavan UlkAinda não há avaliações

- OM SyllabusDocumento2 páginasOM SyllabusMohit AgrawalAinda não há avaliações

- An Introduction To Supply Base Management PDFDocumento16 páginasAn Introduction To Supply Base Management PDFAmrin Diba100% (1)

- Fabm Week 11 20fabm 121 Week 11 20Documento3 páginasFabm Week 11 20fabm 121 Week 11 20Criscel SantiagoAinda não há avaliações

- What Is Process CostingDocumento12 páginasWhat Is Process CostingPAUL TIMMYAinda não há avaliações

- Fruit Punch VRDocumento11 páginasFruit Punch VRkarampal singhAinda não há avaliações

- Inoper2 q2Documento9 páginasInoper2 q2api-353305207100% (1)

- Mod - HRMDocumento104 páginasMod - HRMEve FajardoAinda não há avaliações

- Ch11 Facility LayoutDocumento61 páginasCh11 Facility Layoutmuhendis_8900Ainda não há avaliações

- LNG Business Plan 20130220Documento50 páginasLNG Business Plan 20130220milham0975% (8)

- The Indian Performing Right ... Vs Mr. Aditya Pandey and Anr. On 28 July, 2011 PDFDocumento31 páginasThe Indian Performing Right ... Vs Mr. Aditya Pandey and Anr. On 28 July, 2011 PDFmic2135Ainda não há avaliações

- Rushika EcommerceDocumento18 páginasRushika EcommerceketkiAinda não há avaliações

- PDFDocumento162 páginasPDFAlen Matthew AndradeAinda não há avaliações

- Building A Better Quiznos - Written ReportDocumento12 páginasBuilding A Better Quiznos - Written Reportapi-300185048Ainda não há avaliações

- As One of Barilla's Customer, What Would Your Response To JITD Be? Why?Documento4 páginasAs One of Barilla's Customer, What Would Your Response To JITD Be? Why?Samuel MosesAinda não há avaliações

- Distribution Strategy: Rural MarketingDocumento47 páginasDistribution Strategy: Rural MarketingpnaronaAinda não há avaliações

- Final Ac Problem1Documento12 páginasFinal Ac Problem1Pratap NavayanAinda não há avaliações

- Allied Banking Corporation vs. OrdoñezDocumento13 páginasAllied Banking Corporation vs. Ordoñezcncrned_ctzenAinda não há avaliações

- A Project Report (1) OutlookDocumento52 páginasA Project Report (1) OutlookVersha Singh80% (5)

- Christopher Collins January Bank StatementDocumento2 páginasChristopher Collins January Bank StatementJim Boaz100% (1)

- Business Result Elementary - Student's Book Audio ScriptsDocumento16 páginasBusiness Result Elementary - Student's Book Audio ScriptsAcademia TworiversAinda não há avaliações

- LAB Task 2Documento15 páginasLAB Task 2FaezzRaAinda não há avaliações

- SLUPDocumento1 páginaSLUPMaria Lee100% (1)

- Amazon Consolidated Interview Experience DocumentDocumento4 páginasAmazon Consolidated Interview Experience DocumentNiraj Kumar100% (1)

- Corporate Social Responsibility Practices in Garments Sector of Bangladesh, A Study of Multinational Garments, CSR View in Dhaka EPZDocumento11 páginasCorporate Social Responsibility Practices in Garments Sector of Bangladesh, A Study of Multinational Garments, CSR View in Dhaka EPZAlexander DeckerAinda não há avaliações

- Building & Renovating GuideDocumento39 páginasBuilding & Renovating GuidefastreturnAinda não há avaliações

- Ilana Organics Sales Report MonthlyDocumento3 páginasIlana Organics Sales Report MonthlyRAVI KUMARAinda não há avaliações

- Acct Statement XX8505 15122023Documento6 páginasAcct Statement XX8505 15122023mohdfazal4545Ainda não há avaliações

- Diana Townhouse in Lancaster EstatesDocumento8 páginasDiana Townhouse in Lancaster EstatesdreamtoaddressAinda não há avaliações

- Differrence Between Primary and Secondary CostDocumento3 páginasDifferrence Between Primary and Secondary CostKauam Santos100% (1)

- EDU31E5Y - Project Billing OverviewDocumento66 páginasEDU31E5Y - Project Billing Overviewosmaaziz44100% (1)