Escolar Documentos

Profissional Documentos

Cultura Documentos

Chapter - Consignment For B.com (Ist) Yr

Enviado por

CacptCoaching67%(3)67% acharam este documento útil (3 votos)

11K visualizações5 páginascpt

Título original

Chapter - Consignment for B.com (Ist) Yr

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOCX, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentocpt

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

67%(3)67% acharam este documento útil (3 votos)

11K visualizações5 páginasChapter - Consignment For B.com (Ist) Yr

Enviado por

CacptCoachingcpt

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

Você está na página 1de 5

1

Assignment - Accounting for Consignment

Concept 1 - Meaning of Consignment

Consignment is dispatched of goods by one person (or firm) to other person (or firm) on the basis that goods

will be sold by the latter on behalf of and at the risk of the former in consideration of commission. The

person sending the goods is called the Consignor and the person to whom the goods are sent is called the

Consignee. The legal relation between the consignor and the consignee is that of principal and agent.

Consignor remains the owner of the goods until the goods are sold by the consignee to the final customer.

The consignee receives sale proceeds and pays expenses on be of the consignor.

Concept 2 - Parties of Consignment

Consignor: The person who is sending the goods (principal)

Consignee: The person who receives the goods and sends them on commission

basis.

Concept 3 - Difference between Consignment and Sale

Basis Consignment Sale

1. Definition

2. Parties

3. Ownership

4. Possession

5. Relationship

6. Risk

7. Return

8. Expenses

9. Remuneration

The process whereby one person

(consignee) sell goods on be of other

person (consignee) on commission basis.

Consignor and Consignee.

Ownership is not transferred.

The transfer of possession is Imp. in case

of consignment.

Principal and Agent.

Risk is not transferred. It is of consignor

since risk follows Ownership.

Goods can be retuned by the consignee if

remained unsold.

All expenses are borne by consignor.

Consignee receives commission on sale

of goods.

Transfer of goods or property by seller to

buyer for a price.

Buyer and Seller.

Ownership is immediately transferred.

In sale, goods may be delivered at a later

date.

Seller & Buyer and Debtor & Creditor.

Risk is transferred. Risk is now of buyer.

Goods can be returned except in case of

breach of condition of sale.

Buyer meets his own expenses.

Buyer does not receive any commission.

Concept 4 - Types of Commission

1. Ordinary Commission It is remuneration of the consignee relating to services performed in

connection with the selling of goods on be of consignor. It is usually calculated as an agreed

percentage on gross proceeds of sale. Besides the normal commission, Consignee may be allowed

following commission also.

2. Del-Credere Commission It is additional commission paid by the consignor to the consignee for

bearing the loss on A/c of bad debts in case of credit sale of consignment stock. Thus where the

consignee gets del -credere commission, he guarantees the payment from consignment debtors. Del -

Credere commission is also paid, generally, at fixed percentage of the gross sale proceeds. Sometimes it

is agreed that del-credere commission will be paid only on credit sales. In the absence of such an

agreement, it is calculated on the gross sales proceeds.

a) If D.C.C. paid: Loss of bad debts is of consignee.

b) If D.C.C. not paid: Loss of bad debts is of consignor.

2

1. Over- Riding Commission It is extra commission allowed to the consignee in addition to the normal

commission usually for making extra efforts to sell a new product in the market. It is also calculated at a

predetermined percentage of gross sales proceeds.

Concept 5 - Expenses of Consignee

The expenses of consignee can be categorized into two ways:

Direct: Expenses incurred for reaching goods up to godown.

Indirect: Expenses incurred after godown.

Direct or Non-Recurring: e.g. Custom Duty, Clearing charges, Landing charges, Import duty, Carriage

inward, Octroi, Dock charges, Freight.

Indirect or Recurring: e.g. Carriage outward, Export duty, Advertisement, Salaries, Printing & Stationary,

Godown rent, Warehouse charges, etc.

Concept 6 Types of Prices

a) Cost price

b) Invoice price

c) Sale price

d) Surplus price

Concept 7 Calculation of Commission

E.g. A sends 1000 cycles to B costing Rs. 500 at an invoice price of Rs. 600. B sold 700 cycles for Rs.

7,00,000. Commission is allowed to be 1% of sale price, 5% of invoice price and 10% of surplus price.

Calculate commission.

[Ans. Total = Rs. 56,000]

Concept 8 Treatment of Discount on Bills Receivable

Two alternatives:

a) If discount is treated as consignment expenses, it is debited to consignment A/c

b) If discount is treated as financial charges, it is debited to P/L A/c

Concept 9 Calculation of Closing Stock

a) If no normal loss and abnormal loss

Cost or invoice price of goods unsold

Add: proportionate expenses of consignor

Add: proportionate direct expenses of consignee

b) In case of normal loss but no abnormal loss

Closing stock= Total cost of GSC + Expenses of Consignor + Direct Expenses of

Consignee + X Closing stock unit

Total units of GSC Normal Loss units

GSC means Goods Sent on Consignment

c) In case of Normal Loss & Abnormal Loss

Closing stock = Total cost of GSC + Expenses of consignor +Direct Expenses of

consignee gross abnormal loss + X Closing stock units

Total units of GSC normal loss units abnormal loss units

Concept 10 Normal Loss and Abnormal Loss

Abnormal loss of stock: Any abnormal loss E.g. loss due to fire, accident, theft, negligence etc will be

treated in the books of consignor in such a manner that consignment profit is not recorded. While

calculating the value of loss, proportionate expenses up to the time of occurrence of loss are included.

Normal Loss of stock: Any loss which occurs doe to natural causes e.g. normal leakage, loss in weight

due to nature of goods, etc is termed as normal loss. Such loss inflates the value of closing stock.

3

Practice Questions

Question 1: A consigned to B goods at Ajmer. B was entitled to the commission of 3% on invoice price and

20% of any surplus price. Goods costing Rs. 24,000 were consigned. This was invoiced at a price to show a

profit of 25% on invoice price. A paid thereon Rs. 1,500 for freight and Rs.500 for insurance. On arrival, B

incurs Rs. 800 as landing charges and Rs. 2,000 for selling expenses. B sold 4/5 goods for Rs. 30,000. Show

the ledger in the books of A. [Ans. Profit = Rs. 4,912, CS = Rs. 6,960]

Question 2: A Ltd. consigned 100 bicycles costing Rs. 250 each at invoice price of Rs. 300 each. A Ltd.

incurs Rs. 1,000 in freight and Rs. 10,000 as advance. B paid Rs. 500 on Octroi, Rs. 400 as Rent and Rs. 300

as Insurance. B sold 80 bicycles for Rs. 25,000. B is entitled to a commission of 5% on invoice price and

25% on any surplus . B paid through bank for the balances.

[Ans. Profit = Rs. 1,650, CS = Rs. 6,300, Consignee Balance = Rs. 12,350]

Question 3:

A consigned to B goods costing Rs. 20,000

Consignor expenses: Carriage Rs. 1,500, Transit Insurance Rs. 500

Consignee expenses: Cartage Rs. 800, Carriage on sale Rs. 1,100,

Advertisements Rs. 400, Consignee sold 80% of the goods for Rs. 35,000. He is allowed to a commission of

5% on sales. [Ans. Profit = Rs. 13,510, Stock = Rs. 4,560]

Question 4: A consigned to B 100 cases at an invoice price of Rs. 10,000. Invoice price is 25% on sales.

Consignor paid Rs. 600 as freight. Consignee paid Rs. 1,000 as import duty and dock dues as Rs. 200 B

sold 80 cases for Rs. 10,500. He was allowed to a commission of 5% on sales.

[Ans. Profit = Rs. 2,535, CS = Rs. 2,360]

Question 5: A consigned to B 1,000 tonnes of coal at a cost of Rs. 100 per tonne. Consignor paid 10,000

towards freight. B accepts a bill for Rs. 50,000 for 2 months. Consignee reported that

a) There was shortage of 50 tonnes due to loading and unloading (N.L.)

b) 800 tonnes were sold at Rs. 130 per tone

c) Expenses: Godown rent Rs. 500, Selling expenses Rs. 1,000, Insurance Rs. 500,

d) Commission 4% on sale proceeds.

[Ans. Profit = Rs. 5,208, CS = Rs. 17,368]

Question 6: A consigned to B 1,000 tonnes of Wheat invoiced @ Rs. 400 per tonne. The cost price was Rs.

370 per tonne. Consignor paid Rs. 15,000 as Loading charges. Consignee sold 900 tones @ Rs. 500 each,

with selling expenses Rs. 27,200. Commission 1% of gross sales. There is a normal loss of 10 tonnes.

[Ans. Profit = Rs. 68,300, CS = Rs. 35,000]

Question 7: Mohan consigned 400 packets of lipsticks, each packet containing 100 lipsticks. Cost of each

packet was Rs. 300. Mohan spent Rs. 50 per packet as cartage & freight. One packet was lost on the way

and Mohan lodged a claim of Rs. 270, claim was admitted. Consignee paid Rs. 19,950 on non-recurring

expenses and Rs. 11,250 as recurring expenses. He sold 370 packets @ Rs. 5.50 per lipstick. Commission

2% on sale plus 1% del-credere commission.

[Ans. Profit = Rs. 38,145, CS = Rs. 11,600, AL = Rs. 80]

Question 8: 1,000 bicycles were consigned by A to B for Rs. 150 each. A paid Rs. 10,000 as Freight and

Rs. 1,500 Insurance in transit. During transit 100 bicycles were totally damaged by fire. B took delivery and

spent Rs. 1,530. B sent a draft of Rs. 50,000 for advance payment. B sold 800 cycles for Rs. 220 each. Bs

expenses is Rs. 2,000. Bs commission @ 5%. Insurance claim is Rs. 14,000.

[Ans. Profit = Rs. 34,640; AL = Rs. 2,150; CS = Rs. 16,320; Balance =Rs.1,13,670]

4

Question 9: A consigned to B 100 scooters, cost of each scooter was Rs. 6,000 but was invoiced at cost +

25%. Following expenses are incurred by A: Freight Rs. 3,500 and Insurance Rs. 1,500. During transit one

scooter was damaged and insurance of claim Rs. 4,500 was received. B sold 7 scooters for Rs. 7,500 each

and paid Rs. 1,700 as storage expenses. He accepted a bill of Rs. 45,000 for 3 months. A discounted the bill

@ 6% p.a. Commission was allowed at 5%.

[Ans. Profit = Rs. 5,825, AL = Rs. 1,550, CS = Rs. 5,56,600 ]

Question 10: A consigned goods of the value of Rs. 2,64,000 at a invoice price of 20% profit on cost. A

paid Rs. 10,000 as carriage and other expenses. B incurred Rs. 2000 as selling expenses. Commission

allowed being 5% and 3% on credit sales (Del-credere). B spent Rs. 2,040 as landing charges 3/4 of goods

were sold at 33.33% profit on cost, of which were credit sales. of the remaining was destroyed by fire

and insurance claim of Rs. 28,000 was lodged which was settled at a discount of 10%.

[Ans. Profit = Rs. 37,810, CS [I.P.] = Rs. 41,105]

Question 11: A consigned 10,000 kg of oil to B for Rs. 2 per kg. A incur Rs. 5,000 as freight. During transit

250 kg were accidentally destroyed by fire for which insurance company paid Rs. 450. B took delivery and

sold 7,500 kg at Rs. 3 per kg. Expenses of B Godown rent Rs. 200, Advertisement Rs. 1,000; Salesman

salary Rs. 2,000. B is entitled to commission of 3% plus 1.5% del-credere commission. A party who has

bought 1,000 kg was able to pay only 80% of the amount due from him. B reported a loss of 100 kg due to

leakage in godown (normal). [Ans. Stock = Rs. 5,431, Balance = Rs. 18,287]

Question 12: A consigned 1000 cases of goods costing Rs. 100 each to B. A pays Carriage Rs. 1,000;

Freight Rs. 3,000; Loading charges Rs. 1,000. B sold 700 cases at Rs. 140 per case and incur Clearing

charges Rs. 850; Warehouse and Storage Rs. 1,700; Packing Rs. 600. If found that 50 cases have been lost in

transit and 100 cases are still in transit. Commission to be allowed 10% on sales.

[Ans. Closing stock = Rs. 15,900, AL = Rs. 5,250]

Question 13: A sent cotton goods to B invoices at Rs. 1,000 The invoice price was worked out by adding

25% to cost. Expenses of A: Packing Rs. 24; Carriage Rs. 16; Insurance Rs. 12; other expenses Rs. 26. B

sold the goods for Rs. 600. Expenses by B: Freight Rs. 30; Insurance Rs. 28; Commission 7.5% on sales.

No sale could be made of remainder and they were brought back after 9 months of a further cost of Rs. 60

The goods were damaged and valued at 20% below cost.

[Ans. Loss = Rs. 121, GSC = Rs. 320]

Question 14: A consigned to B Rs. 50,000 of goods. This was made by adding 25% on cost. A paid Rs.

4,000 as expenses. During transit 1/10 of goods were destroyed and insurance claim was Rs. 2,400. On

delivery B paid Rs. 1,800 as Carriage, Rs. 3,600 as Godown rent and Rs. 1,900 for Selling expenses. 1/9 of

remaining goods were destroyed by fire and no claim was received. B sold the original goods for Rs.

30,000. Commission 5% on sales.

[Ans. AL 1 = Rs. 4,400, AL 2 = Rs. 4,600, CS = Rs. 16,800]

Question 15: Meena & Co. of Calcutta who sent 100 sewing machines on consignment to Najma of Patna

spent Rs. 250 on packing. The cost of each machine was Rs. 112 but it was now invoiced at 25% above cost.

One case containing 5 machines was loss in transit. Najma was asked to pay Rs. 475 as freight on the

remaining machines. He had to spend Rs. 95 as cartage and Octroi duty, Rs. 90 as godown rent. He sold 75

machines @ Rs. 190. He found 10 machines defective and therefore returned to Calcutta at a cost of Rs. 50.

Najma is entitled to a commission of 5% on invoice price, 20% of any excess realized on the invoice price

and 1% del-credere commission. Najma could not realized sale proceeds of 5 machines. Prepare

Consignment A/c, Consignees A/c, Consignment Stock A/c and Consignment Stock Reserve A/c in the

books of Meena & Co.

[Ans. AL = Rs. 572.50, Stock = Rs. 1,485, Profit = Rs. 3,470]

5

Question 16: A of Delhi sent 1,000 machines parts to B of Calcutta on Consignment Basis. The cost of each

machine part was Rs. 100, but was invoiced to B at cost + 25%. The expenses of A were: Freight Rs.

12,000; Insurance Rs. 13,000. During the transit 100 parts were destroyed and the Insurance company paid

Rs. 10,000 towards the claim. B sold 800 parts at Rs. 150 each and paid for Insurance and Storage Rs. 3,000

and Rs. 2,000 respectively. B also accepted a bill for Rs. 80,000 at 3 months drawn by A which A

discounted immediately with his bank at 6% p.a. It was agreed that B is to get 5% commission. Prepare

Consignment A/c, Abnormal Loss A/c and Bs A/c.

[Ans. Profit = Rs. 9,000, AL = Rs. 12,500, Stock = Rs. 15,000]

Question 17: 1,000 bicycles were consigned by Roy & Co. of Calcutta to T.Nu of Rangoon at an invoice

cost of Rs. 950 each. Roy & Co. paid Freight Rs. 65,000 and Insurance Rs. 11,500. During the voyage 100

bicycles were totally damaged by fire had to be thrown overboard, T.Nu took delivery of the remaining

bicycles and paid Rs. 86,400 for custom duty. T.Nu sent a bank draft to Roy & Co. for Rs. 3,20,000 in

advance payment and later sent an A/c sales showing that 800 cycles were sold at Rs. 1,400 each. Expenses

incurred by T.Nu on godown rent and advertisement etc Rs. 12,500. He is entitled to a commission of 5%.

Prepare the necessary A/cs, assuming that nothing has been recovered from insurers due to defect in the

policy.

[Ans. Profit = Rs. 1,53,500, AL = Rs. 1,02,650, Stock = Rs. 1,12,250]

Question 18: On 1

st

Jan, 1998 goods cost price of which was Rs. 66,000 were consigned by Ram of Delhi to

agent Haldi Ram of Dadri at a proforma invoice price of 20% above cost. Haldi Ram paid freight and other

forwarding expenses as Rs. 2000. He was allowed Rs. 1000 per month towards establishment cost; 5%

commission on gross sales and 3% del-credere commission. Haldi Ram paid Rs. 500 as rent of godown for 3

months ended 31

st

March,1998. of the goods were sold for Rs. 66,000 of which were credit sales. of

the balance of goods were stolen, but the stock being insured, a claim lodged for Rs. 7,000 was settled for

Rs. 6,900. Prepare necessary A/cs in the books Ram.

[Ans. Profit = Rs. 6,220, AL = Rs. 8,500, Stock = Rs. 10,150]

Você também pode gostar

- BCOM FA Unit-2Documento44 páginasBCOM FA Unit-2Kavitha aradhyaAinda não há avaliações

- Chapter 1Documento31 páginasChapter 1VirencarpediemAinda não há avaliações

- 1.-Accounting For ConsignmentsDocumento40 páginas1.-Accounting For ConsignmentsEligius Nyika50% (6)

- 18415compsuggans PCC FM Chapter7Documento13 páginas18415compsuggans PCC FM Chapter7Mukunthan RBAinda não há avaliações

- Cost Accs Reconciliation Extra SumsDocumento7 páginasCost Accs Reconciliation Extra Sumspurvi doshiAinda não há avaliações

- Cost of Capital: Vivek College of CommerceDocumento31 páginasCost of Capital: Vivek College of Commercekarthika kounderAinda não há avaliações

- Functions of A SalesmanDocumento2 páginasFunctions of A SalesmanpilotAinda não há avaliações

- Assignment Cost Sheet SumsDocumento3 páginasAssignment Cost Sheet SumsMamta PrajapatiAinda não há avaliações

- 19732ipcc CA Vol2 Cp3Documento43 páginas19732ipcc CA Vol2 Cp3PALADUGU MOUNIKAAinda não há avaliações

- Internal Check As Regard of Sales in AuditingDocumento3 páginasInternal Check As Regard of Sales in Auditingsnigdha samvediAinda não há avaliações

- OG1 9 Branch AccountingDocumento25 páginasOG1 9 Branch AccountingsridhartksAinda não há avaliações

- Accounting For Specialized Institution Set 2 Scheme of ValuationDocumento19 páginasAccounting For Specialized Institution Set 2 Scheme of ValuationTitus Clement100% (1)

- Reconciliation of Cost and Financial AccountsDocumento18 páginasReconciliation of Cost and Financial AccountsHari RamAinda não há avaliações

- LKAS 02 & LKAS 16 DiscussionDocumento2 páginasLKAS 02 & LKAS 16 DiscussionKogularamanan NithiananthanAinda não há avaliações

- Accounting For Branches Including Foreign Branch Accounts: © The Institute of Chartered Accountants of IndiaDocumento53 páginasAccounting For Branches Including Foreign Branch Accounts: © The Institute of Chartered Accountants of IndiaHarikrishna100% (1)

- Unit 2 Scope of Total Income and Residential StatusDocumento16 páginasUnit 2 Scope of Total Income and Residential StatusDeepeshAinda não há avaliações

- Branch AccountsDocumento57 páginasBranch Accountsasadqhse50% (2)

- Consignment Accounting FA - II 1643714291Documento43 páginasConsignment Accounting FA - II 1643714291SWAPNA IS FUNNYAinda não há avaliações

- Cost Accounting by Usry Chapter 6 Exercise 1Documento4 páginasCost Accounting by Usry Chapter 6 Exercise 1Saadia Saeed100% (2)

- Chapter SixDocumento47 páginasChapter SixAlmaz Getachew0% (1)

- Job CostingDocumento18 páginasJob CostingBiswajeet DashAinda não há avaliações

- Unit-II ADocumento26 páginasUnit-II APaytm KaroAinda não há avaliações

- L3-L4 CostsheetDocumento30 páginasL3-L4 CostsheetDhawal RajAinda não há avaliações

- Chapter 10 - Dividend PolicyDocumento37 páginasChapter 10 - Dividend PolicyShubhra Srivastava100% (1)

- Capital Gain Sums With SolutionDocumento10 páginasCapital Gain Sums With Solutionkomil bogharaAinda não há avaliações

- 2.2-Module 2 Only QuestionsDocumento46 páginas2.2-Module 2 Only QuestionsHetviAinda não há avaliações

- Chapter 2 Hire Purchase & Installment SystemDocumento26 páginasChapter 2 Hire Purchase & Installment SystemSuku Thomas Samuel100% (1)

- 13 17227rtp Ipcc Nov09 Paper3aDocumento24 páginas13 17227rtp Ipcc Nov09 Paper3aemmanuel JohnyAinda não há avaliações

- Cost EstimationDocumento5 páginasCost EstimationSenelwa AnayaAinda não há avaliações

- Common Size AnalysisDocumento25 páginasCommon Size AnalysisYoura DeAi0% (1)

- Contarct CostingDocumento13 páginasContarct CostingBuddhadev NathAinda não há avaliações

- Consignment QuestionsDocumento7 páginasConsignment QuestionsHimanshu LatwalAinda não há avaliações

- Cost Sheet CaseDocumento4 páginasCost Sheet CasetanishaAinda não há avaliações

- Dissolutioni of Partnership FirmDocumento69 páginasDissolutioni of Partnership FirmbinuAinda não há avaliações

- As-2 Inventory Valuation: 1) IntroductionDocumento17 páginasAs-2 Inventory Valuation: 1) IntroductionDipen AdhikariAinda não há avaliações

- Cost Sheet - Pages 16Documento16 páginasCost Sheet - Pages 16omikron omAinda não há avaliações

- Final AccountsDocumento20 páginasFinal AccountsSeri SummaAinda não há avaliações

- Branch AccountsDocumento12 páginasBranch AccountsRobert Henson100% (1)

- Branch AccountsDocumento4 páginasBranch Accountsnavin_raghuAinda não há avaliações

- Cost Acc Nov06Documento27 páginasCost Acc Nov06api-3825774100% (1)

- Accounting Standard - 20 Earnings Per ShareDocumento34 páginasAccounting Standard - 20 Earnings Per ShareVelayudham ThiyagarajanAinda não há avaliações

- Cash Flow Statement PDFDocumento30 páginasCash Flow Statement PDFDebashish GoraiAinda não há avaliações

- Master Fuel 1957Documento2 páginasMaster Fuel 1957namrvora072504Ainda não há avaliações

- Profits and Gains From Business and ProfessionDocumento4 páginasProfits and Gains From Business and ProfessionAyaan AhmedAinda não há avaliações

- Dividend Decision Question-3Documento10 páginasDividend Decision Question-3Savya Sachi50% (2)

- Mudule 5 Lecture 2Documento28 páginasMudule 5 Lecture 2mmAinda não há avaliações

- Course Name: 2T7 - Cost AccountingDocumento56 páginasCourse Name: 2T7 - Cost Accountingjhggd100% (1)

- Costing AssignmentDocumento15 páginasCosting AssignmentSumit SumanAinda não há avaliações

- Chapter 8 Operating CostingDocumento13 páginasChapter 8 Operating CostingDerrick LewisAinda não há avaliações

- Cost Sheet Practical ProblemsDocumento2 páginasCost Sheet Practical Problemssameer_kini100% (1)

- Chapter Consignment For B Com Ist YrDocumento5 páginasChapter Consignment For B Com Ist YrhanumanthaiahgowdaAinda não há avaliações

- 8 Consignment FTDocumento8 páginas8 Consignment FTShweta BhadauriaAinda não há avaliações

- Consignment Accounts by Prof. Bharat GuptaDocumento9 páginasConsignment Accounts by Prof. Bharat GuptaZENITH EDUSTATIONAinda não há avaliações

- 747102036-Consignment CPT Notes 19 SeptDocumento15 páginas747102036-Consignment CPT Notes 19 SeptFarrukhsgAinda não há avaliações

- Consignment and Joint Ventures Uint 1Documento29 páginasConsignment and Joint Ventures Uint 1NAMYA JAIN 2112672Ainda não há avaliações

- Consignment AccountDocumento15 páginasConsignment AccountMahmudul Mahmud100% (1)

- Consignment CorrectDocumento51 páginasConsignment CorrectPraveetha Prakash75% (4)

- Consignment AccountDocumento24 páginasConsignment Accountbijjaala.devaAinda não há avaliações

- Consignment Accounting Journal EntriesDocumento22 páginasConsignment Accounting Journal EntriesRashid HussainAinda não há avaliações

- MEI Consignment Accounts (Mei) ConsignmentDocumento17 páginasMEI Consignment Accounts (Mei) Consignmentspeed racerAinda não há avaliações

- Cash Flow Statement of M/S.Abc CoDocumento4 páginasCash Flow Statement of M/S.Abc CoCacptCoachingAinda não há avaliações

- Page 1 of 4Documento4 páginasPage 1 of 4CacptCoachingAinda não há avaliações

- Stock Ledger Name of Product:-Date Particulars Opening Receipt Issued Balance Signed byDocumento2 páginasStock Ledger Name of Product:-Date Particulars Opening Receipt Issued Balance Signed byCacptCoachingAinda não há avaliações

- BCI - Certificate of Foreign Inward RemittanceDocumento2 páginasBCI - Certificate of Foreign Inward RemittanceCacptCoachingAinda não há avaliações

- Statement of Book Debts Position Format For Ubi SunDocumento2 páginasStatement of Book Debts Position Format For Ubi SunCacptCoachingAinda não há avaliações

- Payment Voucher: Mode of Payment: Cash Bank Bank DetailsDocumento1 páginaPayment Voucher: Mode of Payment: Cash Bank Bank DetailsCacptCoachingAinda não há avaliações

- Bank Book of XXXX Bank For The Month of January, 2020Documento3 páginasBank Book of XXXX Bank For The Month of January, 2020CacptCoachingAinda não há avaliações

- As Per Karnataka Stamp Act, It Is Re1/-Per Rs.1000/ - of ConsiderationDocumento2 páginasAs Per Karnataka Stamp Act, It Is Re1/-Per Rs.1000/ - of ConsiderationCacptCoachingAinda não há avaliações

- RSCDocumento2 páginasRSCCacptCoachingAinda não há avaliações

- Annual Report: Sales by MonthDocumento2 páginasAnnual Report: Sales by MonthMohzin KmAinda não há avaliações

- Split of Sh. Cert. & Transfer Reso.15.01.10Documento2 páginasSplit of Sh. Cert. & Transfer Reso.15.01.10CacptCoachingAinda não há avaliações

- TDSDocumento1 páginaTDSCacptCoachingAinda não há avaliações

- Sub of The Article: - Tax Calculator For AY:2021-22Documento1 páginaSub of The Article: - Tax Calculator For AY:2021-22CacptCoachingAinda não há avaliações

- 15Th Alphanumeric Hash Logic Particulars 0 1 2 3 4 5 6: K. RaviDocumento2 páginas15Th Alphanumeric Hash Logic Particulars 0 1 2 3 4 5 6: K. RaviCacptCoachingAinda não há avaliações

- SRT 2Documento1 páginaSRT 2CacptCoachingAinda não há avaliações

- SplitDocumento2 páginasSplitCacptCoachingAinda não há avaliações

- Split SCDocumento1 páginaSplit SCCacptCoachingAinda não há avaliações

- Section 192:: Payment of SalaryDocumento7 páginasSection 192:: Payment of SalaryCacptCoachingAinda não há avaliações

- PRTDocumento1 páginaPRTCacptCoachingAinda não há avaliações

- Reqd PVTDocumento1 páginaReqd PVTCacptCoachingAinda não há avaliações

- PVT LTD CoDocumento1 páginaPVT LTD CoCacptCoachingAinda não há avaliações

- DtsDocumento3 páginasDtsCacptCoachingAinda não há avaliações

- Company Incorp NoticeDocumento1 páginaCompany Incorp NoticeCacptCoachingAinda não há avaliações

- FRMT RentDocumento2 páginasFRMT RentCacptCoachingAinda não há avaliações

- Format - Rent AgreementDocumento2 páginasFormat - Rent AgreementCacptCoachingAinda não há avaliações

- 143726Documento6 páginas143726Satish7777777Ainda não há avaliações

- 1341Documento3 páginas1341ashfaqultanim007Ainda não há avaliações

- Request For Proposal For Auditing ServicesDocumento4 páginasRequest For Proposal For Auditing ServicesavifahAinda não há avaliações

- Sample Engagement Letter: California Society of CPAS - Management of An Accounting Practice State CommitteeDocumento2 páginasSample Engagement Letter: California Society of CPAS - Management of An Accounting Practice State CommitteeCacptCoachingAinda não há avaliações

- RadDocumento40 páginasRadCacptCoachingAinda não há avaliações

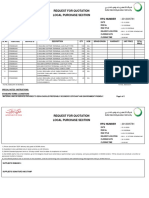

- Request For Quotation Local Purchase Section: RFQ NumberDocumento2 páginasRequest For Quotation Local Purchase Section: RFQ NumberSKS MMGTAinda não há avaliações

- Law RTPDocumento39 páginasLaw RTPPromoting MSAinda não há avaliações

- COIL Reflection Prompts (Spring 2020)Documento3 páginasCOIL Reflection Prompts (Spring 2020)Aldo VlahovljakAinda não há avaliações

- Forensic 4Documento24 páginasForensic 4angeliquezyrahangdaan29Ainda não há avaliações

- Exercise #5-1-3Documento5 páginasExercise #5-1-3Aaron HuangAinda não há avaliações

- Tomasa J 4Documento1 páginaTomasa J 4CDT. NICDAO PRINCE ALREI G.Ainda não há avaliações

- United States Court of Appeals For The Fifth Circuit: FiledDocumento14 páginasUnited States Court of Appeals For The Fifth Circuit: FiledFlorian MuellerAinda não há avaliações

- Self-Assessment For Administrators of Child Care ProgramsDocumento14 páginasSelf-Assessment For Administrators of Child Care ProgramsCYRENE MAE LASQUITEAinda não há avaliações

- Bunga Mega Aprilia, Fis Purwangka, Akhmad SolihinDocumento15 páginasBunga Mega Aprilia, Fis Purwangka, Akhmad SolihinpramAinda não há avaliações

- 3rd Quarter Reviewer Exam HahahakdoqDocumento9 páginas3rd Quarter Reviewer Exam HahahakdoqKurt AgustinAinda não há avaliações

- آليات استقطاب الزوار لترقية السياحة المتحفية من خلال وسائل الإعلامDocumento9 páginasآليات استقطاب الزوار لترقية السياحة المتحفية من خلال وسائل الإعلامSalim GuebboubAinda não há avaliações

- One Past But Many Histories Controversies and Conflicting Views in Philippine HistoryDocumento3 páginasOne Past But Many Histories Controversies and Conflicting Views in Philippine HistoryJanice LibatoAinda não há avaliações

- Social Security and Its Importance in Labour LawDocumento4 páginasSocial Security and Its Importance in Labour LawShilpi AgarwalAinda não há avaliações

- Certificate of Incumbency NewDocumento7 páginasCertificate of Incumbency NewAnna Lisa DaguinodAinda não há avaliações

- Interview Questions On Practicum 1 Subject FINALDocumento3 páginasInterview Questions On Practicum 1 Subject FINALSapphireAinda não há avaliações

- Tickets State of OriginDocumento4 páginasTickets State of OriginSimon MckeanAinda não há avaliações

- DeterminersDocumento2 páginasDeterminerskephyooAinda não há avaliações

- Islamic Concept of JihadDocumento3 páginasIslamic Concept of JihadwaqarAinda não há avaliações

- Tax Remedies DiagramDocumento15 páginasTax Remedies DiagramDomie AbataAinda não há avaliações

- Lesson Summaries: Traditional and Non-Traditional Family Types Existing in The CaribbeanDocumento3 páginasLesson Summaries: Traditional and Non-Traditional Family Types Existing in The CaribbeanConrad SawyersAinda não há avaliações

- Felicitas Amor-Catalan, Petitioner, vs. Court of Appeals, Manila, OrlandoDocumento3 páginasFelicitas Amor-Catalan, Petitioner, vs. Court of Appeals, Manila, Orlandobrian santosAinda não há avaliações

- Qiyas: Presented By: Sijal ZafarDocumento37 páginasQiyas: Presented By: Sijal ZafarSijal zafarAinda não há avaliações

- Unorganised Workers' Social Security Act, 2008-1Documento17 páginasUnorganised Workers' Social Security Act, 2008-1Awadhesh MalviyaAinda não há avaliações

- In Hostile Terrain: A Human Rights Report On US Immigration Enforcement by Amnesty InternationalDocumento88 páginasIn Hostile Terrain: A Human Rights Report On US Immigration Enforcement by Amnesty InternationalBjustb Loewe0% (1)

- Project AssignmentDocumento5 páginasProject AssignmentFariha Younas DarAinda não há avaliações

- Terms Conditions Citi Speed Cash and Citi Balance Conversion Sodexo Promo2 PDFDocumento2 páginasTerms Conditions Citi Speed Cash and Citi Balance Conversion Sodexo Promo2 PDFhoneylyncastro948yahoo.comAinda não há avaliações

- (1952) 2 Q.B. 297Documento11 páginas(1952) 2 Q.B. 297Joshua ChanAinda não há avaliações

- Pil - T16Documento96 páginasPil - T16harsh jainAinda não há avaliações

- Lesson 8 Apportionment and VotingDocumento53 páginasLesson 8 Apportionment and VotingJIANNA SHIR LABAYOAinda não há avaliações

- Agustin vs. Intermediate Appellate Court 187 SCRA 218, July 05, 1990Documento7 páginasAgustin vs. Intermediate Appellate Court 187 SCRA 218, July 05, 1990juan dela cruzAinda não há avaliações