Escolar Documentos

Profissional Documentos

Cultura Documentos

MBA Assignment - Final Project by Mahiuddin Shams

Enviado por

Mahiuddin Shams100%(1)100% acharam este documento útil (1 voto)

56 visualizações104 páginasMBA Assignment - Final Project by Mahiuddin Shams for A Comparative Study of Investment Plan of ICICI Prudential Life Insurance and Life Insurance with other Companies

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOC, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoMBA Assignment - Final Project by Mahiuddin Shams for A Comparative Study of Investment Plan of ICICI Prudential Life Insurance and Life Insurance with other Companies

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOC, PDF, TXT ou leia online no Scribd

100%(1)100% acharam este documento útil (1 voto)

56 visualizações104 páginasMBA Assignment - Final Project by Mahiuddin Shams

Enviado por

Mahiuddin ShamsMBA Assignment - Final Project by Mahiuddin Shams for A Comparative Study of Investment Plan of ICICI Prudential Life Insurance and Life Insurance with other Companies

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOC, PDF, TXT ou leia online no Scribd

Você está na página 1de 104

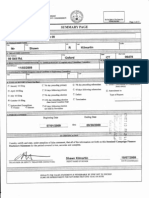

LC Code: 01713

Apar India Institute of Management & Technology

Rohini, Sector - 8, New Delhi - 110085, Tel.: 011 45044000

www.aparindiacollege.com

A Comparatie !tudy of Inestment "lan of ICICI "rudential Life

Insurance and Life Insurance #ith other Companies

By:

Mahiuddin !hams

A project report submitted in partial fulfillment of the requirements for the

degree of Master of Business Administration of Sikkim Manipal University,

NDA

!i$$im Manipal %niersity

of Health, Medical and Technological Sciences

Distance Education Wing, Syndicate house,

Manipal - 576104

P a g e | 1 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

I hereby declare that the project entitled

A Comparatie !tudy of Inestment "lan of ICICI "rudential Life

Insurance and Life Insurance #ith other Companies

Submitted in partial fulfillment of the requirements for the degree of Masters of

Business Administration to Sikkim Manipal University, NDA, is my original

work and not submitted for the award of any other degree, diploma, fellowship,

or any other similar title or prizes.

Place: New Delhi Mahiuddin !hams

Date: 02.02.2009 Reg. No: 510738565

P a g e | 2 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

The project report of

Mahiuddin !hams

A Comparatie !tudy of Inestment "lan of ICICI "rudential Life

Insurance and Life Insurance #ith other Companies

is approved and is acceptable in quality and form.

nternal Examiner External Examiner

P a g e | 3 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

This is to certify that the project report entitled

A Comparatie !tudy of Inestment "lan of ICICI "rudential Life

Insurance and Life Insurance #ith other Companies

Submitted in partial fulfillment of the requirements for the degree of Masters of

Business Administration to Sikkim Manipal University of Health, Medical and

Technological Sciences

Mahiuddin !hams

Has worked under my supervision and guidance and that no part of this report

has been submitted for the award of any other degree, diploma, fellowship or

other similar titles or prizes and that the work has not been published in any

journal or magazine.

Reg. No: 510738565 Certified

(Guide's name)

P a g e | 4 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

A&!T'ACT

An operational definition of the insurance is:

The benefit provided by a particular kind of indemnity contract, called an

insurance policy;

That is issued by one of several kinds of legal entities (stock insurance

company, mutual insurance company, reciprocal, or Lloyd's syndicate,

for example), any of which may be called an insurer;

The business of insurance is related to the protection of the economic

values of assets.

The life insurance business deals with risks relating to life of human

beings.

The objective of this project was to compare the investment plan of ICICI

"rudential Life Insurance with other competitive companies. While doing the

comparison have studied the investment plans ICICI "rudential Life

Insurance and that of the other competitive companies. have also compared

the market status of the company in respect of the other competitive

companies.

would like to thank my mentor who provided me the guidance for

understanding the investment plans, which will give me lots of experience and

help me in future.

P a g e | 5 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

AC()*+L,-.,M,)T

hereby express my gratitude to faculties & Apar India Institute of

Management and Technology for giving me this opportunity to work on this

project and for helping me and providing timely guidance in all matters related

to my project.

am thankful to Mr/ 'am "u0an !harma (Financial Planning Manager, ICICI

"rudential Life Insurance) for providing me with an opportunity to work in this

organization. also thank him for his valuable inputs in my project and for also

giving me an insight into the actual working of the company.

express my indebtedness and gratitude to my company project guide Mr/

Lalit Tyagi (Unit Manager, ICICI "rudential Life Insurance) for his constant

support and encouragement throughout the execution of the project, without

him this project would not have been possible.

Mahiuddin !hams

P a g e | 6 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

I)-,1

!/)* C*)T,)T! "A., )*/

1 ntroduction 8

2 Objectives Of Research 24

3 Research Methodology 25

4 Literature Review 27

5 ndustry profile 33

- SWOT analysis of nsurance sector 39

6 Company profile 44

- Fact Sheet 44

- Distribution 45

- Promoters 45

- Management Team 46

- Products 52

7 Data analysis 78

- On the basis of company share in market 78

- On the basis of investment plan of other companies 88

8 Conclusion 93

9 Recommendation 94

10 Annexure 98

11 Bibliography 104

I)T'*-%CTI*)

P a g e | 7 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

+hat Is Insurance

The business of insurance is related to the protection of the economic values

of the asset. Every asset has a value. The asset would have been created

through the efforts of the owner. The asset is valuable to the owner, because

he expects to get some benefits from it. The benefit may be an income or

something else. t is a benefit because it meets some of his needs. n case of

factory or a cow, the product generated by is sold and income is generated. n

case of a motor car, it provides comfort and convenience in transportation.

There is no direct income.

Every asset is expected to last for a certain period of time during which it will

perform. After that, the benefit may not be available. There is a life-time for a

machine in a factory or a cow or a motor car. None of them will last for ever.

The owner is aware of this and he can so manage his affairs by the end of that

period or life-time, a substitute is made available. Thus, he makes sure that the

value or income is not lost. However, asset may get lost earlier. An accident or

some other unfortunate event may destroy it or make it non-functional. n that

case, the owner and those deriving benefits there from, would be deprived of

the benefit and the planned substitute would not have been ready. There is an

adverse or unpleasant situation. nsurance is a mechanism that helps to

reduce the effect of such adverse situations.

P a g e | 8 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

+hat is Life Insurance2

Life insurance ensures that your family will receive financial support in your

absence. Put simply, life insurance provides your family with a sum of money

should something happen to you. t protects your family from financial crises.

n addition to serving as a protective cover, life insurance acts as a flexible

money-saving scheme, which empowers you to accumulate wealth-to buy a

new car, get your children married and even retire comfortably.

Life insurance also triples up as an ideal tax-saving scheme.

Brief History of Insurance

The business of insurance started with marine business. Traders, who used to

gather in the Lloyd's coffee house in London, agreed to share the losses to

occur because of pirates who robbed on the high seas or because of bad

weather spoiling the goods or sinking the ship. The first insurance was issued

in 1583 in England. n ndia, insurance began in 1870 with life insurance being

transacted by an English company, the European and the Albert. The first

ndian insurance company was the Bombay Mutual Assurance Society Ltd,

formed in 1870. This was followed by the Oriental Life Assurance Co. in 1874,

the Bharat in 1896 and the Empire of ndia in 1897.

Later, the Hindustan Co operative was formed in Calcutta, the United ndia in

Madras, the Bombay Life in Bombay, the National in Calcutta, the New ndia in

Bombay, the Jupiter in Bombay and the Lakshmi in New Delhi. These were all

ndian companies, started as a result of the swadeshi movement in the early

1900's. By the year 1956, when the life insurance business was nationalised

and the Life nsurance Corporation of ndia (LC) was formed on 1

st

September

1956, there were 170 companies and 75 provident fund societies transacting

life insurance business in ndia. After the amendments to the relevant laws in

1999, the L..C. did not have the exclusive privilege of doing life insurance

business in ndia. By the 31.3.2002, eleven new insurers had been registered

and had begun to transact life insurance business in ndia.

P a g e | 9 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

Purpose and Need of Insurance

Assets are insured, because they are likely to be destroyed, through accidental

occurrences. Such possible occurrences are called perils. Fire, floods,

breakdowns, lightning, earthquakes, etc, are perils. f such perils can cause

damage to the asset, we say that the asset is exposed to that risk. Perils are

the events. Risks are the consequential losses or the damages. The risk to an

owner of a building, because of the peril of an earthquake, may be a few lakhs

or a few crores of rupees, depending on the cost of the building and the

contents in it.

The risk only means that there is a possibility of loss or damage. The damage

may or may not happen. nsurance is done against the contingency that it may

happen. There has to be an uncertainty about the risk. nsurance is relevant

only if there are uncertainties. f there is no uncertainty about the occurrence of

an event, it cannot be insured against. n the case of an human being, death is

certain, but the time of death is uncertain. n the case of a person who is

terminally ill, the time of death is not uncertain, though not exactly known. He

cannot be insured.

nsurance does not protect the asset. t does not prevent its loss due to the

peril. The peril cannot be avoided through the insurance. The peril can

sometimes be avoided, through better safety and damage control

management. nsurance only tries to reduce the impact of the risk on the

owner of the asset and those who depend on that asset. t only compensates

the losses and that too, not fully.

Only economic consequences can be insured. f the loss is not financial,

insurance may not be possible. Examples of non-economic losses are love and

affection of parents, leadership of managers, sentimental attachments to family

heirlooms, innovative and creative abilities, etc.

How Insurance Works

The mechanism of insurance is very simple. People who are exposed to the

same risks come together and agreed that, if any one of them suffers a loss,

P a g e | 10 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

the others will share the loss and make good to that person who lost. All people

who send goods by ship are exposed to the same risks which are related to

water damage, ship sinking, piracy, etc. Those owing factories are not exposed

to these risks, but they are exposed to different type of risks like, fire,

hailstorms, earthquakes, lightning, burglary, etc. Like this different type of risks

can be identified and separate groups made, including those exposed to such

risks. By this method the heavy loss that any one of them may suffer (all of

them may not suffer such losses at the same time) is divided into bearable

small losses by all. n other words, the risk is spread among the community

and the likely big impact on one is reduced to smaller manageable impacts on

all.

f a jumbo Jet with more than 350 passenger crashes, the loss would run into

several crores of rupees. No airline would be able to bear such a loss. t is

unlikely that many Jumbo Jets will crash at the same time. f 100 airline

companies flying Jumbo Jets, come together into the insurance pool, whenever

one of the Jumbo Jets in the pool crashes, the loss to be borne by each airline

would come down to a few lakhs of rupees. Thus, insurance is a business of

'sharing'.

There are certain principles, which make it possible for insurance to remain a

fair arrangement. The first is that it is difficult for any one individual to bear the

consequences of the risks that he is exposed to. t will become bearable when

the community shares the burden. The second is that the peril should occur in

an accidental manner. Nobody should be in a position to make the risk happen.

n other words, none in the group should set fire to his assets and asks others

to share the costs of damage. This would be taking the unfair advantage of an

arrangement put into place to protect people from the risks they are exposed

to. The occurrence has to be random, accidental, and not the deliberate

creation of the insured person.

The manner in which the loss is to be shared can be determined before-hand.

t may be proportional to the risk that each person is exposed to. This would be

indicative of the benefit he would receive if the peril befell him. The share could

be collected from the members after the loss has occurred or the likely shares

may be collected in advance, at the time of admission to the group. nsurance

P a g e | 11 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

companies collect in advance and create a fund from which the losses are

paid.

The collection to be made from each person in advance is determined on

assumptions. While it may not be possible to tell beforehand, which person will

suffer, it may be possible to tell, on the basis of past experiences, how many

persons, on an average, may suffer losses. The following example explains the

above concept of insurance:

Example:

n a village, there are 400 houses, each valued at Rs.20, 000. Every year, on

the average, 4 houses get burnt, resulting into a total loss of Rs.80, 000. f all

the 400 owners come together and contribute Rs.200 each, the common fund

would be Rs.80000. This is enough to pay Rs.20000 to each of the 4 owners

whose hoses got burnt. Thus, the risk of 4 owners is spread over 400 house

owners of the village.

The Human Asset

A human being is an income generating asset. One's manual labour,

professional skills and business acumen are the assets. This asset can also be

lost through unexpectedly early death or through sickness and disabilities

caused by accidents. Accidents may or may not happen. Death will happen,

but the timing is uncertain. f it happens around the time of one's retirement,

when it could be expected that the income will normally cease, the person

concerned could have made some other arrangements to meet the continuing

needs. But if it happens much earlier when the alternate arrangements are not

in place, there can be losses to the person and dependents. nsurance is

necessary to help those dependent on the income.

A person, who may have arrangements for his needs after his retirement, also

would need insurance. This is because the arrangements would have been

made on the basis of some expectations like, likely to live for another 15 years,

or that children will look after him. f any of these expectations do not become

true, the original arrangement would become inadequate and there could be

difficulties. Living too long can be as much a problem as dying too young. Both

are risks, which need to be safeguarding against. nsurance takes care.

P a g e | 12 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

The Business of Insurance

nsurance companies are called insurers. The business of insurance is to:-

a) Bring together persons with common insurance interests (sharing the

same risks)

b) Collect the share or contribution (called premium) from all of them and,

c) Pay out compensation (called claims) to those who suffer.

The premium is determined on the same lines as indicated in the example

above, but with some further refinements.

n ndia, insurance business is classified primarily as life and non-life or

general. Life insurance includes all risks related to the lives of human beings

and general insurance covers the rest. General insurance has three

classifications viz, Fire (dealing with all fire related risks), Marine (dealing with

all transport related risks and ships) and Miscellaneous (dealing with all others

like liability, fidelity, motor, crop, personal accident, etc.). Personal accident and

sickness insurance, which are related to human beings, is classified as 'non-

life' in ndia, but is classified as 'life', in many other countries. What is 'Non-life'

in ndia is termed as 'Property and Casualty' in some other countries.

The insurer is in the position of a trustee as it is managing the common fund,

for and on behalf of the community of policyholders. t has to ensure that

nobody is allowed to take undue advantage of the arrangement. That means

that the management of the insurance business requires care to prevent entry

(into the group) of people whose risks are not of the same kind as well as

paying claims on losses that are not accidental. The decision to allow entry is

the process of underwriting of risk. Underwriting includes assessing the risk,

which means, making an evaluation of how much is the exposure to the risk.

The premium to be charged depends on this assessment of the risk. Both

underwriting and claim settlements have to be done with great care.

ole of Insurance In Economic !e"elopment

As we know for economic development, investments are necessary.

nvestments are made out of savings. A life insurance company is a major

P a g e | 13 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

instrument for the mobilization of savings of the people, particularly from the

middle and the lower income groups. These savings are channeled into

investments for economic growth.

All good life insurance companies have huge funds, accumulated through the

payments of small amounts of premia of individuals. These funds are invested

in ways that contribute substantially for the economic development of the

countries in which they do business. The private insurers in ndia are new and

had not built up funds in 2002. But now they are also capable to contribute to

the country's economic development.

Types of Insurance

I/ Classification on the 3asis of nature of 3usiness

i# Life Insurance

Life insurance may be defined as a contract in which the insurer, in

consideration of a certain premium, either in a lump sum or by other periodical

payments, agrees to pay to the assured, or to the person for whose benefit the

policy is taken, the assured sum of money / on the happening of a specified

event contingent on the human life.

A contract of life insurance, as in other forms of insurance, requires that the

assured must have at the time of the contract an insurable interest in his half

upon which the insurance is effected. n a contract of life insurance, unlike

other insurance interest has only to be proved at the date of the contract, and

not necessarily present at the time when the policy falls due.

A person can assure in his own life and every part of it, and can insure for any

sum whatsoever, as he likes. Similarly, a wife has an insurable interest in her

husband and vice-versa. However, mere natural love and affection is not

sufficient to constitute an insurable interest. t must be shown that the person

affecting an assurance on the life of another is so related to that other person

as to have a claim for support. For example, a sister has an insurable interest

in the life of a brother who supports her.

P a g e | 14 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

A person not related to the other can have insurable interest on that other

person. For example, a creditor has insurable interest in the life of his debtor to

the extent of the debt. A creditor can insure the life of his debtor up to the

amount of the debt, at the time of issue of the policy.

An employee has an insurable interest in the life of the employer arising out of

contractual obligation to employ him for a stipulated period at fixed salary.

Similarly, from an employer to the employer, who is bound by the contract to

serve for a certain period of time.

However, mere natural love and affection is not sufficient to constitute an

insurable interest. t must be shown that the person affecting an assurance on

the life of another is so related to that other person as to have a claim for

support. For example, a sister has an insurable interest in the life of a brother

who supports her.

ii# 4ire Insurance

Fire insurance is a contract to indemnity the insured for distribution of or

damage to property caused by fire. The insurer undertakes to pay the amount

of the insured's is loss subject to the maximum amount stated in the policy. Fire

insurance is essentially a contract of indemnity, not against accident, but

against loss caused by accident, ft is becoming very common in fire insurance

policies to insert a condition, called the average clause, by which the insured is

called upon to bear a portion of the loss himself. The main object of this clause

is to check under-insurance and to encourage for full insurance. t impress

upon the property-owner for the need of having his property accurately valued

before insurance.

Regarding insurable interest, the insured must have insurable interest in the

subject matter both at the time of affecting the policy and at the time of loss.

The risk in fire insurance policy commences from the moment of cover note, or

the deposit receipt, or the interim protection is issued, and continues for the

term covered by the contract of insurance. t may even date back; if the parties

so intend. The rate of premium varies to the degree of hazard or risk involved.

iii# Marine insurance

A contract of marine insurance is an agreement whereby the insurer

P a g e | 15 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

undertakes to indemnity the assured in a manner and to the extent thereby

agreed, against marine losses, that is, the losses incidental to marine

adventure. There is a marine adventure when any insurable property is

exposed to marine perils; Marine perils also known as perils of the seas,

means the perils consequent on, or incidental to, the navigation of the sea or

the perils of the seas, such as fire, war perils, pirates, rovers, thieves; captures.

Jettisons, barratry and any other perils which are either of the like kind or may

be designed by the policy.

There are different types of marine policies known by different names

according to the manner of their execution or the risk they cover. They are:

Voyage policy, time policy, valued policy, unvalued policy, floating policy, wager

or honour policy.

i"# !ocial insurance

Social insurance has been developed to provide economic security to weaker

sections of the society who are unable to pay the premium for adequate

insurance Pension plans, disability benefits, unemployment benefits; sickness

insurance, etc. are the various forms of social insurance.

"# Miscellaneous Insurance

The process of fast development in the society gave rise to a number of risks

or hazards. To provide security against such hazards, many other types of

insurance also have been developed. The important among them are:

i) Vehicle insurance on buses, trucks motorcycles, etc.,

ii) Personal accident insurance (by pacing an annual premium of Rs 12/-

Policy worth Rs. 12000/- can be insured.)

iii) Burglary insurance - (against theft, decoity etc.)

iv) Legal liability insurance (insurance whereby the assured is liable to pay

the damages to property or to compensate the loss of personal injury or

death.)

v) Crop insurance (crops are insured against losses due to heavy rain and

floods, cyclone, draughts, crop diseases, etc.)

vi) Cattle insurance - (nsurance for indemnity against the loss of cattle's

from various kinds of disease)

P a g e | 16 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

n addition to the above, insurance policies are available against crime,

medical insurance, bullock cart insurance, jewelry insurance, cycle rickshaw

insurance, radio - T.V. insurance, etc.

II/ Classification from 'is$ "oint of 5ie#

From risk point of view, insurance can be classified into four categories:

i) Personal insurance

ii) Property insurance

iii) Liability insurance

iv) Fidelity guarantee insurance

A brief description of each is given below:

i# "ersonal insurance

Personal insurance refers the loss to life by accident, or sickness to individual

which is covered by the policy. The insurer undertakes to pay the sum insured

on the happening of certain event or on maturity of the period of insurance.

The insurable sum is determined at the time of effecting the policy and includes

life insurance, accident insurance, and sickness insurance. Life insurance

contains the element of investment and protection, while the accidental,

sickness or health insurance contains the element of indemnity only.

ii# "roperty insurance

Contract of property insurance is a contract of indemnity. Proof by the assured

of loss is an essential element of property insurance. "The policies of insurance

against burglary, home-breaking or theft etc. fall under this category. The

assured is required to protect the insured property. After the loss has taken

place, the assured usually required to notify the police as to losses.

iii# Lia3ility insurance

Liability insurance is the major field of General insurance whereby the insurer

promises to pay the damage of property or to compensate the tosses to a third

party. The amount of compensation is paid directly to third party. The fields of

liability insurance include workmen compensation insurance/ third party motor

insurance, professional indemnity insurance and third party liability insurance

etc. n liability insurance, there may be various reasons for the arising of

P a g e | 17 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

liability; viz., accident of a worker at the workplace, defective goods, explosion

in the factory during the process of production, formation of poisonous gas

within the factory, due to the uses of chemicals and other such substances in

the manufacturing process.

i"# 4idelity guarantee insurance

n this type of insurance, the insurer undertakes to indemnify the assured

(employer) in consideration of certain premium, for losses arising out of fraud,

or embezzlement on the part of the employees. This kind of insurance is

frequently adopted as a precautionary measure in cases where new and

untrained employees are given positions of trust and confidence.

$ome Insurance Terms

"remium: The payment made by the insured, as consideration for the grant of

the insurance is known as Premium. The premium may be payable annually or

at shorter intervals of time & may be payable throughout the period of the

policy or only for a fixed term, depending upon the conditions in the policy.

"remium ,arned & "remium +ritten: Premium earned is the amount of

premiums earned by the risk covered by an insurer during a period.

Premium written is the amount customers are required to pay for policies

written during the year. The two differ because of the timing of premium

payments. For example if:

An insurance policy that runs from the 1st July 2005 to the 30th June

2006.

The premium is Rs.10000.

The insurance company has a December year-end.

Then, as the policy runs for six months of this year and six months of next, half

the risk is taken in the current year and half next year. Therefore the premium

earned is Rs.5,000 for 2005 and Rs.5,000 for 2006. However as the cover is

agreed during 2005, the gross premium written is Rs.10,000 for 2005.

Claims: A claim occurs when a policy falls due for payment. n case of life

insurance business, it will arise either on death or on maturity of policy i.e. on

P a g e | 18 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

the expiry of the specified term of years. n case of general insurance

business, a claim arises only when the loss occurs or the liability arises.

"remium -eficiency: Premium deficiency is recognised if the ultimate amount

of expected net claim costs, related expenses and maintenance costs exceeds

the sum of related premium carried forward to the subsequent accounting

period as the reserve for unexpired risk. Premium deficiency is calculated by

line of business. The Company considers maintenance costs as relevant costs

incurred for ensuring claim handling operations.

Catastrophe 'esere: This reserve shall be created in accordance with

norms if any, prescribed by authority. nvestment of funds out of Catastrophe

reserve shall be made in accordance with prescription of the authority.

4air 5alue Change: Fair Value Change account represents unrealised gains

or losses in respect of investments outstanding at the close of the year. The

balance in the account is considered as component of shareholders' funds

though not available for distribution as dividend.

Claims incurred: Claims incurred shall comprise claims paid, specific claims

settlement cost wherever applicable & change in the outstanding provision for

claims at the year-end.

-iminution in the alue of inestments: Diminution in the value of

investments is the reduction in value of investments.

-eferred Ta6es: The deferred taxes assets and liabilities arise due to timing

differences.

Annuity: A recurring payment, which may be constant or may increase, usually

made until the death of the person receiving the annuity. An annuity can also

be paid to 2 people. n this case, the payment ceases on death of second

person.

Annuity Certain: Annuity, which makes payments for a specified period of

time regardless of whether the annuitant is alive or dead during that period.

P a g e | 19 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

"olicyholder7s !urplus: The amount by which an insurance company's

assets exceed its liabilities, as reported in its annual statement. For a stock

insurer, the policyholder's surplus is the sum of its capital & surplus; for a

mutual insurer, the policyholder's surplus equals the company's surplus.

!hareholders7 and "olicyholders7 4und: The Shareholders' Fund comprises

of Share Capital, General Reserve and Capital Reserve. The Policyholders'

Fund comprises of Technical Reserves and Provision for Outstanding Claims.

Ceded 'einsurance: The amount of insurance transferred from a ceding

insurer to a reinsurer.

Ceding Insurer: An original or primary insurer that purchases reinsurance; in

so doing, the primary insurer cedes part of its business to the reinsurer.

'einsurance: Risk transferred from one insurer to another; a contract whereby

the assuming insurer (reinsurer) agrees to indemnify the ceding insurer

(cedent) for all or part of the claim liabilities under policies issued by the ceding

insurer, which pays the reinsurer a premium in return. By ceding some of its

business, an insurer may write more business within its reserve or surplus

requirements. Assuming insurers may cede risks to other reinsurers, which is

called retrocession. The two basic types of reinsurance are facultative,

involving the transfer of individual risks, and treaty, involving the transfer of all

risks in a class of business. The ceding insurer usually remains liable for policy

claims, and the reinsurer must indemnify the cedent. n the less common

assumption reinsurance, the reinsurer becomes directly liable for claims

settlement.

'etrocession: Reinsurance of reinsurance. Example: Company "B has

accepted reinsurance from Company "A, and then obtains for itself, on such

business assumed, reinsurance from Company "C. This secondary

reinsurance is called a Retrocession. The transaction whereby a reinsurer

cedes to another reinsurer all or part of the reinsurance it has previously

assumed.

Ad"anta%es of &ife Insurance

P a g e | 20 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

Life insurance has no competition from any other business. Many people think

that life insurance is an investment or a means of saving. This is not a correct

view. When a person saves, the amount of funds available at any time is equal

to the amount of money set aside in the past, plus interest. This is so in a fixed

deposit in the bank, in national savings certificates, in mutual funds and all

other savings instruments. f the money is invested in buying shares and

stocks, there is the risk of the money being lost in the fluctuations of the stock

market. Even if there is no loss, the available money at any time is the amount

invested plus appreciation. n life insurance, however, the fund available is not

the total of the savings already made (premiums paid), but the amount one

wished to have at the end of the savings period (which is the next 20 or 30

years). The final fund is secured from the very beginning. One is paying for it

later, out of the savings. One has to pay for it only as long as one lives or for a

lesser period if so chosen. There is no other scheme which provides this kind

of benefit. Therefore, life insurance has no substitute.

Even so, a comparison with other forms of savings will show that life insurance

has the following advantages:

n the event of death the settlement is easy. The heirs can collect the

money quicker, because of the facility of nomination and assignment.

The facility of nomination is now available for some bank accounts.

There is a certain amount of compulsion to go through the plan of

savings. n other forms, if one changes the original plan of savings, there

is no loss. n insurance, there is a loss.

There are tax benefits, both in income tax and in capital gains.

Marketability and liquidity are better. A life insurance policy is property

and can be transferred or mortgaged. Loans can be raised against the

policy.

t enhances the existing standards of living.

t helps people live financially solvent lives.

Life insurance is a way of life.

(ey &enefits of Life Insurance

P a g e | 21 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

Life insurance, especially tailored to meet your financial needs

Need for &ife Insurance

Today, there is no shortage of investment options for a person to choose from.

Modern day investments include gold, property, fixed income instruments,

mutual funds and of course, life insurance. Given the plethora of choices, it

becomes imperative to make the right choice when investing your hard-earned

money. Life nsurance is a unique investment that helps you to meet your dual

needs - saving for life's important goals, and protecting your assets.

Let us look at these unique benefits of life insurance in detail.

Asset Protection

From an investor's point of view, an investment can play two roles - asset

appreciation or asset protection. While most financial instruments have the

underlying benefit of asset appreciation, life insurance is unique in that it gives

the customer the reassurance of asset protection, along with a strong element

of asset appreciation.

The core benefit of Life nsurance is that the financial interests of one's family

remain protected from circumstances such as loss of income due to critical

illness or death of the policyholder. Simultaneously, insurance products also

have a strong inbuilt wealth creation proposition. The customer therefore

benefits on two counts and life insurance occupies a unique space in the

landscape of investment options available to a customer.

'oal (ased sa"in%s

Each of us has some goals in life for which we need to save. For a young,

newly married couple, it could be buying a house. Once, they decide to start a

family, the goal changes to planning for the education or marriage of their

children. As one grows older, planning for one's retirement will begin to take

precedence.

P a g e | 22 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

Clearly, as your life stage and therefore your financial goals change, the

instrument in which you invest should offer corresponding benefits pertinent to

the new life stage.

Life Insurance is the only investment option that offers specific products

tailormade for different life stages. t thus ensures that the benefits offered to

the customer reflect the needs of the customer at that particular life stage, and

hence ensures that the financial goals of that life stage are met.

The table below gives a general guide to the plans that are appropriate for

different life stages.

Life !tage "rimary )eed Life Insurance "roduct

Young & Single Asset creation Wealth creation plans

Young & Just

married

Asset creation &

protection

Wealth creation and mortgage

protection plans

Married with kids

Children's education,

Asset creation and

protection

Education insurance, mortgage

protection & wealth creation plans

Middle aged with

grown up kids

Planning for

retirement & asset

protection

Retirement solutions & mortgage

protection

Across all life-

stages

Health plans Health nsurance

*&8,CTI5,! *4 ',!,A'C9

The objectives of research are as follows:-

P a g e | 23 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

To study the investment plans offered by CC.

To study the investment plans offered by other competitive companies

like HDFC, NG Vyasa and Reliance Life nsurance etc.

To carry out comparison of insurance investment plan of ICICI

"rudential Life Insurance with other companies.

To compare the market share of CC with respect to other private

players.

',!,A'C9 M,T9*-*L*.:

P a g e | 24 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

Research comprises defining and redefining problems, formulating hypothesis

or suggested solution collecting, organizing and evaluating data, making

deductions and reaching conclusion and at last carefully testing the conclusion

to determine whether they fit the formulating hypothesis.

The manipulation of things, concepts, or symbols for the purpose of

generalizing to extend, correct or verify knowledge, whether that knowledge

aids in construction of theory or in the practice of art.

The research methodology used in this project is comparative research.

)omparati"e esearch

Comparative research, simply put, is the act of comparing two or more things

with a view to discovering something about one or all of the things being

compared. This technique often utilizes multiple disciplines in one study.

have used this as this includes the comparison of different plans with respect

to investment plan of ICICI "rudential Life Insurance.

-ata source: Data collection is a technique through which data can be

collected within minimum cost and with greater reliability.

Data can be collected from two sources:

i) Primary data

ii) Secondary data

The data collected for my project is only from secondary data from the Unit

Manager and the websites of corresponding companies.

$amplin% Plan

!ampling techni;ue: simple random sampling

n statistics, a simple random sample is a group of subjects (a sample) chosen

from a larger group (a population). Each subject from the population is chosen

randomly and entirely by chance, such that each subject has the same

probability of being chosen at any stage during the sampling process. This

process and technique is known as Simple Random Sampling.

n this project we have taken the population size of 12 companies.

P a g e | 25 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

The sample size selected is 6.

LIT,'AT%', ',5I,+

P a g e | 26 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

With over a billion people, ndia is fast becoming a global economic power.

With a relatively youthful population, ndia will become an attractive insurance

market over the next decades. This review examines the ndian insurance

industry. t starts by examining the details of the regulatory regime that existed

before independence. This is important because the culmination of the

nsurance Act of 1938 became the backbone of the current legislation in place.

t highlights the importance of the rural sector where the majority of the

ndians still live. t shows how the recent privatization is playing out in the

market. Based on recent economic estimates, the review provides projections

of segments of the market for 2025.

An Analysis of the E"olution of Insurance in India

ndia had the nineteenth largest insurance market in the world in 2003. Strong

economic growth in the last decade combined with a population of over a

billion makes it one of the potentially largest markets in the future. nsurance in

ndia has gone through two radical transformations. Before 1956, insurance

was private with minimal government intervention. n 1956, life insurance was

nationalized and a monopoly was created. n 1972, general insurance was

nationalized as well (endnote 1). But, unlike life insurance, a different structure

was created for the industry. One holding company was formed with four

subsidiaries. As a part of the general opening up of the economy after 1992, a

Government appointed committee recommended that private companies

should be allowed to operate. t took six years to implement the

recommendation. Private sector was allowed into insurance business in 2000.

However, foreign ownership was restricted. No more than 26% of any company

can be foreign-owned.

n what follows, we examine the insurance industry in ndia through different

regulatory regimes. A totally regulation free regime ended in 1912 with the

introduction of regulation of life insurance. A comprehensive regulatory scheme

came into place in 1938. This was disabled through nationalization. But, the

nsurance Act of 1938 became relevant again in 2000 with deregulation. With a

strong hint of sustained growth of the economy in the recent past, the ndian

market is likely to grow substantially over the next few decades.

P a g e | 27 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

nsurance business was conducted in ndia without any specific regulation for

the insurance business. They were subject to ndian Companies Act (1866).

After the start of the "Be ndian Buy ndian Movement (called Swadeshi

Movement) in 1905, indigenous enterprises sprang up in many industries. Not

surprisingly, the Movement also touched the insurance industry leading to the

formation of dozens of life insurance companies along with provident fund

companies (provident fund companies are pension funds). n 1912, two sets of

legislation were passed: the ndian Life Assurance Companies Act and the

Provident nsurance Societies Act. There are several striking features of these

legislations. First, they were the first legislations in ndia that particularly

targeted the insurance sector. Second, they left general insurance business out

of it. The government did not feel the necessity to regulate general insurance.

Third, they restricted activities of the ndian insurers but not the foreign insurers

even though the model used was the British Act of 1909.

One holding company was formed with four subsidiaries. As a part of the

general opening up of the economy after 1992, a Government appointed

committee recommended that private companies should be allowed to operate.

t took six years to implement the recommendation. Private sector was allowed

into insurance business in 2000. However, foreign ownership was restricted.

No more than 26% of any company can be foreign-owned.

Comprehensive insurance legislation covering both life and non-life business

did not materialize for the next twenty-six years. During the first phase of these

years, Great Britain entered World War . This event disrupted all legislative

initiatives. Later, ndians demanded freedom from the British. As a concession,

ndia was granted "home rule through the Government of ndia Act of 1935. t

provided for Legislative Assemblies for provincial governments as well as for

the central government. But supreme authority of promulgated laws still stayed

with the British Crown.

The only significant legislative change before the nsurance Act of 1938 was

Act XX of 1928. t enabled the Government of ndia to collect information of

1) ndian insurance companies operating in ndia

2) Foreign insurance companies operating in ndia

3) ndian insurance companies operating in foreign countries

P a g e | 28 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

The last two elements were missing from the 1912 nsurance Act. nformation

thus collected allows us to compare the average size face value of ndian

insurance companies against their foreign counterparts. n 1928, the average

policy value of an ndian company was 619 US dollars against 1,150 US

dollars for foreign companies (Source: ndian nsurance Commissioner's

Report, 1929, p. 23).

Foreign insurance companies were doing well during that period. n 1938, the

average size of the policy sold by ndian companies has fallen to 532 US

dollars (in comparison with 619 US dollars in 1928) and that of foreign

companies had risen somewhat to 1, 188 US dollars (in 1928, the average size

was 1,150 US dollars).

The Birth of the Insurance Act* +,-.

n 1937, the Government of ndia set up a consultative committee. Mr. Sushil

C. Sen, a well known solicitor of Calcutta, was appointed the chair of the

committee. He consulted a wide range of interested parties including the

industry. t was debated in the Legislative Assembly. Finally, in 1938, the

nsurance Act was passed. This piece of legislation was the first

comprehensive one in ndia. t covered both life and general insurance

companies. t clearly defined what would come under the life insurance

business, the fire insurance business and so on (see Appendix 1). t covered

deposits, supervision of insurance companies, investments, commissions of

agents, directors appointed by the policyholders among others. This piece of

legislation lost significance after nationalization. Life insurance was

nationalized in 1956 and general insurance in 1972 respectively. With the

privatization in the late Twentieth Century, it has returned as the backbone of

the current legislation of insurance companies. All legislative changes are

enumerated in Table.

When the market was opened again to private participation in 1999, the earlier

nsurance Act of 1938 was reinstated as the backbone of the current legislation

of insurance companies, as the nsurance Regulatory and Development

Authority Act of 1999 was superimposed on the 1938 nsurance Act. This

revival of the Act has created a messy problem. The nsurance Act of 1938

P a g e | 29 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

explicitly forbade financial services from the activities permitted by insurance

companies.

By 1956, there were 154 ndian life insurance companies. There were 16 non-

ndian insurance companies and 75 provident societies were issuing life

insurance policies. Most of these policies were centered in the cities (especially

around big cities like Bombay, Calcutta, Delhi and Madras).

P a g e | 30 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

Milestones of Insurance 'egulations in the <0th Century

:ear !ignificant 'egulatory ,ent

1912 The ndian Life nsurance Company Act

1928 ndian nsurance Companies Act

1938

The nsurance Act: Comprehensive Act to regulate insurance business in

ndia

1956

Nationalization of life insurance business in ndia with a monopoly

awarded to the Life nsurance Corporation of ndia

1972

Nationalization of general insurance business in ndia with the formation

of a holding company General nsurance Corporation

1993 Setting up of Malhotra Committee

1994 Recommendations of Malhotra Committee published

1995 Setting up of Mukherjee Committee

1996

Setting up of (interim) nsurance Regulatory Authority (RA)

Recommendations of the RA

1997 Mukherjee Committee Report submitted but not made public

1997

The Government gives greater autonomy to Life nsurance Corporation,

General nsurance Corporation and its subsidiaries with regard to the

restructuring of boards and flexibility in investment norms aimed at

channeling funds to the infrastructure sector

1998

The cabinet decides to allow 40% foreign equity in private insurance

companies-26% to foreign companies and 14% to Non-resident ndians

and Foreign nstitutional nvestors

1999

The Standing Committee headed by Murali Deora decides that foreign

equity in private insurance should be limited to 26%. The RA bill is

renamed the nsurance Regulatory and Development Authority Bill

1999 Cabinet clears nsurance Regulatory and Development Authority Bill

2000

President gives Assent to the nsurance Regulatory and Development

Authority Bill

In"estment e%imes

P a g e | 31 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

nvestment regimes in insurance in ndia have always had quantitative

restrictions. Current legal requirements are explained in Table 2 for life

business. At least half of the investment has to be either directly in government

securities (bonds) or for infrastructure investments (which also take the form of

government bonds). These investment options are "safe as they are fully

backed by the government. Of course, it also means they earn the lowest rate

of return in the ndian market. The government (both at the federal and state

levels) has used insurance business as a way of raising capital. Unfortunately,

much of it has been spent on consumption expenditure leading to substantial

increase in government debt.

Inestment 'egulation of Life &usiness

Type of Inestment "ercentage

Government Securities 25%

Government Securities or other approved securities

(including () above)

Not less than

50%

Approved nvestments as specified in Schedule

nfrastructure and Social Sector:

Explanation: For the purpose of this requirement,

nfrastructure and Social Sector shall have the meaning as

given in regulation 2(h) of nsurance Regulatory and

Development Authority (Registration of ndian nsurance

Companies) Regulations, 2000 and as defined in the

nsurance Regulatory and Development Authority (Obligations

of nsurers to Rural and Social Sector) Regulations, 2000

respectively

Not less than

15%

Others to be governed by Exposure/ Prudential Norms

specified in Regulation 5

Not exceeding

20%

V

Other than in Approved nvestments to be governed by

Exposure/ Prudential Norms specified in Regulation 5

Not exceeding

15%

Source: Gazette of ndia Extraordinary Part Section 4. nsurance Regulatory

and Development Authority (nvestment) Regulations, 2000

I)-%!T': "'*4IL,

P a g e | 32 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

With an annual growth rate of 15-20% and the largest number of life insurance

policies in force, the potential of the ndian insurance industry is huge. Total

value of the ndian insurance market (2004-05) is estimated at Rs. 450 billion

(US$10 billion). According to government sources, the insurance and banking

services' contribution to the country's gross domestic product (GDP) is 7% out

of which the gross premium collection forms a significant part. The funds

available with the state-owned Life nsurance Corporation (LC) for investments

are 8% of GDP.

Till date, only 20% of the total insurable population of ndia is covered under

various life insurance schemes, the penetration rates of health and other non-

life insurances in ndia is also well below the international level. These facts

indicate the of immense growth potential of the insurance sector.

The year 1999 saw a revolution in the ndian insurance sector, as major

structural changes took place with the ending of government monopoly and the

passage of the nsurance Regulatory and Development Authority (RDA) Bill,

lifting all entry restrictions for private players and allowing foreign players to

enter the market with some limits on direct foreign ownership.

Though, the existing rule says that a foreign partner can hold 26% equity in an

insurance company, a proposal to increase this limit to 49% is pending with the

government. Since opening up of the insurance sector in 1999, foreign

investments of Rs. 8.7 billion have poured into the ndian market and 21

private companies have been granted licenses.

nnovative products, smart marketing, and aggressive distribution have

enabled fledgling private insurance companies to sign up ndian customers

faster than anyone expected. ndians, who had always seen life insurance as a

tax saving device, are now suddenly turning to the private sector and snapping

up the new innovative products on offer.

The life insurance industry in ndia grew by an impressive 36%, with premium

income from new business at Rs. 253.43 billion during the fiscal year 2004-

2005, braving stiff competition from private insurers. This report, "ndian

nsurance ndustry: New Avenues for Growth 2012, finds that the market

share of the state behemoth, LC, has clocked 21.87% growth in business at

P a g e | 33 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

Rs.197.86 billion by selling 2.4 billion new policies in 2004-05. But this was still

not enough to arrest the fall in its market share, as private players grew by

129% to mop up Rs. 55.57 billion in 2004-05 from Rs. 24.29 billion in 2003-04.

Though the total volume of LC's business increased in the last fiscal year

(2004-2005) compared to the previous one, its market share came down from

87.04 to 78.07%. The 14 private insurers increased their market share from

about 13% to about 22% in a year's time. The figures for the first two months of

the fiscal year 2005-06 also speak of the growing share of the private insurers.

The share of LC for this period has further come down to 75 percent, while the

private players have grabbed over 24 percent.

There are presently 12 general insurance companies with four public sector

companies and eight private insurers. According to estimates, private

insurance companies collectively have a 10% share of the non-life insurance

market.

"riate "layer of Life Insurance

1. CC Prudential Life nsurance

2. HDFC Standard Life

3. SB Life nsurance

4. Birla Sunlife

5. Bajaj Allianz Life

6. Aviva Life nsurance

7. Kotak Mahindra Life nsurance

8. Tata AG Life

9. Reliance Life nsurance Company Limited

10. NG Vyasya Life nsurance

11. Metlife ndia Life nsurance

12. Max New York Life nsurance

13. Shriram Life nsurance

14. Bharti AXA Life nsurance Company Limited

Types of Insurance on The Basis of Business Point of /iew

i) Life nsurance

P a g e | 34 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

ii) General nsurance

i# Life Insurance:

Life nsurance is universally acknowledged to be an institution which eliminates

'risk' and provides the timely aid to the family in the unfortunate event of death

of the breadwinner.

Life nsurance is a contract for payment of a sum of money to the person

assured (or nominee) on the happening of the event insured against. The

contract provides for the payment of premium periodically to the nsurance

Company by the assured.

The contract provides for the payment of an amount on the date of maturity or

at specified dates at periodic intervals or at unfortunate death, if it occurs

earlier.

ii# .eneral Insurance:

General insurance business refers to fire, marine, and miscellaneous

insurance business whether carried on singly or in combination with one or

more of them, but does not include capital redemption business and annuity

certain business. [According to Sec. 3(g) of the General nsurance business

(Nationalization) Act, 1972].

Features of ndian General nsurance Market:

1. Low market penetration.

2. Ever-growing middle class component in population.

3. Growth of consumer movement with an increasing demand for better

insurance products.

4. nadequate application of information technology for business.

5. Adequate fillip from the Government in the form of tax incentives to the

insured, etc.

6. ndia is one of the least insured countries but the potential for further

growth is phenomenal.

7. Rates of claim settlement were earlier in ndia the highest in the world,

70 per cent in general insurance, compared to around 40 per cent

internationally.

8. Non-life premium has a 0.71 per cent share of GDP.

P a g e | 35 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

9. General nsurers (Private Companies) have earned around Rs.1000-cr

income.

10. Half of the current demand for comes from the corporate segment.

Benefits of 'eneral Insurance:

1. nsurance is the instrument of Security, saving and peace of mind. t

provides several benefits by paying a small amount of premium to an

insurance company.

2. Safeguards one's assets.

3. Peace of mind-in case of financial loss.

4. Encourage saving.

5. Tax rebate.

6. Protection from the claim made by creditors.

7. Security against a personal loan, housing loan or other types of loan.

Products of 'eneral Insurance

The Assurance Company Ltd. and the United ndia nsurance Company. The

Government of ndia subscribed to the capital of GC. GC, in turn, subscribed

to the capital of the four companies. All the four companies are government

companies registered under the Companies Act. GC is into the reinsurance

business whereas its subsidiaries are into the insurance of Non Life products.

"roduct 'ange

i# Motor Insurance:

Motor insurance is mandatory for all vehicles in ndia. There are two types of

motor insurance

Third Party- only insures the party (parties) other than the owner in an

incident.

Comprehensive- that insures the owner as well as the third party

involved. The premium for motor Vehicles is decided on the value of the

vehicle and location where it is to be registered. The premium for heavy

commercial vehicle is decided on the value of the vehicle and gross

laden weight.

P a g e | 36 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

ii# Property Insurance:

Property insurance covers land, building and the contents of the building.

iii# Bur%lary:

Burglary insurance covers all losses arisen out of burglary committed in one's

premises.

i"# 0ire Insurance:

Fire nsurance is a Comprehensive policy. This policy besides covering loss on

account of fire also covers loss on account of the following Earthquake, Riots,

Strikes, Malicious intent, Floods.

"# Health Insurance:

Health insurance polices ensure guarding ones health against any calamities

that may cause long term harm to his/her life and can hamper ones earning

available for ability for a lifetime. These health policies are individuals and

groups.

"i# &ia(ility Insurance:

This policy indemnifies the Directors or Officers or other professionals against

loss arising from claims made against them by reason of any wrongful Act in

their Official capacity.

"ii# 1arine Insurance

Cargo in transit

Cargo declaration Policy

Marine Hull nsurance: nland vessels ocean going vessels, fishing &

sailing vessels, freight at risk, construction of ships, voyage insurance of

various vessels, ship breaking, insurance Awaiting break up, nsurance

Oil & Energy in respect of onshore & offshore risks including construction

risk.

"iii# Tra"el Policy:

Any tourist may die or loss their baggage's, passport etc. while traveling. Travel

policies are designed to care of all the problems that generally occur while

traveling.

P a g e | 37 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

ix# Business policy:

A Business policy covers the risks of loss of business goods, plant and

machinery etc.

x# 2ther 'eneral Policy:

Apart from other main general nsurance there are several others

General polices and more are going to introduce, such as:

Bhagyashree Child Welfare Policy-covers girl child in the age group of 0

to 18 years.

Raj Rajeshwari Mahila Kalyan Vojans.

Crop nsurance Scheme.

Jald Rahat Yojana.

!+*T A)AL:!I! *4 I)!%'A)C, !,CT*'

$tren%ths:

P a g e | 38 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

i# Consumer .rieance 'edressal

The nsurers have to face the redressal of the consumers, grievances for

deficiency in products and services. The nsurance Regulatory Development

Authority (RDA), the regulatory body has already appointed Ombudsman for

looking into the grievances of the policyholders. His judgment will be binding

on the insurers. Further under Consumer Protection Act, 1986, the consumer

courts are operating at the district, state and national levels. This is a major

strength from the consumer point of view as they could easily fight for their

rights.

ii# 'ural customers are a must

As per the regulator RDA, all the companies incorporated should at least do

5% of its business in the rural parts of the country. f not, the regulator would

not allow the company to function anywhere within the country. So this is a

great advantage for not only the rural population but also the newly formed

companies since most of the revenue could be earned from the rural ndia.

iii# Channels

nsurance companies are getting savvy. Enhanced marketing thus is crucial.

Already, many companies have full operation capabilities over a 12-hour

period. Facilities such as customer service center are already into 24-hour

mode. These will provide services such as motor vehicle recovery. Technology

also plays an important role in the market.

Weakness:

i# )e# insurers

The new insurers will have to invest a minimum capital of Rs. 100 crores. The

normal gestation period is of 5 years. The generation of profit normally starts in

the sixth year. Hence the new insurers have to lock up their capital for at least

5 years.

ii# *utdated products

Today, LC has more than 60 products and GC has more than 180 products to

offer in the market. But most of them are outdated, as they are not suitable to

the needs of the consumers. Hence old as well as new insurers have to offer

P a g e | 39 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

innovative products to the consumers and bringing more products would

require good amount of capital investment.

2pportunities:

i# 5ast country

ndia is a vast country with more than 5, 76,000 villages having a population of

at least 500-600 per village. The companies could recognize the fact that if it

takes the whole zilla as one, it would consist a population more than 5000-

10000. One zilla could give them a good amount of business. The company

could have this opportunity and tap it and reap revenues.

ii# 8o3 opportunities

Since the sector has opened up, many new companies have already started its

operation and few are just about to begin, Major areas of employment in this

sector are the agents. A company can appoint any number of agents anywhere

within the country on commission basis. Moreover, the professional staff and

the peons and clerks' appointment also increase. Thus this sector has

tremendous scope on employment.

Threats:

i# Lac$ of a#areness

Very soon the market will be flooded by a large number of products by a fairly

large number of insurers operating in the ndian market. Even with limited

range of products offered by LC and GC, there is chaos as far as the

consumers are concerned. Their confusion will further increase in the face of a

large number of products in the market. The existing level of awareness of the

consumers for insurance products is very low. This is because only 62% of the

population of ndia is literate and only 10% are well educated. Even the

educated consumers are ignorant about the various products of insurance.

With new companies coming in the market, the products would be

comparatively more, which would again create confusion in the minds of the

customers so as to which policy best suits the needs.

Insurance 'egulatory and -eelopment Authority Act= 1>>> ?I'-A@

P a g e | 40 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

ndian parliament passed RDA in the year 1999. t is headed by the chairmen.

t was setup on interim RDA for monitoring &controlling of the insurance

business. RDA was sole authority responsible for awarding of licenses. There

is no restriction for new licenses & no composite licenses for life & non life

business. RDA has some restriction for new licenses such like new player

should commence its business within 15-18 month. Shares are not allowed to

transfer without approval.

This Act was passed by Parliament in December 1999 and it received

presidential assent in January 2000. This Act provides for the establishment of

the Authority to protect the interest of holders of insurance policies, to regulate,

promote and ensure orderly growth of insurance industry and for matters

connected therewith or incidental thereto. t amended the nsurance Act, 1938,

which has been noted above. t also amended the Life nsurance Corporation

Act, 1956 and the General nsurance Business (Nationalization) Act, 1972,

thus opening up the insurance sector to private participation.

Under this Act, an authority called RDA has been established. This is a

corporate body established for the purpose and objects as set out in the

explanation to the title. The "Authority" replaces "Controller" under nsurance

Act 1938. The first schedule amends nsurance Act 1938. t states that if

"Authority" is superseded by the Central Government, the "Controller of

nsurance" may be appointed till such time as "Authority" is reconstituted.

n line with the economic reforms that were ushered in ndia in early nineties,

the Government set up a Committee on Reforms (popularly called the Malhotra

Committee) in April 1993 to suggest reforms in the insurance sector. The

Committee recommended throwing open the sector to private players to usher

in competition and bring more choice to the consumer. The objective was to

improve the penetration of insurance as a percentage of GDP, which remains

low in ndia even compared to some developing countries in Asia. Reforms

were initiated with the passage of nsurance Regulatory and Development

Authority (RDA) Bill in 1999. RDA was set up as an independent regulatory

authority, which has put in place regulations in line with global norms. So far in

the private sector, 12 life insurance companies and 9 general insurance

companies have been registered.

P a g e | 41 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

&ottlenec$s .oernment 'egulations

The RDA bill proposes tough solvency margins for private

insurance firms, a 26% cap on foreign equity and a minimum capital

of Rs 100crores for life and general insurance and Rs 200crores for

reinsurance firms section 27A of insurance Act stipulates that LC is

required to invest 75% of its accretions through a controlled fund in

mandated government securities LC may invest the remaining 25% in

private corporate sector, construction and acquisition of immovable

assets besides sanctioning of loans to policy holder.

These stipulations imposed on the insurance companies had resulted in

lack of flexibility in the optimization of risk and profit portfolio. f this

inflexibility continues the insurance companies will have very little

leverage to earn more on their investments and they might not be able

to offer as flexible products as offered abroad.

The government might provide more autonomy to ;insurance

companies by allowing them to invest 50% of their funds as per

their own discretions.

Recently RB has issued stiff guidelines which had death a severe blow

to the plans of banks and financial institutions to enter the insurance

sector. t says that non performing assets ( NPA) levels of the

prospective l players will have to be 1% point lower than the industry

average (presently 7.5%).

RB has also stipulated that all prospective entrants need to have a net

worth of Rs 500crores. These guidelines have made it virtually

impossible for many banks to get into the insurance business. Also

banks and F who are planning to enter the business cannot float

subsidiaries for insurance.

RB has taken too much caution to make sure that the news sector

does not experience the kind of ups and downs that the non bank

financial sector has experienced in the recent past. They had to

rethink about these guidelines if ndia strong banks and financial

P a g e | 42 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

institutions have to enter the new business. The insurance employees

union is offering stiff resistance to any private entry.

ICICI "rudential Life Insurance

P a g e | 43 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

C*M"A): "'*4IL,

"'*4IL, *4 ICICI "rudential Life Insurance Company

0act sheet

The Company

ICICI "rudential Life Insurance Company is a joint venture between CC

Bank, a premier financial powerhouse, and prudential plc, a leading

international financial services group headquartered in the United Kingdom.

CC Prudential was amongst the first private sector insurance companies to

begin operations in December 2000 after receiving approval from nsurance

Regulatory Development Authority (RDA).

CC Prudential Life's capital stands at Rs. 42.72 billion (as of June 30, 2008)

with CC Bank and Prudential plc holding 74% and 26% stake respectively.

For the quarter ended June 30, 2008, the company garnered Retail Weighted

New Business Premium of Rs. 1,174 crores as against Rs 810 crores for the

quarter ended June 30, 2007, thereby posting a growth of 45% and has

underwritten over 6 lakh policies over this period. The company has assets

held over Rs. 30,600 crore as on August 31, 2008.

CC Prudential Life is also the only private life insurer in ndia to receive a

National nsurer Financial Strength rating of AAA (nd) from Fitch ratings. The

AAA (nd) rating is the highest rating, and is a clear assurance of CC

Prudential's ability to meet its obligations to customers at the time of maturity

or claims.

For the past seven years, CC Prudential Life has retained its leadership

position in the life insurance industry with a wide range of flexible products that

meet the needs of the ndian customer at every step in life.

!istri(ution

P a g e | 44 of 104 MAHIUDDIN SHAMS

MBA Assignment - Final Project

CC Prudential Life has one of the largest distribution networks amongst

private life insurers in ndia. t has a strong presence across ndia with over

2000 branches (includung 1,095 micro-offices) and an advisor base of over

261,000 (as on August 31, 2008).

The company has 24 bancassurance partners having tie-ups with CC Bank,

Bank of ndia, South ndian Bank, Shamrao Vitthal Co-Op Bank, Jalgaon

Peoples Co-op Bank, Ernakulam District Co-op Bank, dukki District Co-op

Bank, Ratnagiri Sindhudurg Gramin Bank, Solapur Gramin Bank, Wainganga

Kshetriya Gramin Bank, Aryawart Gramin Bank, Jharkhand Gramin Bank,

Narmada Malwa Gramin Bank, Baitarani Gramya Bank, Ratnagiri District

Central Co-op Bank, Seva Vikas Co-op Bank, Sangli Urban Co-Operative

Bank, Baramati Co-operative Bank, Ballia Kshetriya Co-Operative Bank, The

Haryana State Co-Operative Bank, Renuka Nagrik Sahakari Bank, Amanath

Co-Operative Bank, Arvind Sahakari Bank, Bhandara Urban Co Operative

Bank

Promoters

ICICI &an$

CC Bank Limited (NYSE:BN) is ndia's largest private sector bank and the

second largest bank in the country, with consolidated total assets of $121

billion as of September 30 , 2008. CC Bank's subsidiaries include ndia's

leading private sector insurance companies and among its largest securities

brokerage firms, mutual funds and private equity firms. CC Bank's presence

currently spans 19 countries, including ndia.

"rudential "lc

Established in London in 1848, Prudential plc, through its businesses in the

UK, Europe, US, Asia and the Middle East, provides retail financial services

products and services to more than 21 million customers, policyholder and unit

holders and manages over 256 billion of funds worldwide (as of June 30,