Escolar Documentos

Profissional Documentos

Cultura Documentos

1.farah Mastura Noor Azman

Enviado por

zulikah890 notas0% acharam este documento útil (0 voto)

210 visualizações18 páginasnoor azman

Título original

1.Farah Mastura Noor Azman

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentonoor azman

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

210 visualizações18 páginas1.farah Mastura Noor Azman

Enviado por

zulikah89noor azman

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 18

1

ZAKAT COMPLIANCE INTENTION

BEHAVIOR ON SAVING AMONG

UNIVERSITI UTARA MALAYSIAS STAFF

FARAH MASTURA BINTI NOOR AZMAN

UNIVERSITI UTARA MALAYSIA

2011

2

ZAKAT COMPLIANCE INTENTION BEHAVIOR ON SAVING

AMONG UNIVERSITI UTARA MALAYSIAS STAFF

A thesis submitted to the Graduate School in partial

fulfillment of the requirement for the degree

Master of Business Administration (Accounting)

By

Farah Mastura Binti Noor Azman

ii

DECLARATION

I certify that the substance of this thesis has not been submitted to any degree and is

not currently being submitted for and other degree qualification.

I certify that any help received in preparing this thesis and all sources used have been

acknowledged in this thesis.

Farah Mastura Binti Noor Azman

804534

College of Business

Universiti Utara Malaysia

06010 Sintok

Kedah

iii

PERMISSION TO USE

In presenting this dissertation in partial fulfillment of the requirement for a

postgraduate degree from Universiti Utara Malaysia, I agree that the University

Library may make it freely available for inspection. I further agree that permission

for copying of this thesis in any manner, in whole or in part, for scholarly purpose

may be granted by my supervisor(s) or, in absence, by Assistant Vice Chancellor of

College of Business. It is understood that any copying or publication or use of this

thesis or parts thereof for financial gain should not be allowed without my written

permission. It is also understood that due recognition shall be given to me and to

Universiti Utara Malaysia for any scholarly use which may be made of any material

from my thesis.

Request for permission to copy or to make other use of materials in this thesis, in

while or in part, should be addressed to:

Assistant Vice Chancellor of College of Business

Universiti Utara Malaysia

06010 UUM Sintok

Kedah Darul Aman

iv

ABSTRAK

Kajian lalu menunjukkan kepatuhan yang rendah dalam pembayaran zakat. Namun,

kebanyakan penyelidik hanya memberikan tumpuan pada pembayaran zakat

pendapatan gaji. Jumlah pembayaran zakat wang simpanan yang disimpan di akaun

simpanan, akaun simpanan tetap dan akaun simpanan semasa dilaporkan meningkat.

Kutipan bayaran zakat wang simpanan adalah yang ketiga tertinggi dilaporkan oleh

Jabatan Zakat Negeri Kedah selepas zakat pendapatan dan zakat perniagaan. Oleh

itu, kajian ini merupakan langkah pertama untuk menyiasat niat gelagat kepatuhan

zakat wang simpanan dalam kalangan pekerja Universiti Utara Malaysia dengan

mengaplikasikan teori gelagat terancang. Sebanyak 86 soal selidik diedarkan dan

digunakan dalam kajian ini untuk mengukur ketiga-tiga pemboleh ubah iaitu sikap,

norma subjektif dan kawalan gelagat ditanggap terhadap niat gelagat kepatuhan zakat

wang simpanan. Hasil kajian menunjukan kawalan gelagat ditanggap berhubungan

secara positif terhadap niat gelagat kepatuhan zakat wang simpanan, tetapi sikap dan

norma subjektif tidak berhubungan secara lansung. Secara umumnya, teori gelagat

terancang ini dapat menjelaskan niat gelagat kepatuhan zakat wang simpanan.

Penemuan kajian ini diharap dapat meningkatkan kesedaran umat Islam dalam

menunaikan bayaran zakat serta membantu pembuat dasar untuk menjadi lebih cekap

dan berkesan pada masa akan datang. Keterbatasan dalam kajian ini juga turut

dibincangkan.

v

ABSTRACT

Previous research has shown that there is still low compliance reported in the

payment of zakat. However, most of the researchers only focused on the payment of

zakat on employment income. An increasing number of people are reported to save

their money in saving, fixed deposit and current saving accounts. The collection of

zakat on saving is the third highest collection reported by Jabatan Zakat Negeri

Kedah after zakat on employment income and zakat on trade. Because of this, this

study is motivated to investigate zakat compliance intention on saving among

employees of Universiti Utara Malaysia by using theory of planned behavior. A total

of 86 questionnaires were returned and used to measure the three independent

variables which are attitude, subjective norms, and perceived behavioral control

towards the intention to comply with zakat on saving. Based on the results obtained,

perceived behavioral control was found to significantly influence intention to comply

with zakat on saving, but attitude and subjective norms have no significant influence

at all. Generally, theory of planned behavior can be used to explain zakat compliance

intention behavior on saving. It is hoped that the finding of the present study will

increase the eligible Muslims awareness to pay zakat on saving and help policy

makers to be more efficient and effective in the future. The limitations of the study

are also presented in this paper.

vi

ACKNOWLEDGEMENTS

In the name of Allah, the Most gracious, the Most Merciful. Praise be to Allah

(SWT) the Sustainer of the World, and peace and blessing be unto Prophet

Muhammad (SAW).

First and foremost, I would like to express my special appreciation and

gratitude to Dr. Zainol Bidin for his valuable time in supervising me. His expert

guidance, opinions, encouragements, motivation and thoughtful suggestions has

enabled me to complete this thesis.

I also wish to thank Ustaz Abdul Hamid from Jabatan Zakat Negeri Kedah

for his precious time and knowledge in helping me clarify issues regarding zakat. I

am also grateful to all the respondents of this study for their cooperation to fulfill the

distributed questionnaires.

I also would like to dedicate my special thanks to my beloved father, Noor

Azman Yusof; my mother, Ku Habibah Ku Saad; and as well as to my siblings,

Farah Mardiana, Adi Affandi, Anis Amira, and Afifah Adriana for their prayer,

support, cooperation and understanding throughout my study period. Finally, my

special thanks also goes to my loved one, Abd Aziz Ahmad, who has always given

me motivation, understanding and patience, thank you. May Allah SWT bless all of

you.

vii

TABLE OF CONTENTS PAGE

Declaration ii

Permission to Use iii

Abstrak iv

Abstract v

Acknowledgement vi

Table of Contents vii

List of Tables x

List of Figures xi

Abbreviations xii

CHAPTER 1: INTRODUCTION

Introduction 1

1.1 Background of the Studies 2

1.1.1 Zakat on saving 2

1.1.2 Zakat calculation method 2

1.2 Problem Statement 4

1.3 Scope of Study 5

1.4 Research Question 6

1.5 Research Objectives 6

1.6 Significance of the Study 6

1.6.1 Contribution to the Muslim society 6

1.6.2 Helping the policy makers 6

viii

CHAPTER 2: LITERATURE REVIEW

2.0 Introduction 8

2.1 Previous studies on zakat compliance 8

2.2 Theory of Planned Behavior 9

2.3 Attitude 11

2.4 Subjective Norm 13

2.5 Perceived Behavior Control 15

CHAPTER 3: METHODOLOGY

3.0 Introduction 17

3.1 Population of the study 17

3.2 Sampling 18

3.3 Method of data collection 18

3.4 Measurement 19

3.5 Data analysis

3.5.1 Descriptive statistic 20

3.5.2 Reliability test 20

3.5.3 Factor analysis 21

3.5.4 Multiple regression analysis 21

ix

CHAPTER 4: RESULTS AND DISCUSSION

4.0 Introduction 22

4.1 Findings 22

4.1.1 Descriptive analysis 22

4.1.2 Reliability test 24

4.1.3 Factor analysis 26

4.1.4 Multiple regression analysis 28

CHAPTER 5: CONCLUSION AND RECOMMENDATION

5.0 Introduction 30

5.1 Discussion 30

5.2 Limitation of the study 31

5.3 Conclusion 32

REFERENCES 33

APPENDICES

Appendix A: Cover letter 36

Appendix B: Questionnaire 37

x

LIST OF TABLES

PAGE

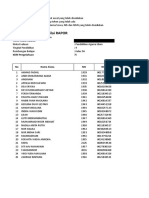

Table 4.1: Respondents profile 23

Table 4.2: Descriptive statistics of variable 25

Table 4.3: Factor analysis 26

Table 4.4: Component matrix 27

Table 4.5: Regression of attitude, subjective norm and perceived 29

behavioral control against zakat compliance intention

xi

LIST OF FIGURES

PAGE

Figure 2.1: Illustration of Ajzens theory of planned behavior 11

(Ajzen, 1991)

Figure 2.2: Theoretical framework model for zakat compliance 16

intention behavior on saving among Universiti Utara

Malaysias staff

xii

ABBREVIATIONS

ATT Attitude

ITT Intention

PBC Perceived Behavior Control

SN Subjective Norm

TPB Theory of Planned Behavior

1

CHAPTER 1

INTRODUCTION

1.0 Introduction

Islam is a religion revealed by Allah S.W. T. for humankind through the Prophet

Adam A.S. until the Prophet Muhammad S.A.W. During the period of Prophet

Muhammad S.A.W, Allah has decreed the five pillars of Islam. It is obliged for every

Muslim to obey and practice these duties. They are testimony of faith, prayer,

almsgiving (zakat), fasting, and pilgrimage to Mecca. Muslim jurists unanimously

agree that zakat is compulsory for Muslims whether it is zakat on individual (zakat

fitrah) or zakat on business, crops and agricultures, gold and silver, or natural

resources. The importance of zakat is consistently mentioned in the Quran after the

word of prayer (solat). For instance, Allah says:

And they have been commanded no more than this: to worship God, offering

Him sincere devotion, being true (in faith); to establish regular prayer, and to

practice regular charity; and that the religion right and straight (Surah al-

Bayyinah: 5).

The verse above clearly indicates us that to every Muslim is obliged to

perform prayers as well as to pay zakat. While prayer benefits directly the individual

who fulfils it, paying zakat will directly benefit the nation especially those who are in

need. Subsequently this can improve the economic growth in the country.

Literally, zakat means purification. Technically, it means the amount of

money or kind taken from specific types of wealth when they reach a specific

The contents of

the thesis is for

internal user

only

33

REFERENCES

Abdullah Yusof Ali (1994). The Holy Quran text and translation. Kuala Lumpur:

Islamic Book Trust.

Ajzen, I. (1991). Theory of planned behavior. Organizational Behavior and Human

Decision Processes, 50, 179-221.

Ajzen, I., & Driver, BL. (1992). Application of the theory of planned behavior to

leisure choice. Journal of Leisure Research, 24(3), 207-224.

Ajzen, I., & Fishbein, M. (1980). Understanding attitudes and predicting social

behavior. Englewood Cliffs, NJ: Prentice-Hall.

Aronson, E., Wilson, TD., & Akert, RM. (1999). Social psychology (3

rd

ed.). New

York: Longman.

Autio, E., Keeley, R. H., Klofsten, M., Parker, G. G. C., & Hay, M. (2001).

Entrepreneurial intent among student in Scandinavia and in the USA.

Enterprise and Innovation Management Studies, 2(2), 145-160.

Bandura, A. (1977). Social learning theory. Englewood Cliffs: Prentice Hall.

Cavana, RY., Delahaye, BL., & Sekaran, U. (2001). Applied business research:

Qualitative and quantitative methods. Queensland: John Wiley & Sons.

Cheng, S., Lam, T., & Hsu, HC. (2005). Testing the sufficiency of the theory of

planned behavior: A case of customer dissatisfaction responses in restaurants.

International Journal of Hospitality Management, 24, 475-492.

Chu, PY., & Wu, TZ. (2004). Proceedings from Pacific Asia Conference on

Information System: Factors influencing tax-payer information usage

behavior: Test of an integrated model. Shanghai: China.

Churchill, G.A. Jr. (1979). A paradigm for developing better measures of marketing

constructs. Journal of Marketing Research, 16(1), 64-73.

Fang, K., & Shih, Y. (2004). The use of a decomposed theory of planned behavior to

study internet banking in Taiwan. Internet Research, 14(3), 213-223.

Fishbein, M., & Ajzen, I. (1975). Belief, attitude, intention, and behavior: An

introduction to theory and research. Reading, MA: Addison-Wesley.

Godin, G., & Kok, G. (1996). The theory of planned behavior: A review of its

applications to health-related behaviors. American Journal of Health

Promotion, 11(2), 87-98.

Hair, JF., Anderson, RE., Tatham, RL., & Black, WC. (1998). Multivariate data

analysis. New Jersey, Prentice Hall.

Hair, JF., Black, WC., Babin, BJ., Anderson, RE., & Tatham, R. L. (2006).

Multivariate

data analysis (6

th

ed.). New Jersey, Pearson Prentice Hall.

Hanno, D., & Violette, GR. (1996). An analysis of moral and social influences on

taxpayer behavior. Behavioral Research in Accounting 8, 57-75.

Ida Husna, H. (2009). Intention to pay zakat on employment income among

manufacturing employees in Penang. Master Dissertation. Universiti Utara

Malaysia.

34

Ingram, KL., Cope, JG., Harju, BL., & Wuensch, K.L. (2000). Applying to graduate

school: A test of theory of planned behavior. Journal of Social Behavior and

Personality, 15(2), 215-226.

Jabatan Zakat Negeri Kedah (2010). Statistik perolehan Jabatan Zakat Negeri Kedah

mengikut jenis perolehan bagi tempoh 3 tahun. Retrieved July 28, 2010 from

http://www.zakatkedah.com.

Jawatankuasa Fatwa Negeri Kedah. (October 5, 1985). Mengeluarkan zakat wang

yang disimpan tambah selepas cukup nisab sebelum genap haul. Majlis Agama

Islam Negeri Kedah, p6.

Kamil, MI. (2002). Gelagat kepatuhan pendapatan gaji di kalangan kakitangan

awam persekutuan Negeri Kedah. Unpublished PhD dissertation, Universiti

Utara Malaysia, Malaysia.

Kamil, MI. (2004). Prosiding muzakarah pakar zakat: Kesan persepsi undang-

undang dan penguasaan zakat terhadap gelagat kepatuhan zakat pendapatan

gaji. Universiti Kebangsaan Malaysia: Kuala Lumpur.

Kamil, MI., Chek Derashid, & Engku Ismail Engku Ali (1997). Zakat penggajian:

Suatu tinjauan terhadap pengetahuan dan amalan muslimin Negeri Perlis.

Paper presented in Research Seminar, Universiti Utara Malaysia, Malaysia.

Lau, ASM (2002). Strategies to motivate brokers adopting on-line trading in Hong

Kong financial market. Review of Pacific Basin Financial Market and Policies,

5(4), 471-489.

Mohd Ali Mohd Nor, Hairunnizam Wahid & Nor Ghani Md.Nor. (2004). Kesedaran

membayar zakat pendapatan di kalangan kakitangan professional Universiti

Kebangsaan Malaysia. Islamiyyat, 26(2),59-67.

Mohd. Masum Billah (2001). Administration of al-Zakat for the poverty alleviation

in Malaysia. Retrieved July 24, 2010 from www.

Takaful.coop/doc_store/takaful/Zakat (Poverty Alleviation) in Malysia.doc

Mohd Rais Haji Alias (2008). The role of zakat institutions in alleviating poverty:

Malaysian experience, IKaZ International Journal of Zakah ,1(1), 65-92.

Mohmad Zaki (2008). Determinant of zakah compliance intention among self-

employed income earners in Kubang Pasu and Kota Star. Unpublished report,

Faculty of Accountancy, UUM, Sintok.

Registrar Department. (2010). Number of academic and non-academic Universiti

Utara Malaysia employees. Universiti Utara Malaysia, Sintok.

Nur Barizah Abu Bakar (2002). Study guide: Zakat accounting concepts and

applications. Kuala Lumpur: Wisewords publishing.

Nur Barizah Abu Bakar & Hafiz Majdi Abdul Rashid. (2010). Motivations of paying

zakat on income: Evidence from Malaysia. International Journal of Economics

and Finance, 2(3), 76-84.

Pouter, DR., Chapman, P., Bibby, PA., Clarke, DD., & Crundall, D. (2008). An

application of the theory of planned behavior and compliance with regulations.

Accident Analysis and Prevention, 40, 2058-2064.

Rhodes, RE., Courneya, KS., & Jones, LW. (2004). Personality and social cognitive

influences on exercise behavior: Adding the activity trait to the theory of

planned behavior. Psychology of Sports and Exercise, 5, 243-254.

35

Sanep, A., & Zulkifli. (2010). International Conference-The tawhidi Epistemology:

Model gelagat pematuhan dan pengelakan zakat: Suatu tinjauan teori. Bangi:

Kuala Lumpur.

Sekaran, U. (2000). Research methods more business: A skill-building approach (3

rd

ed.). New York: John Wiley & Son.

Shimp, T.A., & Kavas, A. (1984). The theory of reasoned action applied to coupon

usage. Journal of Consumer Research, 11, 795-809.

Tonglet, M., Phillips, PS., & Read, AD. (2004).Using the theory of planned behavior

to investigate the determinants of recycling behavior: A case study from

Brixworth, UK. Resources, Conservation and Recycling, 41, 191-214.

Zainol, B., & Kamil. M.I. (2007). The role of attitude an subjective norm on

intention to comply zakah on employment income. IKaZ International Journal

of Zakah, 1(1), 113-130.

Zainol, B. (2008). Faktor-faktor penentu niat gelagat kepatuhan zakat pendapatan

gaji. Unpublished PhD thesis, Universiti Utara Malaysia.

Zainol, B., Kamil, MI., & Faridahwati, MS. (2009). Predicting compliance intention

on zakah on employment income in Malaysia: An application of reasoned

action theory. Jurnal Pengurusan, 28(July), 85-102.

Zainol, B., & Kamil, MI. (2009). Sikap, norma subjektif dan persepsi kawalan

ditanggap terhadap niat gelagat kepatuhan zakat pendapatan gaji, International

Journal of Management Studies, 16(1), 31-55.

Zainol, B., & Kamil, MI. (2009). Ramalan niat gelagat kepatuhan zakat pendapatan

gaji: Perbandingan teori tindakan beralasan dan teori gelagat terancang.

International Journal of Management Studies, 16(2),1-19.

Zikmund, WG. (2003). Business research method (7

th

ed.). United States of America:

Thompson.

Você também pode gostar

- Thesis UEL For SubmissionDocumento87 páginasThesis UEL For SubmissionizahAinda não há avaliações

- TITLE DOC and TABLE OF CONTENTSDocumento9 páginasTITLE DOC and TABLE OF CONTENTSChelsea AnozieAinda não há avaliações

- Designing An Effective Training ProgramDocumento41 páginasDesigning An Effective Training ProgramYahia Mustafa AlfazaziAinda não há avaliações

- Universiti Teknologi Mara: Salwa Binti ZolkaflilDocumento5 páginasUniversiti Teknologi Mara: Salwa Binti ZolkaflilBenjo Ramos HilarioAinda não há avaliações

- Account Research Work 2Documento71 páginasAccount Research Work 2Jayeoba Roseline OlawanleAinda não há avaliações

- Final WorkDocumento70 páginasFinal WorkFRANCIS ACQUAHAinda não há avaliações

- A. BEHAVIOURS LEADERSHIPDocumento5 páginasA. BEHAVIOURS LEADERSHIPGuru MoorthyAinda não há avaliações

- Emperor's Project WorkDocumento133 páginasEmperor's Project WorkHaidee BellaAinda não há avaliações

- Employee Participation in Decision Making and OrganisationalDocumento55 páginasEmployee Participation in Decision Making and OrganisationalRayyan AlghaithyAinda não há avaliações

- Ekeagu FPDocumento8 páginasEkeagu FPEbitanmi AdekunleAinda não há avaliações

- 1.zaid Mat YusopDocumento17 páginas1.zaid Mat YusopAin ZulkifliAinda não há avaliações

- Customers Satisfaction Analysis of DhakaDocumento51 páginasCustomers Satisfaction Analysis of DhakaJannatul FerdausAinda não há avaliações

- Abdulrahaman AbdullahiDocumento41 páginasAbdulrahaman AbdullahiJAY KAYAinda não há avaliações

- Chapter 1Documento22 páginasChapter 1Ajay JaiswalAinda não há avaliações

- 2023 - Derence K. Russell - D&I PúblicoDocumento117 páginas2023 - Derence K. Russell - D&I PúblicoKlislaine LimaAinda não há avaliações

- Financial ManagementDocumento88 páginasFinancial ManagementSomevi Bright KodjoAinda não há avaliações

- The Determinants Influencing The Ethics Among The Accounting Students in Universiti Tenaga Nasional (Uniten)Documento53 páginasThe Determinants Influencing The Ethics Among The Accounting Students in Universiti Tenaga Nasional (Uniten)pavithran selvarajuAinda não há avaliações

- UntitledDocumento87 páginasUntitledRyan Fer GomezAinda não há avaliações

- Img 05134Documento75 páginasImg 05134agsanAinda não há avaliações

- Compliancewith Accounting StandardsDocumento109 páginasCompliancewith Accounting Standardsfalope femiAinda não há avaliações

- Succession Planning and Management Practices Among Private Sector Firms in MalaysiaDocumento10 páginasSuccession Planning and Management Practices Among Private Sector Firms in MalaysiahangnlAinda não há avaliações

- Monicah Watiri Kariuki Mair 2018Documento97 páginasMonicah Watiri Kariuki Mair 2018Lizamhel MendozaAinda não há avaliações

- Pathways To Financial Success Determinants of FinaDocumento121 páginasPathways To Financial Success Determinants of FinaCaren TimanunoAinda não há avaliações

- Afolayan Samson Font PageDocumento82 páginasAfolayan Samson Font Pagelawal kola taofeeqAinda não há avaliações

- Impact of Economic and Institutional Factors On The Socio-Economic Growth of Khyber Pakhtunkhwa, PakistanDocumento24 páginasImpact of Economic and Institutional Factors On The Socio-Economic Growth of Khyber Pakhtunkhwa, PakistanAbdul WadoodAinda não há avaliações

- s810153 AbstractDocumento51 páginass810153 AbstractCurut tuAinda não há avaliações

- Midlands State University Msu Faculty ofDocumento14 páginasMidlands State University Msu Faculty ofxxx98Ainda não há avaliações

- Bibiliography 22Documento90 páginasBibiliography 22Ogunkoya OdunayoAinda não há avaliações

- Methodist Project (Chapter 1 - 5) - David Mbugua (Kenya)Documento46 páginasMethodist Project (Chapter 1 - 5) - David Mbugua (Kenya)waruingi12350% (2)

- The Perception of The Factors That ContrDocumento114 páginasThe Perception of The Factors That ContrArvind RaveeAinda não há avaliações

- Research ProjectDocumento54 páginasResearch Projectyusufgarba2002Ainda não há avaliações

- Financial Literacy 3Documento120 páginasFinancial Literacy 3Chawie CjAinda não há avaliações

- Models-Based Teaching:: As Excellent Innovations in TeachingNo EverandModels-Based Teaching:: As Excellent Innovations in TeachingNota: 4 de 5 estrelas4/5 (1)

- Harrison Masters Thesis 2023Documento79 páginasHarrison Masters Thesis 2023Francis TivoakpobareAinda não há avaliações

- Corporate Governance MGT Full PROJECT 12 09 2020Documento107 páginasCorporate Governance MGT Full PROJECT 12 09 2020Yomi BrainAinda não há avaliações

- The Effect of Budget and Budgetary ContrDocumento58 páginasThe Effect of Budget and Budgetary ContrAjaykumar T Ajaykumar TAinda não há avaliações

- Agboola Olawale SikiruDocumento9 páginasAgboola Olawale SikiruMr Jatto Muhammad AwwalAinda não há avaliações

- Baguma VictorDocumento44 páginasBaguma VictorSiifyoom HarmeeAinda não há avaliações

- My Project Effect of Financial Statement Fraud On Organisational Performance A Case Study of Selected Deposit Money Banks in NigeriaDocumento92 páginasMy Project Effect of Financial Statement Fraud On Organisational Performance A Case Study of Selected Deposit Money Banks in NigeriaRock KimAinda não há avaliações

- Tjiueza 2018Documento81 páginasTjiueza 2018Deus MalimaAinda não há avaliações

- Daranijo Ibiwumi ZainabDocumento78 páginasDaranijo Ibiwumi Zainablawal kola taofeeqAinda não há avaliações

- RESEARCH METHODOLOGY ASSIGNMENT MBACT9docxDocumento9 páginasRESEARCH METHODOLOGY ASSIGNMENT MBACT9docxLoganaiyagee ManogaranAinda não há avaliações

- Ekeagu CMPDocumento76 páginasEkeagu CMPEbitanmi AdekunleAinda não há avaliações

- Doctor of Philosophy DissertationDocumento129 páginasDoctor of Philosophy DissertationCurtis CampbellAinda não há avaliações

- HR ProjectDocumento64 páginasHR Projectvedantmhaske9044Ainda não há avaliações

- M.Phil (Education) Sima AdhikariDocumento134 páginasM.Phil (Education) Sima Adhikarisinghanubhav60Ainda não há avaliações

- Factors Influencing The Muslim Consumer's Level of Confidence On Halal Logo Issued by Jakim An Empirical StudyDocumento34 páginasFactors Influencing The Muslim Consumer's Level of Confidence On Halal Logo Issued by Jakim An Empirical StudyJenny AnnAinda não há avaliações

- JESSICA ALMOND PHILIPS-postgraduateDocumento70 páginasJESSICA ALMOND PHILIPS-postgraduateJaphet KwegyaAinda não há avaliações

- Effects of Deposits Mobilization On The Financial Performance of Microfinance Banks in Nigeria - A Study of Umuchinemere Pro-Credit Micro Finance Bank LimitedDocumento76 páginasEffects of Deposits Mobilization On The Financial Performance of Microfinance Banks in Nigeria - A Study of Umuchinemere Pro-Credit Micro Finance Bank LimitedPrashant chaudharyAinda não há avaliações

- Sample - Project PaperDocumento120 páginasSample - Project Paperwawaozir_518084517Ainda não há avaliações

- Research MethodologyDocumento199 páginasResearch Methodologycelinepillay380Ainda não há avaliações

- Title PageDocumento7 páginasTitle PageElias Samuel UnekwuAinda não há avaliações

- Ppta Ii Group W20Documento57 páginasPpta Ii Group W20Fatin Zafirah Binti Zurila A21A3251Ainda não há avaliações

- G. Love Project Cover PagesDocumento9 páginasG. Love Project Cover Pagesadebowale adejengbeAinda não há avaliações

- Financial Management of Public HospitalsDocumento222 páginasFinancial Management of Public HospitalsPrince T Kwanda100% (1)

- Olayemi Project Front PageDocumento11 páginasOlayemi Project Front PagebrightnytAinda não há avaliações

- Sonal Reference ThesisDocumento296 páginasSonal Reference ThesisChintan Kalpesh ModiAinda não há avaliações

- NguyenDocumento213 páginasNguyenCHÂU ĐÀO BÍCHAinda não há avaliações

- Title Page HeheDocumento10 páginasTitle Page Heheゝ NicoleAinda não há avaliações

- Asrat Alemu PDFDocumento96 páginasAsrat Alemu PDFRuth MgalulaAinda não há avaliações

- Progress in Development Studies 2014 Torri 31 48Documento19 páginasProgress in Development Studies 2014 Torri 31 48zulikah89Ainda não há avaliações

- INFORM 14 Women EntrepreneursDocumento4 páginasINFORM 14 Women Entrepreneurszulikah89Ainda não há avaliações

- Challenges Faced by Women Entrepreneurs A Case Study of Mashonaland Central ProvinceDocumento15 páginasChallenges Faced by Women Entrepreneurs A Case Study of Mashonaland Central Provincezulikah89Ainda não há avaliações

- Examining Successful Iranian Women Entrepreneurs An Exploratory StudyDocumento19 páginasExamining Successful Iranian Women Entrepreneurs An Exploratory Studyzulikah89Ainda não há avaliações

- 07 - Norsida ManDocumento13 páginas07 - Norsida Manzulikah89Ainda não há avaliações

- Challenges Faced by Muslim Women Entrepreneurs: The Malaysian ContextDocumento10 páginasChallenges Faced by Muslim Women Entrepreneurs: The Malaysian Contextzulikah89Ainda não há avaliações

- 2005 2 4 MansorDocumento15 páginas2005 2 4 Mansorzulikah89Ainda não há avaliações

- Education and Employment Outcomes of Young Migrants To Greater JakartaDocumento4 páginasEducation and Employment Outcomes of Young Migrants To Greater Jakartazulikah89Ainda não há avaliações

- 2 Thesunnah 160531170955Documento31 páginas2 Thesunnah 160531170955Prayveen Raj SchwarzeneggerAinda não há avaliações

- 9A Agama Islam Ganjil 2016 2017Documento13 páginas9A Agama Islam Ganjil 2016 2017Yunianto HendrawardhanaAinda não há avaliações

- Ghulam FaridDocumento9 páginasGhulam FaridAmmarah HannanAinda não há avaliações

- Naat in Roman EnglishDocumento12 páginasNaat in Roman EnglishMohamed Moinuddin100% (3)

- Verse Al-Mumtahina From Hoy QuranDocumento3 páginasVerse Al-Mumtahina From Hoy QuranMohammed Abdul Hafeez, B.Com., Hyderabad, IndiaAinda não há avaliações

- Between Secular Activism and Religious Observance-Abu Mayanja and Africa Triple HeritageDocumento20 páginasBetween Secular Activism and Religious Observance-Abu Mayanja and Africa Triple HeritageEisahKMAinda não há avaliações

- 9 Conditions of ShahadaDocumento2 páginas9 Conditions of ShahadaQubeAinda não há avaliações

- HudoodDocumento48 páginasHudoodislampolicy100% (1)

- Marriage BDocumento7 páginasMarriage BNurul HabibahAinda não há avaliações

- AqeeqahDocumento2 páginasAqeeqahSyed KazimAinda não há avaliações

- 11 The 18 Lessons From The Story of Prophet Yunus (As) (JANUARY 11 2014)Documento15 páginas11 The 18 Lessons From The Story of Prophet Yunus (As) (JANUARY 11 2014)Mustafa KhanAinda não há avaliações

- Sources of Muslim LawDocumento7 páginasSources of Muslim LawSheetal ParakhAinda não há avaliações

- All Praise Is Due To Allah AloneDocumento13 páginasAll Praise Is Due To Allah Aloneremo_foru69Ainda não há avaliações

- New PaulyDocumento2 páginasNew PaulyAnonymous xo7GDeQAinda não há avaliações

- Pidato Bahasa InggrisDocumento17 páginasPidato Bahasa InggrisFazry MaharsiAinda não há avaliações

- The Reality of TasawwufDocumento76 páginasThe Reality of TasawwufShaikh Mohammad Iqbal K67% (3)

- Islam: Mosque in Marawi City in The PhilippinesDocumento7 páginasIslam: Mosque in Marawi City in The PhilippinesKath ChuAinda não há avaliações

- Musnad Ali RidhaDocumento36 páginasMusnad Ali RidhaAli Asghar ShahAinda não há avaliações

- Baraka Allahu LakumaDocumento3 páginasBaraka Allahu Lakumaandrilesmana8426Ainda não há avaliações

- Nishtar Medical College Multan Merit List Session 2014-2015Documento26 páginasNishtar Medical College Multan Merit List Session 2014-2015Shawn ParkerAinda não há avaliações

- Christological MonotheismDocumento6 páginasChristological MonotheismDuane Alexander Miller BoteroAinda não há avaliações

- My Son The FanaticDocumento8 páginasMy Son The Fanaticc1ceca100% (1)

- Quran Progress Track by SurahDocumento1 páginaQuran Progress Track by SurahTracy DababsehAinda não há avaliações

- 0493 w14 Ms 21 PDFDocumento7 páginas0493 w14 Ms 21 PDFSeema NisarAinda não há avaliações

- Complete Booklet - Arabic Alphabet With ShapesDocumento32 páginasComplete Booklet - Arabic Alphabet With ShapesSaleem Bhimji100% (10)

- Arab-Khazar WarsDocumento10 páginasArab-Khazar Warsdzimmer6Ainda não há avaliações

- All About Pak Affairs (DMG Officer) - Recommended - CSS ForumsDocumento5 páginasAll About Pak Affairs (DMG Officer) - Recommended - CSS ForumsAzeem ChaudharyAinda não há avaliações

- Landscape Architecture: Global HistoryDocumento67 páginasLandscape Architecture: Global HistoryYash SethiAinda não há avaliações

- Quran English Translation Clearquran Edition AllahDocumento254 páginasQuran English Translation Clearquran Edition AllahMd Sirajul Islam0% (1)

- A History of Pakistani Literature in English by Tariq RahmanDocumento482 páginasA History of Pakistani Literature in English by Tariq RahmanSumaira Ibrar74% (19)