Escolar Documentos

Profissional Documentos

Cultura Documentos

Things You Need To Know About Home Loan Approval-In-Principle

Enviado por

123arica0 notas0% acharam este documento útil (0 voto)

24 visualizações2 páginasNot many people are aware that home loan denial can be avoided by checking for Home loan Approval-In-Principle.

Título original

Things You Need to Know About Home Loan Approval-In-Principle

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoNot many people are aware that home loan denial can be avoided by checking for Home loan Approval-In-Principle.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

24 visualizações2 páginasThings You Need To Know About Home Loan Approval-In-Principle

Enviado por

123aricaNot many people are aware that home loan denial can be avoided by checking for Home loan Approval-In-Principle.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 2

Things You Need To Know

About Home Loan

Approval-In-Principle

Not many people are aware that home

loan denial can be avoided by checking

for Home loan Approval-In-Principle. Mr

Swapnil and his wife Meena spent more

than si months finding their dream

home. !rom short listing vario"s pro#ects

to selecting the ideal location$ the co"ple

finally managed to reach a good price

they deemed affordable after active

bargaining with the developers. %ith all

aspects of their dream home finali&ed$

they felt it was the right time to approach

their bank for a home loan re'"est. (he co"ple however got the shock of their lives

when the bank re#ected their home loan application d"e to low CIBIL score. A car

loan defa"lt some years back and some credit card d"es had impacted the credit

rating of Swapnil leading to the denial of home loan.

(he co"ple are not the only one who face s"ch re#ections after doing all the hard

work of short listing the property of home they are interested in b"ying. (his can be

avoided if they had Home loan Approval-In-Principle.

Approval in principle

(he concept of getting approval before hand is known as approval-in-principle which

can be taken as m"ch as one month in advance before act"al b"ying of the

property. )et "s look at vario"s aspects of approval-in-principle and its associated

advantages.

*Approval in principle+ as the name s"ggests is a pre approval for any loan

amo"nt "s"ally for ho"sing loans before the act"al p"rchase of the home. It takes

into acco"nt the credit history of the loan applicant and overall financial health and

repayment history.

In simple words approval-in-principal offers a g"arantee that the bank wo"ld

approve of a loan of the approved amo"nt when applied within a fied timeline. (he

bank however will still "ndergo all its tests and approval mechanisms at the time of

act"al delivery of the home loan.

%hat makes Approval-in-principal or AIP s"ch a significant tool is that is gives the

b"yer an eact idea of how m"ch loan wo"ld be sanctioned which can be "sef"l in

determining the overall b"dget of the ho"se. ,efore making any down payment or

commitment to the b"ilder and then finding o"t that home loan has been re#ected$

AIP gives an ass"red loan approval for a predetermined amo"nt within stip"lated

timeline.

Advantages of Approval in principle

Approval-in-Principal -AIP. offers an ass"rance from the bank that they wo"ld

sanction a loan s"b#ect to stip"lated amo"nt if applied before the deadline of one

month. In some co"ntries$ the deadline for AIP is as high as fo"r months. Indian

banks however offer AIP for a maim"m limit of / month. %itho"t an AIP loan

approval all the hard work of short listing the apartment premises$ the locality$

b"ilder$ price etc may go to waste if the bank finally disapproves the ho"sing loan.

%ith an AIP$ home loan b"yers can have a s"rety of the home loan they can avail

and "se the same to finali&e their b"dget for their dream home p"rchase.

Eligibility Conditions

,anks give an AIP only after d"e diligence check of the applicants financial

backgro"nd$ history and repayment track record. (he banks check with the 0I,I)

score before confirming any AIP. A bad 0I,I) score may lead to a denial of AIP as

well as any f"t"re loans.

Apart from financial history and repayment track record$ AIP also considers any

conc"rrent eisting loans and debt commitments. !or s"ccessf"l applicants 0I,I)

score m"st be respectable to be eligible for AIP. Altho"gh AIP offers an ass"rance for

the home loan "p to a fied amo"nt if applied within the timeline of one month$ any

lack of information or desired doc"mentation for home loan can mean denial of

home loan even after AIP.

Source1 0ommon!loor.com

!or )atest 2pdates on 3eal 4state 2pdates$ Property News and 0ities

Infrastr"ct"re 5evelopments 6isit1 http177www.commonfloor.com7g"ide

0opyright 8 9::;-/< 0ommon!loor.com. All rights reserved.

Você também pode gostar

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Chennai: Major Real Estate Deals of 2014Documento2 páginasChennai: Major Real Estate Deals of 2014123aricaAinda não há avaliações

- Ajmer Plays It Smart'Documento2 páginasAjmer Plays It Smart'123aricaAinda não há avaliações

- MMR: 15 Major Realty Deals in 2014Documento3 páginasMMR: 15 Major Realty Deals in 2014123aricaAinda não há avaliações

- The Karnataka Rent Control Act 2001 - An AnalysisDocumento4 páginasThe Karnataka Rent Control Act 2001 - An Analysis123aricaAinda não há avaliações

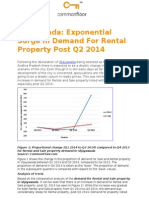

- Vijayawada: Exponential Surge in Demand For Rental Property Post Q2 2014Documento3 páginasVijayawada: Exponential Surge in Demand For Rental Property Post Q2 2014123aricaAinda não há avaliações

- Demand Higher For 2 BHK Apartments in Viman Nagar, PuneDocumento2 páginasDemand Higher For 2 BHK Apartments in Viman Nagar, Pune123aricaAinda não há avaliações

- Varanasi: The New Hotspot On India's Realty MapDocumento2 páginasVaranasi: The New Hotspot On India's Realty Map123aricaAinda não há avaliações

- Bijli Ghar To Electrify Villages in Remote AreasDocumento2 páginasBijli Ghar To Electrify Villages in Remote Areas123aricaAinda não há avaliações

- Mehrauli: Thriving On Connectivity & Proximity To Delhi Univ.Documento2 páginasMehrauli: Thriving On Connectivity & Proximity To Delhi Univ.123aricaAinda não há avaliações

- Planning To Purchase An Apartment in Guntur Go For It NowDocumento2 páginasPlanning To Purchase An Apartment in Guntur Go For It Now123aricaAinda não há avaliações

- Current Residential Real Estate Trend in NCRDocumento3 páginasCurrent Residential Real Estate Trend in NCR123aricaAinda não há avaliações

- Sri City in Andhra Realty Impact in Surrounding AreasDocumento3 páginasSri City in Andhra Realty Impact in Surrounding Areas123aricaAinda não há avaliações

- Delhi: Consider CR Park For Rental AccommodationDocumento2 páginasDelhi: Consider CR Park For Rental Accommodation123aricaAinda não há avaliações

- Finance (No. 2) Bill 2014: Amendments in Real Estate (Part II)Documento4 páginasFinance (No. 2) Bill 2014: Amendments in Real Estate (Part II)123aricaAinda não há avaliações

- Single-Window Clearance in Telangana May Boost RealtyDocumento2 páginasSingle-Window Clearance in Telangana May Boost Realty123aricaAinda não há avaliações

- SEBI Has Finalised The Draft Norms of InvITsDocumento2 páginasSEBI Has Finalised The Draft Norms of InvITs123aricaAinda não há avaliações

- Eco-Friendly Homes Gaining Prominence in IndiaDocumento2 páginasEco-Friendly Homes Gaining Prominence in India123aricaAinda não há avaliações

- Smart Cities - A Futuristic Vision of Urbanisation in IndiaDocumento2 páginasSmart Cities - A Futuristic Vision of Urbanisation in India123aricaAinda não há avaliações

- Budget 2014: PPP Model in InfrastructureDocumento3 páginasBudget 2014: PPP Model in Infrastructure123aricaAinda não há avaliações

- Budget 2014: New FDI Norms To Attract Foreign InvestorsDocumento2 páginasBudget 2014: New FDI Norms To Attract Foreign Investors123aricaAinda não há avaliações

- All You Need To Know About Guwahati Metro!Documento2 páginasAll You Need To Know About Guwahati Metro!123aricaAinda não há avaliações

- Housing For All by 2022Documento2 páginasHousing For All by 2022123aricaAinda não há avaliações

- MCD Delhi Property Tax Guide: Pay Your Property Tax OnlineDocumento3 páginasMCD Delhi Property Tax Guide: Pay Your Property Tax Online123arica100% (1)

- Budget 2014: Tumkur Gets Smart City' TagDocumento2 páginasBudget 2014: Tumkur Gets Smart City' Tag123aricaAinda não há avaliações

- Railway Budget 2014: Railway Minister Announces Diamond QuadrilateralDocumento2 páginasRailway Budget 2014: Railway Minister Announces Diamond Quadrilateral123aricaAinda não há avaliações

- Saving Income Tax During Financial Year 2014-2015 On Property Gains Through Cost Inflation IndexDocumento4 páginasSaving Income Tax During Financial Year 2014-2015 On Property Gains Through Cost Inflation Index123aricaAinda não há avaliações

- How Will The Budget Shape Up The SectorDocumento2 páginasHow Will The Budget Shape Up The Sector123aricaAinda não há avaliações

- Reduce Interest Rate On Home Loan: CommonFloor PollDocumento3 páginasReduce Interest Rate On Home Loan: CommonFloor Poll123aricaAinda não há avaliações

- Noida: NGT's Order Delay Construction and Possession of FlatsDocumento2 páginasNoida: NGT's Order Delay Construction and Possession of Flats123aricaAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- UltraTech Cement Balance Sheet and Profit & Loss AnalysisDocumento6 páginasUltraTech Cement Balance Sheet and Profit & Loss AnalysisMOHAMMED KHAYYUMAinda não há avaliações

- B2B E-Commerce: Selling and Buying in Private E-MarketsDocumento54 páginasB2B E-Commerce: Selling and Buying in Private E-MarketsKrisel IbanezAinda não há avaliações

- Situation AnalysisDocumento5 páginasSituation AnalysissuhailAinda não há avaliações

- CV Fozil SohibovDocumento2 páginasCV Fozil SohibovAnonymous SE69OlIAinda não há avaliações

- SCOR Project and Key Risk Indicator On PT. Albisindo Timber CompanyDocumento83 páginasSCOR Project and Key Risk Indicator On PT. Albisindo Timber CompanyRafly Galih SaputraAinda não há avaliações

- Course Title:: AnnexureDocumento6 páginasCourse Title:: AnnexureGeetika RajputAinda não há avaliações

- Random HRM DataDocumento12 páginasRandom HRM DatasfarhanmehmoodAinda não há avaliações

- SAP Business One Implementation GuideDocumento20 páginasSAP Business One Implementation GuideJesus A Roque Ortiz100% (1)

- Monmouth Inc Solution 5 PDF FreeDocumento12 páginasMonmouth Inc Solution 5 PDF FreePedro José ZapataAinda não há avaliações

- Cpa2901us2-Ver41 Online FarDocumento35 páginasCpa2901us2-Ver41 Online Faralik711698100% (1)

- Pharmacovigilance Systems Master File (PSMF) : Dr. Varun Sharma Senior Project LeaderDocumento22 páginasPharmacovigilance Systems Master File (PSMF) : Dr. Varun Sharma Senior Project LeaderEldaniz Hasanov100% (2)

- e-Commerce Course SyllabusDocumento1 páginae-Commerce Course SyllabusFatima GorineAinda não há avaliações

- Management Implementation in Pharma CompaniesDocumento28 páginasManagement Implementation in Pharma CompaniesRACHMA EQUATRIN PAinda não há avaliações

- Replenishment Planning - Process StepsDocumento1 páginaReplenishment Planning - Process StepsNishu NishuAinda não há avaliações

- Canadian Banks Real Estate Conference Round Up - Nov.14.2016 VeritasDocumento7 páginasCanadian Banks Real Estate Conference Round Up - Nov.14.2016 VeritasKullerglasez RoseAinda não há avaliações

- 8-Difference Between SOPs V Work Instructions V ProceduresDocumento2 páginas8-Difference Between SOPs V Work Instructions V ProceduresJanet BelloAinda não há avaliações

- Chapter 1 - Basic Concepts of Strategic ManagementDocumento6 páginasChapter 1 - Basic Concepts of Strategic ManagementMay JennAinda não há avaliações

- Financial Accounting Canadian 6th Edition Libby Solutions Manual 1Documento107 páginasFinancial Accounting Canadian 6th Edition Libby Solutions Manual 1sharon100% (43)

- L'Oreal of Paris - Q1Documento3 páginasL'Oreal of Paris - Q1rahul_jain_76Ainda não há avaliações

- Vimp Interview QuestionsDocumento19 páginasVimp Interview Questionsppt85Ainda não há avaliações

- Tata Steel's Global Leadership in SustainabilityDocumento5 páginasTata Steel's Global Leadership in SustainabilityVikas AroraAinda não há avaliações

- Developing A Supply Chain Disruption Analysis Model - Application of Colored Petri-NetsDocumento10 páginasDeveloping A Supply Chain Disruption Analysis Model - Application of Colored Petri-Netsmario2008Ainda não há avaliações

- Chowking AnalysisDocumento17 páginasChowking Analysisayanggg.2007Ainda não há avaliações

- 001 SAP Collection Management Config PreviewDocumento31 páginas001 SAP Collection Management Config PreviewKarina NunesAinda não há avaliações

- Internal Assessment Test on Entrepreneurship ConceptsDocumento28 páginasInternal Assessment Test on Entrepreneurship ConceptsRam Krishna KrishAinda não há avaliações

- Reports On Audited Financial Statements PDFDocumento28 páginasReports On Audited Financial Statements PDFoptimistic070% (1)

- Issues and Challenges of Indian Aviation Industry: A Case StudyDocumento7 páginasIssues and Challenges of Indian Aviation Industry: A Case StudyJayant KumarAinda não há avaliações

- Erp QuestionnaireDocumento3 páginasErp Questionnaireviji_kichuAinda não há avaliações

- Shivani TA ResumeDocumento2 páginasShivani TA Resumesabkajob jobAinda não há avaliações

- Mca ReportDocumento70 páginasMca ReportrahulprajapAinda não há avaliações