Escolar Documentos

Profissional Documentos

Cultura Documentos

Working Capital Project Report

Enviado por

Supash AlawadiDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Working Capital Project Report

Enviado por

Supash AlawadiDireitos autorais:

Formatos disponíveis

1

A Project Report

ON

Working Capital Management

Submitted in partial fulfilment of the requirement for the degree of

MBA (General)

By

Supash Alawadi

(Roll no.-151)

Under the guidance of

Prof.Rajita Dixit

A Study Conducted At

Varroc Engineering Ltd., Pantnagar

At

Institute of Management & Entrepreneurship Development

Erandwane, Pune-38

(Year 2010-12)

2

BHARTI VIDYAPEETH UNIVERSITY, PUNE

INSTITUTE OF MANAGEMENT AND ENTREPRENUERSHIP DEVELOPMENT, PAUD ROAD, ERANDWANE

PUNE-38

CERTIFICATE OF COMPLETION

This is to certify that Mr. Supash Alawadi is a bonafide student of MBA program of the university in this

institute for the year 2010-12. As a part of the University curriculum, the student has completed the project

report titled

Working Capital Management in Varroc Engineering Ltd. The project report is prepared by the student

under the guidance of

Prof.Rajita Dixit.

(Teacher Guide) Program Co-ordinator Director

Date:

Place:

3

4

ACKNOWLEDGEMENT

Expression of feeling by words makes them less significant when it comes to make statement of

gratitude.

There are few moments in life when you really feel like expressing gratitude and sincere thanks. I take this

opportunity to express my deep gratitude to persons who have helped me.

First of all, I express my sincere debt of gratitude to the Almighty God who always supports me in my

endeavors.

The Summer Training Project would not have been a success without the timely guidance of Mr Tapas

Kumar Sadhu, Deputy Manager Finance and the proper guidance of Prof.Rajita Dixit.

I enjoyed full freedom to move in the organization and collect the required information from the other

department as well.

And lastly I am also thankful to our honoured faculties for their constant support and for granting the

opportunity to gain practical knowledge through the summer training programme.

5

CONTENTS

Chapter 1- COMPANY OVERVIEW

Page No.

About Varroc. 08

Mission.. 09

Vision. 09

Core and Corporate Values 10

Quality policy 11

Environment health and safety policy 12

Historical Background of a Company 13

Clients. 14

Varroc Group,Clients,Name and location 15

Products.. 16-19

Sales Turnover 20

Awards 21

Chapter 2- Introduction of division where Internship was taken -

Page No.

About Varroc Engineering (VEPL-PN) .. 22

Objective .. 23

Market served ... 24

Turnover 24

Organization Structure .. 25

Functions of all department -

Purchase 26

Finance .. 27

IT ... 28

Store... 29

HR.. 30

Main competitors 31

Sources of Finance. 31

Future Plan. 31

6

Promoters of the Company 32

SWOT Analysis of Varroc (VEPL-PN).... 33

Chapter 3 - Working Capital Management

Working Capital Management. 34-40

Operating cycle Analysis of Four major player 41-46

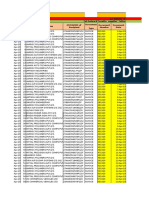

Working Capital Analysis. 47-64

Cash Management. 65-70

Cash Cycle Analysis with its Competitors 71-75

Practices In Varroc for Cash Management 76-79

Inventory Management.. 80-83

Account Receivables.. 84

Chapter 4- Analysis

Research findings 85

Recommendation. 86-87

Conclusion 88

Bibliography

7

EXECUTIVE SUMMARY

The study of the working capital management is crucial for any organization specially the manufacturing

firms as the profitability of the company depends on the operational efficiency.

Decisions relating to working capital and short term financing are referred to as working capital

management. These involve managing the relationship between a firm's short-term assets and its short-term

liabilities.

The objective of the project is to analyze the difference between the theoretical and the practical aspects

related to the Automobile Industry and further analyzing the practices involved in the Varroc Engineering

PVT. LTD.

The methodology used for the analysis part are , the ratio analysis for both the financial as well as the

working capital ratio analysis, operating cycle analysis and the working capital cycle analysis. And the

analysis of cash cycle on the basis of study of cash turnover and component of cash cycle.

The study involves the exploration of the below topics.

Cash management. Identify the cash balance which allows for the business to meet day to

day expenses, but reduces cash holding costs. Cash management seeks to accomplish cash cycle at a

minimum cost and to achieve liquidity and adequate control at same time over cash position to keep

firm sufficiently liquid and to use excess cash in some profitable way.

Inventory management. Identify the level of inventory which allows for uninterrupted

production but reduces the investment in raw materials - and minimizes reordering costs - and hence

increases cash flow; Supply chain management, Just In Time (JIT), EOQ Analysis etc.

Debtors management. Identify the appropriate credit policy, i.e. credit terms which will

attract customers, such that any impact on cash flows and the cash conversion cycle will be offset by

increased revenue.

The projects detailed analysis rests on the Cash Management which includes the theoretical aspects in detail

relating to the motive of maintaining cash balance, objectives of cash management, strategies to minimize

operating cash balance, and investing surplus cash in marketable securities based on their risk, marketability

and yield.

8

CHAPTER 1 Company Overvie

VARROC GROUP

9

ABOUT VARROC

Varroc group is a private group.

The Varroc group manufactures and markets a highly diversified portfolio of automotive components

and subassemblies for two wheelers, three wheelers, four wheelers for sale in domestic and as well as

overseas.

In the four wheeler space the group has ventured only into plastic mounded component, engine

valves and forged component.

The 22group structured into two separate entities: Varroc Polymers Private limited (VPPL) and

Varroc Engineering Private limited (VEPL).

Varroc Polymer manufacture polymer based components and Varroc Engineering manufacture

electrical, electronic and mechanical components.

Two Wheelers

62%

Four Wheelers

33%

White Goods

5%

0%

Market Segment

10

MISSION

Varroc aims to become global player in the business of component supplies to automobile and white goods

industry across India and select foreign markets like USA, Europe, SAARC and ASIAN countries, growing

at 25% CAGR with 15% of the value of products being exported by the year 2010.

VISION

We are committed to serve the society by adding value to the Customers, Employees, Suppliers,

Shareholders and the Community at large in terms of:

Providing Customer Satisfaction by offering Reliable Products and Services at Competitive Prices

Providing an environment conducive to the development, growth and satisfaction of employees

while fulfilling their reasonable aspirations.

Providing adequate returns to the shareholders while nurturing business growth.

Contributing to the well-being of the society and conducting ourselves as a responsible corporate

citizen known for integrity and ethics.

11

CORE VALUES

CORPORATE VALUES

12

13

14

HISTORICAL BACKGROUND OF COMPANY

Year 1984

Increasing Trend in Usage of Automotive Plastics in India due to advent of Suzuki.

Year 1988

Increasing Demand for Consumer Electronics and White Goods in India .

Year 1990

Inception of Operations for Plastic Moulded Components for Automotive and Consumer Electronics

Industry.

Year 1998

Inception of Operation for Metallic Components such as Engine Valves and Electrical Component like

2W Electronic Ignition System.

Year 2007

Foray in Europe in Forgings Space by Acquiring IMES Spa Italy and Poland.

Year 2008

Restructing of the Varroc Group into Varroc Polymer Pvt. Ltd. and Varroc Engineering Pvt. Ltd.

15

CLIENTS

16

NAMES AND LOCATION OF COMPANY

Off roll

Staff Workers Contract

1 VEPL - I Aurangabad 135 78 57 270

2 VEPL - II Aurangabad 23 13 97 133

3 VEPL - III Pune 707 0 204 911

4 VEPL - IV Aurangabad 109 0 57 166

5 VEPL - VI Pune 96 0 220 316

Electrical Total 1070 91 635 1796

6 DIPL Aurangabad 645 37 349 1031

7 VEPL - V Aurangabad 617 0 185 802

8 VEPL - VII - Valves Aurangabad 592 0 112 704

9 VEPL - VII - Forging Aurangabad 98 0 72 170

10 VESPL Pune 54 0 10 64

Metallic Total 2006 37 728 2771

11 VPPL-I Pune 379 0 183 562

12 VPPL-II Pune 278 0 161 439

13 VPPL-III Aurangabad 50 0 13 63

14 VPPL-IV Aurangabad 139 0 113 252

15 TDC Aurangabad 134 0 16 150

16 VPPL-BN Binola 30 0 161 191

17 VPPL-GN Noida 76 0 241 317

Polymer Total 1086 0 888 1974

18 VPPL-PN Uttaranchal 256 0 192 448

19 VEPL - CORP Corporate 136 0 28 164

20 VPPL - CORP Corporate 48 0 0 48

TOTAL 4602 128 2471 7201

Sr. No. Plant Location

Manpower As on 31/08/2010

On roll

Total

17

DIVISONS

1.

2.

3.

18

PRODUCTS

This Division manufactures the following :

Injection moulded engineering plastic components.

Multilayer co-extruded thermoplastic sheets.

Injection & compression moulded automotive and Allied rubber products.

Polyurethane foam seat assemblies.

Rear view mirrors.

Air cleaner assemblies.

+

19

This Division manufactures the following:

AC Generators.

Digital CDI.

Digital Regulator Rectifier.

Starter/ Wiper Motors.

Switch Assemblies & handle bar assemblies for motorcycles.

Lighting systems for motorcycles, LED Lights.

Electronic clusters.

20

Engine Valves.

Crank Pins for motorcycle.

Hot, Cold & Warm `forged Machined Components.

Catalytic converters for 2W, 3W, 4W.

21

SALES TURNOVER

22

AWARDS & APPRECIATION

The Varroc-IMES transaction was awarded the Best Acquisition by a Foreign Company in

Italy for a year 2007.

Kaizen Championship Trophy for the year 2007, which was conferred upon by the TPM Club

of India. (Kaizen Award has been constituted for promotion of Kaizen culture amongst Indian

Industry by the TPM club of India.

Varroc wins ACMA Gold Trophy for excellence in Quality and Productivity.

VEPL-1,VEPL-4,VEPL-6 Plants got Awards from Bajaj Auto Ltd. for outstanding Quality

Performances in this year(20.10.2007).

BAL TPM AWARD was presented to VEPL-6.

VEPL-3 received the Bajaj Silver Award for Quality Supplier.

The Appreciation Award was given to VPPL-4 at the Kaizen Competition in Nasik.

Varroc Group won accolades in the form of appreciation from clients like Bajaj Auto, LG,

Honda and Caterpillar.

Honda Award for best Quality Supplier for the year 2007-2008.

23

Chapter 2 - FIRM WHERE INTERNSHIP UNDERTAKEN-

VARROC ENGINEERING PRIVATE LIMITED

(VEPL-PN)

24

INTRODUCTION OF VEPL-PN

VEPL-PN plant established in 2007.

Total manpower 450 nos.

VEPL-PN plant manufacture subassemblies for Bajajs Discover-100 cc, Discover-150 cc,

Platina-100 cc, Platina-125 cc and pulser-135 cc bike.

OBJECTIVE OF VEPL-PN

To manufacture component that are in perfect accordance with the given specification given by

customer.

Deliver quality product efficiently on time.

To create a corporate system that maximize the efficiency of Production system.(Overall

efficiency improvement).

Create system for preventing the occurrence of all losses on the front line and is focused on the

end product. This include system for realizing zero accidents, zero defects, and zero failures in

the entire life cycle of product system.

Providing customer satisfaction by offering reliable product and service at competitive price.

Providing an environment conductive to the development, growth and satisfaction of employee

while fulfilling their reasonable desire.

Providing adequate return to the shareholders while nurturing business growth.

Conservation of Natural Resources.

25

VEPL-PN served only Domestic market. Its 98% sale is from Bajaj auto limited.

TURNOVER

FISCAL YEAR TURNOVR

2007-2008 95 crore

2008-2009 120 crore

2009-2010 211 crore

2010-2011 500 crore

Bajaj group

98%

Non bajaj group

2%

0%

0%

Sales

26

ORGNISATION STRUTURE

Sumeet

Jhamb

Purna

Sadashiv

Tapas Sadhu

Narender

Singh

Anurudh

Shrivastava

Ashwani

Sharma

Narender

Singh

Narender

Singh

Saurabh

Tiwari

Harsh KohlI

PLANT HEAD

METTALIC POLYMER

ELECTRICAL

PURCHASE

HUMAN

RESOURCE

FINANCE

I.T

ENGINERRIN

G

QUALITY

STORE

DISPATCH

MAINTENCE

Pradeep

Verma

Anil

Choudhary

R P D

Mishra

DEPTT.

27

FUNCTION OF ALL DEPARTMENTS

SCOPE

PURCHASE DEPARTMENT

OBJECTIVE OF PURCHASE DEPARTMENT

TO ACHIEVE ZERO PRODUCTION LOSS DUE TO NO MATERIAL.

TO ACHIEVE ZERO DEFECT IN COMPONENTS.

TO MINIMISE COST LOSS.

BETTER UTILIZATION OF SAP SYSTEM.

ACTIVITIES

GENERATION OF PURCHASE ORDER.

SCHEDULE TO THE SUPPLIERS.

ROAD PERMIT TO THE SUPPLIERS.

ARRANGEMENT OF MATERIALS AS PER REQUIREMENT.

MONITORING OF SUPPLIERS.

CAPACITY INCREASE AT SUPPLIER END / ADDITIONAL SOURCE

COST REDUCTION THROUGH NEGOTIATION / ALTERNATE SOURCE .

LOCALIZATION OF SUPPLIERS / COMPONENTS.

OBSERVATION

TIME LOSS DUE TO DELAY IN PURCHASE ORDER GENERATION.

HIGH TRANSPORTATION COST LOSS.

COMMUNICATION LOSS (DELAY IN SCHEDULE TO SUPPLIER).

REWORK DUE TO VENDOR DEFECTIVE PARTS.

PURCHAS

E

STORES ACCOUNTS I.T HR

Procurement

of material

Material

storage &

issue

Book

keeping, Bills

& Payments

Networking,

computers &

Transaction in SAP

Personnel &

Administratio

n

28

FINANCE DEPARTMENT

OBJECTIVE OF FINANCE DEPARTMENT

NO DELAY IN SUPPLIERS PAYMENT.

CHEQUE PREPARATION ON TIME.

BETTER UTILIZATION OF SAP SYSTEM.

BOOK KEEPING.

PROTECTING THE PROPERTY OF BUSINESS.

COMPLIANCE WITH LEGEL REQUIRMENT.

TO GENERATE RIGHT INFORMATION THIS IS HELPFULL TO VARIOUS PERSONS IN

PLANNING AND DECISION MAKING.

TO ASCERTAIN WHEATHER THE BUSSINESS OPERATION IS PROFITABLE OR NOT.

ACTIVITIES OF FINANCE DEPARTMENT

VERIFICATION AND BOOKING OF INVOICES.

HANDLING DIRECT AND INDIRET TAXES.

CALCULATION OF VARIANCE (BUDGET V/S ACTUAL).

MONTHLY M.I.S (MANAGEMENT INFORMATION SYSTEM).

PAYMENT TO INTERNAL AND EXTERNAL CUSTOMERS.

CLOSING OF ACCOUNTS & PREPARATION OF FINAL ACCOUNTS.

OBSERVATION

MISTAKES IN PREPARATION OF MANUAL CHAQUES.

MISTAKES IN ENTERING INVOICE IN SAP.

SELF AUDIT EVERY MONTH.

STRATEGY ADOPTED BY FINANCE DEPARTMENT

SKILLED EMPLOYEE.

SELF AUDIT EVERY MONTH.

29

I.T DEPARTMENT

ACTIVITY FLOW

SUPPLIER OWN DEPTT CUSTOMER

OBJECTIVE OF IT DEPARTMENT

NO NETWORK FAILURE.

NO COMPUTER BREAKS DOWN.

TO MINIMISE ERROR IN DATA PUNCHING IN SAP.

TO GIVE TRAINING TO USER.

BETTER UTILIZATION OF RESOURCES.

ACTIVITIES

MANAGING NETWORK LINK BETWEEN CENTRAL SERVER AT AURANGABAD TO

VARROC PANTNAGAR PLANT.

MANAGING LOCAL AREA NETWORK TO CONNECT 6 SHEDS.

ENSURE SMOOTH FUNCTIONING OF 78 COMPUTERS AND 20 PRINTERS.

SUPPORT 58 SAP USERS FOR DATA PUNCHING.

UPLOAD MASTER DATA IN SAP SYSTEM.

SUPPORT MANAGEMENT INFORMATION SYSTEM.

TRAINING AND UPGRADING SKILLS FOR COMPUTER USERS.

SERVICE

PROVIDER

DATA CENTER

IT

DEPARTMENT

ALL

DEPARTMENTS

30

STORE DEPARTMENT

ACTIVITY FLOW

SUPPLIER OWN DEPARTMENT CUSTOMER

OBJECTIVE OF STORE

NO PRODUCTION LOSS IN SEARCH OF MATERIAL

ON TIME SERVICE TO PRODUCTION DEPTT.

TO REDUCE MAN POWER COST.

BETTER UTILIZATION OF STORE SPACE.

ACTIVITIES OF STORE

GENERATION OF GRN.

MATERIAL UNLOADING, PHYSICAL VERIFICATION AND STORAGE.

MATERIAL ISSUE TO PRODUCTION.

REJECTION MATERIAL RETURNS TO VENDOR.

INTERPLANT PROCUREMENT.

MAINTAIN STORE INVENTORY.

MONITOR NON-MOVING/SLOW MOVING MATERIALS.

LOGISTICS PLANNING.

VENDOR STORE

PRODUCTION

DEPARTMENT

31

HR DEPARTMENT

ACTIVITY FLOW

SUPPLIER OWN DEPTT CUSTOMER

OBJECTIVE OF HR DEPARTMENT

SMOOTH RUNNING OF PLANT WITH SUPPORT OF EMPLOYEES.

TIMELY PAY-ROLL PROCESSING.

ADHERENCE OF GOVERNMENT RULES AND REGULATIONS.

EMPLOYEE MOTIVATION.

ACTIVITIES

PREPARATION OF JOB DESCRIPTION.

SELECTION AND RECRUITMENT.

TRANSFER AND PROMOTION.

IDENTIFICATION OF TRAINING NEEDS.

ANNUAL APPRAISAL.

CANTEEN MANAGEMENT.

SECURITY ARRANGEMENT.

HOUSE KEEPING.

GOVERNMENT

AUTHORTIES

AUTHORITIES

HR

ALL EMPLOYEES

32

MAIN COMPETITOR

As VEPL-PN mainly supplies their products to Bajaj Pantnagar plant and there is strong relationship

between Bajaj and Varroc group so there is as such no main competitor. But some competitors are:

Roop Polymer Ltd,

Classic Stripes,

V.M. Auto Industries,

Bharat Electronics And

Lumax.

SOURCES OF FINANCING

Sale.

Term loan form Bank.

Internal accruals (sale from other plant).

FUTURE PLANS

Within two years turnover should be 1000 crore.

Expand the business into international market within 5 years.

33

PROMOTERS OF THE COMPANY

The company is a joint venture between Varroc and Mr P J Swamy with the governing body comprising of

Mr Naresh Chandra Jain,

Chairman

B.A. [Economics], M.A.

[History],

D.B.A. [Birmingham, U.K.]

Mr Tarang Jain,

Vice Chairman

MBA(IMD, Switzerland)

Mr P J Swamy,

Managing Director

Mr Naresh Chandra Jain is the

founder of Varroc Group and

Chairman of Varroc Group and

Endurance Group of companies in

addition to being on the board of

several reputed Companies.

Mr Tarang Jain is the driving and

leading force of Varroc group of

companies.

Under his leadership the Varroc

group has grown 10 times from a

$24million company in 2000 to

$240 million in 2009.

In addition to being the Managing

Director of Varroc Group of

Companies,

Mr Tarang Jain is also Chairman

of

IMES, Poland,

Managing Director of

Durovalves India Pvt. Ltd.

Vice Chairman of Plastic

OmniumVarroc Pvt. Ltd.

and

President of IMES , Italy

Mr P J Swamy is a technocrat

entrepreneur with over thirty

years of technical and managerial

experience.

He has been closely associated

with almost every auto company

in India as well as international

companies like General Motors,

Toyota, Honda for Compound

Development, Product

Development And Technical

Service.

Mr Swamy was a member of

technical committee formed in

2000 by Govt of India to upgrade

the quality of automotive rubber

products in India

34

SWOT ANALYSIS OF VEPL-PN

Manufacturing Excellence in all business

vertical

Ability to develop products as per

customer requirements

Land Available for future Expansion Plan

Strategic Supplier of Bajaj group

STRENGTHS

More Dependability on Mother plants

Existing Supplier base facilities in an

Abad & Pune region leads to high

transport cost

Nil R & D Facilities

Main customer is Bajaj.

WEAKNESSES

Manpower Talent scarcity at associate

level, being local OEMs are hiring them

on comparatively higher cost.

THREATS

Potential Business Available with

Automotive OEMs

OEMs preferred choices are local

supplier base

No Major competition in the region.

Export (international market

OPPORTUNITIES

35

Working Capital Management is concerned with the problems that arise in attempting

to manage the current assets, current liabilities, and the relationship that exists

between them.

The term current assets refer to those assets which in ordinary course of business can be, or will be,

converted into cash within one year without undergoing a diminution in value and without disrupting the

operations of the firm. The major current assets are cash, marketable securities, account receivables and

inventory.

Current liabilities are those liabilities which are intended, at their inception to be paid in the ordinary course

of business, within one year out of the current assets or earnings of the concerned. The basic current

liabilities are Account Payables, Bills Payable, Bank Overdraft, and outstanding expenses.

The goal of working capital management is to manage the firms current assets and current liabilities in such

a manner that a satisfactory level of working capital is maintained.

The management of working capital plays an important role in maintaining the financial health of the firm

during the normal course of business. The firm starts functioning with the investment in fixed assets and

starts operation with the own funds or long term debts at its initial stage, but remains in function with the

help of optimum and efficient management of current assets and liabilities. Thus we reveal that not only

fixed assets management is important but also the working capital management is crucial for the firm to

maintain its existence, profitability and liquidity.

Chapter 3 Working Capital Management

36

CONCEPTS OF WORKING CAPITAL

Gross Working Capital- Refers to the firms investment in current assets.

Net Working Capital- Refers to the difference between current assets and current liabilities.

Both concepts are equally significant from the management view point.

Focusing on management of current assets

The gross working capital concept focuses on two aspects of current assets management.

1. How to optimize investment in current assets.

2. How current assets should be financed.

The level of investment in current assets should avoid excess or inadequate investment in current assets.

Excessive investment impairs firms profitability as funds remain idle.

Inadequate investment hampers solvency of the firm.

The gross working capital points its importance for a finance manager to know how he can finance the

current requirements at lowest possible cost but also to look for the most profitable investment avenue for

the surplus fund as the arise in short term.

Net working capital concept focusing on liquidity management

Net working capital is a qualitative concept. It indicates the liquidity position of the firm and suggests the

extent to which working capital needs may be financed by permanent sources of funds. It covers the

judicious mix of the long term and short term funds for financing .

Current assets. Excessive liquidity is also bad as it indicates mismanagement of current assets and less

profitability for the firm.

37

The working capital could be permanent and fluctuating or variable.

Permanent working capital is fixed or minimum level of current assets.

The Fluctuating Working Capital varies with the demand i.e. production and sales.

Temporary or fluctuating

Time

Permanent capital

A

m

o

u

n

t

o

f

w

o

r

k

i

n

g

c

a

p

i

t

a

l

(

R

s

.

)

38

PERMANENT AND TEMPORARY WORKING CAPITAL

The permanent working capital can also follow an increasing trend during expansion needs.

PERMANENT AND TEMPORARY WORKING CAPITAL DURING EXPANSION

PROCESS

Negative Working Capital emerges when current liabilities exceed current assets. Such a situation is

practical, when a firm depends on the bank loans for its operational expenses and occurs when a firm is

nearing a crisis of some magnitude.

Temporary or fluctuating

A

m

o

u

n

t

o

f

w

o

r

k

i

n

g

c

a

p

i

t

a

l

(

R

s

.

)

Permanent capital

39

ESTIMATION OF WORKING CAPITAL

The need for working capital to run the day to day business activities cannot be over- emphasized. We will

hardly find a business firm which does not require any amount of working capital.

We know that a firm should aim at maximizing the wealth of its shareholders. In its endeavor to do so, a

firm should earn sufficient return from its operations. Earning a steady amount of profit requires successful

sales activity. The firm has to invest enough funds in current assets for generating sales. Current assets are

needed because sales do not convert into cash instantaneously. There is an operating cycle involved in the

conversion of sales into cash.

The most appropriate method of calculating the working capital needs of a firm is the concept of

operating cycle.

The operating cycle is defined as the time duration required to convert raw materials or resources to

inventory, inventories to sales or accounts receivables and from accounts receivables to cash. The operating

cycle of a manufacturing company involves three phases:

Acquisition of raw materials

Manufacture of the product

Sale of the product

These phases are not synchronized because cash outflows usually occur before cash inflows.

Thus to estimate the investment required to be done in the three phases has to be analyzed, which is

done depending on the time and resources required for company to complete one operating cycle. The

operating cycle starts with the raw material conversion period and ends at the creditors conversion period.

As the firm makes adequate investment in the inventories and debtors for the smooth and

uninterrupted production for which the estimation of the length of the operating cycle is

determined.

40

The length of the operating cycle is determined by the following formulas:

Length of the operating cycle = inventory conversion period + debtors conversion period

The inventory conversion period is the total time needed for producing and selling the product. Typically it

includes the:

Raw material conversion period= Raw material *365

Raw material consumption

The raw material conversion period is the average time period taken to convert material into work in

progress

Work in progress conversion period= Work-in-progress inventory *365

Cost of Production

Work in progress conversion period is the average time period required to complete the semi-finished goods

or work in progress.

Finished goods conversion period= Finished goods inventory *365

Cost of goods Sold

Finished goods conversion period is the average time taken to sell the finished goods.

Gross operating cycle= ICP + DCP

Gross Operating Cycle is the total time required for the production and sales of the finished goods including

the time of the credit sales.

Debtors conversion period = Debtors *365

Credit Sales

Debtors conversion period is the average time taken to convert debtors into cash.

41

Creditors conversion period= Creditors *365

Credit Purchases

Creditors conversion period is the average time taken by the firm in paying its suppliers .

Net operating cycle= Gross operating cycle Creditors conversion Period

If depreciation is excluded from the expenses in the computation of the operating cycle,

42

OPERATING CYCLE ANALYSIS OF MAJOR PLAYERS OF

VARROC ENG. AND ITS COMPETITORS

VARROC ENGINEERING PVT. LTD.

ITEMS 2010-11 2009-10 2008-09

Rs (Cr.) conversion period(Days) Rs (Cr.)

conversion

period(Days) Rs (Cr.)

conversion

period(Days)

Raw Materials 166.81 30.62 160.06 30.51 145.83 37.32

Work In Progress 32.44 5.03 19.15 3.07 20.42 4.32

Finished Goods 303.6 40.21 189.38 26.11 77.78 13.67

Receivables 435.52 56.45 477.89 66.85 411.79 72.29

Sundry Creditors 592.65 107.45 553.67 104.07 468.63 117.73

DELFE AUTOMOBILES

BASIS 2010-11 2009-10 2008-09

Raw Material Consumption 1988.7 1914.89 1426.12

Cost of Production 2354.86 2278.98 1727.24

Cost of sales 2755.96 2647.84 2076.52

Sales 2816.16 2609.21 2079.08

Credit purchases 2013.1 1941.93 1452.88

ITEMS 2010-11 2009-10 2008-09

Rs (Cr.)

conversion

period(Days) Rs (Cr.)

conversion

period(Days) Rs (Cr.)

conversion

period(Days)

Raw Materials 266.79 31.32 216.21 29.54 193.09 32.43

Work In Progress 93.15 8.97 85.47 9.53 78.06 10.63

Finished Goods 333.48 29.54 263.95 26.48 282.41 34.91

Receivables 551.92 45.72 539.36 52.86 462.34 57.21

Sundry Creditors 483.01 54.49 433.46 57.11 316.07 52.94

43

BASIS 2010-11 2009-10 2008-09

Raw Material Consumption 3109.49 2671.8 2173.52

Cost of Production 3792.05 3274.93 2680.91

Cost of sales 4120.52 3638.6 2952.7

Sales 4406.5 3724.2 2949.85

Credit purchases 3235.61 2770.2 2179.21

METALMEN MICRO TUNER

ITEMS 2010-11 2009-10 2008-09

Rs (Cr.)

conversion

period(Days) Rs (Cr.)

conversion

period(Days) Rs (Cr.)

conversion

period(Days)

Raw Materials 212.47 33.86 219.34 42.70 218.79 54.97

Work In Progress 27.05 3.65 29.41 4.80 23.35 4.55

Finished Goods 212.44 25.10 170.66 24.40 87.98 15.16

Receivables 208.30 23.09 175.14 24.35 156.52 25.67

Sundry Creditors 521.14 80.29 406.54 76.19 371.26 88.32

BASIS 2010-11 2009-10 2008-09

Raw Material Consumption 2290.64 1875.09 1452.86

Cost of Production 2704.91 2235.48 1872.4

Cost of sales 3088.75 2552.52 2117.6

Sales 3292.32 2625.52 2225.49

Credit purchases 2369.14 1947.68 1534.33

44

LUMAX LTD.

ITEMS 2010-11 2009-10 2008-09

Rs (Cr.)

conversion

period(Days) Rs (Cr.)

conversion

period(Days) Rs (Cr.)

conversion

period(Days)

Raw Materials 118.33 29.73 84.5 25.31 94.61 33.92

Work In Progress 22.25 4.69 22.25 5.45 22.40 6.46

Finished Goods 80.80 14.46 80.04 16.94 52.48 12.72

Receivables 263.17 45.00 253.23 52.89 236.60 56.52

Sundry Creditors 435.53 106.28 415.87 121.77 425.20 146.34

BASIS 2010-11 2009-10 2008-09

Raw Material Consumption 1452.93 1218.52 1018.2

Cost of Production 1730.93 1490.73 1266.32

Cost of sales 2040.24 1724.31 1506.19

Sales 2134.78 1747.43 1527.99

Credit purchases 1495.72 1246.57 1060.54

NOTE: Raw material stock includes stores and spares stock raw material consumption includes stores and

spares consumption. Credit purchases include raw material, finished goods and stores and spares.

45

SUMMARY

VARROC ENGINEERING LTD

VARROC ENGINEERING LTD

ITEMS 2010-11 2009-10 2008-09

conversion period(Days)

Raw Materials 30.62 30.51 37.32

Work In Progress 5.03 3.07 4.32

Finished Goods 40.21 26.11 13.67

Receivables 56.45 66.85 72.29

Gross operating cycle 132.31 126.54 127.6

Sundry Creditors 107.45 104.07 117.73

Net operating cycle 24.86 22.47 9.87

ITEMS DELFE AUTOMOBILES METALMEN MICRO TUNER LUMAX Limited

2010-

11

2009-

10

2008-

09 2010-11 2009-10 2008-09

2010-

11

2009-

10

2008-

09

conversion period(Days) conversion period(Days) conversion period(Days)

Raw Materials 31.32 29.54 32.43 33.86 42.7 54.97 29.73 25.39 33.92

Work In Progress 8.97 9.53 10.63 3.65 4.8 4.55 4.69 5.45 6.46

Finished Goods 29.54 26.48 34.91 25.1 24.4 15.16 14.46 16.94 12.72

Receivables 45.72 52.86 57.21 23.09 24.35 25.67 45 52.89 56.52

Gross operating cycle 115.55 118.41 135.18 85.7 96.25 100.35 93.88 75.28 109.62

Sundry Creditors 54.49 57.11 52.94 80.29 76.19 88.32 106.28 121.77 146.34

Net operating cycle 61.06 61.3 82.24 5.41 20.06 12.03 -12.4 -46.49 -36.72

46

OPERATING CYCLE ANALYSIS OF FOUR MAJOR PLAYERS

Raw material conversion period is used to measure the average time taken by raw materials to be used in the

process of production. It indicates how efficiently money is used in raw materials that on one hand should be

sufficient to continue the production and on the other, excess funds must not be blocked in the form of raw

materials. Table shows that raw material conversion period is a bit high in all years & it should be reduced

to get better utilization of funds.

WorkinProgress conversion period reflects the efficiency of the production department which shows the

time taken by the company to process the product. This period has though, increased as compared to the

previous years in 2007 but it still have lot of potential of improvement. According to the table DELFE

Automobiles is the most efficient as far as its operational efficiency is concerned.

Finished goods conversion period indicates how much average time is taken by the finished goods to be

converted into sales. As compared to the previous years it has shown drastic increase as compared to its

competitors which means that the company is not able to sell its products in small period.

The Average Collection Period (ACP) is another litmus test for the quality of the receivables business,

giving the average length of the collection period. As a rule, outstanding receivables should not exceed

credit terms by 1015 days. Though the ACP has reduced from 72 rays to 56 days in the previous years but

still has a room for improvement. On the other hand of DELFE is 45 days and that of METALMEN MICRO

TUNER is 23 days which is the reason of their profitability and less dependency on outsiders funds.

The creditors conversion period indicates the time the company takes to pay its suppliers; it represents the

trade credit limit. The higher CCP as compared to DCP it would be profitable as it also shows the

creditability of the company.

VARROC has maximum credibility to its competitors.

The interpretation of operating cycle analysis is that the GOC should be higher enough than CCP so as to

decrease interest cost and increase profitability.

The gross operating cycle has increased due to increase in the FGCP and RMCP. In case of DELFE

AUTOMOBILES the GOC is decreasing due to decrease in their DCP and quick and high sales turnover.

47

The net operating cycle of VARROC is showing an increasing trend which is a good sign. The reason

behind it is decrease in the DCP and increase in the CCP. On the other hand DELFE is showing the

decreasing trend as it pays its creditors early as compared to others for other cost benefits through the

suppliers.

Creditors and Debtors conversion periods comparative analysis indicates the trade credit utilisation capacity

which further facilitates the firm to borrow less from outside resources for operating expenses. This all

shows positive change in the position of VARROC.

48

DETERMINANTS OF WORKING CAPITAL

Nature of business

Market and demand conditions

Technology and manufacturing policy

Credit policy

Operational efficiency

Price level changes

The growth of the firm is directly based on the working capital management especially in

manufacturing and financial companies. As the output increases the current assets also

increases but at a decreasing rate, if are employed efficiently. The current assets constitute

about 60% of the total assets in case of large and medium public limited companies in India.

The large company like BHEL invests 90% of its capital in current assets. Thus for their

profitability the efficiency of working capital management is very important.

The level of current assets can be measured by relating current assets to

fixed assets.

49

CA/FA RATIO OF VARROC & ITS PEERS

YEAR

VARROC

DELFE

AUTOMOBILES

METALMEN

MICROTUNER

LUMAX

2008-09

0.66 1.70 0.89 1.77

2009-10

0.81 1.87 1.10 0.74

2010-11

0.90 1.73 1.00 0.82

A higher CA/FA ratio means conservative current assets policy and hence greater liquidity and lower risk.

A lower CA/FA ratio indicates aggressive current assets policy, and hence higher risk and poor liquidity.

Varroc has improved on its CA/FA ratio since three years which indicates higher liquidity and lower risk.

The comparative analysis shows that MRF has highest liquidity as compared to others i.e. it pays its

creditors early than its competitors. The ratio also indicates the level of creditors and investors trust in the

company.

0

0.2

0.4

0.6

0.8

1

1.2

1.4

1.6

1.8

2

2008-09 2009-10 2010-11

Varroc

Delfe Automobiles

Metalmen Microtuner

Lumax

50

WORKING CAPITAL REQUIREMENT

The working capital requirement for a firm has to be decided keeping in mind the consequences of the

working capital being above or below the optimum requirement of the firm.

If you have insufficient working capital and try to increase sales, you can easily overstretch the financial

resources of the business. This is called overtrading.

CONSEQUENCES OF THE INADEQUATE WORKING CAPITAL

When working It stagnates growth. It becomes difficult for the firm to undertake profitable

projects for non-availability of working capital funds.

It becomes difficult to implement operating plans and achieve the firms profit target

Operating inefficiencies creep in when it becomes difficult even to meet day to day

commitments.

Fixed assets are not efficiently utilised for the lack of working capital funds. Thus the firms

profitability would deteriorate.

Paucity of working capital funds render the firm unable to avail attractive credit

opportunities etc.

The firm loses its reputation when it is not in a position to honour its short term obligations.

As a result the firm faces tight credit terms.

Capital is inadequate; a company faces the following problems:

CONSEQUENCES OF THE EXCESSIVE WORKING CAPITAL

Too much working is as dangerous as too little of it. Excessive working capital raises the following

problems-

A company may be tempted to under trade and lose heavily.

A company may keep very big inventories and tie up funds unnecessarily.

There may be an imbalance between liquidity and profitability.

It is an indication of defective credit policy and slack collection period.

51

High liquidity may include a company to undertake greater production, which may not have a

matching demand. It may find itself in an embarrassing position unless its marketing policies

are properly adjusted to boost up the market for its goods.

Tendencies of accumulating inventories tend to make speculative profits grow. This may tend

to make the dividend policy liberal and difficult to cope with in future when the firm unable

to make speculative profits.

A company may invest heavily in its fixed equipment which may not be justified by actual

sales or production. This may provide a fertile ground for later overcapitalization.

A determination of the adequacy of working capital poses a problem both to the corporate

body and the banking sector.

Sound financial and statistical techniques, supported by judgement, should be used to predict the quantum of

working capital need at different time periods.

A firms net working capital position is not only important as an index of liquidity but is also used as a

measure of firms risk. All other things being equal, the more the net working capital a firm has the less

likely that it will default in meeting its current financial obligations. Lenders such as commercial banks

insist that the firm should maintain a minimum net working capital position.

52

CONTROL OF WORKING CAPITAL

In case of fixed assets, preliminary studies are made as to its profitability and the item is cleared technically

and financially. Once the purchase is made, the investment is completed and nothing can be done with it

thereafter. In case of investment in working capital, the

Control will have to be stringent and continuous if any semblance of economy is to be achieved in the

investment of working capital.

The control of working capital requires constant vigilance on the part of many executives in different

departments like stores, purchase, production and finance. In practice, the working capital investment which

in the beginning of the project is taken as 3 or 4 (25% to 33%) months of production expenditure would

eventually reach 6070 percent of the total investment of the company, if proper control is not exercised.

53

WORKING CAPITAL ANALYSIS

VARROC ENGINEERING PVT.LTD.

SNO. ITEMS

2010-11 2009-10 2008-09 BASIS

Rs (Cr.) Days Rs (Cr.) Days Rs (Cr.) Days

CURRENT ASSETS

1. INVENTORY:

Raw Materials 153.2 28.57 143.04 27.7 129.95 33.93 RMC

Work In Progress 32.44 5.03 19.15 3.06 20.42 4.31 CoP

Stores and Spares 13.61 156.46 17.02 208.12 15.88 207.08 S & S

Finished Goods 303.6 41.74 189.38 27.11 77.78 14.29 CoS

Total Inventories 502.85 69.14 368.59 52.76 244.03 44.84 CoS

2. Receivables 435.52 56.44 477.89 66.85 411.79 72.29 Sales

3. Other Current Assets 29.47 3.82 39.5 5.53 36.49 6.41 Sales

4. Total Current Assets 967.84 125.44 885.98 123.94 692.31 121.54 Sales

CURRENT LI ABI LI TI ES

1. Sundry Creditors 592.65 107.45 553.67 104.06 468.63 117.73 Cr. prchs

2. Other Liabilities 207.43 38.99 206.52 51.88 170.78 42.9 Cr. prchs

3. Total Liabilities 800.05 103.69 766.34 107.2 675.13 118.52 Sales

Net Working Capital 167.79 119.64 17.18

Less: Bank Borrowings 122.65 139.73 82.94

Own Margin of Company 45.14 -20.09 -65.76

54

Year 2010-11 2009-10 2008-09

CURRENT RATI O 1.32 1.27 1.16

QUI CK RATI O 0.69 0.8 0.8

ACTI VI TY RATI O

I nventory Turnover Ratio 5.5 7.18 8.5

Debtors Turnover Ratio 6.47 5.46 5.05

OPERATI NG PROFI T RATI O 0.06 0.03 0.02

55

DELFE AUTOMOBILES

SNO.

ITEMS

2010-11 2009-10 2008-09 BASIS

Rs (Cr.) Days Rs (Cr.) Days Rs (Cr.) Days

CURRENT ASSETS

1. INVENTORY:

Raw Materials 235.38 28.34 189.15 26.46 168.41 28.99 RMC

Work In Progress 93.15 8.96 85.47 9.52 78.06 10.62 CoP

Stores and Spares 31.33 151.46 27.06 156.33 24.68 168.00 S & S

Finished Goods 333.48 29.54 263.95 26.47 282.41 34.91 CoS

Total Inventories 693.34 61.41 565.63 56.74 553.56 68.42 CoS

2. Receivables 551.92 45.72 539.36 52.86 462.34 51.20 Sales

3. Other Current Assets 73.17 1.08 53.32 4.59 46.29 5.69 Sales

4. Total Current Assets 1318.43 95.54 1158.31 99.86 1062.19 113.66 Sales

CURRENT

LI ABI LI TI ES

1. Sundry Creditors 483.01 54.48 433.46 57.11 316.07 52.93 Cr. prchs

2. Other Liabilities 1.72 0.19 2.43 0.32 4.51 0.75 Cr. prchs

3. Total Liabilities 484.73 35.13 435.89 37.58 320.58 34.30 Sales

Net Working Capital 833.7 722.42 741.61

Less: Bank

Borrowings

104.87 110.95 109.02

Own Margin of

Company

728.83 611.47 632.59

56

year 2010-11 2009-10 2008-09

CURRENT RATI O 2.23 2.39 2.83

QUI CK RATI O 1.24 1.38 1.5

ACTI VI TY RATI O

I nventory Turnover Ratio 5.94 6.43 4.84

Debtors Turnover Ratio 7.98 6.9 6.3

OPERATI NG PROFI T RATI O 0.07 0.03 0.01

57

METAL MEN MICRO TUNER

SNO. ITEMS 2010-11 2009-10 2008-2009 BASIS

Rs

(Cr.)

Days Rs (Cr.) Days Rs (Cr.) Days

CURRENT ASSETS

1. INVENTORY:

Raw Materials 186.33 30.12 192.12 38.00 196.38 50.28 RMC

Work In Progress 27.05 3.65 29.41 4.80 23.35 4.55 CoP

Stores and Spares 26.14 367.72 27.22 401.43 22.41 375.73 S & S

Finished Goods 212.44 25.10 170.66 24.40 87.98 15.16 CoS

Total Inventories 451.95 53.41 419.41 59.97 330.12 56.90 CoS

2. Receivables 208.30 23.09 175.14 24.35 156.52 25.67 Sales

3. Other Current Assets 185.92 20.61 231.57 32.19 110.43 18.11 Sales

4. Total Current Assets 846.17 93.81 826.12 100.44 597.07 82.03 Sales

CURRENT LI ABI LI TI ES

1. Sundry Creditors 521.14 80.28 406.54 76.18 371.26 88.31 Cr. Prchs

2. Other Liabilities 21.07 3.25 9.18 1.72 8.88 2.11 Cr. Prchs

3. Total Liabilities 542.26 52.43 415.72 50.54 380.14 52.22 Sales

Net Working Capital 303.97 410.40 216.93

Less: Bank Borrowings 144.94 299.00 45.06

Own Margin of Company 159.03 111.4 171.87

58

Year 2010-11 2009-10 2008-09

CURRENT RATI O 1.73 2.29 1.81

QUI CK RATI O 0.94 1.27 0.92

ACTI VI TY RATI O

I nventory Turnover Ratio 6.83 6.08 6.41

Debtors Turnover Ratio 15.8 14.9 14.21

OPERATI NG PROFI T RATI O 0.07 0.06 0.06

59

LUMAX

SNO.

ITEMS

2010-11 2009-10 2008-09 BASIS

Rs (Cr.) Days Rs (Cr.) Days Rs (Cr.) Days

CURRENT

ASSETS

1 INVENTORY:

Raw Materials 102.78 26.01 67.16 20.27 78.35 28.34 RMC

Work In Progress 22.25 4.64 22.25 5.46 22.40 6.46 CoP

Stores and Spares 15.55 544.56 17.34 681.49 16.26 645.01 S & S

Finished Goods 80.80 14.45 80.04 16.94 52.48 12.71 CoS

Total Inventories 221.22 39.57 183.45 38.83 168.20 40.76 CoS

2 Receivables 263.17 44.99 253.23 52.89 236.60 56.52 Sales

3

Other Current

Assets

40.55 6.93 39.61 8.27 31.23 7.46 Sales

4 Total Current Assets 524.94 80.14 476.29 89.06 436.04 89.39 Sales

CURRENT

LI ABI LI TI ES

1 Sundry Creditors 435.53 106.28 415.87 121.76 425.20 146.20 Cr. Prchs

2 Other Liabilities 54.12 13.21 158.08 46.28 131.07 45.05 Cr. Prchs

3 Total Liabilities 489.65 74.76 573.95 107.32 556.21 114.04 Sales

Net Working

Capital

35.29 -97.66 -120.17

60

Year 2010-11 2009-10 2008-09

CURRENT RATIO 1.1 0.88 1.59

QUICK RATIO 0.68 0.57 1.3

ACTIVITY RATIO

Inventory Turnover Ratio 9.22 9.3 8.95

Debtors Turnover Ratio 8.1 6.9 9.08

OPERATING PROFIT RATIO 0.06 0.03 0.04

Working Capital Analysis

The gradual increase in the net working capital of Varroc indicates increased profits. It is soon going to

approach Delfe Automobiles.

-200

-100

0

100

200

300

400

500

600

700

800

900

2008-09 2009-10 2010-11

Varroc

Delfe Automobiles

Metal Men Microtuner

LUMAX

61

Current Ratio

The current ratio is a measure of the firms short term solvency. As per conventional rule a 2 to 1 ratio is

considered satisfactory. The liquidity of Varroc is on the verge of improvement as compared to other players

Year

VARROC

DELFE

AUTOMOBILES

METALMEN

MICROTUNER

LUMAX

2008-09 1.16 2.83 1.81 1.59

2009-10 1.27 2.39 2.29 .88

2010-11 1.32 2.23 1.73 1.1

0

0.5

1

1.5

2

2.5

3

2008-09 2009-10 2010-11

Varroc

Delfe Automobiles

Metalmen Microtuner

Lumax

62

Quick Ratio

The quick ratio signifies the immediate conversion potential of the assets of the company. The trend

followed in the industry is responsible for the decreasing trend in the acid test ratio due to the increasing raw

material prices impact follows the situation of cash crunch, the most liquid asset.

Year

Varroc

Delfe

Automobiles

Metalmen

Microtuner

Lumax

2008-09

.8 1.5 .92 1.3

2009-10

.8 1.38 1.27 .57

2010-11

.69 1.24 .94 .68

0

0.2

0.4

0.6

0.8

1

1.2

1.4

1.6

2008-09 2009-10 2010-11

Varroc

Delfe Automobiles

Metalmen Microtuner

Lumax

63

Inventory Turnover Ratio

The inventory turnover ratio signifies how efficiently the raw material is converted into goods and cash

thereafter. The higher the turnover ratio the lesser time is required to turn the inventory into sales. Varroc is

showing a decreasing trend in the ITR this is due to the increase in the Finished Goods Conversion Period or

the slow sales.

YEAR

VARROC

DELFE

AUTOMOBILES

Metalmen

Microtuner

Lumax

2008-09

8.5

4.84

6.83

8.95

2009-10

7.18

6.43

6.08

9.3

2010-11

5.5

5.94

6.41

9.22

0

1

2

3

4

5

6

7

8

9

10

2008-09 2009-10 2010-11

Varroc

Delfe Automobiles

Metalmen Microtuner

Lumax

64

Debtors Turnover Ratio

Debtors conversion period has considerably come down with the increase in the ratio of debtors turnover.

Delfe Automobiles has achieved maximum DTR as compared to its peers.

Year

Varroc

Delfe

Automobiles

Metalmen

Microtuner

Lumax

2008-09 5.05 6.3 14.21 9.08

2009-10 5.46 6.9 14.9 6.9

2010-11 6.47 7.98 15.8 8.1

0

2

4

6

8

10

12

14

16

2010-11 2009-10 2010-11

Varroc

Delfe Automobiles

Metalmen MicroTuner

Lumax

65

NET SALES

Year

Varroc

Delfe

Automobiles

Metalmen

Microtuner

Lumax

2008-09 2079.08 2949.85 2225.49 1527.99

2009-10 2609.21 3724.2 2625.52 1747.43

2010-11 2816.16 4406.55 3292.32 2134.78

0

500

1000

1500

2000

2500

3000

3500

4000

4500

2008-09 2009-10 2010-11

Varroc

Delfe Automobiles

Metalmen Microtuner

Lumax

66

CASH MANAGEMENT

Cash is the lifeblood of business firms as it is needed to acquire assets and to pay obligations of the firm.

Apart from the fact that cash is the most liquid current asset, it is the ultimate output that is expected to be

realised from all company operations, because all major current assets i.e. Inventory and Receivables get

eventually converted into cash.

In narrower sense, cash covers currency and generally accepted equivalents of cash, such as cheques, drafts

and demand deposits in banks. The broader view of cash also includes near cash assets, such as marketable

securities and time deposits in banks that can readily sold and converted into cash. Irrespective of the form

in which it is held, a distinguishing feature of cash, as an asset, is that it has no earning power.

OBJECTIVES OF CASH MANAGEMENT

The basic objectives of cash management are to meet the cash disbursement needs (payment schedule) and

to minimize funds committed to cash balances. These are conflicting and mutually contradictory and the task

of cash management is to reconcile them.

FACTS OF CASH MANAGEMENT

Cash management is concerned with the managing of:

Cash flows into and out of the firm,

Cash flows within the firm, and

Cash balances held by the firm at a point of time by financing deficit or investing surplus

cash.

It can be represented by a cash management cycle. Sales generate cash which has to be

disbursed out. Cash management seeks to accomplish this cycle at a minimum cost and to

achieve liquidity and control at same time. Cash is least productive asset that a firm holds but

it is significant because it is use to pay the firms obligations. Therefore, the aim of the cash

management is to maintain adequate control over cash position to keep firm sufficiently

67

Cash management is also important in terms of:

Synchronizations of cash flows

Short cost

Excess cash balance costs

Procurement and management

MOTIVES FOR MAINTAINING CASH BALANCE

There are four primary motives for maintaining cash balances;

Transaction motive: To meet routine cash requirement or for anticipation of obligations.

Precautionary motive: Reserve for random and unforeseen fluctuations in cash flows. It is held

in the form of marketable securities.

Speculative motive: Refers to firm to take advantage of opportunities which are typically out of

the normal course of business.

Compensating motive: To compensate banks for providing services and loans.

CASH MANAGEMENT STRATEGIES

In order to resolve the uncertainty about cash flow prediction and because of lack of synchronization of cash

inflows and outflows firm should have appropriate strategies for managing cash. The strategies should be

regarding these four steps of cash management.

CASH PLANNING

DETERMINING OPTIMUM CASH LEVEL

MANAGING CASH FLOWS

INVESTING SURPLUS CASH

This ideal cash management system will depend on the firms product, organization structure, competition,

culture and option available. The task is complex and decision taken can affect important areas of the firm.

For example, to improve collections if the credit period is reduced, it may affect sales.

68

CASH PLANNING

Firm needs cash for investing in inventory, receivables, fixed asset and to make payments in operating

expenses in order to maintain growth in sales and earnings. Cash planning is technique to plan and control

the use of cash, helps to anticipate future cash flows and needs of firm, reduces the possibility of cash

surplus and cash deficit. The period and frequency of cash planning generally depends upon the size of the

firm and philosophy of management.

Cash budget is a tool for the application of this technique. It is the most significant device to plan for and

control cash receipts and payments. It states the cash position of a firm as it moves from one budgeting sub

period to another. It gives information on the timing and magnitude of expected cash flows and cash

balances over the projected period.

The time horizon of a cash budget may differ from firm to firm. A firm whose business is affected by

seasonal variations may prepare monthly cash budgets. Daily or weekly cash budgets should be prepared for

determining cash requirements if cash flows show extreme fluctuations. Cash budget for a longer intervals

may be prepared if cash flows are relatively stable.

Cash forecasts are needed to prepare cash budgets. It can be done on short or long term basis. Forecasts

covering periods of one year or less are considered short-term; those extending beyond one year are

considered long-term.

SHORT-TERM CASH FORECASTS: The important functions of short-term cash

forecasts are:

To determine operating cash requirements.

To anticipate short-term financing.

69

MANAGING CASH FLOWS

Once the cash budget has been prepared and appropriate net cash flow has established,

Management should focus that there is no significant deviation in actual and budgeted cash flow. To achieve

this cash management efficiency proper control over cash collection and disbursement system.

In broader sense, cash management strategies are related to cash turnover process i.e. cash cycle with cash

turnover together constitutes this process. Cash cycle refers to the process which includes following three

steps;

Conversion of Cash into inventories.

Conversion of Inventories into receivables.

Conversion of receivables into cash.

The Cash Conversion Cycle or Cash Cycle is an important analysis tool that allows the credit analyst to

determine more easily why and when the business needs more cash to operate, and when and how it will be

able to repay the cash. It is also used to distinguish between the customer's stated loan purpose and the

borrowing cause. Once the cash conversion cycle for the borrower is mapped, the analyst is able to judge

whether the purpose, repayment source and structure of the loan are the adequate ones.

70

The Cash Conversion Cycle represents the number of days it takes a company to purchase raw materials,

convert them into finished goods, sell the finished product to a customer and receive payment from the

customer / account debtor for the product. The CCC has three components (Accounts Receivable Turnover

Days, Inventory Turnover Days and Payables Turnover Days). At its simplest expression the asset

conversion cycle of a company is defined by the sum of the Accounts Receivable Turnover Days and the

Inventory Turnover Days subtracting the Accounts Payable Days.

First lets look at how these numbers are calculated:

1- Accounts Receivable Turnover in Days: Measures the average number of days from the sale of

goods to collection of resulting receivables. It is obtained by the following formula:

(Accounts Receivable / Sales X 365)

For example, A fictional manufacturer of widgets: "Firm X" with annual sales of Rs.5,000,000 and with

accounts receivable outstanding of Rs.500,000 at the end of the year is said to have a 36.5 Account

Receivable Turnover in days.

(Rs.500, 000 / Rs.5, 000,000) X 365 = 36.5 days

2- Inventory Turnover. It is measuring time on an average between acquisition and sale of

merchandise. For a manufacturer it covers the amount of time between purchase of raw material and sale of

the completed product. It is obtained by the following formula: (Inventory / COGS X 365).

Going back to our fictional manufacturer of widgets; "Firm X" let's suppose that the company had COGS of

Rs. 3,000,000 with inventory of Rs. 411,000 at the end of the year. It would be said that Red Widget Co. has

Inventory turnover days of 50.

(Rs. 411,000 / Rs. 3,000,000) X 365 = 50 days.

71

3- Payables Turnover in Days. It measures the average length of time between purchase of goods

and payment for them. It is obtained by the following formula: (Accounts Payable / COGS x 365).

This time "Firm X" has an accounts payable balance of Rs. 456,000 at the end of the year. The result is an

accounts payable days of 55.5

(Rs.456, 000 / Rs. 3,000,000) X 365 = 55.5 days

And Cash cycle = Avg. age of inventories+ A/c receivables- A/c payables

Therefore, In case of Firm X the Cash Conversion Cycle is 31 days. (36.5 + 50 - 55.5).

This cycle is extremely important for retailers and similar businesses. This measure illustrates how quickly a

company can convert its products into cash through sales. The shorter the cycle, the less time capital is tied

up in the business process, and thus the better for the company's bottom line.

Cash turnover means number of times cash is used during each year. Numerically,

Cash turnover = (Assumed no. of days in a year) /cash cycle

Objective of cash management strategies is to have minimum operating cash that can be achieved by higher

cash turnover, as frequent the cash turns, less is the requirement of cash in firm. So, firm should try to

maximize the cash turnover. The minimum level of operating cash is determined by dividing total operating

annual outlays by cash turnover rate.

72

CASH CYCLE OF VARROC & ITS COMPETITORS

Varroc Engineering Pvt. Ltd.

ITEMS 2010-11 2009-10 2008-09 BASIS

Rs (Cr.) Days Rs (Cr.) Days Rs (Cr.) Days

Raw Materials 166.31 30.61 160.06 30.5 145.83 37.32 Raw Material Consumption

Work In Progress 32.44 5.25 19.15 3.22 20.42 4.55 Cost of Production

Finished Goods 303.6 41.74 189.38 27.1 77.78 14.29 Cost of sales

Total Inventories 502.35 77.6 368.59 60.82 244.03 56.16 Cost of sales

Debtors 435.52 56.44 477.89 66.85 411.79 72.29 Sales

Creditors 592.65 107.45 553.67 104.06 468.63 117.73 R/M+ Purchase of FG+S&S Cons.

Cash cycle 345.22 26.59 292.81 23.61 187.19 10.72

Cash turnover 13.73 15.46 34.05

73

Delfe Automobiles

ITEMS 2010-11 2009-10 2008-09 BASIS

Rs

(Cr.)

Days Rs (Cr.) Days Rs (Cr.) Days

Raw Materials 266.71 31.33 216.21 29.53 193.09 32.43 Raw Material Consumption

Work In Progress 93.15 9.34 85.47 9.96 78.06 11.08 Cost of Production

Finished Goods 333.48 30.68 263.95 27.58 282.41 36.26 Cost of sales

Total Inventories 693.34 71.35 565.63 67.07 553.56 79.77 Cost of sales

Debtors 551.92 45.72 539.36 52.86 462.34 51.2 Sales

Creditors 483.01 54.48 433.46 57.11 316.07 52.93 R/M+ Purchase of FG+S&S

Cons.

Cash cycle 762.25 62.59 671.53 62.82 699.83 78.04

Cash turnover 5.83 5.81 4.68

74

Metalmen Microtuner

ITEMS 2010-11 2009-10 2008-09 BASIS

Rs

(Cr.)

Days Rs

(Cr.)

Days Rs

(Cr.)

Days

Raw Materials 212.47 33.95 219.34 42.83 218.79 55.18 Raw Material Consumption

Work In Progress 27.05 3.75 29.41 4.96 23.35 4.69 Cost of Production

Finished Goods 212.44 25.72 170.66 25.12 87.98 15.58 Cost of sales

Total Inventories 451.96 63.42 419.41 72.91 330.12 75.45 Cost of sales

Debtors 208.3 23.09 175.14 24.35 156.52 25.67 Sales

Creditors 521.14 80.28 406.54 76.78 371.26 88.31 R/M+ Purchase of FG+S&S Cons.

Cash cycle 139.12 6.23 188.01 20.48 115.38 12.81

Cash turnover 58.59 17.82 28.49

75

Lumax

ITEMS 2010-11 2009-10 2008-09 BASIS

Rs

(Cr.)

Days Rs

(Cr.)

Days Rs

(Cr.)

Days

Raw Materials 118.33 29.73 84.50 25.31 94.61 33.92 Raw Material Consumption

Work In

Progress

22.25 4.72 22.25 6.66 22.40 8.02 Cost of Production

Finished Goods 80.80 14.67 80.04 17.16 52.48 12.91 Cost of sales

Total Inventories 221.38 49.12 186.79 49.13 169.49 54.85 Cost of sales

Debtors 263.17 44.99 253.23 52.89 236.60 56.52 Sales

Creditors 455.53 106.28 415.87 121.76 425.20 146.20 R/M+ Purchase of FG+S&S

Cons.

Cash cycle 29.02 -12.17 24.15 -19.74 -19.11 -34.83

Cash turnover -29.99 -18.49 -10.48

76

CASH CYCLE ANALYSIS

The above calculations of cash cycle also known as net operating cycle or asset turn over cycle and cash turn

over reveal the following points as follows:

The cash conversion cycle of Varroc is better than Delfe Automobiles and Lumax.

The cash conversion cycle of Varroc has increased from 11 days to 27 days since 2009 and

cash turnover has decreased from 34 times to 14 times. The reason behind this increased in

Cash Conversion Cycle (CCC) could be increase in the Finished Goods Conversion Period

(FGCP) which has increased from 14 days to 42 days.

The increase in FGCP indicates that the sale of finished goods is taking more time than its

competitors (Delfe Automobiles 30 days, Metalmen Microtuner 26 days).

The increase in FGCP is due to the demand for Automobiles has not much increased, and

Varroc has set up a new plant in Noida.

Varroc has good Creditors Conversion Period (CCP) of 107 days as compared to its peers

(Delfe Automobiles 54 days, Metalmen Microtuner 80 days) and is working on reducing

its Debtors Conversion Period (DCP) [from 72 days to 56 days]. By reducing DCP further its

cash cycle would improve.

The impact of decrease in DCP and increase in the CCP is subsided by the increase in the

FGCP.

The ideal cash cycle is of Metalmen Microtuner which has decreased from 13 days to 6 days.

Varroc is soon going to approach the same trend through its efficient operations.

77

PRACTICES AT VARROC AND INDUSTRIES FOLLOWED

REGARDING CASH MANAGEMENT

The objective of cash management processes of the Varroc Industries is to minimize the funds committed to

cash balance. As idle cash balance is non-earning asset and it will incur cost as company will have to

forgone its profit in terms of opportunity cost. At the same time firm has to meet its payment schedule to

foster good relations with its trade creditors and lead to strong credit rating which enables the company to

purchase goods on favorable terms.

PRACTISES: For its payment schedule Varroc have credit facility with different banks in form of Cash

Credit, Overdrafting, Foreign Bill Discounting, Export Packaging Credit and Letter of Credit.

CASH PLANNING

PRACTISES: At Varroc Budgeting process encompassing a detailed exercise in target setting,

continuous performance monitoring, course correction and result achievement.

Varroc have long range forecast of 10-12 years cash flow projections on monthly basis for the first year,

quarterly basis for the next two years and annually for the remaining years.

Varroc has full ERP implantation at all the offices and at plant level which speeds up the transfer of

information in turn increases work efficiency. The use of a computer-based model reduces the tedium of

carrying out numerous repetitive calculations and simplifies the alteration of assumptions and the

presentation of results. Computer model for short-term bank planning uses assumptions on sales, costs,

credit, funding etc. to produce monthly cash flow projections for up to a year ahead. The initial assumptions

can be readily altered to evaluate alternative scenarios. Though budget planning is easy due to ERP package

used in the company but continuous performance monitoring is done by the managers, monthly reports are

been made and are presented to company executives, to compare the deviation of actual figures from

budgeted one and find the reason behind them to minimize these deviations. Basically, assumptions are

based on sales therefore most of the time current market situation decides the deviation. Any abnormal

variations are reviewed thoroughly and immediately steps are taken.

78

MANAGING CASH FLOWS

SPEEDY COLLECTION OF RECEIVABLES

The speedy collection of receivables can conserve cash and reduce its requirement for cash balances in

future. In order to increase the efficiency of collections Varroc follows both approaches, the first is to lure

the customers by offering various cash discounts schemes and second one is early conversion of payments

into cash. The cash discounts schemes not only speed up in collection but also help in reducing the

probability of bad debts.

PRACTICES: Varroc offers 2/30 net 30 as standards discount rates to its traders, slab discount facility and

quantity turnover discount i.e. 20% discount on 3 times turn of goods in one quarter as per scheme . Under

CIS system the sales amount credited at the local regional offices through the local account of sales depot to

the main bank account of the company within 6 hrs. or half of the same day.

Varroc has 12 regional offices, under which there are 47 area offices, these, along with sales operation are

also responsible for the cash collection operation. The cash collection operations include collecting check

from different areas lying under the supervision of the same regional offices, after completing that cheque

(to be done at regional office). The processed cheque is then deposited into the local bank account of that

branch which is transferred into companys concentration banking account through this CIS system. The

processing is done in minimum time through ERP implantation and the report concerned (related to cheque)

is there after is send to head office in Delhi. The Lock box system facility is not use by Varroc as the main

clients are dealers and OEs to operate through concentration banking system. Lock box system is more

useful in case where customer base is geographically dispersed and cash collection is the main aim (For

example; lock box of telephone bills) where as through concentration banking the company not only

collects cash from various collection points located at sales depots but also performs sales and service

operation.

As per Varroc practices its accounts receivables reduced from 72 days to 55 days.

79

EFFICIENT INVENTORY PRODUCTION MANAGEMENT

The efficient management of cash flows could be done by reducing the production cycle and increasing raw

material and finished goods turnover. This would enhance the cash conversion in less time and the firm

would rely on the operating profits for operational expenses.

PRACTICES: Varroc continuously is working on reducing the Raw Material and Finished Goods

conversion periods. On the other hand it works on increasing the work in progress turnover. This

measure would reduce the production cycle and reducing debtors conversion period indicates efficient cash

conversion cycle.

80

EFFICIENT CASH MANAGEMENT THROUGH SAP IN

VARROC(VEPL-PN)

The cash management component allows the analysis of financial transactions for a given period. Cash

management also identifies and records future developments for the purpose of financial budgeting. In SAP

treasury cash management, the companys payment transactions are grouped into cash holdings, cash

inflows, and cash outflows.

It provides information on the sources and uses of funds to secure liquidity to meet payment obligations

when they become due.

It also monitors and controls incoming and outgoing payment flows, and supplies the data required for

managing short term money market investments and borrowings. Depending on the time period under

review, a distinction is made between cash position, short-term cash management and medium and long

term financial budgeting.

SAP cash management component does ensure that all information relevant to liquidity is available for

analysis purposes, creating a basis for the necessary cash management decision. In bank account

management, electronic banking and control functions provide support for managing and monitoring of bank

accounts besides the liquidity forecasts function integrates anticipated payment flows from financial

accounting, purchasing, and sales to create the liquidity outlook for the medium to long term

The cash position and liquidity forecasts components generally cover both foreign currency holdings and

expected foreign currency items.

Working capital management deals with the other two important aspects, namely, receivables management

and inventory management. For smooth production policy and efficient collection and credit policy, the

companys engrossed interest should be involved in receivables management. The hurdle less inventory

management is only possible through effective cash management.

81

INVENTORY MANAGEMENT

In India inventories are approximately 60 per cent of current assets in manufacturing companies. Inventory

management avoids unnecessary investment and contributes to long term profitability. Level of inventories

can be reduced to 10 20 %, without any adverse effect on production and sales of company, by using

simple inventory planning and control technique.

Inventory refers to stockpile of the products a firm is offering for sale and the components that make up the

final product. The various forms of inventory are;

Raw material basic inputs that are converted into finished product.

Work-in- progress semi manufactured goods.

Finished goods complete manufactured products ready for sale.

Supplies or stores and spares include material help indirectly in production process.

The level of all three kinds of inventories for a firm depends upon the nature of its business, production

cycle and turnover. A manufacturing firm will have substantially high levels of all three kinds of inventories,

while a retail or wholesale firm will have a very high level of stock of finished goods inventories and nil

stock of raw materials and work-in-progress.

OBJECTIVE

The twin objective of inventory management is

To maintain large size of inventories for efficient and smooth production as well as uninterrupted

sales operation.

To maintain a minimum investment in inventories to maximize profitability.

The firm should always avoid a situation of over investment or under investment in inventories. The major

dangers of over investment are unnecessary tie up of firms funds, excessive carrying cost and risk of

liquidity. Maintaining an inadequate level of inventories is also dangerous. Production hold ups and failure

to meet delivery commitment are consequences of under investment.

82

INVENTORY PROCUREMENT TECHNIQUES

An effective inventory management concentrates on question like

How much should be ordered?

When should it be ordered?

The inventory to be ordered in quantity is determined through the EOQ analysis. Economic order quantity is

the analyzed lot sized which involves minimum ordering and carrying cost. Apart from EOQ analysis the

inventory is also managed through the inventory turns norms or inventory turnover ratio. Varroc goes for

quantity discount option rather than EOQ if its profitable.

INVENTORY CONTROL TECHNIQUES

After the procurement the necessary materials is important to categorize, analyse and control the items. A

firm which carries a number of items in inventory that differ in value can follow a selective control system.

A selective control system such as,

ABC analysis,

VED analysis,

FNSD analysis,

GOLF analysis and

Input output ratio

They classifies inventory into different categories according to value of items, usage, rotation, obsolesces,

availability and significance. Accordingly control may be applied for items and next procurement policy is

framed.

Large numbers of companies these days try to maintain and control their inventory through scientific

approach like Just in Time inventory, this approach aims at least inventory maintenance and further

procurement of materials only at the time of requirement. This is only possible through strong bonding with

suppliers and efficient logistics management. Though this Japanese concept ensures high profitability for the

firm which adopts the practice but at the same time it is not as easy to do.

83

INVENTORY MANAGEMENT ORGANISATION OF VEPL-PN

PRODUCTION

PLANNING

CONTROL(PPC)

MATERIAL

MANAGEMENT

PURCHASE

GENERATION OF

PURCHASE ORDER

SCHEDULE TO

SUPPLIER

ARRANGEMENT OF

MATERIAL AS PER

REQUIREMENT

MONITORING OF

SUPPLIER

NEGOTIATION

PROCUREMENT OF

MATERIAL

SEGREGATION IN CASE

OF MATERIAL

REJECTION.

STORE

GENERATION OF GRN

MATERIAL

UNLOADING,AND

LOADING

PHYSICAL

VERIFICATION OF

INVENTORY

MAINTAIN STORE

INVENTORY(RM,FG)

MATERIAL ISSUE TO

PRODUCTION

REJECTION MATERIAL

RETURNS TO VENDOR.

FIFO

IMPLEMENTATION

PHYSICAL COUNTING

OF INVENTORY

DISPATCH

SUPPLY RIGHT

MATERIAL SA PER

SCHEDULE OF

CUSTOMER

FINANCE/ACCOUNTS

MANAGEMENT

INFORMATION SYSTEM

MATERIAL

REQUIREMENT

PLANNING

P

PL

MATERIAL

STORTAGE

REVIEW

GIVE

SCHEDULE TO

PURCHASE

GIVE