Escolar Documentos

Profissional Documentos

Cultura Documentos

Fall 2014 Investor Letter

Enviado por

DivGrowth0 notas0% acharam este documento útil (0 voto)

21 visualizações4 páginasEconomic and investment market review third quarter 2014 and investment outlook for balance of 2015.

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoEconomic and investment market review third quarter 2014 and investment outlook for balance of 2015.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

21 visualizações4 páginasFall 2014 Investor Letter

Enviado por

DivGrowthEconomic and investment market review third quarter 2014 and investment outlook for balance of 2015.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 4

Fall 2014

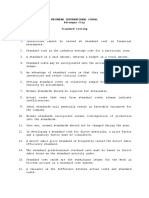

September Third Quarter Calendar Year

Benchmark Returns 2014 2014 2014

Equities

S&P 500 Index -1.40% 1.13% 8.34%

S&P 600 Index (small-cap) -5.37% -6.73% -3.72%

MSCI EAFE Index (Devel oped I nternati onal ) -3.84% -5.88% -1.38%

MSCI EEM Index (Emergi ng Markets) -7.41% -3.50% 2.43%

Commodities

Dow Jones UBS Commodity Index -6.23% -11.83% -5.59%

Real Estate

Cohen & Steers Real Estate Index -5.92% -2.55% 16.08%

Bonds

Barclays Capital U.S. Aggregate Index -0.68% 0.17% 4.10%

S&P U.S. Issued High Yield Corp Bond -2.05% -1.91% 3.53%

*Data provi ded by Bl ackrock

The pessimist complains about the wind; the optimist expects it to change; the realist adjusts the sails.

- William Arthur Ward

Sailing Into The Wind

The sailing analogy noted in our opening quote seems appropriate as we write about the third quarter

and provide perspective on the balance of 2014. A sailing fact: in order to make progress into the wind,

one must tack back and forth into the face of the wind. This headwind of sorts enables a sailboat to

make progress up wind. As in sailing, a certainty for investors is there will most likely always be

headwinds that one must navigate. Index investing is similar to sailing downwind in that the investor is

simply along for the ride and may end up at a destination that was not expected. The third quarter

presented a number of headwinds for investors to navigate.

The consensus view at the start

of 2014 was interest rates would

rise and economic growth would

be globally synchronized led by

the U.S. Now three quarters of

the way through 2014, it is

looking like economic growth in

the U.S. is the only consensus

viewpoint being realized. U.S.

economic growth has been

volatile as exhibited by Q1 GDP (-

2.9%) and Q2 GDP (+4.6%);

however, this growth appears

better than many developed economies around the world. The 10-year treasury rate at the beginning of

2014 was 3.03%. The 10-year treasury ended the third quarter at 2.3% and just recently hit a low of

1.87% on October 15

th

. The October 15

th

rate plunge occurred on a day when the Dow Jones Industrial

Average swung 458 points, nearly 3% from high to low. What headwinds served as catalysts for October

market volatility? There may be no one specific reason, but the list would certainly include the

geopolitical tension in the Ukraine and China, the terrorist threat of ISIS and the Ebola health crisis.

While these issues are real and we do not want to discount their ability to escalate, these events are

more likely short-term in nature. Generally, it is not profitable to make long term investment decisions

based on headline grabbing circumstances. Other factors gaining our attention with potential for a

broader, long-term market impact include: weak economic data in Europe, the European Central Banks

lack of specific and forceful monetary stimulus, the rising strength of the U.S. dollar and the end of QE3

in the U.S. We see opportunities in the wake of this recent volatility.

The Third Quarter (and Beyond)

Although we are less than a month past the end of the third quarter, September 30

th

seems a distant

memory. The third quarter ended on a weak note for most asset classes. The previously noted

headwinds resulted in equity market performance in the third quarter being the weakest since the third

quarter of 2011. The beginning of the fourth quarter has continued to be volatile even with corporate

earnings releases progressing better than expected.

As one reviews the performance of selected market indices on the previous page, September and the

third quarter were certainly challenging time periods. The larger capitalization U.S. stocks were the

standouts in the quarter. The S&P 500 Index was up 1.13% in Q3 and up 8.34% in the first nine months

of the year. Small cap and foreign stocks generated negative returns. The speed with which European

economic data weakened in September surprised many and this negatively impacted global equity

markets. Also contributing to the volatility in European equity markets is the lack of a clear plan from

the European Central Bank (ECB) that deals with the slowing economic environment in Europe. A

quantitative easing program in the Eurozone, similar to the one that is ending in the U.S., would likely be

a positive for European equities.

Implications of a Strong U.S. Dollar

As can be seen in the chart at right, since August of

2011 the trade weighted U.S. Dollar has

strengthened over 17%. The strength of the Dollar

has accelerated in the last several months which is

a signal of a potentially strengthening U.S.

economy. A strengthening U.S. economy is one

reason the Federal Reserve has stated it will end

the current quantitative easing (QE) program in

October. Along with the end of QE, it is anticipated

the Fed will begin the process of normalizing

interest rates towards a neutral 3-4% target range

beginning sometime in 2015. Higher interest rates

in the U.S. would create an environment where the dollar might strengthen further. Interest rates in the

U.S. are currently higher than in many countries around the world; thus attracting foreign investment

into U.S. Dollar denominated assets.

In the short-term, the stronger dollar will pressure multinational earnings growth. A rising dollar reduces

the foreign portion of a U.S. domiciled companys

earnings when converting back to U.S. dollars

from the foreign currency in which they were

earned. If U.S. corporations wish to earn the same

amount in this environment, they must raise

prices in foreign currency terms. This would make

their products and services less competitive.

The Consumer Driven Economy

Consumers account for nearly 70% of U.S. GDP.

Since the end of the financial crisis in 2008, the

consumer has taken steps to improve their own

financial condition: household debt service ratios

(debt payments as a percentage of disposable

personal income) are the lowest they have been

since pre-1980, unemployment continues to

decline, credit is accessible and loan growth is

building in real estate and commercial/industrial

loans. It is our belief we are in the middle of a

potentially long post-recession recovery. The slow

but steady nature of the recovery is helping to

prolong it.

A strong dollar provides downward pressure on

commodity prices as most commodities are

transacted in U.S. Dollars. This downward pressure

on prices, particularly for energy and foreign made products, benefits the U.S. consumer. For example,

according to the U.S. Department of Energy, every one cent drop in the price of a gallon of gasoline

saves consumers $3.65 million per day or $1.33 billion over a year. Since May 2

nd

the retail price of a

gallon of gasoline has declined by 59 cents. This equates to an annual savings of $78.5 billion for

consumers. This savings acts like a tax cut and may lead to an increase in discretionary spending.

U.S. Energy Revolution

As noted above, a strong tailwind benefiting

consumers is the recent decline in oil prices

which translates to lower prices at the

gasoline pump. The energy revolution in the

U.S. has resulted in a dramatic shift both

politically and economically. Whereas the

U.S. was at the mercy of a once dominant

OPEC, that controlled supply and prices, we

now produce more petroleum equivalent

than Saudi Arabia. The increased supply in

the U.S. has overwhelmed U.S. demand

needs and refining capabilities. As a result,

the U.S. government has reduced export

restrictions for U.S. oil. Last month oil was

exported to South Korea from Alaska for the first time since 2004. As noted in a recent New York Times

article, Oil exports (including condensates) remain small, but they have already surged from 67,000

barrels a day in 2012 to 120,000 barrels a day in 2013 to more than double that currently. Citi Research

estimates that under the new condensates ruling,

exports could hit a million barrels a day by next

year.

The increase in oil production is contributing to

growth in other areas of the economy as well.

Much of the pipeline and energy infrastructure in

the U.S. is owned or managed in corporate

structures know as master limited partnerships

(MLPs). As our clients know, we have allocated a

portion of our alternative investments in an index

type investment consisting of a basket of MLPs.

Given the anticipated growth in energy

infrastructure in the U.S., we continue to

believe MLPs can provide our clients with

diversified exposure to this area of the energy

complex. In a report written by IHS Global Inc.

and provided by the American Petroleum

Institute it is noted, The IHS forecast of oil and

gas infrastructure investment over the next 12

years (2014 2025) estimates a cumulative

spending of $890 billion (in 2012 Dollars)

Process, Positioning & Volatility

Increased market volatility increases investor anxiety. This type of sentiment change is a normal reaction

and should lead all investors to evaluate their comfort level with their overall asset allocation.

Nonetheless, we rely on our process and continuously evaluate portfolio risk. James Montier of GMO

said it nicely when he commented, People often judge a past decision by its ultimate outcome rather

than basing it on the quality of the decision at the time it was made, given what was known at that time.

This is outcome bias. We must concentrate on process. Process is a set of rules that govern how we go

about investing. When every decision is measured on outcomes, investors are likely to avoid

uncertainty, chase noise, and herd with the consensus. Sounds like a pretty good description of the

investment industry to me.

Our disciplined process leads us to continue to avoid small company stocks for our clients, although the

recent significant underperformance has us watching this asset class closely. Other portfolio changes we

have implemented in an effort to reduce the risk of client investments: recently exited high yield bonds,

which had generated better than 10% annualized returns over the past four years, added a real estate

fixed income fund during the quarter focused primarily on real estate debt and real estate investment

trusts, on the margin we have transitioned several individual equity positions to be more U.S. earnings

centric and taken advantage of the underperformance of a few cyclical stocks. Lastly, we recently took a

step to incrementally reduce the long underweight exposure to emerging markets. Our thoughts on our

recent changes might best be summed up in this Howard Marks (Oaktree Capital Management)

comment: In order to achieve superior results, an investor must be able with some regularity to find

asymmetries: instances when the upside potential exceeds the downside risk. That's what successful

investing is all about.

We thank our clients and corporate partners for their continued confidence and support. We hope

everyone is looking forward to the holidays and a strong market finish in 2014.

Please visit us at www.horancapitaladvisors.com.

Warm regards,

HORAN Capital Advisors

* HORAN Capital Advisors, LLC is an SEC Registered Investment Advisor.

Você também pode gostar

- Spring 2014 HCA Letter FinalDocumento4 páginasSpring 2014 HCA Letter FinalDivGrowthAinda não há avaliações

- S&P 500 Return and PE Scatter ChartDocumento1 páginaS&P 500 Return and PE Scatter ChartDivGrowthAinda não há avaliações

- Riskier Assets OutperformDocumento1 páginaRiskier Assets OutperformDivGrowthAinda não há avaliações

- The End of The End of The RecessionDocumento72 páginasThe End of The End of The RecessionZerohedge100% (14)

- Recession Is OverDocumento2 páginasRecession Is OverDivGrowth100% (2)

- Lessons Ideas Benjamin GrahamDocumento9 páginasLessons Ideas Benjamin GrahamDivGrowth100% (4)

- SP500 DrawdownAnalysisDocumento10 páginasSP500 DrawdownAnalysisDivGrowth100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- BP803ET LECTURE 5 Marketing Environment Part 1Documento31 páginasBP803ET LECTURE 5 Marketing Environment Part 1Danish KhanAinda não há avaliações

- Chapter 11 The Efficient Market Hypothesis: Answer KeyDocumento33 páginasChapter 11 The Efficient Market Hypothesis: Answer KeyGeorgina AlpertAinda não há avaliações

- Busines PlanDocumento22 páginasBusines PlanAlliah GantongAinda não há avaliações

- Pip Factory Entry PDF.: Table of ContentsDocumento35 páginasPip Factory Entry PDF.: Table of ContentsVillaca KeneteAinda não há avaliações

- Plastic MoneyDocumento13 páginasPlastic MoneyGaurav_bansalAinda não há avaliações

- Spend More Because of The Very Common Modus Operandi of Some Taxi Drivers Which, Honestly, Is Undeniably Happening Here in The PhilippinesDocumento1 páginaSpend More Because of The Very Common Modus Operandi of Some Taxi Drivers Which, Honestly, Is Undeniably Happening Here in The PhilippinesKim Rose ShinAinda não há avaliações

- Chapter 4 Parity Conditions in InternatiDocumento21 páginasChapter 4 Parity Conditions in Internatigalan nationAinda não há avaliações

- What I Have Learned From CSRDocumento5 páginasWhat I Have Learned From CSRI IvaAinda não há avaliações

- Assignment 3 - Standard CostingDocumento4 páginasAssignment 3 - Standard CostingJayhan PalmonesAinda não há avaliações

- 9708 w08 QP 1Documento12 páginas9708 w08 QP 1roukaiya_peerkhanAinda não há avaliações

- ABM-PRINCIPLES OF MARKETING 11 - Q1 - W1 - Mod1 PDFDocumento23 páginasABM-PRINCIPLES OF MARKETING 11 - Q1 - W1 - Mod1 PDFMarie Fernandez - Magbitang83% (23)

- Chapter 5: Aggregate Supply Curve: Y L K F YDocumento9 páginasChapter 5: Aggregate Supply Curve: Y L K F YProveedor Iptv EspañaAinda não há avaliações

- RFP Central Bank of IndiaDocumento46 páginasRFP Central Bank of IndiaSanjay Kumar100% (1)

- Jim Power Beef Report 2020 PDFDocumento106 páginasJim Power Beef Report 2020 PDFcork_ieAinda não há avaliações

- Market Analysis For Ford Motor CompanyDocumento12 páginasMarket Analysis For Ford Motor CompanyHND Assignment Help100% (6)

- Final ProjectDocumento60 páginasFinal ProjectHemant PurohitAinda não há avaliações

- SaaS Pricing Guide (Ebook)Documento26 páginasSaaS Pricing Guide (Ebook)ramanujankAinda não há avaliações

- Legislative History of United States Tax Conventions Vol. 4: Model Tax ConventionsDocumento712 páginasLegislative History of United States Tax Conventions Vol. 4: Model Tax ConventionscaplibraryAinda não há avaliações

- Value Investors Club - Kraton Performance Polymers (Kra)Documento5 páginasValue Investors Club - Kraton Performance Polymers (Kra)Lukas SavickasAinda não há avaliações

- Module 12 Elasticities of Demand and SupplyDocumento17 páginasModule 12 Elasticities of Demand and SupplyJodie CabreraAinda não há avaliações

- Answers To Chapter 14 QuestionsDocumento9 páginasAnswers To Chapter 14 QuestionsManuel SantanaAinda não há avaliações

- Kerja Projek Matematik Tambahan SPM 2012 - Versi BI (Edit)Documento5 páginasKerja Projek Matematik Tambahan SPM 2012 - Versi BI (Edit)rozy185950Ainda não há avaliações

- Applied Economics Problems and SolutionsDocumento4 páginasApplied Economics Problems and SolutionsLa salette roxas67% (3)

- Buy and Sell Business PlanDocumento7 páginasBuy and Sell Business PlanYosh Mor100% (2)

- Unit 4-Philosophy of Market ModelsDocumento31 páginasUnit 4-Philosophy of Market Modelspriyans100% (1)

- Seller Smart Mart Stores Pvt. Ltd. Buyer Rakesh Kumar: Retail InvoiceDocumento1 páginaSeller Smart Mart Stores Pvt. Ltd. Buyer Rakesh Kumar: Retail InvoiceNitinKumarAinda não há avaliações

- Colgate Palmolive FinalDocumento18 páginasColgate Palmolive FinalSruti PujariAinda não há avaliações

- Case Study - Written AnswersDocumento3 páginasCase Study - Written AnswersAAinda não há avaliações

- Mcqs - Marketing Management - 201 Unit I-Product: Dnyansagar Institute of Management and ResearchDocumento394 páginasMcqs - Marketing Management - 201 Unit I-Product: Dnyansagar Institute of Management and ResearchSanjay sadafuleAinda não há avaliações

- Ross Casebook 2008 For Case Interview Practice - MasterTheCaseDocumento65 páginasRoss Casebook 2008 For Case Interview Practice - MasterTheCaseMasterTheCase.com100% (6)