Escolar Documentos

Profissional Documentos

Cultura Documentos

ECONOMIC JUSTIFICATION OF A FLEXIBLE MANUFACTURING SYSTEM PDF Report PDF

Enviado por

vatsalparikh191991Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

ECONOMIC JUSTIFICATION OF A FLEXIBLE MANUFACTURING SYSTEM PDF Report PDF

Enviado por

vatsalparikh191991Direitos autorais:

Formatos disponíveis

ECONOMIC JUSTIFICATION OF A

FLEXIBLE MANUFACTURING SYSTEM

Vatsal Parikh

Romil Modi

Srinivas Shreyas Nirgund

Madhusudhan Subramani

Simon K John

MECH 6335-501/OPRE 6340

FLEXIBLE MANUFACURING

PROF. STECKE

FALL 2013

Page | 2

Table of Contents

1. INTRODUCTION ......................................................................................................................................... 3

1.1 LITERATURE REVIEW ........................................................................................................................... 3

1.2 FLEXIBLE MANUFACTURING SYSTEMS IN THE AUTOMOTIVE INDUSTRY ........................................... 4

1.3 METHODS OF INVESTMENT EVALUATION FOR FLEXIBLE MANUFACTURING SYSTEMS ..................... 5

2. JUSTIFICATION METHODS ......................................................................................................................... 8

2.1 JUSTIFICATION METHOD - AN EXAMPLE ............................................................................................ 8

2.2 NET PRESENT VALUE (NPV) ................................................................................................................. 9

2.3 SIMPLE PAYBACK METHOD ............................................................................................................... 10

2.4 PROFITABILITY INDEX (PI) ................................................................................................................. 11

2.5 INTERNAL RATE OF RETURN (IRR) ..................................................................................................... 11

3. GENERATING THE DATA TO USE FOR JUSTIFICATION ............................................................................. 12

3.1 GENERATING THE DATA TO USE IN JUSTIFICATIONS ........................................................................ 17

4. ASSESSMENT CRITERIA............................................................................................................................ 17

5.ANNUAL OPERATION CASH FLOW FROM A FLEXIBLE MANUFACTURING SYSTEM ................................. 18

6. THE IMPACT OF CHANGES IN FOREIGN EXCHANGE RATE ON INVESTMENT PROJECT EVALUATION

WITH REAL OPTIONS ANALYSIS................................................................................................................... 20

The Linear Model .................................................................................................................................... 20

The Second Order Polynomial Model ..................................................................................................... 21

The Third Order Polynomial Model ........................................................................................................ 22

6.1 MAJOR FACTORS AFFECTING THE REGRESSION MODELS ................................................................ 24

7. CONCLUSION ........................................................................................................................................... 26

8. REFRENCES .............................................................................................................................................. 26

Page | 3

1. INTRODUCTION

1.1 LITERATURE REVIEW

Every year corporations in various industries around the world are making large investments in

research and development, in new product design, as well as in production and operation

facilities in both home markets and international markets in order to provide better service to

customers and stay competitive in their industries.

With increasing technology advancement and global economic cooperation and

competition, more than ever before, economic evaluation of investment project in the

manufacturing industry becomes more and more important in the management decision making

process. Careful investment evaluation, market research, and competitive advantage assessment

have therefore become indispensable steps to reach a well-informed, strategically correct

investment decision.

In the automotive industry, where globalization has long been a reality for more than a

century, competition at home and abroad has intensified in recent years. Leading manufacturers

in the automotive industry invest large amount of funds each year in research and new vehicle

technology development in order to have a competitive edge in new product development.

Financial investments are also made to upgrade or build new manufacturing facilities for the

production of existing and new models of different types of vehicles for different market

segments. Both original vehicle manufacturers and part and component suppliers are making

investments to expand their production capability in both home and international markets.

Because of their apparent advantage to switch from production of one type of product to another,

to expand production capacity, as well as to benefit from longer service life, modern flexible

manufacturing systems have gained wider application in the automotive industry as well as in

other manufacturing industries. Due to the relatively large initial investment and the need to plan

Page | 4

for phased expansion or reconfiguration investments, traditional discounted cash flow (DCF)

techniques of economic evaluation may not be able to fully capture the benefit from flexible

manufacturing systems. Real options analysis, on the other hand may provide a better framework

for the economic evaluation of financial investment in such systems.

A brief literature review will be provided in this chapter to understand the current state of

research activities in flexible manufacturing systems and their applications; methods of

economic evaluation of investment in flexible manufacturing systems; and the application of the

real options approach in the evaluation of investments in flexible manufacturing systems.

1.2 FLEXIBLE MANUFACTURING SYSTEMS IN THE AUTOMOTIVE INDUSTRY

The dramatic improvement in quality and productivity by some of the Japanese automobile

manufactures in the last ten to fifteen years has in large part been contributed to the successful

implementation of advanced manufacturing technology and lean manufacturing facilities for the

production of existing and new models of different types of vehicles for different market

segments. Both original vehicle manufacturers and part and component suppliers are making

investments to expand their production capability in both home and international markets.

Because of their apparent advantage to switch from production of one type of product to another,

to expand production capacity, as well as to benefit from longer service life, modern flexible

manufacturing systems have gained wider application in the automotive industry as well as in

other manufacturing industries. Due to the relatively large initial investment and the need to plan

for phased expansion or reconfiguration investments, traditional discounted cash flow (DCF)

techniques of economic evaluation may not be able to fully capture the benefit from flexible

manufacturing systems. Real options analysis, on the other hand may provide a better framework

for the economic evaluation of financial investment in such systems.

Page | 5

A brief literature review will be provided in this chapter to understand the current state of

research activities in flexible manufacturing systems and their applications; methods of

economic evaluation of investment in flexible manufacturing systems; and the application of the

real options approach in the evaluation of investments in flexible manufacturing systems.

1.3 METHODS OF INVESTMENT EVALUATION FOR FLEXIBLE MANUFACTURING

SYSTEMS

With the increasing trend of the application of flexible manufacturing systems in the automotive

industry and other industries, corporate executives and plant managers have come to a better

understanding of the benefits of product flexibility and long term manufacturing efficiency

offered by flexible manufacturing systems. Due to the relative large financial investment

required and the technical complexity involved in design and implementation of a flexible

manufacturing system, and due to the need for financial accountability in every investment

project, companies that intended to implement flexible manufacturing systems have to perform a

carful economic evaluation of financial investments in such manufacturing systems in order to

make sure that while strategically beneficial with advanced technology, product offering

flexibility, and production efficiency, flexible manufacturing systems do provide positive

economic value to the investing company. In other words, strategically beneficial projects have

to be economically successful in order to justify the required investment and increase the value

of the company. Since the early 1990s, a large number of academic research and business

analysis papers have been published on investment evaluation of flexible manufacturing systems

(Chen and Small 1996, Burcher and Lee 2000, Ajah and Herder 2005).

In an early survey of capital budget methods, Schall, Sundem and Geijsbeek Jr. presented their

findings in 1978 in The Journal of Finance. Out of the 189 responses from large corporations in

Page | 6

the United States, 86% of the companies used the Internal Rate of Return (IRR) or Accounting

Rate of Return (ARR) in capital budgeting practice, 74% of the responding companies used the

Payback Period (PBK) to compare investment projects, while 56% of the companies applied Net

Present Value (NPV) analysis in capital budgeting. Of all the companies responding to the

question of risk consideration in capital budgeting, 90% raised the required rate of return or the

discount rate in NPV calculation to account for added project risk.

John Graham and Campbell Harvey reported in a more recent survey in 2001 of 4440 companies

about corporate capital budgeting and capital structure. Out of the 392 companies that responded,

the survey found that most respondents cited net present value (NPV) and internal rate of return

(IRR) as their most frequently used capital budgeting techniques; with 74.9% of CFOs always or

almost always using NPV, and 75.7% always or almost always using IRR. However, large

companies were significantly more likely to use NPV than were small firms. Other than NPV

and IRR, hurdle rates and payback period was the most frequently used capital budgeting

technique by 56% of the companies. After IRR, NPV, hurdle rates, payback period, and

sensitivity analysis, real options analysis was used in capital budgeting by 27% of the companies,

this reflected a significantly increasing application of real options analysis in corporate

investment evaluation since the last survey in 1978 by Schall and others, in which non of the

responding companies indicated the use of real options evaluation in capital budgeting.

Even though real options analysis is a fairly new capital budgeting technique, over a

quarter of the companies participated in the 2001 survey reported using it in their investment

evaluation. It is believed that the increasing application of real options analysis in corporate

investment evaluation since the later 1970s reflected the following facts:

Page | 7

(1) With the wide application of financial option pricing theory and increasingly large volume of

trading activities in financial options on stock and stock indexes, interest rates, foreign exchange,

as well as real metals and other commodities, the research on the Economic justification of FMS.

Applying financial option pricing theory to real world investment evaluation practice,

real option analysis is quickly emerging as a new approach to economic evaluation and selection

of strategic investment alternatives in non-financial industries.

The objective of this research is to apply real options theory to evaluate financial

investments in flexible manufacturing systems in the automotive industry and help to identify

future growth opportunities both in national and international markets. Models were developed

to capture the strategic value of management and operational flexibility for capital investments in

a flexible manufacturing system.

Financial option pricing models were reviewed with the analogy between financial option

pricing and real option analysis discussed in order to establish the real options analysis

framework.

An evaluation model was also developed to account for foreign exchange risk for

financial investments in foreign countries. Real options analysis was applied to evaluate

investments in flexible manufacturing systems in the automotive industry for both the economy

of scope and the economy of scale. Advantages and concerns related to the application of real

options analysis are discussed with brief comments on future research needs.

Economic justification of FMS is basically a calculation of the return on investment over

time against the cost of implementing an FMS.

One approach would be a comparison of the cost of the machine and software versus

labor, floor space, sales, lead time, production, automation.

Page | 8

Economic justification can be calculated by comparing the data from before and after

implementing the system. Factors include the process cycle time which the conventional

system or job shops would take in comparison to the FMS, the efficiency of the

production as compared to the original systems.

We should also factor in the time it takes to resolve technical glitches and reach a

smoothly functioning system. Thus the question becomes does the cost of buying

implementing such an expensive system justify the production and profit which the

company can make?

2. JUSTIFICATION METHODS

Most of the organizations today use a combination of the methods that are described below.

Important concepts for economic justification are given here:

The time value of money is important.

A dollar today is worth more than a dollar tomorrow.

The expected cash flows from each year of the project is discounted against the

companys desired rate of return.

2.1 JUSTIFICATION METHOD - AN EXAMPLE

ABC Company is considering an FMS for a manual assembly process. It will cost

$25,000 in planning and engineering costs for three years. In the fourth year, the project

will require a capital investment of $200,000. The system will be up and running in year

five. The system will increase productivity by $100,000 per year. It will have annual

Page | 9

operating costs of $30,000. Assume no salvage value at the end of ten years. The

companys required rate of return on projects like this is 15%.

C

0

to C

10

= expected cash flows for the project

C

0

= initial investment = 0

C

1

to C

3

= planning & engineering costs = $25,000

C

4

= capital investment = $200,000

C

5

to C

10

= cost savings operating costs = $100,000 - $30,000

= $70,000

r = companys required rate of return = 15%

2.2 NET PRESENT VALUE (NPV)

The net present value approach involves discounting the expected cash flows from each

year of the project. These cash flows are then summed to produce the projects present

value, hence the term net present value.

Acceptance Criteria: A project that produces a positive NPV is considered to be an

attractive investment opportunity.

) ( 25 . 37 $

) 15 . 1 (

70

) 15 . 1 (

70

) 15 . 1 (

70

) 15 . 1 (

70

) 15 . 1 (

70

) 15 . 1 (

70

) 15 . 1 (

) 200 (

) 15 . 1 (

) 25 (

) 15 . 1 (

) 25 (

) 15 1 (

) 25 (

0

r) (1

C

C NPV

10 9 8 7 6 5 4 3 2

n

1 t

n

n

0

thousands NPV

NPV

Page | 10

RESULT: This is a good investment.

2.3 SIMPLE PAYBACK METHOD

The payback method is an ad hoc rule that looks at how quickly a project pays back the

original investment. In other words, when the NPV of the project is zero. It is sometimes

called the breakeven analysis because of when you finally pay off your investment and

start saving or making money.

The time period can be calculated quickly by constructing an NPV table like the one

shown above. Notice that for this project, the payback period is 8 years (C

8

= 50).

Acceptance criteria: In general, the shorter the payback period, the more desirable the

project, particularly when there is a great deal of uncertainty.

n

t

n

n

r

C

C

1

0

) 1 (

Page | 11

RESULT: Some companies have aggressive payback requirements, such as a maximum

of two or three years to break even. With a payback of 8 years, this may be considered a

marginal or poor investment

2.4 PROFITABILITY INDEX (PI)

Closely related to NPV, PI compares the discounted cash inflows to the discounted cash

outflows.

Acceptance criteria: Projects with an index greater than 1 are generally considered to be

attractive investment opportunities.

RESULT: This is a favorable investment

2.5 INTERNAL RATE OF RETURN (IRR)

Rather than specifying a discount rate, IRR calculates the rate of return that project is

expected to yield over its lifetime. IRR is also know as the discount rate or breakeven

point that makes the project NPV equal to zero. This method takes a little bit more effort

to solve because it must be iterated for various values of IRR until the equation is solved.

However, it is a much better indication of the value of the investment.

Acceptance Criteria: A project with an IRR greater than the companys rate of return is

a good investment opportunity.

1.33 PI

.15) (1

(25)

.15) (1

(25)

.15) (1

(25)

) 15 1 (

) 25 (

.15) (1

70

.15) (1

70

.15) (1

70

.15) (1

70

.15) (1

70

.15) (1

70

PI

) outflows cash d (discounte inflows) cash discounted ( PI

4 3 2

10 9 8 7 6 5

Page | 12

RESULT: While return on investment is made on this project, this may not be suitable to

meet a companys internal requirements.

3. GENERATING THE DATA TO USE FOR JUSTIFICATION

It is important to quantify the improvements that have been made using a justified

calculation, because these potential savings are sometimes challenging to quantify

because of the fuzzy nature of the savings. This is a good chance to show the creativity

in the work, but failing to show important values can limit the ability to justify the

projects.

Consider these savings when a cost justification is undertaken.

Improve product quality and yield.

Quality Improvement is on increasing the effectiveness of activities and processes to

provide added benefits to both the organization and its customers, this also increases the

yield of the organization and attracts new customer.

Lower manufacturing costs.

Reducing manufacturing costs increases profitability by making more with what you

have or the same with less. Some of the measures for lowering manufacturing costs are

reducing Reduce product rework effort.

11% IRR

0) equation this solve to IRR of values arious through v (iterate

IRR) (1

(-25)

....

IRR) (1

(-25)

IRR) (1

(-25)

IRR) (1

(-25)

IRR) (1

(-25)

IRR) (1

(-25)

IRR) (1

(-25)

0 NPV

0 NPV

10 6 5 4 3 2

Page | 13

This reduction in rework time can be enabled by the generation of clear, agreed,

measurable desired business outcomes that are used to drive all dimensions of the project.

These clear and very specific outcome statements ensure clarity of direction and avoid

false starts or misalignments.

Increase manufacturing capacity.

Capacity is often defined as the capability of an object, whether that is a machine, work

center or operator, to produce output for a specific time period, which can be an hour, a

day, etc. Many companies ignore the measurement of capacity, assuming that their

facility has enough capacity, but that is often not the case.

Reduce the design-to-market cycle time.

When developing products, an entrepreneur, startup, inventor or small business can rarely

assume that the market will wait or that a competitor will not introduce something

smaller, better, faster, and at a lower price point. Therefore, reducing Design time-to-

market is a key requirement for business success and can be a competitive advantage for

those that do it right. Downtime through awareness, reducing wastage and reducing

changeover time.

Reduce inventory levels.

Inventory is the collection of unsold products waiting to be sold. Inventory is listed as a

current asset on a company's balance sheet. Reducing the amount of unsold items is

called reduce inventory level.

Reduce, control, and track Work In Process.

Page | 14

Efficient decision making in a manufacturing environment requires the availability of

high quality data in real-time. Any initiative that strives to improve manufacturing costs,

reduce cycle time and demonstrate process compliance starts with this same fundamental

requirement. The Product WIP Tracking, Route Control and Traceability software

module is a tool that is specifically designed to provide work in progress (WIP) visibility

throughout the factory, validate the process flow, and provide the history of the process

steps accomplished on a product.

Improve control of process (simplify, lower, modify)

Understanding processes so that they can be improved by means of a systematic approach

requires the knowledge of a simple kit of tools or techniques. The effective use of these

tools and techniques requires their application by the people who actually work on the

processes, and their commitment to this will only be possible if they are assured that

management cares about improving quality.

Reduce paper handling.

Is a work environment in which the use of paper is eliminated or greatly reduced. This is

done by converting documents and other papers into digital form. Proponents claim that

"going paperless" can save money, boost productivity, save space, make documentation

and information sharing easier, keep personal information more secure, and help the

environment.

Reduce produce design and build time.

Page | 15

Is the process of managing the entire lifecycle of a product from inception, through

design and manufacture, to service and disposal. PLM integrates people, data, processes

and business systems and provides a product information backbone for companies and

their extended enterprise.

Reduction of scrap values and scrap rates.

The worth of a physical asset's individual components when the asset itself is deemed no

longer usable. The individual components, known as "scrap," are worth something if they

can be put to other uses. Sometimes scrap materials can be used as is; other times they

must be processed before they can be reused. An item's scrap value is determined by the

supply and demand for the materials it can be broken down into.

Reduction of plant overhead charges.

An accounting term that refers to all ongoing business expenses not including or related

to direct labor, direct materials or third-party expenses that are billed directly to

customers. Overhead must be paid for on an ongoing basis, regardless of whether a

company is doing a high or low volume of business. It is important not just for budgeting

purposes, but for determining how much a company must charge for its products or

services to make a profit.

Increase manufacturing producibility.

The work has also identified gaps and opportunities for improvements, and suggested an

approach for next step in order to increase producibility in manufacturing of aerospace

engine components.

Page | 16

Eliminate redundant data entry & storage.

Data redundancy leads to data anomalies and corruption and generally should be avoided

by design. Database normalization prevents redundancy and makes the best possible

usage of storage. Proper use of foreign keys can minimize data redundancy and chance of

destructive anomalies

Improve data access.

Data access typically refers to software and activities related to storing, retrieving, or

acting on data housed in a database or other repository. There are two types of data

access, sequential access and random access.

Lower operational costs.

Expenses associated with administering a business on a day to day basis. Operating costs

include both fixed costs and variable costs. Fixed costs, such as overhead, remain the

same regardless of the number of products produced; variable costs, such as materials,

can vary according to how much product is produced.

Delivery of products on time.

On time Delivery of the projects plays a vital role in the development of an organization,

it would avoid the unnecessary charges due to delay, it would also improve the reputation

of the organization in the market for its on time delivery without any defects.

Lower inspection costs.

Page | 17

With the Inventory cost being high and adding to that having inspection cost also to be

high, it is obvious that the organization would shell out lot of money, hence lowering the

inspection cost would add up as an advantage, but we also need to make sure that the

standard of inspection should also be held high.

3.1 GENERATING THE DATA TO USE IN JUSTIFICATIONS

We also need to consider these Potential Gain Costs also while doing the Quantified

Justification.

Increased equipment and system support costs (adding robots will require adding

programming skills).

Qualified Repair & Maintenance requirements.

Higher training costs.

System modification costs.

Higher documentation costs.

Higher equipment tooling costs

4. ASSESSMENT CRITERIA

Payback period

Militate against any investment where the build-up of profits is relatively slow,

even though the eventual return may be high.

Return on investment(ROI)

Page | 18

Average profit per year for the life of the projects over the average investment

employed. Between the less risky project where the profits are earned in the early years

of a project and one with the later earnings.

Discounted cash flow

The principle is the cash flows in the future are always worth less than the same

cash flow today. The Net Present Value (NPV) of a project is obtained by using a

discounted rate to bring present and future cash flows back to today's value. If it is

positive, the project would be acceptable if the discount rate chosen reflected the cost of

capital for this project, taking account of the project risk. Allowances are normally made

for taxation, depreciation allowances etc. A further refinement is to determine the NPVs

at a number of given discount rates and find the discount rate at which the NPV is 0. This

is the Internal Rate of Return (IRR) and can be seen as the rate at which the projects will

earn money for the firm. Internal hurdle rate which it will have to exceed for the project

to be acceptable.

5.ANNUAL OPERATION CASH FLOW FROM A FLEXIBLE MANUFACTURING

SYSTEM

Potential benefits of investment in flexible manufacturing capability gives the

investor the opportunity to capture future operational benefits with additional investment

pending positive market development, it is appropriate to evaluate such potential benefits

of a flexible manufacturing system with real options analysis.

Example:- Considering investment, sale revenue, market demand for different types of

products, unit selling price, fixed cost, variable cost, setup cost, equipment depreciation,

Page | 19

and any possible salvage value after gain tax, the annual cash flow from production in

year i can be expressed as follows

And f

m

is the index variable related with market demand for product type m: f

m=1

if product m is in demand and will be produced by the flexible manufacturing system in

year i; and f

m=

0 if product m is not going to be produced in year i

FC(i) = Fixed cost of production in year i

OH(i) = Overhead cost in year i

DEP(i) = Depreciation of machines and equipment in year i .

SV(i) = Net salvage value of in year i after gain tax

I(i) = Investment made in year i

Tr = Tax rate for the investing company

For a given investment project in flexible manufacturing system, investment cost is

relatively easy to estimate given the detailed technical and financial planning for the

flexible manufacturing system by process design engineers and financial staff in close

M m i P i D f i RV

M

m

M

m

,... 2 , 1 ), ( ). ( ) ( RV(i)

Where,

I(i) - DEP(i) Tr) - (1 SV(i)] DEP(i) - STC(i) - OH(i) - VC(i) - FC(i) - [RV(i) CF(i)

m

1

m m

1

m

M

1 m

m

1

m m m

) ( ). ( ) ( VC VC(i) i UVC i D f i

M

m

M

1 m

) ( STC . STC(i) i f

m m

Page | 20

cooperation with technology and machine suppliers, it is assumed that demand and unit

selling price for product m in any given year D

m

and P

m

satisfy the following two

differential equations.

6. THE IMPACT OF CHANGES IN FOREIGN EXCHANGE RATE ON

INVESTMENT PROJECT EVALUATION WITH REAL OPTIONS ANALYSIS

In real options evaluation of financial investment in foreign countries, real option value

of the investment project could be affected by changes in foreign exchange rate, mostly

because of the fact that changes in foreign exchange rate will affect estimated operation

cash flows and project value, as well as initial investment and expansion investment.

Three regression models are developed to project possible trends of future exchange rate

movement:

The linear model.

The second order polynomial model.

The third order polynomial model.

The Linear Model

The mathematical model for a linear representation of the changes in exchange rate over

time is

Y= 0.0390 x - 0.0075

dz dt

P

dP

dz dt

D

dD

Pm Pm

m

m

Dm Dm

m

m

. .

. .

Page | 21

Fig: Linear Model of Historical Exchange Rate between USD and CNY

Where Y is the accumulative change in US Dollar per Chinese Yuan since January 2005,

x represents time in years since the beginning of 2005. A graphic representation of this

model is shown in Figure 7.7. Based on the linear model projection, exchange rate

between US Dollar (USD) and Chinese Yuan (CNY) at the end of 2015 will be

approximately 0.1670 USD per CNY, or 5.9880 CNY per USD, verse 8.2781 CNY per

USD at the beginning of 2005

The Second Order Polynomial Model

Similarly, a second order polynomial model can be obtained as follows, with the same notation

and covers the same period of historical data. A graphic representation of this model is shown in

Figure

Based on the second order model, an exchange rate of 0.2357 USD per CNY, or 4.2430

CNY per USD could be expected by the end of 2015 if the second order trend of Chinese

Yuan appreciation during the last three years since 2005 continues through 2015.

Y = 0.0083x

2

+ 0.0142x + 0.0008

Page | 22

Fig: 2

nd

Order Model of Historical Exchange Rate between USD and CNY

The Third Order Polynomial Model

With the same set of historical exchange rate data, a third order regression model can be

developed as follows:

The projection from this third order model indicates an even faster appreciation of

Chinese Yuan against US Dollar in the future years. An exchange rate of 0.4258 USD per

Chinese Yuan, or 2.3484 CNY per USD could be expected by the year of 2015 if theprojection

of the 3rd order model holds true until year 2015.

In order to select a reasonable regression model to estimate accumulative changes in

exchange rate, the following major factors must be considered: a) The data set that was used to

generate the regression models are relatively small with only 3 years of historical data, as

compared to the whole project life of 8 years; b) The fast appreciation of Chinese Yuan against

major foreign currencies, including the US Dollar, in the last 3 years, is based on the fact that the

exchange rate of CNY against major foreign currencies has not changed much for a long time

from the 1990s until 2005. The changes in exchange rate during the last three years is partially

Page | 23

due to trade and economic policy discussions and dialogue between Chinese and US government

agencies; c) The fast rate of appreciation of CNY against major foreign currency in the last three

years is not likely to continue long into the future, this rate of appreciation could slow down in

the future; d) For the economic evaluation of industrial investment project in China by an US

company, the selection of an exchange rate projection model where Chinese Yuan appreciates

too quickly against the USD well into the long future will largely and perhaps unrealistically

boost the operation cash flows generated by such an investment project when annual operation

cash flows are translated from Chinese Yuan into the US dollar, leading to risky investment

decisions.

Y= 0.0026x

3

0.0034x

2

+ 0.0265x

Fig: 3

rd

Order Model of Historical Exchange Rate Between USD and CNY

Page | 24

6.1 MAJOR FACTORS AFFECTING THE REGRESSION MODELS

In order to select a reasonable regression model to estimate accumulative changes in

exchange rate, the following major factors must be considered:

1. The data set that was used to generate the regression models are relatively small with

only 3 years of historical data, as compared to the whole project life of 8 years.

2. The fast appreciation of Chinese Yuan against major foreign currencies, including the US

Dollar, in the last 3 years.

3. The fast rate of appreciation of CNY against major foreign currency in the last three

years is not likely to continue long into the future, this rate of appreciation could slow

down in the future.

4. The selection of an exchange rate projection model where Chinese Yuan appreciates too

quickly against the USD and perhaps unrealistically boost the operation cash flows

generated by such an investment project when annual operation cash flows are translated

from Chinese Yuan into the US dollar, leading to risky investment decisions.

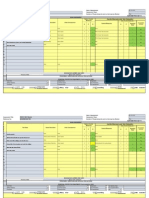

Table: Impact of Changes in Exchange Rate on Investment Requirements and Operation

Cash Flows

Page | 25

Where:

ECF

i

= (1+e

i

) CF

i

= Exchange rate adjusted cash

inflow in year i

EI = (1+e

i

) I = Exchange rate adjusted initial investment

EX = (1+E

i

) X = Exchange rate adjusted expansion investment

j n

n

k

EX

EI

k

ECF

k

ECF

k

ECF

) 1 ( ) 1 (

...

) 1 ( ) 1 (

NPV

2

2 1

Page | 26

7. CONCLUSION

The Economic Status of an organization is basically signified by the roles played by

different Justification methods such as Net Present Value, Simple Payback Method,

Profitability index and Internal Rate of Return. Supporting these justification methods is

the Data Generation and the Criteria for Assessment such as Payback Period, Return of

Investment and Discounted Cash Flow.

Along with this the Evaluation of Annual Operation of Cash flow from FMS and Impact

of Foreign Exchange with help of Regression Models would provide a clear picture of the

Economic Status of the Organization.

This is how the Economic Justification of FMS would help an organization to know their

status in the Market.

8. REFRENCES

1) www.wikipedea.com

2)Engineering costs and production economics.

3)University of Wisconsin- Milwaukee , Milwaukee.

4)Guwahati university , Guwahati,India.

5)IEEE Transactions on engineering management, volume 38, Feb 1991

6)International Journal of CIM

7)www.google.com

8)FMS course pack and class lessons

9)International Journal of Operation and Production management.

10) Investopedia

Você também pode gostar

- Data IntegrationDocumento7 páginasData IntegrationHan MyoAinda não há avaliações

- A Study of the Supply Chain and Financial Parameters of a Small BusinessNo EverandA Study of the Supply Chain and Financial Parameters of a Small BusinessAinda não há avaliações

- Unit 3: The Catering Service Industry Topic: Catering Service Concept Digest (Discussion)Documento5 páginasUnit 3: The Catering Service Industry Topic: Catering Service Concept Digest (Discussion)Justin MagnanaoAinda não há avaliações

- Sharp MX2310U Technical Handy ManualDocumento64 páginasSharp MX2310U Technical Handy ManualUserAinda não há avaliações

- Task Based Risk Assesment FormDocumento2 páginasTask Based Risk Assesment FormKolluri SrinivasAinda não há avaliações

- Permit Part-2 Process-Oriented Permit in SAPDocumento13 páginasPermit Part-2 Process-Oriented Permit in SAPsachinWebDAinda não há avaliações

- Knowledge Management in The Automobile Industry - FinalDocumento13 páginasKnowledge Management in The Automobile Industry - FinalAshrafAbdoSAinda não há avaliações

- Technology Management AssignmentDocumento11 páginasTechnology Management AssignmentVarinder AnandAinda não há avaliações

- 15 04 06 SCDocumento30 páginas15 04 06 SCSugarAinda não há avaliações

- Loan Agreement with Chattel Mortgage SecuredDocumento6 páginasLoan Agreement with Chattel Mortgage SecuredManny DerainAinda não há avaliações

- Kinetics of Acetone Hydrogenation For Synthesis of Isopropyl Alcohol Over Cu-Al Mixed Oxide CatalystsDocumento9 páginasKinetics of Acetone Hydrogenation For Synthesis of Isopropyl Alcohol Over Cu-Al Mixed Oxide Catalysts李国俊Ainda não há avaliações

- Garments & Tailoring Business: Submitted byDocumento6 páginasGarments & Tailoring Business: Submitted bykartik DebnathAinda não há avaliações

- Week Seven SummaryDocumento15 páginasWeek Seven SummarySekyewa JuliusAinda não há avaliações

- Article Review: FIRM RESPONSE STRATEGY UNDER GLOBALIZATION IMPACT IN HI-TECH & KNOWLEDGE-INTENSIVE FIELDS.Documento6 páginasArticle Review: FIRM RESPONSE STRATEGY UNDER GLOBALIZATION IMPACT IN HI-TECH & KNOWLEDGE-INTENSIVE FIELDS.Hairul MusliminAinda não há avaliações

- Strategic Planning of The Petrochemical Industry: Ghanima Al-SharrahDocumento13 páginasStrategic Planning of The Petrochemical Industry: Ghanima Al-SharrahelkamelAinda não há avaliações

- Operations Management in Automotive Industries: From Industrial Strategies to Production Resources Management, Through the Industrialization Process and Supply Chain to Pursue Value CreationNo EverandOperations Management in Automotive Industries: From Industrial Strategies to Production Resources Management, Through the Industrialization Process and Supply Chain to Pursue Value CreationAinda não há avaliações

- 2 Target PDFDocumento13 páginas2 Target PDFمحمد زرواطيAinda não há avaliações

- Cost Analysis Through Life Cycle Analysis and Target CostingDocumento35 páginasCost Analysis Through Life Cycle Analysis and Target CostingSunny KhsAinda não há avaliações

- Dönem Projesi Mert Bi̇lgi̇nDocumento32 páginasDönem Projesi Mert Bi̇lgi̇nMert BilginAinda não há avaliações

- BCME405 Learning Trigger 1 - Lachy FentonDocumento16 páginasBCME405 Learning Trigger 1 - Lachy FentonLachy FentonAinda não há avaliações

- TraviaDocumento6 páginasTraviaFayaz aliAinda não há avaliações

- Business Models, Institutional Change, and Identity Shifts in Indian Automobile IndustryDocumento26 páginasBusiness Models, Institutional Change, and Identity Shifts in Indian Automobile IndustryGowri J BabuAinda não há avaliações

- Application of Neural Networks To Explore Manufact OkDocumento14 páginasApplication of Neural Networks To Explore Manufact OkFerry amirulAinda não há avaliações

- Time-Based Competition in Multistage Manufacturing: Stream-of-Variation Analysis (SOVA) Methodology-ReviewDocumento34 páginasTime-Based Competition in Multistage Manufacturing: Stream-of-Variation Analysis (SOVA) Methodology-Reviewcclan05Ainda não há avaliações

- I M K M A R M E: Nformation Odeling and Nowledge Anagement Pproach To Econfiguring Anufacturing NterprisesDocumento20 páginasI M K M A R M E: Nformation Odeling and Nowledge Anagement Pproach To Econfiguring Anufacturing NterprisesijaitjAinda não há avaliações

- Engine Manufacturing CompanyDocumento11 páginasEngine Manufacturing CompanyperminderlbwAinda não há avaliações

- Institute Emerging Green Trends Future of ManufacturingDocumento69 páginasInstitute Emerging Green Trends Future of Manufacturingqwerty2022Ainda não há avaliações

- Capital Budgeting: Long-Term Investment Decisions - The Key To Long Run Profitability and Success!Documento31 páginasCapital Budgeting: Long-Term Investment Decisions - The Key To Long Run Profitability and Success!Palak NarangAinda não há avaliações

- AECOM Strategy AnalysisDocumento20 páginasAECOM Strategy AnalysisΜαρία ΤιγκαράκηAinda não há avaliações

- ABC ProjectDocumento33 páginasABC ProjectPratyush KumarAinda não há avaliações

- Target Costing in The Budget and Calculation of Costs and of Results For Some Products in The Stainless Steel IndustryDocumento11 páginasTarget Costing in The Budget and Calculation of Costs and of Results For Some Products in The Stainless Steel IndustryRizan MohamedAinda não há avaliações

- India's declining global competitiveness and steps for improvementDocumento13 páginasIndia's declining global competitiveness and steps for improvementlakshmigsr6610Ainda não há avaliações

- Product Lifecycle - ULTRATECHDocumento47 páginasProduct Lifecycle - ULTRATECHaurorashiva1Ainda não há avaliações

- Project For Course of Manufacturing Resource Planning: Industry Sector - FMCGDocumento12 páginasProject For Course of Manufacturing Resource Planning: Industry Sector - FMCGalhad1986Ainda não há avaliações

- 36 - QFD Methodology Application To Small Scale Industries With Special Reference To Fasteners Industry - A Case StudyDocumento8 páginas36 - QFD Methodology Application To Small Scale Industries With Special Reference To Fasteners Industry - A Case StudyMuthu BaskaranAinda não há avaliações

- IGNOU MBA MS-93 Solved Assignment KDocumento19 páginasIGNOU MBA MS-93 Solved Assignment KtobinsAinda não há avaliações

- Silo - Tips - Industrial Services StrategiesDocumento62 páginasSilo - Tips - Industrial Services StrategiesRr.Annisa BudiutamiAinda não há avaliações

- Dissertation Summay (15 Pages - AIB 2004)Documento18 páginasDissertation Summay (15 Pages - AIB 2004)Dearr AgonyyAinda não há avaliações

- Application Management: Challenges in The Automotive IndustryDocumento19 páginasApplication Management: Challenges in The Automotive IndustryshaherfuranyAinda não há avaliações

- Agile Manufacturing A Taxonomy of Strategic and TeDocumento31 páginasAgile Manufacturing A Taxonomy of Strategic and TeKavi Chand KhushiramAinda não há avaliações

- Production Process Structure and Technological Change: 111-Mvarion inDocumento13 páginasProduction Process Structure and Technological Change: 111-Mvarion inOvidiu OvidiuAinda não há avaliações

- Capital BuidgetigDocumento71 páginasCapital BuidgetigAnonymous MhCdtwxQIAinda não há avaliações

- Business Plan Company: Solar System InstallationDocumento12 páginasBusiness Plan Company: Solar System InstallationOsama FaridAinda não há avaliações

- KW Wipro Future of Industry Anand SankaranDocumento6 páginasKW Wipro Future of Industry Anand SankaranukalAinda não há avaliações

- Demand Forecasting L&T ConstructionDocumento17 páginasDemand Forecasting L&T Constructionpradnyar17Ainda não há avaliações

- SynopsisDocumento2 páginasSynopsisomdhakadAinda não há avaliações

- Managing The New Product Development Pro PDFDocumento16 páginasManaging The New Product Development Pro PDFkashemAinda não há avaliações

- SM Vert Integ Report FinalDocumento33 páginasSM Vert Integ Report FinalYahya ZakiAinda não há avaliações

- Global Business Today: by Charles W.L. HillDocumento41 páginasGlobal Business Today: by Charles W.L. HillDiệp Quốc DũngAinda não há avaliações

- Implementation Barriers For Six Sigma in ConstructionDocumento4 páginasImplementation Barriers For Six Sigma in ConstructionseventhsensegroupAinda não há avaliações

- A Project ON " " (Petrol Saver.) : New Product InnovatationDocumento47 páginasA Project ON " " (Petrol Saver.) : New Product InnovatationManish PatelAinda não há avaliações

- SKF India Limited: Shishir Joshipura, Managing DirectorDocumento2 páginasSKF India Limited: Shishir Joshipura, Managing DirectorTasal DosuAinda não há avaliações

- Swot Analysis of Indian Telecom Industry..Documento29 páginasSwot Analysis of Indian Telecom Industry..HEERA SINGH80% (5)

- Components or Elements of Operations StrategyDocumento4 páginasComponents or Elements of Operations Strategyburhan shahAinda não há avaliações

- Esvaran Shummugam AssignmentDocumento21 páginasEsvaran Shummugam Assignmentmoneesha sriAinda não há avaliações

- Capital Budgeting at IOCLDocumento12 páginasCapital Budgeting at IOCLFadhal AbdullaAinda não há avaliações

- Chapter Three: Project Conception and Project FeasibilityDocumento29 páginasChapter Three: Project Conception and Project FeasibilityNeway AlemAinda não há avaliações

- Q4 20 HCM Investment Letter FINALDocumento11 páginasQ4 20 HCM Investment Letter FINALKan ZhouAinda não há avaliações

- Global Production, Outsourcing, and LogisticsDocumento26 páginasGlobal Production, Outsourcing, and LogisticsSozia TanAinda não há avaliações

- Capital Budgeting Techniques and Real OptionDocumento57 páginasCapital Budgeting Techniques and Real OptionPimpim HoneyBee100% (1)

- Strategic capacity planning techniques for new organizationsDocumento5 páginasStrategic capacity planning techniques for new organizationsRahulAinda não há avaliações

- The Global Value Chain DevelopmentDocumento11 páginasThe Global Value Chain DevelopmentErick MwangiAinda não há avaliações

- Power Industry - Project Aqcuisition For Sub-Stations ReportDocumento84 páginasPower Industry - Project Aqcuisition For Sub-Stations ReportAkhilesh DayalAinda não há avaliações

- Shree CementDocumento76 páginasShree Cementrahulsogani1230% (1)

- Managerial Accounting FinalDocumento14 páginasManagerial Accounting FinalVarun AnilAinda não há avaliações

- Engeco Chap 01 - Introduction To Engineering EconomyDocumento43 páginasEngeco Chap 01 - Introduction To Engineering EconomyZhong YingAinda não há avaliações

- Process Choice by Faisal CHDocumento30 páginasProcess Choice by Faisal CHUsman RazaAinda não há avaliações

- Chapter-I: Industry Profile & Company ProfileDocumento61 páginasChapter-I: Industry Profile & Company ProfileSaloni Jain 1820343Ainda não há avaliações

- Engineering Economics & Accountancy :Managerial EconomicsNo EverandEngineering Economics & Accountancy :Managerial EconomicsAinda não há avaliações

- Lifetime Physical Fitness and Wellness A Personalized Program 14th Edition Hoeger Test BankDocumento34 páginasLifetime Physical Fitness and Wellness A Personalized Program 14th Edition Hoeger Test Bankbefoolabraida9d6xm100% (27)

- March 2017Documento11 páginasMarch 2017Anonymous NolO9drW7MAinda não há avaliações

- Is 4032 - 1985Documento45 páginasIs 4032 - 1985yogeshbadyalAinda não há avaliações

- Py Py y Py Y: The Second-Order Taylor Approximation GivesDocumento4 páginasPy Py y Py Y: The Second-Order Taylor Approximation GivesBeka GurgenidzeAinda não há avaliações

- Tugasan HBMT 4303Documento20 páginasTugasan HBMT 4303normahifzanAinda não há avaliações

- A Study of Arcing Fault in The Low-Voltage Electrical InstallationDocumento11 páginasA Study of Arcing Fault in The Low-Voltage Electrical Installationaddin100% (1)

- ReportDocumento4 páginasReportapi-463513182Ainda não há avaliações

- GPL 12800 (80) AhDocumento1 páginaGPL 12800 (80) AhismailAinda não há avaliações

- Pg-586-591 - Annexure 13.1 - AllEmployeesDocumento7 páginasPg-586-591 - Annexure 13.1 - AllEmployeesaxomprintAinda não há avaliações

- How To Block Facebook in Mikrotik Using L7 Protocols (Layer 7) - Lazy Geek - )Documento11 páginasHow To Block Facebook in Mikrotik Using L7 Protocols (Layer 7) - Lazy Geek - )oscar_198810Ainda não há avaliações

- Customer Channel Migration in Omnichannel RetailingDocumento80 páginasCustomer Channel Migration in Omnichannel RetailingAlberto Martín JiménezAinda não há avaliações

- Marking SchemeDocumento8 páginasMarking Schememohamed sajithAinda não há avaliações

- Web Based Tour Management for Bamboo ParadiseDocumento11 páginasWeb Based Tour Management for Bamboo Paradisemohammed BiratuAinda não há avaliações

- Hangup Cause Code Table: AboutDocumento5 páginasHangup Cause Code Table: Aboutwhatver johnsonAinda não há avaliações

- Office of The Controller of Examinations Anna University:: Chennai - 600 025Documento4 páginasOffice of The Controller of Examinations Anna University:: Chennai - 600 025M.KARTHIKEYANAinda não há avaliações

- 0 - Theories of MotivationDocumento5 páginas0 - Theories of Motivationswathi krishnaAinda não há avaliações

- 19286711Documento8 páginas19286711suruth242100% (1)

- Air Purification Solution - TiPE Nano Photocatalyst PDFDocumento2 páginasAir Purification Solution - TiPE Nano Photocatalyst PDFPedro Ortega GómezAinda não há avaliações

- EG3000 ManualDocumento7 páginasEG3000 ManualJose Armando Perez AcostaAinda não há avaliações

- Draft ASCE-AWEA RecommendedPracticeDocumento72 páginasDraft ASCE-AWEA RecommendedPracticeTeeBoneAinda não há avaliações