Escolar Documentos

Profissional Documentos

Cultura Documentos

Visa Perso Data PDF

Enviado por

kotathekatDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Visa Perso Data PDF

Enviado por

kotathekatDireitos autorais:

Formatos disponíveis

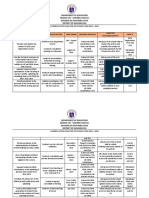

Visa VCBP Card Personalization Data

This document describes card data that Issuers need to prepare to personalize Visa VCBP card applet. The card data is described

in TLV format with defined tags, defined lengths, and sample values. The card data in TLV format is organized in DGIs contained in

Store Data APDU commands used to personalize the card applet.

Visa VCBP card applet can be personalized to support both qVSDC and MSD transactions. Personalization data to support qVSDC

transactions are mandatory. Personalization data to support MSD transactions are optional.

SimplyTapp Defined Card Personalization Data

Data Description

Tag

Length

Attribute

Sample Value

DGI(s)

Maximum Number of Live Transactions: Maximum

number of dynamic account parameters (1-255)

that is stored in the card agent at any time.

Each set of dynamic account parameters can only

be used for one transaction. So this number

also represents the maximum number of

transactions that can be performed without

replenishing dynamic account parameters.

DF30

Optional

Default = 1

08

4000

Minimum Threshold Number of Live Dynamic

Account Parameters: When the number of dynamic

account parameters stored in the card agent

that remains unused for transactions reaches

this minimum threshold (1-255), the card agent

will attempt to replenish dynamic account

parameters.

DF31

Optional

Default = 1

04

4000

Time to Live Check Interval [in minutes]: The

interval (0=never or 1-255 minutes) which the

card agent continuously checks expiration of

dynamic account parameters.

DF39

Optional

Default = 0

(never)

0A

4000

Time to Live [in hours]: The number of hours

(0=forever or 1-255 hours) a set of dynamic

account parameters is active for making a

transaction. The expiration time is calculated

when dynamic account parameters are generated.

DF3A

Optional

Default = 0

(forever)

01

4000

Data Description

Tag

Length

Attribute

Sample Value

DGI(s)

Maximum Number of Transaction Verification

Logs: The maximum number of transaction

verification logs (0-255) that can be stored

and available for post payment processing.

Transaction verification logs are saved in a

queue.

DF3B

Optional

Default = 0

10

4000

Data Description

Tag

Length

Attribute

Sample Value

DGI(s)

File Control Information (FCI) Proprietary

Template: Identifies the data object

proprietary to VCBP in the FCI template

according to ISO/IEC 7816-4.

A5

var.

Mandatory

500B56495341204352454449549 9102

F38189F66049F02069F03069F1A0

295055F2A029A039C019F3704BF0

C089F5A050000000000

Application Interchange Profile (AIP) [for

MSD]: Indicates the capabilities of the card to

support specific functions for MSD transaction.

82

Conditional

to Support

MSD

00C0

9206

Application File Locator (AFL) [for MSD]:

Indicates the location (SFI, range of records)

of the application elementary files for MSD

transaction.

94

var.

Conditional

to Support

MSD

80010100

9206

AIP [for qVSDC]: Indicates the capabilities of

the card to support specific functions for

qVSDC transaction.

82

Mandatory

0040

9207

AFL [for qVSDC]: Indicates the location (SFI,

range of records) of the application elementary

files for qVSDC transaction.

94

var.

Mandatory

08030300

9207

Visa Defined Card Personalization Data

Data Description

Tag

Length

Attribute

Sample Value

DGI(s)

Issuer Application Data (IAD): Contains

proprietary application data for transmission

to the issuer in an online transaction.

Length Indicator = 1F

CVN = 43

Derived Key Indicator

Card Verification Result [partially

dynamically updated during transaction]

Digital Wallet Provider ID (BBBBBBBB)

Derivation Data (0YHHHHCC) [dynamically

updated during transaction]

Issuer Discretionary Data Format = 00

Issuer Discretionary Data =

0000000000000000000000000000

9F10

var. up

to 32

Mandatory

1F4301002000000000BBBBBBBB0 9200

DDDDDDD000000000000000000000

000000000

Track 2 Equivalent Data: Contains the data

elements of track 2 according to ISO/IEC 7813,

excluding start sentinel, end sentinel, and

Longitudinal Redundancy Check (LRC), as

follows:

Primary Account Number

Field Separator = 'D'

Expiration Date (YYMM)

Service Code

Account Parameters Index (YHHHHCC)

[dynamically updated during transaction]

Decimalized Cryptogram (CCCCCC)

[dynamically updated during transaction]

Pad with one Hex 'F' if needed to ensure

whole bytes

57

var. up

to 19

Mandatory

4761739001010010D1012201AAA 0101

AAAACCCCCCF

0E01

Cardholder Name: Indicates cardholder name

according to ISO/IEC 7813.

5F20

2-26

Optional

4558414D504C452F504552534F 0101

0103

0E01

Application Usage Control (AUC): Indicates

issuers specified restrictions on the

geographic usage and services allowed for the

application.

9F07

Mandatory

0080

0103

Data Description

Tag

Length

Attribute

Sample Value

DGI(s)

Issuer Country Code: Indicates the country of

the issuer according to ISO 3166.

5F28

Mandatory

0840

0103

Customer Exclusive Data (CED): Contains certain

data element unique to that consumer or card

(such as a loyalty number or reward number,

etc).

Consists of one or more issuer elements. Each

element in CED consists of a 1-byte proprietary

identifier, 1-byte length, and a value.

The current identifiers that have been defined

are 01 = issuer proprietary, all other values

are RFU.

9F7C

var. up

to 32

Optional

01083132333435363738

0103

Token Requestor ID (TRID): Uniquely identifies

the pairing of Token Requestor with the Token

Domain. Thus, if a given Token Requestor needs

Tokens for multiple domains, it will have

multiple Token Requestor IDs, one for each

domain. It is an 11-digit numeric value

assigned by the Token Service Provider and is

unique within the Token Value.

Positions 1-3: Token Service Provider Code,

unique to each Token Service Provider

Positions 4-11: Assigned by the Token

Service Provider for each requesting entity

and Token Domain

9F19

Optional

012312345678

0103

Application Primary Account Number (PAN)

Sequence Number (PSN): Identifies and

differentiates cards with the same PAN.

5F34

Mandatory

01

0E01

Card Transactions Qualifiers (CTQ): This

element is personalized (using bits 5 and 6 of

byte 1) to establish what action the card

should take when Offline Data Authentication

fails.

9F6C

Mandatory

0100

0E01

Cardholder Verification Method (CVM) List:

Identifies a method of verification of the

cardholder supported by the application.

8E

var. up

to 252

Optional

00000000000000001F00

0E01

Data Description

Tag

Length

Attribute

Sample Value

DGI(s)

Unique Derived Key (UDK): TDES key used to

derive Limited Use Key that is used for

cryptogram generation.

Always used for qVSDC transactions.

Used for MSD transactions if DGI 8001 is not

personalized.

N/A

16

Mandatory

encrypted

8000

UDK Key Check Value: Used to validate recovered

UDK.

N/A

3-8

Mandatory

95C5A8187FDA9947

9000

UDK [for MSD]: TDES key used to derive Limited

Use Key that is used for MSD cryptogram

generation.

N/A

16

Optional

encrypted

8001

UDK Key Check Value [for MSD]: Used to validate

recovered UDK [for MSD].

N/A

3-8

Conditional

to Validate

UDK [for

MSD]

95C5A8187FDA9947

9001

Você também pode gostar

- GCAG ISO Oct2019 FINALDocumento310 páginasGCAG ISO Oct2019 FINALKevin HuAinda não há avaliações

- Verifone Vx805 DsiEMVUS Platform Integration Guide SupplementDocumento60 páginasVerifone Vx805 DsiEMVUS Platform Integration Guide SupplementHammad ShaukatAinda não há avaliações

- Visa Public Key Tables June 2014Documento8 páginasVisa Public Key Tables June 2014Gregorio GazcaAinda não há avaliações

- ISO Global 2008 3Documento294 páginasISO Global 2008 3developer developer100% (1)

- Instructions: Minute InstallDocumento2 páginasInstructions: Minute InstallRafael Perez MendozaAinda não há avaliações

- EMV v4.2 Book 3Documento239 páginasEMV v4.2 Book 3systemcodingAinda não há avaliações

- EMV v4.2 Book 1 ICC To Terminal Interface CR05Documento197 páginasEMV v4.2 Book 1 ICC To Terminal Interface CR05simeranya_00100% (1)

- Iso8583 EspecsDocumento118 páginasIso8583 EspecsAndres LazaroAinda não há avaliações

- Tap On Phone Implementation Guide Oct2021Documento16 páginasTap On Phone Implementation Guide Oct2021Raian DuqueAinda não há avaliações

- Visa Merchant Data Standards Manual PDFDocumento120 páginasVisa Merchant Data Standards Manual PDFPriyeshJainAinda não há avaliações

- GPC Amendment C 1.0.0.7 20110303Documento81 páginasGPC Amendment C 1.0.0.7 20110303nishik_8Ainda não há avaliações

- EMV v4.2 Book 2 Security and Key Management CR05 20111118072236762Documento177 páginasEMV v4.2 Book 2 Security and Key Management CR05 20111118072236762systemcodingAinda não há avaliações

- Visa Merchant Data Standards ManualDocumento120 páginasVisa Merchant Data Standards ManualDoug Forbes100% (1)

- 5 Star Hotels in Portugal Leads 1Documento9 páginas5 Star Hotels in Portugal Leads 1Zahed IqbalAinda não há avaliações

- Hotel ManagementDocumento34 páginasHotel ManagementGurlagan Sher GillAinda não há avaliações

- The Internal Environment: Resources, Capabilities, Competencies, and Competitive AdvantageDocumento5 páginasThe Internal Environment: Resources, Capabilities, Competencies, and Competitive AdvantageHenny ZahranyAinda não há avaliações

- Batch Advantage File SpecificationsDocumento12 páginasBatch Advantage File SpecificationsM J RichmondAinda não há avaliações

- Visa Smart Debit/Credit Acquirer Device Validation Toolkit: User GuideDocumento163 páginasVisa Smart Debit/Credit Acquirer Device Validation Toolkit: User Guideart0928Ainda não há avaliações

- Visa Public Key Tables 2012 11Documento0 páginaVisa Public Key Tables 2012 11OgarSkaliAinda não há avaliações

- VMDS HSM Guide v2.0 PDFDocumento44 páginasVMDS HSM Guide v2.0 PDFThuy VuAinda não há avaliações

- Transaction Acceptance Device Guide TADG V3 May 2015 PDFDocumento273 páginasTransaction Acceptance Device Guide TADG V3 May 2015 PDFNirvana Munar MenesesAinda não há avaliações

- Very Nice EMV Card SpecsDocumento187 páginasVery Nice EMV Card SpecsSaji PillaiAinda não há avaliações

- Emv 1Documento110 páginasEmv 1125820Ainda não há avaliações

- AcquirerMerchant 3DS QRG 9.06.18Documento2 páginasAcquirerMerchant 3DS QRG 9.06.18Rabih AbdoAinda não há avaliações

- Ingenico EMV FAQ 07052012Documento36 páginasIngenico EMV FAQ 07052012Faizan Hussain100% (1)

- 3D Secure 3Documento30 páginas3D Secure 3kominminAinda não há avaliações

- ABc of Credit CardDocumento9 páginasABc of Credit CardamitrathaurAinda não há avaliações

- Integrated Circuit Card Specifications For Payment Systems: Cardholder, Attendant, and Acquirer Interface RequirementsDocumento104 páginasIntegrated Circuit Card Specifications For Payment Systems: Cardholder, Attendant, and Acquirer Interface RequirementsLokeshAinda não há avaliações

- QVSDC IRWIN Testing ProcessDocumento8 páginasQVSDC IRWIN Testing ProcessLewisMuneneAinda não há avaliações

- Amex WS PIP Terminal Interface Spec ISO Apr2011Documento232 páginasAmex WS PIP Terminal Interface Spec ISO Apr2011g10844677Ainda não há avaliações

- PayPass - Transaction Optimization For MChip TerminalsDocumento17 páginasPayPass - Transaction Optimization For MChip TerminalsdubdubAinda não há avaliações

- Handbook: Emv: A Merchant'S PrimerDocumento26 páginasHandbook: Emv: A Merchant'S PrimerAbiy MulugetaAinda não há avaliações

- Tag Definition EMVDocumento2 páginasTag Definition EMVToufiq Zafor100% (1)

- vx520 Download Instructions Terminal ChangesDocumento2 páginasvx520 Download Instructions Terminal ChangesmlopezcobaesAinda não há avaliações

- ADVT User Guide 6.0Documento163 páginasADVT User Guide 6.0fabioluis12Ainda não há avaliações

- Master Card Merchant Admin Guide MR 25Documento119 páginasMaster Card Merchant Admin Guide MR 25Ji MeiAinda não há avaliações

- GlobalPayments Technical SpecificationsDocumento66 páginasGlobalPayments Technical SpecificationssanpikAinda não há avaliações

- Visa Merchant Data Standards Manual PDFDocumento106 páginasVisa Merchant Data Standards Manual PDFmarcpitreAinda não há avaliações

- Amex IsoDocumento25 páginasAmex IsoEzeamama ChimaAinda não há avaliações

- EMV Issuer Security Guidelines: Emvco, LLCDocumento33 páginasEMV Issuer Security Guidelines: Emvco, LLCchinmay451Ainda não há avaliações

- EMV v4.3 Book1 ICC To Terminal Interface 2011113003541414Documento189 páginasEMV v4.3 Book1 ICC To Terminal Interface 2011113003541414ashishkarAinda não há avaliações

- 8 Credit Card System OOADDocumento29 páginas8 Credit Card System OOADMahesh WaraAinda não há avaliações

- 1 Chip Card BasicsDocumento25 páginas1 Chip Card BasicsBilly KatontokaAinda não há avaliações

- Cryptomathic White Paper-Emv Key ManagementDocumento13 páginasCryptomathic White Paper-Emv Key Managementsekhar479100% (2)

- EMV v4.2 Book 4Documento155 páginasEMV v4.2 Book 4systemcoding100% (1)

- Debit Card (Also Known As A Bank Card or Check Card) Is A Plastic Card That Provides AnDocumento7 páginasDebit Card (Also Known As A Bank Card or Check Card) Is A Plastic Card That Provides Anmuthukumaran28Ainda não há avaliações

- EMV-L2 ST100 DraftDocumento72 páginasEMV-L2 ST100 DraftAndali AliAinda não há avaliações

- Visa Approved Dual Chip Cards - January 2022Documento23 páginasVisa Approved Dual Chip Cards - January 2022王二刚Ainda não há avaliações

- VISA RulesDocumento414 páginasVISA RulesЕвгений Безгодов100% (1)

- Smart CardDocumento5 páginasSmart CardAnikesh BrahmaAinda não há avaliações

- VISA CEMEA Personalisation Templates Version 1.5, August 2003Documento107 páginasVISA CEMEA Personalisation Templates Version 1.5, August 2003Mustapha El AlaouiAinda não há avaliações

- M/Chip Functional Architecture For Debit and Credit: Applies To: SummaryDocumento12 páginasM/Chip Functional Architecture For Debit and Credit: Applies To: SummaryAbiy MulugetaAinda não há avaliações

- EMV SDA Vs DDADocumento6 páginasEMV SDA Vs DDAimvijayAinda não há avaliações

- 3-5-Emv L2Documento6 páginas3-5-Emv L2Rafael Perez MendozaAinda não há avaliações

- PayPass - MChip Reader Card Application Interface Specification (V2.0)Documento80 páginasPayPass - MChip Reader Card Application Interface Specification (V2.0)Kiran Kumar Kuppa100% (3)

- Merchant Guide To The Visa Address Verification ServiceDocumento21 páginasMerchant Guide To The Visa Address Verification ServiceCesar ChAinda não há avaliações

- Master Card VPC Integration Guide 3-1-21 - 0Documento57 páginasMaster Card VPC Integration Guide 3-1-21 - 0scribd_fishnetAinda não há avaliações

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNo EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeAinda não há avaliações

- Online Fraud Detection A Complete Guide - 2019 EditionNo EverandOnline Fraud Detection A Complete Guide - 2019 EditionAinda não há avaliações

- Squirrel Cage Induction Motor Preventive MaintenaceDocumento6 páginasSquirrel Cage Induction Motor Preventive MaintenaceNishantPareekAinda não há avaliações

- Check Fraud Running Rampant in 2023 Insights ArticleDocumento4 páginasCheck Fraud Running Rampant in 2023 Insights ArticleJames Brown bitchAinda não há avaliações

- Internship ReportDocumento46 páginasInternship ReportBilal Ahmad100% (1)

- 6 V 6 PlexiDocumento8 páginas6 V 6 PlexiFlyinGaitAinda não há avaliações

- Online Learning Interactions During The Level I Covid-19 Pandemic Community Activity Restriction: What Are The Important Determinants and Complaints?Documento16 páginasOnline Learning Interactions During The Level I Covid-19 Pandemic Community Activity Restriction: What Are The Important Determinants and Complaints?Maulana Adhi Setyo NugrohoAinda não há avaliações

- L1 L2 Highway and Railroad EngineeringDocumento7 páginasL1 L2 Highway and Railroad Engineeringeutikol69Ainda não há avaliações

- Environmental Auditing For Building Construction: Energy and Air Pollution Indices For Building MaterialsDocumento8 páginasEnvironmental Auditing For Building Construction: Energy and Air Pollution Indices For Building MaterialsAhmad Zubair Hj YahayaAinda não há avaliações

- 18 - PPAG-100-HD-C-001 - s018 (VBA03C013) - 0 PDFDocumento1 página18 - PPAG-100-HD-C-001 - s018 (VBA03C013) - 0 PDFSantiago GarciaAinda não há avaliações

- Microsoft Word - Claimants Referral (Correct Dates)Documento15 páginasMicrosoft Word - Claimants Referral (Correct Dates)Michael FourieAinda não há avaliações

- PFI High Flow Series Single Cartridge Filter Housing For CleaningDocumento2 páginasPFI High Flow Series Single Cartridge Filter Housing For Cleaningbennypartono407Ainda não há avaliações

- Information Security Chapter 1Documento44 páginasInformation Security Chapter 1bscitsemvAinda não há avaliações

- BCG - Your Capabilities Need A Strategy - Mar 2019Documento9 páginasBCG - Your Capabilities Need A Strategy - Mar 2019Arthur CahuantziAinda não há avaliações

- Ludwig Van Beethoven: Für EliseDocumento4 páginasLudwig Van Beethoven: Für Eliseelio torrezAinda não há avaliações

- SCDT0315 PDFDocumento80 páginasSCDT0315 PDFGCMediaAinda não há avaliações

- MDOF (Multi Degre of FreedomDocumento173 páginasMDOF (Multi Degre of FreedomRicky Ariyanto100% (1)

- Chapter 5Documento3 páginasChapter 5Showki WaniAinda não há avaliações

- PCDocumento4 páginasPCHrithik AryaAinda não há avaliações

- PLT Lecture NotesDocumento5 páginasPLT Lecture NotesRamzi AbdochAinda não há avaliações

- Action Plan Lis 2021-2022Documento3 páginasAction Plan Lis 2021-2022Vervie BingalogAinda não há avaliações

- Feasibility Study of Diethyl Sulfate ProductionDocumento3 páginasFeasibility Study of Diethyl Sulfate ProductionIntratec SolutionsAinda não há avaliações

- Himachal Pradesh Important NumbersDocumento3 páginasHimachal Pradesh Important NumbersRaghav RahinwalAinda não há avaliações

- Doterra Enrollment Kits 2016 NewDocumento3 páginasDoterra Enrollment Kits 2016 Newapi-261515449Ainda não há avaliações

- Tivoli Performance ViewerDocumento4 páginasTivoli Performance ViewernaveedshakurAinda não há avaliações

- Dike Calculation Sheet eDocumento2 páginasDike Calculation Sheet eSaravanan Ganesan100% (1)

- Introduction To Motor DrivesDocumento24 páginasIntroduction To Motor Drivessukhbat sodnomdorjAinda não há avaliações

- TAB Procedures From An Engineering FirmDocumento18 páginasTAB Procedures From An Engineering Firmtestuser180Ainda não há avaliações

- SILABO 29-MT247-Sensors-and-Signal-ConditioningDocumento2 páginasSILABO 29-MT247-Sensors-and-Signal-ConditioningDiego CastilloAinda não há avaliações