Escolar Documentos

Profissional Documentos

Cultura Documentos

Chicago Tax Increases

Enviado por

jroneill0 notas0% acharam este documento útil (0 voto)

11K visualizações1 páginaThis is a summary of the tax increases endorsed Monday by the City Council's Finance Committee.

Título original

Chicago tax increases

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoThis is a summary of the tax increases endorsed Monday by the City Council's Finance Committee.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

11K visualizações1 páginaChicago Tax Increases

Enviado por

jroneillThis is a summary of the tax increases endorsed Monday by the City Council's Finance Committee.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 1

Summary of Proposed Revenue Ordinance

2015 Budget Recommendation, City of Chicago

MCC

Current Rate

Proposed Rate

Projected New

Revenue

Require Website Facilitators to Collect Hotel Tax

3-24-020

4.5%

4.5%

$1,000,000

Short-term vacation rentals are currently subject to the City's hotel tax, but website facilitators, such as Airbnb, have not been required to collect the tax, making

enforcement difficult. The proposed amendment would require facilitators to collect the hotel tax on transactions that occur through their websites.

Close Sales-Use Tax Loophole

3-27-030

credited

1%

$17,000,000

Purchases made outside of the City of Chicago for use in Chicago are subject to the City's use tax of 1 percent, but if a purchaser can show that they paid sales tax in the

jurisdiction where they purchased the goods, they receive a credit against the use tax owed to the City. However, some companies purchase goods in other

municipalities, receive use tax credits from the City for sales taxes paid to those municipalities, and then receive sales tax rebates from the municipalities where they

made the purchases. The proposed change would close this loophole by eliminating City use tax credits for any amounts that have been rebated by the other

municipality.

Personal Property Lease Tax Increase

3-32-030

8%

9%

$15,000,000

The personal property lease tax is collected on the lease of personal property such as software and equipment. This tax was last increased from 6 to 8 percent in 2008,

and the current proposal would increase the tax rate by 1 percent to 9 percent effective January 1, 2015.

Eliminate Lease Tax Exemption for Car Sharing

3-32-020

0%

9%

$1,000,000

In 2006, an ordinance was passed to exempt car sharing companies from the personal property lease tax. This exemption was provided to help this new industry,

including a number of non-profit car sharing groups, grow. Since that time, car sharing has become an established business model, and the smaller companies that were

in the market at the time the exemption was provided have been acquired by larger companies - ZipCar is now part of Avis, IGO is now part of Enterprise, and Hertz has

expanded into the car share industry.

Eliminate Loopholes and Exemptions from the Amusement Tax

Tax Full Price of Luxury/Special Seating Packages

4-156-020F

9% on 60% of price

9% on 100% of price

$4,400,000

Currently, the amusement tax is imposed on only 60 percent of the charge for special seating areas such as skyboxes. The proposed amendment would eliminate the 40

percent exemption and impose the amusement tax on the full charge for such packages. A credit will be provided to the payer in the amount of any other City taxes

actually paid on the same charges.

Eliminate Cable Exemption

4-156-020J

6%

9%

$12,000,000

Prior to 2014, cable companies received a 5 percent exemption, paying amusement tax at a rate of 4 percent, as opposed to the 9 percent rate applied to other similar

amusements. The exemption was reduced to 3 percent in 2014, resulting in a 6 percent amusement tax rate for cable companies. The 2015 budget proposes eliminating

this exemption, requiring cable companies pay the 9 percent amusement tax applied to other amusements. If cable companies pass this increased cost on to subscribers,

it would result in an estimated increase of $2.40 per $80 monthly cable bill.

Garage Tax Increase

4-236-020

20%/18%

22%/20%

$10,000,000

The garage tax was last increased in 2012 and then switched from a 12-tier bracketed structure to a simpler percentage-based structure in July 2013. This proposal

would increase the weekday rate from 20 percent to 22 percent and the weekend rate from 18 percent to 20 percent; weekly and monthly rates would increase from 20

percent to 22 percent. The $10 million in new revenue will be dedicated to pothole and street repair.

Consistently Apply Garage Tax to Valets

4-236-025

20%/18% on lesser amount

20% on full amount

$2,000,000

Currently, valets often receive discounted rates at the garages, they pay tax on an amount less than the amount they charge to the customer. Moreover, if the valet

parks the car on the public way, they are not required to pay the tax. This proposal will simplify the ordinance and impose the garage tax rate of 20 percent on the full

amount charged by valets.

Você também pode gostar

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- LTR MBJHousingResignation 04012024Documento2 páginasLTR MBJHousingResignation 04012024jroneillAinda não há avaliações

- Burke IndictmentDocumento59 páginasBurke Indictmentjroneill100% (2)

- Water Dept ComplaintDocumento40 páginasWater Dept Complaintjroneill100% (1)

- OIG First Quarter 2019 ReportDocumento40 páginasOIG First Quarter 2019 ReportjroneillAinda não há avaliações

- BBB Study of Counterfeit Goods Sold OnlineDocumento13 páginasBBB Study of Counterfeit Goods Sold OnlineKevinSeanHeldAinda não há avaliações

- Chicago Law Department Files Civil Complaint Against Jussie SmollettDocumento13 páginasChicago Law Department Files Civil Complaint Against Jussie SmollettWGN Web DeskAinda não há avaliações

- Special Prosecutor Request in Case of Jedidiah BrownDocumento18 páginasSpecial Prosecutor Request in Case of Jedidiah BrownjroneillAinda não há avaliações

- Krupa LawsuitDocumento39 páginasKrupa LawsuitjroneillAinda não há avaliações

- Fair Tax For IllinoisDocumento8 páginasFair Tax For IllinoisjroneillAinda não há avaliações

- Chicago-Peres Center For Peace and Innovation Draft AgreementDocumento3 páginasChicago-Peres Center For Peace and Innovation Draft AgreementjroneillAinda não há avaliações

- Filed Complaint 3.8.19Documento29 páginasFiled Complaint 3.8.19jroneillAinda não há avaliações

- Krupa LawsuitDocumento39 páginasKrupa LawsuitjroneillAinda não há avaliações

- United States Court of Appeals: For The Seventh CircuitDocumento24 páginasUnited States Court of Appeals: For The Seventh CircuitjroneillAinda não há avaliações

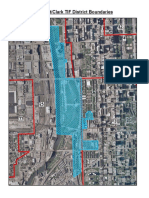

- The 78 BoundariesDocumento1 páginaThe 78 BoundariesjroneillAinda não há avaliações

- Lawsuit Against Chicago Aviation DepartmentDocumento27 páginasLawsuit Against Chicago Aviation DepartmentjroneillAinda não há avaliações

- Greer v. Board of EducationDocumento48 páginasGreer v. Board of Educationjroneill100% (1)

- Rhonda Barrett vs. CHA LawsuitDocumento7 páginasRhonda Barrett vs. CHA LawsuitjroneillAinda não há avaliações

- Chicago Police OT April 2018 - PresentDocumento166 páginasChicago Police OT April 2018 - Presentjroneill100% (1)

- CFD Internal Affairs Report On Juan LopezDocumento19 páginasCFD Internal Affairs Report On Juan LopezWGN Web DeskAinda não há avaliações

- Pritzker Campaign Lawsuit 10-16-18Documento12 páginasPritzker Campaign Lawsuit 10-16-18The Center SquareAinda não há avaliações

- Lawsuit Against Treasure IslandDocumento8 páginasLawsuit Against Treasure IslandjroneillAinda não há avaliações

- MWRD ComplaintDocumento21 páginasMWRD ComplaintjroneillAinda não há avaliações

- Lori Lightfoot Kalchik LetterDocumento1 páginaLori Lightfoot Kalchik LetterjroneillAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Yulo V Yang Chiao SengDocumento5 páginasYulo V Yang Chiao SengCessy Ciar KimAinda não há avaliações

- Swot Analysis Sheet Strengths Weaknesses Opportunities Threats Product/ Service OfferingDocumento9 páginasSwot Analysis Sheet Strengths Weaknesses Opportunities Threats Product/ Service OfferingSebastian KiambaAinda não há avaliações

- Pasig City v. Republic PDFDocumento2 páginasPasig City v. Republic PDFAngela ConejeroAinda não há avaliações

- 68529bos54855 cp7Documento80 páginas68529bos54855 cp7Kunal BhatnagarAinda não há avaliações

- Dep't of Transportation v. Adams Outdoor Advertising of Charlotte LP, No. 206PA16 (N.C. Sep. 29, 2017)Documento38 páginasDep't of Transportation v. Adams Outdoor Advertising of Charlotte LP, No. 206PA16 (N.C. Sep. 29, 2017)RHTAinda não há avaliações

- Entry Condition Report - General Tenancies (Form 1a) : Lessor/agentDocumento7 páginasEntry Condition Report - General Tenancies (Form 1a) : Lessor/agentSome RoomsAinda não há avaliações

- Case No. 1 (Saludo, Jr. v. Philippine National Bank)Documento15 páginasCase No. 1 (Saludo, Jr. v. Philippine National Bank)Ambassador WantedAinda não há avaliações

- MIAA v. Court of Appeals: Carpio, JDocumento31 páginasMIAA v. Court of Appeals: Carpio, JIsaias S. Pastrana Jr.Ainda não há avaliações

- Deed 1Documento4 páginasDeed 1MozaharAinda não há avaliações

- Restaurant Opening ChecklistDocumento12 páginasRestaurant Opening ChecklistKebutuhan Rumah MurahAinda não há avaliações

- NR NORDIC RUSSIA Prospectus 17 December 2007 ENDocumento200 páginasNR NORDIC RUSSIA Prospectus 17 December 2007 ENAli SaifyAinda não há avaliações

- SpecPro Rules 89-91Documento18 páginasSpecPro Rules 89-91BananaAinda não há avaliações

- Advances Policy V1.6 - 15 Dec 2014Documento4 páginasAdvances Policy V1.6 - 15 Dec 2014sangeethaAinda não há avaliações

- Lagon Vs CADocumento2 páginasLagon Vs CAGwenBañariaAinda não há avaliações

- Trust 16-20 Case DigestsDocumento6 páginasTrust 16-20 Case DigestsLeng Villeza50% (2)

- The Following Facts Pertain To A Non Cancellable Lease Agreement Between PDFDocumento2 páginasThe Following Facts Pertain To A Non Cancellable Lease Agreement Between PDFTaimur TechnologistAinda não há avaliações

- Reyes v. TuparanDocumento3 páginasReyes v. TuparanIldefonso HernaezAinda não há avaliações

- 5.civil Case-Mahalaxmi-FinalDocumento20 páginas5.civil Case-Mahalaxmi-FinalCAAniketGangwalAinda não há avaliações

- Building and MachineriesDocumento21 páginasBuilding and MachineriesChristine ErnoAinda não há avaliações

- Girl 928214Documento11 páginasGirl 928214point clickAinda não há avaliações

- 26 Henson vs. Intermediate Appellate CourtDocumento2 páginas26 Henson vs. Intermediate Appellate CourtJemAinda não há avaliações

- Contract of Lease of Commercial BuildingDocumento7 páginasContract of Lease of Commercial BuildingSol VirtudazoAinda não há avaliações

- San Diego Vs NombreDocumento6 páginasSan Diego Vs Nombrediamajolu gaygonsAinda não há avaliações

- Corporate FinanceDocumento42 páginasCorporate FinanceNguyễn Thụy Ngọc HânAinda não há avaliações

- Text Book 2023Documento142 páginasText Book 2023Henna NguboAinda não há avaliações

- Portfolio MergedDocumento23 páginasPortfolio MergedNisha JodhanAinda não há avaliações

- CJ Yulo & Sons VS Roman CatholicDocumento6 páginasCJ Yulo & Sons VS Roman Catholicchristopher1julian1aAinda não há avaliações

- Gist of IFRS 16Documento6 páginasGist of IFRS 16Aswathy JejuAinda não há avaliações

- ATS march-2020-insight-part-IIDocumento104 páginasATS march-2020-insight-part-IIAromasodun Omobolanle IswatAinda não há avaliações

- 6317349301Documento2 páginas6317349301Rengan NathanAinda não há avaliações