Escolar Documentos

Profissional Documentos

Cultura Documentos

ACC2002 Managerial Accounting Textbook Solution-Ch8 EXERCISE 8-15

Enviado por

coffeedanceDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

ACC2002 Managerial Accounting Textbook Solution-Ch8 EXERCISE 8-15

Enviado por

coffeedanceDireitos autorais:

Formatos disponíveis

ACC2002 Managerial Accounting

Textbook Solution-Ch8

EXERCISE 8-15

Inventory calculations (units):

Finished-goods inventory, January 1 .......................................................

Add: Units produced ................................................................................

Less: Units sold .......................................................................................

Finished-goods inventory, December 31 ..................................................

1.

2,000

20,000

21,000

1,000

units

units

units

units

Variable costing:

Inventoriable costs under variable costing:

Direct material used .................................................................................

Direct labor incurred .................................................................................

Variable manufacturing overhead ............................................................

Total .........................................................................................................

$ 600,000

300,000

200,000

$1,100,000

Cost per unit produced = $1,100,000/20,000 units = $55 per unit

Ending inventory: 1,000 units $55 per unit .........................................

$55,000

2. Absorption costing:

Predetermined fixed-overhead rate

fixed manufacturing overhead

$420,000

=

planned production

20,000 units

= $21 per unit

Difference in fixed

overhead expensed under

absorption and variable costing

change in predetermined

inventory fixed-overhead

in units

rate

(1,000 units) ($21 per unit)

$21,000

Difference in reported income:

Since inventory decreased during the year, income reported under absorption costing will be

$21,000 lower than income reported under variable costing.

ACC2002 Managerial Accounting

Textbook Solution-Ch8

EXERCISE 8-17

1.

a. Inventory decreases by 3,000 units, so income is greater under variable costing.

b.

Fixed overhead

rate per unit

Difference in

reported income

2.

$2,200,000

= $110

20,000

$110 3,000 = $330,000

a. Inventory remains unchanged, so there is no difference in reported income under the two

methods of product costing.

b. No difference.

3.

a. Inventory increases by 2,000 units, so income is greater under absorption costing.

b.

Fixed overhead

rate per unit

Difference in

reported income

$2,200,000

= $200

11,000

$200 2,000 = $400,000

ACC2002 Managerial Accounting

Textbook Solution-Ch8

EXERCISE 8-18

1.

Cost-volume profit graph:

Dollars (in millions)

$5

$4

Break-even point:

14,667 units

(rounded)

Total cost

Revenue

$3

$2

Fixed cost

($2,200,000)

$1

5

2.

10

15

Calculation of break-even point:

Break-even point

=

=

=

3.

Units (in

thousands)

fixed cost

unit contribution margin

$2,200,000

$350 $200

14,667 units (rounded)

Variable costing is more compatible with the cost-volume-profit chart, because it maintains the

distinction between fixed and variable costs as does CVP analysis.

Absorption costing, in contrast, does not maintain the separation of fixed and variable costs.

Fixed costs are unitized in the fixed overhead rate and inventoried as product costs along with

variable manufacturing costs.

3

ACC2002 Managerial Accounting

Textbook Solution-Ch8

PROBLEM 8-23

1.

Since the planned production volume was 100,000 units, actual production was also 100,000

units.

Beginning inventory .................................................................................

Production ................................................................................................

Ending inventory ......................................................................................

Sales ........................................................................................................

0 units

100,000 units

(20,000) units

80,000 units

Since inventory increased during the year, reported income is higher under absorption costing.

Difference in

reported income

$20,000

change in

inventory

20,000 units

fixed overhead

per unit

fixed overhead

100,000 units

Solving this equation: fixed overhead = $100,000

Now we can compute the contribution margin:

Reported income under variable costing ..................................................

Fixed overhead ........................................................................................

Total contribution margin .........................................................................

Contribution margin

per unit

Break-even point

in units

$220,000

100,000

$320,000

total contribution margin

sales in units

$320,000

= $4 per unit

80,000 units

fixed cost (overhead)

unit contribution margin

$100,000

= 25,000 units

$4 per unit

ACC2002 Managerial Accounting

2.

Textbook Solution-Ch8

Profit-volume graph:

Dollars

$250,000

Profit = $220,000 at

80,000 unit sales volume

$200,000

$150,000

$100,000

Break-even

point 25,000 units

$50,000

Profit

Loss

25,000

50,000

75, 000

$(50,000)

$(100,000)

$(150,000)

100,000

Sales in units

ACC2002 Managerial Accounting

Textbook Solution-Ch8

PROBLEM 8-24

Outback Corporations reported 20x1 income will be higher under absorption costing because actual

production exceeded actual sales. Therefore, inventory increased and some fixed costs will remain in

inventory under absorption costing which would be expensed under variable costing.

1.

Beginning inventory (in units) ...................................................................

Actual production (in units) ......................................................................

Available for sale (in units) .......................................................................

Sales (in units) .........................................................................................

Ending inventory (in units) .......................................................................

35,000

130,000

165,000

125,000

40,000

Budgeted manufacturing costs:

Direct material ..........................................................................................

Direct labor ..............................................................................................

Variable manufacturing overhead ............................................................

Fixed manufacturing overhead .................................................................

Total .....................................................................................................

Total budgetedmanufacturing costs (variable and fixed)

Total planned production(in units)

Value of ending inventory

2.

quantity cost per unit

40,000 units $30 per unit

$1,200,000

$1,680,000

1,260,000

560,000

700,000

$4,200,000

$4,200,000

140,000

= $30 per unit

=

Budgeted variable manufacturing costs:

Direct material ..........................................................................................

Direct labor ..............................................................................................

Variable manufacturing overhead ............................................................

Total .........................................................................................................

Total budgeted variable manufacturing costs

$3,500,000

=

Total planned production(in units)

140,000

= $25 per unit

$1,680,000

1,260,000

560,000

$3,500,000

ACC2002 Managerial Accounting

Value of ending inventory

3.

Increase in inventory (in units)

Textbook Solution-Ch8

quantity cost per unit

40,000 units $25 per unit

$1,000,000

=

production sales

130,000 units 125,000 units

5,000 units

Budgeted fixed manufacturing overhead per unit

$700,000

140,000 units

= $5 per unit

Difference in reported income

= budgeted fixed overhead per unit change in inventory (in units)

= $5 5,000 units = $25,000

Income reported under absorption costing will be higher than that reported under variable

costing, because inventory increased during the year.

4.

If Outback Corporation had adopted a JIT program at the beginning of 20x1:

a. It is unlikely that the company would have manufactured 5,000 more units than it sold.

Under JIT, production and sales would be nearly equal.

b. Reported income under variable and absorption costing would most likely be nearly the

same. Differences in reported income are caused by changes in inventory levels. Under

JIT, inventory levels would be minimal. Therefore, the change in these levels would be

minimal.

ACC2002 Managerial Accounting

Textbook Solution-Ch8

PROBLEM 8-25

1.

Cost per unit:

(a) Absorption Costing

(b) Variable Costing

Direct material ............................... $35 ....................................................... $35

Direct labor .................................... 16 ....................................................... 16

Manufacturing overhead

Variable ..................................... 10 ....................................................... 10

Fixed ($210,000 30,000) ........

7

Total absorption cost per unit..

$68

Total variable cost per unit ..................................................................................$61

2.

a.

STARS ABOVE LTD.

INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 20X1

ABSORPTION COSTING

Sales revenue (27,000 at $95 per unit) ..............................................

$2,565,000

Less: Cost of goods sold (27,000 units at

absorption cost of $68 per unit) ........................................................

1,836,000

Gross margin .....................................................................................

729,000

Less: Selling and administrative expenses:

Variable (27,000 at $1 per unit) ..............................................

27,000

Fixed ......................................................................................

230,000

Operating income ..............................................................................

$ 472,000

b.

STARS ABOVE LTD.

INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 20X1

VARIABLE COSTING

Sales revenue (27,000 units at $95 per unit) .....................................

Less: Variable expenses:

Variable manufacturing costs

(27,000 units at variable cost of $61 per unit) ......................

Variable selling and administrative costs

(27,000 units at $1 per unit) .................................................

Contribution margin ............................................................................

Less: Fixed expenses:

Fixed manufacturing overhead ...............................................

Fixed selling and administrative costs ....................................

Operating income ..............................................................................

3.

Change in

inventory

(in units)

3,000 unit increase

$2,565,000

1,647,000

27,000

891,000

210,000

230,000

$ 451,000

predetermined

fixed overhead

rate

absorption-costing income

minus variable-costing

income

$7

$21,000

ACC2002 Managerial Accounting

4.

Textbook Solution-Ch8

If Stars Above had implemented JIT and installed a flexible manufacturing system at the

beginning of 20x1, it is unlikely that reported income would have differed by as great a

magnitude. Under this scenario, production and sales would have been nearly the same. As a

result, reported income under variable and absorption costing would have been nearly equal.

Differences in reported income are caused by significant changes in inventory levels, which do

not occur under JIT because inventory is minimal.

PROBLEM 8-29

1.

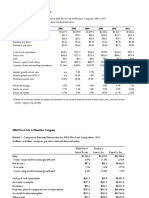

a. Absorption-costing income statements:

Year 1

Year 2

Sales revenue (at $50 per case) ..............................................................

$4,000,000 $3,000,000

Less: Cost of goods sold (at

absorption cost of $42 per case*) ..........................................................

3,360,000

2,520,000

Gross margin ...........................................................................................

$ 640,000 $ 480,000

Less: Selling and administrative expenses:

Variable (at $1 per case) ..............................................................

80,000

60,000

Fixed ............................................................................................

75,000

75,000

Operating income ....................................................................................

$ 485,000 $ 345,000

Year 3

$4,500,000

3,780,000

$ 720,000

90,000

75,000

$ 555,000

*The absorption cost per case is $42, calculated as follows:

variable manufacturing

Budgeted fixed manufacturing overhead

Planned production

$800,000

80,000

$32

$10

$32 = $42

b. Variable-costing income statements:

cost per case

ACC2002 Managerial Accounting

Textbook Solution-Ch8

Year 1

Year 2

Sales revenue (at $50 per case) ..............................................................

$4,000,000 $3,000,000

Less: Variable expenses:

Variable manufacturing costs (at

variable cost of $32 per case)

2,560,000

1,920,000

Variable selling and administrative

costs (at $1 per case) ................................................................

80,000

60,000

Contribution margin ..................................................................................

$1,360,000 $1,020,000

Less Fixed expenses:

Fixed manufacturing overhead .....................................................

800,000

800,000

Fixed selling and administrative

expenses ...................................................................................

75,000

75,000

Operating income ....................................................................................

$ 485,000 $ 145,000

2.

2,880,000

90,000

$1,530,000

800,000

75,000

$ 655,000

Reconciliation:

Year

1

2

3

Difference In

Difference

Predetermined Fixed Overhead

Reported Income

in

Change in

Fixed

Expensed Under

Absorption Variable Reported

Inventory

Overhead

Absorption and

Costing

Costing

Income

(in units)

Rate*

Variable Costing

$485,000 $485,000

-0-0$10

0

345,000

145,000

$200,000

20,000

10

$200,000

555,000

655,000

(100,000)

(10,000)

10

(100,000)

*Predetermined fixed manufacturing overhead rate =

3.

Year 3

$4,500,000

$800,000

80,000

a. In year 4, the difference in reported operating income will be $100,000, calculated as

follows:

Change in

inventory

(in units)

Predetermined

fixed overhead

rate

(10,000)

$10

$(100,000)

Income reported under absorption costing will be lower, because inventory will decline

during year 4.

b. Over the four-year period, the total of all reported operating income will be the same under

absorption and variable costing. This result will occur because inventory does not change

over the four-year period. It starts out at zero on January 1 of year 1, and it ends up at zero

on December 31 of year 4.

10

Você também pode gostar

- 1 Given:: D Annual Demand Per Unit S Ordering Cost Per Purchse Order H Holding Cost Per UnitDocumento13 páginas1 Given:: D Annual Demand Per Unit S Ordering Cost Per Purchse Order H Holding Cost Per Unitkerie gashayeAinda não há avaliações

- Godrej Builds 'Sampark' With Distributors - E-Business - Express Computer IndiaDocumento2 páginasGodrej Builds 'Sampark' With Distributors - E-Business - Express Computer IndiaPradeep DubeyAinda não há avaliações

- CH 2ansDocumento3 páginasCH 2ansab khAinda não há avaliações

- A Study of Vivel Active Fair Performance Across ChannelsDocumento47 páginasA Study of Vivel Active Fair Performance Across ChannelsDhirender Chauhan0% (1)

- Cost Accounting AssignmentDocumento4 páginasCost Accounting AssignmentShubham TetuAinda não há avaliações

- Prithvi Electricals B2B Motor StrategyDocumento4 páginasPrithvi Electricals B2B Motor StrategyOishik BanerjiAinda não há avaliações

- Tata Nano : ONE LakhDocumento24 páginasTata Nano : ONE Lakharunaghanghoria2803Ainda não há avaliações

- Porter's 5 Forces Analysis of Toyota's Automotive Industry PositionDocumento9 páginasPorter's 5 Forces Analysis of Toyota's Automotive Industry PositionBiju MathewsAinda não há avaliações

- DI Printer Production OptimizationDocumento3 páginasDI Printer Production OptimizationErikaNicoleDumoranGumilinAinda não há avaliações

- HULDocumento25 páginasHULrriittuu100% (7)

- Crompton Greaves LTD Case StudyDocumento24 páginasCrompton Greaves LTD Case Studyketanmokal24Ainda não há avaliações

- SCM CaseletDocumento10 páginasSCM CaseletSreejith P MenonAinda não há avaliações

- V-Guard - Case PDFDocumento20 páginasV-Guard - Case PDFFood On ThoughtAinda não há avaliações

- HR Managers Duties, Functions, and StrategiesDocumento10 páginasHR Managers Duties, Functions, and StrategiesMd Shadab Alam0% (1)

- P&G Case: Proctor and Gamble India: Gap in The Product Portfolio?Documento6 páginasP&G Case: Proctor and Gamble India: Gap in The Product Portfolio?Param NagdaAinda não há avaliações

- Turnaround Plan For Linens N ThingsDocumento15 páginasTurnaround Plan For Linens N ThingsTinakhaladze100% (1)

- LaxmiDocumento11 páginasLaxmikattyperrysherryAinda não há avaliações

- Cost Sheet For The Month of January: TotalDocumento9 páginasCost Sheet For The Month of January: TotalgauravpalgarimapalAinda não há avaliações

- LPP FormulationDocumento15 páginasLPP FormulationGaurav Somani0% (2)

- Wilkerson Company Case Numerical Approach SolutionDocumento3 páginasWilkerson Company Case Numerical Approach SolutionAbdul Rauf JamroAinda não há avaliações

- Cost Accounting ProjectDocumento7 páginasCost Accounting ProjectRupen ChawlaAinda não há avaliações

- Improve Sub-ProcessesDocumento1 páginaImprove Sub-ProcessesAjay SahuAinda não há avaliações

- MB2D2Documento15 páginasMB2D2Praghathi PaiAinda não há avaliações

- On Nirma CaseDocumento36 páginasOn Nirma CaseMuskaan ChaudharyAinda não há avaliações

- 4587 2261 10 1487 54 BudgetingDocumento46 páginas4587 2261 10 1487 54 BudgetingDolly BadlaniAinda não há avaliações

- Financial Statement Analysis of HUL, Dabur and MaricoDocumento50 páginasFinancial Statement Analysis of HUL, Dabur and MaricoJKIOAinda não há avaliações

- Case Problem 2 Office Equipment, Inc.Documento2 páginasCase Problem 2 Office Equipment, Inc.Something ChicAinda não há avaliações

- Probability questions on cricket, advertising, bombing targets, batting performances, project delays, quality control, and Poisson processesDocumento4 páginasProbability questions on cricket, advertising, bombing targets, batting performances, project delays, quality control, and Poisson processesArvind KumarAinda não há avaliações

- 2 Manas BuildingDocumento6 páginas2 Manas BuildingSandhali JoshiAinda não há avaliações

- ERP ExerciseDocumento1 páginaERP Exercisefriendajeet123Ainda não há avaliações

- ITC Distribution Channel & TasksDocumento11 páginasITC Distribution Channel & TasksShashank KamleAinda não há avaliações

- Product Availability in SCMDocumento25 páginasProduct Availability in SCMNiranjan ThirAinda não há avaliações

- Airtel Mobile Marketing PlanDocumento53 páginasAirtel Mobile Marketing PlanShilpa Ravindran100% (1)

- Fishbay PPT NotesDocumento1 páginaFishbay PPT NotesDivyank JyotiAinda não há avaliações

- Case Study of Hand Made Silver Filigree / Jewellery Cluster at Cuttak - OrrisaDocumento5 páginasCase Study of Hand Made Silver Filigree / Jewellery Cluster at Cuttak - OrrisasupriyadhageAinda não há avaliações

- Glenorna Coffee PDFDocumento10 páginasGlenorna Coffee PDFAMITAinda não há avaliações

- Infosys BPO Case AnalysisDocumento4 páginasInfosys BPO Case AnalysisDHRUV SONAGARAAinda não há avaliações

- Great DaKota Bank Case StudyDocumento10 páginasGreat DaKota Bank Case StudyItsCjAinda não há avaliações

- Norgan TheatreDocumento21 páginasNorgan TheatreGunay GozalovaAinda não há avaliações

- Memory Manufacturing Company MMC Produces Memory Modules in A Two StepDocumento1 páginaMemory Manufacturing Company MMC Produces Memory Modules in A Two StepAmit PandeyAinda não há avaliações

- General Management Project - Analysis of Growth in the Indian Retail IndustryDocumento5 páginasGeneral Management Project - Analysis of Growth in the Indian Retail IndustryMaThew MarkoseAinda não há avaliações

- Aldens Products Group Report on European OperationsDocumento13 páginasAldens Products Group Report on European Operationsddoherty27465100% (2)

- Frequent FlierDocumento2 páginasFrequent FlierSuman Nayak0% (2)

- Business Statistic Linear Programming ExerciseDocumento3 páginasBusiness Statistic Linear Programming ExerciseSimon Gee0% (2)

- E Auction For Tea - The Indian ExperienceDocumento40 páginasE Auction For Tea - The Indian ExperienceAnil Kumar Singh67% (3)

- Ingersol RandDocumento3 páginasIngersol RandBitan RoyAinda não há avaliações

- Case Example - Delhi Metro - SolutionDocumento14 páginasCase Example - Delhi Metro - Solutionlakshya jainAinda não há avaliações

- Honda Motorcycle & Scooter India PVT LTD PDFDocumento27 páginasHonda Motorcycle & Scooter India PVT LTD PDFSaurabh SinghAinda não há avaliações

- Quiz 2Documento6 páginasQuiz 2Mukund AgarwalAinda não há avaliações

- HP GAS RASOI GHAR: Providing Clean Cooking to Rural IndiaDocumento16 páginasHP GAS RASOI GHAR: Providing Clean Cooking to Rural Indiaadarshkrishna2Ainda não há avaliações

- Tata MotorsDocumento11 páginasTata MotorsYogita SharmaAinda não há avaliações

- Case Radiance Transaction Level PricingDocumento10 páginasCase Radiance Transaction Level PricingSanya TAinda não há avaliações

- Zappos' Service Marketing Strategies to Bridge Performance GapsDocumento7 páginasZappos' Service Marketing Strategies to Bridge Performance GapsNishan ShettyAinda não há avaliações

- V Guard Case Assignment 2Documento4 páginasV Guard Case Assignment 2RohitSuryaAinda não há avaliações

- MONDELEZ INDIA FACTORY TRAININGDocumento12 páginasMONDELEZ INDIA FACTORY TRAININGMonika JhaAinda não há avaliações

- AOL.com (Review and Analysis of Swisher's Book)No EverandAOL.com (Review and Analysis of Swisher's Book)Ainda não há avaliações

- Variable Costing vs Absorption Costing Income and InventoryDocumento4 páginasVariable Costing vs Absorption Costing Income and InventoryNor Hanna DanielAinda não há avaliações

- Chapter 12 - Answer PDFDocumento13 páginasChapter 12 - Answer PDFHarlenAinda não há avaliações

- Chapter 12 AnswerDocumento13 páginasChapter 12 AnswershaneAinda não há avaliações

- Chapters 11 & 12Documento4 páginasChapters 11 & 12Manal ElkhoshkhanyAinda não há avaliações

- Week 3 Caiata-ZuffereyDocumento13 páginasWeek 3 Caiata-ZuffereycoffeedanceAinda não há avaliações

- Week 3 Health Communication - RuttenDocumento4 páginasWeek 3 Health Communication - RuttencoffeedanceAinda não há avaliações

- DSC 2Documento3 páginasDSC 2coffeedanceAinda não há avaliações

- CH 9Documento47 páginasCH 9coffeedanceAinda não há avaliações

- Sample Questions For Mid-Term QuizDocumento1 páginaSample Questions For Mid-Term QuizcoffeedanceAinda não há avaliações

- FIN3102 01 IntroductionDocumento88 páginasFIN3102 01 IntroductioncoffeedanceAinda não há avaliações

- FIN3102 Fall14 Investments SyllabusDocumento5 páginasFIN3102 Fall14 Investments SyllabuscoffeedanceAinda não há avaliações

- CH 02 SampleDocumento7 páginasCH 02 SamplecoffeedanceAinda não há avaliações

- Tutorial 1 QDocumento3 páginasTutorial 1 QcoffeedanceAinda não há avaliações

- Questions For DSCDocumento62 páginasQuestions For DSCcoffeedance0% (1)

- AFM102 2008 MidtermDocumento32 páginasAFM102 2008 MidtermcoffeedanceAinda não há avaliações

- DSC 1Documento7 páginasDSC 1coffeedanceAinda não há avaliações

- NUS Investment Analysis Portfolio Management Practice ProblemsDocumento1 páginaNUS Investment Analysis Portfolio Management Practice ProblemscoffeedanceAinda não há avaliações

- BSP2001 Practice MCQsDocumento3 páginasBSP2001 Practice MCQscoffeedance100% (1)

- Current Liabilities and BondsDocumento35 páginasCurrent Liabilities and BondscoffeedanceAinda não há avaliações

- Fabozzi ETF SolutionsDocumento10 páginasFabozzi ETF SolutionscoffeedanceAinda não há avaliações

- Corporate Finance Workshop 1Documento24 páginasCorporate Finance Workshop 1coffeedanceAinda não há avaliações

- Chapter 1: IntroductionDocumento13 páginasChapter 1: IntroductioncoffeedanceAinda não há avaliações

- BRisk and Return IDocumento37 páginasBRisk and Return IcoffeedanceAinda não há avaliações

- 01 IntroductionDocumento47 páginas01 IntroductioncoffeedanceAinda não há avaliações

- Chapter 15 Questions V1Documento6 páginasChapter 15 Questions V1coffeedanceAinda não há avaliações

- PracticeProblems 1 SolutionsDocumento4 páginasPracticeProblems 1 SolutionscoffeedanceAinda não há avaliações

- Fabozzi Chapter09Documento21 páginasFabozzi Chapter09coffeedanceAinda não há avaliações

- NUS Investment Analysis Portfolio Management Practice ProblemsDocumento1 páginaNUS Investment Analysis Portfolio Management Practice ProblemscoffeedanceAinda não há avaliações

- Fabozzi ETF SolutionsDocumento10 páginasFabozzi ETF SolutionscoffeedanceAinda não há avaliações

- Ross. Westerfield. Jaffe. Jordan Chapter 22 Test PDFDocumento26 páginasRoss. Westerfield. Jaffe. Jordan Chapter 22 Test PDFSitti NajwaAinda não há avaliações

- CH 13 Ans 4 eDocumento33 páginasCH 13 Ans 4 ecoffeedanceAinda não há avaliações

- RWJ CHPT 17Documento23 páginasRWJ CHPT 17coffeedanceAinda não há avaliações

- Ross. Westerfield. Jaffe. Jordan Chapter 22 Test PDFDocumento26 páginasRoss. Westerfield. Jaffe. Jordan Chapter 22 Test PDFSitti NajwaAinda não há avaliações

- Key Concepts of Strategic ManagementDocumento12 páginasKey Concepts of Strategic ManagementY.h. TariqAinda não há avaliações

- Full Projecte EditedDocumento131 páginasFull Projecte Editedshabin_aliAinda não há avaliações

- Angelwood Development Phase II - 2009 VADocumento298 páginasAngelwood Development Phase II - 2009 VADavid LayfieldAinda não há avaliações

- Fabm2 q2 Module 4 TaxationDocumento17 páginasFabm2 q2 Module 4 TaxationLady HaraAinda não há avaliações

- Hermès H1 2014 Sales Up 8%, Net Income Rises 8Documento1 páginaHermès H1 2014 Sales Up 8%, Net Income Rises 8ArcharvindAinda não há avaliações

- Final Exam Fin 2Documento3 páginasFinal Exam Fin 2ma. veronica guisihanAinda não há avaliações

- Statement of Cash Flows: - Indirect Method: Learning Objective 3Documento18 páginasStatement of Cash Flows: - Indirect Method: Learning Objective 3TIFFANNY SHELIAAinda não há avaliações

- TVM-Time Value of Money ConceptsDocumento45 páginasTVM-Time Value of Money ConceptsHisham MohammedAinda não há avaliações

- Balakrishnan 2011Documento67 páginasBalakrishnan 2011novie endi nugrohoAinda não há avaliações

- Investor Digest 23 Oktober 2019Documento10 páginasInvestor Digest 23 Oktober 2019Rising PKN STANAinda não há avaliações

- Magadh University BBM 2ND YEAR QUESTIONSDocumento13 páginasMagadh University BBM 2ND YEAR QUESTIONSSuryansh SinghAinda não há avaliações

- Cambridge International General Certificate of Secondary EducationDocumento12 páginasCambridge International General Certificate of Secondary EducationSamiksha MoreAinda não há avaliações

- Project Financed at Sbi Project Report Mba FinanceDocumento77 páginasProject Financed at Sbi Project Report Mba FinanceBabasab Patil (Karrisatte)Ainda não há avaliações

- Manila Bankers' Life Insurance Corp. vs. CIR, GR Nos. 199729-30 & 199732-33 Dated February 27, 2019 PDFDocumento22 páginasManila Bankers' Life Insurance Corp. vs. CIR, GR Nos. 199729-30 & 199732-33 Dated February 27, 2019 PDFAbbey Agno PerezAinda não há avaliações

- Viability of Class Division While Accessing Tax - An Appraisal Dr. Ram Manohar Lohia National Law UniversityDocumento16 páginasViability of Class Division While Accessing Tax - An Appraisal Dr. Ram Manohar Lohia National Law UniversityHimanshumalikAinda não há avaliações

- Full Download Financial Accounting 17th Edition Williams Test BankDocumento35 páginasFull Download Financial Accounting 17th Edition Williams Test Bankmcalljenaevippro100% (42)

- Chapter 9 Prospective AnalysisDocumento23 páginasChapter 9 Prospective AnalysisPepper CorianderAinda não há avaliações

- Final Income Taxation Lesson 5: Passive Income and Withholding Tax RatesDocumento28 páginasFinal Income Taxation Lesson 5: Passive Income and Withholding Tax Rateslc50% (4)

- Wild Wood Case StudyDocumento6 páginasWild Wood Case Studyaudrey gadayAinda não há avaliações

- New Pond-Tilapia Fish CultureDocumento21 páginasNew Pond-Tilapia Fish Culturesantosh kumarAinda não há avaliações

- 3D HologramDocumento12 páginas3D HologramRiza ArdinaAinda não há avaliações

- Life Insurance An Investment AlternativeDocumento63 páginasLife Insurance An Investment Alternativepriya100% (2)

- Plant Business PlanDocumento9 páginasPlant Business PlanramsekherAinda não há avaliações

- Test Bank With Answers of Accounting Information System by Turner Chapter 12Documento31 páginasTest Bank With Answers of Accounting Information System by Turner Chapter 12Ebook free100% (3)

- Quiz1 QuestionsAnswersDocumento8 páginasQuiz1 QuestionsAnswersMCIPEAinda não há avaliações

- Cost of Goods Old Transport Operating ExpDocumento24 páginasCost of Goods Old Transport Operating Expapi-3705996Ainda não há avaliações

- Ferrari Company Presentation: Strategic AnalysisDocumento25 páginasFerrari Company Presentation: Strategic AnalysisEmanuele BoreanAinda não há avaliações

- Scott CH 8 TRNSLTDocumento36 páginasScott CH 8 TRNSLTTika Tety PratiwiAinda não há avaliações

- Maf 635 Chapter 3Documento39 páginasMaf 635 Chapter 3anisaa_safriAinda não há avaliações

- Wirecard Annual Report Highlights Record GrowthDocumento245 páginasWirecard Annual Report Highlights Record GrowthBlanche RyAinda não há avaliações