Escolar Documentos

Profissional Documentos

Cultura Documentos

RMC54 2014

Enviado por

Sherhan KahalanDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

RMC54 2014

Enviado por

Sherhan KahalanDireitos autorais:

Formatos disponíveis

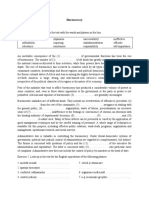

VALUE-ADDED TAX

A. Period of filing the claim - the administrative claim for VAT refund or TCC

must be filed within two years from the close of the taxable quarter when

the zero-rated sales and/or effectively zero-rated sales were made.

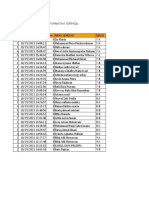

B. Documentation requirement - The application for VAT refund must be

accompanied by complete supporting documents as specifically

enumerated in Annex A of the RMC.

In this case, the taxpayer should attach a sworn statement/affidavit:

(i)

(ii)

(iii)

attesting to the completeness of the submitted documents;

stating that the attached supporting documents are the only

documents which the taxpayer will present to support the claim;

and,

in the case of corporations or other juridical persons, there should

be a sworn statement that the officer signing the affidavit (which

should at the very least be the Chief Finance Officer) has been

authorized by the companys Board of Directors.

C. Processing of claims - Upon submission of the administrative claim and its

supporting documents, the BIR shall process the claim, and no other

documents shall be accepted or required from the taxpayer in the course

of its evaluation. A decision shall be rendered by the Commissioner based

only on the documents submitted by the taxpayer. The application shall

be denied if the taxpayer fails to submit the complete supporting

documents.

D. Periods to decide the claim

1. The Commissioner shall have 120 days from the submission of the

complete supporting documents within which to decide whether or not to

grant the claim. If the claim is not acted upon by the Commissioner within

the 120 days, such inaction shall be deemed a denial of the claim.

2. If the Commissioner denies the claim, whether in full or in part, or if the

Commissioner does not act on the claim within the 120-day period, the

taxpayer should file a judicial claim with the Court of Tax Appeals (CTA):

(i)

(ii)

within 30 days from receipt of the Commissioners decision

denying the claim (whether in full or in part) within the 120-day

period, or

from the expiration of the 120-day period if the Commissioner does

not act within the 120-day period. The taxpayer is required to

observe the 120+30 day rule before lodging a petition for review

with the CTA.

E. Jurisdiction - In cases where the taxpayer has filed for a Petition for

Review with the CTA, the Commissioner loses jurisdiction over the

administrative claim. However, the processing office of the administrative

agency shall still evaluate internally the administrative claim for purposes

of intelligently opposing the taxpayers judicial claim.

F. Controversial issue raised by the RMC:

Failure to file a judicial claim with the CTA within 30 days from the expiration of

the 120-day period renders the Commissioners decision or inaction deemed a

denial, final and unappealable. This applies to all currently pending

administrative claims for refund or tax credit.

Você também pode gostar

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeNo Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeNota: 1 de 5 estrelas1/5 (1)

- RMC No 54-2014Documento3 páginasRMC No 54-2014lktlawAinda não há avaliações

- G.R. No. 207112 Case DigestDocumento3 páginasG.R. No. 207112 Case DigestAlvin Earl NuydaAinda não há avaliações

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNo EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersAinda não há avaliações

- REMEDIES OF THE TAXPAYER and GOVERNMENTDocumento7 páginasREMEDIES OF THE TAXPAYER and GOVERNMENTChrisMartinAinda não há avaliações

- 2020 Reme TPDocumento24 páginas2020 Reme TPManuel VillanuevaAinda não há avaliações

- Concept of Assessment Requisites For A Valid Assessment: 10 Years After DiscoveryDocumento5 páginasConcept of Assessment Requisites For A Valid Assessment: 10 Years After DiscoveryJD BarcellanoAinda não há avaliações

- GROUP 1 Tax RemediesDocumento6 páginasGROUP 1 Tax RemediesEunice Kalaw VargasAinda não há avaliações

- Remedies of The TaxpayerDocumento4 páginasRemedies of The TaxpayerHaze Q.Ainda não há avaliações

- UNIT II Tax RemediesDocumento17 páginasUNIT II Tax RemediesAl BertAinda não há avaliações

- 106 Pilipinas Total Gas Vs CIRDocumento3 páginas106 Pilipinas Total Gas Vs CIRPia100% (1)

- Tax Law 1 DG3 NOTES Part 2Documento28 páginasTax Law 1 DG3 NOTES Part 2Fayie De LunaAinda não há avaliações

- Tax2 Finals REMDocumento16 páginasTax2 Finals REMAlexandra Castro-SamsonAinda não há avaliações

- A. Assessment B. Collection: Remedies of The GovernmentDocumento10 páginasA. Assessment B. Collection: Remedies of The GovernmentGianna CantoriaAinda não há avaliações

- Tax Remedies and IncrementsDocumento16 páginasTax Remedies and Incrementscobe.johnmark.cecilioAinda não há avaliações

- Commissioner of Internal Revenue, Petitioner vs. Univation Motor Philippines, Inc. (Formerly NISSAN MOTOR PHILIPPINES, INC.), RespondentDocumento93 páginasCommissioner of Internal Revenue, Petitioner vs. Univation Motor Philippines, Inc. (Formerly NISSAN MOTOR PHILIPPINES, INC.), RespondentJv FerminAinda não há avaliações

- Zuellig Pharma v. CIRDocumento5 páginasZuellig Pharma v. CIRPaul Joshua SubaAinda não há avaliações

- Bureau of Internal Revenue: Deficiency Tax AssessmentDocumento9 páginasBureau of Internal Revenue: Deficiency Tax AssessmentXavier Cajimat UrbanAinda não há avaliações

- Bureau of Internal RevenueDocumento13 páginasBureau of Internal Revenuenathalie velasquezAinda não há avaliações

- HEDCOR, INC vs. CIRDocumento3 páginasHEDCOR, INC vs. CIRgel nicdaoAinda não há avaliações

- CIR v. Dash Engg PH Inc (DEPI) : FactsDocumento3 páginasCIR v. Dash Engg PH Inc (DEPI) : FactsTeodoro Jose BrunoAinda não há avaliações

- Petitioner Vs Vs Respondent: First DivisionDocumento13 páginasPetitioner Vs Vs Respondent: First DivisionRalph H. VillanuevaAinda não há avaliações

- 9 12 SAT (Afternoon)Documento8 páginas9 12 SAT (Afternoon)Daryl Noel TejanoAinda não há avaliações

- Exercise RemediesDocumento9 páginasExercise RemediesJazzd Sy GregorioAinda não há avaliações

- CBK V CIR GR198729-30Documento2 páginasCBK V CIR GR198729-30Espie TorresAinda não há avaliações

- Ce Casecnan Vs CirDocumento3 páginasCe Casecnan Vs CirJulioAinda não há avaliações

- 36 - PILIPINAS TOTAL GAS vs. CIRDocumento2 páginas36 - PILIPINAS TOTAL GAS vs. CIRLEIGH TARITZ GANANCIALAinda não há avaliações

- Digest - Team Energy Corporation V CirDocumento2 páginasDigest - Team Energy Corporation V CirArthur SyAinda não há avaliações

- Cir Vs Mirant Pagbilao CorporationDocumento2 páginasCir Vs Mirant Pagbilao CorporationPeanutButter 'n Jelly100% (1)

- Team Energy Corporation V CIR - DigestDocumento1 páginaTeam Energy Corporation V CIR - DigestKate GaroAinda não há avaliações

- 3.1.2 Exceptions To Prior Notice of The Assessment. - Pursuant To Section 228 of The Tax CodeDocumento4 páginas3.1.2 Exceptions To Prior Notice of The Assessment. - Pursuant To Section 228 of The Tax CodeLab Lee0% (1)

- Pilipinas Total Gas v. CIRDocumento4 páginasPilipinas Total Gas v. CIRDanJalbunaAinda não há avaliações

- TAX - Meting 1 To 4 (01-23 To TR Part 1)Documento56 páginasTAX - Meting 1 To 4 (01-23 To TR Part 1)Karen Daryl BritoAinda não há avaliações

- Tax RemediesDocumento51 páginasTax RemediesBianca IyiyiAinda não há avaliações

- Taxrev CasesDocumento455 páginasTaxrev CasesJeffrey L. OntangcoAinda não há avaliações

- CIR v. TEAM SUALDocumento3 páginasCIR v. TEAM SUALDawn Bernabe100% (1)

- Case Digest - Visayas Geothermal v. CIRDocumento1 páginaCase Digest - Visayas Geothermal v. CIRAj DalidaAinda não há avaliações

- Team Sual Corp. v. CIR G.R. No. 201225 April 18, 2018Documento6 páginasTeam Sual Corp. v. CIR G.R. No. 201225 April 18, 2018William SantosAinda não há avaliações

- Tax RemediesDocumento6 páginasTax RemediesPATRICIA ANGELICA VINUYAAinda não há avaliações

- Tax 01-Lesson 02 - Tax RemediesDocumento42 páginasTax 01-Lesson 02 - Tax RemediesShannise Dayne Chua0% (1)

- Ursabia TaxDocumento3 páginasUrsabia TaxHarry PeterAinda não há avaliações

- Tax Remedies Under The NIRCDocumento7 páginasTax Remedies Under The NIRCmaeprincess100% (1)

- 17) SAN ROQUE Vs CIR - J. MartiresDocumento7 páginas17) SAN ROQUE Vs CIR - J. MartiresjdonAinda não há avaliações

- Rmo 26-2016Documento4 páginasRmo 26-2016Raniel MirandaAinda não há avaliações

- Tax RemediesDocumento6 páginasTax RemediesArielle CabritoAinda não há avaliações

- Pilipinas Total Gas v. CIRDocumento2 páginasPilipinas Total Gas v. CIRTrem GallenteAinda não há avaliações

- Topic: Tax Refunds Commissioner of Internal Revenue V. Univation Motor Philippines, Inc. (Formerly Nissan Motor Philippines)Documento2 páginasTopic: Tax Refunds Commissioner of Internal Revenue V. Univation Motor Philippines, Inc. (Formerly Nissan Motor Philippines)Joshua Erik MadriaAinda não há avaliações

- CIR Vs Team Energy CorporationDocumento5 páginasCIR Vs Team Energy CorporationDNAAAinda não há avaliações

- Al. CIR V ToledoDocumento4 páginasAl. CIR V ToledoJas100% (1)

- Tax Remedies NotesDocumento8 páginasTax Remedies NotesLaurene Ashley Sore-YokeAinda não há avaliações

- Appeal Tax Procedure (Malaysia)Documento2 páginasAppeal Tax Procedure (Malaysia)Zati TyAinda não há avaliações

- Silicon vs. CirDocumento2 páginasSilicon vs. CirAnalou Agustin VillezaAinda não há avaliações

- CIR v. Univation Motor Philippines, Inc. G.R. No. 231581, April 10, 2019 FactsDocumento4 páginasCIR v. Univation Motor Philippines, Inc. G.R. No. 231581, April 10, 2019 FactsIsabel Claire OcaAinda não há avaliações

- Tax Remedies of The Taxpayer PDFDocumento4 páginasTax Remedies of The Taxpayer PDFJester LimAinda não há avaliações

- CIR v. Univation, GR 231581, 10 Apr 2019Documento4 páginasCIR v. Univation, GR 231581, 10 Apr 2019Dan Millado100% (2)

- Tax 2 (Remedies & CTA Jurisdiction)Documento13 páginasTax 2 (Remedies & CTA Jurisdiction)Monice RiveraAinda não há avaliações

- CIR V Univation MotorDocumento3 páginasCIR V Univation MotoriptrinidadAinda não há avaliações

- Taxation: CIR Vs Achi Forging CompanyDocumento2 páginasTaxation: CIR Vs Achi Forging CompanygailacdAinda não há avaliações

- AJJJJJJJJJJJJJJJDocumento2 páginasAJJJJJJJJJJJJJJJanthony paduaAinda não há avaliações

- Remedies On COA DisallowanceDocumento20 páginasRemedies On COA DisallowanceIan dela Cruz Encarnacion100% (2)

- COA Decision 2013-153Documento9 páginasCOA Decision 2013-153Sherhan KahalanAinda não há avaliações

- Tolentino vs. LaurelDocumento14 páginasTolentino vs. LaurelSherhan KahalanAinda não há avaliações

- C89 300Documento2 páginasC89 300Sherhan KahalanAinda não há avaliações

- Startup Trainee Agreement SampleDocumento6 páginasStartup Trainee Agreement SamplekarenAinda não há avaliações

- Affidavit of Loss For UncleDocumento1 páginaAffidavit of Loss For UncleSherhan KahalanAinda não há avaliações

- COA Decision 2013-153Documento9 páginasCOA Decision 2013-153Sherhan KahalanAinda não há avaliações

- Five Tips To Lower Blood Pressure in 7 Days 2017Documento22 páginasFive Tips To Lower Blood Pressure in 7 Days 2017Sherhan KahalanAinda não há avaliações

- Startup Trainee Agreement SampleDocumento6 páginasStartup Trainee Agreement SamplekarenAinda não há avaliações

- Certificate of GuardianshipDocumento1 páginaCertificate of GuardianshipSherhan KahalanAinda não há avaliações

- X For Documents Not Submitted and NA For Documents Not ApplicableDocumento1 páginaX For Documents Not Submitted and NA For Documents Not ApplicableGedan TanAinda não há avaliações

- Guidelines To Be Observed in Pre-Trial A.M. NO. 03-1-09-SC PDFDocumento20 páginasGuidelines To Be Observed in Pre-Trial A.M. NO. 03-1-09-SC PDFAziel Marie C. GuzmanAinda não há avaliações

- Dole Roxi Spes FormsDocumento9 páginasDole Roxi Spes FormsSherhan KahalanAinda não há avaliações

- Rmo 31-2009Documento0 páginaRmo 31-2009Peggy SalazarAinda não há avaliações

- WitnessingDocumento1 páginaWitnessingSherhan KahalanAinda não há avaliações

- Serconcillo V FidelDocumento14 páginasSerconcillo V FidelSherhan KahalanAinda não há avaliações

- Five Tips To Lower Blood Pressure in 7 Days 2017Documento22 páginasFive Tips To Lower Blood Pressure in 7 Days 2017Sherhan KahalanAinda não há avaliações

- Five Tips To Lower Blood Pressure in 7 Days 2017Documento22 páginasFive Tips To Lower Blood Pressure in 7 Days 2017Sherhan KahalanAinda não há avaliações

- Office MemoDocumento2 páginasOffice MemoSherhan KahalanAinda não há avaliações

- X For Documents Not Submitted and NA For Documents Not ApplicableDocumento1 páginaX For Documents Not Submitted and NA For Documents Not ApplicableGedan TanAinda não há avaliações

- November 9 LetterDocumento1 páginaNovember 9 LetterSherhan KahalanAinda não há avaliações

- RMC No 37-2016Documento6 páginasRMC No 37-2016sandra100% (1)

- Contract of Lease FormatDocumento4 páginasContract of Lease FormatSherhan KahalanAinda não há avaliações

- Champion.: VI. Installing The PMS-OPESDocumento3 páginasChampion.: VI. Installing The PMS-OPESSherhan KahalanAinda não há avaliações

- Solid Builders V ChinaDocumento28 páginasSolid Builders V ChinaSherhan KahalanAinda não há avaliações

- GovernmentDocumento1 páginaGovernmentSherhan KahalanAinda não há avaliações

- Jeddah Resolution For Muslim Minorities June 18 19 2014Documento16 páginasJeddah Resolution For Muslim Minorities June 18 19 2014Sherhan KahalanAinda não há avaliações

- Huwa Allah KuficDocumento1 páginaHuwa Allah KuficSherhan KahalanAinda não há avaliações

- Why The CCM Won't Lose: The Roots of Single Party Dominance in TanzaniaDocumento21 páginasWhy The CCM Won't Lose: The Roots of Single Party Dominance in Tanzaniaapi-164583005Ainda não há avaliações

- Railway Express Agency, Inc. v. New York, 336 U.S. 106 (1949)Documento8 páginasRailway Express Agency, Inc. v. New York, 336 U.S. 106 (1949)Scribd Government DocsAinda não há avaliações

- Istoric Cont: Criterii de CautareDocumento4 páginasIstoric Cont: Criterii de CautareRyō Sumy0% (1)

- UK Defence Academy Higher Command Hcsc11-Reading-list-2011Documento2 páginasUK Defence Academy Higher Command Hcsc11-Reading-list-2011Spin WatchAinda não há avaliações

- MAMUN Research GuideDocumento6 páginasMAMUN Research GuideSami BenjellounAinda não há avaliações

- ENGLEZA - Bureaucracy and MaladministrationDocumento3 páginasENGLEZA - Bureaucracy and MaladministrationCristian VoicuAinda não há avaliações

- TUGAS PRAMUKA DARING - 29 OKT 2021 (Responses)Documento13 páginasTUGAS PRAMUKA DARING - 29 OKT 2021 (Responses)EditriAinda não há avaliações

- PAYNE, Stanley G. Fascism. Comparison and DefinitionDocumento243 páginasPAYNE, Stanley G. Fascism. Comparison and DefinitionClara Lima100% (1)

- Bill of Rights 1688 (1689)Documento3 páginasBill of Rights 1688 (1689)Anderson CandeiaAinda não há avaliações

- The Loeb Classical Library. Aristotle. Politics. 1932 (Reprint 1959)Documento728 páginasThe Loeb Classical Library. Aristotle. Politics. 1932 (Reprint 1959)MJohn JSmith100% (1)

- DigestsDocumento4 páginasDigestsReghz De Guzman PamatianAinda não há avaliações

- Congressional Debates of The 14th AmendmentDocumento401 páginasCongressional Debates of The 14th AmendmentJoe Reeser100% (9)

- ItalyDocumento3 páginasItalyasdfseAinda não há avaliações

- Test D'entree en Section Internationale Americaine 2018Documento3 páginasTest D'entree en Section Internationale Americaine 2018Secondary CompteAinda não há avaliações

- Tourism Statistics: Kingdom of CambodiaDocumento8 páginasTourism Statistics: Kingdom of CambodiaAubrey LabardaAinda não há avaliações

- Why I Killed The Mahatma Under - Elst DR Koenraad PDFDocumento251 páginasWhy I Killed The Mahatma Under - Elst DR Koenraad PDFdarshanAinda não há avaliações

- MC CarthyDocumento1 páginaMC Carthyarghya_bi108Ainda não há avaliações

- 2nd WeyaneDocumento3 páginas2nd WeyaneTeweldebrhan Kifle100% (2)

- Report of Visit To The NGODocumento4 páginasReport of Visit To The NGOVaibhav RajAinda não há avaliações

- Theme 5 Past Paper Questions Adjustments To EmancipationDocumento5 páginasTheme 5 Past Paper Questions Adjustments To Emancipationantaniesh hewitt100% (1)

- India Will Not Become A Great Power byDocumento13 páginasIndia Will Not Become A Great Power bymanchorusAinda não há avaliações

- Water Project Final DocumentDocumento19 páginasWater Project Final DocumentssweaverAinda não há avaliações

- Chapter 13: Rizal'S Visit To The United StatesDocumento9 páginasChapter 13: Rizal'S Visit To The United StatesJOMARI DL. GAVINOAinda não há avaliações

- ICC Moot Court Competition (International Rounds: Finalists) : Defence MemorialDocumento44 páginasICC Moot Court Competition (International Rounds: Finalists) : Defence MemorialAmol Mehta100% (9)

- Xeridt2n cbn9637661Documento7 páginasXeridt2n cbn9637661Naila AshrafAinda não há avaliações

- Civil Rights Performance TaskDocumento5 páginasCivil Rights Performance Taskapi-295086698Ainda não há avaliações

- Lee Vs Ilagan Case DigestDocumento1 páginaLee Vs Ilagan Case DigestNico RavilasAinda não há avaliações

- Kas - 35056 1522 2 30Documento170 páginasKas - 35056 1522 2 30jonas msigalaAinda não há avaliações

- Static GK MaharashtraDocumento5 páginasStatic GK MaharashtravivekekekAinda não há avaliações

- Case Brief (Mesaros V US Mint)Documento3 páginasCase Brief (Mesaros V US Mint)bf8th4ulAinda não há avaliações

- Prisoners of Geography: Ten Maps That Explain Everything About the WorldNo EverandPrisoners of Geography: Ten Maps That Explain Everything About the WorldNota: 4.5 de 5 estrelas4.5/5 (1145)

- Jesus and the Powers: Christian Political Witness in an Age of Totalitarian Terror and Dysfunctional DemocraciesNo EverandJesus and the Powers: Christian Political Witness in an Age of Totalitarian Terror and Dysfunctional DemocraciesNota: 5 de 5 estrelas5/5 (6)

- Son of Hamas: A Gripping Account of Terror, Betrayal, Political Intrigue, and Unthinkable ChoicesNo EverandSon of Hamas: A Gripping Account of Terror, Betrayal, Political Intrigue, and Unthinkable ChoicesNota: 4.5 de 5 estrelas4.5/5 (498)

- An Unfinished Love Story: A Personal History of the 1960sNo EverandAn Unfinished Love Story: A Personal History of the 1960sNota: 5 de 5 estrelas5/5 (2)

- Age of Revolutions: Progress and Backlash from 1600 to the PresentNo EverandAge of Revolutions: Progress and Backlash from 1600 to the PresentNota: 4.5 de 5 estrelas4.5/5 (6)

- Broken Money: Why Our Financial System Is Failing Us and How We Can Make It BetterNo EverandBroken Money: Why Our Financial System Is Failing Us and How We Can Make It BetterNota: 5 de 5 estrelas5/5 (3)

- Pagan America: The Decline of Christianity and the Dark Age to ComeNo EverandPagan America: The Decline of Christianity and the Dark Age to ComeAinda não há avaliações

- How States Think: The Rationality of Foreign PolicyNo EverandHow States Think: The Rationality of Foreign PolicyNota: 5 de 5 estrelas5/5 (7)

- The Return of George Washington: Uniting the States, 1783–1789No EverandThe Return of George Washington: Uniting the States, 1783–1789Nota: 4 de 5 estrelas4/5 (22)

- The Exvangelicals: Loving, Living, and Leaving the White Evangelical ChurchNo EverandThe Exvangelicals: Loving, Living, and Leaving the White Evangelical ChurchNota: 4.5 de 5 estrelas4.5/5 (13)

- Ten Years to Save the West: Lessons from the only conservative in the roomNo EverandTen Years to Save the West: Lessons from the only conservative in the roomAinda não há avaliações

- Darkest Hour: How Churchill Brought England Back from the BrinkNo EverandDarkest Hour: How Churchill Brought England Back from the BrinkNota: 4 de 5 estrelas4/5 (31)

- The Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpNo EverandThe Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpNota: 4.5 de 5 estrelas4.5/5 (11)

- Bind, Torture, Kill: The Inside Story of BTK, the Serial Killer Next DoorNo EverandBind, Torture, Kill: The Inside Story of BTK, the Serial Killer Next DoorNota: 3.5 de 5 estrelas3.5/5 (77)

- The Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteNo EverandThe Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteNota: 4.5 de 5 estrelas4.5/5 (16)

- The Wars of the Roosevelts: The Ruthless Rise of America's Greatest Political FamilyNo EverandThe Wars of the Roosevelts: The Ruthless Rise of America's Greatest Political FamilyNota: 4 de 5 estrelas4/5 (14)

- Compromised: Counterintelligence and the Threat of Donald J. TrumpNo EverandCompromised: Counterintelligence and the Threat of Donald J. TrumpNota: 4 de 5 estrelas4/5 (18)

- The Conservative Heart: How to Build a Fairer, Happier, and More Prosperous AmericaNo EverandThe Conservative Heart: How to Build a Fairer, Happier, and More Prosperous AmericaNota: 3.5 de 5 estrelas3.5/5 (9)