Escolar Documentos

Profissional Documentos

Cultura Documentos

PTU Trend Jumper Rules

Enviado por

paulnidDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

PTU Trend Jumper Rules

Enviado por

paulnidDireitos autorais:

Formatos disponíveis

Premier Trader University

Trend Jumper

Premier Trader University

Basic Premise

The Trend Jumper seeks to find near term support and

resistance levels and then identifies places on the

chart to JUMP off of, for quick and immediate

profits.

Premier Trader University

Long trades are like jumping off of a

trampoline

Premier Trader University

Long trades are like jumping off of a trampoline

Premier Trader University

Short trades are like jumping out of an airplane

Premier Trader University

It is a pure price action strategy

Premier Trader University

The indicators are designed to show us

where the near term support and

resistance levels are and to give us

lines to jump off of

Trade Psychology

Indicators

1. Two EMAs; 50 and 200

2. Two PTU Jumplines; 9 and 4

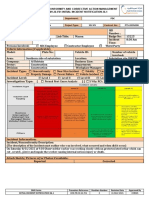

3. PTU_TrendJumper Calculator

Premier Trader University

Long trades are like jumping off of a trampoline

Premier Trader University

Short trades are like jumping out of an airplane

10

Premier Trader University

Dynamic Setups

Trades are based on the length of the setup bar itself,

making it dynamic and self adjusting.

11

Premier Trader University

Jumpline Crossover Trade

1.

2.

3.

4.

5.

6.

Fast Jumpline (JL) crosses over the slow Jumpline from below to above,

for long trades

Fast Jumpline crosses over the slow Jumpline from above to below, for

short trades

Can not take these trades against the direction of the 50 ema

Can adjust around the ema to get through it, even if it is against the

direction

Trade is cancelled if the fast JL moves back to the other side of the slow

JL prior to triggering in, or, if a bar closes below the slow JL

Setup is the FIRST green bar for longs or red bar for shorts that occurs AT

or AFTER the crossover

12

Premier Trader University

Jumpline Crossover Examples

13

Premier Trader University

JUMP Trade

1.

2.

3.

4.

5.

6.

7.

8.

Island Bar(s) needed

Proximity Bar needed (pullback bar)

First Green Bar is the long setup bar

First Red Bar is the short setup bar

Dojis are ok to use a setup bars

Fast JL must be above the slow JL for longs

Fast JL must be below the slow JL for shorts

Trades are cancelled if the Fast JL moves to the other side of the slow JL,

or, if a bar closes on the other side of the slow JL prior to triggering in

14

Premier Trader University

JUMP Trade Definitions

1.

2.

3.

4.

Island Bar: A bar that is above the line you are jumping off of for longs

(or below for shorts) that is NOT touching that line. It must be a certain

distance, the default being 2 ticks in most cases.

Proximity Bar: AFTER an island bar, this bar must pullback to the line we

are jumping off of, typically by 2 ticks or less.

Setup Bar: The FIRST Green (or red, for shorts) bar that closes after the

proximity bar has been established. It could be the SAME bar AS the

proximity bar.

JL Confirmation: The fast JL4 must be above JL9 for longs and below for

shorts. It can be ON or equal to the JL9 in some cases.

15

Premier Trader University

JUMP Trade Setup ReCap

1.

2.

3.

4.

5.

6.

7.

Island Bar(s) needed

Proximity Bar needed

JL Confirmation needed

Can occur off of the JL9, or either of the EMAs (50 or 200)

Trade is cancelled when the bar closes on the opposite side of the line

that is being jumped off of, or, JL confirmation goes away.

First green bar or doji is the long trade setup when all conditions are met

First red bar or doji is the short setup when all conditions are met

16

Premier Trader University

Island & Proximity Bars

17

Premier Trader University

All TrendJumper Trade Setups Behave

the Same Way

1.

2.

3.

4.

5.

6.

Entry is a breakout beyond the setup bar, typically 2 ticks, depending on

the market.

Stops are typically 1 tick on the other side of the setup bar

Key level adjustments are very important to make both on the entries

and stops

The length of the bar is the x factor and dictates the size of the trade.

Targets are 1x, 1.5x and 2x from the high or low of the setup bar

Risk Reward ratios are typically 1 to 1.4 or 1 to 1.9 in most cases,

depending on what target we are going for

18

Premier Trader University

Other Aspects

Setups are color coded; Blue for Crossovers; White for Jumps off of the JL9, Yellow for

Jumps off of the 50 ema, Magenta for Jumps off of the 200 ema

Setup types can share the same setup bar but the trade profile itself is always the

same no matter what.

There is a small trade rule

There is a long setup bar rule

Breakout and stop levels can and should be adjusted for different markets

TJ can be traded as a single or multi position approach

Setups happen while in a current trade

You have the option to add to your position, or not

Trailing positions should use the Jumpline Indicators to trail, typically 2 ticks below the

last bar that closed above the JL for longs or below for shorts

We typically want to lock in a tick of profit once the trade has progressed to a certain

point, typically the 1st or 2nd target

19

Premier Trader University

Small Trade Rule

I typically like to exit my fixed position at the 2nd target, 1.5x, unless the setup is too

small. Then I will exit at the 3rd target, or 2x.

The small trade rule is dependant upon what market and timeframe chart one is

trading

Some setups are just too small to trade, depending on the market and timeframe

Crude Oil Futures 377 tick chart example: I like the 1.5x to be 15 ticks or greater. If it

is less than 15 ticks, I will exit my fixed position at the 2x, (3rd target)

20

Premier Trader University

Long Bar Rule

Some setup bars are larger than most of the bars that appear on the chart, making the

targets harder to achieve.

I like to exit at the first target in these cases

If the Small Target Rule is 15 ticks, as is the case with the Crude Oil 377 tick chart, then

if the first target is 15 ticks or greater, due to a long setup bar, I will exit at the first

target.

21

Premier Trader University

Trade Management Rules

Lock in 1 tick at the first target, unless the trade is a Small Trade and were going for

the 3rd target.

If going for the 3rd target, then lock in 1 tick at the 2nd target

Trade must also travel a minimum amount. In the case of CL 377, for example, it must

go at least 10 ticks to qualify for locking in 1 tick

If the setup is too small to lock in a tick of profit, then dont move the stop and just let

it play out as is.

You can use one of the JLs to cut risk or lock in additional profit as the trade

progresses

22

Premier Trader University

Trailing and Adding to your Position

A 2nd position can be trailed. Use one of the JLs to trail.

For swing trading, you can scale out at different target levels and trail the remainder

You can add another position while still in a trade. Manage it independent of the

original position. I recommend being tighter with your trade management to protect

the original trade

Always make sure you are adequately capitalized to trade multiple positions and that

you have a complete mastery of the strategy

23

Premier Trader University

Nuances

EMA convergence; you will find that trades that setup inside the space of where the

50 ema is converging with the 200 ema, that the odds will be somewhat lower.

Setups that occur after a big move, and in the same direction, have a lower chance of

success

Sometimes the proximity bar doesnt actually pull back, but the Jumpline gets closer

to the bar. This is ok.

The first island bar can not be a proximity bar. You need a proximity bar AFTER the

first island bar occurs.

The proximity can be and often IS the setup bar

EMA Jump trades DO require that the JL4 be below the JL9 for shorts and above it for

longs to confirm the setup. It doesnt matter what side of the JL9 the bar closes on

however. The close of the bars correspond to the LINE that is being jumped off of.

24

Premier Trader University

Trade Sensibly

TrendJumper should be able to give you enough good trades to quit positive on most

sessions and most charts and markets

Always take a good long look at your charts prior to trading live. You should be able to

determine the best times to trade and IF the chart and timeframe give enough good

trades on a consistent basis.

If trading stocks with daily charts, make sure to place your trades after the market has

opened to avoid getting bad fills due to gaps

Practice, practice, practice; you should be able to execute your trades perfectly and

without hesitation or doubts.

25

Você também pode gostar

- Belong To Melbourne's New West: Find Your Home at Mt. AtkinsonDocumento5 páginasBelong To Melbourne's New West: Find Your Home at Mt. AtkinsonpaulnidAinda não há avaliações

- Wet Area Construction Application Guide June 2016 PDFDocumento20 páginasWet Area Construction Application Guide June 2016 PDFmichael_percy1179Ainda não há avaliações

- Ger 3793Documento38 páginasGer 3793scribadocumentAinda não há avaliações

- Cable Sheath Bonding Application Guide Companion PDFDocumento45 páginasCable Sheath Bonding Application Guide Companion PDFskylimit.skylimitAinda não há avaliações

- Absolute Backdoor RevisitedDocumento21 páginasAbsolute Backdoor RevisitedpaulnidAinda não há avaliações

- 11 Distance ProtectionDocumento22 páginas11 Distance ProtectionSristick100% (1)

- Shower Tile - Over Tray Installation Guide Wet Area Solutions (Aust) Pty LTDDocumento4 páginasShower Tile - Over Tray Installation Guide Wet Area Solutions (Aust) Pty LTDpaulnidAinda não há avaliações

- FaultDocumento706 páginasFaultpaulnidAinda não há avaliações

- Adaptive SystemsDocumento130 páginasAdaptive SystemspaulnidAinda não há avaliações

- 3 Phase SystemsDocumento30 páginas3 Phase SystemspaulnidAinda não há avaliações

- 3 Phase SystemsDocumento30 páginas3 Phase SystemspaulnidAinda não há avaliações

- Chapter 14Documento4 páginasChapter 14jorroAinda não há avaliações

- L90 Instruction ManualDocumento870 páginasL90 Instruction ManualpaulnidAinda não há avaliações

- Line Drop CompensationDocumento4 páginasLine Drop Compensationchaman_pundirAinda não há avaliações

- Automatic Relay SettingDocumento37 páginasAutomatic Relay SettingpaulnidAinda não há avaliações

- QUT Digital Repository:: Perera, Lasantha BDocumento7 páginasQUT Digital Repository:: Perera, Lasantha BpaulnidAinda não há avaliações

- PM7500 7600 Installation GuideDocumento28 páginasPM7500 7600 Installation GuidepaulnidAinda não há avaliações

- Calculation of Short-Circuit CurrentsDocumento35 páginasCalculation of Short-Circuit CurrentsdaodoquangAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Evaluasi Pengolahan Dan Mutu Bahan Olah Karet Rakyat (Bokar) Di Tingkat Petani Karet Di Sumatera SelatanDocumento10 páginasEvaluasi Pengolahan Dan Mutu Bahan Olah Karet Rakyat (Bokar) Di Tingkat Petani Karet Di Sumatera SelatanFerly OktriyediAinda não há avaliações

- Special Contract Assignment PDFDocumento11 páginasSpecial Contract Assignment PDFsankalp bhardwajAinda não há avaliações

- IFRS 17 Insurance Contracts - SummaryDocumento8 páginasIFRS 17 Insurance Contracts - SummaryEltonAinda não há avaliações

- MwigaDocumento89 páginasMwigamichael richardAinda não há avaliações

- Analisis Keberlanjutan Aksesibilitas Angkutan Umum Di Kota SukabumiDocumento19 páginasAnalisis Keberlanjutan Aksesibilitas Angkutan Umum Di Kota Sukabumisahidan thoybahAinda não há avaliações

- Chapter 4 PDFDocumento10 páginasChapter 4 PDFMinh TúAinda não há avaliações

- Activist Spotlight - Abhilasha - A - SinghDocumento14 páginasActivist Spotlight - Abhilasha - A - SinghSikh Parent LeaderAinda não há avaliações

- Stores and Inventory ManagementDocumento19 páginasStores and Inventory Managementjagdeep_naidu92% (50)

- Project ReportDocumento6 páginasProject ReportMayank SinhaAinda não há avaliações

- HRM TataDocumento46 páginasHRM TataAsifshaikh7566Ainda não há avaliações

- 8 PA116 RA7160 LGU Officials in GeneralDocumento69 páginas8 PA116 RA7160 LGU Officials in GeneralJewel AnggoyAinda não há avaliações

- 403 OBLICON Review Case Digests Part 2Documento67 páginas403 OBLICON Review Case Digests Part 2Harold CasalemAinda não há avaliações

- Current Affairs August 2 2023 PDF by AffairsCloud New 1Documento26 páginasCurrent Affairs August 2 2023 PDF by AffairsCloud New 1Rishabh KumarAinda não há avaliações

- Exercises in MerchandisingDocumento10 páginasExercises in MerchandisingJhon Robert BelandoAinda não há avaliações

- Treasury Challan No: 0200025706 Treasury Challan No: 0200025706 Treasury Challan No: 0200025706Documento1 páginaTreasury Challan No: 0200025706 Treasury Challan No: 0200025706 Treasury Challan No: 0200025706Mallikarjuna SarmaAinda não há avaliações

- Survey Questionnaire 2Documento4 páginasSurvey Questionnaire 2Pradeep BalasubramaniamAinda não há avaliações

- Gold Volatility Prediction Using A CNN-LSTM ApproaDocumento9 páginasGold Volatility Prediction Using A CNN-LSTM ApproasdaffeAinda não há avaliações

- Chapter 1. Introduction To Consumer BehaviourDocumento8 páginasChapter 1. Introduction To Consumer BehaviourjentitularAinda não há avaliações

- Human Resource Management: Internal Employee RelationsDocumento46 páginasHuman Resource Management: Internal Employee RelationsAsyima AmidAinda não há avaliações

- Lecture 1 TextDocumento9 páginasLecture 1 TextStepan RychkovAinda não há avaliações

- The Impact of Sustainability Reporting Quality On The Value Relevance of Corporate Sustainability PerformanceDocumento21 páginasThe Impact of Sustainability Reporting Quality On The Value Relevance of Corporate Sustainability PerformanceFarwa KhalidAinda não há avaliações

- MAS Answer KeyDocumento18 páginasMAS Answer KeyMitch Regencia100% (1)

- Assignment 2Documento12 páginasAssignment 2Waqar Ali MustafaiAinda não há avaliações

- Introduction To Everyday MathDocumento36 páginasIntroduction To Everyday MathKamran AliAinda não há avaliações

- Report On DARAZ Bangladesh Prepared ForDocumento31 páginasReport On DARAZ Bangladesh Prepared ForFarhanur RahmanAinda não há avaliações

- A1 ISMS Manual - v1Documento13 páginasA1 ISMS Manual - v1Rharif AnassAinda não há avaliações

- Ohs-Pr-09-26-F01 Initial Incident Notification 26.1 (2022)Documento2 páginasOhs-Pr-09-26-F01 Initial Incident Notification 26.1 (2022)Shafie ZubierAinda não há avaliações

- Libro InglésDocumento67 páginasLibro InglésAmanda Laynez Bermúdez100% (1)

- Simple Ordinary AnnuityDocumento10 páginasSimple Ordinary AnnuityOje Gitanes NalabagsAinda não há avaliações

- Tesla Case SolutionDocumento2 páginasTesla Case SolutionMarutiAinda não há avaliações