Escolar Documentos

Profissional Documentos

Cultura Documentos

Foreclosure Report.4.23.13 PDF

Enviado por

RecordTrac - City of OaklandTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Foreclosure Report.4.23.13 PDF

Enviado por

RecordTrac - City of OaklandDireitos autorais:

Formatos disponíveis

2013 APR n AM 9:50

CITY OF OAKLAND

FROM:

T O : D E A N N A J. S A N T A N A

CITY A D M I N I S T R A T O R

S U B J E C T : Quarterly Report on Foreclosure Issues

City Administrator

Approval

\/9/i,

W k

AGENDA REPORT

DATE:

Fred Blackwell

Assistant City Administrator

March 29, 2013

Date

A

N ^

COUNCIL DISTRICT: City-wide

RECOMMENDATION

Staff recommends that the Committee accepts this quarterly informational report;

Quarterly Tracking Report on Housing Foreclosure and Outcome Data

from Related City Programs.

BACKGROUND

This report responds to the standing request of the Community and Economic Development

Committee for a quarterly report tracking housing foreclosure data and outcomes from City of

Oakland programs designed to help address problems caused by foreclosures.

ANALYSIS

I.

RESIDENTIAL FORECLOSURE D A T A & TRENDS

National information on foreclosure issues shows the following trends in many urban

communities:

1. Significant decrease in foreclosure activities.'

2. Increase in short sales.^

3. Increase in investors purchasing foreclosed properties.^

' RealtyTrac, U.S. Foreclosure Starts Fall to Six-Year Low in January, 2/14/13. www.reallvtrac.com.

^ New York Times, Despite Aid, Borrowers Still Face Foreclosure, 2/21/13.

^ SF Chronicle, Foreclosures Drop in Bay Area, California, 1/23/13. When Investors Buy Up The Neighborhood:

Preventing Investor OwnershipfromCausing Neighborhood Decline. Policy Link, April 2010.

Item:

CED Committee

April 23,2013

Deanna J. Santana, City Administrator

Subject: Quarterly Report on Foreclosure Issues

Date: March 29, 2013

Page 2

The following provides a snapshot of national and state outcomes from the National Mortgage

Settlement Agreement negotiated with five (5) major banks: Ally, Bank of America, Citibank,

JP Morgan Chase, and Wells Fargo. As highlighted in recent media articles, there is significant

concern that the banks are fulfilling Settlement Agreement (SA) obligations through short sales

rather than loan modification and other homeownership preservation strategies.'' Nationally,

short sales constitute 44% while homeownership support^ only constitutes 22% of the SA

implementation. In California, short sales have constituted 52% and homeownership support

24% of the SA.

National, Program Status as of Dec.31, 2012

Citibank

Chase

Wells

Total

$21IM

34%

Bank of

America

$4.002B

15%

$974M

35%

$2.3758

30%

$2.0568

49%

$9.6188

22%

$94 M

15%

168

27%

$9.818B

37%

$11.8468

44%

$1.3848

50%

$426M

15%

$7M

.09%

$5.2608

67%

$290M

7%

$1.8058

43%

$11.5938

26%

$19.5058

44%

Other

153

24%

$1.181B

4%

$7M

.25%

$224M

3%

$65M

1.9%

$1.628M

4%

TOTAL

COMPLETED

$626M

$26.8473

$2.7918

$7.8668

$4.2168

$42.3468

Citibank

Chase

Wells

Total

$264M

33%

$1,018

32%

$827M

42%

$3,988

24%

Type of Consumer

Relief

Homeownership

Support (Loan

mods., principal

reduction, interest

rate relieO

Second Lien

Modifications

Short Sales

Ally Bank

California, Program Status as of December 31, 2012^

Type of

Consumer Relief

Homeownership

Support (Loan

mods., principal

reduction,

Ally Bank

$51M

71%

Bank of

America

$1.8268

17%

SF Chronicle, 5 Big Banks Mortgage Relief Progress, 11/19/12. LA Times, Most Aid From Mortgage Settlement

in State Going to Short Sales, 11/19/12.

^ Since it is unclear if modification of second liens, without first lien modification, results in homeownership

preservation, it is listed separately rather than included as part of the Homeownership Support category. There may

be instances when modification of second liens would be sufficient for homeownership preservation.

* At least $25 billion was anticipated in homeowner relief funds. '

' The California Attorney General negotiated a separate side agreement that provided an additional $18 billion for

California.

Item:

CED Committee

April 23,2013

Deanna J. Santana, City Administrator

Subject: Quarterly Report on Foreclosure Issues

Date: March 29, 2013

Page 3

Type of

Consumer Relief

interest rate

relieO

Second Lien

Modification

Ally Bank

Bank of

America

Citibank

Chase

Wells

Total

$20M

29%

$3.4288

32%

$366M

45%

$4M

.1%

$138M

7%

$3.9568

23%

Short Sales

$5.4778

51%

$58M

.54%

$10.7898

$179M

22%

$1,5M

.2%

$809M

$2.1528

67%

$I7M

1%

$3.1928

$985M

50%

$22M

1%

$1.9728

$8.7938

52%

$111M

1%

$16.85B

Other

TOTAL

COMPLETED

$71M

Oakland data follows these national trends.

A. Decreasing Numbers of Oakland Foreclosure Activities

The rate of foreclosure activities has significantly decreased in Oakland. However, there are still

significant numbers of Oakland residents in or at risk for foreclosure. In addition, Corelogic data

shows that there are about 20,000 underwater borrowers in Oakland. Staff is working on

accessing data on how many of these households are delinquent.

Notice of Default: decreased 64.1% since the prior year.

o However, there are over 1,000 Oakland households with a current NOD.^

o In the past quarter, 197 new NODs were filed.

Sale to Third Parties Via Trustee Sales: decreased 33% since the prior year."'

o However, there were 1,722 scheduled trustee sales in the months of December,

January and,February,

o There were 423 NOD properties sold to third parties through trustee sales in 2012.

Back to Bank, REO: decreased 71.11% since the prior year.

o However, there are 815 current REO properties in Oakland.''

o The City's registry shows that about 42% of the REO properties are vacant; 31%

are tenant occupied; and 27% are occupied by the prior owner.

^ ForeclosureRadar http://www.foreclosureradar.com/califomia/alameda-county/oakland-foreclosures.

^ ForeclosureRadar shows that there are 1,179 properties with a NOD. Id. The City's registry has 1,072 NODs

registered, but this figure is an undercount as lenders have not registered 100% of their properties.

'' Id^ The City's registry has 436 REOs registered, but this figure is an undercount as lenders have not registered

100% of their properties.

Item:

CED Committee

April 23,2013

Deanna J. Santana, City Administrator

Subject: Quarterly Report on Foreclosure Issues

Date: March 29, 2013

Page 4

More information, including foreclosure activities by specific major lenders is available at

Attachment A.

B. Increasing Short Sale*^ Activities in Oakland

The rate of short sales in Oakland has significantly increased with a 35%) increase from 2011 to

2012.

- Year,;;

. '-.'KlsMSf'SHort.iSaiesTotaH

2011

598

2012

804

% increase from 2011 to 2012

35%

For many homeowners, short sales may be the best available option. However, recent reports

have indicated instances when some homeowners feel compelled into short sales without the

opportunity to explore other options.'^ For example, a recent statewide survey conducted by the

California Reinvestment Coalition of 84 housing counseling or legal service agencies, including

about 8 providers for Oakland, found that over 30% of survey respondents believed that there has

been pressure on homeowners to do short sales, at least "sometimes."^''

C. Investor Purchase of Foreclosed Properties

Recent research shows that from 2007 to 2011, investors purchased 65 to 88% of Oakland's

residential, 1-4 unit, foreclosed properties. About 93% of these properties are in Oakland's lowto-moderate income neighborhoods, ^QQ Attachment B.

In a recent Urban Strategies Council report'^ and at Council meetings, Oakland residents have

complained about their inability to purchase these properties by being out-bid by investors. In

addition, there exists potential impact to the Oakland housing market when investors dispose of

their properties in Oakland after their investment holding period, anticipated to be in five (5) to

seven (7) years.

12

Short sales are when a property is sold and the lender agrees to accept less money than is actually owed. In a

short sale, the homeowner does not receive any proceeds from the sale.

Oakland Reveals the Impact of Homeowners Steered into Short Sales, ACCE Home Defenders League and East

Bay Move On, March 8, 2013, Race-Talk Blog by the Kirwan Institute for the Study of Race and Ethnicity, Ohio

State University.

Chasm Between Words and Deeds IX: Bank Violations Hurt Hardest Hit Communities. California Reinvestment

Coalition, April 2013.

Who Owns Your Neighborhood? The Role of Investors in Post-Foreclosure Oakland. Urban Sfrategies Council,

June 2012.

Item:

CED Committee

April 23, 2013

Deanna J. Santana, City Administrator

Subject: Quarterly Report on Foreclosure Issues

Date: March 29, 2013

II.

Page 5

FORECLOSURE PREVENTION & MITIGATION P R O G R A M STATUS

On October 16, 2012, Council approved funds for new and expanded activities to prevent and

mitigate foreclosures, including the following:

Direct outreach to homeowners with a NOD and tenants living in NOD properties.

Hotline services for tenants and homeowners in distress to connect to appropriate

services.

Housing counseling and legal services.

City escalation team to work with Bank escalation teams.

ROOT loan fund program to preserve homeownership for qualified distressed families.

Reporting of violations of National Mortgage Settlement Agreement or the new State

Homeowner Bill of Rights Act to the State Monitor or Attorney General's office.

Several of these programs required a start-up period before providing direct services. The

outreach workers began their door to door outreach services in mid-January. CHDC's housing

coimseling services in Oakland began in March.

Status

Oakland

Households

Reached or

Served

Outcomes

Outreach

(Allen

Temple,

OCCUR,

Family

Bridges,

MLK FC,

CJJC)

774

attempts

158

successful

contacts

23

homeowners

contacted

services

22 tenants

contacted

services

Homeowner

Hotline

(HERA)

Housing

Counseling

(CHDC

since March

& Unity

Council)

Homeowner

Legal

Services

(HERA)

Tenant

Hotline

(CJJC)

Tenant

Counseling

(CJJC)

Tenant Legal

Services

(Centro Legal

& EBCLC)

;

17

Total: 23

76

22

19

Total: 51

17

homeowners

served by

direct

services

(HERA or

CHDC)

10 CHDC

13 Unity

Council

CHDC

3 referred to

ROOT

4 in process

for loan

mod

41 EBCLC

10 Centro

45 brief

service

1 loan mod

19 in process

for loan mod

11 referred to

ROOT or

CHDC

counseling

2 legal

services

referral

13 Case

Managem

ent

6 Brief

Counselin

S

3 stopped

eviction or

lock-out ,

2 Legal

services

2 Cash for

keys

I stopped

Illegal Rent

Increase

5 Repairs

Addressed

6 Brief

Counseling

EBCLC:

30 brief

service

7 stopped

evictions

I won

habhability

2 cash for

keys

Centro:

4 nego

settlement

2 rent in

rescinded

4 brief service

Item:

CED Committee

April 23,2013

Deanna J. Santana, City Administrator

Subject: Quarterly Report on Foreclosure Issues

Date: March 29, 2013

Page 6

The ROOT Loan Fund Program

The ROOT program, administered by Community Housing Development Corporation, an

affordable housing nonprofit agency, preserves homeownership for qualified homeowners by

purchasing their properties at current market value and reselling them back to the homeowner.

Wells Fargo and Chase Banks have agreed to participate in the program. Bank of America is

evaluating their participation. The City is in communication with Fannie Mae and Freddie Mac

and requesting that the Federal Housing Finance Agency (FHFA), which serves as the regulator

and conservator for Fannie Mae and Freddie Mac, consider participation in the program. While

FHFA has prohibhed the use of principal reduction nationally, h recently agreed to engage in

principal reductions in California through the Keep Your Home California program and funds.

There are 12 Oakland households who have passed the preliminary review for the ROOT

program'^ and property valuation and other needs are being assessed for negotiation with

participating lenders. In addition, there are 4 Oakland households who have expressed interest in

the ROOT program but need to go through a loan modification process first, which CHDC is

conducting for them. 10 Oakland households are working on submitting their applications for

the ROOT program and 3 households were reviewed and deemed ineligible, i.e. the property was

not their primary residence. Outreach will also be conducted to Oakland homeowners with

NODs and loans from participating lenders.

Jobs for Oakland Residents

In addition to staff currently employed with the funded organizations, the outreach organizations

employed 8 employees to conduct street outreach on a part-time basis, all of whom are Oakland

residents.

Provision of Technical Assistance for Other Communities

There has been interest from other communities regarding the City's foreclosure prevention and

mitigation plan and staff has provided information and/or assistance to the following

communities: San Jose, Seattle, and Prince George's County. Mayor Quan also conducted a

presentation at a recent US Conference of Mayors meeting regarding the City's programs.

III.

FORECLOSED PROPERTIES P R O G R A M STATUS

The following is a quarterly and year-to-date summary of performance outcomes from the City's

Foreclosed and Defaulted Properties Registration, Inspection, and Maintenance Programs.

Specific information, including performance by major lenders is provided m Attachment A.

Preliminary criteria include participating lender, denial of loan modification, hardship, sufficient income, and NSP

target areas.

Item:

CED Committee

April 23, 2013

Deanna J. Santana, City Administrator

Subject: Quarterly Report on Foreclosure Issues

Date: March 29, 2013

Page 7

Time Period

1/1/13-3/31/13

Registrations

570

Inspections

126

FY to date

1,511

641

Charges Collected

$561,688 total

$193,688 reg fees

$368,000 penalties

$822,056 total

$393,056 reg fees

$429,000 penalties

Proactive inspections of 641 foreclosed and defaulted properties have found 41 instances of

blight, mostly minor, 93% of which were timely abated.

However, there are 3 current cases that came in through complaints that involve problem

occupants in foreclosed properties. Unless the occupants are engaging in criminal activities or

nuisance activities that arise to a certain threshold, the City, through OPD or the City Attorney's

office, is unable to directly intervene with the occupants. The City's recourse is to escalate

communications with the bank property owner and to use blight penalties, if there's the presence

of blight, as leverage to compel expedited bank action. Staff has been working with the City

Attorney's office to develop new tools to more effectively address these challenging situations.

Use of Liens on Properties Owned by Non-Major Lenders

There has been an increase in the sale of foreclosed properties. In order to protect the City's

financial interests on properties owned by non-major lenders, staff has begun issuing liens for

outstanding penalties. Non-major lenders own about 11% of the Oakland foreclosed properties

inventory. Liens are not generally issued on properties owned by major lenders^^ as the City has

assurance, including from past practice, that outstanding payments will be paid, even after the

properties are transferred.

Provision of Technical Assistance to Other Communities

There has been interest from other communities regarding the City's foreclosed and defaulted

properties program and staff has provided information and/or assistance to the following

jurisdictions: Los Angeles, Richmond, and San Diego. Information about the City's program

was also included in Mayor Quan's recent presentation to the US Conference of Mayors.

IV.

STATUS OF INVESTOR O W N E D FORECLOSED AND D E F A U L T E D PROPERTIES P R O G R A M

On November, 2013, the Council passed an ordinance requiring the registration, inspection, and

maintenance of foreclosed or defaulted properties purchased by investors. Staff has been

working on the development of the program, including a new online registration system and a

17

Bank of America, Chase, Fannie M^e, Freddie Mac, US Bank, and Wells Fargo.

Item:

CED Committee

April 23,2013

Deanna J. Santana, City Administrator

Subject: Quarterly Report on Foreclosure Issues

Date: March 29, 2013

Page 8

new database system to identify targeted properties for enforcement. It is anticipated that the

online registration program will be available in July. Staff will be providing outreach to the real

estate community to notify them of the new requirements. In addition, individual notices will be

issued on specific properties that are subject to the new requirements with the provision of time

to register.

V.

D E V E L O P M E N T OF PROACTIVE P R O G R A M S AND P O L I C Y RECOMMENDATIONS

As discussed in prior CED Committee meetings and requested by Committee members, staff has

been conducting due diligence to develop new strategies to accomplish the following goals:

1. Preserve homeownership for qualified residents.

2. Provide meaningful access to foreclosed properties for owner-occupant purchasers.

3. Support the disposition of foreclosed properties into affordable and quality rental housing.

Expanding First Look Programs& Assistance from National Experts

Research was conducted into best practice strategies in other cities, such as St. Paul Minnesota.

Staff also consulted with national and local experts, including Wells Fargo and Chase Banks'

Community Development programs. National Community Stabilization Trust, Enterprise

Community Partners, LISC, Alameda County Public Health Department, Urban Strategies

Council, ACCE, EBHO, CHDC, Harvard Law School's Technical Assistance Project, Self-Help,

Habitat for Humanity, and others. A proposal was developed that built upon best practice

strategies and existing systems for the disposition of foreclosed properties.

Preliminary communications occurred with the Oakland Realtors Association and its leadership

will be consulted in program development and operations. Staff will also consult with the Jobs

and Housing Coalition and other real estate development interests.

The administration convened a recent meeting with senior officials who oversee the disposition

of REO properties for the top six (6) lenders in Oakland'^ to discuss the below proposal:

1. Create a pipeline for all REO properties to go through existing First Look

programs, especially operated by the National Community Stabilization Trust (NCST)'^

for purchase by:

Bank of America, Chase, Fannie Mae, Freddie Mac, US Bank, and Wells Fargo.

The National Community Stabilization Trust, is a national nonprofit agency with support from HUD, set up to

assist communities to weather the foreclosure crisis. The Trust operates a First Look program where participating

lenders provide a pre-market opportunity for nonprofit and some for-profit agencies approved by the Trust to

purchase foreclosed properties. Some lenders, such as Fannie Mae, operate their own First Look program and

include owner-occupant purchasers.

Item:

CED Committee

April 23, 2013

Deanna J. Santana, City Administrator

Subject: Quarterly Report on Foreclosure Issues

Date: March 29, 2013

Page 9

a. Nonprofits and for profits with socially responsible outcome commitments as

vetted by a City of Oakland RFQ, to be developed in collaboration with the

National Community Stabilization Trust and major lenders.

b. Owner-occupant purchasers with down-payment assistance or through housing

counseling programs.

Major lenders have expressed openness to and interest in supporting the development of

this program. Staff is working with the NCST, collaborative partners and major lenders

to develop a new First Look program for Oakland REO properties.

2. For homeowners denied a loan modification, provide information to the City for a

Second Look opportunity for Bank Escalation or City sponsored programs.

The response from major lenders has been that they cannot share confidential information

and provide a list of homeowners denied loan modifications to the City or nonprofit

agency. However, if the City approaches them with specific cases, they will connect us

with their Escalation offices.

3. Short Sale purchases to City vetted nonprofits or for-profits with socially

responsible outcomes:

a. Resale to existing homeowners, in some agreed upon time period, as

homeownership preservation for qualified homeowners through the ROOT

program.

b. Sale to new owner-occupant purchasers.

c. Sale to nonprofits or for-profits, approved by the City's RFQ, who are engaging

in resale to owner-occupant purchasers or providing quality and affordable rental

housing.

As short sales are initially real estate transactions involving the homeowner, realtors, and

a new buyer, the City will need to work with Oakland homeowners and the realtor

community in identifying homeowners who are interested in engaging in a short sale that

results in either homeownership preservation or resale to a new owner occupant. The

lenders would then need to approve the short sale.

4. Provide City or acceptable nonprofit agency with access to 60 day delinquent borrower

information for City-sponsored outreach and housing counseling services.

The response from major lenders has been that they are unable to share this confidential

and proprietary information with the City.

Given the rising numbers of short sales and reports that home preservation options may not be

fully considered, the Administration is concerned that Oakland homeowners in distress may not

Item:

CED Committee

April 23,2013

Deanna J. Santana, City Administrator

Subject: Quarterly Report on Foreclosure Issues

Date: March 29, 2013

Page 10

be fiiUy informed about their rights or have access to supportive housing counseling services.

Staff has identified a database system that will provide the City with information on delinquent

borrowers, Experian, and will be using this data to expand the City's outreach efforts to

delinquent borrowers who may not have yet been issued a NOD. An additional $10,000 will be

added to the City's existing contract with HERA to support a public awareness campaign and

connect interested delinquent homeowners with City sponsored housing counseling and legal

services.

Development of Policy Recommendations for Council Consideration

There may be policy recommendations for Council action to support the alternative disposition

goals of home preservation, new homeownership opportunities, and quality and affordable rental

housing. Staff will be convening meetings with different stakeholder groups to develop any

policy recommendations for Committee consideration, including the following: ACCE,

Alameda County Public Health Department, CJJC, East Bay Rental Housing Association, Jobs

and Housing Coalition, OCO, Oakland Realtors Association, Urban Strategies Council, and

others.

For questions regarding this report, please contact Margaretta Lin, Departments of Housing and

Community Development and Planning and Building, at 510-238-6314.

Respectfully submitted.

Fred Blackwell

Assistant City Administrator

Reviewed by:

Michele Byrd

Director of Housing and Community Development

Rachel Flynn

Director of Planning and Building Department

Ray Derania

Attachment A: Foreclosure Data

& Properties Status

Attachment B: Map of InvestorOwned Foreclosed Properties

Building Services Division

Prepared by;

Margaretta Lin

Strategic Initiatives Manager

Departments of Housing and Community Development

and Planning and Building

Item:

CED Committee

April 23,2013

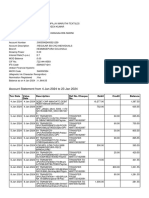

Attachment A: Foreclosure Data and Programs

Vr^'^-iiiiiiliRegistra'tibhs'^iy,!

igjSi^Foreclosure Events ,

Recorded NOD/REO Filings

Time

Bank

Period

l/l/13rT3/31/13;i'i'

Trustee

NOD

Notice of Default

REO

Sale

Total

Owner

Tenant

NOD

Occupied

Occupied

Vacant

12

67

45

14

Chase

Fannie

Freddie

US Bank

197

Total

11

Tenant

REO

Occupied

Occupied

26

97

20

112

Chase

118

52

353

10

Fannie

US Bank

""^.;o '

49

;^

41

142

.;;o

: ! ' ' : '..'1

558

17

55

31

217

56

67

60

15

5

;i

40

' i ''S'iir/

8

27

A

1

. 801

'IS

12

2

25

52

1

"^f-:

1

irni-n. ^ifOKL

-. . v.

^ .

106

MrcHw'ii^-lO

^:;;:;;;.k:';::;;..:i^o

60

95

126

0

53 / ' : . 27

191

83

"... . '-.-^-i^

7

v/4

'; !;)\~.,

36

18

15

189

28

76

85

I- ;v-.38

.. "^"10

.8

.'!^.;20

13

'16

,4

21

37

; ^ 65

... 13

22

- v ; 3 0i

436

109

139

188

% :25

3

42

. 25

; " ^^1^6

- :.^^^8A .'':0

45 . ,

Penalties

,. '

s.r/-;^v^2

11

Violations

'

1075

#Inspected

r-.

' ': '-;<>f:: 3

10

75

296

Vacant

Abatement

Timely

Abatement

-::r'';-;:

s-;-^v,5;;^io

r ;'^1l38 :0'";'\l ':v/7 ^:^^^

;39

30

255 ' ':'::J\"85 . :: ' : ' '37 ^!:'-474

36

15

6

3

Lil: 445

:.::n56 ^:/'i,;;;-2io

1096

288

:.'">

' >

77

i;",; ..I;:N:67

I;ili^b'"^i;?!i6

Ifii^iiili^^i45 ^5'/ i(?ri2

BofA

F-Y:to Diate: :

Total

;;i^^5i

fSitf^ii'li'62

Others

Others

Owner

:-.vS:i:^12

19

y5f!^;-;":MlO

Ocwen

Wells

Ocwen

Total

^^;^^:.:;3

Wells

Freddie

Inspection

''^'

I'v"

17

BofA

J; Property Conditions;

Foreclosed / REO

1 ..

641

41

4

3

'T-

.7

12

. '12

4

1

~ '1

496

- '72

"

38

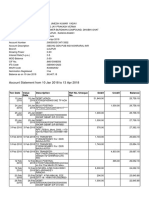

ATTACHMENT B

111

ii

Key Facts

II foreclosed properties in O a k l a n d between 2 0 0 7

ber 2011 were purchased by investor-speculators.

9 3 % of all investor-speculator acquisitions are in O a k l a n d ' s

flatland neighborhoods.

Investor A c q u i r e d P r o p e r t y ( 2 0 0 7 through O c t 201 1)

I City Council District

0 0.25 0.5

I Miles ijiij'

^1 ^I ^ I^ ^I ^I^ ^I ^I ^ I^ I

O n l y 10 out of the 30 most active investors are based in O a k l a n d .

ji^alysis by U r b o n S t r a t e g i e s C o u n c i l .

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Oct Bank - NewDocumento7 páginasOct Bank - NewLisa Hester100% (1)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- PDF DocumentDocumento6 páginasPDF DocumentGregory RodriguezAinda não há avaliações

- Cashier Training EssentialsDocumento17 páginasCashier Training EssentialsDaryl Nuera Carpo0% (1)

- 17 026186 PDFDocumento5 páginas17 026186 PDFRecordTrac - City of Oakland100% (1)

- Service Requests 116371 187330 Redacted PDFDocumento2 páginasService Requests 116371 187330 Redacted PDFRecordTrac - City of OaklandAinda não há avaliações

- CMS PDFDocumento7 páginasCMS PDFRecordTrac - City of OaklandAinda não há avaliações

- CMS PDFDocumento18 páginasCMS PDFRecordTrac - City of OaklandAinda não há avaliações

- Reg Work HoursDocumento2 páginasReg Work HoursRecordTrac - City of OaklandAinda não há avaliações

- CMS Report 2 PDFDocumento30 páginasCMS Report 2 PDFRecordTrac - City of OaklandAinda não há avaliações

- CMS PDFDocumento1 páginaCMS PDFRecordTrac - City of OaklandAinda não há avaliações

- DayBreak PDFDocumento5 páginasDayBreak PDFRecordTrac - City of OaklandAinda não há avaliações

- CMS Report PDFDocumento17 páginasCMS Report PDFRecordTrac - City of OaklandAinda não há avaliações

- CMS Report 1 PDFDocumento10 páginasCMS Report 1 PDFRecordTrac - City of OaklandAinda não há avaliações

- CMS Report PDFDocumento8 páginasCMS Report PDFRecordTrac - City of OaklandAinda não há avaliações

- CMS PDFDocumento5 páginasCMS PDFRecordTrac - City of OaklandAinda não há avaliações

- 12-0323 Report PDFDocumento8 páginas12-0323 Report PDFRecordTrac - City of OaklandAinda não há avaliações

- CMS PDFDocumento7 páginasCMS PDFRecordTrac - City of OaklandAinda não há avaliações

- CMS PDFDocumento6 páginasCMS PDFRecordTrac - City of OaklandAinda não há avaliações

- Weblink To Public Right-of-WayDocumento1 páginaWeblink To Public Right-of-WayRecordTrac - City of OaklandAinda não há avaliações

- $Gguhvv+Lvwru/%Hjlqqlqj : $31 8Qlw 5HFRUG,' 'Dwh2Shqhg 6Wdwxv 6Wdwxv'Dwh 'HvfulswlrqDocumento8 páginas$Gguhvv+Lvwru/%Hjlqqlqj : $31 8Qlw 5HFRUG,' 'Dwh2Shqhg 6Wdwxv 6Wdwxv'Dwh 'HvfulswlrqRecordTrac - City of OaklandAinda não há avaliações

- Service Requests Redacted PDFDocumento2 páginasService Requests Redacted PDFRecordTrac - City of OaklandAinda não há avaliações

- Record ID:: Address History With Inspection LogDocumento5 páginasRecord ID:: Address History With Inspection LogRecordTrac - City of OaklandAinda não há avaliações

- Permit/Complaint History 1987 Current: Record # Status Filed Date Status Date Description AddressDocumento109 páginasPermit/Complaint History 1987 Current: Record # Status Filed Date Status Date Description AddressRecordTrac - City of OaklandAinda não há avaliações

- CGS Permit For 4421 Gilbert ST PDFDocumento2 páginasCGS Permit For 4421 Gilbert ST PDFRecordTrac - City of OaklandAinda não há avaliações

- CMS PDFDocumento8 páginasCMS PDFRecordTrac - City of OaklandAinda não há avaliações

- Response From Right-of-Way ManagementDocumento1 páginaResponse From Right-of-Way ManagementRecordTrac - City of OaklandAinda não há avaliações

- Record ID:: Address History With Comments LogDocumento2 páginasRecord ID:: Address History With Comments LogRecordTrac - City of OaklandAinda não há avaliações

- Central District Urban Renewal Plan-21239 PDFDocumento37 páginasCentral District Urban Renewal Plan-21239 PDFRecordTrac - City of OaklandAinda não há avaliações

- PDFDocumento127 páginasPDFRecordTrac - City of OaklandAinda não há avaliações

- $Gguhvv+Lvwru/%Hjlqqlqj : $31 8Qlw 5HFRUG,' 'Dwh2Shqhg 6Wdwxv 6Wdwxv'Dwh 'HvfulswlrqDocumento4 páginas$Gguhvv+Lvwru/%Hjlqqlqj : $31 8Qlw 5HFRUG,' 'Dwh2Shqhg 6Wdwxv 6Wdwxv'Dwh 'HvfulswlrqRecordTrac - City of OaklandAinda não há avaliações

- PDFDocumento4 páginasPDFRecordTrac - City of OaklandAinda não há avaliações

- PDFDocumento5 páginasPDFRecordTrac - City of OaklandAinda não há avaliações

- $Gguhvv+Lvwru/%Hjlqqlqj : $31 8Qlw 5HFRUG,' 'Dwh2Shqhg 6Wdwxv 6Wdwxv'Dwh 'HvfulswlrqDocumento2 páginas$Gguhvv+Lvwru/%Hjlqqlqj : $31 8Qlw 5HFRUG,' 'Dwh2Shqhg 6Wdwxv 6Wdwxv'Dwh 'HvfulswlrqRecordTrac - City of OaklandAinda não há avaliações

- Bangko Sentral ng Pilipinas: Role and Functions of the Central Bank (39Documento2 páginasBangko Sentral ng Pilipinas: Role and Functions of the Central Bank (39bunsopinkikayAinda não há avaliações

- A Day in The Life of A Bank ManagerDocumento2 páginasA Day in The Life of A Bank Managerjustin yeboahAinda não há avaliações

- Common Financial Terms and Concepts ExplainedDocumento3 páginasCommon Financial Terms and Concepts ExplainedPaulaBaqRodAinda não há avaliações

- Sia Publication InsurenceDocumento11 páginasSia Publication Insurencesyedazehrafatima1434Ainda não há avaliações

- Indigency Application (Completed) - Part2 PDFDocumento2 páginasIndigency Application (Completed) - Part2 PDFdcarson90Ainda não há avaliações

- MAE by Maybank2u: Frequently Asked QuestionsDocumento40 páginasMAE by Maybank2u: Frequently Asked Questionslim wey songAinda não há avaliações

- TNG Ewallet TransactionsDocumento2 páginasTNG Ewallet TransactionsGerney OngAinda não há avaliações

- Acct Statement - XX0575 - 21052022Documento4 páginasAcct Statement - XX0575 - 21052022shivji007Ainda não há avaliações

- Kotak Mahindra Bank Performance AnalysisDocumento18 páginasKotak Mahindra Bank Performance AnalysisSurbhî GuptaAinda não há avaliações

- Outline of the Conventional Banking System and Central Bank FunctionsDocumento5 páginasOutline of the Conventional Banking System and Central Bank FunctionsMohamed YazAinda não há avaliações

- Multifamily Finance ReformDocumento7 páginasMultifamily Finance ReformDanielSiesser100% (1)

- Print Bukti Transfer BCADocumento10 páginasPrint Bukti Transfer BCAchristian andrewAinda não há avaliações

- Valuing Money Market Securities Using Present ValueDocumento2 páginasValuing Money Market Securities Using Present ValueGenelle SorianoAinda não há avaliações

- MB.6 UNC mortgage licensing records comparisonDocumento44 páginasMB.6 UNC mortgage licensing records comparisonFazila KhanAinda não há avaliações

- IRJM Paper5 June2013Documento14 páginasIRJM Paper5 June2013Anurag SahrawatAinda não há avaliações

- Loan Settlement Audit ProgramDocumento3 páginasLoan Settlement Audit ProgramJohn MfumyaAinda não há avaliações

- SS-CIS - DB GM-Luxury Hideaway Real Estate GMBH (Moon-2023)Documento6 páginasSS-CIS - DB GM-Luxury Hideaway Real Estate GMBH (Moon-2023)Stephen SpilbergAinda não há avaliações

- Account Statement From 4 Jan 2024 To 23 Jan 2024: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocumento4 páginasAccount Statement From 4 Jan 2024 To 23 Jan 2024: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balancerangaswamy8194Ainda não há avaliações

- B 3 Summary TableDocumento1 páginaB 3 Summary Tablecarlosito_lauraAinda não há avaliações

- Business Breif U06-2 PDFDocumento1 páginaBusiness Breif U06-2 PDFAdam MichałekAinda não há avaliações

- Account Statement From 10 Jan 2018 To 13 Apr 2018Documento3 páginasAccount Statement From 10 Jan 2018 To 13 Apr 2018UMESH KUMAR YadavAinda não há avaliações

- Manage finances with online bankingDocumento12 páginasManage finances with online bankingDikesh JaiswalAinda não há avaliações

- CvpreviewDocumento2 páginasCvpreviewAjay LaboAinda não há avaliações

- Soneri Bank Internship+ (Marketing)Documento66 páginasSoneri Bank Internship+ (Marketing)qaisranisahibAinda não há avaliações

- Difference Between Trade Bill and Accommodation Bill:: Accommodation Bills of ExchangeDocumento5 páginasDifference Between Trade Bill and Accommodation Bill:: Accommodation Bills of ExchangeRaghuAinda não há avaliações

- Important Precautions Soayib 2Documento54 páginasImportant Precautions Soayib 2soayibq100% (2)

- Ibs Port Klang 1 31/10/23Documento11 páginasIbs Port Klang 1 31/10/23iemaqeelnasAinda não há avaliações