Escolar Documentos

Profissional Documentos

Cultura Documentos

P 2

Enviado por

Mikee FactoresTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

P 2

Enviado por

Mikee FactoresDireitos autorais:

Formatos disponíveis

Since 1977

PRACTICAL ACCOUNTING 2

P2.706- Home Office and Branch

DE LEON/DE LEON

OCTOBER 2009

LECTURE NOTES

Agencies and branches are established to decentralize

operations or to expand into new markets. Agencies are

simple extensions of the home office; branches,

generally, are with regulated autonomy to operate as an

independent entity.

Because agencies do not maintain its own set of

accounting records, all its transactions are recorded in

the books of the home office. If the home office would

like to determine viabilities of the agencies, real and

nominal accounts for the agency are identified in the

home office books to facilitate such determination.

Otherwise, the agency items are merged without

identification with those of the home office.

The branch has its own complete set of accounting

records, therefore all its transactions, including those

with the home office, are recorded in its books. It also

presents its own set of financial statements: the income

statement, the balance sheet, and the statement of

cash flows. But because the branch is but a part of the

home office, therefore, these set of financial statements

are not acceptable for general purposes. And since the

home office is just also a part of the whole organization,

its own set of financial statements: the income

statement, the balance sheet and the statement of cash

flows are also not acceptable for general purposes.

These two different sets of financial statements are

internal to each of the reporting entities, combined

financial statements must be prepared for the combined

entities (taken as one and the same) to meet the

requirements of general-purpose statements.

A branch and its home office represent two accounting

systems but just one accounting and reporting entity.

All entries in the accounting records of the branch are

also entered, at least in summary form, in the

accounting records of the home office. The records of

the home office and the branch are linked by two

reciprocal accounts; the Home Office Equity account in

the books of the Branch and the Investment in Branch

account in the books of the Home Office. Because they

are reciprocal, it means that the two accounts always

have the same balance although the Investment in

Branch is a debit account (as an asset in the books of

the Home Office) and the Home Office is a credit

account (as an equity item in the books of the branch).

The two accounts frequently show different balances on

a temporary basis due to errors and items in transit. A

very important aspect of the study of home office and

branches is the reconciliation of the reciprocal balances.

An illustration of journal entries recorded for interoffice transactions follow:

Transactions

Transfer of cash from the home office

Transfer of cash from the branch

Transfer of mdse from HO at cost

Transfer of mdse from HO at above

cost

Payment by HO of branch expenses

Allocation of prev. paid branch exp

Transfer of Fixed asset from home

office to Branch

To take-up branch Profit/(loss)

To adjust the reported branch NI /NL)

for realized allowance

Page 1 of 8

Home Office Books

Investment in branch

Cash

Cash

Investment in branch

Investment in branch

Shipment to branch

Investment in Branch

Allowance for OV

Shipment to branch

Investment in branch

Cash

Investment in branch

Expenses

Memo entry

x

x

x

x

x

x

x

x

x

x

x

x

x

Branch Books

Cash

Home office equity

Home Office Equity

Cash

Shipment from HO

HO Equity

Shipment from HO

HO Equity

Expenses

HO Equity

Expenses

HO Equity

Memo entry

x

x

x

x

x

x

x

x

x

x

x

x

(Note: There will be no entry if all fixed assets are accounted in the books of

the home office); otherwise:

Investment in branch

x

Fixed Assets

x

Accumulated depn

x

Acc Depn

x

Fixed Assets

x

HO Equity

x

Investment in branch

x

Income Summary

x

Branch Income

x

HO Equity

x

Branch loss

x

HO Equity

x

Investment in branch

x

Income Summary

x

Allowance for Ovrvltn

x

No Entry

Branch Income

x

Note: The adjusting entry to reflect the true net income or loss of the branch

from the standpoint of the home office is always favorable and only relevant

when billing policy is above cost:

www.prtc.com.ph

P2.706

EXCEL PROFESSIONAL SERVICES, INC.

Detailed

computation

of

realized

allowance

for

overvaluation thru sales by the branch to outsiders during

the period:

Billed

Cost

Mark-up

Price

Price

on Cost

Branch Beg Invty

xx

xx

xx

(from HO))

Current shipments

xx

xx

xx

(from HO

Branch End Invty

(xx)

(xx)

(xx)

(from HO)

Cost of Goods Sold

xx

xx

xx

Cost = Billed Price/100% + % mark-up on cost = Markup on cost/% mark-up on cost. The amount of allowance

considered realized will be the allowance carried by the

cost of goods sold.

There are two pricing methods generally used by the

home office in billing the branch for merchandise

transfers:

1. Billed at cost the merchandise is transferred at

cost, thus when the branch sells the merchandise,

the entire gross margin is included in the branch net

income.

2. Billed at cost plus markup the merchandise is

transferred at an amount between cost and the

selling price. This intermediate pricing method

allocates part of the gross margin to the branch and

the remainder to the home office.

Working paper adjustments and eliminations must be

determined in order to:

1. Eliminate inter-company balances from the combined

statements to avoid redundancy, and

2.

Adjust some items in the cost of sales section of the

branch income statement to their true costs (as a

consequence of the billing policy not equal to cost).

The working paper adjustment/elimination entries are as

follows:

a. Billed at Cost

b. Billed above cost

HO Equity

x

HO Equity

x

Investment in Branch

x

Investment in Branch

x

Accounts Payable

x

Accounts Payable

x

Accounts Receivable

x

Accounts Receivable

x

Shipment to Branch x

Shipment to Branch

x

Shipment from

Allowance for Ovrvltn x

Home Office

x

Shipment from HO

x

None

Allownce for Ovrvltn

x

Branch Beg Invty

x

None

Br Ending Invty (I/S) x

Branch End Invty (B/S) x

When a company is composed of a home office and more

than one branch, the home office records include a

separate investment in branch account and a separate

allowance for overvaluation account for each branch.

Separate worksheet adjustments are made for each

branch.

When assets are transferred from one branch to another

branch, the home office account on each branchs records

are used to record the transfers. (Inter-branch

receivables and payables are not created.) In essence,

the transferring branch reverses the entry to record the

transfer from the home office and the receiving branch

enters a transfer as if it comes from the home office.

- done -

MULTIPLE CHOICE THEORETICAL

Select the best answer for each of the following multiple-choice questions:

1.

May be Investment in Branch account of a home office

be accounted for by the

Cost Method

Equity Method

of accounting

of accounting

a.

Yes

Yes

b.

Yes

No

c.

No

Yes

d

No

No

5.

Does the branch use a Shipments from Home Office

ledger account under the:

Perpetual Inventory

Periodic Inventory

Method

Method

a.

Yes

Yes

b.

Yes

No

c.

No

Yes

d.

No

No

2.

Which of the following generally is not a method of

billing merchandise shipments by a home office to the

branch?

a. Billing at cost

b. Billing at a percentage above cost

c. Billing at a percentage below cost

d. Billing at retail selling price

6.

3.

A branch journal entry debiting Home Office and

crediting Cash may be prepared for:

a.

The branchs transmittal of cash to the

Home Office

b.

The branchs acquisition for cash of plant

assets to be carried in the home office accounting

records only

c.

Either (a) or (b)

d.

Neither (a) nor (b)

A journal entry debiting Cash in Transit and crediting

Investment in Branch is required for:

a.

The Home Office to record the mailing of a

check to the branch early in the accounting period.

b.

The branch to record the mailing of a check

to the home office early in the accounting period.

c.

The home office to record the mailing of a

check by the branch on the last day of the

accounting period.

d.

The branch to record the mailing of a check

to the home office on the last day of the

accounting period.

7.

For a home office that uses the periodic inventory

system of accounting for shipments of merchandise to

the branch, the credit balance of the Shipments to

Branch ledger account is displayed in the home office

separate:

a.

Income statement as an offset to purchase

b.

Balance sheet as an offset to Investment in

Branch

c.

Balance sheet as an offset to inventories

d.

Income statement as revenue.

4.

A Home Office s

Allowance for Overvaluation of

Inventories: Branch ledger account, which has a credit

balance, is

a. an asset valuation account c. an equity account

b. a liability account

d. a revenue account

Page 2 of 8

www.prtc.com.ph

P2.706

EXCEL PROFESSIONAL SERVICES, INC.

8.

9.

If the home office maintains in its general ledger

accounts for a branchs plant assets, the branch debits

its acquisition of office equipment to:

a. Home Office

b. Office Equipment

c. Payable to Home Office

d. Office equipment carried by home office

In a working paper for combined financial statements

of the home office and the branch of a business

enterprise, an elimination that debits Shipments to

Branch and credits Shipments from Home Office is

required under:

a.

The periodic inventory system only

b.

The perpetual inventory system only

c.

Both the perpetual inventory system and

the periodic inventory system

d.

Neither the perpetual inventory nor the

periodic inventory system

10. The appropriate journal entry for the home office to

recognize the branchs expenditure of P10,000 for

equipment to be carried in the home office accounting

records is:

a. Equipment

10,000

Inv in Branch

10,000

b. Home Office

10,000

c.

d.

Equipment

Investment in branch

Cash

Equipment-Branch

Inv in Branch

10,000

10,000

10,000

10,000

10,000

11. On January 31, 2009, East Branch of Far Company,

which uses the perpetual inventory system, prepare

the following journal entry.

Inventories in transit

10,000

Home Office

10,000

To record merchandise shipment in transit from home

office.

When the merchandise is received on February 4,

2009, East Branch should:

a. Prepare no journal entry

b. Debit Inventories and credit Home Office, P10,000

c. Debit Home Office and credit Inventories in transit,

P10,000

d. Debit inventories and credit Inventories in transit,

P10,000.

12. If a Home Office bills merchandise shipments to the

branch at a markup of 20% on cost, the markup on

billed price is:

a. 16.67%

c. 25%

b. 20%

d. Some other percentage

STRAIGHT PROBLEMS

Problem 1 (Branch was billed at cost)

Alet Company, which prepares financial reports at the end

of the calendar year, established a branch on July 1,

2009. The following transactions occurred during the

formation of the branch and its first six months of

operations, ending December 31, 2009.

1. The Home Office sent P35,000 cash to the branch to

begin operations.

2. The Home Office shipped inventory to the branch.

Intracompany billings totaled P75,000, which was the

Home Office's cost. (Both the Home Office and the

Branch use a periodic inventory system.)

3. The branch acquired merchandise display equipment

which cost P15,000 on July 1, 2009. (Assume that

branch fixed assets are carried on the home office

books).

4. The branch purchased inventory costing P53,750

from outside vendors on account.

5. The branch had credit sales of P106,250 and cash

sales of P43,750.

6. The branch collected P55,000 of its accounts

receivable.

7. The branch paid outside vendors P35,000.

8. The branch incurred selling expenses of P18,750 and

general and administrative expenses of P15,000.

These expenses were paid in cash when they were

incurred and include the expense of leasing the

branch's facilities.

9. The home office charged the branch P2,500 for its

share of insurance.

10. Depreciation expense on the display equipment

acquired by the branch is P1,250 for the six-month

period. (Depreciation expense is classified as a selling

expense.)

11. The branch remitted P12,500 cash to the home office.

12. The branch's physical inventory on December 31,

2009 is P41,250, of which P31,250 was acquired from

the home office (there was no beginning inventory).

Page 3 of 8

Requirements:

1. Prepare journal entries in the books of the home

office and in the books of the branch office for the

above transactions.

2. Prepare closing entries in the books of the branch

office to close its income statement accounts.

3. Prepare adjusting entry in the books of the home

office to reflect the increase or decrease in the

branch's net assets resulting from the branch

operations.

Problem 2 (Branch was billed at more than cost)

The following transactions pertain to a branch's first

month's operations:

1. The home office sent P11,250 cash to the branch.

2. The home office shipped inventory costing P50,000 to

the branch; the intracompany billing was for P62,500.

3. Branch inventory purchases from outside vendors

totalled P37,500.

4. Branch sales on account were P100,000.

5. The home office allocated P2,500 in advertising

expense to the branch.

6. Branch collections on accounts receivable were

P56,250.

7. Branch operating expenses of P17,500 were incurred,

none of which were paid at month-end.

8. The branch remitted P21,250 to the home office.

9. The branch's ending inventory (as reported in its

balance sheet) is composed of:

Acquired from outside vendors.............. .P15,000

Acquired from home office (at billing price). 25,000

Total ............................................... 40,000

Requirements:

1. Prepare the home office and branch journal entries

for these transactions, assuming a periodic inventory

system is used

2. Prepare the month-end closing entries for the branch.

3. Prepare the month-end adjusting entries for the

home office relating to the branch's operations for the

month.

www.prtc.com.ph

P2.706

EXCEL PROFESSIONAL SERVICES, INC.

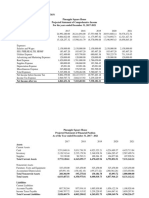

Problem 3

The pre-closing trial balances of Nicole Company and its

Angeles City branch for the year ended December 31,

2009, prior to adjusting and closing entries are as

follows:

Home Office

Accounts

Cash

Accounts

receivable,

net

Inventory,

January 1,

2008:

Acquired

from

vendors

Acquired

from

home

office

Deferred

profit

Fixed

assets, net

Investment

in branch

Accounts

payable

Long-term

debt

Common

stock

Retained

Earnings,

January 1,

2008

Home

office

equity

Sales

Purchases

Shipments

from home

office

Shipments

to branch

Selling

expenses

Administra

tive

expenses

Totals

Debit

P 35,000

Branch Office

Credit

80,000

Debit

P10,000

Credit

50,000

230,000

20,000

25,000

90,000

155,000

3.

221,000

45,000

400,000

300,000

350,000

4.

5.

960,000

800,000

115,000

320,000

120,000

90,000

84,000

101,000

69,000

P2,340,000

34,000

_______

P2,340,000

16,000

P 480,000

_______

P480,000

Inventory per physical count on December 31, 2009:

Acquired from vendors

P180,000

P 20,000

Acquired from home office

30,000

Additional information:

1. Inventory transferred to the branch from the home

office is billed at 125% of cost.

2. The home office billed the branch P15,000 for

inventory it shipped to the branch on December 28,

2009; the branch received and recorded this

shipment on January 2, 2010.

3. The branch remitted P25,000 cash to the home office

on December 31, 2009; the home office received and

recorded this remittance on January 4, 2010.

Requirements:

1. Prepare the year-end adjusting entries to bring the

intracompany accounts into agreement. Be sure to

adjust the other accounts in the trial balance as

appropriate.

2. Complete the following analysis of the branchs

inventory

Transfers

Above cost

Transfers

__at cost__

Total goods

available for

sale

Less: Ending

inventory

Acquired

from

vendors

Acquired

from home

office

Cost of goods

sold

50,000

870,000

inventory:

Acquired

from

vendors

Acquired

from home

office

Add:

Purchases

(from vendors)

Shipments

from office

Mark-up

6.

Prepare the following year-end adjusting entries to:

a. Record the branch income on the home office

books

b. Adjust the deferred profit account to the proper

balance

Prepare the year-end closing entries for the home

office and the branch

Prepare a combining statement worksheet as of

December 31, 2009, after completing requirements 1

to 4

From the completed worksheet prepare:

a. An income statement and balance sheet for the

branch.

b. An income statement and balance sheet for the

home office.

c. An income statement and balance sheet

combined for home office and branch office.

Problem 4

On December 31, the Inv. in Branch account on the home

books shows a balance of P150,000. The following facts

are ascertained:

1. Merchandise billed at P5,000 is in transit on

December 31, from the home office to the branch.

2. The branch collected a home account receivable for

P2,000. The branch did not notify the home office of

cash collection.

3. On December 30, the home office mailed a check of

P10,000 to the branch but the bookkeeper charged

the check to General Expenses; the branch has not

received the check as of December 31.

4. Branch profit for December was recorded by the

home office at P8,900 instead of P9,800.

5. Branch returned supplies of P1,000 to the home office

but the home office has not yet recorded the receipt

of the supplies.

Required:

a) Compute the balance of the Home Office account on

the branch book as of December 31 before its

adjustment.

b) Prepare a reconciliation statement to compute the

adjusted balances on December 31.

Problem 5

The interoffice accounts between the main office of ABC

COMPANY and its branch in Ayala were adjusted to

P145,500 as of December 31, 2008. The transactions

between the home office and the branch for 2009 were:

Beginning

Page 4 of 8

www.prtc.com.ph

P2.706

EXCEL PROFESSIONAL SERVICES, INC.

a.

b.

c.

d.

e.

f.

g.

Remittance by the branch (P38,000 was still in transit

as of December 31, 2009) P 178,000.

Shipments to branch (includes goods worth P44,000

that are not yet received by the branch as of

December 31, 2009) are P470,000.

The home office has not yet informed the branch of

its share in the advertising expense amounting to P

15,000.

Accounts receivable of the branch amounting to

P30,000 was collected by home office, net ,of 4%

discount. The branch has not yet been notified.

The home office incorrectly credited the branch by P

10,000 for the remittance of its Cubao Branch. The

Ayala Branch made no entry.

The home office corrected the above entry on

January 5, 2010. However, the Ayala Branch

inadvertently received a copy of this memo and

entered a credit in favor of the home office as of

December 31, 2009

The branch returned merchandise worth P 12,500 to

the office and was duly acknowledge by the latter

during the year.

1. The unadjusted balance of the Home Office

Current account as of December 31, 2009.

2. The adjusted balance of the interoffice accounts

as of December 31, 2009.

Problem 6

The Armani Corp. established a branch store in Ortigas on

June 30, 2009. The branch is to receive substantially all

merchandise for sale from the home office. During the

remainder of 2009, shipments to the branch amounted to

P240,000 that included a 20% mark-up on cost. The

branch purchased P 180,000 additional merchandise for

cash and reported unsold merchandise for P 145,000 at

year-end. The branch made sales of P420,000, paid

expenses of P105,000 and remitted to the home office all

sales proceeds.

The allowance for overvaluation of branch inventory

account on the home office books showed a balance of

P22,500 after adjustment.

1. The branch ending inventory that represented

purchase from outsiders

2. The branch net income as far as the home office is

concerned.

Problem 7

Home office bills its branch for merchandise shipment at

25% above cost. The following are some of the account

balances appearing on the books of home office and its

branch as of December 31

Home Office

Branch's

Books

Books

Inventory, Jan I

P 22,500

P36,000

Shipments from Home Office

210,000

Purchases

675,000

225,000

Shipments to branch

180,000

Allowance for overvaluation of

branch inventory

Sales

Operating Expenses

49,500

900,000

217,500

540,000

82,500

The ending inventory of the branch of P54,000 includes

goods from outside purchases of P12,000; the ending

inventory of the home office is P 112,500

1. The amount of shipments in transit at cost

2. The overstatement of branch cost of sales

3. The combined net income for the year

Problem 8

Branch A was authorized by its home office to send cash

of P1,500 that it can spare to Branch B. How is this

transfer best recorded on the books of

(a) Branch A

(b) Branch B and

(c) the Home Office

Problem 9

The DIANNA Company has established several branches

that sell the product that it manufactures. Manufactured

units are billed to the branches at the manufacturing

costs, the branches paying the freight charges from the

home office. On November 1, the home office ships goods

to Branch No.1 charging the branch P10,000. The branch

pays freight charges of P500. It is subsequently

discovered that the home office had shipped the goods to

Branch No. 1 by mistake and the home office directs

Branch No.1 to forward to goods to Branch No.2. Branch

No.2 upon receiving the goods pays freight charges from

Branch No. 1 of 150. If the shipment had been made

directly from the home office the freight would have been

P350.

Give journal entries to record all of the foregoing

transactions on the books of (1) home office; (2) Branch

No.1 and (3) Branch No. 2.

Problem 10

On December 31, 2009, the branch manager of Nancy

Company in Iloilo City submitted the following data to the

home office in Manila:

Petty cash fund

6,000

Sales

390,000

Shipment from home office

270,000

Accounts receivable, January 1, 2009

86,000

Inventory, January 1, 2009

74,000

Inventory, December 31, 2009

82,000

Expenses

96,000

All cash collected on Accounts Receivable amounting to

P378,000 were remitted to the Home Office.

Required:

1. What is

January

2. What is

January

the balances of the Home Office Account on

1, 2009.

the balance of the Home Office Account on

1, 2010.

MULTIPLE CHOICE

Romy Corporation has one branch office, named Tibo

Branch. Romy is performing the end-of-the-period

reconciliation of its Tibo Branch account whose current

balance is P000,000 and Tibos Home Office account

whose current balance is P000,000. The following items

are unsettled at the end of the accounting period (you

may assume that the item has been reflected in the

accounts of the underlined entity):

Romy has agreed to remove P750 of excess freight

charges charged to Tibo when Romy shipped twice

as much inventory as Tibo requested.

Page 5 of 8

Tibo mailed a check for P11,000 to Romy as a payment

for merchandise shipped from Romy to Tibo. Romy

has not yet received the check.

Tibo returned defective merchandise to Romy. The

merchandise was billed to Tibo at P4,000 when its

actual cost was P3,000.

Advertising expense attributable to the branch office

were paid for by the home office in the amount of

P5,000.

1. If the adjusted balances for the Tibo Branch Account

and the Romy Home Office Account is P500,000,

what unadjusted balance was listed in (1) Romys

www.prtc.com.ph

P2.706

EXCEL PROFESSIONAL SERVICES, INC.

Tibo Branch Account and (2) Tibos Home Office

Account?

a. (1) P510,250 and (2) P505,000.

b. (1) P515,000 and (2) P495,750.

c. (1) P514,000 and (2) P516,000.

d. (1) P504,000 and (2) P500,750.

The Meycauayan branch of Marco Company, at the end of

its first quarter of operations, submitted the following

income statement:

Sales

Cost of sales:

Shipments from home office

Local purchases

Total

Inventory at end

Gross margin on sales

Expenses

Net income

P300,000

P280,000

30,000

P310,000

50,000

260,000

P 40,000

35,000

P 5,000

Shipments to the branch were billed at 140% of cost.

The branch inventory as at September 30 amounted to

P50,000 of which P6,600 was locally purchased. Markup

on local purchases, 20% over cost. Branch expenses

incurred by home office amounted to P2,500.

2. On September 30, the branch inventory at cost and

net income realized by the home office from the

branch operations, respectively are:

a. P37,600 and P72,600

b. P31,600 and P 5,000

c. P50,000 and P55,000

a d.

P37,600 and P70,100

b

A home office transfers inventory to its branch at a 20%

markup on cost. During 2008, inventory costing the

home office P80,000 was transferred to the branch. At

year-end, the home office adjusted its Unrealized

Intercompany Inventory Profit account downward by

P18,200. The branchs year-end balance sheet shows

P4,800 of inventory acquired from the home office.

3. How much is the beginning inventory of the branch

at cost?

a. P 15,000

c. P 3,000

b. P 18,000

d. P 16,000

Sulu, Inc. established a branch in Jolo to distribute part

of the goods purchased by the home office. The home

office prices inventory shipped to the branch at 20%

above cost. The following account balances were taken

from the ledger maintained by the home office and the

branch:

Sales

Beginning inventory

Purchases

Shipment to branch

Shipment from home office

Operating expenses

Ending inventory

Sulu, Inc.

P 600,000

120,000

500,000

130,000

72,000

98,000

Jolo, Branch

P 210,000

60,000

156,000

36,000

48,000

All of the branch inventory is acquired from the home

office.

4. On the basis of these account balances, the

combined net income of the home office and the

branch is:

a. P170,000

c. P278,000

b. P 70,000

d. P132,000

Bicol Company is engaged in merchandising both at

Home Office in Makati and a branch in Cebu. Selected

accounts in the trial balances of the Home Office, and

the branch at December 31, 2008 follow:

Debit

Inventory, January

Branch

Purchases

Shipments from Home Office

Page 6 of 8

Home Office

P 23,000

58,300

190,000

Branch

P 11,550

Freight in from Home Office

Sundry expenses

Credit

Home Office

Sales

Shipments to Branch

Allow. for overvaluation of

branch inventory Jan. 1

50,000

155,000

110,000

5,500

25,000

53,300

140,000

1,000

Additional information:

a.

Cebu branch receives all its merchandise from

the home office. The Home Office bills the goods at

cost plus 10% mark-up. At December 31, 2008 a

shipment with a billing price of P5,000 was in transit

to the branch. Freight on this shipment was P250

which is to be treated as part of inventory.

b.

December 31, 2008 inventories, excluding the

shipment in transit was:

Home Office, at cost

30,000

Cebu Branch, at billed value

(excluding freight of P520)

10,400

5.

Net income of the Home Office was

a. P 10,000

c. P 20,000

b. P 15000

d. P 22,000

6.

True income of Cebu Branch was

a. P 10,470

c. P 12,470

b. P 11,470

d. P 13,470

The following data were taken from the records of Star

Corporation of Manila and its Bulacan Branch for 2008:

Manila office Bulacan branch

Sales

P 530,000

P157,500

Inventory, Jan. 1

57,500

22,250

Purchases

410,000

Shipment to branch

105,000

Shipment

from

home office

126,000

Inventory, Dec. 31

71,250

29,250

Expenses

191,000

50,750

In 2008, Home office billed the branch at 120% of cost

which was lower by 5% than last years.

7. The combined net income of the home office and the

branch for 2006 was:

a. P48,325

c. P49,850

b. P48,575

d. P56,075

Nicole Company has a branch in Boracay established on

April 1, 2008. During the year 2008, the home office

shipped merchandise to the branch at billed value of

P125,000 which was 25% above cost. At the end of the

year, the branch reported sales of P200,000, operating

expenses of P95,000, and a net income from the

operation of P15,000.

8. The true income of the branch was

a. P 15,000

c. P 18,000

b. P 25,000

d. P 33,000

Xero Corporation operates a number of branches in

Metro Manila. On June 30, 2008, its Sta. Clara branch

showed a Home Office account balance of P27,350 and

the Home Office books showed a Sta. Clara branch

account balance of P25,550. The following information

may help in reconciling both accounts:

1. A P12,000 shipment charged by Home Office to Sta.

Clara branch was actually sent to and retained by

Sta. Isabel branch.

2. A P15,000 shipment, intended and charged to Sto.

Domingo branch was shipped to Sta. Clara branch

and retained by the latter.

3. A P2,000 emergency cash transfer from Sta. Isabel

branch was not taken up in the Home Office books.

4. Home Office collects a Sta. Clara branch accounts

receivable of P3,600 and fails to notify the branch.

105,000

www.prtc.com.ph

P2.706

EXCEL PROFESSIONAL SERVICES, INC.

5.

6.

Home office was charged for P1,200 for merchandise

returned by Sta. Clara branch on June 28. The

merchandise is in transit.

Home office erroneously recorded Sta. Clara branch's

net income for May, 2008 at P16,275. The branch

reported a net income of P12,675.

9. What is the reconciled amount of the Home Office and

Sta. Clara branch reciprocal accounts?

a.

P21,750

c. P27,350

b.

P23,750

d.P20,150

The LL Company established a branch in Makati City on

June 1, 2008. The branch is to receive substantially all

merchandise from the home office. During the remainder

of 2008, shipments to the branch amounted to P180,000

which included a 20% mark-up on cost. The branch

purchased P45,000 additional merchandise for cash and

reported unsold merchandise of P60,000 at year-end.

The branch made sales of P292,500, paid expenses of

P72,000 and remitted to the home office all sales

proceeds. The allowance for overvaluation of branch

inventory account on the home office books showed a

balance of P7,500 after adjustment.

10. Compute the: (1) branch inventory on December 31,

2008 at cost, and (2) the branch net income as far

as the home office is concerned:

a.

(1) P45,000; (2) P78,000

b.

(1) P52,500; (2) P78,000

c.

(1) P52,000; (2) P55,500

d.

(1) P50,000; (2) P79,500

- now do the DIY drill DO-IT-YOURSELF (DIY) DRILL

The following information are extracted from the books

and records of PP Company and its branch. The

balances are at December 31, 2009, the third year of

the corporation's existence.

Home Office

Books

Branch

Books

Sales

P600,000

Expenses

200,000

Shipments from home office

360,000

Allowance for overvaluation

P72,500

The branch acquired all of its merchandise from the

home office. The inventories of the branch at billed

prices are as follows:

January 1, 2009

P75,000

December 31, 2009

84,000

1.

The adjusted profit of the branch in so far as the

home office is concerned is:

a. P107,500

c. P 58,500

b. P 49,000

d. P 60,000

Nicole Companys Kalibo branch reports a profit of

P17,000 for the year 2009 and a balance in its Home

Office account at the end of the year of P88,000 after

closing. The branch income currently is unrecorded by

the home office. During the year, the home office had

shipped inventory to the branch at an intracompany

profit of P14,000. Of that amount, P6,000 currently is

unrealized.

2. Assuming the branch has made all entries to adjust

and close its books for 2009, what is balance in the

home offices Investment in Branch account?

a. P 65,000

c. P 88,000

b. P 71,000

d. P 94,000

On December 1, 2009, the Dustine Company

established an agency in Las Pinas, sending its

merchandise samples costing P15,750 and a working

fund of P9,000 to be maintained on the imprest basis.

During the month of December, the agency transmitted

to the home office sales orders which were billed at

P64,380 of which 20,400 was collected. A home office

disbursement chargeable to the sales agency is the

acquisition of furniture and fixtures for Las Pinas,

P25,000 to be depreciated at 24% per annum. The

agency paid expenses of P3,815 and received

replenishment thereof from the home office. On

December 31, 2008, the agency samples were valued at

P10,075. It was estimated that the gross profit on

Page 7 of 8

goods shipped to bill agency sales orders average 25%

of cost.

3. How much is the net income of the agency for the

month ended December 31, 2008?

a. P 2,886

c. P 12,876

b. P 3,386

d. P (2,614)

Trial balances for the home office and for the branch of

Mermaid Company show the following accounts before

adjustment as of December 31, 2008. The home office

bills merchandise to the branch at 20% above cost.

HO

Branch

Unrealized intercompany

inventory profit

P10,800

Shipments to branch

24,000

Purchases (other vendors)

P7,500

Shipments from Home Office

28,800

Merchandise

inventory

December 1, 2008

45,000

4.

What part of the December 1, 2008 branch

inventory represents acquisitions from outside

purchases, and what part represents acquisitions

from the home office?

Outsider

Home Office

a.

P9,000

P36,000

b.

10,000

35,000

c.

12,000

33,000

d.

15,000

30,000

Universal Textiles has a single branch in Cagayan de

Oro City. On March 1, 2009, the home office accounting

records included an Allowance for Overvaluation of

Inventories with a credit balance of P32,000. During

March, merchandise costing P36,000 was shipped to the

CDO branch and billed at a price representing a 40%

markup on the billed price. On March 31, the branch

reported a net loss of P11,500 for March and ending

inventories at billed prices of P25,000. Mark-up was

uniform on all shipments.

5. Calculate the overstatement of the cost of sales in

the branch income statement in terms of the actual

cost of sales, i.e. per home office cost.

a. P46,000

c. P39,257

b. P22,000

d. P40,000

On December 31, 2009, the Branch account in the

Manila Home Office books shows a balance of P55,500.

You ascertain the following facts in analyzing this

account.

www.prtc.com.ph

P2.706

EXCEL PROFESSIONAL SERVICES, INC.

1.

2.

3.

4.

5.

6.

On December 31, 2009, merchandise billed at

P5,800 was in transit from the home office to the

branch.

The branch had collected home office accounts

receivable of P560; the home office was not

notified.

On December 29, 2009, the home office mailed a

check for P2,000 to the branch, but the accountant

for the home office had recorded the check as a

debit to Charitable Contributions; the branch had

not received the check as of December 31, 2009.

Branch net income for December 2009 was

recorded erroneously by the home office at P840

instead of P480.

On December 28, 2009, the branch had returned

supplies costing P220 to the home office; the home

office had not recorded the receipt of the supplies

as at Dec. 31.

Calculate the adjusted balance of the reciprocal

accounts at December 31, 2009.

a. P49,680

c. P46,980

b. P57,480

d. P54,870

Excel Corporation operates a branch in Calamba City.

The Home Office ships merchandise to the branch at

20% of the billed price. Selected information from the

December 31, 2009 trial balance are as follows:

Home Office

Branch

Books

Books

Sales

P600,000

P300,000

Shipments to branch

200,000

Purchases

350,000

Shipments from home

office

250,000

Inventory, January 1

100,000

40,000

Unrealized inter-company

inventory profit

58,000

Expenses

120,000

50,000

Inventory at December

31, 2009

30,000

60,000

7. Calculate the combined net income for the home

office and the branch for 2009:

a. P236,000

c. P280,000

b. P263,000

d. P326,000

8.

The AB Trading Co. operates a branch in Iloilo. At

close of business on December 31, 2008, Home

Office account in the branch books showed a credit

balance of P372,900. The interoffice accounts were

in agreement at the beginning of the year. For

purpose of reconciling the interoffice accounts, the

following facts were ascertained;

a. A furniture costing the home office P4,600 was

picked up by the branch as P460. The branch

will maintain and use the asset.

b. The branch writes-off uncollectible, accounts of

P1,260. The allowance for doubtful accounts is

maintained on the books of the home office.

The home office was not yet notified.

c. Freight charge on merchandise made by the

home office for P2,715 was recorded in the

branch books as P7,215.

d. Home office credit memo for P9,710 was

recorded by the branch at P7,91 0.

e. Iloilo branch failed to take up a P2,450 debit

memo from the home office.

f

The home office inadvertently recorded a

remittance for P3,730 from its Ilocos branch as

remittance from its Iloilo branch.

g. Insurance premium of P1,675 charged by the

home office was taken up twice by the branch.

h. A P14,500 branch remittance to the home office

initiated on December 28, 2008, was recorded

on the home office books on January 2, 2009.

i. A home office inventory shipment to Ilocos

branch on December 29, 2008, was recorded by

the branch on January 3, 2009; the billing of

P47,000 was at cost,

j. A branch customer remitted a P19,000 to the

home office, The home office recorded this cash

collection on December 22, 2008. Meanwhile,

back at the branch, no entry has been made

yet.

Determine the balance of the Investment in Branch

account before adjustments:

a. P364,545

c. P319,545

b. P307,515

d. P366,545

- end of P2.701 -

- now do the classroom drill -

Page 8 of 8

www.prtc.com.ph

P2.706

Você também pode gostar

- Home Office, Branch and Agency AccountingDocumento17 páginasHome Office, Branch and Agency AccountingJoanne TolentinoAinda não há avaliações

- Lesson 4 Accounting For Home OfficeDocumento8 páginasLesson 4 Accounting For Home OfficeheyheyAinda não há avaliações

- CMPC 221 Punzalan PDFDocumento9 páginasCMPC 221 Punzalan PDFRialeeAinda não há avaliações

- MidtermQ2 - Home Office Branch Accounting Billing Above CostDocumento7 páginasMidtermQ2 - Home Office Branch Accounting Billing Above Costsarahbee33% (3)

- Home Office and Branch Accounting ProblemsDocumento6 páginasHome Office and Branch Accounting ProblemsMary Dale Joie Bocala100% (1)

- DocDocumento5 páginasDocYour Materials33% (3)

- P2 105 Agency Home Office and Branch Accounting Key AnswersDocumento6 páginasP2 105 Agency Home Office and Branch Accounting Key AnswersHikari100% (1)

- HOBA Problem SetDocumento3 páginasHOBA Problem SetFayehAmantilloBingcangAinda não há avaliações

- Home Office and Branch Acccounting 2020Documento3 páginasHome Office and Branch Acccounting 2020ReilpeterAinda não há avaliações

- Home Office, Branch and Agency AccountingDocumento15 páginasHome Office, Branch and Agency AccountingErwin Labayog MedinaAinda não há avaliações

- Aa2e Hal Testbank Ch04Documento26 páginasAa2e Hal Testbank Ch04jayAinda não há avaliações

- Home Office IntegDocumento9 páginasHome Office IntegReshielyn Vee Entrampas LopezAinda não há avaliações

- Accounting principles for branches and agenciesDocumento4 páginasAccounting principles for branches and agenciesJohn Bryan100% (1)

- Afar 2Documento24 páginasAfar 2KriztleKateMontealtoGelogo100% (1)

- Case 1 - Computations of GW or IFADocumento3 páginasCase 1 - Computations of GW or IFAJem Valmonte0% (1)

- Home Office and Branch AccountingDocumento5 páginasHome Office and Branch Accountingjelviee1575% (4)

- OfficeDocumento12 páginasOffice123r12f1100% (1)

- Billed price calculations for home office and branch shipmentsDocumento4 páginasBilled price calculations for home office and branch shipmentsJohnmichael Coroza0% (1)

- Final Examination in Business Combi 2021Documento7 páginasFinal Examination in Business Combi 2021Michael BongalontaAinda não há avaliações

- Installment Sales Multiple QuestionsDocumento36 páginasInstallment Sales Multiple QuestionsTrixie CapisosAinda não há avaliações

- ADV2 Chapter12 QADocumento4 páginasADV2 Chapter12 QAMa Alyssa DelmiguezAinda não há avaliações

- Advanced Accounting Home Office, Branch and Agency TransactionsDocumento7 páginasAdvanced Accounting Home Office, Branch and Agency TransactionsMajoy Bantoc100% (1)

- HOBA QuestionsDocumento7 páginasHOBA QuestionsKristine CorporalAinda não há avaliações

- 2 - Home Office and Branch, Joint VentureDocumento6 páginas2 - Home Office and Branch, Joint VentureJason Bautista0% (1)

- HOBA - Practice SetDocumento5 páginasHOBA - Practice SetCarl Dhaniel Garcia SalenAinda não há avaliações

- Hoba 2019 QuizDocumento10 páginasHoba 2019 QuizJo Montes0% (1)

- Home Office and BranchDocumento4 páginasHome Office and BranchRed YuAinda não há avaliações

- AA2Q1Documento1 páginaAA2Q1Sweet EmmeAinda não há avaliações

- Requirement: Prepare Journal Entries in The Books of The Home Office and in The Books of The Branch Office ForDocumento2 páginasRequirement: Prepare Journal Entries in The Books of The Home Office and in The Books of The Branch Office ForvonnevaleAinda não há avaliações

- Business Combinations ExplainedDocumento8 páginasBusiness Combinations ExplainedLabLab ChattoAinda não há avaliações

- Home Office and Branch Accounting: Trial Balances, Adjustments, and Financial StatementsDocumento4 páginasHome Office and Branch Accounting: Trial Balances, Adjustments, and Financial StatementsMaurice AgbayaniAinda não há avaliações

- Responsibility Accounting and Transfer Pricing: Variable Costing & Segmented ReportingDocumento8 páginasResponsibility Accounting and Transfer Pricing: Variable Costing & Segmented ReportingJonailyn YR PeraltaAinda não há avaliações

- Advanced Accounting Part II Quiz 1 Home Office and Branch AccountingDocumento10 páginasAdvanced Accounting Part II Quiz 1 Home Office and Branch AccountingAzyrah Lyren Seguban UlpindoAinda não há avaliações

- CMPC Quiz 2Documento5 páginasCMPC Quiz 2Mae-shane Sagayo50% (2)

- C Par First Pre Board 2008 ADocumento17 páginasC Par First Pre Board 2008 AJaylord Pido100% (1)

- Home Office and Branch Accounting Covidproject4accountants Aug 2020 PDFDocumento9 páginasHome Office and Branch Accounting Covidproject4accountants Aug 2020 PDFKathrina RoxasAinda não há avaliações

- Problems Chapter 11 and 12Documento8 páginasProblems Chapter 11 and 12u got no jamsAinda não há avaliações

- HOBADocumento4 páginasHOBAHannah YnciertoAinda não há avaliações

- Activity 1 Home Office and Branch Accounting - General ProceduresDocumento4 páginasActivity 1 Home Office and Branch Accounting - General ProceduresDaenielle EspinozaAinda não há avaliações

- BAC 318 Final Examination With AnswersDocumento10 páginasBAC 318 Final Examination With Answersjanus lopez100% (1)

- P2 03v2Documento5 páginasP2 03v2Rhegee Irene RosarioAinda não há avaliações

- BRanch and Home OfficeDocumento1 páginaBRanch and Home OfficeSharonLargosaGabrielAinda não há avaliações

- HOBA ProblemsDocumento3 páginasHOBA ProblemsEmma Mariz Garcia67% (3)

- Home Office BranchDocumento5 páginasHome Office BranchRodAinda não há avaliações

- Toaz - Info Afar PRDocumento95 páginasToaz - Info Afar PRMiraflor Sanchez BiñasAinda não há avaliações

- Accounting for Home Office, Branch and Agency TransactionsDocumento30 páginasAccounting for Home Office, Branch and Agency TransactionsHarvey Dienne Quiambao100% (3)

- 4 Home Office Agency Handout SolutionDocumento15 páginas4 Home Office Agency Handout SolutionRyan CornistaAinda não há avaliações

- Cost To CostDocumento1 páginaCost To CostAnirban Roy ChowdhuryAinda não há avaliações

- Chapter 8: Home Office, Branch, and Agency AccountingDocumento32 páginasChapter 8: Home Office, Branch, and Agency Accountingjammy Agno50% (2)

- C. The Results of Operations, Cash Flow, and The Balance Sheet As If The Parent and Subsidiary Were A Single EntityDocumento13 páginasC. The Results of Operations, Cash Flow, and The Balance Sheet As If The Parent and Subsidiary Were A Single EntityAlijah MercadoAinda não há avaliações

- Trial Balance Home Office DR (CR) Branch Office DR (CR)Documento2 páginasTrial Balance Home Office DR (CR) Branch Office DR (CR)Adriana CarinanAinda não há avaliações

- Home Office Branch Accounting at CostDocumento12 páginasHome Office Branch Accounting at Costsarahbee100% (2)

- AFAR Assessment October 2020Documento8 páginasAFAR Assessment October 2020FelixAinda não há avaliações

- Define Fraud, and Explain The Two Types of Misstatements That Are Relevant To Auditors' Consideration of FraudDocumento3 páginasDefine Fraud, and Explain The Two Types of Misstatements That Are Relevant To Auditors' Consideration of FraudSomething ChicAinda não há avaliações

- Afar - Business Combinations - Mergers Ellery de Leon Far Eastern UniversityDocumento3 páginasAfar - Business Combinations - Mergers Ellery de Leon Far Eastern UniversityRyan Joseph Agluba Dimacali50% (2)

- NFJPIA Mockboard 2011 P2Documento13 páginasNFJPIA Mockboard 2011 P2Regie Sharry Alutang PanisAinda não há avaliações

- Advanced Financial Accounting Chapter 2 LECTURE - NOTESDocumento14 páginasAdvanced Financial Accounting Chapter 2 LECTURE - NOTESAshenafi ZelekeAinda não há avaliações

- p2Documento8 páginasp2elizaAinda não há avaliações

- 3004 Home Office and BranchesDocumento6 páginas3004 Home Office and BranchesTatianaAinda não há avaliações

- Excel Professional Services Financial Statement InsightsDocumento7 páginasExcel Professional Services Financial Statement InsightsAzriele Rayne Fajardo BenozaAinda não há avaliações

- Monopolistic Competition and MonopolyDocumento4 páginasMonopolistic Competition and MonopolysarahbeeAinda não há avaliações

- Standard Costing and Variance AnalysisDocumento5 páginasStandard Costing and Variance AnalysissarahbeeAinda não há avaliações

- Acctg201 Assignment 1Documento7 páginasAcctg201 Assignment 1sarahbeeAinda não há avaliações

- Acctg201 Exercises2Documento18 páginasAcctg201 Exercises2sarahbeeAinda não há avaliações

- Standard Cost and Variance Analysis SeatworkDocumento2 páginasStandard Cost and Variance Analysis SeatworksarahbeeAinda não há avaliações

- Cost Concepts and ClassificationsDocumento19 páginasCost Concepts and ClassificationssarahbeeAinda não há avaliações

- Product CostingDocumento10 páginasProduct CostingsarahbeeAinda não há avaliações

- Standard Costing and Variance Analysis Problems Exam SolutionDocumento5 páginasStandard Costing and Variance Analysis Problems Exam SolutionsarahbeeAinda não há avaliações

- ACCTG 201 Illustrative ProblemsDocumento4 páginasACCTG 201 Illustrative ProblemsJewel Anne RentumaAinda não há avaliações

- Standard CostingDocumento7 páginasStandard CostingsarahbeeAinda não há avaliações

- Accounting 201 Cost Accounting Exam ReviewDocumento11 páginasAccounting 201 Cost Accounting Exam Reviewsarahbee75% (4)

- Job Order Costing Difficult RoundDocumento8 páginasJob Order Costing Difficult RoundsarahbeeAinda não há avaliações

- Job Order Costing SeatworkDocumento7 páginasJob Order Costing SeatworksarahbeeAinda não há avaliações

- Job Order Costing QuizbowlDocumento27 páginasJob Order Costing QuizbowlsarahbeeAinda não há avaliações

- Exercise 5 Short Computations Backflush CostingDocumento2 páginasExercise 5 Short Computations Backflush CostingsarahbeeAinda não há avaliações

- Exercise 6-1 (Classification of Cost Drivers)Documento18 páginasExercise 6-1 (Classification of Cost Drivers)Barrylou ManayanAinda não há avaliações

- Process Costing Exercises Series 1Documento23 páginasProcess Costing Exercises Series 1sarahbeeAinda não há avaliações

- Cost AccountingDocumento6 páginasCost Accountingulquira grimamajowAinda não há avaliações

- Process Costing Exercises Series 1Documento23 páginasProcess Costing Exercises Series 1sarahbeeAinda não há avaliações

- Sales (De Leon)Documento737 páginasSales (De Leon)Bj Carido100% (7)

- ZARA CaseStudy Group5 FinalDocumento16 páginasZARA CaseStudy Group5 Finalsarahbee100% (1)

- Job Order Costing SeatworkDocumento7 páginasJob Order Costing SeatworksarahbeeAinda não há avaliações

- Journal of Business EthicsDocumento13 páginasJournal of Business EthicssarahbeeAinda não há avaliações

- Corporation Commencement ExceptionsDocumento10 páginasCorporation Commencement ExceptionssarahbeeAinda não há avaliações

- Sustainability Reporting in The PhilippinesDocumento45 páginasSustainability Reporting in The PhilippinessarahbeeAinda não há avaliações

- Gitman Chapter4Documento49 páginasGitman Chapter4sarahbeeAinda não há avaliações

- Complex Adaptive SystemsDocumento9 páginasComplex Adaptive Systemssprobooste100% (1)

- Sustainability 09 02112 PDFDocumento12 páginasSustainability 09 02112 PDFTawsif HasanAinda não há avaliações

- Resonance Performance ModelDocumento20 páginasResonance Performance ModelsarahbeeAinda não há avaliações

- 20201111report Financial Report December 2020 TheresidencesatbrentDocumento18 páginas20201111report Financial Report December 2020 TheresidencesatbrentChaAinda não há avaliações

- ULOa Let's Analyze Week 8 9Documento2 páginasULOa Let's Analyze Week 8 9emem resuentoAinda não há avaliações

- Adjusting Process PDFDocumento47 páginasAdjusting Process PDFJohn Oliver D. OcampoAinda não há avaliações

- Finance Process Flow in JDEDocumento35 páginasFinance Process Flow in JDERamesh KumarAinda não há avaliações

- Partnership profit distribution and capital account changesDocumento4 páginasPartnership profit distribution and capital account changesMaria Carmela MoraudaAinda não há avaliações

- Banana Bell Patty Income StatementDocumento2 páginasBanana Bell Patty Income StatementLyanAinda não há avaliações

- Las 4Documento8 páginasLas 4Venus Abarico Banque-AbenionAinda não há avaliações

- Financial Reporting Act 2015 BNDocumento31 páginasFinancial Reporting Act 2015 BNOsman GoniAinda não há avaliações

- Chapter 2 JournalizingDocumento21 páginasChapter 2 Journalizingkakao100% (1)

- IFRS Diploma Answers 2015Documento7 páginasIFRS Diploma Answers 2015Soňa SlovákováAinda não há avaliações

- FinancialPlan - 2013 Version - Prof DR IsmailDocumento129 páginasFinancialPlan - 2013 Version - Prof DR IsmailSyukur Byte0% (1)

- Chap-2 Quản trị tài chínhDocumento12 páginasChap-2 Quản trị tài chínhQuế Anh TrươngAinda não há avaliações

- Annual-Report-13-14 AOP PDFDocumento38 páginasAnnual-Report-13-14 AOP PDFkhurram_66Ainda não há avaliações

- CPM Construction Company AccountingDocumento6 páginasCPM Construction Company AccountingPrita HerdiantiAinda não há avaliações

- Oktay Urcan: Financial Accounting: Advanced TopicsDocumento39 páginasOktay Urcan: Financial Accounting: Advanced TopicsRishap JindalAinda não há avaliações

- Cash Flow StatementDocumento19 páginasCash Flow StatementROHIT SHAAinda não há avaliações

- Ey Leases A Summary of Ifrs 16Documento28 páginasEy Leases A Summary of Ifrs 16Wedi TassewAinda não há avaliações

- Sarath & Associates: To The Board of Directors of GSS Infotech LimitedDocumento9 páginasSarath & Associates: To The Board of Directors of GSS Infotech LimitedAkshay AKAinda não há avaliações

- Five-Year Financial Projection Pineapple Square House Projected Statement of Comprehensive Income For The Years Ended December 31, 2017-2021Documento4 páginasFive-Year Financial Projection Pineapple Square House Projected Statement of Comprehensive Income For The Years Ended December 31, 2017-2021Rey PordalizaAinda não há avaliações

- Wa0000 PDFDocumento12 páginasWa0000 PDFsipheleleAinda não há avaliações

- Laporan Keuangan PT BFI Finance IndonesiaDocumento103 páginasLaporan Keuangan PT BFI Finance IndonesiaAdi HamdaniAinda não há avaliações

- Fsa Solved ProblemsDocumento27 páginasFsa Solved ProblemsKumarVelivela100% (1)

- Financial Accountinng 3Documento10 páginasFinancial Accountinng 3Nami2mititAinda não há avaliações

- Liquidity and Solvency Ratios: Google vs Yahoo 2015Documento57 páginasLiquidity and Solvency Ratios: Google vs Yahoo 2015cvilalobos198527100% (1)

- Cfas Cash Flow Theories and ProblemsDocumento30 páginasCfas Cash Flow Theories and ProblemsIris MnemosyneAinda não há avaliações

- Akuntansi DagangDocumento13 páginasAkuntansi DagangAsmarani SiregarAinda não há avaliações

- Test Bank For Intermediate Accounting 13th Edition Donald e KiesoDocumento36 páginasTest Bank For Intermediate Accounting 13th Edition Donald e Kiesoheatingbultow.ji9fo100% (42)

- Business Finance - Horizontal AnalysisDocumento2 páginasBusiness Finance - Horizontal AnalysisAnon0% (1)

- Lecture Notes 2 Formation of A PartnershipDocumento14 páginasLecture Notes 2 Formation of A PartnershipMegapoplocker MegapoplockerAinda não há avaliações

- Key Words: Multiple Choice QuestionsDocumento7 páginasKey Words: Multiple Choice QuestionsMOHAMMED AMIN SHAIKHAinda não há avaliações