Escolar Documentos

Profissional Documentos

Cultura Documentos

Consumer Pricing Information Brochure

Enviado por

Carlos Matute NeavesDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Consumer Pricing Information Brochure

Enviado por

Carlos Matute NeavesDireitos autorais:

Formatos disponíveis

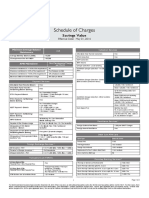

Package Checking Options

Consumer

Pricing

Information

at more than 23,000

Platinum Checking

Gold Checking

Silver Checking

Minimum

Opening Deposit

$25

$25

$25

Monthly

Maintenance Fee

$17.95 with online statements,

OR

$19.95 with paper statements7

$10.95 with online statements,

OR

$12.95 with paper statements7

Requirement

to Waive Monthly

Maintenance Fee

No Monthly Maintenance Fee

with one of the following:

$25,000 in combined

personal deposit, investment*

and/or credit balances,9 OR

Relationship with

U.S. Bank Trust Services

No Monthly Maintenance Fee

with a Package Money Market

Savings account AND one of

No Monthly Maintenance Fee with:

the following:

An open U.S. Bank personal

Combined monthly direct

loan, line or credit card11

deposits totaling $1,000+, OR

Combined account balance12

of $1,500

$6.95 with online statements,

OR

$8.95 with paper statements7

Effective February 24, 2014

Interest Tiers10

ATM Transactions

$0 - $2,499

$2,500 - $9,999

$10,000 and above

None

None

Free at U.S. Bank ATMs

and Non-U.S. Bank ATMs1

Free at U.S. Bank ATMs

Two free non-U.S. Bank ATM

transactions in a statement period

(Non-U.S. Bank ATM fees1 apply

after two)

Free at U.S. Bank ATMs

(Non-U.S. Bank ATM fees1 apply)

For a complete list of checking account features and benefits refer

to the U.S. Bank Personal Banking brochure.

Refer to the last page of this document for additional disclosures.

Consumer Pricing Information

Checking Options

Minimum

Opening Deposit

Premium Checking

Easy Checking

Student Checking14

Electronic Transfer

Account (ETA)15

$25

$25

$25

$0

$6.95 with online statements,

OR

$8.95 with paper statements7

No Monthly Maintenance Fee

$3

Requires direct deposit

of federal benefits or

federal payroll payments

No Monthly Maintenance Fee

with one of the following:

Combined monthly direct

deposits totaling $1,000+, OR

Average account balance13

of $1,500

None

None

None

None

None

Free at U.S. Bank ATMs

(Non-U.S. Bank ATM fees1 apply)

Free at U.S. Bank ATMs

Four free non-U.S. Bank ATM

transactions in a statement period

(Non-U.S. Bank ATM fees1 apply

after four)

Free at U.S. Bank ATMs

(Non-U.S. Bank ATM fees1 apply)

Monthly

Maintenance Fee

$10.95 with online statements,

OR

$12.95 with paper statements7

Requirement

to Waive Monthly

Maintenance Fee

No Monthly Maintenance Fee

with one of the following:

Average account balance13

of $5,000, OR

Account holder(s) age 65

or greater

Interest Tiers10

ATM Transactions

$0 - $999

$1,000 - $9,999

$10,000 - $49,999

$50,000 - $99,999

$100,000 and above

Free at U.S. Bank ATMs

and Non-U.S. Bank ATMs1

For a complete list of checking account features and benefits refer

to the U.S. Bank Personal Banking brochure.

Refer to the last page of this document for additional disclosures.

Consumer Pricing Information

Savings & Money Market Account Options

Package

Money Market Savings16

Elite Money Market

Money Market

Standard Savings

Goal Savings

Star Savers Club20

$25

Minimum

Opening Deposit

$25

$100

$100

$25

$0, with a minimum $25

automatic monthly transfer from

a U.S. Bank personal checking

account, per statement cycle19

Monthly

Maintenance Fee

$0

$10

$10

$4

$0

$0

Requirement

to Waive Monthly

Maintenance Fee

None

$10,000 minimum

daily ledger balance17

$1,000 minimum daily ledger

balance17 OR $2,500 average

monthly collected balance18

$300 minimum daily ledger

balance17 OR $1,000 average

monthly collected balance18

None

None

$0 - $1,499

$1,500 - $9,999

$10,000 - $49,999

$50,000 - $99,999

$100,000 - $499,999

$500,000 and above

$0 - $9,999

$10,000 - $24,999

$25,000 - $49,999

$50,000 - $99,999

$100,000 - $499,999

$500,000 and above

$0 - $999

$1,000 - $9,999

$10,000 - $24,999

$25,000 and above

Single Tier

$0 - $999

$1,000 - $9,999

$10,000 - $24,999

$25,000 and above

$0 - $499

$500 - $999

$1,000 - $4,999

$5,000 - $9,999

$10,000 and above

Free at U.S. Bank ATMs

(Non-U.S. Bank ATM fees1 apply)

Free at U.S. Bank ATMs

(Non-U.S. Bank ATM fees1 apply)

Free at U.S. Bank ATMs

(Non-U.S. Bank ATM fees1 apply)

Free at U.S. Bank ATMs

(Non-U.S. Bank ATM fees1 apply)

Free at U.S. Bank ATMs

(Non-U.S. Bank ATM fees1 apply)

Free at U.S. Bank ATMs

(Non-U.S. Bank ATM fees1 apply)

Interest Tiers10

ATM Transactions

Refer to the last page of this document for additional disclosures.

Consumer Pricing Information

Miscellaneous Checking, Savings

or Money Market Fees

Account Charge-Off Processing Fee

$30.00

__________________________________________________________

Debit Fees (ATM and Check Card)

ATM Transactions includes withdrawals, balance inquiries,

denied transactions, fund transfers, and deposits

U.S. Bank ATM Transaction

no charge

Non-U.S. Bank ATM Transaction1

$2.50

Mini Statement at U.S. Bank ATM

$1.00

Full Statement at U.S. Bank ATM

$1.50

International Processing Fee - U.S. Dollars

2% of transaction

International Processing Fee - Intl Currency

3% of transaction

Check Card Cash Advance Fee2

$2.00

Check Card Replacement Card Fee3

$5.00

Express Delivery Fee - new or replacement card

$25.00

(2-3 business days)

__________________________________________________________

Check Collection (incoming/outgoing)

$30.00 + direct cost

__________________________________________________________

Counter Checks

$2.00 per check

__________________________________________________________

DepositPointTM 4

(Remote Deposit Capture)

up to $0.50

per deposited item

__________________________________________________________

Dormant Account (per month)

$5.00

__________________________________________________________

5

Overdraft Item Paid

Item Amount

$5.00 or less

no charge

$5.01 or greater

$36.00 per item

Overdraft Item Returned (NSF) 5

Item Amount

$5.00 or less

no charge

$5.01 or greater

$36.00 per item

Extended Overdraft Fee

(Charged beginning on the 8th calendar day

and each week thereafter if the available

account balance remains below zero.)

$25 per week

Overdraft Protection Transfer Fee6

$12.50

For Gold Checking

$7.50

For Platinum Checking

no charge

__________________________________________________________

Photocopy Requests

Copy of Check, or other items

$2.00 per item

Copy of Statement

$6.00 per statement

__________________________________________________________

Miscellaneous Checking, Savings

or Money Market Fees (contd)

Returned Deposited Item or Cashed Check

$19.00

__________________________________________________________

Statement Fees (Per Statement Cycle)

Statements with Check Images7

$2.00

Statements with Check Return7

$6.00

Paper Statement (Student Checking Only)

$2.00

__________________________________________________________

Foreign Checks/Currency Fees

Checks Deposited in Foreign Currency on Foreign Banks

Checks on Canadian Banks

up to $0.50

Checks on Select Countries/Banks*

$1.00

Checks over $10,000 USD equivalent

or by arrangement

Collection Basis

Checks on all other Countries/Banks

Collection Basis

Returned Check Fee8

$25.00

Return rate subject to sell rates in effect on return date.

*Contact International Banking at 612-303-7400 for more information.

Other Service Fees

Account Balancing and Research

$30.00/hour

1 hour minimum

__________________________________________________________

Cashiers Check

$7.00

__________________________________________________________

Individual Retirement Account (IRA)

Annual Fee for Plan Balances Below $25,000

CESA Balances Below $5,000

$30.00

Platinum Checking customers

no charge

IRA External Transfer Fee

$30.00 per IRA Plan

__________________________________________________________

Legal Charges

Garnishments

$100.00

Tax Levy & Child Support

$100.00

__________________________________________________________

Personal Money Order

$5.00

__________________________________________________________

Safe Deposit Box Fees

Late Payment (per month)

$10.00

Lock Drilling

$150.00

Invoice Fee

$10.00

__________________________________________________________

Stop Payment

24-month duration

$35.00

__________________________________________________________

Travelers Cheques

2% of purchase

__________________________________________________________

Wire Transfer

Incoming (domestic)

$20.00

Incoming (international)

$25.00

Outgoing (domestic)

$30.00

Outgoing (international)

$50.00

__________________________________________________________

__________________________________________________________

Checks Deposited in U.S. Dollars on Foreign Banks

Checks on Canadian Banks

up to $0.50

Checks on Select Countries/Banks*

$50.00

Checks over $10,000 or by arrangement**

Collection Basis

Checks on all other Countries/Banks**

Collection Basis

**Check subject to review by International Banking.

Returned Check Fee8

$25.00

*Contact International Banking at 612-303-7400 for more information.

__________________________________________________________

Foreign Check Collection8 (incoming/outgoing)

Courier Fee (per check)

$45.00

Initiation Fee (per check)

$40.00

Returned Check Fee

$25.00

__________________________________________________________

Tracer Fee

$25.00

Fee collected on all checks presented, paid and unpaid.

__________________________________________________________

Foreign Currency

Purchase

Next Day Delivery

$10.00

Next Day Priority Delivery

$12.00

Sold

Shipping Charge

$10.00

__________________________________________________________

Foreign Draft Purchase

Next Day Delivery

$12.00

Next Day Priority Delivery

$15.00

Processing Fee

$20.00

Stop Payment Orders

$25.00

__________________________________________________________

Personal Banking

Consumer Pricing Information

Additional Disclosures

1. Non-U.S. Bank ATM owners will apply a surcharge fee unless they participate in the MoneyPass Network.

To find MoneyPass ATM locations, please visit www.moneypass.com.

2. $2.00 per advance assessed when performing a cash advance at any financial institution that accepts Visa.

3. A fee will be assessed for the replacement of a check card plastic when requested more than once

within a 12-month period. Replacement check card includes those cards that are requested to replace a

current check card product with the same card number. Replacement check card does not include ATM

cards, check cards that are lost, stolen or expired. Replacement Card Fee will not apply to replacement

of Private Client Reserve and Ascent Visa Check Cards.

4. To be eligible for DepositPoint, you must be a U.S. Bank Online Banking customer with direct ownership

in a U.S. Bank checking or savings account and have no more than two returned deposited items in the

past three months. The DepositPoint fee is waived for Platinum Checking accounts. Deposit limits and other

conditions may apply. DepositPoint is only available for use within the United States.

5. In the event the available balance at the end of the business day is or would be overdrawn $5.01 or greater,

an overdraft item paid and/or overdraft item returned (NSF) fee(s) may be assessed. In the event the

available balance at the end of the business day is or would be overdrawn $5.00 or less, a fee will not be

assessed. Fees are subject to a daily maximum of 4 overdraft items paid and 4 overdraft items returned

(NSF), a maximum total of 8 per day.

6. If you have linked eligible accounts, and the negative available balance in your checking account is $5.01 or

more, the advance amount will transfer in multiples of $50. If however, the negative available balance is

$5.00 or less, the amount advanced will be $5.00 and the Overdraft Protection Transfer Fee will be waived.

Refer to Your Deposit Account Agreement, section titled Overdraft Protection Plans, for additional information.

7. Additional fees apply for Statements with Check Images and Statements with Check Return. Check Images

and Check Return is available only with Paper Statements. Accounts with the Senior customer indicator

receive $1.00 discount per statement cycle for Statement with Check Return fee and the Statement with

Check Images fee is waived.

12. The combined balance is the total average account balance of the Silver Checking account

and all Package Money Market Savings accounts you own. The average account balance is

calculated by adding the combined balance at the end of each calendar day during the

statement period, up until and not including the last two business days of the statement

period, and dividing that sum by the number of days used. Business days are Monday through

Friday; federal holidays are not included.

13. The average account balance for Premium and Easy Checking is calculated by adding the

balance at the end of each calendar day in the statement period and dividing that sum by the

total number of calendar days within the statement period.

14. Student enrolled in high school, technical college, trade school or university.

15. ATM Card only, no checks issued and no third party transactions accepted. Refer to Electronic

Transfer Account sales sheet for additional benefits and features.

16. A U.S. Bank Package Money Market Savings account requires you to maintain an open

U.S. Bank Silver, Gold or Platinum Package Checking account with at least one common

account holder on each account. The Package Money Market Savings account will be converted

to a U.S. Bank Standard Savings account if the Silver, Gold or Platinum Package Checking

account is closed or transferred to a different non-qualifying product.

17. The daily ledger balance is the balance at the end of each business day, equal to the beginning

balance for that day plus the current business day credits, minus the current business day

debits. Business days are Monday through Friday; federal holidays are not included.

18. The average monthly collected balance is calculated by adding the principal in the account

for each calendar day in the statement period and dividing that figure by the total number of

calendar days in the statement period.

19. Must have a U.S. Bank personal checking account to qualify.

20. Account will be converted to Standard Savings when minor reaches 18 years of age.

8. Any additional Foreign Bank fees incurred while processing will be charged to the depositors account.

9. Combined deposit balances include the average monthly collected balances for U.S. Bank

personal checking, savings, money markets, CDs and IRAs. Outstanding credit balances

include U.S. Bank personal purpose loans (excluding some indirect loans), U.S. Bank

Mortgages, U.S. Bank Home Equity Loans and Lines of Credit, U.S. Bank Premier Line and

U.S. Bank Credit Cards. Investment balances include the aggregate minimum daily balance

of all investment types held through the statement period with U.S. Bancorp Investments.

10. Variable rate account. Interest rates are determined at the banks discretion and can change

at any time. See the Current Deposit Rates for disclosures on rates, compounding and

crediting, and other balance information.

Federal Regulation D limits certain types of withdrawals and transfers made from a

savings or money market account to a combined total of six per account cycle. This

includes withdrawals made by check or draft to third parties; debit or ATM card

point-of-sale (POS) purchases; and pre-authorized withdrawals such as automatic

transfers for overdraft protection and transfers made by telephone, online banking,

mobile banking, bill pay, wire and facsimile. Withdrawals and/or transfers exceeding

the six per account cycle allowance, will result in a $15 excessive withdrawal fee per

transaction. If limitations are continuously exceeded, it may result in conversion to an

Easy Checking account. Withdrawals and transfers made in person at a U.S. Bank

branch or at an ATM are not included in the limit of six per account cycle.

24 Hours a Day

Day,,

7 Days a W

Week.

eek.

Branch and A

ATM

TM

More

Mor

e than 3,080 branches in 25 states

Free

Fr

ee access at mor

more

e than 5,000

5,000 U.S.

U.S. Bank

ATMs and no surcharges

surcharges at more

more than 23,000

ATMs

MoneyPass 1 A

ATMs

TMs

Online

usbank.com

Mobile

U.S. Bank Mobile

U.S.

Phone

Cincinnati

Denver

Milwaukee

Minn./St. Paul

Portland

St. Louis

800.USBANKS (872.2657)

513.632.4141

303.585.8585

414.765.4636

612.USBANKS (872.2657)

503.USBANKS (872.2657)

314.425.2000

Outside the U.S.

503.401.9991 (call collect)

503.401.9991

Areas 800.685.5065

TDD-All Areas

11. Includes U.S. Bank: personal purpose loans, Home Equity Loans, Home Equity Line of Credit,

Premier Line, Home Mortgage and activated Credit Cards. (U.S. Bank Reserve Line of Credit

and Student Loans are excluded). Mortgage and Credit products are subject to eligibility

requirements and normal credit approval. Mortgage and Credit products may be subject

to additional charges such as annual fees. Please refer to the credit agreement for full details.

Investment products and services are:

U.S. Bank, U.S. Bancorp Investments and their representatives do not provide tax or legal advice. Each

individuals tax and financial situation is unique. Clients should consult their tax or legal advisor for

advice and information concerning their particular situation.

For U.S. Bank:

For a comprehensive list of all pricing, terms and policies see the Consumer Pricing Information brochure, the Your Deposit Account Agreement and the Personal Banking

brochure. Other conditions and restrictions may apply. Terms may change without notice.

Deposit and Mortgage products, Home Equity Loans and Lines of Credit and Credit Cards

are offered through U.S. Bank National Association. Member FDIC

*For U.S. Bancorp Investments: Investment products and services are available through

U.S. Bancorp Investments, the marketing name for U.S. Bancorp Investments, Inc., member FINRA

and SIPC, an investment adviser and a brokerage subsidiary of U.S. Bancorp and affiliate of U.S. Bank.

.com/usbank

.co

m/usbank

Deposit products offered by U

U.S.

.S. Bank Na

National

tional Associa

Association.

tion. Member FDIC.

National

Association.

Credit products offered by U.S. Bank Na

tional Associa

tion.

2014 U.S. Bank

41862 2/14

Você também pode gostar

- Consumer Pricing Information BrochureDocumento5 páginasConsumer Pricing Information BrochureKristian LAinda não há avaliações

- PNC - Consumer Schedule of Service Charges and FeesDocumento4 páginasPNC - Consumer Schedule of Service Charges and FeesblarghhhhAinda não há avaliações

- Bac Core Checking EnusDocumento2 páginasBac Core Checking Enusapi-285070305Ainda não há avaliações

- Salem Five Direct Consumer Banking Fee ScheduleDocumento2 páginasSalem Five Direct Consumer Banking Fee ScheduleshoppingonlyAinda não há avaliações

- BofA CoreChecking en ADADocumento2 páginasBofA CoreChecking en ADAFrank TilemanAinda não há avaliações

- RBC account service fee and interest rate changes effective June 1Documento8 páginasRBC account service fee and interest rate changes effective June 1legolas55569Ainda não há avaliações

- Deposit ProductsDocumento14 páginasDeposit ProductssupportAinda não há avaliações

- 3584 CS MyAccess ALL 8 2013Documento2 páginas3584 CS MyAccess ALL 8 2013rasheed-aliAinda não há avaliações

- Chase FeeDocumento5 páginasChase FeePeter Ruliang YanAinda não há avaliações

- How to Avoid Hidden Fees on Credit Cards and Bank AccountsDocumento2 páginasHow to Avoid Hidden Fees on Credit Cards and Bank AccountsFlaviub23Ainda não há avaliações

- Hit Me UpDocumento20 páginasHit Me Upapi-374831403Ainda não há avaliações

- PB Fees and ChargesDocumento32 páginasPB Fees and ChargesechipbkAinda não há avaliações

- Yield Pledge Checking: Account Opening & UsageDocumento2 páginasYield Pledge Checking: Account Opening & Usageshenzo_Ainda não há avaliações

- Understanding Bank of America Interest Checking: An Overview of Key Policies and FeesDocumento2 páginasUnderstanding Bank of America Interest Checking: An Overview of Key Policies and FeesGheorghiu GheorgheAinda não há avaliações

- No Monthly Fees or Minimums for Asterisk-Free Checking AccountDocumento3 páginasNo Monthly Fees or Minimums for Asterisk-Free Checking AccountMarcells Danyel JordanAinda não há avaliações

- 2013 Fee Comparison Guide: Description Old Fee New FeeDocumento1 página2013 Fee Comparison Guide: Description Old Fee New FeeBernewsAdminAinda não há avaliações

- Jan 28-Feb 24, 2010: Account ActivityDocumento3 páginasJan 28-Feb 24, 2010: Account ActivityAna OdenAinda não há avaliações

- Schedule of Charges: Smart Salary ExclusiveDocumento2 páginasSchedule of Charges: Smart Salary ExclusivevedavakAinda não há avaliações

- Bank Accounts: What You Should KnowDocumento36 páginasBank Accounts: What You Should KnowthiruvenuAinda não há avaliações

- SessionDocumento7 páginasSessionVinay YelluriAinda não há avaliações

- Yes Bank Smart SalaryDocumento2 páginasYes Bank Smart SalaryVicky SinghAinda não há avaliações

- Credit Card ActvitiesDocumento9 páginasCredit Card ActvitiesNickAinda não há avaliações

- Student Guide Lesson EightDocumento9 páginasStudent Guide Lesson EightKhosrow KhazraeiAinda não há avaliações

- Yes Bank - Schedule of Charges - Savings Select AccountDocumento2 páginasYes Bank - Schedule of Charges - Savings Select AccountBOOMTIMEAinda não há avaliações

- Shopping For CreditDocumento8 páginasShopping For CreditmooAinda não há avaliações

- 2016 Personal Schedule FeesDocumento24 páginas2016 Personal Schedule FeescampeonpcAinda não há avaliações

- Weston Brown - L4Activities5Documento9 páginasWeston Brown - L4Activities5Weston BrownAinda não há avaliações

- Bank Accounts: What You Should KnowDocumento36 páginasBank Accounts: What You Should Knowrohit7853Ainda não há avaliações

- Shopping For CC HatchDocumento4 páginasShopping For CC Hatchapi-299234513Ainda não há avaliações

- Netspend All-Access Account: Monthly UsageDocumento2 páginasNetspend All-Access Account: Monthly UsageSam BojanglesAinda não há avaliações

- New Balance CR$800.00 Minimum Payment Due $0.00 Payment Not RequiredDocumento6 páginasNew Balance CR$800.00 Minimum Payment Due $0.00 Payment Not RequiredKevin Diaz100% (1)

- Account Opening DisclosuresDocumento8 páginasAccount Opening DisclosuresEliseu Simplicio de OliveiraAinda não há avaliações

- Schedule of Charges: Savings ValueDocumento2 páginasSchedule of Charges: Savings ValueNavjot SinghAinda não há avaliações

- Shopping For CreditDocumento4 páginasShopping For Creditapi-372302973Ainda não há avaliações

- Easy Checking SnapshotDocumento2 páginasEasy Checking SnapshotsupportAinda não há avaliações

- July 2013: Current, Call and Savings AccountsDocumento1 páginaJuly 2013: Current, Call and Savings AccountsBala MAinda não há avaliações

- Student-Guide-Lesson-Eight 3Documento9 páginasStudent-Guide-Lesson-Eight 3api-344973256Ainda não há avaliações

- Rapid Meta Visa Fixed 2 - 194007202 - CHA Online Bundle - 05935-30-900Documento12 páginasRapid Meta Visa Fixed 2 - 194007202 - CHA Online Bundle - 05935-30-900Valeria M.SAinda não há avaliações

- Learn payroll card fees and alternativesDocumento4 páginasLearn payroll card fees and alternativesJonathan GameroAinda não há avaliações

- Terms ElitePremCreditCardDocumento1 páginaTerms ElitePremCreditCardAaron Aureliano VijayanAinda não há avaliações

- Fees and Charges GuideDocumento3 páginasFees and Charges GuideShashank AgarwalAinda não há avaliações

- RetailfeescheduleDocumento2 páginasRetailfeeschedulecabbattAinda não há avaliações

- Summary of Rates and FeesDocumento2 páginasSummary of Rates and Fees7fr8cr5wt2Ainda não há avaliações

- PreQual - Celtic.bank.300. .1000.terms - And.conditionsDocumento5 páginasPreQual - Celtic.bank.300. .1000.terms - And.conditionsDonald PetersonAinda não há avaliações

- Rightrespcc EngDocumento20 páginasRightrespcc Engapi-200845891Ainda não há avaliações

- JPMorgan Chase Bank statement summaryDocumento6 páginasJPMorgan Chase Bank statement summaryNelson Lanyuy67% (3)

- Overview of Regular Savings Key Policies and Fees: Bank of America Clarity StatementDocumento2 páginasOverview of Regular Savings Key Policies and Fees: Bank of America Clarity StatementJacob DaleAinda não há avaliações

- American Express Amex Blue Cash EveryDay Card Benefits and AgreementDocumento24 páginasAmerican Express Amex Blue Cash EveryDay Card Benefits and AgreementGreg JohnsonAinda não há avaliações

- Victorias Secret Angel Credit CardDocumento21 páginasVictorias Secret Angel Credit Cardapi-285771275Ainda não há avaliações

- Bank Alfalah Islamic Banking Schedule of Charges July-Dec 2013Documento14 páginasBank Alfalah Islamic Banking Schedule of Charges July-Dec 2013krishmasethiAinda não há avaliações

- Account Opening DisclosuresDocumento9 páginasAccount Opening DisclosuresEAZY CHARAinda não há avaliações

- Boa CardDocumento5 páginasBoa Cardapi-285069637100% (1)

- Member Business Account Fee Schedule: EmbershipDocumento1 páginaMember Business Account Fee Schedule: EmbershipMikey ZhouAinda não há avaliações

- En Fair Fees ScheduleDocumento3 páginasEn Fair Fees ScheduleHassan AliAinda não há avaliações

- Minimum Payment Due $332.46Documento4 páginasMinimum Payment Due $332.46Anonymous ZgROrLNLCjAinda não há avaliações

- 730462222Documento20 páginas730462222Tank ZillaAinda não há avaliações

- CC DCBDocumento7 páginasCC DCBHugo DivalAinda não há avaliações

- Credit and Charge CardsDocumento5 páginasCredit and Charge CardsatilabAinda não há avaliações

- Account Opening DisclosuresDocumento7 páginasAccount Opening DisclosuresLauren EgasAinda não há avaliações

- You’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountNo EverandYou’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountNota: 2 de 5 estrelas2/5 (1)

- StopUsingEQWrong PDFDocumento47 páginasStopUsingEQWrong PDFpaciughino1974Ainda não há avaliações

- Audiobox Ione and Itwo: Owner'S ManualDocumento56 páginasAudiobox Ione and Itwo: Owner'S ManualCarlos Matute NeavesAinda não há avaliações

- StopUsingEQWrong PDFDocumento47 páginasStopUsingEQWrong PDFpaciughino1974Ainda não há avaliações

- Energy Forms and ChangesDocumento4 páginasEnergy Forms and ChangesCarlos Matute NeavesAinda não há avaliações

- Notion 6 User Guide PDFDocumento285 páginasNotion 6 User Guide PDFCarlos Matute NeavesAinda não há avaliações

- Aztec MusicDocumento25 páginasAztec MusicCarlos Matute NeavesAinda não há avaliações

- StopUsingEQWrong PDFDocumento47 páginasStopUsingEQWrong PDFpaciughino1974Ainda não há avaliações

- Energy Forms and ChangesDocumento4 páginasEnergy Forms and ChangesCarlos Matute NeavesAinda não há avaliações

- StopUsingEQWrong PDFDocumento47 páginasStopUsingEQWrong PDFpaciughino1974Ainda não há avaliações

- Música de MariachiDocumento40 páginasMúsica de MariachiAdelaido Alvarez Morán67% (3)

- EssayHellPromptsPrimer2016 17Documento77 páginasEssayHellPromptsPrimer2016 17Carlos Matute Neaves100% (1)

- Analyzing DataDocumento4 páginasAnalyzing DataCarlos Matute NeavesAinda não há avaliações

- Owner's Manual: Stage PianoDocumento60 páginasOwner's Manual: Stage PianoDante PiccinelliAinda não há avaliações

- Merengue Moderno Piano BasicDocumento8 páginasMerengue Moderno Piano BasicJorge Luis Montiel100% (1)

- PhetDocumento4 páginasPhetCarlos Matute NeavesAinda não há avaliações

- Summer NightDocumento1 páginaSummer NightCarlos Matute NeavesAinda não há avaliações

- Free Travel Agency Business Plan TemplateDocumento17 páginasFree Travel Agency Business Plan TemplateSteph Lee87% (31)

- Starsky and Hutch PDFDocumento2 páginasStarsky and Hutch PDFCarlos Matute NeavesAinda não há avaliações

- 1-2-3 (6-10-18) - Bass GuitarDocumento3 páginas1-2-3 (6-10-18) - Bass GuitarCarlos Matute NeavesAinda não há avaliações

- 1-2-3 (6-10-18) - Baritone SaxDocumento2 páginas1-2-3 (6-10-18) - Baritone SaxCarlos Matute NeavesAinda não há avaliações

- Sibelius 7 ReferenceDocumento780 páginasSibelius 7 ReferenceGRB2100% (1)

- Peruvian GroovesDocumento3 páginasPeruvian GroovesCarlos Matute Neaves100% (1)

- Foggy Day ChoirDocumento5 páginasFoggy Day ChoirCarlos Matute NeavesAinda não há avaliações

- Tameri Guide For Writers - Words To AvoidDocumento3 páginasTameri Guide For Writers - Words To AvoidCarlos Matute NeavesAinda não há avaliações

- Josef Matthias Hauer's Melischer Entwurf - Reinhardt, LauriejeanDocumento8 páginasJosef Matthias Hauer's Melischer Entwurf - Reinhardt, LauriejeanJuan Andrés Palacios100% (1)

- Piano GuideDocumento8 páginasPiano GuideCarlos Matute NeavesAinda não há avaliações

- A Modern Physiological Approach To Piano Technique in Historical ContextDocumento204 páginasA Modern Physiological Approach To Piano Technique in Historical Contextjgwlaos100% (14)

- Hang Up Your HangupsDocumento1 páginaHang Up Your HangupsCarlos Matute NeavesAinda não há avaliações

- How To Deal With A Codependent Family Member - 7 StepsDocumento4 páginasHow To Deal With A Codependent Family Member - 7 StepsCarlos Matute NeavesAinda não há avaliações

- Nay Nay's PrivateDocumento1.203 páginasNay Nay's Privatemriley@gmail.comAinda não há avaliações