Escolar Documentos

Profissional Documentos

Cultura Documentos

FDI in South East Asia

Enviado por

Nina SantikaDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

FDI in South East Asia

Enviado por

Nina SantikaDireitos autorais:

Formatos disponíveis

Available online at www.sciencedirect.

com

ScienceDirect

Procedia Economics and Finance 15 (2014) 903 908

Emerging Markets Queries in Finance and Business

The foreign direct investments in South-East Asia during the last

two decades

Laura Diaconu (Maxim)a,*

a

Faculty of Economics and Business Administration, Alexandru Ioan Cuza University of Iasi, Carol I Avenue, no. 22, Iasi 700505,

Romania

Abstract

Foreign direct investments have played an important role in the economic development of ASEAN states, especially after

the 1990s. However, the two economic crises, from 1997 and 2007, have significantly influenced the investments inflows

in South-East Asia, each country from the region experiencing a different evolution of the FDI. The purposes of the present

paper are to analyse the trends of the ASEANs inward FDI between 1990 and present, by identifying the factors that have

encouraged or discouraged these flows in the context of the two crises, and to estimate the possible future evolution of these

investments. In order to achieve these purposes, we have analysed and interpreted information included in several statistical

reports, data-bases and year-books. The conclusions underline that, despite the economic downturns, South-East Asia will

continue to attract the investors due to its competitive advantages.

2014 The

Publishedby

by Elsevier

Elsevier B.V.

is an open

accesspeer-review

article under the

CC BY-NC-ND

license

Authors.

2013 Published

Ltd.This

Selection

and/or

under

responsibility

of Emerging

(http://creativecommons.org/licenses/by-nc-nd/3.0/).

Markets Queries in Finance and Business local organization.

Selection and peer-review under responsibility of the Emerging Markets Queries in Finance and Business local organization

Keywords: South-East Asia; foreign direct investments; economic crisis; reforms;

1. Introduction

The foreign direct investments (FDI) have played an important role in the economic development of the

South-East Asia over the last two decades, as a source of capital and technological know-how. These countries

have benefited of the foreign direct investments made not only by their neighbors, such as Japan or the newly

industrializing economies (like the Chinese Taipei), but they have also attracted investments from the rest of

the OECD, notably the United States and Europe. With high economic development achievements during the

* Laura Diaconu (Maxim). Tel.: +4-023-220-1399.

E-mail address: dlaura_es@yahoo.com.

2212-5671 2014 The Authors. Published by Elsevier B.V. This is an open access article under the CC BY-NC-ND license

(http://creativecommons.org/licenses/by-nc-nd/3.0/).

Selection and peer-review under responsibility of the Emerging Markets Queries in Finance and Business local organization

doi:10.1016/S2212-5671(14)00554-1

904

Laura Diaconu (Maxim) / Procedia Economics and Finance 15 (2014) 903 908

period 1991-1997, the FDI inflows to South-East Asia (ASEAN) have reached about 8% of the global foreign

direct investments, being placed among the worlds largest recipients of FDI in the 1990s.

However, the attention of the investors shifted away from South-East Asia after the 1997-1998 regional

economic collapse. It was the moment when the international investment patterns have changed dramatically

and the FDI flows started to move to developed countries. Therefore, we may notice that during the period

1998-2001, the FDI flows into ASEAN declined sharply, the percentage of the FDI inflows to this region from

the global FDI has fallen significantly to 2,76% in 2001 (from 7,85% in 1996). Meanwhile, a significant

deterioration of the economic growth could be seen in some ASEAN member countries, in the end of the XXth

century. However, the revival of the economic growth after the crisis has not been waited for long, since the

exit of the economic reform has boosted the FDI flows into ASEAN. The success of some South-Eastern Asian

states in attracting investments during the nowadays global economic downturn demonstrates that the reforms

implemented after the Asian crisis have made many ASEAN states much more resistant against the external

shocks.

2. Aim, objectives and research methodology

The aim of the present paper is to analyse the evolution of the FDI in South-East Asia since 1990, taking

into consideration the two economic downturns that have occurred since then: the 1997 and 2007 crisis.

Considering these aspects, the main objectives of the research are:

To identify the trend of the FDI in ASEAN between 1990 and 1997;

To analyse the foreign direct investments in the region after the 1997 crises started, by identifying the

factors that have encouraged or discouraged the investors;

To determine the evolution of these investments inflows in the context of the nowadays crisis.

In order to achieve the established objectives, we have collected, tabulated, analysed and interpreted the

information included in several statistical reports, data-bases and year-books.

3. Results and discussions

3.1. Foreign direct investments in South-East Asia before 1997

Analyzing the statistical information regarding the evolution of FDI in ASEAN 4 (Malaysia, Indonesia,

Thailand and Philippine), we could notice that the region has been a major recipient of foreign direct

investments until 1997. However, the amount of the investments attracted by Philippines was smaller than of

the other three states. This situation is understandable considering the fact that until the 1990s the country did

not generally welcome the foreign investors.

South-East Asias success in attracting FDI was mainly as an export platform because, with the exception of

Indonesia, the markets were too small to welcome much market-seeking investments, especially Singapore and

Malaysia, and, at that time, the regional integration was not sufficient. Despite these drawbacks, the export

platform strategy had a great success.

Foreign investors in ASEAN 4 were mainly attracted by those sectors that have registered the fastest export

growth. Therefore, the ASEAN 4 members were able to shift quickly towards manufacturing-based countries in

which the economic growth was driven by the fast expanding exports. As Thomsen, Otsuka and Lee (2011)

have noticed, the region was gradually integrated into the world economy and became a global production

platform, with the help of the increasing influx of foreign direct investments into the export-oriented industries.

Actually, these large inflows of foreign investments started to become more visible since the end of the 1980s,

when companies from Japan and the Newly Industrializing Economies (NIEs) became interested in settling the

Laura Diaconu (Maxim) / Procedia Economics and Finance 15 (2014) 903 908

production bases abroad, in order to escape from the appreciation of their currencies and from the loss of

preferential access to many OECD markets (for the NIEs).

In the Table 1 could be noticed that the ASEAN 4 members have been considered together among the most

important destinations for the FDI outside of the OECD area, between 1990 and 1997, being placed on the fifth

position. However, they were still situated far behind China.

Table 1. Top 5 according to the total FDI inflows between 1990 and 1997 (in million USD)

Country

Value of FDI inlows (million $)

USA

414074

China

200578

UK

176889

France

149587

ASEAN 4 (Malaysia, Indonesia, Thailand, Philippine)

84417

Source: Adapted from OECD, Working Paper on International Investment, 1999, http://www.oecd.org/indonesia/1897793.pdf

However, despite the emergence of China after 1991, the ASEAN share of the total stock of FDI in

developing countries (excluding tax havens in the Caribbean) has registered a positive trend during the end of

the last century, increasing from about 8% in 1986 to more than 20% in 1996 (UNCTAD, 1998).

Until 1997, Singapore remained by far the largest recipient of FDI in the region. Up to the middle of the

1990s, Malaysia had almost 1/4 of the total inflows into ASEAN, while the shares of Indonesia, Thailand and

the Philippines remained far below the percentage of Malaysia. According to UNCTAD (1998), in the first half

of the 1990s, the net capital inflow relative to gross domestic capital formation represented more than 19% in

Malaysia, 30% in Singapore, 10% in the Philippines and 4% in Thailand.

Over the time, the evolution of the foreign investments has been influenced not only by the external

conditions but also by the internal environment of the ASEAN countries. The policies implemented in each

ASEAN state have largely determined the distribution of these inflows within the region. For example, while

Malaysia has shifted the export promotion within the ASEAN 4 into a constant ability to attract investments

made by the export-oriented firms, Thailand has attracted both market-seeking and export oriented investors.

Meanwhile, most of the Indonesias success could be related to the oil and gas sector.

3.2. FDI in South-East Asia between 1997 and 2007

The Asian financial crisis that has started in 1997 has generated a slowdown in the FDI inflows into the

ASEAN countries. The worse affected by the crisis seemed to be Malaysia, if we compare the level of the FDI

attracted by it immediately after 1997 to the level of the previous two decades and to other major FDI-receiving

countries from the region. A possible explanation for this situation could be given by the fact that the

Malaysian economy is caught into a middle-income trap: it is no longer able to compete with China or other

countries that have a low-cost production and, moreover, it lacks the innovative ability and skills to specialize

in the high-end tasks in the global production networks of the region (World Bank 2011).

Even if in Indonesia and Thailand the magnitude of the foreign direct investments recession was not

comparable to that of Malaysia, these two countries were also negatively influenced by the economic and

financial downturn. Actually, the decline in the FDI attracted by Malaysia, Thailand and Indonesia could be

seen until the end of 2001.

905

906

Laura Diaconu (Maxim) / Procedia Economics and Finance 15 (2014) 903 908

An explanation for the foreign direct investments decreasing trend in ASEAN region at the end of the XXth

century could be given by the fact that the volume of the FDI, as that of trade, increases together with the GDP

and diminishes with the resistance posed by geographic and policy barriers. These barriers refer especially to

the regulations and institutions, to the education level and to the innovation capability. To all these, another

significant element could be added - the distance, which involves costs related to information, communication

and corporate control (Eichengreen and Tong 2007).

According to Eichengreen and Tong (2007), another possible explanation for the reduction of the FDI

inflows into the ASEAN countries after 1997 could be the fact that a large amount of FDI was attracted by

China. However, this argument is largely debated, some other analysts considering that China has actually

helped the ASEAN countries, by attracting the investors in the region (Cheong and Plummer, 2009). As

Thomsen (2004) has noticed, FDI is not a zero sum game, with one country gaining at the expense of all

others. Investments in China can stimulate greater FDI throughout East Asia, acting like a regional magnet for

investors much as Singapore has done within ASEAN (Thomsen, 2004).

As resulting from the statistical reports, starting with 2003, the ASEAN states were prepared to attract the

foreign capital. The FDI inflows to South-East Asia have significantly increased from 17.33 billion U.S. dollars

in 2002 to 24.84 billion U.S. dollars in 2003. In 2007, the amount of the FDI has reached a peak of 73.97

billion U.S. dollars, meaning 3.52% of global FDI. With this statistics, the ASEAN countries share of the

world GDP has regained its pre-crisis position, reaching 2.5% of global GDP.

However, after 2000, it was noticed that most of the investors in the ASEAN region have been attracted

especially by Singapore and Thailand, Malaysia continuing to lose ground after the financial crisis from 1997.

Indonesia, which has also faced a significant contraction of FDI inflows between 1998 and 2000, has regained

the credibility in front of the investors after 2000.

This positive evolution of the investments flows was a result of the ASEANs reforms in FDI laws and

regulations, as they opened further to foreign investments.

3.3. The foreign investments evolution in ASEAN after 2007

The global economic crisis from 2007-2008 have hit again the FDI flows into ASEAN, their value dropping

sharply from almost 74 billion U.S. dollars in 2007 to 49.49 billion U.S. dollars in 2008 and to 39.62 billion

U.S. dollars in 2009. Meanwhile, it can be noticed that, despite the fact that global FDI has fallen from 2100

billion U.S. dollars in 2007 to 1114 billion U.S. dollars in 2009, China and India have still remained very

attractive for the foreign investors during this period.

As a result of the different degrees of the external economic dependency and market liberalization within the

region, the ASEAN states were uneven influenced by the global crisis. The more an economy was connected to

the external demand, the more significant was the loss in terms of the FDI inflows. Considering this aspect, it is

easy to understand why the investments attracted by Singapore and Malaysia have sharply decreased.

Meanwhile, the relatively large economies, more dependent on the internal demand, like Indonesia, Philippines

and Vietnam were less adversely affected. However, no matter the magnitude of the impact, the recovery was

very rapid: the severe drop in FDI inflows into ASEAN between 2008 and 2009 was compensated by the

recovery that started in 2010, when the total inflows have returned to the level gained in 2007 - the historic

peak for their inflows. South-East Asia has seen a big revival of the FDI inflows thanks to the flexible rules,

sustained growth and greater political and economic stability. Inflows to the 10 ASEAN countries more than

doubled in 2010, when they reached the value of 79 billion USD. This positive trend was led especially by the

sharp increases in Indonesia, Singapore, Philippines, Malaysia and Thailands inflows (see Table 2).

The same evolution could also be seen in 2011, when the inflows received by South-East Asia were around

92 billion USD, meaning an almost 14% increase, compared to 2010. These good performances of the region

were driven again by the sharp increases of the FDI inflows to Indonesia, Malaysia, Singapore and Thailand.

Laura Diaconu (Maxim) / Procedia Economics and Finance 15 (2014) 903 908

However, some low-income ASEAN states, like Cambodia, the Lao Peoples Democratic Republic and

Myanmar, had also success in attracting the foreign investments.

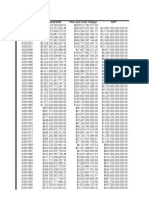

Table 2. Distribution of FDI flows among countries, by range*, in 2010

Range

Inflows

Above 50 billion UDS

China and Hong-Kong

10 to 49 billion UDS

Singapore, India, Indonesia

1 to 9,9 billion UDS

Malaysia, Vietnam, Korea, Thailand, Iran, Macao, Taiwan, Pakistan, Philippines, Mongolia

0,1 to 0,9 billion UDS

Bangladesh, Cambodia, Myanmar, Brunei, Sri Lanka, Timor-Leste, Maldives, Lao

Below 0,1 billion UDS

Afghanistan, Nepal, Bhutan

*The countries are listed according to the size of their FDI inflows

Source: Adapted from Chandran, R., FDI in focus: South-East Asia surprises, Financial Times, 2011, http://tilt.ft.com/#!posts/201108/27696/fdi-focus-southeast-asia-surprises

An annual survey conducted by UNCTAD in 2012 shows that Indonesia and Thailand started to become

preferred by the transnational corporations as host economies, fact which proves that there are strong chances

for further increases in FDI inflows to the two countries, in the next years. The statistics show that up to now,

the amount invested by the multinational companies from OECD states in ASEAN countries - more than 320

billion USD, overpasses the sum received by China and India considered together. These data demonstrate that

ASEAN has a growing role in the global production networks.

Moreover, the ASEAN states are continuing the economic reforms, which also include an improvement in

their investments environment, being aware of the fact that the FDI could help them sustain the growth.

ASEAN member states have already signed the ASEAN Comprehensive Investment Agreement in 2009 and

are trying to establish the ASEAN Economic Community by 2015. The purpose of this Community will be to

transform ASEAN into an integrated region with free movement of goods, services, investments, skilled labor

and freer flows of capital (Hoang, 2012).

4. Conclusions

During time, the evolution of the foreign investments has been influenced not only by the external

environment but also by the internal political conditions from each ASEAN country. The statistics show that

the ASEAN 4 have been a major destination for the FDI until 1997. The investors from all over the world have

considered the region a good location for their production, especially because it had an important role as an

export platform.

However, the Asian crisis from 1997-1998 induced a slowdown in the FDI inflows into the ASEAN

countries. Malaysia seemed to be the worst affected by the crisis but, looking at the numbers, it could be seen

that Indonesia and Thailand have also experienced a decrease in the investments inflows. This negative trend

of the FDI attracted by the three states did not last for long since the FDI inflows to South-East Asia regained a

positive evolution after 2002. The peak of the FDI inflows was reached in 2007, when they totaled 3.52% of

the global FDI amount. This ascending trend of the investments inflows could be partly explained by the

reforms implemented in the ASEAN states, regarding the FDI laws and regulations, meant to open further the

economies to the foreign investors.

The global financial and economic downturn from 2007-2008 have hit again the FDI inflows to ASEAN,

their value dropping sharply. However, the magnitude of the crisis was not the same for all these countries. Yet,

907

908

Laura Diaconu (Maxim) / Procedia Economics and Finance 15 (2014) 903 908

for all of them, the recovery seemed to be very rapid, since the total inflows into this region have reached, in

2010, the maximum level obtained in 2007.

As shown in various studies conducted on the multinational companies, some of the South-East Asian states

started to become preferred by these corporations as host economies, fact that allows us to assume that there are

strong chances for further increases in FDI inflows to the region, in the next years. This trend is positively

influenced by the economic reforms that the ASEAN states continue to implement, which are focused on

improvements in their investments environment.

Considering these last aspects, it would be interesting to investigate, in a future research, if these

assumptions will prove to be true and if ASEAN will compete with China and, maybe, with the states from the

Central and Eastern Europe, for the first place in the top of the most attractive FDI destinations.

References

Athukorala, P., 2003. FDI in crisis and recovery: Lessons from the 1997-98 Asian financial crisis, Australian Economic History Review,

43(2), p. 197-213.

Chandran, R., 2011. FDI in focus: South-East Asia surprises, Financial Times, http://tilt.ft.com/#!posts/2011-08/27696/fdi-focus-southeastasia-surprises, accessed on January 2013.

Cheong, D., Plummer, M., 2009. FDI effects of ASEAN integration, Munich Personal RePEc Archive Paper no. 26004, http://mpra.ub.unimuenchen.de/26004/, accessed on January 2013.

Eichengreen, B., Tong, H., 2007. Is Chinas FDI coming at the expense of other countries?, Journal of the Japanese and International

Economies 21, p. 153-172.

Gomez, E. T., 2011. The Politics and Policies of Corporate Development: Race, Rents and Redistribution in Malaysia, in Graduating

from the Middle: Malaysias Development Challenges, Hill, H., Tham, S-Y & Ragayah, H. M. Z. (Eds.), London: Routledge.

Hoang, H.H., 2012. Foreign direct investment in South-East Asia: determinants and spatial distribution, Centre of Studies and Research on

International Development.

OECD, 1999. Working Paper on International Investment, http://www.oecd.org/indonesia/1897793.pdf , accessed on July 2008.

Thomsen, S., 2004. Investment incentives and FDI in selected countries, International Investment Perspectives, OECD, Paris.

Thomsen, S., Otsuka, M. & Lee, B., 2011. The Evolving Role of Southeast Asia in Global FDI Flows, Center for Asian Studies.

UNCTAD, 1998. World Investment Report, http://unctad.org/en/Docs/wir1998_en.pdf, accessed on January 2008.

UNCTAD, 2012. New records for Foreign direct investment inflows to east and south-east asia, Press Release,

http://unctad.org/en/Pages/PressRelease.aspx?OriginalVersionID=81&Sitemap_x0020_Taxonomy=640, accessed on January 2013.

World Bank, 2011. Malaysia Economic Monitor. Washington DC: World Bank.

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- 7910 Location IndicatorsDocumento286 páginas7910 Location Indicatorsvicrattlehead2013Ainda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- ISIC Rev 4 Publication PDFDocumento307 páginasISIC Rev 4 Publication PDFGiiang Hoàng0% (1)

- Pan Africa & World Review 1Q2010Documento337 páginasPan Africa & World Review 1Q2010Muhammed KamilAinda não há avaliações

- TaxationDocumento24 páginasTaxationNina SantikaAinda não há avaliações

- Pengaruh PMDN Dan PMA Terhadap PADDocumento84 páginasPengaruh PMDN Dan PMA Terhadap PADNina SantikaAinda não há avaliações

- Relevance FDI For Sustainable DevelopmentDocumento6 páginasRelevance FDI For Sustainable DevelopmentNina SantikaAinda não há avaliações

- Determinents of FDI in PakistanDocumento14 páginasDeterminents of FDI in PakistanGhulam MujtabaAinda não há avaliações

- 1 Dampak Program Minapolitan Terhadapat Pendapatan Usahatani Rumput Laut Kecamantan Tinangguea SultengDocumento11 páginas1 Dampak Program Minapolitan Terhadapat Pendapatan Usahatani Rumput Laut Kecamantan Tinangguea SultengNina SantikaAinda não há avaliações

- Ricardian Model PDFDocumento1 páginaRicardian Model PDFNina SantikaAinda não há avaliações

- The Economics of Fishing and Understanding Fisher BehaviorDocumento23 páginasThe Economics of Fishing and Understanding Fisher BehaviorArif RachmanAinda não há avaliações

- Analisis Peran Multi Aktor Dalam Implementasi Kebijakan Minapolitan Berbasis Sustainable DevelopmentDocumento9 páginasAnalisis Peran Multi Aktor Dalam Implementasi Kebijakan Minapolitan Berbasis Sustainable DevelopmentNina SantikaAinda não há avaliações

- Introduction MacroDocumento16 páginasIntroduction MacroNina SantikaAinda não há avaliações

- Asean & Saarc FrameworksDocumento19 páginasAsean & Saarc FrameworksAnthriqueAinda não há avaliações

- Project On Ethical Values Followed by AmulDocumento9 páginasProject On Ethical Values Followed by AmulRavindra Danane0% (3)

- Understanding CSR in China: Government, Corporations and StakeholdersDocumento5 páginasUnderstanding CSR in China: Government, Corporations and StakeholdersLester Eslava OrpillaAinda não há avaliações

- Health SectorDocumento25 páginasHealth SectorKamalakkannanAinda não há avaliações

- IMFDocumento4 páginasIMFRitwiz RishabhAinda não há avaliações

- Swot For HotelDocumento2 páginasSwot For HotelRobin BahugunaAinda não há avaliações

- Cameroon Cabinet Meeting 30 August 2013Documento4 páginasCameroon Cabinet Meeting 30 August 2013cameroonwebnewsAinda não há avaliações

- Metrology in Short 3rd Ed Serbian - Cyrilic Sept 2008Documento80 páginasMetrology in Short 3rd Ed Serbian - Cyrilic Sept 2008sina123Ainda não há avaliações

- US National Debt 1929-2008Documento6 páginasUS National Debt 1929-2008Rich100% (4)

- Line(s)Documento8 páginasLine(s)TL LeAinda não há avaliações

- Danjugan IslandDocumento5 páginasDanjugan IslandChelsea Shayne AmbrocioAinda não há avaliações

- ISO - ISO 10333-1 - 2000 - Personal Fall-Arrest Systems - Part 1 - Full-Body HarnessesDocumento2 páginasISO - ISO 10333-1 - 2000 - Personal Fall-Arrest Systems - Part 1 - Full-Body Harnessesbonnietrixiee100% (2)

- Trece Martires City Economic ConditionDocumento4 páginasTrece Martires City Economic ConditionIvern BautistaAinda não há avaliações

- How BRICS countries are challenging the global economic status quoDocumento3 páginasHow BRICS countries are challenging the global economic status quoReinAinda não há avaliações

- District Report: Recovery Aceh Nias DatabaseDocumento87 páginasDistrict Report: Recovery Aceh Nias Databaseyahwa ahyarAinda não há avaliações

- AP TourismDocumento16 páginasAP TourismAnudeep ChappaAinda não há avaliações

- Ellis Marshall Global: UK Economy Returns To GrowthDocumento2 páginasEllis Marshall Global: UK Economy Returns To GrowthPR.comAinda não há avaliações

- CEN ISO TR 20173 - en Grouping Syst - American MaterialDocumento61 páginasCEN ISO TR 20173 - en Grouping Syst - American Materialumur kaçamaklı100% (2)

- Agenda Workshop GPWMDocumento3 páginasAgenda Workshop GPWMbbharaniprasadAinda não há avaliações

- Final-Varkala-Draft-Report-On - 25 July 14 PDFDocumento126 páginasFinal-Varkala-Draft-Report-On - 25 July 14 PDFArchana Gopalsamy100% (1)

- India's foreign trade composition and directionDocumento42 páginasIndia's foreign trade composition and directionNeha ThakurAinda não há avaliações

- International Organizations Name, Headquarters and Heads by AffairsCloudDocumento8 páginasInternational Organizations Name, Headquarters and Heads by AffairsCloudsauravAinda não há avaliações

- Invitation To North South Forum 2012 International Conference in Marrakech, MoroccoDocumento1 páginaInvitation To North South Forum 2012 International Conference in Marrakech, Moroccoapi-187964886Ainda não há avaliações

- Let Us Think - Telugu BookDocumento50 páginasLet Us Think - Telugu BookzabilaxusAinda não há avaliações

- ISO 10980-1995 ScanDocumento45 páginasISO 10980-1995 ScanAriyandi Yuda PraharaAinda não há avaliações

- Contoh Report TextDocumento1 páginaContoh Report TextRandi naufAinda não há avaliações

- Thailand - Myanmar Relations 001Documento1 páginaThailand - Myanmar Relations 001maungyukhinAinda não há avaliações