Escolar Documentos

Profissional Documentos

Cultura Documentos

Research About ESP in Business

Enviado por

Ellain GarciaTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Research About ESP in Business

Enviado por

Ellain GarciaDireitos autorais:

Formatos disponíveis

RESEARCHES CBA

What is the situation of the topic internationally or globally? What are the general concepts

governing my topic?

University of Hawaii at Manoa Shidler College of Business. (2015). Curriculum & Requirements | Shidler College of Business. Retrieved

January 3, 2015, from http://shidler.hawaii.edu/undergraduate/curriculum

CURRICULUM & REQUIREMENTS

As a Bachelor of Business Administration candidate, you must complete the General Education Core and Graduation requirements

pertinent to the year that you entered the University of Hawaii system. For detailed information on all requirements, schedule an

appointment with an academic advisor. You may also download a copy of the BBA program requirements sheet here. Students may

also join the Honors Program to earn a BBA degree with Honors distinction.

You should note that prerequisites and sequencing of courses are strictly enforced. For course descriptions and prerequisites, check

the University Catalog.

GENERAL EDUCATION FOUNDATION REQUIREMENTS:

Written Communication (FW): One Course

ENG 100, 101, 190, ESL 100

Symbolic Reasoning (FS): One Course

Calculus required for Admission to Shidler: NREM 203, BUS 250, MATH 203, 215, 205/241, or 251

BUS 250 is only offered at Kapiolani Community College

Global and Multicultural Perspectives (FG): Two courses, each selected from a different group (A, B, or C)

List of available FG courses can be viewed here.

GENERAL EDUCATION DIVERSIFICATION REQUIREMENTS:

Arts, Humanities, Literature (DA, DH, DL): Two courses, each from a different group

COMG 151 or 251 (SP 151, 251) (DA) will satisfy Pre-Business Core requirement.

Natural Sciences (DB, DP, DY): Two lecture courses AND one lab

Biological Science (DB)

Physical Sciences (DP)

Science Lab (DY)

Social Sciences (DS): Two Courses, each from a different department

RESEARCHES CBA

ECON 130 and 131 meet Pre-Business Core

PSY 100 OR SOC 100 meets the prerequisite requirement for BUS 315

SHIDLER COLLEGE OF BUSINESS REQUIREMENTS

Completion of admission/pre-business requirements to Shidler College. Please refer to Admissions page here.

BUSINESS CORE:

BLAW 200: Legal Environment of Business

BUS 310: Statistical Analysis for Business Decisions

BUS 311: Information Systems for Global Business Environment

BUS 312: Principles of Marketing

BUS 313: Economic and Financial Environment of Global Business

BUS 314: Business Finance

BUS 315: Global Management and Organizational Behavior

BUS 345: Strategic Management

BUS 310 and 311 must be completed within a students FIRST SEMESTER in the Shidler College of Business.

BLAW 200, BUS 310- 315 must be completed PRIOR to BUS 345, which is taken in a students final semester.

BUSINESS COMMUNICATION:

BUS 209, ENG 209, ENG 306, OR ENG 307 (All are Writing Intensive courses)

If ENG 306 or 307 is taken, it may NOT be used to fulfill both business communication and Upper Division Elective requirements.

BUS 209 WRITTEN COMMUNICATION IN BUSINESS

3 credit(s)

An interactive writing class stressing persuasive writing in the context of memos, letters, and business reports. A-F only. Pre: ACC 201

and ENG 100. Students may not earn credit for both BUS 209 and ENG 209. NI

Bus 209: Written Communication in Business

Eng 209: Business Writing

Eng 306: Argumentative Writing I

Eng 307: Rhetoric, Composition, and Computers

RESEARCHES CBA

Top Universities. (2010). Accounting Degrees | Top Universities. Retrieved January 3, 2015, from

http://www.topuniversities.com/courses/accounting-finance/guide

The universal language of business, commerce and finance, accounting is perfect for students with a good head for numbers and

analysis, a driving interest in business and a keen eye for detail. Accounting degrees involve learning how to measure, process, analyze

and communicate financial information about an organization to a variety of concerned parties, including investors, creditors,

management, regulators and the general public in order to facilitate improvements and adherence to established rules and guidelines.

What is accounting?

But first, what is accounting? Accounting is the process by which financial information about a business, organization or individual is

recorded, classified, summarized, interpreted and communicated. Drawing from fields such as information technology, law, statistics,

business and economics, accounting is a multidisciplinary subject that focuses on an organization or individuals economic activities.

Accounting students will gain advanced theoretical and practical knowledge of accounting and finance; master computational and

calculation skills and techniques used in professional accounting practice; learn how to use specialized accounting software (such as

CIMA Sage, which may allow you to gain an official CIMA Sage users certificate); and gain a broad understanding of the accounting,

finance and commercial sectors, often within an international context.

Types of accounting degrees

There are many different types of accounting degrees, with undergraduate-level titles such as Bachelor of Accountancy or Bachelors in

Accounting. The specialized Bachelor of Accountancy (BAcy, BAcc or BAccty) in the US is often the only undergraduate degree

recognized in the country for subsequent practice as a professional accountant in that respect, it works as a first professional degree.

Elsewhere, accounting degrees may be offered as a Bachelor of Arts (BA) in Accounting, or as a Bachelor of Science (BSc) in Accounting

(also abbreviated as BS/ACC). Meanwhile, South Africa offers undergraduate accounting degrees titled Bachelor of Accounting Science

(BAccSci) and Baccalaureus Computationis (BCompt).

While many universities offer undergraduate degrees with a sole focus on accounting, its also common to find accounting offered

alongside other subjects (most commonly finance, economics or business management) in a joint-degree format. There are also

general business degrees with a focus on accounting such as the Bachelor of Business Administration (BBA) in Accounting and the

Bachelor of Commerce (BCom) in Accounting.

Most accounting degrees are accredited by a relevant professional body for accountants at the national level. Examples include the UKbased Association of Chartered and Certified Accountants, Institute of Financial Accountants and Chartered Institute of Management

Accountants, and the American Institute of Certified Public Accountants based in the US. Studying an accredited degree allows

graduates to apply to the relevant body for exemptions from certain exams once they start working towards chartered accountant

status.

Entry requirements for accounting degrees

Those applying to study accounting are usually required to demonstrate a strong background in mathematics, while those who have

taken courses in statistics or business will be at an additional advantage. Some universities allow students to switch between

accountancy programs after their first year, to choose a track that best matches their interests and abilities, following their general

introductory courses.

What to expect from undergraduate accounting degrees

Generally, undergraduate-level accounting degrees last four years in the US, three years in Singapore, the UK and Australia (and most

other countries), and two years in Malta provided the student has obtained exceptional grades in a Bachelor of Commerce degree.

RESEARCHES CBA

In the first year or half of their degree, students will be introduced to key topics within accounting, finance and business. They can then

choose to specialize in particular accounting topics and that interest them, contingent on the institutions available modules.

Students generally work towards completing a major research project, with other assessment methods including reports, group

presentations and portfolios. Teaching is usually classroom-based, involving individual and group exercises, case studies, lectures,

seminars and IT workshops, including the use of accounting software.

Most institutions provide teaching staff with professional experience in the accounting and finance sectors, while many also allow

students to spend a year on an industrial placement, gaining valuable work experience, language and accounting skills and professional

contacts, either locally or abroad.

California State University, Long Beach. (2000). Why Major in Accounting? / Accountancy / CBA. Retrieved January 3, 2015, from

http://www.csulb.edu/colleges/cba/accountancy/major/

Why Major in Accounting?

The Accounting Profession

During your college years, you will be faced with many important decisions on your career choice. Two critical questions you will have

to answer will be: Which college major will you choose? And which career path will you pursue? This guide will try to give you the

information you need to make these important decisions that will profoundly affect your professional and personal life.

Why Major in Accounting?

Perhaps the American Institute of Certified Public Accountants (AICPA) summarized it best in its newly issued pamphlet: "Accounting:

The One Degree with 360 Degrees of Possibilities": "You may already have an idea about what you want to do for a career. Then again,

maybe you're not so sure. Either way, there's one degree that gives you the education to succeed at just about anything in the business

world. It's an accounting degree. Accounting opens doors in every kind of business coast to coast. It can give you the foundation you

need to go on and become a CPA. It can prepare you to become a partner in an accounting firm, to pursue a career in finance or

corporate management, to work in government, or even to become an entrepreneur. In fact, no matter what you decide to do, having

an accounting background can open doors wide."

The reason accounting may be the best route to a successful business career is because accounting has always been considered as the

language and basic tool of business. It has always concerned itself with determining how a business is doing and what is the bottom

line. But over the last two decades, the field of accounting has been changing dramatically in response to such explosive trends as the

computer revolution, increased government regulations, frequent tax law changes, the globalization of business, and the on-going

downsizing and restructuring of corporations. In this increasingly complex and competitive business environment, accounting skills are

very much in demand and accounting has become a dynamic career. Accountants have shed their stodgy image of green eyeshade's

and thick glasses to assume the more prestigious role of financial experts, system professionals, management consultants, budget

analysts, etc.. The demand for accountants appears to be growing and outstripping supply. Job opportunities in today's business

climate is better than ever for accountants.

These opportunities are particularly good for women. Women have generally done well in accounting. In the last decade and half, the

number of women entering the accounting profession has almost doubled. In 1977, females made up 28 percent of all graduating

accounting majors. Recently, according to an AICPA survey, there were more female accounting graduates than male (52 vs. 48

percent) and the gender breakdown of new accounting graduates hired by public accounting firms was 54 percent male and 46 percent

RESEARCHES CBA

female. There are now two national societies for women accountants, the American Society of Women Accountants and the American

Woman's Society of Certified Public Accountants.

Career Opportunities in Accounting

Once you have decided that accounting is your major, the next step is to choose which career path you will pursue. The varied job

opportunities opened to accountants may be summarized into three major areas: public accounting, private accounting, and

government and not-for profit accounting.

PUBLIC ACCOUNTING

Public accounting firms provide auditing, tax, accounting, and consulting services to businesses and individuals. These firms range in

size from single practitioner to large international firms with hundreds of offices worldwide and thousands of professionals.

Accountants in these firms work with a variety of and companies and gain wide exposure and experience. At the same time, the job

often involves pressure, travel, and seven-day workweeks.

A certified public accountant (CPA) is usually qualified to audit the traditional financial statements prepared by a company and render

an opinion on the "firm presentation" and reasonableness of these financial statements. The independent auditor's opinion lends

credibility to the company's financial statements and helps the users of these financial statements make their investment decisions.

The auditor thus plays an important role in facilitating the smooth functioning of the investment process and the efficient allocation of

resources in the economy.

To protect the public from individuals who are not qualified to express opinions on financial statements, all states impose strict

licensing requirements for the practice of public accounting. A CPA license is required in most states to perform independent audits.

The state boards of accountancy, which are the regulatory agencies for each state, set the requirements for licensing. To become a CPA

and practice public accounting, there are generally four basic requirements:

Education: Most states require CPA candidates to possess an undergraduate degree with the equivalent of a major in accounting. A

number of states now require 150 hours of college education; however, California has two pathways to becoming a CPA; Pathway One

requires 120 semester units of education and Pathway Two requires 150 semester units of education. Additionally, Pathway One

requires two years of practical experience while Pathway Two requires only one year of practical experience to become a CPA.

Passing the CPA examination: The CPA candidate must pass all four parts of a uniform CPA examination. The exam is developed by the

AICPA and administered four times each year in all U.S. states and territories. The CPA exam is a computer-based test and consists of

the following four parts:

Auditing (4.5 Hours)

Regulation (3 Hours )

Financial Accounting and Reporting (4 Hours)

Business Environment & Concepts (2.5 Hours)

Application to sit for the CPA exam must be made to your individual state board of accountancy. In California, write or call or Email to:

California Board of Accountancy

Main Telephone: (916) 263-3680

2000 Evergreen Street, Suite 250

Fax: (916) 263-3675

Sacramento, CA 95815-3832

RESEARCHES CBA

Website: www.cba.ca.gov

Experience. Most states require persons who have passed the CPA exam to have a period of experience before they are awarded the

CPA certificate. In California, candidates must have public accounting experience working as an employee of a CPA firm. Work in

government (i.e. the Internal Revenue Service, the Franchise Tax; Board, the State Board of Equalization, the Employment

Development Department, etc.) can also substitute for public accounting experience, but it generally takes longer.

Satisfying state requirements for education and experience, successful candidates are awarded the CPA certificate by a state. A new

CPA must then pay a fee to obtain a state license to practice. All states have reciprocity laws, allowing a CPA moving to another state to

obtain a new license from that state without having to take the uniform CPA exam again.

Educational Requirements for CPA Licensure

Areas Within Public Accounting

CPA firms generally offer the following types of services: auditing, income taxes, accounting and review, and consulting services.

AUDITING

Auditing is the most important function of the certified public accountant. International CPA firms and many national CPA firms devote

a large percentage of their time and resources to financial statement auditing. Auditing fees account for 45~0% of their total revenues.

ACCOUNTING AND REVIEW SERVICES

CPA firms, both large and small, perform a variety of accounting services for their clients. These services range from maintaining

accounting records to performing compilation, that is preparing financial statements without providing any assurance on them. A form

of limited assurance can be provided by a "review" which is more limited in scope than a full-blown financial statement audit.

TAXES

CPA firms perform many tax services for their individual and corporate clients, including preparation and review of tax returns, tax

planning (the legitimate avoidance or deferral of taxes), and tax litigation (appearance before a court or an administrative body on

behalf of their clients).

MANAGEMENT SERVICES

The fastest growing area for CPA firms is management consulting services, which was formally known as management advisory

services. These services can cover such wide-ranging fields as computer systems, management information systems, marketing,

executive recruiting, personal financial planning, and budgeting techniques, etc..

INCOME TAX PLANNING AND PREPARATION

Specializing in income tax preparation and planning is a very viable career path since taxation has such an pervasive effect on business

decisions and on all aspects of our personal as well as professional life. If you want to work in the area of taxation, you may want to

earn the E. A. (Enrolled Agent) designation or the master in taxation

RESEARCHES CBA

What is the situation of the topic locally? Ex. Asia Philippines. What are the supporting ideas

regarding my general concept?

De La Salle University- Dasmarinas. (2014). CBAA :: College of Business Administration and Accountancy | De La Salle University Dasmarias. Retrieved January 3, 2015, from http://www.dlsud.edu.ph/CBAA.htm

The De La Salle University-Dasmarias - College of Business Administration and Accountancy (CBAA) seeks to produce socially-aware

and competent business professionals and entrepreneurs in the country, particularly in Southern Luzon by promoting adherence to

high business moral standards and commitment to community development.

Guided by the Lasallian ideals of faith, zeal, and communion, CBAA provides the students with academic training expertise to cope with

the fast-paced industry. It also seeks to develop the students' technical and manasgerial skills necessary for effective performance in

business, government, industry, and education.

The task of producing socially responsible and competent business professionals and entrepreneurs is contingent on its four

departments: Accountancy Department, Allied Business Department, Business Management Department, and Marketing Department.

Bachelor of Science in Accountancy

Bachelor of Science in Management Accounting

These programs instill among students the significance of professional competence, independence in mental attitude and integrity in

the practice of Accountancy.

Career Options

Passing the government examinations or board exams will be helpful in securing top-level finance positions in economic enterprises.

Graduates of the course may work as bookkeepers, auditors, tax advisers, cost accountants, finance managers, supervisors, treasurers,

controllers, accounting clerks, budget officers, payroll accountants, credit managers, analysts, billing clerks or educators.

Bachelor of Science in Business Administration* Major in:

Business and Operations Management

The program prepares students for actual application of theories and exposes them to various business opportunities to develop their

ability to handle management situations based on current trends and issues.

Career Options

Graduates of the course can find work as management trainees, junior executives, production managers, supervisors, personnel

managers, branch managers or sales supervisors.

Economics

The program equips students with mathematical and statistical tools of solving real economic and other business-related problems.

Career Options

Students who graduate from this program find employment as researchers and research analysts, finance managers or consultants,

budget officers, finance controllers, bank tellers, managers and educators.

Human Resource Development Management

The course aims to develop skills in managing people and carrying out effective personnel programs.

RESEARCHES CBA

Career Options

Graduates of the program may work as human resource managers, personnel officers, supervisors, compensation analysts, training

specialists, wage and salary administrators, labor relations officers, administrative officers and educators.

Marketing and Advertising Management**

with specialization track in :

Business Analytics

Service Management

Advertising

The program trains students to become competent and socially-responsive professionals adept in identifying market needs, developing

and innovating products and making pricing, advertising and promotion and distribution decisions.

Career Options

Graduates find lucrative work as market analysts, marketing managers or executives, field representatives, production assistants,

researchers, public relations officers, job analysts and educators.

Bachelor of Science in Entrepreneurship

The program develops the students' competencies and skills in entrepreneurial management in order for them to establish their own

businesses and contribute to the economic well-being of their community.

Career Options

Graduates may pursue micro-enterprises started in school and have it registered under one's name. The end-view of the program is for

students to be competent, concerned, confident entrepreneurs who will be involved in the development of the region in particular and

the country in general.

Bachelor of Science in Office Administration

Associate in Office Administration (2 yrs)

The program provides broad knowledge on computer operation and business correspondence through general education and

professional secretarial administration programs.

Career Options

Graduates may find work as legal, technical or medical stenographers, executive secretaries, administrative assistants, office

supervisors, educators, encoders, bank tellers, or filing clerks.

Graduate Studies

Graduate School of Business

Masters in Business Administration (Regular MBA)

Masters in Business Administration with Specialization in Supply Chain Management (MBS)

Executive Masters in Business Administration (EMBA)

Doctor of Philosophy in Business Administration (PhD)

Note :

*There are two specialization tracks namely: a. Business Analytics; b. Service Management

**There are three tracks specialization tracks : namely: a. Business Analytics; b. Service Management;c. Advertising

RESEARCHES CBA

The University of Rhode Island. (2015). Accounting | college of business administration. Retrieved January 3, 2015, from

http://web.uri.edu/business/accounting/

accounting

The accounting program provides specialized training in financial reporting, auditing, tax, and cost accounting. Upon completion of all

course and credit degree requirements, accounting majors are prepared to sit for the Certified Public Accountant (CPA) examination if

they choose to do so.

Our undergraduate and graduate accounting programs are the only ones in Rhode Island that hold the highly regarded, separate

accreditation from the Association to Advance Collegiate Schools of Business (AACSB) International. Accounting, one of the largest

undergraduate majors on the URI campus, has an extremely high job placement rate.

curriculum

Courses required for the major are:

BUS 301 Intermediate Accounting I

BUS 302 Intermediate Accounting II

BUS 401 Accounting Computer Systems

BUS 402 Advanced Accounting

BUS 403 Federal Tax Accounting

BUS 404 Auditing

BUS 428 Multinational Finance

Our Lady of Fatima University. (2013). Our Lady of Fatima University. Retrieved January 3, 2015, from

http://www.fatima.edu.ph/content.asp?pid=217&cat=3

The worlds of business and finance continue to evolve, creating the need to adjust to the complexities of business ideas and financial

management innovations, technological and scientific advancement, market competition and emerging international markets. The

programs under the College of Business & Accountancy aim to equip students with solid general foundations in business

administration progressing to the mastery of concepts, tools and skills needed for advanced management and financial science, and

reinforced with practical exposure in the real business world through its practicum program and industry tie-ups.

In the school year 2012-2013, the college, in its continuous pursuit of growth and development launched the BS Accountancy and BS

Accounting Technology courses with a competitive curriculum and a roster of highly qualified professors. These new program offerings

will further enhance the quality of academic services rendered by the University to its students, particularly in the fields of financial

management and business entrepreneurship. The accountancy related programs aim to develop students in the field of accountancy

that would help them excel in the professional licensure examinations.

Major in Operation and Supply Chain Management

Operations and Supply Chain Management involves in the systematic planning, designing and operating, controlling, and improving the

processes that transform inputs into finished goods and services. The Operations and Supply Chain Management degree will equip

students to be managers in the challenging environment of modern manufacturing and service industries. Upon graduation, they

RESEARCHES CBA

should be prepared to address critical issues related to productivity management in a globally competitive economy and play

leadership roles in the design and implementation of quality control and management programs.

Major in Marketing Management

BSBA Marketing Management is a comprehensive program designed to provide students with a solid general foundation in this exciting

field. First, the emphasis is on basic business administration knowledge and skills; then students explore intensively the discipline of

Marketing, with emphasis on the job skills and experience the industry demands. Strategic Market Research and Projects with local

businesses and organizations are also included to offer students real world experiences.

Major in Banking

The BSBA Banking aims to provide its graduates an excellent grasp on the inner workings of the banking industry from concepts to

operations. Through the linkages and partnerships with established financial institutions of OLFU-CBA, the students will gain knowledge

and learning experiences in various aspects of consumer and commercial banking.

Bachelor of Science in Accountancy and Accounting Technology download BSA 2011 Curriculum here

The college introduces competitive curricula for Bachelor of Science in Accountancy and Bachelor of Science in Accounting Technology

for students who aspire to become Certified Public Accountants (CPAs) or Accounting Technologist/Financial Analysts, respectively.

Both programs are designed to integrate computer aided learning platforms like SAP Business One of Fasttrack Solutions (Systems,

Applications and Products in Data Processing) and international standards in accounting discipline.

Accreditations

ISO 9001:2008 Certified

Level I, PACUCOA

International Affiliations

ZIP Travel

First Place Incorporated

National Affiliations

Philippine Association of Collegiate Schools of Business

Council of Management Educators and Practitioners of the Philippines

Operations Research Society of the Philippines

Social Security System

Hyaat Industrial Manufacturing Corporation

Insurance Commission

RESEARCHES CBA

Honda Cars Caloocan, Incorporated

JO-ES Publishing House, Incorporated

RGMA Network, Incorporated

Philippine National Bank

Creative Programs, Incorporated

Land Bank of the Philippines

United Coconut Planters Bank

Alliance Select Foods, Incorporated

Career Opportunities

Purchasing Manager

Materials Manager

Contract Specialist

Human Resources (HR)

Manager

Business Manager

General Manager

Insurance Sales Agent

Regional Sales Manager

Retail Store Manager

Personal Banker

Operations Manager

Supply Chain Analyst

Accounts Payable Specialist

Sales Director, Office Manager

Account Manager

Business Development

Manager

Business Analyst

Information Technologist

Financial Analyst

Financial Controller

Advertising Manager

Advertising Sales Director

Account Executive

Account Coordinator

Media Director

RESEARCHES CBA

Media Coordinator

Media Buyer

Brand Manager

Product Manager

Product Development Manager

Market Research Director

Market Research Manager

Market Research Supervisor

Market Analyst

Public Relations Specialist

Public Relations Director

Corporate Communication Manager

Book Publicist

Press Secretary

Budget Analysts

Buyers and Purchasers

Claim Adjusters

Examiners and Investigators

Cost Estimators

Financial Analysts

Insurance Underwriters

Loan Officers and Counselors

Personal Financial Advisors

Real Estate Appraisers

Tax Examiners, Collectors

Revenue Agents

What is the situation of my idea in the community or school level? Ex. Pasig PLP (Pamantasan

ng Lungsod ng Pasig)

Because of the situations mentioned above, here are the important problems to solve; here are

the important objectives to achieve; here are the important purposes to meet.

Você também pode gostar

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- B.a.H Eco. 2nd Semester Mathematical Methods For Economics IIDocumento3 páginasB.a.H Eco. 2nd Semester Mathematical Methods For Economics IINitinSharma100% (1)

- 007-Student Council NominationDocumento2 páginas007-Student Council NominationrimsnibmAinda não há avaliações

- Articol de CercetareDocumento3 páginasArticol de CercetareLuiza Carmen PîrvulescuAinda não há avaliações

- Call Me by Your Name-SemioticsDocumento2 páginasCall Me by Your Name-SemioticsJoevic FranciaAinda não há avaliações

- The Challenge of Drug Discovery in The 21st CenturyDocumento5 páginasThe Challenge of Drug Discovery in The 21st CenturyHugo de CeaAinda não há avaliações

- (2016) The Role of Requirements in The Success or Failure of Software Projects-DikonversiDocumento11 páginas(2016) The Role of Requirements in The Success or Failure of Software Projects-DikonversiFajar HatmalAinda não há avaliações

- Study On SantalsDocumento18 páginasStudy On SantalsJayita BitAinda não há avaliações

- Brenda Alderman v. The Philadelphia Housing Authority, 496 F.2d 164, 3rd Cir. (1974)Documento16 páginasBrenda Alderman v. The Philadelphia Housing Authority, 496 F.2d 164, 3rd Cir. (1974)Scribd Government DocsAinda não há avaliações

- Convert 2.0 - Frank Kern Official Full Download + FREEDocumento127 páginasConvert 2.0 - Frank Kern Official Full Download + FREETwo Comma Club100% (1)

- Metric Schnorr Lock Washer SpecDocumento3 páginasMetric Schnorr Lock Washer SpecGatito FelinoAinda não há avaliações

- Beed 3a-Group 2 ResearchDocumento65 páginasBeed 3a-Group 2 ResearchRose GilaAinda não há avaliações

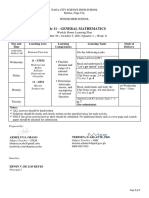

- Midterm Examination: General MathematicsDocumento5 páginasMidterm Examination: General MathematicsJenalyn CardanoAinda não há avaliações

- General Mathematics - Module #3Documento7 páginasGeneral Mathematics - Module #3Archie Artemis NoblezaAinda não há avaliações

- Subiecte Engleza August 2018 - V1Documento6 páginasSubiecte Engleza August 2018 - V1DenisAinda não há avaliações

- Creativity and AestheticDocumento17 páginasCreativity and AestheticSyahirah Erahzs100% (1)

- Amnesty - Protest SongsDocumento14 páginasAmnesty - Protest Songsimusician2Ainda não há avaliações

- Reported Speech Rd1Documento3 páginasReported Speech Rd1Jose ChavezAinda não há avaliações

- Gordon College: Lived Experiences of Family Caregivers of Patients With SchizophreniaDocumento128 páginasGordon College: Lived Experiences of Family Caregivers of Patients With Schizophreniaellton john pilarAinda não há avaliações

- Sequences and Series Integral Topic AssessmentDocumento6 páginasSequences and Series Integral Topic AssessmentOrion BlaqueAinda não há avaliações

- Retaining Talent: Replacing Misconceptions With Evidence-Based StrategiesDocumento18 páginasRetaining Talent: Replacing Misconceptions With Evidence-Based StrategiesShams Ul HayatAinda não há avaliações

- Academic Calendar 2019-20 Odd Semester PDFDocumento1 páginaAcademic Calendar 2019-20 Odd Semester PDFPiyush ManwaniAinda não há avaliações

- Noli Me Tangere CharactersDocumento4 páginasNoli Me Tangere CharactersDiemAinda não há avaliações

- Cranial Deformity in The Pueblo AreaDocumento3 páginasCranial Deformity in The Pueblo AreaSlavica JovanovicAinda não há avaliações

- A Clinico-Microbiological Study of Diabetic Foot Ulcers in An Indian Tertiary Care HospitalDocumento6 páginasA Clinico-Microbiological Study of Diabetic Foot Ulcers in An Indian Tertiary Care HospitalJoko Cahyo BaskoroAinda não há avaliações

- RBG - CRM BRD - Marketing - v4.1Documento68 páginasRBG - CRM BRD - Marketing - v4.1Manvi Pareek100% (2)

- Study On Perfromance Appraisal System in HPCLDocumento12 páginasStudy On Perfromance Appraisal System in HPCLomkinggAinda não há avaliações

- SDS SheetDocumento8 páginasSDS SheetΠΑΝΑΓΙΩΤΗΣΠΑΝΑΓΟΣAinda não há avaliações

- Alien Cicatrix II (Part 02 of 03) - The CloningDocumento4 páginasAlien Cicatrix II (Part 02 of 03) - The CloningC.O.M.A research -stopalienabduction-Ainda não há avaliações

- I. Revised Penal Code (RPC) and Related Special Laws: Riminal AWDocumento11 páginasI. Revised Penal Code (RPC) and Related Special Laws: Riminal AWMc Vharn CatreAinda não há avaliações

- TENSES ExerciseDocumento28 páginasTENSES ExerciseKhanh PhamAinda não há avaliações