Escolar Documentos

Profissional Documentos

Cultura Documentos

Share: Definition, Types and Factors Affecting The Stock Price

Enviado por

LINA AQMORINA0 notas0% acharam este documento útil (0 voto)

62 visualizações2 páginasSHARE DESCRIPTION

Título original

Share

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOC, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoSHARE DESCRIPTION

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOC, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

62 visualizações2 páginasShare: Definition, Types and Factors Affecting The Stock Price

Enviado por

LINA AQMORINASHARE DESCRIPTION

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOC, PDF, TXT ou leia online no Scribd

Você está na página 1de 2

SHARE : DEFINITION, TYPES AND FACTORS AFFECTING

THE STOCK PRICE

Is a sign of ownership of shares in a limited liability company as it has been known

that investors buy the stock for the purpose of income from these shares. Public

investors was categorized as an investors and speculator. Investors here are the people

who buy the companys shares to have a hope of getting dividends and capital gains in

the long term, while speculators are the people who buy the shares for resale

immediately if the situation is considered the most favourable exchange rate as it has

been known that the stock provides two kinds of income that is dividends and capital

gains.

There are various definitions of stocks that have been raised by experts and various

text books, among others :

a) According to Gitman :

Shares is the most pure and simple form of ownership of the company.

(Gitman: 2000, 7)

b) According to Bernstein :

Stock is a piece of paper stating ownership of most firms.

(Bernstein: 1995, 197)

c) According to Mishkin :

Stock is a security that has a claim against the income and assets of a

company. Securities them selves can be interpreted as a claim on future

income of a borrower being sold bye the borrower to the landing, often

called financial instrument. (Mishkin: 2001, 4)

Types or share :

In the transaction on the stock exchange, shares or stock is often called the most

dominant instrument traded. The shares may be issued by way of or on behalf on the

bearer. Further shares can be distinguished between ordinary shares (common stocks)

and preferred stock (preferred stock)

A. Common Stock (common stock)

Common stock is the effect of the inclusion of ownership (equity security) of

the business entity Limited Liability Company. Common stock gives

assurance to participate in the distribution of income in the form of dividens, if

the company makes profit.

According to Dahlan Siamat (1995:385), traits-traits of common stock are as

follows :

1) Dividens paid during the company makes profit.

2) Has the voting rights (one share one vote).

3) The right to receive dividends if insolvent companys assets after all

liabilities of the company repaid.

B. Preferred Stock (preferred stock)

Is a stock that has the nature of a combination of bonds and common stock.

The traits-traits of preferred stock according to Dahlan Siamat (1995:385) are :

1) Have the right to obtain prior dividend.

2) Does not have voting rights.

3) It can affect the companys management, especially in the nomination

committee.

4) Have the right maximum payment or par value shares advance after the

creditors if the company is liquidated.

Shares price :

Stocks is a sign of ownership or possession of any person or entity in a company, a

share is a piece of paper stating that the owner of the paper is the owner (whatever

portion/number) of a company that published the paper (stock) is. A share has a

Value or price. According Sawidji Widioatmojo (1996;46) stock prices can be

dividend into 3 (three) :

A. Nominal Prices

The price listed in the stock certificates set by issuers to access each share

issued. Nominal price of importance on the stock because dividends are

usually determined by a minimum of nominal value.

B. Price Premium

This price is at the time the shares price recorded on the stock exchange.

Shares on the primary market prices are usually set by underwriters and issuer.

Thus it would be known how the stock price will be sold to the public

generally to determine the issue price.

C. Market Price

If the initial price is selling price of the emissions trading to investors, the

market price is the selling price of a single investors to another investors. This

happened after the price of the shares listed on the exchange. Transaction is no

longer here involve issuers and underwriters price is called the price in the

secondary market and the price is what truly represent the price the issuer

company, because the transactions in the secondary market, small investors

price negotiations take place with publisher. Price published daily in

newspapers or other media is the market price.

Factors Affecting the Stock Price :

Factors that could affect the stock price by Weston and Brigham (1993:26-27) was

projected earnings per share, when earned income, the level of risk from projectes

earning, proportion of corporate debt to equity, and dividend policy. Other factors that

can affects stock price movement are external constraints such as economics activity

in general, and the state of the stock market tax. Investment should really be aware

that in addition will benefit not rule out the possibility they will lose. Gains or losses

are largely influenced by the ability of investors to analyze the state of momentary

assessment applying the stock price is influenced by many factors including the

condition (performance) of the company, external constraints, the forces of supply and

demand in the stock market, as well as the ability of investors to analyse stock

investments. According Sawidji (1996:81) : The main factor that caused the stock

price is a different perception of each investor in accordance with the information

obtained.

Você também pode gostar

- Equity Investment for CFA level 1: CFA level 1, #2No EverandEquity Investment for CFA level 1: CFA level 1, #2Nota: 5 de 5 estrelas5/5 (1)

- 61 - 2004 Winter-SpringDocumento25 páginas61 - 2004 Winter-Springc_mc2Ainda não há avaliações

- Issue Mechanism PDFDocumento4 páginasIssue Mechanism PDFNikshitha100% (1)

- General Mathematics - Stocks and BondsDocumento32 páginasGeneral Mathematics - Stocks and BondsLourence Clark ElumbaAinda não há avaliações

- Issuing SecuritiesDocumento6 páginasIssuing SecuritiesKomal ShujaatAinda não há avaliações

- INTRODUCTION TO MACROECONOMICS: INTEREST RATES, INVESTMENT, AND AGGREGATE DEMANDDocumento4 páginasINTRODUCTION TO MACROECONOMICS: INTEREST RATES, INVESTMENT, AND AGGREGATE DEMANDCördïî X Cördïî100% (1)

- An Introduction To BacktestingDocumento20 páginasAn Introduction To BacktestingwhitecrescentAinda não há avaliações

- Basics of EquityDocumento27 páginasBasics of EquityVikas Jeshnani100% (1)

- Immunization With FuturesDocumento18 páginasImmunization With FuturesNiyati ShahAinda não há avaliações

- Letter of GuaranteeDocumento3 páginasLetter of GuaranteeblcksourceAinda não há avaliações

- Continental CarriersDocumento2 páginasContinental Carrierschch917100% (1)

- Financial Detective Case AnalysisDocumento11 páginasFinancial Detective Case AnalysisBrian AlmeidaAinda não há avaliações

- Finance Project Mahindra and MahindraDocumento34 páginasFinance Project Mahindra and Mahindrarohitraj.iitm3326100% (3)

- Investment Analysis of Marginal FieldsDocumento39 páginasInvestment Analysis of Marginal FieldssegunoyesAinda não há avaliações

- Capital Market and Its InstrumentsDocumento26 páginasCapital Market and Its InstrumentsHariniAinda não há avaliações

- Chapter 19 NotesDocumento5 páginasChapter 19 NotesGloria HuAinda não há avaliações

- Financial Management - Grinblatt and TitmanDocumento68 páginasFinancial Management - Grinblatt and TitmanLuis Daniel Malavé RojasAinda não há avaliações

- Finance My NotesDocumento19 páginasFinance My NotespappuAinda não há avaliações

- Organisation and Function of Equity MarketsDocumento9 páginasOrganisation and Function of Equity MarketsAbhinav PatilAinda não há avaliações

- Rights and Roles of Shareholders ExplainedDocumento6 páginasRights and Roles of Shareholders ExplainedArham KothariAinda não há avaliações

- Capital Market InstrumentsDocumento4 páginasCapital Market InstrumentsJanhavi SrivastavaAinda não há avaliações

- Primary MKT Handout !!!Documento26 páginasPrimary MKT Handout !!!Garima AroraAinda não há avaliações

- Common Stocks: SummaryDocumento5 páginasCommon Stocks: SummaryZain MughalAinda não há avaliações

- FMO Module 2Documento8 páginasFMO Module 2Sonia Dann KuruvillaAinda não há avaliações

- Financial Markets and ServicesDocumento57 páginasFinancial Markets and ServicessharathAinda não há avaliações

- Basic Terms of Capital MarketDocumento44 páginasBasic Terms of Capital Marketdhanabalu87Ainda não há avaliações

- Options Contracts in UKDocumento34 páginasOptions Contracts in UKuzairAinda não há avaliações

- 210fin-Ch15 4Documento33 páginas210fin-Ch15 4Mazen SalahAinda não há avaliações

- Capital Markets: 1.1 Fundamental RoleDocumento9 páginasCapital Markets: 1.1 Fundamental Roletushki7792Ainda não há avaliações

- Name:-Gohil Hitesh Roll No: - 17 Subject: - Corporate Finance - I Date: - Submitted To: - Savita MissDocumento14 páginasName:-Gohil Hitesh Roll No: - 17 Subject: - Corporate Finance - I Date: - Submitted To: - Savita MissHitesh GohilAinda não há avaliações

- Capital MarketDocumento24 páginasCapital MarketHamdan NajathAinda não há avaliações

- IM Module 2Documento57 páginasIM Module 2vanitha gkAinda não há avaliações

- Stock Split, Spin-Offs ExplainedDocumento11 páginasStock Split, Spin-Offs Explainedsanjay mehtaAinda não há avaliações

- Financial Markets and Services (F) (5 Sem) : Unit-2 Primary and Secondary Market: Primary MarketDocumento11 páginasFinancial Markets and Services (F) (5 Sem) : Unit-2 Primary and Secondary Market: Primary Marketdominic wurdaAinda não há avaliações

- Overview of Indian Securities Market: Chapter-1Documento100 páginasOverview of Indian Securities Market: Chapter-1tamangargAinda não há avaliações

- FMM 12Documento18 páginasFMM 12gameofgreed876Ainda não há avaliações

- Siddik Sir 1Documento1 páginaSiddik Sir 1Numaer SiddiqueAinda não há avaliações

- Introduction to Managerial Finance ChapterDocumento24 páginasIntroduction to Managerial Finance ChapterAffan AhmedAinda não há avaliações

- Debt Securities MarketDocumento3 páginasDebt Securities MarketSean ThyrdeeAinda não há avaliações

- 711Documento12 páginas711samuel debebeAinda não há avaliações

- Financial Environment - Lecture2Documento20 páginasFinancial Environment - Lecture2mehnaz kAinda não há avaliações

- Basics of Capital Market: InvestmentsDocumento19 páginasBasics of Capital Market: InvestmentslathaharihimaAinda não há avaliações

- Book Building ExplainedDocumento15 páginasBook Building ExplainedRishi KumarAinda não há avaliações

- Nigerian Security and Exchange Market Second NoteDocumento24 páginasNigerian Security and Exchange Market Second NoteEneji ClementAinda não há avaliações

- Equity and Debt SecuritiesDocumento16 páginasEquity and Debt Securitieskaran pawarAinda não há avaliações

- Essentials of Investments, 8th Edition-3Documento46 páginasEssentials of Investments, 8th Edition-3Tara BrownAinda não há avaliações

- What is a Market and its Key CharacteristicsDocumento19 páginasWhat is a Market and its Key CharacteristicsHussain khawajaAinda não há avaliações

- Capital MarketDocumento38 páginasCapital Marketapi-3798892Ainda não há avaliações

- Chapter Four Financial Market in The Financial SystemsDocumento136 páginasChapter Four Financial Market in The Financial SystemsNatnael Asfaw100% (1)

- Barclay 1989 (Premium)Documento25 páginasBarclay 1989 (Premium)Avinash MehrotraAinda não há avaliações

- Security Market: 2.1 Concept of Primary MarketDocumento10 páginasSecurity Market: 2.1 Concept of Primary MarketTawsif BracAinda não há avaliações

- Financial Market SecuritiesDocumento3 páginasFinancial Market SecuritiesHND Assignment HelpAinda não há avaliações

- STOCK Market: Secondary Market Is A Market in Which ExistingDocumento26 páginasSTOCK Market: Secondary Market Is A Market in Which Existingpankaj vermaAinda não há avaliações

- Securities and InvestmentDocumento24 páginasSecurities and InvestmentSyed Ali ShakeelAinda não há avaliações

- Principles of Finance Assignment 02Documento7 páginasPrinciples of Finance Assignment 02RakibImtiazAinda não há avaliações

- How Securities Are TradedDocumento32 páginasHow Securities Are TradedZawad47 AhaAinda não há avaliações

- Investment Environment and Investment Management Process-5Documento1 páginaInvestment Environment and Investment Management Process-5CalvinsAinda não há avaliações

- Module 3Documento20 páginasModule 3Esha GowdaAinda não há avaliações

- Financial Markets and Institutions ExplainedDocumento3 páginasFinancial Markets and Institutions ExplainedkimAinda não há avaliações

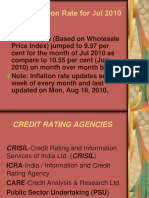

- India's Inflation Rate For Jul 2010Documento21 páginasIndia's Inflation Rate For Jul 2010priyaAinda não há avaliações

- Unit 2Documento6 páginasUnit 2Om PatelAinda não há avaliações

- Assets (Meaning) .: 1 8 BCF 412 (Asset Management) - NotesDocumento8 páginasAssets (Meaning) .: 1 8 BCF 412 (Asset Management) - NotessamAinda não há avaliações

- FNM 106 M-TERM lECTURE 3,4Documento10 páginasFNM 106 M-TERM lECTURE 3,4haron franciscoAinda não há avaliações

- M-Term FNM 106 (20230316133325)Documento46 páginasM-Term FNM 106 (20230316133325)Joan Marie LeonorAinda não há avaliações

- What Are Derivative InstrumentsDocumento3 páginasWhat Are Derivative InstrumentsAnonymous PXYboWdvm100% (1)

- Merchant Banking Cha-3 by Saidul AlamDocumento11 páginasMerchant Banking Cha-3 by Saidul AlamSaidul AlamAinda não há avaliações

- Listing in Stock Trade and Related RulesDocumento7 páginasListing in Stock Trade and Related RulesMehak AzamAinda não há avaliações

- Shares of StockDocumento7 páginasShares of StockAdityaMohanAinda não há avaliações

- Common Stock Ownership GuideDocumento20 páginasCommon Stock Ownership GuideAfifa AkterAinda não há avaliações

- GROUP 1 - Final Presentation: Financial Metrics in Business and Services A.Y. 2021-2022Documento24 páginasGROUP 1 - Final Presentation: Financial Metrics in Business and Services A.Y. 2021-2022Alberto FrancesconiAinda não há avaliações

- Steamboat Springs City Council AgendaDocumento265 páginasSteamboat Springs City Council AgendaScott FranzAinda não há avaliações

- Industrial Development in IndiaDocumento17 páginasIndustrial Development in IndiaSiddharth VermaAinda não há avaliações

- Choice IntroductionDocumento22 páginasChoice IntroductionMonu SinghAinda não há avaliações

- P 6 KK 6 UDocumento33 páginasP 6 KK 6 URichard OonAinda não há avaliações

- E08 00 gb2008Documento330 páginasE08 00 gb2008usa_mercAinda não há avaliações

- Problem 1: Take Home Quiz Mid Term Advanced Accounting 2Documento3 páginasProblem 1: Take Home Quiz Mid Term Advanced Accounting 2Mohamad Nurreza RachmanAinda não há avaliações

- Financial Statements enDocumento30 páginasFinancial Statements enNHÃ THY TRẦN PHƯƠNGAinda não há avaliações

- Thomson Reuters Eikon BrochureDocumento5 páginasThomson Reuters Eikon BrochureIvon BacaicoaAinda não há avaliações

- OPEN FORUM 2011 BookletDocumento40 páginasOPEN FORUM 2011 BookletOpensiliconvalley AdmAinda não há avaliações

- Case Study Presentation-Consumer BehaviourDocumento26 páginasCase Study Presentation-Consumer BehaviourPravakar KumarAinda não há avaliações

- C7 8 Equity Portfolio ManagementDocumento42 páginasC7 8 Equity Portfolio ManagementRusa AlexandraAinda não há avaliações

- Income Tax FormatDocumento2 páginasIncome Tax FormatmanmohanibcsAinda não há avaliações

- BusinessLawTE ch30Documento22 páginasBusinessLawTE ch30Mari SolAinda não há avaliações

- The Elasticity of DemandDocumento53 páginasThe Elasticity of DemandShekhar SinghAinda não há avaliações

- Do You Know Your Cost of CapitalDocumento12 páginasDo You Know Your Cost of CapitalSazidur RahmanAinda não há avaliações

- USAID GDA - Indonesia Ecotourism Concept Paper Submission - GWA-idGuides-Daemeter-TNC (17feb2015) PDFDocumento12 páginasUSAID GDA - Indonesia Ecotourism Concept Paper Submission - GWA-idGuides-Daemeter-TNC (17feb2015) PDFPeter Skøtt PedersenAinda não há avaliações

- JF Tech Annual Report Summary for 2020Documento136 páginasJF Tech Annual Report Summary for 2020Brendon SoongAinda não há avaliações

- Solutions To A2StudyPack2012Documento21 páginasSolutions To A2StudyPack2012Juncheng WuAinda não há avaliações

- BofA & Home123 Corp (New Century Mortgage) Master Repurchase AgreementDocumento46 páginasBofA & Home123 Corp (New Century Mortgage) Master Repurchase Agreement83jjmackAinda não há avaliações