Escolar Documentos

Profissional Documentos

Cultura Documentos

CFA Level 2 FSA

Enviado por

素直和夫Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

CFA Level 2 FSA

Enviado por

素直和夫Direitos autorais:

Formatos disponíveis

The typical retirement plans are:

o Defined contribution plan

Contribution is specified and future amount is unknown

The pension holder bears all the risk

Accounting treatment is expensed as incurred

o Defined benefit plan

Employer promises to pay a specified annual payment

o Other benefit

Life or health insurance

Projected Benefit Obligation

o Definition

The actuarial present value of all benefits attributes by the plans benefit

formula to employee service rendered prior to that date

o Assumption

Expected future salary increases

Going concern

Employee continue service

Balance sheet presentation

o Both IFRS and GAAP require pension plans fund status to be reported on the

balance sheet

o F

The fund status either a surplus or a deficit will be reported on the balance

sheet

In the case that there is a fund surplus, then it may be subject to a

ceiling where it cannot pass

o

o

Discount rate: the interest rate to compute the PV of benefit obligation and

the current service cost

Based on a similar duration fix asset discount rate

Rate of compensation growth: average expected annual growth

Expected vesting period: refers to a provision in pension plan whereby an

employee gain rights to future benefits only after meeting certain criteria

Periodic Pension Cost (GAAP) is recognized in profit or loss and categorized in OCI

o Current service cost: the present value of benefits earned by the employee during

the current period

o Interest cost: the increase in the PBO due to the passage of time. It is calculated by

multiplying the PBO at the beginning of the period by the discount rate

o Expected return on plan asset: expected return on plan asset reduces pension

expense

o Amortization of actuarial gain and losses:

An change in the PBO from a change in actuarial assumption

Difference between the expected return and actual return

This only applies to the case of fund surplus that had passed the

applied ceiling; the extra section is then amortized.

The method of the amortization is the corridor approach

Periodic Pension Cost (IFRS)

o Service cost-includes both the current and past:

Current service cost is the amount by which a companys pension obligation

increases as a result of employee service in the current period

Past service cost is the amount by which a companys pension obligation

relating to employees service in prior period changes as a result of plan

amendments or a plan curtailment

o Net interest expense/income

Calculated by multiplying the net pension liability or asset by the discount

rate

The expected return on plan assets is assumed to be the same as

the discount rate used for computation of pension obligation

Net interest expense or income recognized in P&L

o Remeasurement:

(a) Actuarial gain and losses

(b) Difference between actual return on plan asset and the amount included

for net interest expense / income calculation

o Special note:

Actuarial gains and losses are not included in P&L

Difference between GAAP and IFRS

o Past Service Cost

GAAP: goes into OCI and amortized over service life

IFRS: goes into I/S

o Actuarial gain/losses

GAAP: amortized portion in I/S & unamortized in OCI

IFRS: all in OCI and not amortized. And a remeasurement account is created

Effect of changing pension assumption

o Increase the discount rate

Reduce PBOImprove fund status

Result in lower pension expense

The volume of decrease for PBO offsets the increase in interest rate

Reduce interest cost

o Decreasing the compensation growth rate

Reduce PBOImprove fund status

Reduce current service cost and lower interest cost

Pension expense will decrease

o Increasing the expected return on plan assets

Reduce pension expense

Not affecting the benefit obligation or the fund status

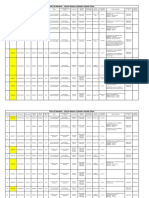

Effect on

Balance sheet

liability

Pension expense

Increase discount

rate

Decrease

Decrease

Decrease rate of

compensation growth

Decrease

Decrease

Increase expected

rate of return

No effect

Decrease (GAAP)

For health care pension, there is the ultimate healthcare trend rate, which is used for the

prediction

Analysts view: Disclosures of Pension and Other Post Employment Benefits

o Evaluating the disclosure assumptions

Discount rate

Expected compensation growth rate

Expected return on assets

o Metric for analysis:

Consistency with other company

Consistency with economic environment

Consistent internally

Net Pension Liability or Asset

The balance sheet discloses only the net amount

Analysts can use the net amount to adjust a companys asset and

liability for the gross amount so it better reflects the companys

true asset and liability

Compare the gross amount with the sponsor companys asset,

equity and earnings.

Total periodic cost (analyst view of total periodic cost)

Definition: The total periodic cost of a companys DB pension plan is the

change in the net pension liability or asset, excluding the effect of the

employers periodic contribution into the plan

Net Periodic Pension Cost=Ending fund status Beginning fund

status employers contribution

Periodic Pension cost recognized in P&L vs. OCI

Adjust GAAP companys P&L so it becomes comparable with IFRS

(a) Include past service cost

(b) Exclude amortization of past service cost arising in pervious

period

(c) Including an amount of return on plan assets at the discount

rate rather than the expected rate

Or use OCI as the basis for comparison

Classification of periodic pension cost

Exclude from operating income the amortization of past service cost and

net actuarial gain and losses

Exclude interest expense and the return on plan assets from operating

income

Interest expense be added to the companys interest expense and return on

plan asset be treated as non-operating income

Added back the actual return of asset back into other income

Cash flow

If sponsoring companys periodic contribution to a plan exceed the total

pension costs of the period, the excess can be viewed as a reduction of

pension obligation

Over-contribution (prepayment)

o CFO is added

o CFF is subtracted

Under-contribution (borrowing)

o CFO decreases

o CFF is added

A periodic contribution that is less than the total pension cost of the period

can be viewed as a source of financing

Você também pode gostar

- CFA 2012: Exams L1 : How to Pass the CFA Exams After Studying for Two Weeks Without AnxietyNo EverandCFA 2012: Exams L1 : How to Pass the CFA Exams After Studying for Two Weeks Without AnxietyNota: 3 de 5 estrelas3/5 (2)

- CFA Level II Formula Sheet CFA Level II Formula Sheet: Finance (Harvard University) Finance (Harvard University)Documento5 páginasCFA Level II Formula Sheet CFA Level II Formula Sheet: Finance (Harvard University) Finance (Harvard University)smith100% (1)

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)No EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Nota: 4.5 de 5 estrelas4.5/5 (5)

- Level I of CFA Program 6 Mock Exam June 2020 Revision 1Documento43 páginasLevel I of CFA Program 6 Mock Exam June 2020 Revision 1JasonAinda não há avaliações

- Corporate Finance: A Beginner's Guide: Investment series, #1No EverandCorporate Finance: A Beginner's Guide: Investment series, #1Ainda não há avaliações

- Dokumen - Tips Finquiz Cfa Level I Mock Exam 1 Solutions Am Questions Topic MinutesDocumento76 páginasDokumen - Tips Finquiz Cfa Level I Mock Exam 1 Solutions Am Questions Topic MinutesНаталия МорзаAinda não há avaliações

- Certified Risk Analyst A Complete Guide - 2020 EditionNo EverandCertified Risk Analyst A Complete Guide - 2020 EditionAinda não há avaliações

- CFA Level 1 Formulae Booklet - PArt 2Documento99 páginasCFA Level 1 Formulae Booklet - PArt 2Rohit DevanaboinaAinda não há avaliações

- Cfa Level 2 - Test Bank With SolutionsDocumento14 páginasCfa Level 2 - Test Bank With SolutionsAditya BajoriaAinda não há avaliações

- CFA Level 2 Fixed Income 2017Documento52 páginasCFA Level 2 Fixed Income 2017EdmundSiauAinda não há avaliações

- Fund Accounting A Complete Guide - 2020 EditionNo EverandFund Accounting A Complete Guide - 2020 EditionNota: 2 de 5 estrelas2/5 (1)

- CFA Level 2 Cheat SheetDocumento24 páginasCFA Level 2 Cheat SheetdbohnentvAinda não há avaliações

- R27 CFA Level 3Documento10 páginasR27 CFA Level 3Ashna0188Ainda não há avaliações

- Ninja Study Plan: The Definitive Guide to Learning, Taking, and Passing the CFA® ExaminationsNo EverandNinja Study Plan: The Definitive Guide to Learning, Taking, and Passing the CFA® ExaminationsNota: 4 de 5 estrelas4/5 (13)

- Free CFA Level 2 Mock Exam (300hours)Documento20 páginasFree CFA Level 2 Mock Exam (300hours)ShrutiAinda não há avaliações

- SERIES 79 EXAM STUDY GUIDE 2022 + TEST BANKNo EverandSERIES 79 EXAM STUDY GUIDE 2022 + TEST BANKAinda não há avaliações

- CFA L1 3 Month ScheduleDocumento9 páginasCFA L1 3 Month ScheduleSakura2709Ainda não há avaliações

- Morningstar Guide to Mutual Funds: Five-Star Strategies for SuccessNo EverandMorningstar Guide to Mutual Funds: Five-Star Strategies for SuccessAinda não há avaliações

- CFA Preparation RecommendationsDocumento3 páginasCFA Preparation RecommendationsShynara MuzapbarovaAinda não há avaliações

- CFAI L2 Practice Exam 2017 PM SessionDocumento23 páginasCFAI L2 Practice Exam 2017 PM SessionsergiopelaezboverAinda não há avaliações

- Cfa Level III 4 Months Study PlanDocumento12 páginasCfa Level III 4 Months Study Planvidit1Ainda não há avaliações

- CFA Revision NotesDocumento18 páginasCFA Revision NotesklkjlkjlkjlkjlAinda não há avaliações

- CFA I Study Plan 12weeksDocumento1 páginaCFA I Study Plan 12weeksconnectshyamAinda não há avaliações

- Cfa Notes IftDocumento15 páginasCfa Notes IftShubham SharmaAinda não há avaliações

- CFA III-Performance Evaluation关键词清单Documento9 páginasCFA III-Performance Evaluation关键词清单Thanh NguyenAinda não há avaliações

- 2019 20 CFA Level I Curriculum ChangesDocumento20 páginas2019 20 CFA Level I Curriculum ChangesNadia JAinda não há avaliações

- Cfa Level 1 LOS Command WordsDocumento0 páginaCfa Level 1 LOS Command WordsHummingbird11688Ainda não há avaliações

- 01 Alternative InvestmentsDocumento61 páginas01 Alternative InvestmentsSardonna Fong0% (1)

- R5 Time Value of Money SlidesDocumento49 páginasR5 Time Value of Money SlidesAnkur MadaanAinda não há avaliações

- CFA二级 财务报表 习题 PDFDocumento272 páginasCFA二级 财务报表 习题 PDFNGOC NHIAinda não há avaliações

- CFA Level I Mock Exam C Morning SessionDocumento67 páginasCFA Level I Mock Exam C Morning SessionSai Swaroop MandalAinda não há avaliações

- CFA Level 2 Exam Preparation Strategy TipsDocumento2 páginasCFA Level 2 Exam Preparation Strategy TipsgregdebickiAinda não há avaliações

- Accounting Shenanigans On The Cash Flow Statement IFT NotesDocumento8 páginasAccounting Shenanigans On The Cash Flow Statement IFT NoteskautiAinda não há avaliações

- CFA Level 1 - Section 2 QuantitativeDocumento81 páginasCFA Level 1 - Section 2 Quantitativeapi-376313867% (3)

- CFA Level I Mock Exam B - February 2022Documento109 páginasCFA Level I Mock Exam B - February 2022Hường Trần Thu100% (1)

- Level II of CFA Program Mock Exam 1 - Solutions (AM)Documento56 páginasLevel II of CFA Program Mock Exam 1 - Solutions (AM)Faizan UllahAinda não há avaliações

- Equity Level II 2019 PracticeDocumento119 páginasEquity Level II 2019 Practicehamza omar100% (2)

- CFA Institute 2020 Mock Exam A - Afternoon SessionDocumento23 páginasCFA Institute 2020 Mock Exam A - Afternoon Sessionkazeemsheriff8Ainda não há avaliações

- CFA Level I Revision Day IDocumento63 páginasCFA Level I Revision Day IAspanwz SpanwzAinda não há avaliações

- Mock Exam 2023 #2 First Session Ethical and Professional StandardsDocumento93 páginasMock Exam 2023 #2 First Session Ethical and Professional StandardsKunal PoddarAinda não há avaliações

- CFA Level 1Documento90 páginasCFA Level 1imran0104100% (2)

- CFA Level III FormulaDocumento39 páginasCFA Level III Formulammqasmi100% (1)

- 2011FRM金程模拟考题Documento50 páginas2011FRM金程模拟考题Liu ZhilinAinda não há avaliações

- DA4399 CFA Level III Quick SheetDocumento9 páginasDA4399 CFA Level III Quick SheetJackAinda não há avaliações

- 2024 l1 Topics CombinedDocumento27 páginas2024 l1 Topics CombinedShaitan LadkaAinda não há avaliações

- Jobs After CFADocumento26 páginasJobs After CFAhari96973Ainda não há avaliações

- Finquiz Mock 2018 QuestionsDocumento34 páginasFinquiz Mock 2018 QuestionsEdgar Lay100% (1)

- FinQuiz - Curriculum Note, Study Session 4-6, Reading 13-21 - EconomicsDocumento124 páginasFinQuiz - Curriculum Note, Study Session 4-6, Reading 13-21 - EconomicsNattKoon100% (2)

- 道德、经济、数量、组合、固收、衍生Documento170 páginas道德、经济、数量、组合、固收、衍生Ariel MengAinda não há avaliações

- 2018年6月CFA2级Mock Exam PM(试题版)Documento27 páginas2018年6月CFA2级Mock Exam PM(试题版)merton14Ainda não há avaliações

- 2019 CFA Ethics L1-2-3 PDFDocumento511 páginas2019 CFA Ethics L1-2-3 PDFKathy Ho100% (1)

- 2020 Mock Exam A - Afternoon Session (With Solutions)Documento62 páginas2020 Mock Exam A - Afternoon Session (With Solutions)NikAinda não há avaliações

- R01 Ethics and Trust in The Investment Profession: Instructor's NoteDocumento26 páginasR01 Ethics and Trust in The Investment Profession: Instructor's NoteMani ManandharAinda não há avaliações

- CFA Level III - Combined Total Formula Mini TestDocumento18 páginasCFA Level III - Combined Total Formula Mini TestcpacfaAinda não há avaliações

- AnsCFA Level I Mock Exam A - February 2022Documento113 páginasAnsCFA Level I Mock Exam A - February 2022nngọc_829676100% (2)

- Level III 2018 IFT Mock Exams SampleDocumento30 páginasLevel III 2018 IFT Mock Exams SamplepharssAinda não há avaliações

- CFA Level I - 8feb (Optimized)Documento55 páginasCFA Level I - 8feb (Optimized)RAHUL AggarwalAinda não há avaliações

- 2-Port Antenna Frequency Range Dual Polarization HPBW Adjust. Electr. DTDocumento5 páginas2-Port Antenna Frequency Range Dual Polarization HPBW Adjust. Electr. DTIbrahim JaberAinda não há avaliações

- NewspaperDocumento11 páginasNewspaperКристина ОрёлAinda não há avaliações

- AsiaSat 7 at 105Documento14 páginasAsiaSat 7 at 105rahman200387Ainda não há avaliações

- DC Motor Dynamics Data Acquisition, Parameters Estimation and Implementation of Cascade ControlDocumento5 páginasDC Motor Dynamics Data Acquisition, Parameters Estimation and Implementation of Cascade ControlAlisson Magalhães Silva MagalhãesAinda não há avaliações

- Panel Data Econometrics: Manuel ArellanoDocumento5 páginasPanel Data Econometrics: Manuel Arellanoeliasem2014Ainda não há avaliações

- Interpretation of Arterial Blood Gases (ABGs)Documento6 páginasInterpretation of Arterial Blood Gases (ABGs)afalfitraAinda não há avaliações

- Phys101 CS Mid Sem 16 - 17Documento1 páginaPhys101 CS Mid Sem 16 - 17Nicole EchezonaAinda não há avaliações

- Controle de Abastecimento e ManutençãoDocumento409 páginasControle de Abastecimento e ManutençãoHAROLDO LAGE VIEIRAAinda não há avaliações

- Quantification of Dell S Competitive AdvantageDocumento3 páginasQuantification of Dell S Competitive AdvantageSandeep Yadav50% (2)

- Steam Turbine Theory and Practice by Kearton PDF 35Documento4 páginasSteam Turbine Theory and Practice by Kearton PDF 35KKDhAinda não há avaliações

- Free Radical TheoryDocumento2 páginasFree Radical TheoryMIA ALVAREZAinda não há avaliações

- Case 5Documento1 páginaCase 5Czan ShakyaAinda não há avaliações

- CMC Ready ReckonerxlsxDocumento3 páginasCMC Ready ReckonerxlsxShalaniAinda não há avaliações

- Sewage Pumping StationDocumento35 páginasSewage Pumping StationOrchie DavidAinda não há avaliações

- The Ultimate Advanced Family PDFDocumento39 páginasThe Ultimate Advanced Family PDFWandersonAinda não há avaliações

- Maverick Brochure SMLDocumento16 páginasMaverick Brochure SMLmalaoui44Ainda não há avaliações

- Malware Reverse Engineering Part 1 Static AnalysisDocumento27 páginasMalware Reverse Engineering Part 1 Static AnalysisBik AshAinda não há avaliações

- DELcraFT Works CleanEra ProjectDocumento31 páginasDELcraFT Works CleanEra Projectenrico_britaiAinda não há avaliações

- NAT Order of Operations 82Documento39 páginasNAT Order of Operations 82Kike PadillaAinda não há avaliações

- 5054 w11 QP 11Documento20 páginas5054 w11 QP 11mstudy123456Ainda não há avaliações

- The European Journal of Applied Economics - Vol. 16 #2Documento180 páginasThe European Journal of Applied Economics - Vol. 16 #2Aleksandar MihajlovićAinda não há avaliações

- C6030 BrochureDocumento2 páginasC6030 Brochureibraheem aboyadakAinda não há avaliações

- Column Array Loudspeaker: Product HighlightsDocumento2 páginasColumn Array Loudspeaker: Product HighlightsTricolor GameplayAinda não há avaliações

- Three-D Failure Criteria Based on Hoek-BrownDocumento5 páginasThree-D Failure Criteria Based on Hoek-BrownLuis Alonso SAAinda não há avaliações

- Prenatal and Post Natal Growth of MandibleDocumento5 páginasPrenatal and Post Natal Growth of MandiblehabeebAinda não há avaliações

- Exercises2 SolutionsDocumento7 páginasExercises2 Solutionspedroagv08Ainda não há avaliações

- Music 7: Music of Lowlands of LuzonDocumento14 páginasMusic 7: Music of Lowlands of LuzonGhia Cressida HernandezAinda não há avaliações

- Books of AccountsDocumento18 páginasBooks of AccountsFrances Marie TemporalAinda não há avaliações

- GMWIN SoftwareDocumento1 páginaGMWIN SoftwareĐào Đình NamAinda não há avaliações

- Leaked David Fry II Conversation Regarding Loopholes and Embezzlement at AFK Gamer LoungeDocumento6 páginasLeaked David Fry II Conversation Regarding Loopholes and Embezzlement at AFK Gamer LoungeAnonymous iTNFz0a0Ainda não há avaliações

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNo EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNota: 3.5 de 5 estrelas3.5/5 (8)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNo EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNota: 4.5 de 5 estrelas4.5/5 (14)

- Joy of Agility: How to Solve Problems and Succeed SoonerNo EverandJoy of Agility: How to Solve Problems and Succeed SoonerNota: 4 de 5 estrelas4/5 (1)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialAinda não há avaliações

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistNo EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistNota: 4.5 de 5 estrelas4.5/5 (73)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsAinda não há avaliações

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityNo EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityNota: 4.5 de 5 estrelas4.5/5 (4)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisNo EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisNota: 5 de 5 estrelas5/5 (6)

- Finance Basics (HBR 20-Minute Manager Series)No EverandFinance Basics (HBR 20-Minute Manager Series)Nota: 4.5 de 5 estrelas4.5/5 (32)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanNo EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanNota: 4.5 de 5 estrelas4.5/5 (79)

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthNo EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthAinda não há avaliações

- Value: The Four Cornerstones of Corporate FinanceNo EverandValue: The Four Cornerstones of Corporate FinanceNota: 4.5 de 5 estrelas4.5/5 (18)

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000No EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Nota: 4.5 de 5 estrelas4.5/5 (86)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingNo EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingNota: 4.5 de 5 estrelas4.5/5 (17)

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNo EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorAinda não há avaliações

- Financial Risk Management: A Simple IntroductionNo EverandFinancial Risk Management: A Simple IntroductionNota: 4.5 de 5 estrelas4.5/5 (7)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelAinda não há avaliações

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)No EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Nota: 4.5 de 5 estrelas4.5/5 (4)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNota: 4.5 de 5 estrelas4.5/5 (32)

- LLC or Corporation?: Choose the Right Form for Your BusinessNo EverandLLC or Corporation?: Choose the Right Form for Your BusinessNota: 3.5 de 5 estrelas3.5/5 (4)

- Key Performance Indicators: Developing, Implementing, and Using Winning KPIsNo EverandKey Performance Indicators: Developing, Implementing, and Using Winning KPIsAinda não há avaliações

- The Business of Venture Capital: The Art of Raising a Fund, Structuring Investments, Portfolio Management, and Exits, 3rd EditionNo EverandThe Business of Venture Capital: The Art of Raising a Fund, Structuring Investments, Portfolio Management, and Exits, 3rd EditionNota: 5 de 5 estrelas5/5 (3)

- The McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/ENo EverandThe McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/ENota: 4.5 de 5 estrelas4.5/5 (6)

- Will Work for Pie: Building Your Startup Using Equity Instead of CashNo EverandWill Work for Pie: Building Your Startup Using Equity Instead of CashAinda não há avaliações

- The Fundraising Strategy Playbook: An Entrepreneur's Guide To Pitching, Raising Venture Capital, and Financing a StartupNo EverandThe Fundraising Strategy Playbook: An Entrepreneur's Guide To Pitching, Raising Venture Capital, and Financing a StartupAinda não há avaliações

- Investment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionNo EverandInvestment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionNota: 5 de 5 estrelas5/5 (1)