Escolar Documentos

Profissional Documentos

Cultura Documentos

ANDI2010

Enviado por

siul7894Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

ANDI2010

Enviado por

siul7894Direitos autorais:

Formatos disponíveis

Colombia

Mining Projects

Report 2010

Projected Investment on Mine Development and

Expansion Projects in Colombia; 2010 to 2020

A market research study on behalf of

The Australian Trade Commission - Austrade

And

Australian Mining Equipment and Services Export Association - Austmine

By

Asomineros Chamber of National Business Association of Colombia - ANDI -

Bogota, D. C.

April 2010

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

I.

TABLE OF CONTENTS

1. INTRODUCTION ............................................................................................ 1

1.1. Background ................................................................................................ 2

2. COLOMBIAN MINING SECTOR POLICIES .................................................. 4

3. THE COLOMBIAN MINING SCENE IN 2009 ................................................. 6

3.1 Coal ............................................................................................................... 8

3.2 Nickel ........................................................................................................... 11

3.3 Precious Metals ........................................................................................... 12

4. ELECTRICITY GENERATION PROJECTS ................................................. 14

5. DEVELOPMENT AND EXPANSION PROJECTS BY COMPANY .............. 15

5.1. Carbones del Cerrejn LLC. ....................................................................... 19

5.2. Cerro Matoso .............................................................................................. 21

5.3. Drummond Ltd. ........................................................................................... 22

5.4. Prodeco ...................................................................................................... 24

5.5. Mineros S. A. .............................................................................................. 26

5.6. Vale............................................................................................................. 27

5.7. Grupo EBX .................................................................................................. 29

5.8. Carbones San Fernando............................................................................. 31

5.9. Carbones del Norte del Cesar Norcarbn S. A. ....................................... 32

5.10. Minera El Roble Miner S. A. .................................................................... 33

5.11. Carbones de Los Andes Carboandes S. A. ............................................ 34

5.12. Greystar Resources Ltd. Sucursal Colombia ............................................ 35

5.13. Anglogold Ashanti ..................................................................................... 37

5.14. B2Gold Corp. ........................................................................................... 39

5.15. Continental Gold Ltd. ................................................................................ 41

5.16. Grupo de Bullet S. A. Inversiones Mineras ............................................... 42

5.17. Cosigo Resources..................................................................................... 43

5.18. Goldman Sachs Group ............................................................................. 44

5.19. Coalcorp Mining Inc. ................................................................................. 46

5.20. Galway Resources Ltd. ............................................................................. 47

5.21. Medoro Resources Ltd. ............................................................................. 49

5.22. Colombian Mines Corp. ............................................................................ 51

5.23. Anglo American Plc................................................................................... 53

5.24. Cordillera Exploraciones ........................................................................... 54

5.25. Inversiones Argos ..................................................................................... 55

5.26. Holcim Ltd. ................................................................................................ 56

5.27. Ventana Gold Corp. .................................................................................. 57

5.28. Votorantim Siderurgia ............................................................................... 58

5.29. Yamana Gold ............................................................................................ 60

5.30. Miranda Gold Corp. ................................................................................... 61

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

5.31. Orofino Gold Corp. .................................................................................... 62

5.32. Oroandes Resource Corp. ........................................................................ 63

5.33. Bandera Gold ............................................................................................ 64

5.34. Bearing Gold Corp. ................................................................................... 65

5.35. Bellhaven Copper & Gold ......................................................................... 66

5.36. El Zancudo Mining .................................................................................... 67

5.37. Cadan Resources Corp. ........................................................................... 68

5.38. Gemini Exploration.................................................................................... 69

5.39. Caerus Resources Corp. .......................................................................... 70

II.

LIST OF FIGURES

Figure

Page

1. Quarterly Gross Domestic Product 2003 2009 ............................................ 6

2. Value of Colombian oil and mining exports ..................................................... 7

3. Distribution of the value of Colombian Mining exports .................................... 7

4. Quarterly Foreign Direct Investment FDI - 2000 2009 ................................. 8

5. Production of Colombian coal 1998-2009 ....................................................... 9

6. National Nickel Production and International Nickel prices ........................... 11

7. Colombian production of precious metals ..................................................... 12

8. Colombian Gold Exports and international gold prices ................................. 13

9. Development and Expansion projects in Colombia ....................................... 17

10. Location of development and expansion projects ....................................... 18

III. LIST OF TABLES

Table

Page

1. Historical mining production of Colombia 2000-2009 ....................................... 2

2. Colombian Coal production by departments (2008 2009) ........................... 10

3. Electricity generation expansion projects ....................................................... 14

4. Projection of mining investments for the 2010 through 2020 period. ............. 16

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

1. INTRODUCTION

This study has been performed under the coordination of the ASOMINEROS

Chamber of ANDI and has had participation by the IMCPortal Ltda. Company.

The objective of the study is to provide information on existing mining projects and

those that are planned in the forthcoming decade in Colombia, in order to provide

to Australian Mining Equipment and Services Export Association AUSTMINE

with an outlook of the future opportunities that the Colombian mining sector offers.

The scope of the study covers detailed known and disclosed mining expansion

projects for existing mine operations, estimated future developments for mines that

are currently in production, and new potential mining developments arising from

many exploration projects that are being performed at this time in the country. The

study spans a 10-year time frame, from 2010 through 2020.

A brief description of the Colombian mining sector is presented, including

background, recent mining performance, composition of mining in Colombia,

historic figures for Production, Exports and Direct Foreign Investment, and

highlights the main producers of coal, nickel, gold, and other minerals. Government

mining goals for the next decade are also included.

Moreover, a detailed description is presented for each project, including contact

information, available technical and commercial data, as well as a description of

services, plant and equipment opportunities, for the benefit of AUSTMINE

members.

There was a certain reticence that was observed on the part of several companies

with regard to making public the progress in their projects and the investments

required, which made it somewhat difficult to obtain part of the information.

Consequently, in addition to the official information provided directly by some

companies, further information was obtained in individual consultation with persons

that are close to the companies, press reports endorsed by the companies, and in

the companies pages on the Internet.

On account of the above, it was not possible to obtain complete information on the

needs for goods and services for each of the projects.

Based on the information collected, we could establish that for this decade, there

are at least 12 expansion projects, 5 projects with defined feasibility, and 38 in the

pre-feasibility and exploration stage.

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

1.1.

Background

In recent years, Colombia has risen quickly in the worldwide scales for coal

exports, ferronickel production, and interest generated in mining exploration.

Projects that are under execution indicate that this positive evolution will continue

in the future.

Colombia, with close to 70 million metric tonnes (MT) is ranked fourth among world

coal exporters, after Australia (252 MT), Indonesia (203 MT), and Russia (101 MT).

In steam coal, Indonesia ranks first, followed by Australia, Russia and Colombia1.

Moreover, the Cerromatoso mine produces close to 4% of the total world

production of nickel with one of the lowest operational costs.

Growth in mining production in Colombia has been associated with expansions in

existing mines. Evolution of Colombian mining over the last 10 years has exhibited

an interesting pattern: coal extraction increased from 38 MT in 2000 to 72.3 MT in

2009, with a 91.6% increase; nickel grew by 80.2% during the same period, and

gold production has increased by 29.2%, showing a significant recovery in

comparison with the amounts reported for 2006 and 2007.

TABLE 1. Historical Mining production of Colombia (2000 2009)

Source: Ingeominas

Based on a study performed by the Ministry of Mines and Energy (Herrera, 20082 ),

it is estimated that annual production in 2019 for the main minerals could reach the

following levels: 197 MT of coal, 106 tonnes (3.5 million ounces) of gold, 50,700

tonnes of nickel, and 33.4 tonnes (1.1 million ounces) of silver.

With few exceptions, metal projects that are about to commence production in

Latin America have taken over nine years, on average, between the time of

discovery of the deposit through its socio-economic environmental and financial

viability. With this outlook, it is possible to consider that, towards the second half of

the decade, important metalliferous finds will have materialized in Colombia, on the

basis on the exploration projects that are taking place at present.

The Australian Bureau of Agricultural and Resource Economics ABARE. 2010. Australian Commodities,

December quarter, Vol. 16. Number 4. http://www.abare.gov.au/interactive/09ac_dec/htm/coal.htm

HERRERA, J. 2008. Estimate of Colombian mining production based on projections for the Latin American

GDP. Consulting assignment for the Ministry of Mines and Energy. 71 pag.

http://www.minminas.gov.co/minminas/downloads/archivosEventos/3607.pdf

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

Growth possibilities for coal are clearer, and it is highly feasible that by 2019, the

country will be producing close to 197 MT per annum.

On the other hand, in accordance with reports issued by INGEOMINAS (Spanish

acronym for the Colombian Geology and Mining Institute), the number of mining

titles granted by the Colombian State through December 2009 reached 8,623,

which, altogether, span an area of close to 19,000 km2, that is to say, 1.7% of the

national territory.

Mining titles in the country, at present, are distributed approximately as follows:

29.6% for construction materials (7.9% of the total area granted under concession),

19.3% for coal (30% of the total area granted under concession), 18.8% for

precious metals (38.8% of the total area granted under concession), 4.9% for

emeralds (1.8% of the total area granted under concession) and 27.4% distributed

among other minerals (22% of the total area granted under concession).

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

2. COLOMBIAN MINING SECTOR POLICIES

On the basis of the National Mining Development Plan, 2019 Vision (UPME,

2006)3, the National Mining Policy Advisory Council recommended that the Ministry

of Mines and Energy establish three government policies for the sector, as follows:

1. Policy to promote Colombia as a mining country: This policy seeks to

increase participation by mining investors in the country, both junior companies

and promoters of mining projects such as mining conglomerates and traditional

mining companies that can attract national and foreign technical and capital

resources to the sector and provide increased value added to the chain. For the

proper performance of this policy, the following activities have been set forth:

A communications strategy to position the countrys mining industry.

Government-Industry Agenda.

Structuring and set-up of the Mining Investment Project Database in

Colombia

Organization and operation of the Mining Promotion Bureau at

INGEOMINAS

Digital portal for the Mining Country and dissemination and communications

campaign

Training for mining authorities and entering into inter-institutional

agreements

Participating in national and international events

Guide for the Mining Investor.

2. Management policy for the mining resource: Seeks to attain optimisation of

the support processes for the mining activity. In this sense, the purpose is for

management of the mining resource to be performed under criteria of efficiency,

efficacy and effectiveness, for which purpose the response time in contracting must

comply with the best known standards, and there must be a higher level of followup on fulfillment of the obligations entered into by the holders of mining titles. The

following are the activities to develop this policy:

Institutional adjustments: INGEOMINAS, Ministry of Mines and Energy

(MME), Mining and Energy Planning Unit (UPME).

Adjustments to the Mining Code.

Colombian mining land register inventory on line for INGEOMINAS and

governorships.

Strategic Information Technology and Communications Plan for the

Colombian mining sector.

Joint agenda for the Ministry of Mines and Energy and the Ministry of the

Environment, Housing and Territorial Development.

UPME, 2006. National Mining Development Plan, Vision for 2009. Mining and Energy Planning Unit, Bogot

125 pg. http://www.imcportal.com/galeria/PNDM%202019.pdf

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

3. Policy for the enhancement of productivity and competitiveness: Aimed at

enhancing the social profitability of the mining industry, based on exploitation with

the best practices, generating employment, carrying out its activities with high

levels of industrial safety and occupational health, that ensure sufficient surplus

income for the small-scale miner to improve his quality of life. This policy also

expects to boost the States efforts to increase productivity and competitiveness of

legal traditional mining exploitation operations that exist in the national territory.

The activities for this policy are:

A comprehensive program to control illegal mining activities

Financing strategies for the mining sector

A management model for mining districts (analysis of their present situation

and the future projection for areas with a significant mining presence)

National Mining Development Plan, Vision for 2019 (UPME, 2006)

In order to be able to affirm that the Colombian mining industry is one of the

activities that contribute the most to the national economy and that it is also

considered to be one of the most important in the continent by the year 2019, the

following objectives have been set forth:

1. To attract a larger number of investors to develop the mining resource.

2. To achieve an increased capture of value for the State as a consequence of

the successful results in the mining activity.

3. To optimize the support processes that the mining institutional framework

requires in order to fulfill the value proposals that it structures for the

different segments of clients.

And the following goals have been established for the year 2019, which are to use

the figures reported as of December 2005 as a baseline for comparison purposes:

To triple the volume of coal production.

To increase the production of precious metals four-fold.

To convert Colombia into one of the three main destinations in Latin

America for private, internal and external, investment destined to mining

exploration.

To increase the extent of contracted area for geological and mining

exploration.

To optimize mine contracting and customer service processes.

To gain increased knowledge on the countrys subsoil.

To develop agendas for productivity and competitiveness in all mining

districts.

To increase production in community-based mining developments.

To reach a growth rate in the mining GDP that exceeds the Latin American

average.

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

3. THE COLOMBIAN MINING SCENE IN 2009

According to the National Administrative Statistics Bureau (DANE, its acronym in

Spanish), the national economy grew by 0.4% in 2009. Nevertheless, the mining

and hydrocarbon sector consolidated itself as the second sector with greatest

growth, with 11.3%. On the other hand, mining, without hydrocarbons, grew 6.7%,

despite the reduction of 1.6% in coal extraction, and in response to the increase in

ferronickel production (22.2%), gold production (39.4%) and growth in construction

materials (26.1%).

38

28

PIB

Minas&e Hydrocarbons

Hidrocarburos

Mines

GDP

PIB

MinasGDP

sin Hidrocarburos

Mines

w/o Hydrocarbons

Variacin porcentual anual

Percent

annual variation

Gross Interno

Domestic

Producto

Bruto Product

Colombia

18

-2

-12

I

II

III IV

2003

II III IV

2004

II

III IV

2005

II

III IV

2006

II

III IV

2007

II III IV

2008p

II

III IV

2009p

Year

Aos // Trimestre

Quarter

FIGURE 1. Quarterly Gross Domestic Product 2003 2009 annual percent variation

(Source: DANE)

The results for exports and direct foreign investment in mining were quite favorable

in 2009.

Exports reached US$ 8.153 billion, maintaining their upward trend, at 24.8%. Direct

Foreign Investment in mining, which represented 43% of the total direct foreign

investment in the country in 2009, exhibited record levels, in accordance with the

latest statistics released by the Central Bank (the Banco de la Repblica) with US$

3.094 billion.

In the following graphs we can observe the historical data for exports and direct

foreign investment in the mining sector:

Millions of US$

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

FIGURE 2. Value of Colombian oil and mining exports in billions of US$

(Source: Banco de la Repblica. Calculations: IMCPortal)

FIGURE 3. Distribution of the value of Colombian mining exports in millions of dollars.

(Source: Banco de la Repblica)

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

FIGURE 4. Quarterly Foreign Direct Investment FDI. 2003 2009 en USD Millions.

(Source: Banco de la Repblica)

The main investments in the sector came from Brazilian company Vale,

representing close to US$ 373 million, on account of the acquisition of several coal

assets from Colombian company Inversiones Argos, and from the North American

company Drummond Ltd., for its coal projects, particularly those destined for the El

Descanso mine.

3.1 Coal

Albeit the forecasts of the Ministry of Mines and Energy indicated coal production

of 87 MT, the 1.6% reduction in actual production in comparison with 2008 (73.5

MT) could have been greater due to the accumulation of inventories due to

slowdown in European purchases, cost of freight, and the high costs involved in

reaching Asian markets (both El Cerrejn and Drummond are exporting to Asia as

of this year). The historical evolution of coal production can be observed in the

following graph. The location of main mine producers is presented in figure 10,

page 18.

Thousands of tonnes

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

FIGURE 5 Production of Colombian coal in millions of tonnes

(Source: INGEOMINAS)

The following table presents coal production in detail, by department and by

project, in accordance with official figures published by INGEOMINAS.

The Northern Region, which comprises the departments of La Guajira, Cesar and

Crdoba, which represents 90% of national production, reduced its extraction by

1.08% (0.7 MT) with respect to 2008, reaching 65.4 MT in 2009.

On the other hand, the region of the interior, which comprises the departments of

Antioquia, Boyac, Cundinamarca, Norte de Santander and others, to a lesser

extent), exhibited a 6.21% drop, reaching 6.9 MT in 2009.

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

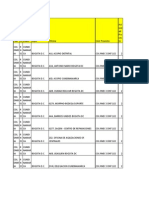

TABLE 2. Colombian coal production by departments (2008 2009)

! / Proyecto

"

Departamento

CERREJON ZONA NORTE

CONSORCIO CERREJON - AREA PATILLA

LA GUAJIRA

CARBONES COLOMBIANOS DEL CERREJON AREA LA COMUNIDAD

CARBONES DEL CERREJON - AREA LA

COMUNIDAD

CARBONES DEL CERREJON - AREA OREGANAL

TOTAL LA GUAJIRA

DRUMMOND LTD - AREA LA LOMA

DRUMMOND LTD - EL DESCANSO

CARBONES EL TESORO S.A.

CARBONES DE LA JAGUA

CESAR

CONSORCIO MINERO UNIDO S.A.

C.I. PRODECO S.A.

COMPAA CARBONES DEL CESAR S.A.

NORCARBON S.A. - AREA LA DIVISA

EMCARBON S.A.- DIAMOND LTDA

TOTAL CESAR

CORDOBA

CARBONES DEL CARIBE - AREA LA

GUACAMAYA Y MINA BIJAO

ANTIOQUIA

BOYACA

CASANARE

CUNDINAMARCA

SANTANDER

NORTE DE SANTANDER

VALLE DEL CAUCA

CAUCA

TOTAL COLOMBIA

2008

(Kt)

2009

(Kt)

Var

%

17,982.9

4,535.5

15,881.7

5,287.9

-11.7

16.6

1,095.5

1,178.2

7.6

4,161.3

4,404.9

5.9

4,164.6

4,678.2

12.3

31,939.9

21,396.5

1,849.5

2,517.1

0.0

4,697.7

1,299.2

356.0

1,560.1

33,676.2

31,430.9

18,431.5

2,157.8

1,078.5

2,667.5

801.3

5,700.1

806.7

306.7

1,622.2

33,572.3

-1.6

-13.9

493.2

392.3

-20.4

403.9

2,230.9

0.1

2,405.6

178.1

2,085.2

79.0

9.9

73,502.1

655.8

2,276.2

0.6

1,941.6

116.5

1,938.4

0.0

4.9

72,329.6

62.4

2.0

829.8

-19.3

-34.6

-7.0

-100.0

-50.4

-1.6

-41.7

6.0

21.3

-37.9

-13.9

4.0

-0.3

Source: INGEOMINAS, for data on the collection of royalties.

The value of coal and coking coal exports increased in 2009 to US$ 5.416 billion,

increasing its share of total exports from 13.4% to 16.5%, consolidating itself as the

second export product in the country, second to oil.

During 2009, there was an increase in coal sales to rather non-traditional

destinations such as The Netherlands (from US$ 534 million in 2008 to US $1.138

billion in 2009), Turkey (US$ 168 million to US$ 303.2 million) and India (US$ 85.4

million in 2009).

According to INGEOMINAS data, coal is the main contributor to national royalty

collections, with an 85% share of total royalties. In 2009, royalties reached US$

597 million, registering 26% growth with respect to 2008.

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

3.2 Nickel

Colombia represents close to 3.6% of world nickel production, with an average

48,000 thousand tonnes (kT) per year. Despite the decreasing trend in

international prices for nickel, national production during 2009 interrupted the

decreasing production trend from previous years, going from 41.6 kT in 2008 to

50.8 kT in 2009 (22% growth).

40.000

Prod

Colombiana

deProduction

Nquel (t)

Colombian

Nickel

60000

International

NiNi

Prices

Precios

Internac.

(US$/(US$/t)

tn)

35.000

48000

30.000

42000

25.000

36000

20.000

US$ / t

Toneladas (t)

54000

30000

15.000

24000

18000

10.000

12000

5.000

6000

0

0

2003

2004

2005

2006

Aos

2007

2008

2009

FIGURE 6. National nickel production and international nickel prices.

(Source: INGEOMINAS. International Prices: IMF, LME. Calculations: IMCPortal)

Figure 6 shows the decreasing trend in international nickel prices, with a 60.8%

drop since the historical maximum price registered in 2007, averaging US$

14,564.81 US$/T during 2009.

With respect to the amount exported by this industry, in accordance with Banco de

la Repblica data, revenues decreased by 15.96%, going from US$ 863.7 million in

2008 down to US$ 725.9 million in 2009, for a 2% share of total Colombian

exports.

Cerromatoso S.A. paid US$ 50 million in royalties in 2009, going from a 14%

contribution to national collections down to 7%, a 37.6% drop with respect to 2008.

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

3.3 Precious Metals

Colombian production of gold, silver and platinum during 2009 reached 59.6

tonnes (1.95 million ounces), registering a 32.9% growth with respect to production

in 2008.

48.000

Oro

42.000

Plata

Platino

36.000

Kg

30.000

24.000

18.000

12.000

6.000

0

2005

2006

2007

2008

2009

Aos

FIGURE 7. Colombian production of precious metals in kilograms

(Source: INGEOMINAS. Calculations: IMCPortal)

The countrys gold production increased 39.4%, going from 34.3 tonnes (1.12

million ounces) in 2008 to 47.84 tonnes (1.56 million ounces), the contributions of

the departments of Antioquia and Choc representing 95.1%.

Silver production, with an 18.2% growth, went from 9.2 tonnes (300,000 ounces) in

2008 to 10.8 tonnes (354,000 ounces) in 2009, and platinum production went from

1.37 tonnes (45,000 ounces) to 0.93 tonnes (30,000 ounces) in 2009, that is to

say, a 32.2% decrease in comparison with production in 2008.

Consistent with international gold price quotations (US$ 973 per ounce on average

for 2009), Colombian gold exports reached a historical maximum of US$ 1,537.2

million in 2009, US$ 645.9 million more than in 2008. The main destination markets

were the United States and Switzerland.

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

1100

1000

1400

Colombian

gold de

exports

Exportac

Colombiana

oro in millions of

US$ FOB

Millones

de US$ FOB

International

prices

Precios

Internac. (US

$/ oz) (US$/oz)

900

800

700

800

600

US$ / oz

"#

$

MillonesUS$ FOB

1100

500

500

400

200

300

2005

2006

2007

2008

2009

Aos

FIGURE 8. Colombian gold exports and international gold prices

(Source: DANE. International Prices, IMF. Calculations: IMCPortal)

During 2009, the precious metals industry paid US$ 43 million on account of

royalties, increasing royalty collections by 62% with respect to 2008, reaching a 6%

participation in total royalties paid by the mining industry.

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

4. ELECTRICITY GENERATION PROJECTS

The mining sector is one of the largest consumers of electricity, reason for which it

is important to know about the electricity generation expansion projects for the

period under study. The following table presents a description of these projects:

TABLE 3. Electricity generation expansion projects (2012 2019)

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

5. DEVELOPMENT AND EXPANSION PROJECTS BY COMPANY

In addition to the historic solidity of basic coal and ferronickel mining and the large

number of new exploration projects driven by the under-explored geological

potential that the country offers, there are several internal circumstances that have

come together so far in the decade of the 2000s: the issuance of a new Mining

Code in 2001, the beginning of the major greenfield mining exploration thrust in

national history by large mining companies, with close to 83,000 km2, which raised

considerable interest by other international mining companies, improvements in

physical and legal security conditions in the country, and the national government

policies that generate trust with attractive tax schemes.

Albeit true that the global economic downturn has placed the Colombian mining

industry in an atmosphere of expectation, the large majority of coal extractive

companies has continued with their original plans that seek to double their

production capacity through 2015, to achieve a total national production in the

order of 140 million tonnes, which are expected to reach 200 million tonnes by the

year 2020 with the entry of new coal production projects.

With the information obtained on the volume of investments in certain large-scale

coal mining projects, one can infer that the investments required in this sector in

order to attain the aforementioned production levels could reach figures in the

order of US$ 12.5 billion through the year 2010.

Even though future investments in mining of basic metals imply a high level of

uncertainty until results of the exploration activities are obtained, one can

conservatively state that expansions in ferronickel and the forecast entry of new

metal transformation facilities for metals such as bauxite for the production of

alumina in the Urab region of Antioquia, could entail investments in the order of

US$ 4.5 billion during this decade.

The exploration for gold, which intensified as of 2004, has led to three discoveries

with large-scale deposits with reserves that exceed 25 million ounces and which

would require large investments in order to materialize their production. These

results, and the significant exploratory activity in search for this metal, permit

estimating investments in the order of US$ 5 billion during the 2010 through 2020

period.

Lastly, one can estimate that the recent discoveries of gold deposits, together with

the expected reinforcement on account of decisions in the mining policy that strive

to convert Colombia into a world-class mining country, should generate new

exploration activities that could conservatively be estimated in an amount of US$ 2

billion during the period under study.

Table 4 shows a summary of expected investments, which add up to a total of US$

24 billion for the 2010 through 2020 period:

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

TABLE 4. Projection of mining investments for the 2010 through 2020 period.

SECTOR

ESTIMATED

EXPENDITURES

(US$ MILLIONS)

Coal expansions &new projects

12,500

Basic metals expansions & new projects

4,500

Gold expansions & new projects

5,000

Exploration activities

2,000

TOTAL

24,000

Source: Company reports and calculations by Asomineros Chamber of ANDI

With the expected investments in the mining sector, solid growth in the mining

sector is evident, consistent with the interest in the development of mining in

Colombia, vis--vis other countries that have a greater tradition in the mining

industry, such as Chile, which expects future investments in the order of US$ 35

billion, and Peru, in the amount of US$ 33.067 billion dollars4.

Consequently, the results obtained in this study present an important tool for the

process or setting strategies for the provision of goods and services that are

offered to the growing Colombian mining industry.

AGAR, B., 2009. Projected investment in mine development and expansion projects in Per; 2009 2010.

Research for Austrade and Austmine. 39 pg.

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

Figure 9 shows a schematic diagram of the principal mining projects in Colombia,

distributed as follows: under expansion, undergoing feasibility studies, and in the

pre-feasibility study and exploration stage.

FIGURE 9. Development and expansion projects in Colombia

Following is a rendering of the companies that are most advanced in their projects

and with the greatest possibility of expanding or developing in course of the next

10 years. For development projects, we have used, as a tool for inclusion, the level

of knowledge regarding the deposit, or the investments in exploration that are

foreseen to advance towards opening up the mine5.

Note: A good part of the information was obtained from company reports. Consequently, the ASOMINEROS

Chamber of the ANDI does not assume responsibility for errors or inaccuracies on the status of projects where

the companies did not respond to the survey that was undertaken.

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

FIGURE 10. Location of development and expansion projects that are to be

Undertaken in forthcoming years (IMCPortal, 2010)

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

5.1. Carbones del Cerrejn LLC.

Contact:

Position:

Address:

Phone:

City:

E-Mail:

Url:

Luis Germn Meneses

Executive Operations Vice president

Calle 100 # 19-54, 12th Floor

(571) 595 25 72

Bogot, D. C.

luis.german.meneses@cerrejoncoal.com

http://www.cerrejoncoal.com/secciones/CERWEB/ENGHOME/seccion_HTML.html

CORPORATE PROFILE: Cerrejn is an open pit coal mining operation that is

carried out in the North, Central and South areas of la Guajira, in the Northeast of

Colombia, the northernmost area of South America. The owners of Cerrejn, in

three equal portions, are subsidiary companies of BHP Billiton plc, Anglo American

plc and Xstrata plc.

The operation began in 1982. It is an integral operation with dedicated facilities for

the production, transport and loading of high quality thermal coal for export.

Present coal production and export capacity is 32 million tonnes per year. There

are technical feasibility studies that provide for an expansion of up to 40 million

metric tonnes as of 2012, the development of which shall depend on the evolution

of the world coal market and its technical, economic and environmental viability.

CERREJN MINE: The coal deposits are located in a 69,000 hectare stretch of

land that contains five contracted areas, as follows: North Zone, Patilla, Oreganal

and South Zone with the Colombian State, and the Central Zone with the Cerrejn

Community.

The mining operation uses 320-tonne and 240-tonne over- and inter-burden

haulage trucks, and 190-tonne trucks for coal haulage. In addition, it has a fleet of

12 P&H electric shovels, 11 of which have a 27.5M3 capacity, and one, a 34M3

capacity, as well as 6 of 42 M3 capacity Komatsu PC800 front-end shovel loaders.

For coal loading, there is a fleet of wheel and track tractors, as well as hundreds of

units of mining operation ancillary equipment. The mine facilities comprise

maintenance shops for major mining equipment and support equipment, in addition

to refurbishing shops, administrative offices and a satellite and microwave

telecommunications system between Bogot, the mine, and Puerto Bolvar.

PUERTO BOLVAR: The port is located 150 kilometres North of the mine, on the

Caribbean Sea, and receives vessels of up to 250,000 deadweight tonnes, that are

up to 300 metres long and 45 metres beam. Its navigation channel is 19 metres

deep, 225 metres wide and 4 kilometres long.

The main port facilities are: the train unloading station, three stacker-reclaimers,

and the linear shiploader that deposits the coal in the vessel holds. The present

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

annual average ship-loading rate is 6,000 tonnes per hour, peaking at up to 11,000

tonnes per hour.

Moreover, the port has a commodities pier that can receive vessels of up to 30,000

tonnes, that deliver machinery, spare parts, and other materials for the operation.

RAILROAD: The 150-kilometre long railway system connects the mine with the

export load port. The coal is transported in trains up to 130 coal cars loaded at the

silos, through a continuous process system.

The complete cycle of loading, transport, unloading at the port and return to the

mine takes approximately 12 hours. On average, seven trains are dispatched every

day.

Moreover, there is a service train that transports supplies, materials and spare

parts. The railroad system is electronically controlled from a Centralized Traffic

Control located at the mine.

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

5.2. Cerro Matoso

Contact:

Position:

Phone:

City:

E-Mail:

Url:

Peter Bergsneider

Technical Services and Business Optimization Manager

(574) 772 39 75

Montelbano, Crdoba

Peter.S.Bergsneider@bhpbilliton.com

http://www.bhpbilliton.com/bb/home.jsp

CORPORATE PROFILE: Cerromatoso S. A., owned by BHP Billiton, is a company

located in the Municipality of Montelbano (Crdoba), which produces and exports

ferronickel. It is the world'

s second largest producer of ferronickel and the nickel

industry leader in unit cost of production. The ferronickel smelter and refinery are

integrated with an open pit mine.

Present process design capacity is 50,000 tonnes per year of nickel, in the form of

ferronickel, in two production units.

The Cerro Matoso nickel deposit, the exploitation of which began in 1982, follows

an alignment of nickel-laden deposits associated with peridotites in the

departments of Antioquia and Crdoba.

The company is carrying out feasibility studies for the following projects:

-

Nickel Ore Smelting System: This project will mitigate the risk of operating

with a low SiO2/MgO ore, will allow a safer and more stable operation

during the life of the asset, will assist in maintaining throughput and as

platform for de-bottlenecking; a way of compensating for declining ore

head grades.

Potential for power generation with local coal resources study.

Early stage concept study to evaluate potential for de-bottlenecking of

Mine and process plant.

Local and regional exploration to find Nickel Resources with grade as high

as possible.

INVESTMENTS: The investments in these CMSA projects are still to be confirmed.

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

5.3. Drummond Ltd.

Contact:

Position:

Address:

Phone:

City:

E-Mail:

Url:

Jos Miguel Linares Martnez

Corporate Affairs Vice president

Calle 72 # 10-07 Of. 1302

(57-1) 587 10 00

Bogot, D. C.

jlinares@drummondltd.com

http://www.drummondco.com/operations/coal/Colombia.aspx

CORPORATE PROFILE: Drummond Ltd., Colombia Branch, is a branch of

Drummond Ltd., a company with headquarters in the United States of America and

an affiliate of the Drummond Company Inc. Group. The companys operation in

Colombia is located in the department of Cesar and is dedicated to the exploitation

of thermal coal destined for export markets. It has recoverable reserves in the

order of two billion tonnes. During 2009, the company exported 20 million metric

tonnes, mainly for consumers in the United States and Europe.

Drummond, through its affiliate, ABC Coke, is one of the main producers and

marketers of coking coal in the United States. It is widely recognized in the iron

foundry industry on account of the quality offered and its reliability in supplies. ABC

Coke has 132 furnaces with an aggregate capacity of 750,000 tonnes. Its main

consumers are the automotive industry and the pipe industry for construction.

AFFILIATES IN COLOMBIA: Drummond Ltd., Colombia Branch, and Drummond

Coal Mining LLC, Colombia Branch.

In its mining operations, Drummond uses draglines, hydraulic shovels, trucks,

electric shovels, conveyor belt systems, apron feeders and support equipment.

PRIBBENOW MINE (LA LOMA, CESAR): In the decade of the 80s, the company

acquired the rights to the areas where the open pit coal mine is located nowadays,

in the Cesar river basin, in the municipalities of El Paso, La Jagua de Ibirico and

Chiriguan. Production commenced in middle of the following decade. Sustained

growth in operations has permitted the company to increase production from one

million tonnes in 1995 to 20 Mt in 2009. During this period, close to 200 Mt have

been extracted.

The contract area spans 6,600 hectares, where the company estimates it has

recoverable reserves in the order of 230 Mt of thermal coal.

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

EL DESCANSO MINE: The El Descanso mining contract area extends through

the municipalities of Becerril, Agustn Codazzi, El Paso, La Jagua de Ibirico and

Chiriguan, in the department of Cesar, and spans 42,800 hectares.

This contractual area is divided into four blocks, one of which, the largest one,

known as Descanso Norte, began mining operations in June 2009, once the

required environmental permits were obtained. It is expected that annual

production levels will reach 25 Mt. The coal that is capable of being mined reaches

a depth of 300 m.

RINCN HONDO AND SIMILOA PROJECTS: Located in Chiriguan, Cesar,

these projects have recoverable reserves in the order of 170 million tonnes of

thermal coal.

At present, the corresponding environmental permits are in the process of being

obtained.

CERROLARGO CENTRO PROJECT: This project is located in the municipality of

La Jagua de Ibirico, department of Cesar. It is a relatively small project with

excellent quality coal. The environmental permits are in the process of being

obtained.

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

5.4. Prodeco

Contact:

Position:

Address:

Phone:

Mobile:

City:

E-mail:

Url:

Patricia de Manga

Procurement and Materials Manager

Carrera. 54 # 72-80, Ed. Ejecutivo Miss Universo, 7th Floor

(575) 369 55 00

3106420576

Barranquilla, Atlntico

patricia.demanga@prodeco.com.co

http://www.xstrata.com/

CORPORATE PROFILE: Prodeco is a thermal coal producing and exporting

company owned by Xstrata, one of the most diversified mining groups in the world,

with headquarters in Zug, Switzerland. Moreover, Xstrata also owns 33% of

Carbones del Cerrejn Llc, which is reported on separately in this study.

AFFILIATE IN COLOMBIA: Comercializadora Internacional Productos de

Colombia S. A. - C.I. Prodeco - (acquired from Glencore in 2009), is a company

that is specialized in extracting and exporting Colombian coal, which has operated

for over 40 years in the country. At present, there is a project for the repurchase of

Prodeco by Glencore International.

CALENTURITAS MINE: A deposit with a potential of one hundred million tonnes of

coal, located in the Calenturitas river basin in the Municipality of Becerril,

department of Cesar. The property spans 4,000 hectares. Although annual

production is 4.9 Mt, the Calenturitas Mine has a 10 Mt production capacity.

LA JAGUA MINE: Located in the municipality that bears its same name, in the

department of Cesar, the mine produces 4.3 Mt per year at present and has a 6 Mt

production capacity. This project integrates the mining operations of the following

companies: Consorcio Minero Unido CMU (acquired by Glencore in 2006),

Carbones El Tesoro CET (acquired by Glencore in 2007) and Carbones de La

Jagua CDL (acquired by Glencore in 2005), all acquired by Glencore and located

in the Tucuy River basin in the municipalities of Becerril and La Jagua de Ibirico in

the department of Cesar, 240 km away from the Santa Marta port area.

The integrated operation of the three mines began during the first quarter of 2009,

offering operational efficiency and permitting mining access to the 133 Mt in

reserves, the expectations being that production will increase from 4.5 Mt to 6 Mt in

2011.

The coal that is mined is transported by train to the ports in Santa Marta.

The company estimates that the useful life of the mine will extend through the year

2022.

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

GALCA PROJECT: After having entered into a shared-risk contract with Galway

Resources, Prodeco has commenced an initial program that consists of 19 drilling

operations in this project, located in the department of Cesar.

INVESTMENTS: The Company expects to increase the joint exploitation of both

mines, to reach 21 Mt by 2014, with projected investments through 2014 forecast

at US$ 1.292 billion in mining equipment, transport equipment, the port, and other

infrastructure works.

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

5.5. Mineros S. A.

Contact:

Position:

Address:

Phone:

City:

E-Mail:

Url:

Gonzalo Gmez

New Businesses Manager

Carrera 43 # 14-109

(574) 266 57 57

Medelln, Antioquia

ggomez@mineros.com.co

http://www.mineros.com.co/sitio/

CORPORATE PROFILE: Mineros is a private company, dedicated to mining of

precious metals, geared at generating the greatest value for its shareholders

through growth in its mining operations, by means of an excellent comprehensive

management system and framed in Corporate Social Responsibility.

AREAS OF OPERATIONS:

MINEROS concentrates its alluvial mining operations in profound alluviums in the

Nech River Valley, with an annual production of 120,000 ounces of gold.

Moreover, in the area of underground mining, at present, MINEROS has the La Ye

Mine, located in the Municipality of Zaragoza, sector of Naranjal, located 3.5 km

southwest of the Mineros S.A. camp.

The gold-bearing seam project has a production of approximately 35,000 ounces

per year, and measured, indicated and inferred resources are in the order of

300,000 ounces of gold.

Mine development and the erection of the ore production plant took place in 2008

and 2009, with a 500-tonne/day ore concentration capacity.

SLAG UTILIZATION: In the department of Antioquia, the company has an ore

reduction plant with a 6,200-tonne/month capacity to process the slag left from the

exploitation of the El Zancudo Mine.

INVESTMENTS: Mineros has considered the objective of going from an annual

production of 113,158 ounces in 2009 to 500,000 ounces in 2020.

EXPLORATION: In 2010, MINEROS has over 35 on-going exploration projects in

4 municipalities in the department of Antioquia.

Moreover, the company will continue to develop its growth plan, which began in

2009, with a horizon in operations in nearby locations in Latin America.

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

5.6. Vale

Contact:

Position:

Address:

Phone:

City:

E-Mail:

Url:

Marco Puccini

Manager

Calle 71B # 59-61 Of. 1204

(575) 361 49 01

Barranquilla, Atlntico

marco.puccini@vale.com.co

http://www.vale.com/vale_us/cgi/cgilua.exe/sys/start.htm?tpl=home

CORPORATE PROFILE: Vale, formerly known as Vale Do Rio Doce, is the

second most diversified mining and metal company in the world, with a presence in

30 countries. It is the most important logistics operator in Brazil, with annual

revenues of US$ 35 billion.

Moreover, it is the largest world producer of ferrous minerals and pellets, and one

of the largest nickel producers. The company also produces copper, manganese,

steel alloys, bauxite, alumina, aluminum and coal.

The companys strategy in Colombia is the creation of a platform to increase its

coal assets.

AFFILIATE IN COLOMBIA: Vale Colombia Ltda.

EL HATILLO MINE: In March 2009, Vale closed the purchase of this open pit coal

mine, located in the municipalities of El Paso, Chiriguan and La Jagua de Ibirico,

in the department of Cesar, from Emcarbn S.A. (wholly owned affiliate of

Inversiones Argos S.A.), for US$ 300 million, and attained an 8.43% shareholding

in the Fenoco railway concession, which connects these mining concessions with

the coal export ports located in the department of Magdalena.

During 2009, the mine produced 1.2 Mt of thermal coal. At present, an expansion is

taking place, which is expected to permit reaching 3.2 Mt in 2010 and 4.5 Mt in

2011. The Las Cuevas coal deposit is located within the concession, which holds

additional resources in the amount of 50 million tonnes, the exploitation of which is

scheduled to permit reaching a production of 9.5 Mt by the year 2014.

The coal handling facilities, along with the various support facilities and

infrastructure necessary for the Hatillo Corridor Mine operations include: a ROM

coal storage area, ROM hopper, crusher, screening plant and stockpile, equipped

with a linear stacker. Stockpiled coal is reclaimed with front-end loaders and placed

in either over-the-road trucks, or a mobile reclaim hopper that feeds a train-loading

silo.

A fully equipped analytical laboratory is located at the coal-handling site.

Mine support facilities include a shop and warehouse, equipment yard, storage

area for explosives and drainage control facilities.

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

RAILWAY: Vale owns 8.43% of the Fenoco partnership and the right to transport

up to 3.5Mt per year. At the moment, Vale has 3 locomotives with a towing

locomotive, and 134 wagons, each with a capacity of 60 tonnes. This year, in order

to increase hauling capacity, Vale is buying 2 locomotives and 125 wagons.

RIO CORDOBA PORT PROCESS: Receiving Area of coal from the El Hatillo mine

(railway and trucks). Stockpiles: Coal stocking in two 420m long by 15m height

stockpiles. Each stockpile has a stocking capacity of 140kt to provide a total of

280kt. Shipping: 1,500t barges are loaded at the dock, then the coal is transported

to a deep enough zone to load ships with a capacity of up to 150kt. Marine

equipment: 4 1,500 t barges, 1 1,200t barge, and 2 3,000t barges (currently being

acquired). 1 Tugboat 30 days availability and 1,000 HP, 1 Tugboat for every

shipment with 2,000 HP, 1 Crane with 30 days availability and 12,000-tonne daily

loading capacity.

CERROLARGO SUR PROSPECT: Located in the Municipality of La Jagua de

Ibirico, department of Cesar. This prospect has a potential of 500 million tonnes

and is under exploration.

OTHER PROSPECTS: The company has 57 outstanding mining concession

applications, particularly for thermal coal and also for iron ore and copper.

INVESTMENTS: Investments in excess of US$ 1.5 billion are estimated, in order to

reach a projected production in the order of 15 million tonnes in the period.

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

5.7. Grupo EBX

Contact:

Position:

Address:

Phone:

City:

E-Mail:

Url:

Jos Saade

General Manager, MPX Colombia S.A.

Av. Carrera 9 # 113-52, Of. 1803

(571) 592 22 77

Bogot, D. C.

jose.saade@mpx.com.co

http://www.ebx.com.br/grupoebx.php

CORPORATE PROFILE: The Brazilian Group EBX began its gold and iron mining

activities during the decade of the 80s. Over the last few years, it has focused its

efforts on the identification of investment opportunities in the infrastructure and

natural resource sectors: MMX (minerals), MPX (energy), LLX (logistics), OGX

(hydrocarbons) and OSX (oil services).

MPX Energa S. A. (BOVESPA: MPXE3), is a company that is listed in the Sao

Paulo, Brazil stock market.

AFFILIATE IN COLOMBIA: MPX Colombia S.A.

THERMAL COAL PROJECT IN LA GUAJIRA: The company has 68,000 hectares

(168,000 acres) that are included in the Cerrejn Formation in the municipalities of

San Juan, Fonseca and El Morro, department of La Guajira, south of the Cerrejn

Complex, where three areas have been identified where thermal coal exploitation

activities will commence as of 2012, with the goal of attaining 15 million tonnes (Mt)

per annum in 2021, in three open pit mines (Caaverales, Papayal and San

Benito) and one underground mine (San Juan). In March 2010, the company

announced resources in the amount of 1,740 Mt and reserves of 55.8 Mt.

Estimated investments for these mining developments through 2021 shall be US$

962 million.

COAL PORT PROJECT: Future production in the coal project in La Guajira shall

be transported initially by truck along approximately 150 km to our own port on the

Caribbean Sea at the Municipality of Dibulla, department of La Guajira, which shall

have a capacity of 20 Mt per annum as of 2013. Until then, piers in the cities of

Santa Marta and Cinaga (Magdalena) will be used. Estimated investments for the

port shall amount to US$ 400 million.

RAILROAD PROJECT: 3 alternatives are under study for the route for a railroad

that is to operate as of 2016, with a transport capacity of 20 Mt per year.

Investments are estimated at US$ 400 million.

CESAR PROSPECT: The Company is exploring for coal in 13,000 hectares

(32,000 acres) in the municipalities of El Paso and Codazzi in the department of

Cesar.

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

LA BODEGA PROSPECT: Following the acquisition of 17.5% of Canadian

exploration company Ventana Gold (TSX:VEN), EBX obtained participation

through its AUX company in the exploration projects at the La Bodega prospect,

particularly at the site known as La Mascota, considered by international experts as

being world class.

The prospect, which includes the La Bodega, Coloro and El Cuatro properties, is

located in the municipalities of Vetas and California, department of Santander. It

spans 863 hectares (2,100 acres), where close to 64,000 meters have been drilled,

finding assay values of up to 7.8 g/t.

Ventana Gold considers that the La Bodega prospect will reach an annual

production of 500,000 ounces of gold, with extraction costs of US$ 295 per ounce.

VETAS-CALIFORNIA PROSPECT: This project, also belonging to Ventana Gold

(TSX:VEN), has 3,710 hectares (9,200 acres), located in the municipalities of

Vetas and California in the department of Santander.

The prospect is located in the Santander mountain mass on the Eastern mountain

range, with outcrops of rocks of the Bucaramanga Formation (Precambrian).

OTHER PROSPECTS: The Company has 22 mining titles and 31 mining

concession applications distributed throughout the country.

INVESTMENTS: In summary, for coal developments, the company estimates that,

between 2010 and 2015, it will be investing US$ 376 million in mine exploitation

and US$ 617 million in railroad and port infrastructure. Subsequently, between

2016 and 2020, it shall invest US$ 856 million more, reaching US$ 1.85 billion.

Investments in the country for gold shall be approximately US$ 35 million initially

and could reach US$ 400 million during the period through the year 2020.

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

5.8. Carbones San Fernando

Contact:

Position:

Address:

Phone:

City:

E-Mail:

Jorge E. Buitrago

Mining Manager

Av. 6 Norte No. 47N-32

(572) 6652400 ext. 110

Cali, Colombia

jebuitrago@genercauca.com

CORPORATE PROFILE: Carbones San Fernando (CSF) is an affiliate of

Genercauca S.A. ESP, an energy generation and marketing company throughout

the Colombian territory. CSF was founded in 1961 and since then, has been

dedicated to the underground exploitation of coal in the Municipality of Amag,

Antioquia. In the last 5 years, CSF has also developed mines in Jamund, Valle del

Cauca and in Cucunub in Cundinamarca, and in 2009 produced close to 300,000

tonnes of coal.

SAN JOAQUIN PROJECT: In 2007, the company started the exploitation of this

project in Amag, which consists of semi-mechanized underground mining in long

pits, with production at present of 1,000 tones/day and a forecast of 2,500

tonnes/day by the end of 2011.

INVESTMENTS: With the purpose of completing the mechanization of this mine,

CSF plans a US$ 10 million investment for coal production.

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

5.9. Carbones del Norte del Cesar Norcarbn S. A.

Contact:

Position:

Address:

Phone:

City:

E-Mail:

URL:

Hugo Tamayo

Manager

Carrera 28 # 134A-11

(574) 3135258

Bogot, D. C.

norcarbon@norcarbon.com.co

http://norcarbon.com.co (under construction)

CORPORATE PROFILE: Norcarbn is a company created with Colombian capital

(Atlantic Coal and Geominas S. A.)

CERROLARGO NORTE MINE: During 2009, the company extracted 306,000

tonnes of thermal coal at this mine, located in the Municipality of La Jagua de

Ibirico, department of Cesar. The project comprises two open pit exploitation areas,

known as Cerro Largo Norte, with a maximum production of 96,000 tonnes per

year, and Cerro Largo South, with 288,000 tonnes per year.

Exploitation is performed with open pit and underground mining. The operation is

performed through mining operator companies under the companys supervision

and control.

Based on the limits established for open pit exploitation, there are reserves to be

exploited in the order of 8.2 Mt with an average 7.7:1 stripping ratio, which will be

exploited over the next 5 years.

During 2009, production capacity was 600,000 tonnes per year. It is expected to

reach 800,000 tonnes in 2011 and shall stabilize as of 2012 at 1 million tonnes.

INVESTMENTS: No information.

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

5.10. Minera El Roble Miner S. A.

Contact:

Position:

Address:

Phone:

City:

E-Mail:

Jorge Vera

Manager

Carrera 43A 1 Sur-69 Of. 701 Tempo Building

(574) 266 08 11

Medelln, Antioquia

javera@une.net.co

CORPORATE PROFILE: The Mina El Roble S.A. company is a national company,

whose main activity is to obtain copper concentrates.

EL ROBLE MINE: This mine, owned by the Minera El Roble S. A. Company, is the

only mine that produces significant copper volumes in Colombia. It is located 4 km

north of the Municipality of Carmen de Atrato in the department of Choc, where

the mineralization consists of pyrite, yellow copper ore and pyrrhotite in quartz and

carbonate veins.

Production at El Roble began in 1990, when the reserves were calculated at 1 Mt

with average tenors of 4.41% of copper, 3.11 g/t of gold and 9.81 g/t of silver. At

the time, the mine had a 14 kt/year production of concentrate, with 24% average

copper content. The average annual production at this mine is 8 kt of copper

concentrate.

Exploitation of the copper mineral that is carried out by the Mina El Roble S.A.

company is performed in an underground manner, using the method of sinking

blocks, achieving a 90% recovery of the deposit. The mine is scheduled to produce

96 tonnes of copper mineral per year, for which purpose it has compressors, drills,

loaders, a locomotive, tipping skips, a bulldozer and a truck equipped with a crane.

For beneficiation, crushers are used, as well as a ball mill, vibrating sieves, a

flotation battery, concentrate condensers, drum filters and conveyor belts.

Close to 50% of production corresponds to gold and platinum and the 50% balance

to copper.

INVESTMENTS: No information

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

5.11. Carbones de Los Andes Carboandes S. A.

Contact:

Position:

Address:

Phone:

City:

E-Mail:

Url:

Mara Victoria Saade

Manager

Av. Calle 127 # 16A-76, Of. 403 - 404

(571) 627 93 46

Bogot, D. C

informacin@carboandes.com

http://www.carboandes.com.co/portal/

CORPORATE PROFILE: Carboandes is a Colombian company involved in the

productive chain of exploration, production and marketing of coal and other

minerals.

RONDN PROJECT: This project is located in the Municipality of Rondn in the

department of Boyac and will have a portion of its coal exploitation as an open pit

mine and another portion underground. At present, it is requesting the

environmental license for the construction of this mine, in which US$ 3.4 million

have been invested in the exploration process.

Aside from indicating that there are large reserves, the company has not made the

project technical or financial information for the public.

OTHER PROJECTS: The Company has the Santa Luca and Simcota projects,

considered to have great strategic importance. However, the company does not

offer information for commercial reasons.

INVESTMENTS: No information.

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

5.12. Greystar Resources Ltd. Sucursal Colombia

Contact:

Position:

Address:

City:

Phone:

E-mail:

Url:

Frederick Felder

Executive Vicepresident

Carrera 27 No. 36-14 Of 601

Bucaramanga, Santander

(+577) 6347778

ffelder@greystar.com.co

www.greystar.com.co

Current Development Project: ANGOSTURA GOLD PROJECT.

Stage of development: Feasibility Study.

The preliminary Feasibility Study was developed by GRD Minproc Limited, an

Australian engineering and development company. Website: www.minproc.com

Greystars wholly owned Angostura gold and silver deposit is located in the

northeastern region of Colombia, some 450 km to the north of the capital city of

Bogot, and approximately 67 km northeast of the city of Bucaramanga. The

Angostura deposit is a typical high sulphidation gold/silver deposit.

Greystar is a Toronto Stock Exchange listed Canadian public company.

Development is due to commence immediately on approval of the Environmental

Impact Study with construction of production facilities scheduled to start-up in the

first quarter of 2011. The construction phase is estimated in two and a half years,

and the initial investment will be of around 640 million dollars. The total capital cost

for the project is estimated in 945 million dollars.

Angostura mining is an open pit operation.

Mineral processing and plant design: The processing facility proposed for the

Angostura gold project has been designed to include both heap leaching and

flotation processes. The initial start-up (year 3) would entail processing of oxides,

transitional and low sulphide material by heap leaching. In year 5, the operation

would also start producing sulphide float concentrates and high sulphur

mineralization for sale to third parties, from higher grade sulphide ore by milling

and flotation process.

The pregnant leach solutions (PLS) will be treated in a Merrill Crowe process plant

for metal production. Smelting will take place in an electric induction, tilting crucible

furnace to produce Dore.

The following timeframe was devised, in order to establish the overall development

of the project and key targets.

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

Year 1: Phase 0. Platform for crushing and milling facilities.

Year 2: Preproduction phase 1. Construction and assembling of crushing plant.

Year 3: Heap leaching process start-up.

Year 5: Milling and flotation process start-up.

Services, plant and equipment requirements

The main surface mining equipment required for period 2011 to 2020 is as follows:

5 hydraulic shovels 29 yd3 capacity, 1 wheel loader 23 yd3 capacity, 41 trucks of

185 tons capacity, 6 bulldozers of 550 HP, 3 wheel dozers of 500 HP, 3 motor

graders of 280 HP, 3 water trucks with 30,000 gallons tanks, 1 backhoe with a

bucket capacity of 1 m3 and 6 rotary drilling equipment, crawler-mounted, with a

pull down capacity of 45,000 pounds.

Plants and ancillary facilities: Belt conveyors, crushing and milling facilities, heap

leach pads, tanks, piping, valves, submersible pumps, tailings dam construction,

Merril Crowe refinery plant, power supply, water supply, water diversion channels,

water treatment plant, access and service roads, communication systems, control

systems, fire protection systems, truck workshop, storage and handling of

concentrates facilities at port site, and mine camp and administration facilities.

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

5.13. Anglogold Ashanti

Contact:

Position:

Address:

Phone:

City:

E-mail:

Url:

Ramiro Santa

Corporative Affairs Vice-president

Calle 116 # 7-15 Piso 8.

(571) 657 91 00

Bogot

rsanta@anglogoldashanti.com

http://www.anglogoldashanticolombia.com/

CORPORATE PROFILE: A private South African gold mining affiliate of Paulson &

Co., whose main listing is in the Johannesburg Stock Market, and is also listed in

the Stock Markets in New York, London, Australia, Ghana, Euronext Pars and

Euronext Brussels. Among its properties in Latin America, there is the gold and

silver Cerro Vanguardia mine in Argentina, and the Morro Velho and Serra Grande

mines in Brazil.

Since 2003, when it established itself in Colombia, the company and its associates

have invested over US$ 140 million in greenfield type exploration. Since 2004, the

systematic base exploration program in the country included the exploration with

systematic sampling of active sediments, prospecting, and, in certain areas, airtransported geophysics in 112,000 square kilometres (km2) of the 113,000 square

km2 that had previously been applied for. This work concluded with the return of

104,000 km2, 423 active mining concession contracts (8,250 km2), in which the

forecast is the objective definition through pre-feasibility studies, 42 drilling targets,

and two projects with a relevant importance: La Colosa (100% AngloGold) and

Gramalote (49% AngloGold).

These prospects are operated directly by the company and with joint venture

shared risk contracts with B2Gold, Mineros S. A., Mega Uranium and Glencore.

AFFILIATE IN COLOMBIA: AngloGold Ashanti Colombia S.A.

LA COLOSA PROJECT: This is a greenfield type project discovered by AngloGold

Ashanti in 2006, that is located in the Municipality of Cajamarca in the department

of Tolima and is 100% AngloGold. AngloGold Ashanti has forecast the entry into

operation of this project for 2014, with 31 t annually, and its stabilization in 2017, at

25,5 t annually.

Based on the drilling performed and the modeling of the resources, it is considered

that this is a gold-bearing porphyry system, with tenors exceeding 0.3 g/t and

inferred resources in the amount of 12.3 million ounces.

The low copper content gold-bearing porphyry system at La Colosa is genetically

associated with intrusive porphyritics that intrude Paleozoic schists. The

mineralizations with the highest assays are associated with a group of porphyric

intrusions and gaps, with sodium calcium alterations, 5% pyrite and traces of

yellow copper ore and molybdenite.

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

GRAMALOTE PROJECT: This property is located in the Municipality of San

Roque in Antioquia. Through a shared risk joint venture contract with B2Gold (51%

B2Gold 49% AngloGold Ashanti), in which B2Gold is the operator and performed

the exploration of the area during 2009 by means of a drilling program.

The inferred gold-bearing resources are estimated at 74,375 million tonnes, with

tenors of 1 g/t, for a total of 2.39 million ounces of gold (NI 43-101).

The property is contained within the medium grain tonalites and granodiorites in

the Cretaceous Era batholith in Antioquia, and has had traditional artisan mining

since pre-Columbian times. In 2008, the company completed a total of 30,189 m

drilled with 90 diamond drilling bores that were added to the 12,312 m previously

drilled by AngloGold in 2007.

The mineralization consists of an intrusive with stockwork and structurally

controlled quartz and quartz pyrite veins.

QUEBRADONA PROJECT: The property, located in the Municipality of Jeric in

the department of Antioquia, contains five gold-bearing porphyry systems. In 2008,

B2Gold, the operator of the exploration, completed a 43 borehole drilling program

with a total of 13,318 m in the areas of Aurora, Isabella, La Sola, Chaquiro and

Tenedor.

The area is explored under a shared risk joint venture contract (B2Gold 51% AngloGold 49%). AngloGold has a future option to increase its share to 51% or

65%.

OTHER PROSPECTS: The company has 649 mining titles, of which 245 were

granted during 2009, and 2,702 applications for mining concessions.

INVESTMENTS: For the opening of the La Colosa mine, it is estimated that a US$

2.0 billion investment will be required for the exploration phase, and US$ 2.5 billion

additional investment to start up the mine.

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

5.14. B2Gold Corp.

Contact:

Position:

Address:

Phone:

City:

E-Mail:

Url:

Julin Villarruel

Corporate Affairs Director

Calle 113 No. 7-21 Office 1001 Tower A

(571) 638 61 68

Bogot, D. C.

jvillarruel@b2gold.com

http://www.b2gold.com

CORPORATE PROFILE: B2Gold Corp. (TSX-BTO) is a company with

headquarters in Vancouver, with two mines in Nicaragua and a strong portfolio of

development and exploration objectives in Nicaragua, Colombia, Costa Rica and

Eastern Russia.

B2Gold was founded as a private company in 2007 by the former administrative

team of Bema Gold Corp., which grew from junior explorer to become an

international producer and finally, was acquired by Kinross Gold Corp.

AFFILIATE IN COLOMBIA: Andean Avasca S. A.

QUEBRADONA PROJECT: The property, located in the Municipality of Jeric,

department of Antioquia, contains five gold-bearing porphyry systems. In 2008, the

company completed a 43 bore drilling program with a total of 13,318 m in the areas

of Aurora, Isabella, La Sola, Chaquiro and Tenedor.

The area is explored under a shared risk joint venture contract (B2Gold 51% AngloGold 49%).

GRAMALOTE PROJECT: This property is located in the Municipality of San

Roque in Antioquia. Under a shared risk contract with AngloGold Ashanti (51%

B2Gold 49% AngloGold Ashanti), in which B2Gold, as the operator, performed

the exploration of the area during 2009 through a drilling program. The company

expects to commence production in 2014 with an annual extraction of 150 ounces

of gold.

The inferred gold-bearing resources are estimated at 74,375 million tonnes with

tenors of 1 g/t, for a total of 2.39 million ounces of gold (NI 43-101).

The property is contained within the medium grain tonalites and granodiorites in

the Cretaceous Era batholith in Antioquia, and has had traditional artisan mining

since pre-Columbian times. In 2008, the company completed a total of 30,189 m

drilled in 90 diamond drilling bores, in addition to the 12,312 m that had previously

been drilled by AngloGold in 2007.

Project Investment on Mine Development

and Expansion Projects in Colombia 2010 - 2020

The mineralization consists of an intrusive with stockwork and structurally