Escolar Documentos

Profissional Documentos

Cultura Documentos

Vietnam Review Economy 2012

Enviado por

toanvmpetrologxDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Vietnam Review Economy 2012

Enviado por

toanvmpetrologxDireitos autorais:

Formatos disponíveis

Economic and Trade Office

Embassy of Israel in Hanoi

Economic Overview

Vietnam entered 2012 in a phase of heightened macroeconomic vulnerabilities. This was

characterized by the high and rising inflation rate, extreme volatility in the foreign

exchange market, rapidly dwindling international reserves, a sharp rise in country risk

following default by one of its biggest state-owned enterprises, high level of fiscal and

trade deficits, and weaknesses in the banking and corporate sectors. These

vulnerabilities and the absence of a persuasive strategy to address them led to

progressive weakening sentiments towards the countrys economic prospects.

In early 2012 Vietnam unveiled a broad "three pillar" economic reform program,

proposing the restructuring of public investment, state-owned enterprises and the

financial sector. Throughout the year these three issues were at the focus of public

interest, political turmoil and concern from business community. But what has so far been

missing is a restructuring roadmap with a clear timetable and an effective oversight

mechanism for implementing it.

The lack of implementation resulted in credit crunch (mainly for small and medium

enterprises which practically could not get reasonable loans) and concerns of defaults

due to increasing lost debt by the SOEs. The latter scenario has been prevented so far,

mainly due to the governments tightening of its spending.

GDP in the first three quarters, 2012 went up by 4.73% y-o-y, still far from 5.77% of

quarter 3 of 2011. Loosening monetary and fiscal policies, aggressively implemented

since quarter 2 in order to revert growth momentum via public investment and financial

supporting packages for businesses and companies, have resulted in the improvement of

GDP. However, aggregate demand and retail sales still remained weaker than expected.

GDP is expected to grow around 5.2% by the end of 2012 and 5.5%-5.8% in 2013.

Agriculture's share of economic output has continued to shrink from about 25% in 2000 to

about 22% in 2011, while industry's share increased from 36% to 40% in the same period

Chart of GDP Growth

68 Nguyen Thai Hoc, Hanoi; Tel: +84-4-38433140 (ext. 513, 514)

E-mail: Vietnam@israeltrade.gov.il

Website: http://itrade.gov.il/vietnam

Linkedin: Israel Trade Mission- Vietnam

Facebook: vietnam.israel

2

Economic and Trade Office

Embassy of Israel in Hanoi

Quarter 3 of 2012 economic statistics showed a slow improvement in the economy, while

pressure on inflation returned. Hence, in quarter 4/2012 and next year the Government

would focus on stabilizing prices, prudently disbursing public investments, and continuing

to restructure the banking system and state-owned groups.

With gains from macroeconomic stabilization still recent and fragile, especially in an

external environment that is fraught with uncertainty, the government needs to be careful

not to shift to an expansionary stance prematurely. With rapid disinflation and negative

credit growth during the first four months of the year, a decline in interest rates (from 15%

in 2011 to 9% in 2012) was perhaps justified.

Similarly, Governments Resolution 13 tries to support affected enterprises by deferring

tax payments and lowering land lease fees, whose fiscal impact will be limited to less

than0.5 percent of GDP. But given Vietnams history of premature loosening of policy,

there are reasons to exercise caution.

Since public debt is at a more elevated level, there is less room for fiscal stimulus in

2012-3 than was the case in 2009. Finally, with lingering inefficiencies in state-owned

enterprises and weaknesses in the banking system, stimulus measures will contribute to

preserving an inefficient growth model, going against the Governments own desire to

move towards a more productive and competitive economy.

Fiscal Policy

There is a need for the government to rein in the fiscal deficit, both to prevent the

economy from overheating and also to avoid financing problems (outstanding public debt

is estimated to have stood at 51% of annual GDP at the end of 2011). However, the

authorities will make only limited progress in reducing the shortfall in 2012-16. The deficit

narrowed to an estimated 4.8% of GDP in 2011, in part reflecting the fact that the

government had some success in its efforts to reduce public investment spending.

However, the Economist Intelligence Unit expects the deficit to widen in 2012, to the

equivalent of 6.1% of GDP, as slowing growth in exports and a fall in global oil prices will

reduce the amount of tax collected (the Vietnamese authorities receive substantial tax

and royalty revenue from the oil and gas sector).

68 Nguyen Thai Hoc, Hanoi; Tel: +84-4-38433140 (ext. 513, 514)

E-mail: Vietnam@israeltrade.gov.il

Website: http://itrade.gov.il/vietnam

Linkedin: Israel Trade Mission- Vietnam

Facebook: vietnam.israel

3

Economic and Trade Office

Embassy of Israel in Hanoi

Monetary policy

The State Bank of Vietnam (SBV) has reiterated its commitment to taming inflation, and

in January its governor, announcement of reducing target for annual credit growth this

year of between 15% and 17%, compared with a goal of 20% in 2011. However credit

growth declined rapidly to 14.3 percent by the end of 2011 and continued its decelerating

trend in the first four months of 2012.

The rules on lending to real estate and for private consumption were relaxed. SBV

encouraged commercial banks to lower lending rates and promote credit for production,

agriculture and rural development, exports, and small and medium enterprises. SBV also

lowered the foreign exchange position limit of credit institutions and branches of foreign

banks by day-end to 20 percent, from the current level of 30 percent.

Inflation

Annual inflation has slowed for more than

9 consecutive months since August 2011,

suggesting that the rate of price increases

may have peaked. Inflation is expected to

remain elevated and that it will average

10% in 2012, above the governments

target of 9%.

Inflation in 2013 is expected to reach

around 12% as economy recovers and

government increases it spending.

Credit Rating

The near-bankruptcy and subsequent default of the state-owned-enterprise Vinashin, a

leading shipbuilder, led to a ratings downgrade of Vietnam's sovereign debt, exacerbating

Vietnam's borrowing difficulties. Two major credit rating agencies (S&P and Moodys)

gave opposite outlooks on Vietnam. Standard & Poors revised its Banking Industry

Country Risk Assessment (BICRA) on Vietnam to group 9 from group 10, while the

economic risk score was lowered from 10 to 9 in the wake of changes in assessment of

economic imbalance to high risk from very high risk. On the contrary, Moodys

Investor Service downgraded domestic and international bonds by one notch to B2, longterm foreign currency deposit to B3 from B2, with all being assigned stable outlook.

These credit rating agencies commended Vietnam governments effort on mitigating

macroeconomic imbalance, inflation, restructuring economy, especially banking sector.

However, bad-debt fears, co-ownership among banks as well as macroeconomic

uncertainties (accelerating inflation, low aggregate demand, high inventory levels signify

heaps of challenges while long-term macroeconomic stability is not clear.

68 Nguyen Thai Hoc, Hanoi; Tel: +84-4-38433140 (ext. 513, 514)

E-mail: Vietnam@israeltrade.gov.il

Website: http://itrade.gov.il/vietnam

Linkedin: Israel Trade Mission- Vietnam

Facebook: vietnam.israel

4

Economic and Trade Office

Embassy of Israel in Hanoi

Foreign Direct Investment

A major source of the growth deceleration is the slow growth in public and private

investment, as the government prepares to move the economy away from factors

accumulation to productivity as the key source of growth. With slowdown in credit growth

and efforts to restructure public investment, total investment has fallen sharplyfrom

41.9 percent of GDP in 2010 to 34.6percent in 2011 (panel A). The decline has been

uniformly shared between state budget, state-owned enterprises and private sector. And

within the private sector, while domestic private enterprises have scaled back their

investment plans, the disbursement from foreign firms has not slowed down significantly.

However, the commitment of foreign investors has declined in recent months (panel B)

a source of major concern, since Vietnam is looking for new sources of growth and will

require infusion of foreign capital to restructure its stateowned enterprises and banking

sector.

Monthly Foreign Investment Forecast

68 Nguyen Thai Hoc, Hanoi; Tel: +84-4-38433140 (ext. 513, 514)

E-mail: Vietnam@israeltrade.gov.il

Website: http://itrade.gov.il/vietnam

Linkedin: Israel Trade Mission- Vietnam

Facebook: vietnam.israel

5

Economic and Trade Office

Embassy of Israel in Hanoi

Exchange Rate

Exchange rate was stable in 2012 around

VND20,900 per USD

The strengthening of the Vietnam Dong (+2%

ytd) was due to a Balance of Payment surplus,

estimated around USD8 bn in the first three

quarters. Healthier foreign reserves, which

amounted to USD22 bn in October according

to the SBV, also gave some firm support to the

dong. According to some officials, the value of

the dong should be stable through year-end as

expecting the SBV will continue to enhance its

reserves (~USD23bn by year end) while USD

inflows via FDI and remittances should be

stable, reaching USD10-11bn each.

Trade Performance

Vietnams growth pessimism stands in sharp contrast with its robust export performance

in recent years. As shown in figure 10, at 34.2 percent in 2011, Vietnam recorded the

highest rate of export growth in developing East Asia, with China coming at a distant

second. The same performance has been repeated in the first four months of 2012,

though Vietnams overall growth of exports has declined.

68 Nguyen Thai Hoc, Hanoi; Tel: +84-4-38433140 (ext. 513, 514)

E-mail: Vietnam@israeltrade.gov.il

Website: http://itrade.gov.il/vietnam

Linkedin: Israel Trade Mission- Vietnam

Facebook: vietnam.israel

6

Economic and Trade Office

Embassy of Israel in Hanoi

Foreign Trade Policy

Vietnam and the United States signed a bilateral trade agreement in July 2000 and

Vietnam acceded to the WTO in January 2007. Since then, Vietnam has done well in

exploiting the benefits of these trade agreements and has steadily increased the market

share of its main export items relative to key competitors. In 2011 Vietnam became the

26th largest source of merchandise imports for the United States, with its total exports

increasing by 21 times in nominal terms between 2000 and 2011.

Obama and his second term cabinet will focus more on trade with Vietnam than during

the first term. Partners in the Asia-Pacific and Vietnam can expect a more focused effort

to bring the Transpacific Partnership Agreement (TTP) negotiations to a successful end

and will drive for an agreement as early as end of 2013. The TPP is a multilateral free

trade agreement that aims to further liberalize the economies of the Asia-Pacific region.

The objective of the original agreement was to eliminate 90 percent of all tariffs between

member countries by January 1, 2006, and reduce all trade tariffs to zero by the year

2015. It is a comprehensive agreement covering all the main pillars of a free trade

agreement, including trade in goods, rules of origin, trade remedies, sanitary and

phytosanitary measures, technical barriers to trade, trade in services, intellectual

property, government procurement and competition policy.

68 Nguyen Thai Hoc, Hanoi; Tel: +84-4-38433140 (ext. 513, 514)

E-mail: Vietnam@israeltrade.gov.il

Website: http://itrade.gov.il/vietnam

Linkedin: Israel Trade Mission- Vietnam

Facebook: vietnam.israel

7

Economic and Trade Office

Embassy of Israel in Hanoi

The Vietnam-Japan Economic Partnership Agreement came into effect on July 1 2009

and has already aided an increase in garment exports to Japan. It is currently negotiating

bilateral free trade agreements with South Korea and the European Union and will start

negotiating with Ukraine in early 2013.

Vietnam is a member of a growing network of regional trade agreements, both

individually and as part of the Association of Southeast Nations (ASEAN). In its capacity

of member of ASEAN, Vietnam is part of the ASEAN-China Preferential Trade

Agreement, ASEAN-China Economic Integration Agreement and the ASEAN Free Trade

Area (AFTA), ASEAN-Japan Free Trade Agreement and ASEAN-Australia-New Zealand

Free Trade Economic Integration Agreements. Vietnam is a signatory of the Global

System of Trade Preferences among Developing Countries (GSTP), a Preferential Trade

Agreement signed with other seventy-six developing countries.

Summary

Vietnam still has much to do in terms of stabilizing the economy and restoring consumer

and investor confidence. Vietnams currency, the dong, has fallen sharply in value in the

past two years, and there has consequently been strong demand for locally available

safe-haven assets in the form of US dollars and gold.

On the international front, there remains the risk that the global economy could re-enter

recession, triggered by sovereign debt defaults in the euro zone. This would not only hit

Vietnams export performance but would also have a knock-on effect on domestic

consumer and business spending, thereby inhibiting economic growth. Given the

precarious nature of the countrys foreign-exchange reserves, there is also cause for

concern regarding Vietnams ability to finance its current-account deficit. Citing concerns

about the possibility of an external-payments crisis global credit rating agencies have

downgraded Vietnams sovereign debt rating.

A fall in inward foreign investment in the past year which was previously one of the main

drivers of economic growth is expected to hang over until inflation stabilises and global

economic conditions improve.

In light of the weak economy, the National Assembly approved a GDP growth target for

2013 of 5.5%, lower than its previous plan of 6% growth. Hence, the consensus is that

Vietnams economy will continue to grow relatively slowly, around 5-6% for the next 2-3

years. It will be hard for the country to restore confidence among businesses and

consumers until inflation issues are addressed.

Vietnam will continue to make strides in strengthening its ties with the West, and

particularly the US. Relations with China will remain strained over competing claims to

the Spratly and Paracel islands in the South China Sea.

The growth slowdown in Vietnam needs to be viewed also through the prism of several

developments at home and abroad. The global economy as well as the East Asia

regional economy are both expected to slowdown in 2012 even more than in 2011

reflecting weaknesses in the external environment and slower than expected recovery

68 Nguyen Thai Hoc, Hanoi; Tel: +84-4-38433140 (ext. 513, 514)

E-mail: Vietnam@israeltrade.gov.il

Website: http://itrade.gov.il/vietnam

Linkedin: Israel Trade Mission- Vietnam

Facebook: vietnam.israel

8

Economic and Trade Office

Embassy of Israel in Hanoi

from the financial crisis. Given the structure of Vietnams economy that is characterized

by high trade to GDP ratio, large share of foreign investment in total investment, and

sizeable level of remittances it is unlikely to remain immune from global developments for

an extended period of time. At the same time, efforts to stabilize the economy through

tight monetary and fiscal policies and the ongoing restructuring agenda are having

adverse effects, including closure of enterprises and loss of jobsthough not stabilizing

the economy would have led to even bigger losses.

Sectors at a Glance

Medical Devices

In October 2009, Vietnam Government introduced a new law regarding compulsory

health insurance for all citizens and expects to achieve total coverage by 2014. There are

three levels of benefits under the health insurance scheme; the first level covers all or

100% of expenses at nominated medical facilities, another cover 95% and 80% of the

expenses respectively with the patient making up the rest.

In addition, the government has pledged 45.2 trillion Dong (US$2.5 billion) to build or

upgrade specialty hospitals and some provincial-level general hospitals in mountainous

and other disadvantaged areas in the 2009-2013 period.

The private healthcare sector in Vietnam has expanded since the lifting of the ban on

private practice in 1989. People often choose to use private facilities, if they can afford to

do so, as the quality of state healthcare provision is very poor. According to latest data,

an estimated 62.2% of healthcare expenditure is private.

An estimated 91% of the medical device market is supplied by imports, and the sector is

growing rapidly. Japan, Germany, China and the USA are the leading suppliers,

accounting for 42.6% of imports in 2011. Local production is limited to basic items such

as syringes and hospital beds. The value of exports reached US$420.9 million in 2011,

with 34.2% of medical products exported to Japan.

In 2012, the Vietnamese market for medical equipment and supplies is estimated at

US$634 million, or just over US$7 per capita. It is expected that the device market will

continue to expand strongly at 18.6% per annum to 2017. This will take the Vietnamese

market to around US$1.5 billion in 2017, although the per capita rate will remain low at

only US$16.

Vietnams government has been changing its policies by creating more land leasing and

tax incentives in order to attract more investors to get engaged in health care services

with the motive of assisting Vietnamese people have better access to medical facilities&

services. According to ministrys statistic of Foreign Press Center, Vietnam currently has

90 private hospitals. Franco-Vietnam hospital, for example, was built in 2001 and located

in the central area of Southern Saigon. It was sponsored by France with a total cost of

$40 million. Franco hospital is one of a few modern hospitals in Vietnam. This hospital is

68 Nguyen Thai Hoc, Hanoi; Tel: +84-4-38433140 (ext. 513, 514)

E-mail: Vietnam@israeltrade.gov.il

Website: http://itrade.gov.il/vietnam

Linkedin: Israel Trade Mission- Vietnam

Facebook: vietnam.israel

9

Economic and Trade Office

Embassy of Israel in Hanoi

specialized in imaging, emergency care, laboratory service and more. The hospital is

financed by 20% of government budget and 80% of foreign aid.

Vietnam receives a large amount of international aid in the form of loans and donated

medical equipment. A number of small projects are currently taking place in Vietnam,

including those funded by the World Bank and the EU. However, Vietnam has been

facing budget deficit and regional economic crisis since 2010 which influenced pending

payment to public hospitals and medical devices suppliers/ traders.

There is a trend that local hospitals are seeking for modern technologies and technique.

For instance, In 2012 two hospitals, Viet Duc and Bao Son, have applied advanced

medical technologies of Israel. Viet Duc hospital used Laparoscopic surgery with the

support of the robot that helps remote surgery applications in gyne-cological surgery,

urology, general and heart diseases. Bao Son hospital engaged with ExAblate integrates

that focuses ultrasound thermal ablation with GEs MR imaging capabilities to provide a

non-invasive surgery for ablating (destroying) targeted tissue.

Pharmaceuticals

Report by Ministry of Health revealed that the total value of Vietnams drug consumption

reached almost US$2.0 billion in 2010. During the period 2005 to 2010, production

increased by a CAGR (Compound Annual Growth Rate) of around 25%. The government

announced that improving the domestic pharmaceutical industry is the health sectors

highest priority over the next few years, in order to meet around 70% of the nations drug

demand by 2015. A plan to develop and restructure the pharmaceutical industry is

underway, which includes boosting production of essential drugs in order to cut prices,

stabilise the market and reduce the countrys dependence on foreign pharmaceutical

imports.

Vietnam is one of the few countries, alongside China and South Korea, which have fully

integrated traditional medicines within their healthcare system. Additionally, the WHO has

organised training workshops on the use of traditional medicines for selected diseases

and disorders in Vietnam. However, despite having a vast and diverse array of medicinal

plants, Vietnam lacks the investment to turn these into commercial medicines. Currently,

many materials required to manufacture herbal medicines are imported from China.

According to the DAV, locally-produced drugs accounted for just50.18% of

pharmaceutical demand in 2008.

In 2011, Vietnam spent around VND 154,919 billion (US$7.5 billion) on healthcare,

equivalent to 6.1% of GDP. Private spending accounted for around 61.6% of the total, the

majority of which was out of pocket spending. At US$85 in 2011, per capita spending

was comparable to Indonesia and slightly higher than the Philippines. By global

standards it is relatively low, with Vietnam ranking well outside the top 50 countries in the

world for per capita health spending.

Despite recent improvements to the IP environment, illegal copying remains

commonplace due to the lack enforcement of legislation. The government has little scope

to tackle the problem, since majority of drug sales in Vietnam are achieved not through

regulated pharmacies but through private dealers that handle drugs worth an estimated

68 Nguyen Thai Hoc, Hanoi; Tel: +84-4-38433140 (ext. 513, 514)

E-mail: Vietnam@israeltrade.gov.il

Website: http://itrade.gov.il/vietnam

Linkedin: Israel Trade Mission- Vietnam

Facebook: vietnam.israel

10

Economic and Trade Office

Embassy of Israel in Hanoi

US$450mn per year. In addition, the country has long, poorly monitored borders with

countries such as Laos, China and Cambodia, where the counterfeit drug trade is active.

Not only fake forms of common drugs, such as Tanganil, for the treatment of vertigo,

Mobic tablets for the short-term treatment of painful osteoarthritis are illegally made, but

other specialised drugs such as Vastarel, for chest pain and Dogmatil, mental

imbalances, have been on the market. The Vietnam National Institute of Drug Quality

Control said that in 2011, they discovered 31 different kinds of fake drugs being sold.

Furthermore, of 48,261 drug samples that were tested, 940 did not meet the standards.

According to regulations, after the discovery of low quality medication, the Vietnam Drug

Administration or the local department of health must immediately issue a ban on that

drug on hospitals, pharmacies and enterprises to purchase them. But the system has

been slow in action and many of these drugs slipped through the cracks.

New Media

With 30 million of Internet users, every Vietnamese person has 82 friends on social

networks, and he is a member of eight different social networks. These are high figures if

compared with other countries in the region.

New Media is a new concept in Vietnam but it has been applied widely especially in

Marketing for Fast Moving Consumer Goods (FMCGs)*, electricity, consumers services

etc. Social Networks (use interaction social pages such as Facebook, Zingme), web

advertising, chat rooms, online community (different industry has different specialized

forum), email and mobile computing starts to have a position in this market. However, the

use of a variety of advanced New Media technologies is very limited in the market.

Currently, there are 3 main mobile providers present in the Mobile Value Added Service

Market- Mobifone, Vinaphone, and Viettel. Each operator has hundreds of value-added

services for particular users but there is not much difference among operators which

have made users confused. Mobile value-added services used to be provided via SMS,

now subscribers can use these services by directly browsing website, online stores and

application stores. Though credit card and on line payment is not very common in

Vietnam, payment methods are becoming more convenient and transparent and that

helps to boost the users demand.

68 Nguyen Thai Hoc, Hanoi; Tel: +84-4-38433140 (ext. 513, 514)

E-mail: Vietnam@israeltrade.gov.il

Website: http://itrade.gov.il/vietnam

Linkedin: Israel Trade Mission- Vietnam

Facebook: vietnam.israel

11

Economic and Trade Office

Embassy of Israel in Hanoi

According to interviews with Vietnamese gamers, many were spending 60,000 to

100,000 VND ($3 - $6) per month on on-line gaming. In one high-end Internet caf, a few

interviewees were spending an average of 500,000 VND ($31) per month. These

consumers are driving the digital entertainment and online games market with virtual item

purchases. Top online games in Vietnam can attract 200,000 users. The Internet cafes

that the researchers visited in Vietnam were consistently crowded with users playing

online games.

Since producing games online is temporarily prohibited by The Vietnamese Ministry of

Information and Communications (MIC), there has been a chance for browser-based

games and social games. As browser-based games and social games are not

considered as game online and also publishing is quite simple and easy, it was

recognised that there were around 60 browser-based games published in 2011. With

This gave birth to a new trend--the operators now co-publish online games, which is

called 'channelling'. Then gamers can enjoy by visiting Business Tycoon Online on

SGame's site, VNG's social network Zing Me, and FPT Online's online gaming portal

Gate.

IBC 2012 The international exhibition to promote Electronic Media and Entertainment

Industry has been taken place in Amsterdam last September and has attracted numerous

of visitors from Vietnam such as Satecom, Thaicom and Mediatec. This reflects the

potentials of Vietnam New Media Market in the recent and coming years.

Sources

1. Country Risks Report 2012 The Economist Intelligence Unit Limited 2012

2. Vietnam Outlook Aug Report 2012 MB Security

3. VCB September Economic Report

4. CIA The World Factbook, Vietnam, https://www.cia.gov/library/publications/the worldfactbook/geos/vm.html

5. Country Report - The Economist Intelligence Unit Limited 2012

6. World Bank Review of Vietnam Report June 2012

7. Macro Update 2012 Viet Capital

8. Vietnam Business Forecast 2012 Business Monitor International Ltd

9. http://www.qdnd.vn/qdndsite/vi-VN/43/Default.aspx

10. Medical Devices Market Vietnam 2012 Espicon Business Intelligence

11. ThePharma Market Vietnam Espicon Intelligence Business

12. BMI Pharmaceuticals & Healthcare 2011 Report Business Monitoring International

13. http://internationalbusiness.wikia.com/wiki/Vietnam_growth_of_private_hospitals

14. http://english.vietnamnet.vn/fms/business/51715/business-in-brief-4-11.html

15. Vietnam Online Game Market 2011 - The Economist

*Fast Moving Consumer Goods (FMCG) or Consumer Packaged Goods (CPG) are

products that are sold quickly and at relatively low cost. Examples include non-durable

goods such as soft drinks, toiletries, and grocery items

68 Nguyen Thai Hoc, Hanoi; Tel: +84-4-38433140 (ext. 513, 514)

E-mail: Vietnam@israeltrade.gov.il

Website: http://itrade.gov.il/vietnam

Linkedin: Israel Trade Mission- Vietnam

Facebook: vietnam.israel

12

Economic and Trade Office

Embassy of Israel in Hanoi

About Us

The Economic & Trade Mission at the Embassy of Israel in Vietnam

aims to enhance the business relations between the two countries by arranging a wide

range of activities through which mutual trust and cooperation can be achieved.

For Further information

E-mail: Vietnam@israeltrade.gov.il

Tel: +84-4-3843-3140

Ho Chi Minh City Office:

Email: Israel.trade.hcmc@gmail.com

Disclaimer:

This review is not a recommendation to take action or refrain from taking an action.

This document is for reference only.

December 2012

68 Nguyen Thai Hoc, Hanoi; Tel: +84-4-38433140 (ext. 513, 514)

E-mail: Vietnam@israeltrade.gov.il

Website: http://itrade.gov.il/vietnam

Linkedin: Israel Trade Mission- Vietnam

Facebook: vietnam.israel

13

Você também pode gostar

- Example of Calculating Molecular MassDocumento1 páginaExample of Calculating Molecular MasstoanvmpetrologxAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Enabling Environment in PakistanDocumento1 páginaThe Enabling Environment in PakistantoanvmpetrologxAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Prefixes Used in The SI SystemDocumento1 páginaPrefixes Used in The SI SystemtoanvmpetrologxAinda não há avaliações

- Measurement of Density and TemepraturesDocumento1 páginaMeasurement of Density and TemepraturestoanvmpetrologxAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Measurement of Some Physical PropertiesDocumento1 páginaMeasurement of Some Physical PropertiestoanvmpetrologxAinda não há avaliações

- The Importance of ChemistryDocumento1 páginaThe Importance of ChemistrytoanvmpetrologxAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- How To Calculate Molecular MassDocumento1 páginaHow To Calculate Molecular MasstoanvmpetrologxAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Reference On Properties of Various Southern Diesel BlendsDocumento2 páginasReference On Properties of Various Southern Diesel BlendstoanvmpetrologxAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Flow Totalization of LiquidDocumento1 páginaFlow Totalization of LiquidtoanvmpetrologxAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- 3.3.1 Waveforms: Waveforms Are A Kind of Graph. Graphs Have An X-Axis, Which RunsDocumento1 página3.3.1 Waveforms: Waveforms Are A Kind of Graph. Graphs Have An X-Axis, Which RunstoanvmpetrologxAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Clausen Weir Rule For Wate Measurement UtahDocumento1 páginaClausen Weir Rule For Wate Measurement UtahtoanvmpetrologxAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Overshot Gates For Water MeasurementDocumento1 páginaOvershot Gates For Water MeasurementtoanvmpetrologxAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Environment Management System ManualDocumento5 páginasEnvironment Management System ManualtoanvmpetrologxAinda não há avaliações

- English Studying TipsDocumento3 páginasEnglish Studying TipstoanvmpetrologxAinda não há avaliações

- Solvent Extraction OsunDocumento1 páginaSolvent Extraction OsuntoanvmpetrologxAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- API DocumentationDocumento115 páginasAPI DocumentationEric ScrivnerAinda não há avaliações

- Chapter 5 Cisco Forensik DigitalDocumento5 páginasChapter 5 Cisco Forensik DigitalEuwinto ChristianAinda não há avaliações

- Lesson Plan-2Documento5 páginasLesson Plan-2api-464424894Ainda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- 5G Basic TrainingDocumento3 páginas5G Basic TrainingShubham Singh TomarAinda não há avaliações

- Wireless Communications Using RatsDocumento16 páginasWireless Communications Using RatsManik BhadwalAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Graduate Rotational Internship ProgramDocumento15 páginasGraduate Rotational Internship ProgramDinesh KhicharAinda não há avaliações

- H02 Answer CNDocumento6 páginasH02 Answer CNAjay MalikAinda não há avaliações

- Hurricane Irma After Action Report - City of Marco IslandDocumento16 páginasHurricane Irma After Action Report - City of Marco IslandOmar Rodriguez OrtizAinda não há avaliações

- Best Practices For Data QualityDocumento37 páginasBest Practices For Data Qualitysyed ahmed moizAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Opticodec-PC WowzaDocumento2 páginasOpticodec-PC WowzaFauzan SasmitaAinda não há avaliações

- Cyber Lab ManualDocumento15 páginasCyber Lab ManualATAinda não há avaliações

- Using Event Log Using Syslog - Moxa Technologies Managed Ethernet Switch - Extender User Manual (Page 96)Documento1 páginaUsing Event Log Using Syslog - Moxa Technologies Managed Ethernet Switch - Extender User Manual (Page 96)Boudam BoudjemaAinda não há avaliações

- CF Lecture 10 - Email ForensicsDocumento55 páginasCF Lecture 10 - Email ForensicsFaisal ShahzadAinda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Outage Report 05 PM 25 Jan 2021Documento57 páginasOutage Report 05 PM 25 Jan 2021Nokia scffilesAinda não há avaliações

- Stair Reynolds Is Essentials PPT Chapter 1Documento77 páginasStair Reynolds Is Essentials PPT Chapter 1Robinson MojicaAinda não há avaliações

- Hand Punch 3000Documento2 páginasHand Punch 3000oserranomAinda não há avaliações

- MNC Error Fix For Teletech v2.1Documento8 páginasMNC Error Fix For Teletech v2.1Vincent AndradeAinda não há avaliações

- Oracle Advanced Security: Administrator's GuideDocumento282 páginasOracle Advanced Security: Administrator's GuideRaja RamAinda não há avaliações

- WSTG (Web Application Security Testing) OWASP - Mind MapDocumento1 páginaWSTG (Web Application Security Testing) OWASP - Mind MapMatheus FragaAinda não há avaliações

- TCP - IP Protocol Suite - Chapter 03 - Multiple Choice QuizDocumento3 páginasTCP - IP Protocol Suite - Chapter 03 - Multiple Choice QuizSulaimon Bashir100% (1)

- Specification EVOLUTIONneoDocumento5 páginasSpecification EVOLUTIONneoRiky FitriadiAinda não há avaliações

- Ecommerce Lecture Series: E-Commerce & E-Business Concepts and ComponentsDocumento38 páginasEcommerce Lecture Series: E-Commerce & E-Business Concepts and ComponentsBadder DanbadAinda não há avaliações

- The Courage To Be Disliked How To Change Your Life and Achieve Real Happiness Free Download, Borrow, and Streaming Internet 2Documento1 páginaThe Courage To Be Disliked How To Change Your Life and Achieve Real Happiness Free Download, Borrow, and Streaming Internet 2cgrmontoyaAinda não há avaliações

- InterLink BrochureDocumento8 páginasInterLink BrochurePetyo GeorgievAinda não há avaliações

- CS101 SyllabusDocumento5 páginasCS101 SyllabusDrake HerreraAinda não há avaliações

- Amelia de VeyraDocumento1 páginaAmelia de VeyraAnonymous bjxzfFRNFBAinda não há avaliações

- Exercise EmailDocumento6 páginasExercise EmailMammeri ElhachemiAinda não há avaliações

- Barriers and Enablers To Adoption of ISO 20121Documento66 páginasBarriers and Enablers To Adoption of ISO 20121SoniaSegerMercedes100% (1)

- Name: S Class: Fybmm Roll No: 47 Subject: FMC Topic: Linked Presented To: Neha GurdasaniDocumento12 páginasName: S Class: Fybmm Roll No: 47 Subject: FMC Topic: Linked Presented To: Neha GurdasaniSujal KambleAinda não há avaliações

- m330 31 Oms v100 A4 e ScreenDocumento545 páginasm330 31 Oms v100 A4 e ScreenBoonsub ThongwichitAinda não há avaliações

- Chesapeake Requiem: A Year with the Watermen of Vanishing Tangier IslandNo EverandChesapeake Requiem: A Year with the Watermen of Vanishing Tangier IslandNota: 4 de 5 estrelas4/5 (38)

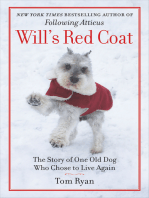

- Will's Red Coat: The Story of One Old Dog Who Chose to Live AgainNo EverandWill's Red Coat: The Story of One Old Dog Who Chose to Live AgainNota: 4.5 de 5 estrelas4.5/5 (18)