Escolar Documentos

Profissional Documentos

Cultura Documentos

News Flash 26.11.2014

Enviado por

binalamitDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

News Flash 26.11.2014

Enviado por

binalamitDireitos autorais:

Formatos disponíveis

Baroda Academy, Ahmedabad

NEWS FLASH 26.11.2014

Stressed banks may face lending curbs: RBI has asked banks facing excessive stress due

to a rise in bad loans and restructured debt to beef up recovery efforts, failing which lending

restrictions could be imposed. According to sources, the RBI is mulling action in terms of

limiting loan-sanctioning powers of banks with stressed asset ratios near 20 per cent. (BS)

RBI: ready to flexible on loan recast to spur growth: RBI Governor said that the

regulator was exploring ways to allow banks more flexibility in restructuring loans in

response to their constant demand for grater flexibility to restructure loans. (IE)

Credit System needs reforms: Governor: Calling for reforms in the credit system, the

Reserve Bank of India Governor Raghuram Rajan on Tuesday said the present credit

mechanism protects large borrowers and needs reforms with regard to lending and borrowing.

(BL)

Recast dry up as ARCs, banks wage price war: With banks reluctant to sell bad loans to

asset reconstruction companies (ARCs) at steeply discounted rates, ARCs expect a dull time

ahead.

According to P Rudran, managing director and CEO of Indias oldest ARC Arcil the

company is now targeting a purchase of around Rs 3,500 crore of bad loans in the fiscal,

compared with the Rs 5,000-crore target at the beginning of the year. (FE)

Rupee rises as CAD seen under control on drop in crude prices: Rupee rose on

optimism a drop in oil prices will help keep the nations current account deficit under control

and slow inflation. (FE)

At $39.66 billion, foreign portfolio flows at record high: Foreign Portfolio Investors

(FPIs) have broken the record for the highest-ever purchases of Indian stocks and debt in a

calendar year with a full month still to go. They have bought (net basis) $39.66 billion of

equity and fixed-income assets so far, beating the $39.45 billion in 2010. (BL)

Jaitley to review Jan Dhan scheme today: Finance Minister will chair the first

quarterly meeting of the Mission of PMJDY to review, among others, the progress of account

opening and deposits, duplication and multiplicity of accounts, lack of telecom connectivity,

and challenges being faced by the Yojana. (BL)

Public sector banks top Jan Dhan score at halftime: Public sector banks (PSBs) are

racing ahead in the opening of accounts under the scheme. Of the 7.91 crore total accounts

opened till November 22, the PSBs accounted for 6.36 crore. This was followed by regional

rural banks sponsored by PSBs) at 1.34 crore accounts. Private sector banks have so far

opened 21.33 lakh accounts. (BL)

SBI draws up social media code, warns of action against non-compliance: SBI is

pressing employees to accept a social media policy, styled Code of conduct for employees for

expressing views in social media. A circular was issued by the bank on June 17 and the same

is now being circulated digitally in the banks Human Resource Management System portal.

(BL)

Kotak Mahindra Bank to foray into general insurance business: A week after

acquiring ING Vysya bank in an all-share deal, private-sector lender Kotak Mahindra Bank has

announced it will foray into the general insurance business and received RBIs approval on

Tuesday to form a subsidiary for general insurance. (BS)

Quote of the day: To succeed, jump as quickly at opportunities as you do at

conclusions.

https://www.facebook.com/Barodaacademy ; https://twitter.com/barodaacademy

A snapshot of economic data points

25.11.201

4

28388.05

8463.10

Call Rate

5 yrs G Sec

7.70

8.17

SENSEX

NIFTY

10 yrs G Sec

8.14

$/

BPLR of our Bank (09.02.2013)

CRR/SLR (09.02.2013)/(09.08.14)

4.00/22.00

61.87

14.50%

This is an initiative of Baroda Academy, Ahmedabad- Compiled by Santosh Kumar Gupta; Research Associate

Disclaimer: The above does not purport to substitute or supplement banks extant guidelines on operational issues.

Baroda Academy

Inventing Methods for Igniting Minds

Baroda Academy, Ahmedabad

Repo Rate/Rev. Repo Rate

(28.01.2014)

Forex Res. (14.11.2014) in $ billion

6 Month LIBOR (25.11.2014)

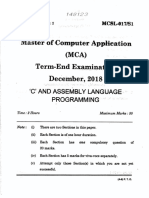

NEWS FLASH 26.11.2014

Base Rate of Our Bank (09.02.13)

10.25%

8.00/7.00

Brent Crude ($ per barrel)

315.551

0.32740%

Gold (Rs. per 10 gms)

78.97

26700

This is an initiative of Baroda Academy, Ahmedabad- Compiled by Santosh Kumar Gupta; Research Associate

Disclaimer: The above does not purport to substitute or supplement banks extant guidelines on operational issues.

Baroda Academy

Inventing Methods for Igniting Minds

Você também pode gostar

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- Accounting Past MCQDocumento108 páginasAccounting Past MCQbinalamitAinda não há avaliações

- Group 8 Original WorkDocumento41 páginasGroup 8 Original WorkbinalamitAinda não há avaliações

- MCQ Accounting DoneDocumento7 páginasMCQ Accounting DonebinalamitAinda não há avaliações

- sYLLABUS sEM 3Documento9 páginassYLLABUS sEM 3binalamitAinda não há avaliações

- Acc Exam 1Documento21 páginasAcc Exam 1binalamitAinda não há avaliações

- MCA NotesDocumento189 páginasMCA NotesbinalamitAinda não há avaliações

- Data StructuresDocumento59 páginasData StructuresbinalamitAinda não há avaliações

- Important Circular June 2019 ETE 115Documento1 páginaImportant Circular June 2019 ETE 115binalamitAinda não há avaliações

- Assignment Bca Visual BasicDocumento12 páginasAssignment Bca Visual BasicbinalamitAinda não há avaliações

- Assignment Bca DBMSDocumento13 páginasAssignment Bca DBMSbinalamitAinda não há avaliações

- Qpaper - Ignou - 2018 - C 3Documento2 páginasQpaper - Ignou - 2018 - C 3binalamitAinda não há avaliações

- DSC VivaQuestions PDFDocumento7 páginasDSC VivaQuestions PDFbinalamitAinda não há avaliações

- Qpaper - Ignou - 2018 - C - Asm 1Documento2 páginasQpaper - Ignou - 2018 - C - Asm 1binalamitAinda não há avaliações

- Bachelor of Computer Applications (Revised) (BCA) Term-End Practical Examination December, 2017 Bcsl-021 (P) /S4: C Language Programming LabDocumento1 páginaBachelor of Computer Applications (Revised) (BCA) Term-End Practical Examination December, 2017 Bcsl-021 (P) /S4: C Language Programming LabbinalamitAinda não há avaliações

- Session Schedule - 18062018 To 19062018Documento1 páginaSession Schedule - 18062018 To 19062018binalamitAinda não há avaliações

- Please Send The Details of Zonal Credit Officer To Be Nominated, at The EarliestDocumento3 páginasPlease Send The Details of Zonal Credit Officer To Be Nominated, at The EarliestbinalamitAinda não há avaliações

- Qpaper - Ignou - 2018 - C - Asm 2Documento2 páginasQpaper - Ignou - 2018 - C - Asm 2binalamitAinda não há avaliações

- Qpaper - Ignou - 2018 - C - Asm 3Documento2 páginasQpaper - Ignou - 2018 - C - Asm 3binalamitAinda não há avaliações

- Qpaper - Ignou - 2018 - C 5Documento2 páginasQpaper - Ignou - 2018 - C 5binalamitAinda não há avaliações

- Bachelor of Computer Application (Revised) (BCA) Term-End Examination December, 2018 'C' Language Programming LabDocumento2 páginasBachelor of Computer Application (Revised) (BCA) Term-End Examination December, 2018 'C' Language Programming LabbinalamitAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- INSTA SUBJECT TEST - 25 2023 (WWW - Upscmaterial.online)Documento110 páginasINSTA SUBJECT TEST - 25 2023 (WWW - Upscmaterial.online)youpsc2024Ainda não há avaliações

- Banking LawDocumento2 páginasBanking LawDamini MannAinda não há avaliações

- Gulf Rupees - A History: Peter SymesDocumento7 páginasGulf Rupees - A History: Peter SymesSudhathJainAinda não há avaliações

- Business Quiz: A: Organization of The Petroleum Exporting CountriesDocumento53 páginasBusiness Quiz: A: Organization of The Petroleum Exporting CountriessoumitrabehuraAinda não há avaliações

- Changing Landscape of BankingDocumento18 páginasChanging Landscape of BankingAkash YadavAinda não há avaliações

- Economics Upsc 2021Documento18 páginasEconomics Upsc 2021Pulkit MalikAinda não há avaliações

- Plagiarism Checker X - Report: Originality AssessmentDocumento30 páginasPlagiarism Checker X - Report: Originality Assessmentaurorashiva1Ainda não há avaliações

- Comparative Study of The Public Sector Amp Private Sector BankDocumento67 páginasComparative Study of The Public Sector Amp Private Sector Bankvandana_daki3941Ainda não há avaliações

- Tender Document-Tendersure WorkDocumento161 páginasTender Document-Tendersure WorkVinay RajAinda não há avaliações

- Amendments and Additions To Ifsca Banking Handbook and Other Issues12112021075247Documento5 páginasAmendments and Additions To Ifsca Banking Handbook and Other Issues12112021075247Rishab GoelAinda não há avaliações

- Padmashri Annasaheb Jadhav Bharatiya Samaj Unnati Mandal'SDocumento88 páginasPadmashri Annasaheb Jadhav Bharatiya Samaj Unnati Mandal'Sstar kingAinda não há avaliações

- Bajaj Auto Finance LTDDocumento3 páginasBajaj Auto Finance LTDradhikaAinda não há avaliações

- Pcs Montlhy Current Affairs November 2019 English 29Documento30 páginasPcs Montlhy Current Affairs November 2019 English 29veer singhAinda não há avaliações

- Case Study On Inflation PDFDocumento2 páginasCase Study On Inflation PDFMansi GuptaAinda não há avaliações

- Suggested Reference Material For RbiDocumento4 páginasSuggested Reference Material For RbiMadhu BalaAinda não há avaliações

- Chapter - 1 Reserve Bank of India Act, 1934Documento13 páginasChapter - 1 Reserve Bank of India Act, 1934arushiAinda não há avaliações

- State of Indian Fintech Report, Q3 2022Documento54 páginasState of Indian Fintech Report, Q3 2022axfAinda não há avaliações

- Role of Central BankDocumento32 páginasRole of Central BankAsadul Hoque100% (3)

- Analyzing Punjab National Bank Scam: June 2019Documento9 páginasAnalyzing Punjab National Bank Scam: June 2019TejaswiniAinda não há avaliações

- Chapter 5 - RevisionDocumento13 páginasChapter 5 - RevisionActOn Business Solutions (Simplifying Business)Ainda não há avaliações

- Basel - I, II, IIIDocumento23 páginasBasel - I, II, IIISangram PandaAinda não há avaliações

- Sample Application Form (Clix)Documento4 páginasSample Application Form (Clix)Digi CreditAinda não há avaliações

- Safe Deposit Locker Service in KCBLDocumento8 páginasSafe Deposit Locker Service in KCBLtanimaAinda não há avaliações

- ECSDocumento53 páginasECSApurva MeshramAinda não há avaliações

- (Eng) February Monthly Current Affairs Capsule by Vikas TayaDocumento6 páginas(Eng) February Monthly Current Affairs Capsule by Vikas TayariyasharmastudiesAinda não há avaliações

- HDFC Bank - Wikipedia, The Free Encyclopedia - Part2Documento1 páginaHDFC Bank - Wikipedia, The Free Encyclopedia - Part2Rahul LuharAinda não há avaliações

- LLM 411: Indian Constitutional Law: Schedule-A Ll.M. Course of Study Ll.M. First Semester Core PaperDocumento50 páginasLLM 411: Indian Constitutional Law: Schedule-A Ll.M. Course of Study Ll.M. First Semester Core Paperbhavishyat kumawatAinda não há avaliações

- Financial InclusionDocumento37 páginasFinancial Inclusionparvati anilkumarAinda não há avaliações

- Amit Black Book Idbi BankDocumento83 páginasAmit Black Book Idbi Bankamit100% (3)

- AEE219 FINANCE (SEM 2) Before MTT BITS PDFDocumento13 páginasAEE219 FINANCE (SEM 2) Before MTT BITS PDFnarra bharathAinda não há avaliações