Escolar Documentos

Profissional Documentos

Cultura Documentos

Fiscal Incentives To Tourism Economic Zone Operators and Registered Tourism Enterprises Within The TEZ

Enviado por

Agnes Pajilan0 notas0% acharam este documento útil (0 voto)

55 visualizações3 páginasTEZ

Título original

Fiscal Incentives to Tourism Economic Zone Operators and Registered Tourism Enterprises Within the TEZ

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOC, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoTEZ

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOC, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

55 visualizações3 páginasFiscal Incentives To Tourism Economic Zone Operators and Registered Tourism Enterprises Within The TEZ

Enviado por

Agnes PajilanTEZ

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOC, PDF, TXT ou leia online no Scribd

Você está na página 1de 3

Fiscal Incentives to Tourism Economic Zone

Operators

and

Registered

Tourism

Enterprises

Within

the

TEZ

(under

TIEZA/Tourism Infrastructure and Enterprise

Zone Authority)

1. Income Tax Holiday

a.

New enterprises in Greenfield

and Brownfield Tourism Zones

shall, from the start

of business operations, be exempt from tax on income for a

period of six (6) years.

b.

The income tax holiday may be extended if the enterprise

undertakes a substantial

expansion or upgrade of its facilities

prior to the expiration of the first six (6) years.

c. Existing enterprise in Brownfield Tourism Zone shall be entitled to

avail of a non-extendible income tax holiday if it undertakes an

extensive expansion or upgrade of facilities. The cost of such

expansion or upgrade in relation to the original investment shall

be considered in the grant of said incentive.

d. These enterprises shall be allowed to carryover as a deduction

from the gross income for the next six (6) consecutive years

immediately following the year of the loss, their net operating

losses for any taxable year immediately preceeding the current

taxable year which had not been previously offset as deduction

from gross income. Only such losses as have been incurred after

registration may be carried over.

2. Gross Income Taxation

a.

Except real estate taxes and such fees as may be imposed by the

TIEZA, a new enterprise shall be exempt from payment of all

national and local taxes and license fees, imposts and

assessments.

b.

In lieu thereof, it shall pay a tax of five percent (5) on its gross

income earned which shall be distributed as follows:

One- third (1/3) to be proportionately allocated among affected

cities or

municipalities

One- third (1/3) to the national government; and

One- third (1/3) to TIEZA

1.

Tax and Duty-Free importation of:

1.1. Capital Investment and Equipment

Registered enterprises shall be entitled to an exemption of one

hundred percent (100%) of all taxes and customs duties on

importation of capital investment and equipment provided that

these are directly and actually needed and will be used

exclusively by the enterprises in its registered activity.

1.2.

Transportation Equipment and Spare Parts

Importation of transportation equipment and the accompanying

spare parts of new and expanding registered enterprises shall

be exempt from customs duties and national taxes, provided

that:

a.

They are not manufactured domestically in sufficient

quantity, of comparable

quality and at reasonable prices;

b.

They are reasonably needed; and

c.

Shall be used exclusively by an accredited tourism

enterprise.

3.3. Goods and Services

a.

Importation of goods actually consumed in the course of

services actually rendered by or through registered

enterprises within a TEZ shall enjoy one hundred percent

(100%) exemption from all taxes and customs duties:

Provided, however, That no goods shall be imported for the

purpose of operating a wholesale or retail establishment in

competition with the Duty Free Philippines Corporation

(DFPC); and

b.

A tax credit equivalent to all national internal revenue

taxes paid on all locally-sourced goods and services

directly or indirectly used by the registered enterprise for

services actually rendered within the TEZ.

2.

Social Responsibility Incentive

TEZ Operators and Registered Tourism Enterprises shall be

entitled to a tax deduction equivalent to fifty percent (50%) of

the cost of environmental protection or cultural heritage,

preservation activities, sustainable livelihood programs for local

communities, and other similar activities as approved by the

TIEZA Board.

II. Non-fiscal Incentives Available

Operators

and

Registered

Enterprises

1.

to TEZ

Tourism

Employment of Foreign Nationals

A registered enterprise may employ foreign nationals in

executive, supervisory, technical, or advisory position for such

reasonable periods and under such terms as may be provided by

the TIEZA Board.

2.

Special Investors Resident Visa

A foreign national who invests at least US$200,00.xx in a TEZ

and/or a Registered Tourism Enterprise, his dependents, spouse

and unmarried children under 18 yrs. of age, shall be entitled to

a special investors resident visa enabling the foreign national to

reside in the Philippines while his or her investment subsists.tives

for Retirement Economic Zone Developer / Operator

1.

Subject to regulations to be issued by the Bureau of

Immigration, the TIEZA shall issue working visas renewable every

2 years to foreign personnel and other aliens possessing highlytechnical skills which no Filipino within the TEZ possesses, after

they have secured Alien Employment Permits (AEP) from the

Department of Labor and Employment (DOLE).

SOURCE : TIEZA Website

Você também pode gostar

- Philippine Bank Not Responsible for Imported Goods Not Matching DocumentsDocumento4 páginasPhilippine Bank Not Responsible for Imported Goods Not Matching DocumentsAgnes PajilanAinda não há avaliações

- Crespo vs. MogulDocumento5 páginasCrespo vs. MogulPanday L. MasonAinda não há avaliações

- CIR V IsabelaDocumento6 páginasCIR V IsabelaAgnes PajilanAinda não há avaliações

- List of Incentives Under EO 226Documento1 páginaList of Incentives Under EO 226Agnes PajilanAinda não há avaliações

- Cases - ConflictsDocumento87 páginasCases - ConflictsAgnes PajilanAinda não há avaliações

- Mosquera V PanganibanDocumento7 páginasMosquera V PanganibanAgnes PajilanAinda não há avaliações

- Petitioner Vs Vs Respondent: Second DivisionDocumento7 páginasPetitioner Vs Vs Respondent: Second DivisionAgnes PajilanAinda não há avaliações

- SEC Opinion To Romulo Mabanta PDFDocumento1 páginaSEC Opinion To Romulo Mabanta PDFAgnes PajilanAinda não há avaliações

- RF - Checklist of Requirements - New ApplicantsDocumento1 páginaRF - Checklist of Requirements - New ApplicantsAgnes PajilanAinda não há avaliações

- People Vs TandaDocumento5 páginasPeople Vs TandaZyril MarchanAinda não há avaliações

- Allied Special Services - PEZADocumento2 páginasAllied Special Services - PEZAAgnes PajilanAinda não há avaliações

- US V OrtegaDocumento2 páginasUS V OrtegaAgnes PajilanAinda não há avaliações

- People V de Los SantosDocumento4 páginasPeople V de Los SantosAgnes PajilanAinda não há avaliações

- CIR vs. AichiDocumento21 páginasCIR vs. AichijerrymanalangAinda não há avaliações

- GR 187485 Cir V San RoqueDocumento51 páginasGR 187485 Cir V San RoqueNick NañgitAinda não há avaliações

- Mercantilelawqa1990 2006 PDFDocumento103 páginasMercantilelawqa1990 2006 PDFCarmela Paola R. DumlaoAinda não há avaliações

- EstafaDocumento3 páginasEstafaAgnes PajilanAinda não há avaliações

- Eo 495Documento4 páginasEo 495Agnes PajilanAinda não há avaliações

- Tricare Guam Study ChartDocumento1 páginaTricare Guam Study ChartAgnes PajilanAinda não há avaliações

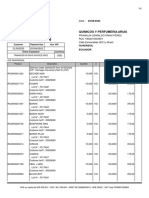

- Cta 00 CV 06533 D 2003may16 Ass PDFDocumento15 páginasCta 00 CV 06533 D 2003may16 Ass PDFAgnes PajilanAinda não há avaliações

- Financial AnalysisDocumento10 páginasFinancial AnalysisAgnes PajilanAinda não há avaliações

- PRAYER For Strategic PlanningDocumento1 páginaPRAYER For Strategic PlanningAgnes PajilanAinda não há avaliações

- Nursing Homes in The PHDocumento6 páginasNursing Homes in The PHAgnes PajilanAinda não há avaliações

- Eo 495Documento4 páginasEo 495Agnes PajilanAinda não há avaliações

- Malaysia's MM2H Program Targets 3,000 Participants in 2012Documento3 páginasMalaysia's MM2H Program Targets 3,000 Participants in 2012Agnes PajilanAinda não há avaliações

- RF - Suggested Feasibility StudyDocumento2 páginasRF - Suggested Feasibility StudyAgnes PajilanAinda não há avaliações

- MP - Application FormDocumento2 páginasMP - Application FormAgnes PajilanAinda não há avaliações

- MP - Checklist of RequirementsDocumento1 páginaMP - Checklist of RequirementsAgnes PajilanAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Student Activity Permit Approval ProcessDocumento1 páginaStudent Activity Permit Approval ProcessJorge Erwin RadaAinda não há avaliações

- 16 - People Vs Chi Chan Liu DigestDocumento2 páginas16 - People Vs Chi Chan Liu DigestAmberChan100% (1)

- People vs Cagoco - Murder conviction upheld for fatal blow to victim's headDocumento72 páginasPeople vs Cagoco - Murder conviction upheld for fatal blow to victim's headGerard Anthony Teves RosalesAinda não há avaliações

- NYC B14 FEMA - Ted Monette FDR - Draft Interview QuestionsDocumento3 páginasNYC B14 FEMA - Ted Monette FDR - Draft Interview Questions9/11 Document ArchiveAinda não há avaliações

- Pentagon PapersDocumento4 páginasPentagon PapersGill ChetanpalAinda não há avaliações

- Court rules on petition to dismiss criminal caseDocumento1 páginaCourt rules on petition to dismiss criminal caseBetson CajayonAinda não há avaliações

- R V Jordan NotesDocumento3 páginasR V Jordan NotesVenus WangAinda não há avaliações

- Public Corp Cases FulltextDocumento96 páginasPublic Corp Cases FulltextJose MasarateAinda não há avaliações

- People v. TulinDocumento1 páginaPeople v. TulinAnonymous 5MiN6I78I0100% (1)

- CASE #91 Republic of The Philippines vs. Alvin Dimarucot and Nailyn Tañedo-Dimarucot G.R. No. 202069, March 7, 2018 FactsDocumento2 páginasCASE #91 Republic of The Philippines vs. Alvin Dimarucot and Nailyn Tañedo-Dimarucot G.R. No. 202069, March 7, 2018 FactsHarleneAinda não há avaliações

- DiplomacyDocumento8 páginasDiplomacyRonnald WanzusiAinda não há avaliações

- Gross Negligence ManslaughterDocumento53 páginasGross Negligence Manslaughterapi-24869020180% (5)

- Rene Ronulo Vs PeopleDocumento2 páginasRene Ronulo Vs PeopleAlexylle Garsula de ConcepcionAinda não há avaliações

- High Court Appeal Seeks Reversal of Dismissed Debt Recovery SuitDocumento2 páginasHigh Court Appeal Seeks Reversal of Dismissed Debt Recovery SuitBhumikaAinda não há avaliações

- An Assignment On The Bangladesh Studies: Submitted ToDocumento16 páginasAn Assignment On The Bangladesh Studies: Submitted ToTarun Kr Das100% (1)

- Cheeseboro Govt MemoDocumento9 páginasCheeseboro Govt MemoThe Valley IndyAinda não há avaliações

- (Art 163) Person Who Makes False or Counterfeit Coins and (Art 166) Forges Treasury orDocumento4 páginas(Art 163) Person Who Makes False or Counterfeit Coins and (Art 166) Forges Treasury orQuiquiAinda não há avaliações

- Factura ComercialDocumento6 páginasFactura ComercialKaren MezaAinda não há avaliações

- Asia Trust Devt Bank v. First Aikka Development, Inc. and Univac Development, IncDocumento28 páginasAsia Trust Devt Bank v. First Aikka Development, Inc. and Univac Development, IncSiobhan RobinAinda não há avaliações

- Cuozzo Speed Technologies, LLC v. Lee, No. 15-446 (June 26, 2016)Documento3 páginasCuozzo Speed Technologies, LLC v. Lee, No. 15-446 (June 26, 2016)Mitali PatelAinda não há avaliações

- List of Taxpayers For Deletion in The List of Top Withholding Agents (Twas)Documento217 páginasList of Taxpayers For Deletion in The List of Top Withholding Agents (Twas)Hanabishi RekkaAinda não há avaliações

- AIOU Migration/NOC ApplicationDocumento1 páginaAIOU Migration/NOC Applicationbakiz89Ainda não há avaliações

- TortDocumento11 páginasTortHarshVardhanAinda não há avaliações

- Sale of Land Agreement For ManiDocumento4 páginasSale of Land Agreement For Maniisaac setabiAinda não há avaliações

- Case Update - Ayache vs. Pjcmi - 6.22.22Documento2 páginasCase Update - Ayache vs. Pjcmi - 6.22.22Lemwil SaclayAinda não há avaliações

- Memorandum of Agreement Maam MonaDocumento2 páginasMemorandum of Agreement Maam MonaYamden OliverAinda não há avaliações

- Brigada Pabasa MOU TemplateDocumento3 páginasBrigada Pabasa MOU TemplateNimfa Payosing Palmera100% (10)

- Reviewer in Philippine ConstitutionDocumento7 páginasReviewer in Philippine ConstitutionMarvin Cabantac50% (2)

- Home design ltd shareholders dispute resolutionDocumento5 páginasHome design ltd shareholders dispute resolutionCarl MunnsAinda não há avaliações

- Omnibus Rules On Leave: Rule Xvi of The Omnibus Rules Implementing Book V of Eo 292Documento2 páginasOmnibus Rules On Leave: Rule Xvi of The Omnibus Rules Implementing Book V of Eo 292Miguel GonzalesAinda não há avaliações