Escolar Documentos

Profissional Documentos

Cultura Documentos

School District Tax Cap 0215

Enviado por

jspectorDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

School District Tax Cap 0215

Enviado por

jspectorDireitos autorais:

Formatos disponíveis

Local Government Snapshot

N E W YO R K S TAT E O F F I C E O F T H E S TAT E CO M P T R O L L E R

Thomas P. DiNapoli State Comptroller

February 2015

Three Years of the Tax Cap Impact on School Districts

Enacted in 2011, the States property tax cap law generally limits the amount by which local governments and

school districts, outside of New York City, can increase property taxes.1 The tax cap, which first applied to the

2012-13 school year, limits a school districts tax levy increase to the lesser of the rate of inflation or 2 percent

with some exceptions, including a provision that allows school districts to seek approval from voters to override

the cap. The Office of the State Comptroller is responsible for collecting the data that is necessary to compute

the tax cap. This report summarizes the experience of New York States school districts during the first three

years of budgeting under the tax cap law.

School Districts and the Property Tax

The property tax is the major revenue source for school districts. In 2013, school districts, excluding New York

City, spent $37.5 billion, of which 54.8 percent ($20.5 billion) was raised through the property tax.

Local wealth varies across the State, and

therefore the State/local revenue mix among

school districts varies substantially. State aid

is allocated to school districts using a series

of formulas which equalize for factors such as

pupil need and district wealth (ability to pay).

Districts that have low levels of wealth, or more

pupils with special needs, will receive more

State aid than wealthier districts with fewer high

need pupils. As a result, high need districts are

more reliant on State aid, and less reliant on the

property tax, compared to average need or low

need districts.

Percentage of School District Revenue from Property

Tax by Need Resource Category (2013)

100%

80%

80.3%

57.8%

60%

41.5%

40%

29.7%

20%

The tax cap poses more of a constraint on those

school districts that derive a larger portion of

their revenues from the property tax.

0%

Low Need

Average Need

High Need - Rural

Division of Local Government and School Accountability

High Need

Urban/Suburban

Local Government Snapshot

Overview of the Tax Cap

While commonly referred to as a 2 percent cap (possibly because of the laws reference to 2 percent in comparison

to the rate of inflation), the actual increase allowed by the law is usually something other than 2 percent. For the

2014-15 school fiscal year, the inflation-related component of the formula was 1.46 percent, not 2 percent.2 The

formula also includes several other components which impact the tax levy limit calculation, such as growth in the tax

base, payment in lieu of tax (PILOT) agreements, and exclusions for school district capital expenditures. As a result,

the total allowable increase from 2014 to 2015 was 2.2 percent for districts, on average. Indeed, there were no

school districts for which the allowable tax cap increase was exactly 2 percent, though 38 districts had an increase

that rounded to 2.0 percent.

Based on the individual tax levy limit calculations,

363 school districts could have increased the tax

levy by more than 2 percent (if they levied right

up to the tax levy limit) and, of these, 62 could

have increased the tax levy by 4 percent or more

while still remaining under the cap. In contrast,

69 districts were held to less than a 1 percent

increasewith 17 of these actually being subject

to a levy decrease from the prior year.

For school districts overall, the total levy increase

allowed by the tax cap has ranged from 2.2

percent to 3.8 percent during the first three years

the law has been in place. School districts levies

increased each year at a rate slightly less than

what was allowed by the tax capand school

districts planned to stay under the tax cap in

2015 by a total of $59 million, consuming 99.7

percent of their available tax limit.5

School District Tax Cap Results:

Year-Over-Year Change in Tax Levy Compared to Change

Allowed by the Tax Cap

4.0%

3.80%

3.5%

3.0%

2.5%

2.0%

1.5%

2.60%

2.14%

Change in Levy

Allowed by Cap

2.93%

2.00%

2.00%

1.0%

2.19%

1.90%

Change in Levy

1.46%

Allowable Levy

Growth Factor

0.5%

0.0%

2012 to 2013

2013 to 2104

2014 to 2015

School District Tax Cap Results:

Tax Levy Vs. Tax Levy Limit

$25

$20

Billions

At the individual district level, there are clear

exceptions. From 2014 to 2015, one districts

allowable levy limit was 21.7 percent less than

in the year prior while another districts allowable

levy limit was 45.5 percent higher than in the

prior year.3 As mentioned above, outliers and

large fluctuations are often caused by changing

PILOT and/or capital exclusion amounts within

the prescribed formula. The district that realized

the lower (-21.7 percent) levy limit did so because

the amount of its capital exclusion decreased

significantly from one year to the next. The district

that realized a higher (45.5 percent) levy limit did

so because of a large decrease to its total PILOT

amount from one year to the next.4

Used 99.6% of

Available Limit

($88 Million Unused)

$19.69 $19.78

Used 99.2% of

Available Limit

($172 Million Unused)

$20.27 $20.44

Used 99.7% of

Available Limit

($59 Million Unused)

$20.66 $20.72

$15

Tax

Levy

$10

Tax

Levy

Limit

$5

$0

2013

2014

2015

From 2014 to 2015, the levies of average need

Year

districts increased the most in terms of percentage

increasing it by 2.2 percent and remaining under

the allowable increase of 2.4 percent. High need rural districts had an allowable increase of 2.3 percent while increasing

the levy by only 1.3 percentthe smallest percentage increase compared to other need resource groups.6

N e w Yo r k S t a t e O f f i c e o f t h e S t a t e C o m p t r o l l e r

Local Government Snapshot

Overriding the Tax Cap

School districts can legally exceed the tax

levy limit by seeking an override. An override

requires at least 60 percent voter approval

and, as a result, fewer school districts override

the tax cap compared to other types of local

governments, which only need to obtain a vote

of at least 60 percent of their governing boards.

If a school districts budget fails twice, the district

is then held to a zero-growth budget that also

includes restrictions on how money is used to

fund programs.

The number of school districts overriding the

tax cap has declined each year. In school year

2013, 6.5 percent of school districts exceeded

the tax levy limit. By school year 2015, the

number of school districts overriding the tax cap

decreased by more than half, to 2.8 percent.

This decline may be due in part to the newly

enacted Property Tax Freeze Credit (tax

freeze).7 Generally, the two-year tax freeze

program provides credits to qualifying taxpayers

who live within taxing jurisdictions that remain

within the tax cap. Taxpayers will not be eligible

for the credit if their school district exceeds the

tax capproviding added incentive for districts

to stay under the cap.

Over the three years that the tax cap has been

in place, 79 school districts (11.7 percent)

have exceeded the tax cap at least once. One

district, the Kiryas Joel Union Free School

District, exceeded the cap in each of the three

years, and 14 districts exceeded the cap in two

of the three years.

Low need and average need districts were

twice as likely to override the tax cap compared

to high need districts. These districts receive

less State aid than high need districts, and are

therefore more dependent on property taxes to

fund their programs.

Allowable Tax Levy Increase and Actual Levy Increase

by Need Resource Category (2014 to 2015)

Actual Levy Increase

3.0%

2.5%

2.2%

2.4%

Allowable Increase

2.3%

2.3%

2.0%

1.8%

1.5%

1.7%

1.9%

1.3%

1.0%

0.5%

0.0%

Average Need

High Need - Rural

High Need Urban/Suburban

Low Need

School District Tax Cap Results:

Percentage Exceeding the Tax Cap

7.0%

6.5%

6.0%

5.0%

4.0%

4.7%

44

School

Districts

32

3.0%

School

Districts

2.0%

19

School

Districts

1.0%

0.0%

2.8%

2013

2014

Fiscal Year End

N e w Yo r k S t a t e O f f i c e o f t h e S t a t e C o m p t r o l l e r

2015

Local Government Snapshot

In general, school districts decisions to

override the tax cap were based, at least in part,

on necessity. Comptroller DiNapoli recently

implemented a Fiscal Stress Monitoring System

to evaluate and report on the level of fiscal

stress being faced by localities and school

districts across the State. School districts

received their first round of scores in January

2014. When examining the relationship between

fiscal stress and tax cap overrides, we found

that in each of the three years the law has been

in effect, fiscally stressed school districts were

nearly three times more likely to override the

tax cap when compared to school districts that

were grouped in the No Designation category.

Percentage Exceeding the Tax Cap at Least Once in

Three Years by Fiscal Stress Designation

30%

25%

26.4%

20%

15%

9.1%

10%

5%

0%

Fiscally Stressed

No Designation

Of the 19 school districts that are overriding

the tax cap for the 2014-15 fiscal year, five

(26 percent) were found to be in fiscal stress.

Note: The analysis in this report is based on school district tax cap filings for three years (2012-13, 2013-14, and

2014-15) as well as the tax freeze certification filing for the 2014-15 school fiscal year. Determinations as to whether a

school district exceeded the tax cap were made by comparing the tax levy limit (as calculated in the submitted form)

against the prior year levy reported in the following years form. Years listed in the report refer to fiscal year end. Tax

cap results do not include the fiscally dependent Big Four city school districts of Buffalo, Rochester, Syracuse and

Yonkers because the tax levy for these districts is subject to their respective Citys tax cap

General Municipal Law 3-c, Education Law 2023-a

This component (allowable levy growth factor) for the 2015-16 school year, will be 1.62 percent.

3

Fonda-Fultonville (-21.7 percent) and Barker Central (45.5 percent).

4

For more detail on the levy limit formula, visit: http://www.osc.state.ny.us/localgov/realprop/schools/files/formula.pdf

5

Based on data collected from school district tax freeze certifications, filed in 2014.

6

The need/resource categories referenced in this report were developed by the New York State Education Department and represent a districts

2

ability to meet student needs using local capacity. For information on the definitions of these categories, see:

www.p12.nysed.gov/irs/accountability/2011-12/NeedResourceCapacityIndex.pdf

Chapter 59 of the Laws of 2014 (Part FF).

New York State Office of the State Comptroller

Division of Local Government and School Accountability

110 State Street, 12th Floor Albany, New York 12236

w w w. o s c . s t a t e . n y. u s

February 2015

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Cornell ComplaintDocumento41 páginasCornell Complaintjspector100% (1)

- Joseph Ruggiero Employment AgreementDocumento6 páginasJoseph Ruggiero Employment AgreementjspectorAinda não há avaliações

- Stat Con Interpretation and ConstructionDocumento5 páginasStat Con Interpretation and ConstructionGraziela MercadoAinda não há avaliações

- Locating and Defining The CaribbeanDocumento29 páginasLocating and Defining The CaribbeanRoberto Saladeen100% (2)

- State Health CoverageDocumento26 páginasState Health CoveragejspectorAinda não há avaliações

- Pennies For Charity 2018Documento12 páginasPennies For Charity 2018ZacharyEJWilliamsAinda não há avaliações

- IG LetterDocumento3 páginasIG Letterjspector100% (1)

- Federal Budget Fiscal Year 2017 Web VersionDocumento36 páginasFederal Budget Fiscal Year 2017 Web VersionjspectorAinda não há avaliações

- Teacher Shortage Report 05232017 PDFDocumento16 páginasTeacher Shortage Report 05232017 PDFjspectorAinda não há avaliações

- NYSCrimeReport2016 PrelimDocumento14 páginasNYSCrimeReport2016 PrelimjspectorAinda não há avaliações

- Film Tax Credit - Quarterly Report, Calendar Year 2017 2nd Quarter PDFDocumento8 páginasFilm Tax Credit - Quarterly Report, Calendar Year 2017 2nd Quarter PDFjspectorAinda não há avaliações

- Abo 2017 Annual ReportDocumento65 páginasAbo 2017 Annual ReportrkarlinAinda não há avaliações

- Inflation AllowablegrowthfactorsDocumento1 páginaInflation AllowablegrowthfactorsjspectorAinda não há avaliações

- Darweesh Cities AmicusDocumento32 páginasDarweesh Cities AmicusjspectorAinda não há avaliações

- 2017 08 18 Constitution OrderDocumento27 páginas2017 08 18 Constitution OrderjspectorAinda não há avaliações

- SNY0517 Crosstabs 052417Documento4 páginasSNY0517 Crosstabs 052417Nick ReismanAinda não há avaliações

- Oag Sed Letter Ice 2-27-17Documento3 páginasOag Sed Letter Ice 2-27-17BethanyAinda não há avaliações

- Class of 2022Documento1 páginaClass of 2022jspectorAinda não há avaliações

- Opiods 2017-04-20-By Numbers Brief No8Documento17 páginasOpiods 2017-04-20-By Numbers Brief No8rkarlinAinda não há avaliações

- 2017 School Bfast Report Online Version 3-7-17 0Documento29 páginas2017 School Bfast Report Online Version 3-7-17 0jspectorAinda não há avaliações

- Youth Cigarette and E-Cigs UseDocumento1 páginaYouth Cigarette and E-Cigs UsejspectorAinda não há avaliações

- Hiffa Settlement Agreement ExecutedDocumento5 páginasHiffa Settlement Agreement ExecutedNick Reisman0% (1)

- Schneiderman Voter Fraud Letter 022217Documento2 páginasSchneiderman Voter Fraud Letter 022217Matthew HamiltonAinda não há avaliações

- Activity Overview: Key Metrics Historical Sparkbars 1-2016 1-2017 YTD 2016 YTD 2017Documento4 páginasActivity Overview: Key Metrics Historical Sparkbars 1-2016 1-2017 YTD 2016 YTD 2017jspectorAinda não há avaliações

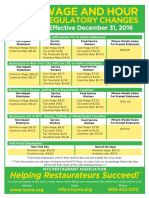

- Wage and Hour Regulatory Changes 2016Documento2 páginasWage and Hour Regulatory Changes 2016jspectorAinda não há avaliações

- Siena Poll March 27, 2017Documento7 páginasSiena Poll March 27, 2017jspectorAinda não há avaliações

- 16 273 Amicus Brief of SF NYC and 29 Other JurisdictionsDocumento55 páginas16 273 Amicus Brief of SF NYC and 29 Other JurisdictionsjspectorAinda não há avaliações

- Review of Executive Budget 2017Documento102 páginasReview of Executive Budget 2017Nick ReismanAinda não há avaliações

- p12 Budget Testimony 2-14-17Documento31 páginasp12 Budget Testimony 2-14-17jspectorAinda não há avaliações

- Pub Auth Num 2017Documento54 páginasPub Auth Num 2017jspectorAinda não há avaliações

- 2016 Local Sales Tax CollectionsDocumento4 páginas2016 Local Sales Tax CollectionsjspectorAinda não há avaliações

- Voting Report CardDocumento1 páginaVoting Report CardjspectorAinda não há avaliações

- Reasons For Collapse of Ottoman EmpireDocumento8 páginasReasons For Collapse of Ottoman EmpireBilal Ahmed Khan100% (2)

- Application For Social Security Card - Ss-5Documento1 páginaApplication For Social Security Card - Ss-5Casey Orvis100% (1)

- 227 - Luna vs. IACDocumento3 páginas227 - Luna vs. IACNec Salise ZabatAinda não há avaliações

- The Soviet Paradise Lost Ivan Solonevich 1938 313pgs COM - SMLDocumento313 páginasThe Soviet Paradise Lost Ivan Solonevich 1938 313pgs COM - SMLThe Rabbithole WikiAinda não há avaliações

- A 3 Commonwealth Flags Poster 2010Documento2 páginasA 3 Commonwealth Flags Poster 2010Jose MelloAinda não há avaliações

- January 2024-CompendiumDocumento98 páginasJanuary 2024-CompendiumKirti ChaudharyAinda não há avaliações

- Thuy Hoang Thi ThuDocumento8 páginasThuy Hoang Thi Thukanehai09Ainda não há avaliações

- Cbsnews 20230108 ClimateDocumento27 páginasCbsnews 20230108 ClimateCBS News PoliticsAinda não há avaliações

- Social Movements (Handout)Documento4 páginasSocial Movements (Handout)Mukti ShankarAinda não há avaliações

- Nafta Good-Bad - Michigan7 2013 PCFJVDocumento301 páginasNafta Good-Bad - Michigan7 2013 PCFJVConnor MeyerAinda não há avaliações

- (Saurabh Kumar) Polity Mains 2021 NotesDocumento197 páginas(Saurabh Kumar) Polity Mains 2021 NotesJeeshan AhmadAinda não há avaliações

- Invoice 1708 Narendra Goud Narendra GoudDocumento1 páginaInvoice 1708 Narendra Goud Narendra GoudNarendra GoudAinda não há avaliações

- HUM111 Pakistan StudiesDocumento17 páginasHUM111 Pakistan StudiesMuneebAinda não há avaliações

- Judith Butler 1997 Further Reflections On The Conversations of Our TimeDocumento4 páginasJudith Butler 1997 Further Reflections On The Conversations of Our TimeSijia GaoAinda não há avaliações

- Tesco Share Account Clean Version Final 30 10 15Documento4 páginasTesco Share Account Clean Version Final 30 10 15George DapaahAinda não há avaliações

- Appeals, 368 Phil. 412, 420 (1999)Documento5 páginasAppeals, 368 Phil. 412, 420 (1999)Vin LacsieAinda não há avaliações

- Degree Prelims Stage 2 MarkedDocumento25 páginasDegree Prelims Stage 2 MarkedDeepak JoseAinda não há avaliações

- (2014) Big Boxes, Small PaychecksDocumento18 páginas(2014) Big Boxes, Small PaychecksJordan AshAinda não há avaliações

- Form "D-1" Annual Return (See 2020-2021 General Information: Regulation 2.1.13)Documento2 páginasForm "D-1" Annual Return (See 2020-2021 General Information: Regulation 2.1.13)Shiv KumarAinda não há avaliações

- Sumbingco v. Court of AppealsDocumento2 páginasSumbingco v. Court of AppealsRubyAinda não há avaliações

- Class 8 Revolt 1857 QADocumento3 páginasClass 8 Revolt 1857 QAAK ContinentalAinda não há avaliações

- Application Form For Entry Pass H.C. LkoDocumento2 páginasApplication Form For Entry Pass H.C. LkoDivyanshu SinghAinda não há avaliações

- Hakaraia-Sj l4 May 2015Documento5 páginasHakaraia-Sj l4 May 2015api-277414148Ainda não há avaliações

- Prospective Member LetterDocumento1 páginaProspective Member LetterClinton ChanAinda não há avaliações

- Afghan National Army (ANA) : Mentor GuideDocumento76 páginasAfghan National Army (ANA) : Mentor GuidelucamorlandoAinda não há avaliações

- 00 IdeologiesDocumento4 páginas00 Ideologies朱奥晗Ainda não há avaliações

- Listening ST AnswersDocumento16 páginasListening ST AnswersHELP ACADEMYAinda não há avaliações

- Joseph Ejercito EstradaDocumento12 páginasJoseph Ejercito EstradaEricka CozAinda não há avaliações